- Home

- »

- Market Trend Reports

- »

-

Top 20 Prostate Cancer Drugs Market Analysis and Segment Forecasts to 2030

Report Overview

The global prostate cancer drugs market continues to experience strong growth, driven by rising incidence rates, advancements in diagnostic technologies, and increasing government initiatives and awareness campaigns. These top-performing drugs span a wide range of therapeutic classes, including targeted therapies such as PARP inhibitors, immune checkpoint inhibitors, immunotherapies like prostate cancer vaccines, radiation therapy, and hormonal therapies such as LHRH antagonists and anti-androgens, highlighting the diversity and complexity of modern prostate cancer treatment approaches.

While established blockbusters-particularly androgen receptor inhibitors (ARIs) such as Xtandi (enzalutamide)-continue to hold a strong market presence, newer entrants like Pluvicto, a radioligand therapy, are gaining momentum due to their targeted radiation approach to prostate-specific membrane antigen (PSMA)-positive tumors. Advances in diagnostic technologies, including genetic testing, advanced imaging, and improved screening methods, enable prostate cancer detection earlier. This, in turn, supports better disease management and treatment outcomes and is expected to shape the competitive landscape over the forecast period. However, the market also faces challenges, including intensifying competition among drugs with similar mechanisms of action and the rising impact of biosimilar erosion in emerging markets.

The prostate cancer drug market is undergoing a transformative shift, driven by a combination of clinical, technological, and commercial factors. On one hand, rising global incidence, particularly among the aging male population, along with widespread screening programs using prostate-specific antigen (PSA) tests and digital rectal exams, is expanding the patient pool. On the other hand, innovations in genomics, personalized medicine, and novel drug delivery methods are driving progress in ARIs, PARP inhibitors, and radioligand therapies. These advancements are significantly improving treatment outcomes and redefining standards of care in both early-stage and metastatic prostate cancer settings.

Top 20 Prostate Cancer Drugs Market, by Revenue (USD Million), 2024 & 2030

Drug Name (Generic Name)

Company

2024 Revenue (USD Billion)

2030 Revenue (USD Billion)

Year of First Regulatory Approval

Approved Indications

XTANDI (Enzalutamide)

Astellas Pharma

5.31

6.43

2012 (U.S. FDA)

castration-resistant prostate cancer (nmCRPC), (mCRPC), (mCSPC)

Nubeqa (Darolutamide)

Pluvicto (Lutetium Lu 177 vipivotide tetraxetan)

Decapeptyl 9Triptorelin)

Zoladex (Goserelin)

Zytiga (Abiraterone acetate

Prolia (Denosumab)

Jevtana (Cabazitaxel)

Lupron (Leuprolide acetate)

XGEVA (Denosumab)

Xofigo (Radium Ra 223 dichloride)

ORGOVYX (Relugolix)

Rubraca (Rucaparib)

Lynparza (Olaparib)

FIRMAGON (Degarelix)

Casodex (Bicalutamide)

Zometa (Zoledronic acid)

The most prominent driver is the increasing global burden of prostate cancer, now accounting for over 1.46 million new cases annually. Enhanced screening programs and growing public awareness have led to earlier detection, enabling timely and more effective interventions. The National Cancer Institute (NIH) has introduced three evidence-based prostate cancer screening programs designed to improve knowledge and promote greater patient involvement in the decision-making process. Additionally, the adoption of comprehensive screening tests plays a critical role in the early detection of prostate cancer. The American Urological Association (AUA) recommends that clinicians offer prostate cancer screening to people aged 50 to 69 years every 2 to 4 years. According to the report of March 2025, the European Randomized Study of Screening for Prostate Cancer (ERSPC) demonstrated a 20% reduction in prostate cancer mortality among men aged 55 to 69 who underwent PSA (prostate-specific antigen) screening every four years, compared to those who were not screened.

Despite its strong momentum, the prostate cancer drug market faces several hurdles. High treatment costs and the financial burden of long-term care remain significant barriers. Furthermore, the growing impact of biosimilars and generics on established blockbuster drugs. With multiple first-generation agents now off-patent, originator brands are losing market share, forcing companies to justify premiums through incremental innovation or combination strategies. This trend threatens profitability, particularly for companies heavily reliant on one or a few flagship oncology products like XGEVA (Denosumab). Lastly, the complex and evolving regulatory and reimbursement landscapes, coupled with the low success rate in clinical trials, continue to limit commercial potential. These dynamics underscore the need for balanced strategies that combine innovation with affordability and broader global access.

Patent Expiry & Biosimilar Impact

Patent expirations continue to reshape the competitive landscape of the prostate cancer drug market. Legacy blockbusters such as Nubeqa (darolutamide) have already faced biosimilar or generic erosion, significantly impacting revenue streams for their originators. The availability of biosimilars, particularly for monoclonal antibodies like Avastin, which targets vascular endothelial growth factor (VEGF), has introduced more affordable options, improving access in price-sensitive markets while intensifying competition in more mature ones.

Table: Key Patent Expiries & Biosimilar Landscape

Drug

Originator

Indication

Patent Expiry

Biosimilar Status

Zytiga (Abiraterone)

Janssen Biotech

Metastatic castration-resistant prostate cancer (mCRPC), metastatic hormone-sensitive prostate cancer (mHSPC)

2027

Biosimilars named Mvasi and Zirabev

Erleada (Apalutamide)

Janssen Biotech

Metastatic castration-resistant prostate cancer (mCRPC), metastatic hormone-sensitive prostate cancer (mHSPC)

2028

No

Nubeqa (Darolutamide)

Bayer

Metastatic castration-resistant prostate cancer (mCRPC), metastatic hormone-sensitive prostate cancer (mHSPC)

2032

No

Xofigo (Radium-223)

Bayer

Bone metastases in castration-resistant prostate cancer (CRPC)

2023

Yet to launch

Lynparza (Olaparib)

AstraZeneca

Hormone-sensitive prostate cancer, endometriosis, uterine fibroids

2026

Yes (Goserelin Biosimilars)

Zoladex (Goserelin)

AstraZeneca

Non-Small Cell Prostate Cancer (NSCLC) with EGFR Exon 19 Deletions or Exon 21 L858R Mutations

Expected in 2026

Generics available

Casodex (Bicalutamide)

AstraZeneca

Early prostate cancer, advanced prostate cancer in combination with LHRH agonists

2009

Generics available

The emergence of biosimilars is not only helping reduce costs for healthcare systems but also putting pressure on branded drug manufacturers to differentiate through lifecycle management strategies, such as combination therapies, label expansions, and novel formulations. Immunotherapies like Zometa, Lupron, Casodex, and Zoladex have biosimilars in development, though none have received approval as of 2025. Over the next few years, additional biologics are expected to lose market exclusivity, creating further opportunities for biosimilar launches. However, biosimilar adoption varies significantly by region, influenced by regulatory preparedness, provider confidence, and payer incentives.

Pipeline & Innovation Spotlight

The prostate cancer treatment pipeline is increasingly driven by innovation, with a focus on both prevalent subtypes and underserved patient populations. In recent years, next-generation therapies such as ORGOVYX (relugolix), Lynparza (olaparib), and Rubraca (rucaparib) have shown promising clinical outcomes in advanced prostate cancer and BRCA-mutated metastatic castration-resistant prostate cancer (mCRPC) areas that previously had limited therapeutic options. These advancements are not only redefining treatment thresholds for mCRPC but also expanding the eligible patient pool, unlocking new commercial opportunities.

Table: Selected Promising Pipeline Therapies in Prostate Cancer

Drug (Code Name)

Developer

Target/Subtype

Class

Stage

ABBV-969

AbbVie

PSMA and STEAP1 dual-targeting

Antibody-drug conjugate (ADC)

Early clinical (Phase I/II)

JNJ-1900 (NBTXR3)

Johnson & Johnson

Nanoparticle radiation enhancer

Radiotherapy enhancer

Phase III (Localized prostate cancer)

177Lu-PSMA-I&T

Curium

PSMA-expressing tumor cells

Radioligand therapy

Phase III (ECLIPSE trial)

Opevesostat

Merck / Orion

CYP11A1 inhibitor (steroidogenesis)

Oral non-steroidal inhibitor

Phase III

AZD5305

AstraZeneca

Selective PARP1 inhibitor

Targeted therapy (PARP inhibitor)

Phase I/II

Saruparib (EvoPAR)

AstraZeneca

PARP inhibitor

Targeted therapy (PARP inhibitor)

Phase III

Capivasertib

AstraZeneca

AKT inhibitor

Targeted therapy

Phase III

Beyond targeted therapies, the pipeline features novel biologics, combination therapy, Antibody-drug conjugates, PARP inhibitors, and radioligand therapies aimed at overcoming resistance or enhancing response durability. Notably, several androgen receptor N-terminal domain antagonists, PD-1 immune checkpoint inhibitors, and CYP11A1 inhibitors are progressing through mid-to-late-stage trials. Many of these investigational drugs are being explored in combination regimens, a trend driven by the need for multi-pronged strategies against tumor heterogeneity and adaptive resistance.

As precision oncology continues to drive the prostate cancer R&D engine, these next-generation therapies are expected to transform future treatment pathways and potentially redefine the Top 20 drug rankings in the years ahead.

Regulatory & Policy Environment

The regulatory landscape for prostate cancer therapies has become increasingly adaptive and innovation-friendly, particularly in the U.S., EU, and select Asia-Pacific markets. Agencies like the U.S. FDA and European Medicines Agency (EMA) have embraced expedited pathways such as Breakthrough Therapy Designation, Fast Track, Accelerated Approval, and Priority Review to bring promising prostate cancer treatments to patients faster. Regulatory trends emphasize biomarker-driven approvals, precision medicine, and the use of real-world evidence to balance efficacy and safety, as seen in approvals of PARP inhibitors and PSMA-targeted therapies.

The European Association of Urology (EAU) updated its guidelines in April 2024 to recommend XTANDI (enzalutamide) for high-risk biochemical recurrent non-metastatic hormone-sensitive prostate cancer, with or without androgen deprivation therapy, after radiation or surgery. Simultaneously, EAU guidelines continue to emphasize evidence-based, risk-adapted management for all stages of prostate cancer, including the use of radiotherapy, ADT, and novel hormonal agents. However, global disparities in regulatory efficiency remain a concern. The Asia Pacific region is the fastest-growing market for prostate cancer drugs, driven by increasing incidence, improved healthcare infrastructure, and growing adoption of advanced therapies. While markets like South Korea and Australia are aligning with Western standards, slower drug review cycles in regions like Latin America and parts of Africa continue to delay patient access. Overall, the regulatory ecosystem is evolving toward a balance of speed, safety, and science-based evaluation.

Pricing & Reimbursement Landscape

Under the Inflation Reduction Act of 2022, Medicare negotiates prices for high-spending drugs, including Xtandi (enzalutamide), which is slated for price negotiation in 2025, with negotiated prices effective in 2027. This will affect the cost and availability of prostate cancer medications starting in 2027. The Medicare Drug Price Negotiation Program focuses on drugs with significant Medicare spending and a lengthy market presence, with the goal of lowering costs and enhancing affordability for millions of beneficiaries. Governments in countries like India, Brazil, and South Africa are implementing price caps, centralized purchasing, or risk-sharing agreements to expand access while containing costs.

Generic and biosimilar entries, such as the recent FDA approval of generic Erleada (Apalutamide), are expected to gradually improve affordability, but branded drug prices remain a major cost driver. Many pharmaceutical companies offer patient assistance programs to help reduce the financial burden on patients, especially in high-income countries like the U.S. As global pressure mounts for affordability without sacrificing innovation, pricing and reimbursement strategies will play a pivotal role in shaping both patient access and long-term market dynamics.

Product Insights

The prostate cancer therapeutics market is dominated by hormonal therapies such as metastatic castration-resistant prostate cancer (mCRPC), non-metastatic castration-resistant prostate cancer (nmCRPC), androgen deprivation therapy (ADT), androgen receptor blockers, and 5-alpha reductase inhibitors, each playing a distinct role in the evolving treatment landscape. As of 2024, Xtandi (enzalutamide) holds the largest market share, driven by its widespread adoption as a first-line therapy and adjuvant treatment for metastatic castration-resistant prostate cancer (mCRPC) and non-metastatic castration-resistant prostate cancer (nmCRPC). Its widespread adoption is driven by a mechanism that involves a triple action of inhibition and its prolonged action. Additionally, ongoing trials combining Xtandi with other agents like talazoparib (TALZENNA) show promise in further improving outcomes for metastatic castration-resistant prostate cancer, potentially expanding its use. Besides Xtandi, Erleada was also among the largest market contributors of 2,999 million revenue in 2024. Despite Xtandi’s earlier market entry and broad approvals, Erleada demonstrated survival benefit, and ongoing clinical evidence provides a compelling reason for clinicians to choose Erleada, particularly in metastatic castration-sensitive settings

Zytiga (abiraterone) and Casodex (bicalutamide) have emerged as fast-growing prostate cancer treatments, driven by their clinical benefits and expanding indications. Zytiga is approved for metastatic castration-resistant prostate cancer (mCRPC) and is increasingly used in metastatic hormone-sensitive prostate cancer (mHSPC), broadening its patient reach. Its oral administration with a corticosteroid and its ability to slow disease progression and improve survival have supported its widespread global adoption.

Nubeqa (darolutamide) also remains a significant revenue driver, reaching blockbuster status in 2024. Bayer reports it as the fastest-growing androgen receptor inhibitor in the U.S., with strong physician uptake. Its unique structure and low central nervous system (CNS) penetration set it apart from other ARIs like enzalutamide and apalutamide, enhancing its safety and efficacy profile.

Meanwhile, Pluvicto (lutetium-177 PSMA-617) has become a cornerstone in PSMA-targeted radioligand therapy for mCRPC. It delivers targeted radiation to PSMA-expressing cancer cells, effectively killing tumors while minimizing systemic toxicity. Ongoing studies are evaluating its potential when combined with androgen receptor inhibitors or immunotherapies to further improve outcomes.

Route of Administration Insights

The prostate cancer therapeutics market is segmented into oral, intravenous (IV), and topical routes of administration, with each route serving specific clinical needs based on drug formulation, efficacy, patient convenience, and safety profiles.

The majority of top-performing prostate cancer drugs, including Zytiga and XTANDI, are administered orally. This route accounted for the majority of the market share in 2024, driven by Oral therapies, which provide improved patient compliance, convenience of administration in the outpatient setting, and lower healthcare costs. With the CRPC therapeutic environment moving increasingly toward chronic disease management and home care, the need for oral agents will increase substantially. Despite the growing availability of alternative formulations, oral route administration remains preferred for drugs requiring convenient dosing, particularly in metastatic prostate cancer.

Injectables (IV) are expected to grow at the fastest from 2025 to 2030. This growth is primarily driven by LHRH (GnRH) agonists like Zoladex (Goserelin Acetate), as well as LHRH (GnRH) antagonists like Degarelix (Firmagon), other Injectable hormonal agents like Zytiga (Abiraterone Acetate), and radiopharmaceuticals Pluvicto (Lutetium-177 PSMA-617). The long-acting injectable formulations reduce dosing frequency compared to daily oral medications, making treatment easier for patients and improving adherence.

Drugs like Pluvicto, which currently holds the largest market share among prostate cancer treatments, are limited due to a limited treatment options for the late-stage, aggressive form of prostate cancer. Injectable therapy lies in its precise, systemic delivery of targeted radiation, enabling controlled treatment of advanced prostate cancer with optimized safety and efficacy.

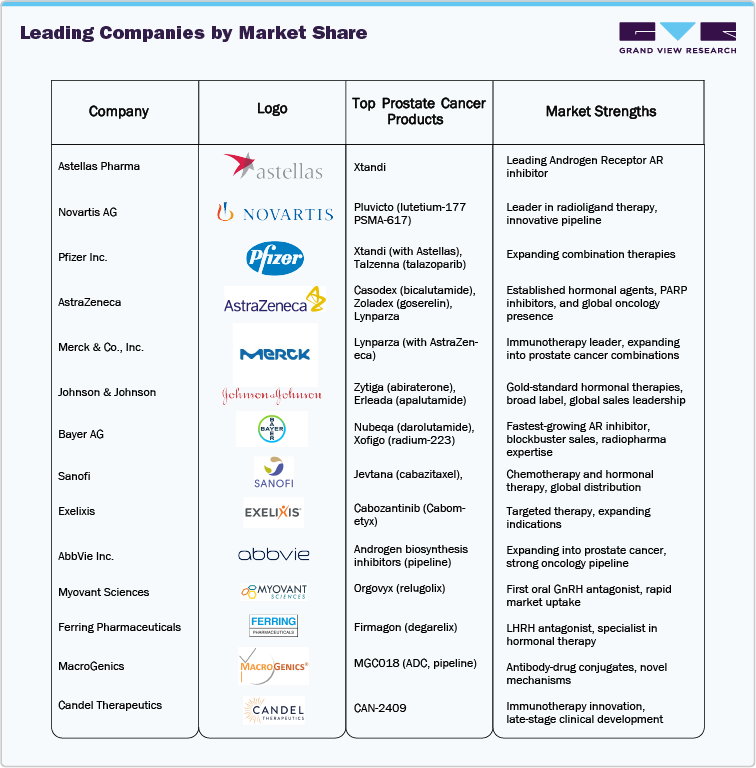

Key Companies & Market Share Insights

The top 20 prostate cancer drugs market is led by a few major global pharmaceutical companies known for their innovative treatments, strong clinical research, and effective marketing. The market remains highly competitive, with companies striving to enhance patient outcomes through targeted therapies, antibody-drug conjugates (ADCs), and target-based treatments.

Leading Companies by Market Share

Market Share Insights

-

Pfizer & Astellas Pharma continue to dominate the leading androgen receptor inhibitor market, driven by established blockbusters like Xtandi (enzalutamide).

-

Johnson & Johnson (Janssen) is the market leader with Erleada (apalutamide) and Zytiga (abiraterone), holding significant shares in hormonal therapy segments, while Merck & Co. increasingly active in prostate cancer treatment combinations.

-

Novartis is a leader in radioligand therapy with Pluvicto (lutetium-177 PSMA-617), a novel targeted therapy gaining rapid adoption in metastatic castration-resistant prostate cancer.

-

AstraZeneca and Sanofi are actively expanding their presence in prostate cancer with Casodex (bicalutamide) and Jevtana (cabazitaxel), and hormonal therapies.

-

Myovant Sciences is an innovator of Orgovyx (relugolix), the first oral GnRH antagonist, gaining traction in androgen deprivation therapy.

Key Top 20 Prostate Cancer Drugs Companies:

The following are the leading companies in the top 20 prostate cancer drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Astellas Pharma

- Novartis AG

- Pfizer Inc.

- AstraZeneca

- Merck & Co., Inc.

- Johnson & Johnson

- Bayer AG

- Sanofi

- Exelixis

- AbbVie Inc.

- Myovant Sciences

- Ferring Pharmaceuticals

- MacroGenics

- Candel Therapeutics

Recent Developments

-

In January 2024, the FDA approved Xtandi for patients with rising PSA levels post-surgery or radiation, demonstrating improved metastasis-free survival.

-

In January 2024, the FDA approved Rexigo (Oral GnRH Antagonist) by Zydus Lifesciences for testosterone suppression in advanced prostate cancer. Rexigo provides a cost-effective oral alternative to injectable therapies, enhancing patient convenience and adherence

-

In 2022, Open MedScience launched Pluvicto (Lutetium-177 PSMA-617), a radiopharmaceutical that delivers targeted beta radiation to tumor cells, offering a new treatment avenue for advanced prostate cancer.

-

In May 2021, Pfizer developed TAVT-45, an oral suspension formulation of abiraterone acetate designed to improve bioavailability and ease of swallowing for patients with dysphagia.

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global top 20 prostate cancer drugs market report based on product, route of administration, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Zytiga

-

Erleada

-

Nubeqa

-

Xofigo

-

Lynparza

-

Zoladex

-

Casodex

-

XTANDI

-

Jevtana

-

Decapeptyl

-

Lupron

-

Rubraca

-

Pluvicto

-

ORGOVYX

-

FIRMAGON

-

XGEVA

-

Prolia

-

Zometa

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Injectable

-

Oral

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified