- Home

- »

- Advanced Interior Materials

- »

-

Aerospace Adhesives & Sealants Market Size Report, 2030GVR Report cover

![Aerospace Adhesives And Sealants Market Size, Share & Trends Report]()

Aerospace Adhesives And Sealants Market (2025 - 2030) Size, Share & Trends Analysis Report By Adhesive Resin (Epoxy, Polyurethane), By Sealants Resin (Polysulfide, Silicone), By Aircraft (Commercial, Military), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-755-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Adhesives And Sealants Market Summary

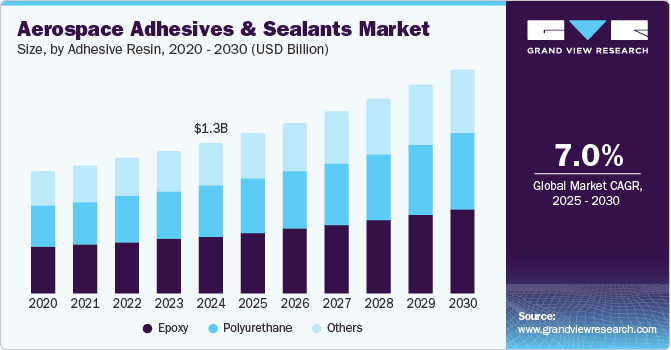

The global aerospace adhesives and sealants market size was estimated at USD 1,319.6 million in 2024 and is projected to reach USD 1,966.0 million by 2030, growing at a CAGR of 7.0% from 2025 to 2030. The aerospace adhesives & sealants market is primarily driven by a rising demand for lightweight and fuel-efficient aircraft.

Key Market Trends & Insights

- The North America dominated the market and accounted for 47.13% of global revenue in 2024.

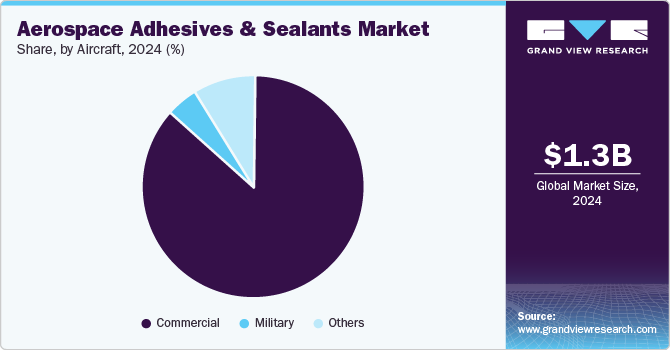

- Based on aircraft, the commercial aircraft segment accounted for volume share of more than 63.8% in the adhesives market in 2024.

- Based on resin, epoxy held the highest share in adhesive market in 2019 and accounted for a revenue share of more than 40.3% in 2024.

- Based on sealants resin, the polysulfide segment is expected to grow at fastest CAGR of 2.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,319.6 Million

- 2030 Projected Market Size: USD 1,966.0 Million

- CAGR (2025 to 2030): 7.0%

- North America: Largest market in 2024

As the aerospace industry seeks to improve fuel economy and reduce greenhouse gas emissions, there is a significant shift toward using lightweight materials, such as composites and aluminum alloys. Adhesives and sealants play a crucial role in these applications, as they provide strong bonding solutions while reducing the need for fasteners and heavy materials, which would otherwise add weight to the aircraft. The need for durable, high-strength bonding solutions that perform under extreme temperatures and pressure conditions further drives the adoption of advanced aerospace adhesives and sealants.

Technological advancements in adhesive and sealant formulations also contribute to market growth. Innovations in epoxy, polyurethane, and silicone-based adhesives have improved their compatibility with various substrates and enhanced their resistance to environmental factors such as UV radiation, moisture, and chemicals. This is particularly crucial in aerospace applications, where structural integrity and safety are paramount. In addition, government and regulatory bodies worldwide are imposing strict safety and performance standards for aerospace materials, which further increases the need for high-performance adhesives and sealants that meet these criteria.

The expansion of the global aerospace industry, fueled by increasing air travel, defense spending, and space exploration initiatives, also drives the demand for aerospace adhesives and sealants. Emerging economies, particularly in Asia Pacific and the Middle East, are investing heavily in commercial and military aviation, which is expected to boost the market. As aircraft production scales up, manufacturers rely on adhesives and sealants to streamline production processes, improve assembly efficiency, and ensure long-term durability in harsh flight conditions, further amplifying their demand in the market.

Aircraft Insights

The commercial aircraft segment accounted for volume share of more than 63.8% in the adhesives market in 2024. The growth in the aerospace adhesives & sealants market within the commercial aircraft segment is driven by increasing global air travel demand, particularly in emerging economies in Asia Pacific and the Middle East. As these regions experience rapid economic growth, there is a substantial rise in passenger traffic and business travel, leading to an expansion of commercial airline fleets. Airlines are investing in new aircraft to accommodate this demand, driving a need for high-performance adhesives and sealants that support modern assembly and maintenance practices while enhancing fuel efficiency and structural integrity. In addition, a growing focus on fuel efficiency and reducing carbon emissions has led manufacturers to incorporate lightweight materials, such as composites, in aircraft structures. Advanced adhesives and sealants are essential in joining these materials, providing strong bonding solutions while avoiding the weight penalties associated with traditional fasteners.

The military aircraft segment is expected to grow at fastest CAGR over the forecast period. The integration of stealth and advanced electronic systems in modern military aircraft is a significant driver for adhesives and sealants. These aircraft often incorporate radar-absorbing materials and sophisticated electronics that require specialized adhesives for assembly and protection against electromagnetic interference. Advanced sealants also play a crucial role in enhancing the durability and performance of these systems by protecting sensitive components from environmental exposure and ensuring seamless stealth characteristics. As military aircraft design evolves, demand for highly specialized adhesives and sealants that can support these advanced technologies continues to grow.

Resin Insights

Epoxy held the highest share in adhesive market in 2019 and accounted for a revenue share of more than 40.3% in 2024. In the aerospace adhesives & sealants market, epoxy resins play a crucial role due to their superior mechanical strength, adhesion properties, and resistance to high temperatures, making them a top choice for bonding in structural applications. The growing demand for lightweight, fuel-efficient aircraft has intensified the need for high-performance materials like epoxy-based adhesives and sealants, which contribute to weight reduction by eliminating or reducing the reliance on metal fasteners. Epoxy resins are particularly valued for their ability to form strong bonds with composite materials, which are increasingly used in modern aircraft construction due to their lightweight and high-strength properties.

The polyurethane segment is expected to grow significantly at CAGR of 7.4% over the forecast period. Polyurethane adhesives and sealants are increasingly popular in the aerospace industry due to their high flexibility, strong bonding capabilities, and excellent resistance to impact and vibration. Polyurethane’s ability to withstand harsh environmental conditions, such as extreme temperature variations and exposure to moisture, makes it ideal for applications in areas like aircraft interiors and external airframe components. This material also offers superior bonding to diverse surfaces such as metals, composites, and plastics, which are frequently used in modern aircraft. The demand for polyurethane adhesives is further driven by the need for noise and vibration reduction in aircraft, as these adhesives contribute to quieter cabin experiences by absorbing sound and shock.

Sealants Resin Insights

Silicone held the highest share in adhesive market in 2024. A primary driver for silicone sealants is their exceptional thermal stability and resistance to extreme temperatures, which are essential in the aerospace industry where materials must perform consistently under challenging conditions. Silicone sealants can withstand high heat and cold, making them particularly suitable for exterior applications and components exposed to varying atmospheric pressures and temperatures during flight. This reliability in extreme environments drives the demand for silicone-based sealants as aerospace manufacturers prioritize safety and durability.

The polysulfide segment is expected to grow at fastest CAGR of 2.9% over the forecast period. Polysulfide sealants are a key component in the aerospace adhesives & sealants market, driven by their unique properties suited to the rigorous demands of aerospace applications. Polysulfide resins are known for their exceptional resistance to chemicals, fuels, and solvents, making them ideal for applications in fuel tanks and other critical aircraft areas exposed to harsh chemicals. The ability of polysulfide sealants to maintain flexibility and adhesion under extreme temperature variations ensures that they perform reliably in environments where other materials might degrade, driving their demand in aerospace manufacturing and maintenance.

Regional Insights

North America dominated the market and accounted for 47.13% of global revenue in 2024. Technological advancements in adhesive formulations, including innovations in epoxy, silicone, and polyurethane-based products, drive demand as they offer enhanced performance and versatility. These new formulations allow adhesives to perform effectively in varying temperatures, pressure changes, and exposure to chemicals. The ongoing focus on research and development in the U.S., supported by funding from both government and private sectors, accelerates advancements in adhesive and sealant technologies. This environment of continuous innovation and regulatory support makes North America a significant and resilient market for aerospace adhesives and sealants.

U.S. Aerospace Adhesives And Sealants Market

The U.S. Aerospace adhesives & sealants market is driven by the country's robust aerospace and defense sector. The U.S. is home to some of the largest aerospace manufacturers globally, including Boeing, Lockheed Martin, and Northrop Grumman, which contributes significantly to the demand for high-performance adhesives and sealants. These companies rely on advanced bonding solutions to ensure structural integrity and durability while meeting stringent safety and quality standards mandated by regulatory bodies such as the Federal Aviation Administration (FAA). As these companies expand production to meet rising demand in both commercial and defense segments, the need for adhesives and sealants that meet critical performance requirements has increased.

Middle East & Africa Aerospace Adhesives And Sealants Market

The Aerospace adhesives & sealants market in the Middle East & Africa is primarily driven by the region’s increasing investments in aerospace infrastructure, defense, and commercial aviation. Countries such as the UAE and Saudi Arabia are heavily investing in modernizing their air fleets, both for commercial airlines and defense purposes. As part of their efforts to reduce reliance on imported products and boost local manufacturing capabilities, governments in this region are fostering the growth of a domestic aerospace industry. This shift is increasing demand for locally sourced adhesives and sealants, especially those that meet the rigorous standards required for aircraft maintenance, repair, and overhaul (MRO).

Asia Pacific Aerospace Adhesives And Sealants Market

The Aerospace adhesives & sealants market in the Asia Pacific region is driven by rapid growth in the aerospace sector, particularly in emerging economies like China, India, and Southeast Asia. With rising passenger demand, low-cost airlines are expanding, leading to increased aircraft production and maintenance activities. This drives the need for high-performance adhesives and sealants that can withstand the harsh operational conditions in aerospace applications. Many countries in the region are investing in developing domestic aerospace manufacturing capabilities, which is further fueling demand for these materials as they seek to produce reliable, efficient aircraft locally.

The rapid growth in air travel demand within China has led to increased production of commercial aircraft and the expansion of the country’s maintenance, repair, and overhaul (MRO) sector. This has boosted the market for aerospace adhesives and sealants, as these materials are critical in maintaining the structural integrity and safety of aircraft. Moreover, as China seeks to reduce its reliance on imported aerospace components, there is a strong push to develop locally sourced, high-quality adhesives and sealants, contributing to the market’s growth as domestic suppliers increase their production capacities and technological capabilities.

Europe Aerospace Adhesives And Sealants Market

One of the primary drivers is the increasing focus on sustainable aviation practices within the European Union. With stringent regulations aimed at reducing carbon emissions and enhancing fuel efficiency, the aerospace industry is compelled to adopt lightweight materials and innovative manufacturing processes. Adhesives and sealants are crucial in enabling the use of composite materials, which are lighter than traditional metals, thus contributing to overall weight reduction in aircraft.

Key Aerospace Adhesives And Sealants Company Insights

Some of the key players operating in the market include Henkel AG, 3M, PPG Industries

-

Henkel provides a range of products focused on meeting the specific needs of the industry. Their offerings include structural adhesives, such as epoxy and polyurethane-based formulations, which are designed for strong bonding in various aerospace applications. In addition, Henkel supplies sealants that provide effective sealing solutions to ensure airtight and watertight conditions. The company also offers specialty products for surface preparation and repair, catering to the requirements of manufacturers and maintenance operations within the aerospace sector.

-

3M is a diversified technology and manufacturing company, 3M has established itself as a leading provider of aerospace adhesives and sealants that meet stringent performance standards and regulatory requirements. The company's product offerings in the aerospace sector include a wide range of high-performance adhesives, sealants, and bonding agents designed for applications such as structural bonding, surface protection, and insulation. Notable products include 3M Scotch-Weld structural adhesives, 3M Adhesive Sealants, and 3M VHB tape, which are engineered to deliver exceptional strength, durability, and resistance to environmental factors, ensuring reliability and safety in various aerospace applications.

Key Aerospace Adhesives And Sealants Companies:

The following are the leading companies in the aerospace adhesives and sealants market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- 3M

- Huntsman International LLC

- PPG Industries, Inc.

- Solvay

- Bostik

- DuPont

- Hexcel Corporation

- Dow

Aerospace Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,404.6 million

Revenue forecast in 2030

USD 1,966.0 million

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

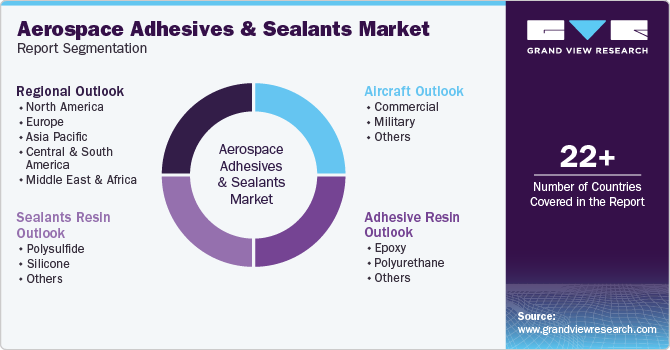

Segments covered

Resin, aircraft, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil

Key companies profiled

Henkel AG; 3M; PPG Industries; Huntsman Corporation; Cytec-Solvay; H.B. Fuller; Bostic; Hexcel Corporation; Dow; Master Bond

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Adhesives And Sealants Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aerospace adhesives and sealants market on the basis of resin, aircraft, and region

-

Adhesive Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethane

-

Others

-

-

Sealants Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polysulfide

-

Silicone

-

Others

-

-

Aircraft Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Military

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The aerospace adhesives & sealants market size was estimated at USD 1.319.6 million in 2024 and is expected to register a growth of 7.0% in terms of revenue over the forecast period.

b. The commercial aircraft segment accounted for volume share of more than 50.0% in adhesives market in 2024. The growth in the aerospace adhesives & sealants market within the commercial aircraft segment is driven by increasing global air travel demand, particularly in emerging economies in Asia-Pacific and the Middle East.

b. Some key players operating in the aerospace adhesives & sealants market include Henkel AG, 3M, PPG Industries.

b. The aerospace adhesives & sealants market is primarily driven by a rising demand for lightweight and fuel-efficient aircraft.

b. The global aerospace adhesives & sealants market size was estimated at USD 1319.6 million in 2024 and is expected to reach USD 1404.5 million in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.