- Home

- »

- Communications Infrastructure

- »

-

5G Testing Equipment Market Size, Industry Report, 2030GVR Report cover

![5G Testing Equipment Market Size, Share & Trends Report]()

5G Testing Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Signal & Spectrum Analyzers, Network Analyzers), By Revenue Source (New, Rental), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-716-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Testing Equipment Market Size & Trends

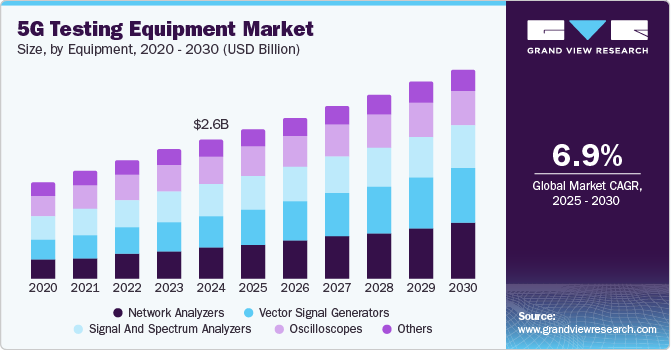

The global 5G testing equipment market size was valued at USD 2.60 billion in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2030, primarily influenced by the rapid expansion of 5G networks and the increasing number of 5G smartphone subscriptions. For instance, a report by the National Association of Software and Service Companies (NASSCOM) indicates that 5G telecom networks are projected to contribute nearly 2% to India's GDP by 2030. The surge in mobile data traffic, driven by the proliferation of smart devices and IoT applications, necessitates robust testing solutions to ensure network reliability and performance. In addition, advancements in testing technologies, such as the integration of artificial intelligence, are enhancing the efficiency and accuracy of testing processes, allowing for faster deployment and optimization of 5G services.

The ongoing development of new applications requiring high bandwidth, such as augmented reality and connected vehicles, creates a demand for more sophisticated testing solutions. As telecom operators invest in expanding their 5G infrastructure, the need for equipment that can validate and optimize these networks correspondingly increases. The trend toward software-defined testing solutions also gains momentum, allowing for more flexible and efficient testing capabilities.

Moreover, as cyber threats become more sophisticated, telecom operators require comprehensive testing solutions to ensure the integrity and security of their networks. Regulatory requirements for network performance and safety also drive investments in testing technologies that comply with these standards. For instance, in December 2024, the U.S. Federal Communications Commission (FCC) announced new measures requiring telecom carriers to enhance network security. This initiative aims to bolster the resilience of U.S. communications against potential cyberattacks, particularly in light of recent breaches in the country. Furthermore, the convergence of various technologies, such as edge computing and cloud services, creates new opportunities for innovative testing solutions, reinforcing the growth trajectory of the 5G testing equipment industry.

Equipment Insights

The vector signal generators segment dominated the market with a share of 23.2% in 2024, underscoring their vital role in evaluating 5G network performance. These generators are essential for simulating various signal conditions, which allows manufacturers and service providers to ensure compliance with stringent performance standards. The ability to generate complex waveforms and modulations is crucial for testing the capabilities of 5G devices under real-world conditions. The increasing complexity of 5G technology and the demand for precise testing solutions have reinforced the significance of vector signal generators within the 5G testing equipment industry.

The network analyzers segment is projected to grow at the highest CAGR during the forecast period, driven by the complexities associated with 5G networks. Network analyzers provide critical insights into network performance, enabling the identification and resolution of potential issues before they affect service delivery. These tools are vital for assessing parameters such as signal integrity, interference, and overall network health. As telecom operators and equipment manufacturers prioritize optimizing their networks for enhanced reliability and efficiency, the demand for sophisticated network analysis tools continues to rise.

Revenue Source Insights

The new segment dominated the market with the largest revenue share in 2024. This growth can be attributed to ongoing technological advancements and the integration of 5G capabilities across various sectors. Industries such as automotive, healthcare, and smart cities are rapidly adopting 5G technology, necessitating tailored testing solutions that can address specific operational requirements. For instance, in 2023, Ford Pro announced significant upgrades to its Transit and E-Transit commercial vehicles, incorporating 5G connectivity as a key enhancement. Moreover, as companies strive to enhance efficiency and performance through automation and connectivity, the demand for advanced testing solutions that support these initiatives becomes critical.

The rental segment is projected to grow at a significant CAGR during the forecast period as many organizations prefer leasing equipment rather than making large capital expenditures. This approach allows companies to access cutting-edge testing technologies without incurring substantial upfront costs, facilitating flexibility in adapting to changing market conditions. The growing inclination toward rental solutions reflects a strategic shift within the 5G testing equipment industry, catering to cost-conscious firms and those seeking competitive advantages through access to advanced testing capabilities.

End-use Insights

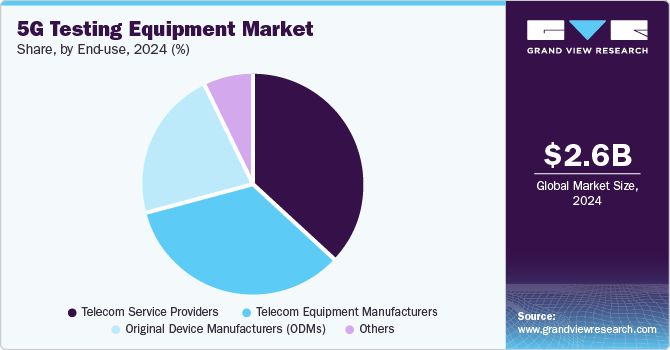

The telecom service providers segment dominated the market with the largest revenue share in 2024, driven by their essential role in deploying and managing 5G networks. Service providers require comprehensive testing solutions to ensure optimal network performance and customer satisfaction as they expand their services. Their significant investments in infrastructure development contribute substantially to the overall growth of the 5G testing equipment industry. In addition, as competition intensifies among service providers, there is an increasing emphasis on delivering high-quality services with minimal downtime.

The telecom equipment manufacturers segment is expected to grow at a significant CAGR over the forecast period due to increasing demand for advanced infrastructure components necessary for 5G deployment. These manufacturers are crucial in developing essential hardware that supports high-speed connectivity and low latency associated with 5G technology. The rising need for base stations, antennas, and other critical components creates opportunities for manufacturers to innovate and enhance their product offerings. For instance, in 2024, Nokia introduced a manufacturing facility that produced 5G receivers, fiber-to-the-home termination devices, and Wi-Fi routers. This new facility aims to enhance Nokia's capabilities in delivering advanced telecommunications equipment and supports the growing demand for high-speed connectivity solutions across various sectors.

Regional Insights

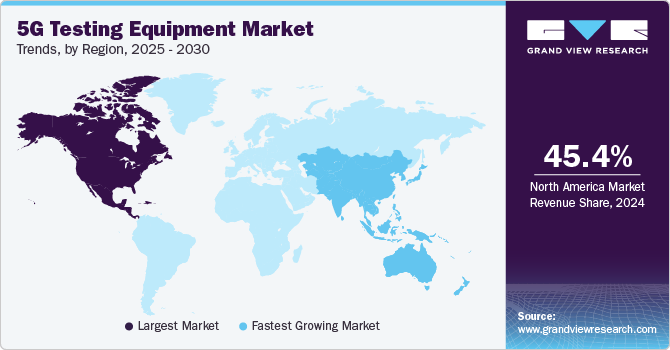

North America 5G testing equipment market dominated the global market with a revenue share of 45.4% in 2024, reflecting the region's strong investment in telecommunications infrastructure and technology. The presence of major telecom operators and equipment manufacturers in the U.S. facilitates rapid deployment and testing of 5G networks, ensuring high-quality service delivery. In addition, government initiatives to enhance broadband access and promote advanced wireless technology contribute to market growth.

U.S. 5G Testing Equipment Market Trends

The U.S. 5G testing equipment market dominated the regional market in 2024, driven by substantial investments from major telecom companies such as AT&T, Verizon, and T-Mobile. These companies are actively expanding their 5G infrastructure and require advanced testing solutions to validate network performance and reliability. The competitive landscape in the U.S. fosters continuous innovation and development of new testing technologies, enhancing the overall effectiveness of network services.

Europe 5G Testing Equipment Market Trends

Europe 5G testing equipment market is expected to grow at a significant CAGR from 2025 to 2030, fueled by increasing demand for high-speed connectivity and improved network performance across various sectors. The European Union's commitment to digital transformation and investment in next-generation telecommunications infrastructure drives this growth. As European countries adopt 5G technology for applications ranging from smart cities to autonomous vehicles, reliable testing solutions are essential. This trend highlights the evolving landscape of the European sector as it adapts to meet emerging technological demands.

Asia Pacific 5G Testing Equipment Market Trends

Asia Pacific 5G testing equipment market is expected to grow at a significant CAGR from 2025 to 2030, due to rapid urbanization and digitalization across the region. Countries such as India, Japan, and South Korea are investing heavily in their telecommunications infrastructure to support the deployment of advanced technologies. The increasing adoption of IoT devices and smart applications further drives demand for effective testing solutions that ensure optimal network performance. This growth trajectory reflects a broader trend within the industry as Asia Pacific emerges as a vital hub for technological advancement.

China 5G testing equipment market dominated the Asia Pacific region in 2024, owing to its advancements in telecommunications innovation. The Chinese government's aggressive push for nationwide 5G deployment has led to substantial investments in testing infrastructure and technology development. As one of the largest markets for mobile devices and services globally, China requires comprehensive testing solutions to ensure its vast network meets performance standards.

Key 5G Testing Equipment Company Insights

The 5G testing equipment market features several key players who shape its landscape. Anritsu develops advanced testing solutions that enhance the performance and reliability of 5G networks. EXFO Inc. provides a range of testing and monitoring tools to ensure optimal network performance during 5G deployments. Cloudflare, Inc. integrates testing capabilities with security features for network operators, while Ceragon offers diverse testing equipment to validate and optimize 5G infrastructure. These companies play a significant role in shaping the 5G testing equipment industry.

-

Anritsu specializes in advanced test and measurement solutions for the telecommunications industry in 5G technology. The company offers a wide range of products designed to support the development, production, and maintenance of mobile and wireless networks. Anritsu’s solutions include the MT8821C Radio Communication Analyzer, which is widely used for testing mobile devices and IoT modules, as well as various signal and spectrum analyzers that ensure optimal performance across multiple frequency ranges.

-

Ceragon Networks Ltd. specializes in providing high-capacity, wireless transport solutions essential for deploying 5G networks. The company offers a range of products designed to support mobile operators in upgrading their infrastructure to meet the demands of 5G connectivity. Ceragon's solutions include advanced microwave and millimeter-wave technologies that facilitate efficient data transmission over long distances, ensuring reliable network performance.

Key 5G Testing Equipment Companies:

The following are the leading companies in the 5G testing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Anritsu

- Artiza Networks Inc.

- EXFO Inc.

- Ceragon

- Intertek Group Plc

- Keysight Technologies

- MACOM

- Rohde & Schwarz

- Teradyne Inc.

- VIAVI Solutions Inc.

Recent Development

-

In September 2024, Tata Elxsi launched the "xG-Force" lab in Bengaluru, a state-of-the-art facility aimed at accelerating 5G innovation. This lab provides advanced tools, ready-to-use infrastructure, and an integrated partner ecosystem to support various applications across the transportation, healthcare, Industry 4.0, and media sectors. The facility enables companies to explore and validate emerging technologies while facilitating the development of 5G solutions.

-

In July 2024, Accenture completed its acquisition of Fibermind, an Italian network services company specializing in deploying mobile 5G networks and fiber. This acquisition enhances Accenture's telecommunications network engineering capabilities and provides clients with extensive industry knowledge and technological resources powered by automation, robotics, data, and AI.

-

In February 2024, Artiza Networks, Inc. announced the launch of its latest high-performance network testing product, FH MONITOR. This innovative solution is specifically designed to enhance the debugging process for Open Radio Unit (O-RU) systems by providing advanced capabilities for fronthaul packet capture and analysis. The introduction of FH MONITOR aims to redefine the testing landscape for radio frequency (RF) developers, addressing the complexities associated with modern telecommunications.

5G Testing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.80 billion

Revenue forecast in 2030

USD 3.91 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, revenue source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; Oman

Key companies profiled

Anritsu; Artiza Networks Inc.; EXFO Inc.; Ceragon; Intertek Group Plc; Keysight Technologies; MACOM; Rohde & Schwarz; Teradyne Inc.; VIAVI Solutions Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Testing Equipment Market Report Segmentation

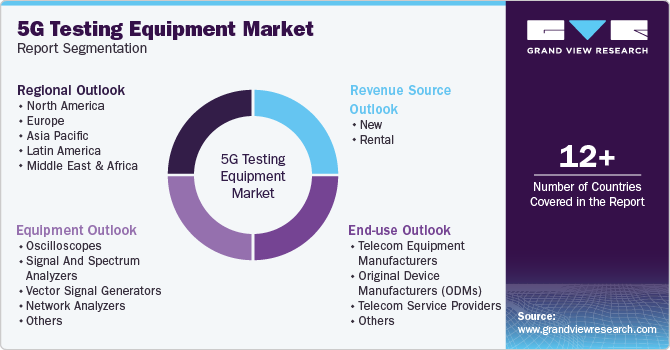

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 5G testing equipment market report based on equipment, revenue source, end-use, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Oscilloscopes

-

Signal and Spectrum Analyzers

-

Vector Signal Generators

-

Network Analyzers

-

Others

-

-

Revenue Source Outlook (Revenue, USD Million, 2018 - 2030)

-

New

-

Rental

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecom Equipment Manufacturers

-

Original Device Manufacturers (ODMs)

-

Telecom Service Providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

Oman

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.