- Home

- »

- Healthcare IT

- »

-

Africa Digital Health Market Size And Share Report, 2030GVR Report cover

![Africa Digital Health Market Size, Share & Trends Report]()

Africa Digital Health Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Tele-Healthcare, mHealth), By Component (Hardware, Software), By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-201-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Africa Digital Health Market Size & Trends

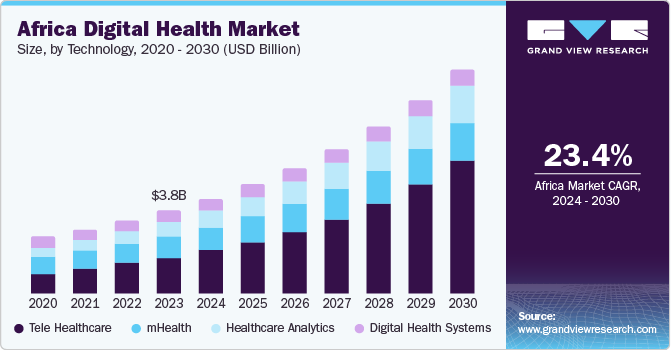

The Africa digital health market size was valued at USD 3.8 billion in 2023 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 23.4% from 2024 to 2030. The increasing need to decrease the burden on the region's healthcare system and the development of digital health technologies to diagnose, monitor, and treat health conditions remotely are expected to drive the growth of the market over the forecast period. According to World Bank data, the physician-to-patient ratio of Nigeria was 0.4 per 1,000 patients in 2021, which is below the World Health Organization (WHO) prescribed ratio. This lack of healthcare professionals is expected to fuel the demand for digital health solutions in Africa.

Several challenges faced by the healthcare system, including a shortage of skilled doctors and nurses and lack of access to healthcare services, are creating opportunities for the Africa digital health industry and are expected to fuel the market growth. The lesser access to healthcare services has been a major challenge faced in the African region. For instance, according to an article published by the United Nations Development Programme in May 2020, around 408.6 million people in the sub-Saharan African region did not have access to healthcare services. Digital health can help solve this healthcare access issue in the region and thus is expected to witness demand in the coming years.

Africa is one of the most disease-affected regions in the world. The limited healthcare infrastructure and the limited awareness about the diseases have contributed to the rising prevalence of diseases such as non-communicable diseases in the region. For instance, according to the WHO, the mortality rate due to non-communicable diseases such as cancer, diabetes, and cardiovascular diseases has increased significantly from 24% in 2000 to 37% in 2019. This prevalence of non-communicable diseases is contributing to the rising premature deaths in the region. Digital health can assist in the management of diseases and thus is expected to witness growth over the forecast period.

Moreover, the treatment and healthcare facility visit costs are restricting access to healthcare services to the lower-income class of the region. According to the Economic Development in Africa Report 2021, it was estimated that approximately 490 million people in Africa were living under the poverty line in 2021. The low income restricts access to healthcare services to a major chunk of the population in the region.

The region has also witnessed a rise in people's access to smartphone technology and internet services. According to the GSM Association, approximately 30 million new mobile internet service users were added in Sub-Saharan Africa in 2022. Moreover, the cost of using the internet has decreased significantly in the region, which is further increasing the affordability of internet services to smartphone users in the region. This increasing number of internet users and the growing affordability of the internet are expected to offer growth opportunities for the digital health market in the region.

Market Concentration & Characteristics

The Africa digital health market growth stage is high, and the pace of the market growth is accelerating. The African digital health market is characterized by a high degree of innovation owing to the growing demand and penetration of mobile phones and internet services in the region that are allowing healthcare professionals to develop technologies such as wearable devices and trackers that monitor the health condition of users.

The market is characterized by a medium level of merger and acquisition (M&A) activity by the market players. This is due to the opportunities being offered by the untapped markets in the region and the rise of several startups providing different digital health services in the region.

The regulatory framework offers both opportunities and challenges for the Africa digital health industry. The regulatory framework differs from country to country in Africa, which becomes challenging for the market players. Meanwhile, adopting data privacy and security regulations builds users' trust and ensures data safety.

There are a limited number of direct product substitutes to the market as the region lacks healthcare resources. However, developing the region’s healthcare infrastructure and increasing investments in the healthcare sector can offer a substitute for the market products.

End-user concentration is a significant factor in the market as there is a wide range of end-users that opt for digital health platforms. The increasing number of patients as well as providers with the increasing concentration of digital technologies is offering several opportunities for companies.

Technology Insights

Tele-healthcare dominated the market with a share of 43.2% in 2023 owing to technological advancements and a shortage of healthcare professionals. The development of digital health solutions to improve patient outcomes and treatment effectiveness is contributing to the growth of the segment. For instance, in November 2023, Vodafone launched two digital health systems in South Africa. The Assisted Reality Medico-Legal Surveillance System (ARMSS) offers voice-enabled and hands-free documentation of medical procedures and the Computer-Aided Dispatch (CAD) System can be used to monitor ambulance requests when a call is received till the patient reaches the hospital. The development of such technologies is contributing to the rising demand for tele-healthcare segment.

The healthcare analytics segment is also anticipated to witness significant growth over the forecast period owing to the rising demand for personalized medicine and the benefits of healthcare analytics. Healthcare analytics offer several advantages, such as early disease detection, better patient outcomes, and better decision-making that increase the overall accuracy and efficiency of the treatment. Moreover, the ability to measure a patient’s risk of developing a disease can streamline the treatment process and contribute to decreasing the burden on healthcare facilities.

Application Insights

The diabetes segment accounted for the largest market revenue share in 2023 and is expected to witness the fastest CAGR over the forecast period owing to the growing prevalence of diabetes in the African region. For instance, according to the WHO Africa, the number of people living with diabetes is expected to increase by 129% from 24 million in 2022 to 55 million in 2045. This rising prevalence of diabetes is a major concern for African countries and is driving the attention of several organizations through different initiatives. For instance, in November 2022, the University of Pretoria (UP) along with Aviro Health, launched the Aviro Pocket Clinic app. The app was developed to assist type 2 diabetes patients in registration and scheduling home visits for insulin initiation. These increasing initiatives to counter the rising prevalence of diabetes are driving the segment growth.

The obesity segment is also expected to witness significant growth during the forecast period. According to the World Obesity Atlas 2023, obesity in girls in the Sub-Saharan African region is expected to increase from 5% to 14% from 2020 to 2035. Similarly, the prevalence of obesity in women is expected to increase from 18% to 31% in the same period. Moreover, the increasing support for fitness apps that assist weight management, track physical activities and calorie intake, and suggest potential solutions are further contributing to the segment growth. For instance, according to Disrupt Africa, a Tanzanian startup, OnilBox became the country’s largest fitness technology platform within one year of its launch in April 2021. The app allows its users to track health, fitness, and data trends.

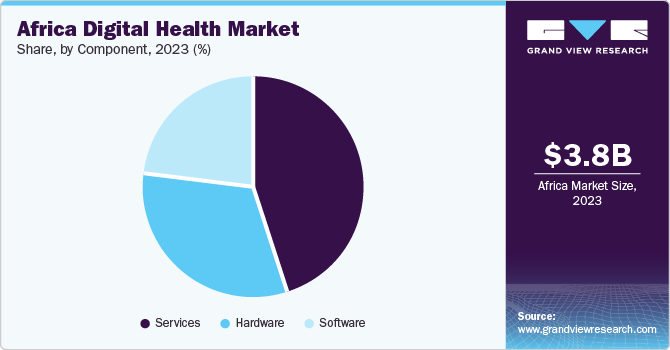

Component Insights

The services segment accounted for the largest market share in 2023. The increasing penetration of digital health providers in the region, owing to the competitive rivalry between the market players to capture the larger market share of digital health services in the region, is contributing to the segment growth. For instance, in August 2023, Utopian Health Services partnered with smart remote patient monitoring technology provider Clinitouch to improve patient outcomes in Nigeria. This partnership was aimed at keeping the companies at the forefront of the evolving landscape of Nigeria's remote patient monitoring. This increasing number of service providers is expected to drive the segment growth.

The software segment is expected to grow at the fastest CAGR over the forecast period about the rising investments and government initiatives to promote digital health platforms in Africa. The growth opportunities offered by Africa’s digital health market attract several new players and investments in the market. This is leading to the rise in demand for software for app development, data storage, creating user interfaces, and other purposes. Moreover, the increasing government initiatives to promote digital health platforms are further driving the segment growth. For instance, in August 2020, the Ethiopian Ministry of Health (MOH) launched the Digital Health Innovation and Learning Center (DHILC) to support the use of digital technology in the country’s healthcare sector. This center allows healthcare professionals to scale up innovation by designing and validating digital health tools.

End Use Insights

The patients segment dominated the market in 2023 and is expected to grow at the fastest CAGR over the forecast period owing to the increased smartphone penetration, cost-effectiveness and affordability of digital health over traditional healthcare alternatives. The online consultation and services are cheaper than the in-facility check-ups and treatment. Moreover, digital healthcare platforms offer opportunities for patients to get the best quality care from healthcare professionals, with one-on-one consultation as well. For instance, in October 2020, Myclinic.ng mobile app was launched in Africa. This app provided a platform for anyone in Africa to consult a doctor and get professional consultation, regardless of their location.

The providers segment is also anticipated to witness significant growth owing to the improved decision-making offered by digital health platforms by clear communication between patients and healthcare providers. Moreover, the development of technologies such as wearable devices and mHealth apps has increased the accuracy of patient health monitoring owing to the access to patients' health data, which is further pushing the use of digital health solutions for providers.

Key Africa Digital Health Company Insights

Some of the key players operating in the market include Helium Health, mPharma, Yodawy Wella Health, and Healthtracka.

-

Helium Health aims to transform healthcare using technology and innovation. It offers an electronic medical record/hospital management information system (EMR/HMIS) for patients and healthcare providers.

-

mPharma aims to spread good health across Africa by providing quality pharmaceuticals to patients at reduced cost through its online pharmacy platform. Moreover, the company’s digital platform MyMutti, allows patients to consult doctors directly and track health data.

TIBU Health, DrugStoc, DabaDoc are some of the other market participants in the Africa digital health market.

-

TIBU Health is an omnichannel health service-delivering company that aims to offer high-quality healthcare services to people with advanced technologies. The company's virtual team ensures that the patient gets appropriate care whenever needed.

-

DrugStoc combines technology with its product knowledge, financial solutions and supply chain innovation to increase access to medication in emerging economies. The company partners with consumer health & pharmaceutical companies to reach hospitals, clinics, retailers, pharmacies, etc.

Key Africa Digital Health Companies:

The following are the leading companies in the Africa digital health market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Africa digital health companies are analyzed to map the supply network.

- HeliumHealth

- mPharma

- Yodawy

- WellaHealth

- Healthtracka

- TIBU Health

- DrugStoc

- DabaDoc

- MediBuddy

- BroadReach Group

- HealthDart pty ltd.

- Hello Doctor

Recent Developments

-

In September 2023, Mobicel South Africa announced a partnership with Eagle Intelligent Health to connect skilled doctors with individuals who need healthcare in South Africa. This partnership will allow users of the Eagle Intelligent Health app to get virtually in touch with doctors preloaded on Mobicel phones as a utility app.

-

In May 2023, MediBuddy launched Eagle Intelligent Health, a telehealth app in South Africa. This app allows the individual who needs healthcare services to connect with the healthcare specialist and local skilled doctors regardless of their locations.

-

In May 2023, the Nigerian Communications Satellite Limited (NIGCOMSAT) launched NIGCOMHEALTH in Nigeria, a digital healthcare platform with the collaboration of Ethnomet and Sawtrax. NIGCOMHEALTH allows users to book appointments with healthcare professionals, seek medical advice and get consultations virtually regardless of their location.

Africa Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.8 billion

Revenue forecast in 2030

USD 16.6 billion

Growth rate

CAGR of 23.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end use

Key companies profiled

HeliumHealth; mPharma; Yodawy; WellaHealth; Healthtracka; TIBU Health; DrugStoc; DabaDoc; MediBuddy; BroadReach Group; HealthDart pty ltd.; Hello Doctor

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Digital Health Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Africa digital health market report based on technology, component, application, and end use.

-

Technology Outlook (Revenue in USD Million, 2018 - 2030)

-

Tele Healthcare

-

Tele-care

-

Actively Monitoring

-

Remote Medication Management

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

mHealth

-

Wearables

-

BP Monitors (type)

-

Glucose Meters

-

Pulse Oximeters

-

Sleep Apnea Monitors (PSG)

-

Neurological Monitors

-

Activity Trackers/ Actigraphs

-

-

mHealth Apps

-

Medical Apps

-

Fitness Apps

-

-

Services

-

Services, by Type

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management and Post-acute Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

Services, by Participant

-

Mobile Operators

-

Device Vendors

-

Content Players

-

Healthcare Providers

-

-

-

-

Healthcare Analytics

-

Digital Health Systems

-

EHR

-

E-prescribing systems

-

-

-

Component Outlook (Revenue in USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Others

-

-

End Use Outlook (Revenue in USD Million; 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

Frequently Asked Questions About This Report

b. The Africa digital health market size was estimated at USD 3.8 billion in 2023 and is expected to reach USD 4.69 billion in 2024.

b. The Africa digital health market is expected to grow at a compound annual growth rate (CAGR) of 23.4% from 2024 to 2030 to reach USD 16.6 billion by 2030.

b. The tele-healthcare segment dominated the market with the largest market share of 43.2% in 2023. This high share is attributable to development of digital health solutions to improve patient outcomes and treatment effectiveness in the region.

b. Some key players operating in the Africa digital health include IQVIA Inc.; HeliumHealth; mPharma; Yodawy; Healthtracka; TIBU Health; DrugStoc; DabaDoc; MediBuddy; BroadReach Group; and HealthDart pty ltd.; among others.

b. Key factors driving the market growth include the rising need to decrease the burden on the region’s healthcare system, growing smartphone and internet penetration in the region, and the development of digital health technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.