- Home

- »

- Catalysts & Enzymes

- »

-

Activated Alumina Market Size, Share & Growth Report, 2030GVR Report cover

![Activated Alumina Market Size, Share & Trends Report]()

Activated Alumina Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Water Treatment, Oil & Gas, Plastics, Healthcare, Others), By Application (Catalyst, Desiccant, Fluoride Adsorbent, Bio Ceramics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-611-0

- Number of Report Pages: 89

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Activated Alumina Market Size & Trends

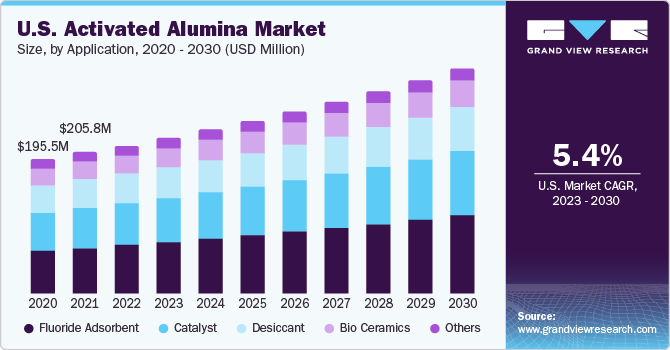

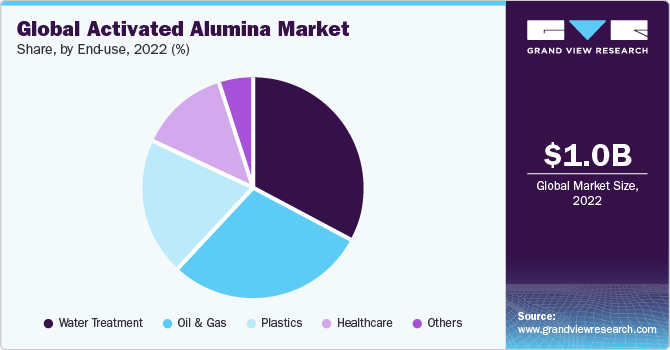

The global activated alumina market size was valued at USD 1.01 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The market is majorly driven by factors, such as rising demand for clean water, shrinking water reserves, and the implementation of new water treatment facilities. Activated alumina is formed by dihydroxylation of aluminum hydroxide to produce highly porous material. It is used in various applications including catalyst, desiccant, fluoride adsorbent, bioceramics, and others.

Activated alumina can adsorb harmful contaminants in both aquifers and wastewater. It is used in various water purification techniques, such as the removal and adsorption of PCB, lead, fluoride, copper, arsenic, and other heavy metals from water. PCBs have a risk of spillage and can contaminate the surface and groundwater.

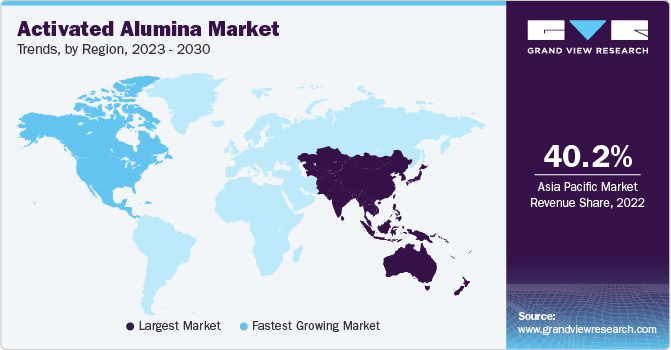

Increasing population coupled with rapid economic growth is expected to boost the market growth in Asia Pacific. Government initiatives, such as the launch of various projects for the regular supply and treatment of water, are likely to propel the product demand over the forecast period. Products usage in the purification of lithium is gaining popularity. Lithium finds use in ceramics, glass, batteries, lubricating greases, and air treatment applications.

It is used to power cell phones, digital cameras, and laptops and is becoming a prime energy source for powering electric and hybrid motor vehicles. The product utilizes adsorption process for the removal of impurities, which involves high capital and operational costs. Thus, the end-users are shifting toward its substitutes despite their efficiency and effectiveness. This is likely to restrain market growth over the coming years

End-use Insights

The water treatment segment accounted for the largest revenue share of 33.9% in 2022 and is expected to grow at the fastest CAGR of 6.7% during the forecast period. Activated alumina is often used for water treatment due to its excellent adsorption properties. It is porous and has a high surface area, which makes it effective adsorbent. It is used to remove the fluoride from water, to make it equivalent to a potable grade. This process of adsorption occurs when contaminants in the water adhere to the surface of the activated alumina.

In the oil & gas industry, the product is used in the adsorption of water from natural gas streams. Natural gas is regarded as the fastest-growing source of domestic energy production. The establishment of new refinery projects is anticipated to be the key driver for segment growth. Polyethylene is the most common plastic and is used in a wide range of applications. Rising demand for polyethylene is expected to propel product usage over the forecast period.

Activated alumina bio ceramics were developed as an alternative to surgical metal alloys and for use in tooth implants and hip prosthesis due to their anti-corrosion properties, and hardness. The other application segment includes chemical, food & beverage, and nuclear industries.

Application Insights

The fluoride adsorbent segment held the largest revenue share of 33.2% in 2022 and is expected to grow at the fastest CAGR of 6.7% over the forecast period. The product is used for fluoride removal during the purification of drinking water. It is used particularly in situations where the fluoride concentration in water exceeds the recommended limits for safe drinking water. As the water flows over the bed of activated alumina, the fluoride ions are effectively taken away from the water, thereby reducing the fluoride concentration in the water. The growing need for water purification is expected to drive product demand over the forecast period.

Regional Insights

Asia Pacific dominated the global activated alumina market and accounted for the largest revenue share of 40.2% in 2022. The key countries including India and China are expected to observe steady growth in their refining capacities, thereby augmenting the product demand. Rising demand for freshwater supply due to the growing population in the region will drive the market over the coming years.

North America is expected to grow at a CAGR of 5.5% during the forecast period. According to the world energy and climate statistics report published in 2023, there has been an increase in the production of crude oil in the U.S. by 6.5% and by 2.6% in Canada. In addition to that, as per the International Energy Agency (IEA) publication in 2018, refinery expansion in the U.S. and steady production volume of crude are likely to solidify the country’s position as a key exporter of crude across the globe.

Brazil also registered a healthy growth rate. The political and economic reforms in the country are expected to drive the key end-use sectors, such as pharmaceutical, oil & gas, and water treatment, thereby supporting market development.

Key Companies & Market Share Insights

The market is highly competitive, with large number of manufacturers accounting for a majority of market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The following are some of the major participants in the global activated alumina market:

-

BASF SE

-

Honeywell International Inc.

-

Sumitomo Chemical Co., Ltd.

-

Axens

-

AGC CHEMICALS PVT. LTD.

-

Sorbead India

-

Shandong Zhongxin New Material Technology Co., Ltd.

-

Luoyang Xinghua Chemical Co., Ltd.

-

Sialca Industries

-

Shayan Corporation

-

BeeChems

-

Hengye Inc.

-

Huber Engineered Materials

Recent Developments

-

In September 2020, BASF SE expanded its product offerings for selective hydrogenation catalysts by introducing commercially proven alumina catalysts. This innovative series of catalysts exhibits improved tolerance to poisons like sulfur, attributed to its higher Pd dispersion. The launch of these new catalysts is anticipated to bolster BASF SE's market presence and penetration.

-

In October 2021, Shell plc and BASF SE joined forces in a collaboration aimed at evaluating, derisking, and deploying BASF's Sorbead adsorption technology. In contrast to activated alumina or molecular sieves, Sorbead, an aluminosilicate gel material, can regenerate at a lower temperature and exhibits resistance to acids and water. Additionally, the Sorbead adsorption technology ensures that the treated gas complies with stringent pipeline and underground storage regulations, guaranteeing its glycol-free quality.

Activated Alumina Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.07 billion

Revenue forecast in 2030

USD 1.60 billion

Growth Rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018- 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Belgium; Russia; China; Japan; India; South Korea; South East Asia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Honeywell International Inc.; Sumitomo Chemical Co., Ltd.; Axens; AGC CHEMICALS PVT. LTD.; Sorbead India; Shandong Zhongxin New Material Technology Co., Ltd.; Luoyang Xinghua Chemical Co., Ltd.; Sialca Industries; Shayan Corporation; BeeChems; Hengye Inc.; Huber Engineered Materials

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Activated Alumina Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global activated alumina market on the basis of end-use, application, and region:

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Water Treatment

-

Oil & gas

-

Plastics

-

Healthcare

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Catalyst

-

Desiccant

-

Fluoride Adsorbent

-

Bio Ceramics

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South East Asia

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global activated alumina market size was valued at USD 1.01 billion in 2022 and is expected to reach USD 1.07 billion in 2023.

b. The global activated alumina market is estimated to witness a CAGR of 5.9% from 2023 to 2030 to reach USD 1.60 billion by 2030. The market is majorly driven by factors, such as rising demand for clean water, shrinking water reserves, and implementation of new water treatment facilities.

b. Asia Pacific dominated the Activated Alumina market with a share of 40.2% in 2022. The key countries including India and China, are expected to observe steady growth in their refining capacities, thereby augmenting the product demand.

b. The major players in the global activated alumina market include BASF SE; Sumitomo Chemical Co.; Honeywell International Inc.; Porocel Industries LLC; and Dynamic Adsorbents Inc.

b. Rising demand for the product across various end-use industries, such as water treatment, oil & gas, plastics and healthcare is anticipated to drive the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.