- Home

- »

- Next Generation Technologies

- »

-

3D Machine Vision Market Size, Share, Industry Report, 2033GVR Report cover

![3D Machine Vision Market Size, Share & Trends Report]()

3D Machine Vision Market (2026 - 2033) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Application (Measurement, Identification), By Product (PC-Based, Smart Camera-Based), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-986-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Machine Vision Market Summary

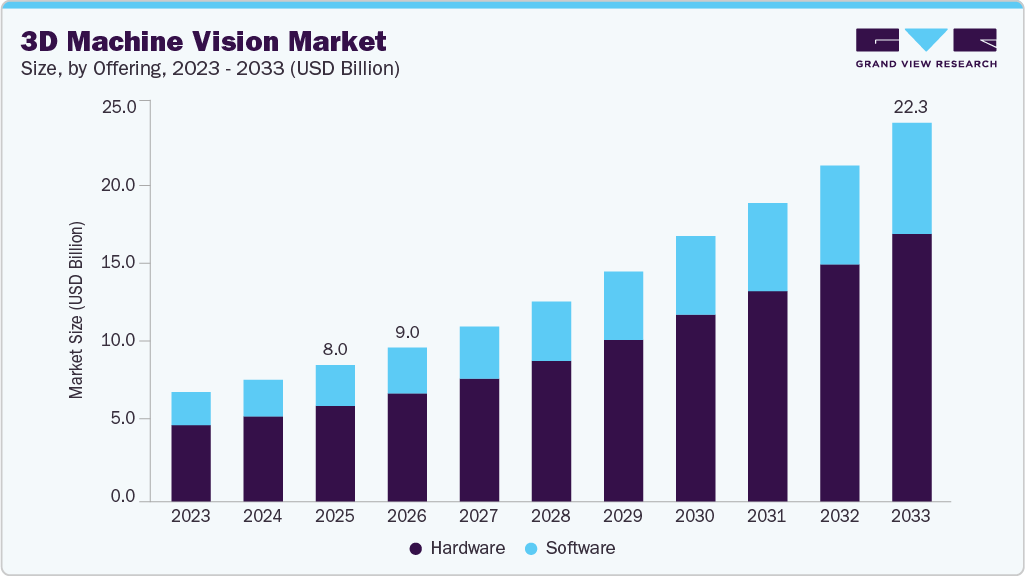

The global 3D machine vision market size was estimated at USD 8,027.8 million in 2025 and is projected to reach USD 22,314.5 million by 2033, growing at a CAGR of 13.7% from 2026 to 2033. The market growth is driven by the rapid adoption of Industry 4.0 and smart factory initiatives, as well as the increasing demand for high-precision inspection.

Key Market Trends & Insights

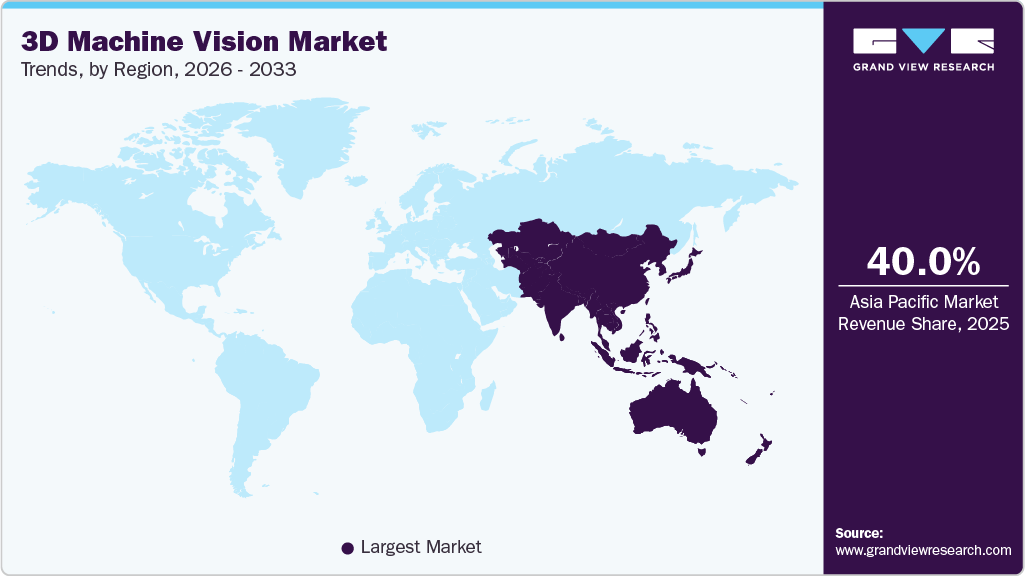

- The Asia Pacific 3D machine vision market accounted for the largest revenue share of over 40.0% in 2025.

- The Japan 3D machine vision industry dominated with a share of over 26.0% in 2025.

- By offering, the hardware segment accounted for the largest revenue share of over 70.0% in 2025.

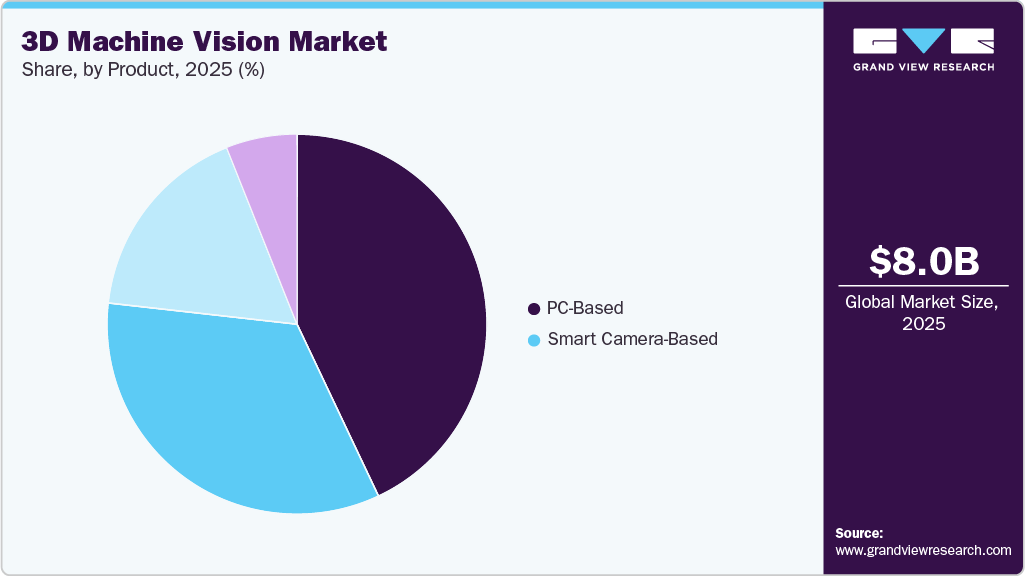

- By product, the PC-Based segment accounted for the largest revenue share of over 55.0% in 2025.

- By application, the quality assurance & inspection segment accounted for the largest revenue share of over 52.0% in 2025.

- By end use, the automotive segment accounted for the highest market share of over 19.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8,027.8 Million

- 2033 Projected Market Size: USD 22,314.5 Million

- CAGR (2026-2033): 13.7%

- Asia Pacific: Largest market in 2025

Technological advancements in 3D imaging sensors, AI-powered vision algorithms, and high-speed data processing enable accurate depth perception, real-time defect detection, and inline measurement, further accelerating the market growth. The increasing adoption of industrial automation, AI, and machine learning technologies to enhance production accuracy, throughput, and operational efficiency is significantly driving market growth. 3D machine vision systems integrate advanced hardware, such as cameras, sensors, and structured light or laser-based imaging, with intelligent software to enable precise depth sensing, object recognition, and spatial analysis in real time. The growing emphasis on quality compliance, worker safety, and robotics-enabled processes is accelerating global adoption, thereby driving the expansion of the 3D machine vision industry.

Additionally, technological advancements are redefining the 3D machine vision market, with AI-driven image processing, deep learning algorithms, edge computing, and digital twin integration becoming core enablers of industrial intelligence. Modern 3D machine vision systems are evolving from basic inspection tools to predictive and adaptive platforms that support real-time decision-making, precision measurement, and autonomous robotic guidance. The increasing deployment of smart cameras, high-resolution 3D sensors, and real-time analytics is reducing defect rates, improving throughput, and enhancing manufacturing efficiency, thereby driving market growth.

The growing emphasis on quality assurance, traceability, and zero-defect manufacturing is pushing industries to adopt advanced 3D machine vision solutions. Regulatory compliance in sectors such as the automotive, electronics, pharmaceutical, and food & beverages is encouraging manufacturers to invest in metrology systems. Rising labor shortages and increasing production complexity are also accelerating the shift toward automated visual inspection, as 3D machine vision enables consistent performance, reduced rework, and lower operational costs across high-volume production environments.

Moreover, the expanding adoption of robotics, autonomous systems, and smart logistics is strengthening demand for 3D machine vision technologies. Applications such as bin picking, robot navigation, object recognition, and palletizing rely heavily on accurate depth perception and spatial awareness. The competitive landscape is witnessing innovation-led growth, with vendors focusing on scalable architectures, interoperability with industrial automation platforms, and cybersecurity-ready solutions. As investments in smart factories and advanced manufacturing infrastructure increase globally, the 3D machine vision industry is positioned as a critical pillar of next-generation industrial automation.

Offering Insights

The hardware segment led the 3D machine vision industry, accounting for the largest revenue share of over 70.0% in 2025, driven by the rising adoption of automation in manufacturing, the increasing deployment of robotic guidance and quality inspection systems, and the growing demand for high-speed, high-resolution imaging across the automotive, electronics, and logistics industries. Continuous advancements in sensor technologies, such as structured light, time-of-flight (ToF), and laser triangulation, along with declining hardware costs, are further supporting the widespread adoption of these technologies in the market.

The software segment is expected to register a significant CAGR of over 13.0% from 2026 to 2033. The increasing need for intelligent inspection, real-time data interpretation, and adaptive decision-making in smart factories primarily drives the growth. The rising complexity of production lines, demand for defect classification and root-cause analysis, and integration of 3D machine vision with manufacturing execution systems (MES) and robotics are significantly boosting software adoption. The shift toward edge AI and cloud-based vision platforms is accelerating demand for scalable, flexible, and upgradeable 3D machine vision software solutions.

Product Insights

The PC-based segment accounted for the largest share of the 3D machine vision market in 2025, driven by the increasing need for high computational power, flexibility in algorithm development, and the integration of multi-camera systems across automotive, semiconductor, and electronics manufacturing. The ability to process large volumes of 3D data, support deep learning models, and integrate with factory automation and MES platforms further strengthens the adoption of PC-based 3D machine vision solutions.

The smart camera-based segment is expected to register the fastest CAGR from 2026 to 2033, owing to the rising demand for cost-effective, easy-to-deploy vision solutions in logistics, packaging, food & beverage, and small-to-mid-scale manufacturing facilities. The increasing adoption of edge AI, simplified system configuration, reduced wiring complexity, and lower maintenance requirements are accelerating the uptake of smart camera-based 3D machine vision systems. Additionally, their suitability for space-constrained environments and rapid scalability is further boosting market demand.

Application Insights

The quality assurance & inspection segment accounted for the largest share of the 3D machine vision industry in 2025, driven by the widespread deployment of advanced 3D vision systems for defect detection, dimensional measurement, and surface inspection across manufacturing environments. The integration of high-resolution 3D cameras, laser profilers, and AI-based vision software enables manufacturers to capture precise depth information and identify defects that are difficult to detect using conventional 2D systems. This infrastructure supports improved product consistency, enhanced compliance with stringent quality standards, and lower rework costs, thereby driving the dominance of the segment in the 3D machine vision industry.

The identification segment is expected to register the fastest CAGR from 2026 to 2033. The growth is fueled by the increasing adoption of 3D machine vision for object recognition, part verification, and traceability applications. Advanced 3D vision, combined with AI and deep learning, enables the reliable recognition of objects regardless of orientation, lighting conditions, or surface variations. This capability enhances robotic guidance, automated sorting, and inventory tracking, making identification one of the fastest-growing market segments.

End Use Insights

The automotive segment accounted for the largest market share in 2025, driven by extensive adoption of advanced vision systems across vehicle manufacturing and assembly lines. Automotive manufacturers increasingly deploy 3D machine vision for robotic guidance, dimensional measurement, weld inspection, surface defect detection, and quality validation of complex components. Growing investments in electric vehicles (EVs), autonomous driving technologies, and smart manufacturing further strengthen the segment in the global 3D machine vision industry.

The food & beverage (packaging and bottling) segment is expected to register the fastest CAGR from 2026 to 2033, driven by rising demand for high-speed, hygienic, and accurate inspection solutions. The growing emphasis on food safety, regulatory compliance, and traceability, combined with increasing automation in packaging and bottling facilities, is accelerating adoption. Additionally, the need to handle diverse package shapes, reflective surfaces, and high-throughput production environments is positioning 3D machine vision as a critical technology for this rapidly growing segment.

Regional Insights

The North America 3D machine vision market accounted for a revenue share of over 21.0% in 2025, driven by strong investments in advanced manufacturing, robotics, and industrial automation. The rapid adoption of Industry 4.0, AI-driven quality inspection, and autonomous systems across the automotive, aerospace, electronics, and logistics sectors is accelerating demand. The region’s mature digital infrastructure, high penetration of smart factories, and early adoption of AI-based vision analytics further strengthen North America’s leadership in the 3D machine vision industry.

U.S. 3D Machine Vision Market Trends

The U.S. 3D machine vision industry dominated North America with a revenue share of over 67.0% in 2025, driven by robust government and private-sector investments in smart manufacturing and advanced robotics. U.S. manufacturers are increasingly utilizing 3D machine vision for precision inspection, robotic guidance, and inline metrology to enhance productivity and minimize defects. Strong R&D ecosystems, widespread use of AI and deep learning, and the presence of leading vision technology providers continue to drive market expansion.

Europe 3D Machine Vision Market Trends

The Europe 3D machine vision industry is expected to grow at a CAGR of over 11.0% from 2026 to 2033, owing to the rapid adoption of Industry 4.0 and increasing integration of AI, IoT, and data analytics in manufacturing operations. European industries are focusing on high-precision inspection, traceability, and automation to meet stringent quality and safety standards. Government-backed digitalization programs and investments in smart factories are further boosting adoption across automotive, electronics, and industrial machinery sectors.

The Germany 3D machine vision market is expected to grow significantly in the coming years, owing to the country’s strong automotive and industrial manufacturing base. Rising demand for precision engineering, robotic automation, and zero-defect production is accelerating the adoption of advanced 3D vision systems. German manufacturers are increasingly leveraging 3D machine vision for dimensional measurement, robotic bin picking, and automated inspection to enhance efficiency, reduce downtime, and maintain global competitiveness.

The 3D machine vision market in the UK is experiencing rapid expansion, driven by increasing investments in smart manufacturing, logistics automation, and advanced inspection technologies. Manufacturers are adopting 3D machine vision to improve production accuracy, reduce labor dependency, and support flexible manufacturing environments. Government initiatives promoting digital transformation and innovation in industrial automation, along with the rising adoption of AI-enabled vision systems, are driving the market growth.

Asia Pacific 3D Machine Vision Market Trends

The Asia Pacific 3D machine vision industry is expected to grow at the fastest CAGR of 15.0% from 2026 to 2033, driven by rapid industrialization, the expansion of electronics and automotive manufacturing, and increasing adoption of automation. Countries across the region are investing heavily in smart factories and robotics to enhance productivity and global competitiveness. The growing presence of manufacturing hubs, combined with cost-effective production and the rising adoption of AI-based inspection systems, is significantly accelerating demand for 3D machine vision.

The China 3D machine vision market is driven by large-scale industrial automation, strong government support for intelligent manufacturing, and rapid deployment of AI and 5G technologies. Chinese manufacturers are increasingly adopting 3D machine vision for electronics inspection, semiconductor fabrication, and robotic guidance. The presence of domestic vision technology providers and growing investments in smart manufacturing infrastructure are further strengthening market growth.

The 3D machine vision market in Japan is expanding rapidly, fueled by the country’s leadership in robotics, precision manufacturing, and automation technologies. High demand for accurate inspection, robotic assembly, and quality assurance in the automotive and electronics industries is driving the adoption. Japan’s focus on advanced robotics, combined with continuous innovation in 3D imaging sensors and AI-based vision systems, is strengthening the country’s leading position in the global market.

Key 3D Machine Vision Company Insights

Some of the key players operating in the market include Cognex Corporation and Keyence Corporation, among others.

-

Cognex Corporation is a provider of machine vision products and solutions, specializing in 2D and 3D vision systems for industrial automation. The company’s portfolio includes 3D vision sensors, smart cameras, vision software, and deep learning-based inspection tools used for defect detection, dimensional measurement, robotic guidance, and barcode reading. Cognex serves a wide range of industries, including automotive, electronics, logistics, packaging, and semiconductor manufacturing, and has a strong global presence.

-

Keyence Corporation designs and manufactures advanced automation and sensing technologies, with a strong focus on high-performance 3D machine vision systems. Its product offerings include 3D vision sensors, laser profilers, measurement systems, and integrated inspection solutions that enable high-speed, high-precision quality control. Keyence serves industries such as automotive, electronics, pharmaceuticals, food & beverages, and industrial manufacturing, and is known for its direct-sales model and rapid adoption of cutting-edge vision technologies.

Visionatics Inc. and Softweb Solutions Inc. (An Avnet Company) are some of the emerging participants in the 3D machine vision market.

-

Visionatics Inc. is an emerging player specializing in AI-powered 3D machine vision and deep learning-based image analysis solutions. The company focuses on advanced inspection, object recognition, and spatial analytics for applications such as automated quality control, robotics, and intelligent manufacturing. Visionatics’ strength lies in its software-centric approach, enabling scalable and customizable 3D vision solutions for complex industrial environments.

-

Softweb Solutions Inc. (An Avnet Company) provides AI, IoT, and data analytics-driven solutions, including 3D machine vision system integration and intelligent automation platforms. The company supports industries such as manufacturing, logistics, healthcare, and smart infrastructure by delivering consulting, implementation, and managed services for AI-enabled vision systems. Its focus on edge AI, cloud integration, and predictive analytics positions Softweb Solutions as a growing participant in the 3D machine vision industry.

Key 3D Machine Vision Companies:

The following are the leading companies in the 3D machine vision market. These companies collectively hold the largest market share and dictate industry trends.

- Basler AG

- Cognex Corporation

- National Instruments Corporation

- OMRON Corporation

- Sick AG

- Allied Vision Technologies GmbH

- Softweb Solutions Inc. (An Avnet Company)

- Visionatics Inc.

- Keyence Corporation

- Intel Corporation

Recent Developments

-

In November 2025, Allied Vision Technologies GmbH introduced Alecs, an open smart camera, merging its Alvium camera platform with the NVIDIA Jetson Orin NX 16GB SoM to deliver powerful on-camera AI processing for next-generation machine vision applications, enhancing flexibility and performance for 3D visual inspection and embedded vision use cases.

-

In August 2025, Omron Corporation partnered with KUKA to integrate its 3D vision sensors with KUKA’s bin-picking robotics systems, enabling tighter integration of 3D sensing and robotic manipulation across complex manufacturing lines, boosting automation efficiency and reliability.

-

In April 2024, Cognex Corporation launched the In-Sight L38, the world’s first AI-based 3D vision system, combining AI, 2D, and 3D imaging technologies to simplify deployment, improve inspection accuracy, and accelerate adoption in automated manufacturing lines for quality inspection, measurement, and object recognition.

3D Machine Vision Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9,062.4 million

Revenue forecast in 2033

USD 22,314.5 million

Growth rate

CAGR of 13.7% from 2026 to 2033

Base Year of estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; Japan; India; South Korea; Singapore; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Basler AG; Cognex Corporation; National Instruments Corporation; OMRON Corporation; Sick AG; Allied Vision Technologies GmbH; Softweb Solutions Inc. (An Avnet Company); Visionatics Inc.; Keyence Corporation; Intel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global 3D Machine Vision Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 3D machine vision market report based on offering, product, application, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Camera

-

Frame Grabber

-

Optics

-

LED Lighting

-

Processor

-

-

Software

-

Application Specific

-

Deep Learning Software

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

PC-Based

-

Smart Camera-Based

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Quality Assurance & Inspection

-

Positioning & Guidance

-

Measurement

-

Identification

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Pharmaceuticals & Chemicals

-

Electronics & Semiconductor

-

Pulp & Paper

-

Printing & Labeling

-

Food & Beverage (Packaging and Bottling)

-

Glass & Metal

-

Postal & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D machine vision market size was estimated at USD 8,027.8 million in 2025 and is expected to reach USD 9,062.4 million in 2026.

b. The global 3D machine vision market is expected to grow at a compound annual growth rate of 13.7% from 2026 to 2033 to reach USD 22,314.5 million by 2033.

b. Asia Pacific dominated the 3D machine vision market with a share of over 40% in 2024. This growth is fueled by rapid industrialization, expansion of electronics and automotive manufacturing, and increasing automation adoption. Countries across the region are investing heavily in smart factories and robotics to enhance productivity and global competitiveness. The growing presence of manufacturing hubs, combined with cost-effective production and rising adoption of AI-based inspection systems, is significantly accelerating 3D machine vision demand.

b. Some key players operating in the 3D machine vision market include Basler AG, Cognex Corporation, National Instruments Corporation, OMRON Corporation, Sick AG, Microscan Systems, Inc., Softweb Solutions Inc. (An Avnet Company), Visionatics Inc., Keyence Corporation, Intel Corporation.

b. Key factors that are driving the market growth include the rapid adoption of Industry 4.0 and smart factory initiatives, increasing demand for high-precision inspection. Technological advancements in 3D imaging sensors, AI-powered vision algorithms, and high-speed data processing enable accurate depth perception, real-time defect detection, and inline measurement,

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.