- Home

- »

- Agrochemicals & Fertilizers

- »

-

Agricultural Adjuvants Market Size And Share Report, 2030GVR Report cover

![Agricultural Adjuvants Market Size, Share & Trends Report]()

Agricultural Adjuvants Market Size, Share & Trends Analysis Report By Product (Activator Adjuvant, Utility Adjuvant), By Application (Herbicides, Insecticides), By Source, By Formulation, By Type By Crop, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-903-5

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Agricultural Adjuvants Market Size & Trends

The global agricultural adjuvants market size was estimated at USD 3.80 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.7 % from 2024 to 2030. The growth of the product market is attributed to the rise in demand for crop protection products in agricultural fields across the globe. Approximately 25% of the world’s crop output is lost every year due to diseases and attacks by pests and weeds. Crop protection chemicals play a vital role in protecting crops and enhancing crop yield and production. Pesticide consumption is also expected to drive market growth, as the majority of adjuvants are used in pesticides.

According to the Food and Agriculture Organization (FAO), global pesticide consumption was 4.2 million tons in 2019, an increase of 11.6% from 2009. Pesticide consumption has increased by 436 thousand tons over the last decade. Furthermore, total traded quantities of pesticides increased by around 30% in 2020, with America importing most pesticides worth USD 6.9 million. Thus, the global increase in pesticide consumption is in turn boosting demand for agricultural adjuvants. However, major restraining factors for market growth are different regulations regarding use of agricultural adjuvants by various authorities around the world.

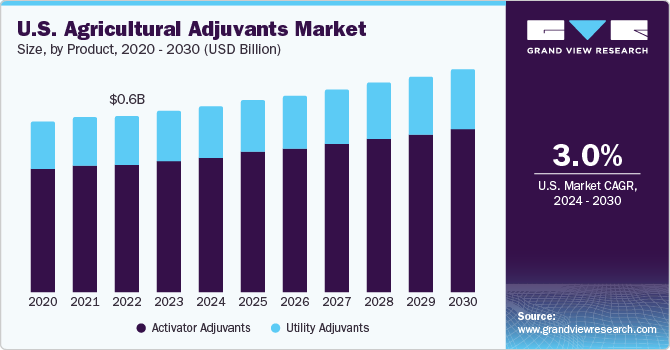

In Brazil, until 2017, adjuvant regulation was the same as agrichemical regulation (Law 7,802 regulated by Decree 4,074). After 2017, the Ministry of Agriculture, Livestock, and Supply (MAPA) in Brazil undertook regulation of agricultural adjuvants. In addition, adjuvants in Canada are regulated by the Pest Management Regulatory Agency (PMRA), which ensures each adjuvant is properly tested and proven effective and safe with every active ingredient with which it is to be used. Thus, all these stringent regulations are acting as a restraining factor in the growth of the market. The U.S. is the largest consumer of product in North America with a revenue share of 69.3% in 2023.

This is attributed to the fact that the U.S. is one of the top ten food-producing countries in the world, with significant production of maize, soybean, sorghum, blueberry, soybean, and almond. This, in turn, fuels the expansion of the market in the country. Moreover, the presence of some key product manufacturers in the U.S. has a significant impact on the market growth in the country. It decreases the dependency of the U.S. on other countries for importing agrochemicals. Farmers and companies operating in the agriculture sector of the U.S. can directly order agrochemicals within their domestic market. Thus, driving product demand in the country.

Market Dynamics

Due to population explosion, farmers are required to produce more food grains in a short span of time. Also, the sizes of arable lands have shrunk due to growing population, urbanization, and industrialization, further increasing pressure on farmers to produce more on less available land. This is a huge concern for agriculture-based economies in the world, such as India, which is highly dependent on agriculture and related activities. Thus, farmers resort to using agricultural adjuvants, and fertilizers in order to increase yield in a short span of time.

Pesticide consumption is expected to drive the market for adjuvants, as the majority of adjuvants are used in pesticides. According to the Food and Agriculture Organization (FAO), global pesticide consumption was 4.2 million tons in 2019, an increase of 11.6% from 2009. Pesticide consumption has risen by 436 thousand tons over the last decade. Furthermore, according to the FAO, total traded quantities of pesticides increased by around 30% in 2020, with America importing the most pesticides worth USD 6.9 million. The global increase in pesticide consumption is increasing demand for agricultural adjuvants.

Product Insight

The activator adjuvants product segment dominated the market with a revenue share of around 70.0% in 2023. This growth is attributed to the fact that agrochemicals when applied with an activator adjuvant exhibit increased penetration and absorption rates, which helps them offer better control over insects, weeds, or diseases. Activator adjuvants are chemical products that help a crop protection product perform better. Herbicides, for instance, have the ability to enter and kill unwanted plants and weeds; however, when activator adjuvants are added to herbicides, herbicides enter weeds more readily.

The utility adjuvants segment is also expected to witness rapid growth over the forecast period. This growth is attributed to the increasing use of pesticides to limit the growth of various unwanted things in the cropland. There are various types of utility adjuvants based on their application. The segment includes compatibility agents, buffering agents, drift control agents, water conditioning agents, defoaming agents, deposition agents, and acidifying agents. Utility adjuvants are majorly non-pesticide product adjuvants that are tank-mixed in spray solution. Among utility adjuvants, compatibility agents are extensively used in the formulation of crop protection products.

Application Insight

The herbicides application segment is anticipated to dominate the global market with a revenue share of around 48% in 2023. This growth is attributed to the widespread use of herbicides, such as glyphosate and glufosinate, in crop production around the world. The insecticides segment is expected to witness the fastest growth over the forecast period. According to the Federation of Indian Chambers of Commerce and Industry (FICCI), insecticides account for the largest market share in Indian agrochemical market. This growth can be attributed to increasing product demand for various crops, such as cotton, paddy (rice crop), fruits, and vegetables.

They are found effective in preventing early germination pest attacks in various crops. Malathion is a commonly known organophosphate (OP) insecticide. It is mostly used in agricultural sector for a wide variety of food and crops to control various types of insects, such as Japanese beetles, aphids, and leafhoppers. Globally, increasing focus on prevention of pest attacks on crops is driving insecticide market growth, which, in turn, is expected to propel product demand.

Source Insight

Based on the source, the global industry has been further categorized into petroleum-based and bio-based segments. The petroleum-based source segment dominated the global market in 2023 and accounted for the highest share of overall revenue. These majorly include oil-based adjuvants. Common examples of these adjuvants are crop oils and crop oil concentrates. Crop oils have 95%–98% naphtha or paraffin-based petroleum oil and 1-2% surfactants.

Crop oil concentrates are made of 80-85% petroleum-based oil and 15-20% non-ionic surfactants. The bio-based source segment is expected to witness the fastest growth rate over the forecast period. These are the ones made from renewable and environment-friendly raw materials. They have more biodegradability and offer a higher safety level to humans than their petroleum-based counterparts.

Formulation Insight

Based on formulation, the market has been further categorized into oil-based and other formulations. The other formulations segment dominated the global market in 2023 and accounted for the highest share of 78.6% of the overall revenue. It includes surfactants and spray adjuvants. They enhance the performance of herbicides, insecticides, fungicides, fertilizers, etc. by increasing their surface contact, improving their leaf penetration, and reducing their runoff.

The oil-based formulations segment is projected to register a significant growth rate during the forecast period. Oil-based formulations can be further classified into crop oil concentrates, crop oils, and vegetable oil concentrates. They enable slow drying of crop protection products applied to plants, resulting in their improved absorption by plants, thereby making them highly effective in improving the yield of plants.

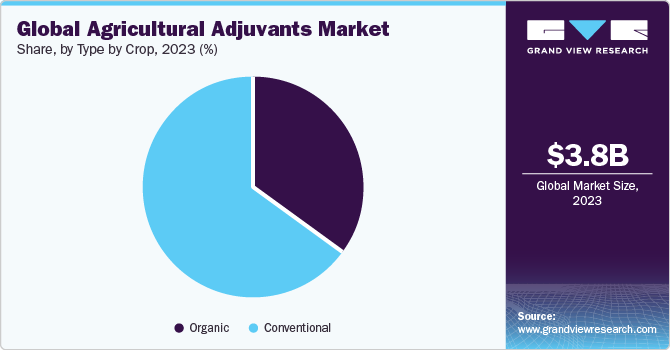

Type by Crop Insight

Based on type by crop, the global industry has been further categorized into conventional crops and organic crops. The conventional crops segment dominated the market in 2023 and accounted for a maximum share of over 65.0% of overall revenue. It includes additives used with insecticides, pesticides, herbicides, and fungicides to make them highly effective. They are either surfactants and polymers or chemical and petroleum-based additives.

They help improve the physical properties of pesticide and herbicide sprays for their even distribution on plants and their increased absorption by them. The organic crops segment is estimated to register the fastest growth rate during the forecast period. Oils are used for a wide range of applications in organic agriculture. Farmers use vegetable oils, such as soybean, sunflower, and rapeseed oil, as organic adjuvants with pesticides and fertilizers for adding hydrophobic material to them.

Regional Insights

Asia Pacific emerged as a dominating region with a revenue share of over 37% in 2023. This growth is attributed to the fact that Asia Pacific is the largest producer of agricultural commodities, accounting for 53% of the global agricultural product and fish output by 2030 according to the Organization for Economic Cooperation and Development and the FAO. China emerged as a major consumer of products in the region. This is due to the fact that China is one of the major exporters, consumers, and producers of pesticides, which is a major application of the product market. According to the University of Melbourne and Baojing Gu, a Zhejiang-based researcher, China is the world's largest agricultural pesticide consumer. It consumes approximately 30% of the global pesticides and fertilizers and meets around 90% of the global technical raw material requirements.

Europe will also witness significant growth over the forecast period. Crop production in some of countries has been declining in recent years. However, some European countries have shown positive growth in the production of a few crops. For example, according to a USDA report published in November 2021, total wheat production in Russia was 74.5 million metric tons, indicating an increase in country's wheat production. The market is primarily driven by the growing need to improve crop yield and production efficiency as a result of rising population and shrinking farmland. Thus, the region's increasing agricultural production and shrinking farming land are driving demand for crop protection chemicals, which, in turn, is driving product demand.

Key Companies & Market Share Insights

The market is highly competitive with the presence of a large number of independent small-scale and large-scale manufacturers and suppliers. While large-scale companies concentrate on innovation and product development, small-scale players primarily compete based on price. Players are entering into mergers and partnerships to establish their position in market. For instance, BASF acquired a range of businesses and assets from Bayer, a crop protection and agricultural products manufacturer.

This acquisition has enhanced BASF’s existing crop protection product line. Moreover, this acquisition has enabled company to enter seeds, nematicide seed treatments, and non-selective herbicides business. In 2022, Evonik Industries AG opened its applied technology center (ATC) in Brazil to develop additives for biopesticides and bioinoculants for its customers in the region. This ATC will help Evonik to strengthen its business line and performance in the agricultural business.

Key Agricultural Adjuvants Companies:

- Clariant AG

- Solvay SA

- The Dow Chemical Company

- Huntsman International LLC

- Evonik Industries AG

- Ingevity

- Nufarm Limited

- Corteva Agriscience

- Croda International PLC

- BASF SE

- Miller Chemical & Fertilizer, LLC.

- Helena Chemical Company

- Winfield United

- Wilbur-Ellis Holdings, Inc.

- Stepan Company

Agricultural Adjuvants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.97 billion

Revenue forecast in 2030

USD 5.25 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, source, formulation, type by crops, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Clariant AG; Solvay SA; The Dow Chemical Company; Huntsman International LLC; Evonik Industries AG; Ingevity; Nufarm Ltd.; Corteva Agriscience; Croda International PLC; BASF SE; Miller Chemical & Fertilizer, LLC; Helena Chemical Company; Winfield United; Wilbur-Ellis Holdings, Inc.; Stepan Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Adjuvants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural adjuvants market report based on product, application, source, formulation, type by crops, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Activator Adjuvants

-

Surfactants

-

Oil-based Adjuvants

-

-

Utility Adjuvants

-

Compatibility Agents

-

Drift Control Agents

-

Buffering Agents

-

Water Conditioning Agents

-

Others

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Herbicides

-

Insecticides

-

Fungicides

-

Others

-

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Petroleum-based

-

Bio-based

-

-

Formulation Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Oil-based

-

Others

-

-

Type by Crop Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Conventional

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global agricultural adjuvants market size was valued at USD 3.80 billion in 2023 and is expected to reach USD 3.97 billion in 2024.

b. The global agricultural adjuvants market is anticipated to grow at a compounded annual growth rate (CAGR) of 4.7% from 2024 to 2030 to reach USD 5.25 billion by 2030.

b. Asia Pacific dominated the agricultural adjuvants market and accounted for a 37.6% share of global revenue in 2023, This growth is attributed to the fact that Asia Pacific is the largest producer of agricultural commodities, accounting for 53% of global agricultural product and fish output by 2030 according to the Organization for Economic Cooperation and Development and FAO.

b. Some prominent players in the agricultural adjuvants market include Clariant AG, Solvay, The Dow Chemical Company, Huntsman International LLC., Evonik Industries AG, Ingevity, Nufarm Limited, Croda International PLC, BASF SE, Miller Chemical & Fertilizer, LLC., Helena Chemical Company, WinField United, Wilbur-Ellis Company LLC, Stepan Company.

b. The agricultural adjuvants market growth is expected to be driven by the growing demand for effective insecticides across the globe. Moreover, increasing pesticides utilization in agriculture to increase crop production and yield is also driving the demand for agricultural adjuvants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."