- Home

- »

- Medical Devices

- »

-

Advanced Therapy Medicinal Products CDMO Market Report 2030GVR Report cover

![Advanced Therapy Medicinal Products CDMO Market Size, Share & Trends Report]()

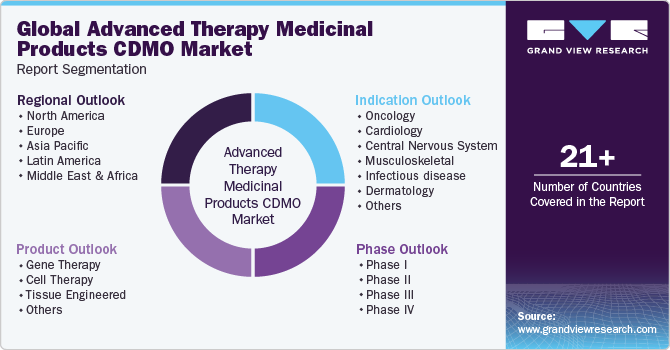

Advanced Therapy Medicinal Products CDMO Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Gene Therapy, Cell Therapy), By Phase, By Indication, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-676-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

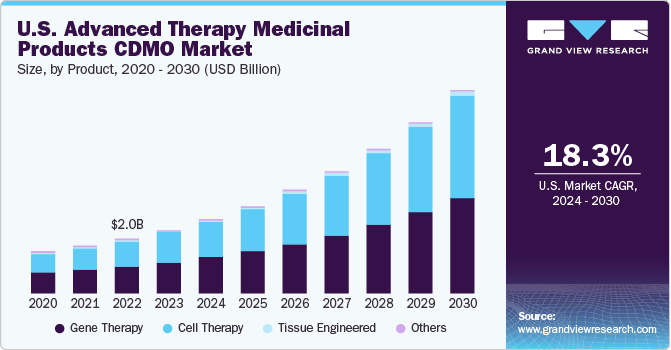

The global advanced therapy medicinal products CDMO market size was estimated at USD 5.64 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 18.92% from 2024 to 2030. The growth of the market is attributed to factors such as the rising demand for advanced therapy, rising number of clinical trials for ATMPs and growing number of treatments. Moreover, increased investment in research and developments of advanced therapy pharmaceutical products, as well as an increase in the prevalence of rare and severe disorders including metabolic and optical diseases.

The COVID-19 pandemic has had a massive impact on the development and manufacturing of advanced therapy medicinal products. Cell-based therapy was one of the fastest growing classes of medicines during the COVID-19 pandemics. The USA, Jordan, China, Iran, and several other nations started cell-based therapy clinical research to treat COVID-19 individuals with acute respiratory distress at the same time that the disease was spreading over the world. For instance, more than 80 clinical trials had been registered as of 2022, according to a search on ClinicalTrials.gov for "Mesenchymal stem cells and COVID-19.

One of the major drivers of the market is the increasing number of clinical trials for ATMPs. According to the American Society of Gene and Cell Therapy report, as of Q1 2022, 3,579 therapies are in the pipeline of gene, cell, and RNA therapies. As per a report, the gene cell therapy pipeline has increased by 16% as of Q1 2021. In the pipeline, CAR-T cell therapies are dominating genetically modified cell therapies. Moreover, 98% of CAR-T cell therapies are in the development phase for cancer indication. In addition to it, in August 2023, the European Commission declared financial support for combined Advanced Therapy Medicinal Products (ATMPs) by earmarking funding specifically for Phase 2 clinical trials and subsequent stages.

Furthermore, outsourcing activities in this domain are rising, as this strategy enables companies to acquire additional competencies required for successful development and commercialization of ATMPs. Apart from offering extended expertise and aiding in better management of cash flows, outsourcing provides significant manufacturing advantages, such as a reduction in investment risks. In addition, low incidence-to-prevalence ratios for genetic and rare diseases make outsourcing an attractive option, as the construction of in-house facility for producing a single gene therapy for these diseases requires a faster cost recovery in a short time frame.

Moreover, increasing competition among the key companies to gain considerable market share in the field is expected to boost R&D investment flow in the market. For Instance, in January 2022, Excellos, a cell therapy CDMO, announced the launch and closing of USD 15 million in funding from Telegraph Hill Partners. The company is engaged in supplying cGMP cellular Cell Therapy and products, with manufacturing and process development expertise to clinicians and scientists working with cell and gene therapies.

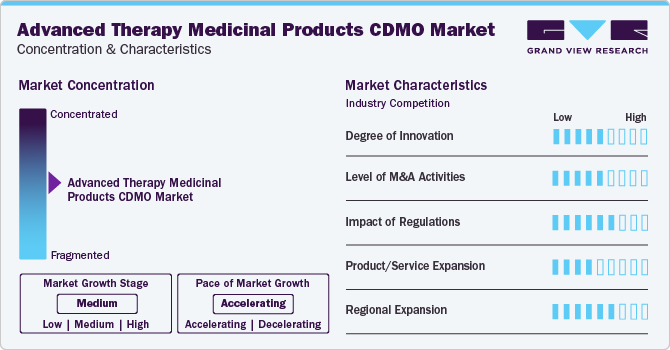

Market Characteristics

The global market is marked by a significant degree of innovation, incorporating advanced technologies like CRISPR and next-generation sequencing for heightened accuracy.

Several market players such as AGC Biologics, WuXi Advanced Therapies and Lonza, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Necessitating compliance with rigorous safety and quality standards drives the adoption of advanced testing methodologies which significantly impact the market.

Potential product substitutes for this market include other specialized contract manufacturing services for cell and gene therapies, as well as in-house manufacturing capabilities adopted by pharmaceutical companies to produce ATMPs.

The market exhibits robust regional expansion as companies strategically establish manufacturing facilities and collaborations worldwide to meet growing demand for gene and cell therapies. This global footprint reflects the industry's commitment to proximity, compliance with regional regulations, and catering to diverse patient populations.

Product Insights

The gene therapy segment held the largest share of over 49.2% in 2023. Increase in financial support and rise in number of clinical trials for gene therapies are driving demand for gene therapy segment. In 2020, in the first three quarters, gene therapies attracted financing of over USD 12 billion globally, with around 370 clinical trials underway. Additionally, in mid-2022, approximately 2,000 gene therapies were in development, targeting several therapeutic areas, such as neurological, cancer, cardiovascular, blood, and infectious diseases.

The cell therapy segment is expected to show lucrative growth over the forecast period. The field of cellular therapeutics is constantly advancing with inclusion of new cell types, which, in turn, provides ample opportunities for companies to enhance their market positions. Furthermore, the market is attracting new entrants due to high unmet demand for cell therapy manufacturing, the recent approval of advanced therapies, and proven effectiveness of these products.

Indication Insights

The oncology segment accounted for the largest revenue share in 2023. The segment’s dominance is attributed to disease burden, strategic initiatives undertaken by key players, and availability of advanced therapies used for treating various cancer indications. In January 2021, around 18,000 to 19,000 patients and 124,000 patients were estimated to be potential patients for treating cancer using cell & gene therapy products Kymriah (Novartis AG) and Yescarta (Gilead Sciences, Inc.), respectively. Furthermore, a publication on PubMed reports that as of the conclusion of the first quarter of 2023, there have been over 100 distinct gene, cell, and RNA therapies approved globally, along with an additional 3,700-plus in various stages of clinical and preclinical development.

The cardiology segment is estimated to register the fastest CAGR over the forecast period. This is attributed to the increasing prevalence of cardiovascular diseases and research collaboration for development of advanced therapies. For instance, in October 2023, Cleveland Clinic administered a novel gene therapy to the first patient globally as part of a clinical trial, aiming to deliver a functional gene to combat the primary cause of hypertrophic cardiomyopathy (HCM). Similarly, in February 2021, Trizell GmbH entered into partnership with Catalent, Inc. for development of phase 1 cell therapy to treat micro- and macroangiopathy. Trizell's medication is an Advanced Therapy Medicinal Product (ATMP) that employs regulatory macrophages—a platform technology developed in Germany.

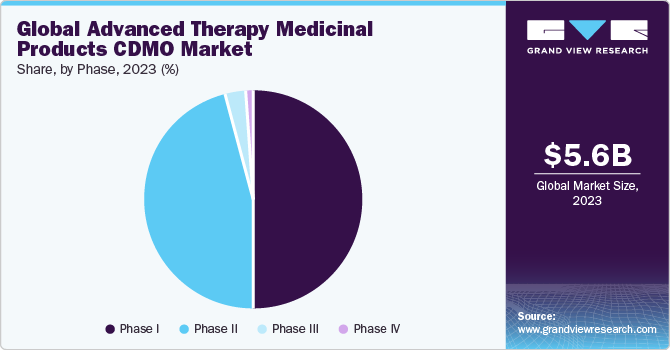

Phase Insights

The phase I segment dominated the market in 2023due to growing R&D activities and increasing number of human trials for advanced therapies. Phase 1 helps ensure the safety levels of a drug at different doses and dosage forms administered to a small number of patients. This phase is mainly conducted to determine the highest dose a patient can take without any adverse effects. Around 70% of drugs in phase 1 move to the next phase.

The phase II segment has been anticipated to show lucrative growth over the forecast period.Phase II clinical studies comprise the largest number of developing ATMPs, due to the high clearance rate of phase I clinical studies. According to data published by Alliance for Regenerative Medicine, as of June 2022, more than 2,093 clinical trials are ongoing globally, out of which 1,117 are under phase II clinical trials accounting for 53%. Thus, the increase in number of products in phase II is driving the segment.

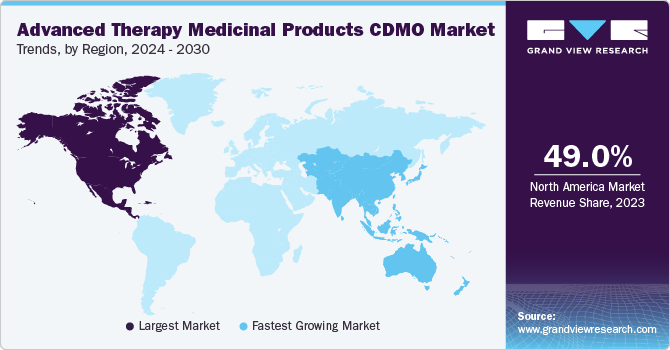

Regional Insights

North America dominated the overall market share of 49.0% in 2023. This can be attributed to increasing outsourcing activities and rising awareness about advanced therapy. North America has consistently been a leader in R&D for advanced treatments, and it is anticipated that it will keep this position during the forecast period. Recent approvals of products such as Kymriah and Yescarta have propelled investments in the regional market. Moreover, in March 2021, the U.S. FDA approved Abecma, the first approval of CAR-T cells to fight against cancer. Similarly, in December 2023, Casgevy and Lyfgenia, the initial cell-based gene therapies for sickle cell disease (SCD) in patients aged 12 and above, received approval from the U.S. Food and Drug Administration, marking a significant milestone.

The U.S. accounted for the largest share of the global market in the North America region in 2023. The U.S. maintains dominance in this sector due to the presence of a robust and highly advanced biopharmaceutical industry with a considerable focus on research and development. Additionally, the continuous presence of numerous pharmaceutical and biotechnology companies, along with academic and research institutions, generates a sustained demand for rigorous safety testing, further reinforcing the country's leadership in the field.

The Asia Pacific region is expected to grow at the fastest CAGR over the forecast period due to the increasing demand for novel ATMPs and rising R&D activities to develop novel therapies. Moreover, the market growth is driven by continuously expanding CDMO Cell Therapy in the country, a number of domestic players have collaborated with biotech companies from other countries involved in mesenchymal stem cell research and therapy development. In addition, in September 2022 Takara Bio, Inc. launched CDMO Cell Therapy for gene therapy products using siTCR technology for its genetically modified T-cell therapy products.

China accounted for the largest share of the global market in the Asia Pacific region in 2023 due to its strategic focus on advancing research and development capabilities, particularly in the pharmaceutical and biotechnology sectors. Additionally, with a rapidly growing biopharmaceutical industry and supportive government initiatives, China has become a key market for advanced therapy medicinal products (CDMO) market.

Key Companies & Market Share Insights

Some of the key players operating in the market include AGC Biologics,WuXi Advanced Therapies and Celonic

-

AGC Biologics offers a range of Cell Therapy for advanced therapy medicinal products (ATMPs), including gene and cell therapies.AGC Biologics specializes in the development and manufacturing of protein-based biologics and advanced therapies, including cell therapy, viral vectors, and mammalian and microbial cell therapy.

-

WuXi AppTec provides a comprehensive range of analytical testing Cell Therapy to characterize complex biologics, vaccines, and advanced therapies.

Minaris Regenerative Medicine and BlueReg are some of the emerging market players in the global market.

- Minaris Regenerative Medicine offers a wide range of cell types, manufacturing technologies, and procedures, analytical methods, and regulatory expertise.

Key Advanced Therapy Medicinal Products CDMO Companies:

- Celonic

- Bio Elpida

- CGT Catapult

- Rentschler Biopharma SE

- AGC Biologics

- Catalent

- Lonza

- WuXi Advanced Therapies

- BlueReg

- Minaris Regenerative Medicine

- Patheon

Recent Developments

-

In July 2023, The US FDA approved the Investigational New Drug (IND) application for NTLA-2001, marking the clearance for the first-ever CRISPR-based gene therapy designed for in vivo treatment of transthyretin (ATTR) amyloidosis with cardiomyopathy.

-

In December 2023, the US FDA granted approval for two gene-based treatments for sickle cell disease, marking a significant milestone. Notably, one of these therapies represents the first application of the gene-editing technique CRISPR in the treatment of the disease.

-

In February 2022, Recipharm AB completed the acquisition of Vibalogics. With this agreement, Recipharm will obtain expertise in biologics modalities, utilizing Vibalogics' capability in viral vaccines, oncolytic viruses, and viral vector gene treatments to deliver high level of diversification through several technologies and modalities.

-

In April 2022, Pfizer announced the opening of its unit for phase III trial of investigational gene therapy for patients with Duchenne muscular dystrophy.

Advanced Therapy Medicinal Products CDMO Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.6 billion

Revenue forecast in 2030

USD 18.8 billion

Growth rate

CAGR of 18.92% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, phase, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Celonic; Bio Elpida; CGT Catapult; Rentschler Biopharma SE; AGC Biologics; Catalent; Lonza; WuXi Advanced Therapies; BlueReg; Minaris Regenerative Medicine; Patheon

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Therapy Medicinal Products CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global advanced therapy medicinal products CDMO market report based on product, phase, indication, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gene Therapy

-

Cell Therapy

-

Tissue Engineered

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Central nervous system

-

Musculoskeletal

-

Infectious disease

-

Dermatology

-

Endocrine, metabolic, genetic

-

Immunology & inflammation

-

Ophthalmology

-

Hematology

-

Gastroenterology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global advanced therapy medicinal products CDMO market size was estimated at USD 5.64 billion in 2023 and is expected to reach USD 6.6 billion in 2024.

b. The global advanced therapy medicinal products CDMO market is expected to grow at a compound annual growth rate of 18.92% from 2024 to 2030 to reach USD 18.80 billion by 2030.

b. Gene therapy dominated the advanced therapy medicinal products CDMO market with a share of 49.2% in 2023. This is attributable to the fact of advancement in therapy as the treatment can alter and improve the genetics or specifically modify the targeted therapeutical treatment.

b. Some key players operating in the advanced therapy medicinal products CDMO market include Celonic, Bio Elpida, CGT Catapult, Rentschler Biopharma SE, AGC Biologics, Catalent, Lonza, WuXi Advanced Therapies, BlueReg, Minaris Regenerative Medicine, Patheon

b. Key factors driving the advanced therapy medicinal products CDMO market growth include increasing prevalence of rare & life-threatening diseases, rising investment in R&D of advanced therapy medicinal products, and increasing outsourcing activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.