- Home

- »

- Next Generation Technologies

- »

-

AI Accelerator Market Size & Share, Industry Report, 2033GVR Report cover

![AI Accelerator Market Size, Share & Trends Report]()

AI Accelerator Market (2025 - 2033) Size, Share & Trends Analysis Report By AI Accelerator Types (Graphics Processing Units, Tensor Processing Units), By Technology Integration, By End-use (IT & Telecom, Healthcare, Automotive, Retails), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-449-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Accelerator Market Summary

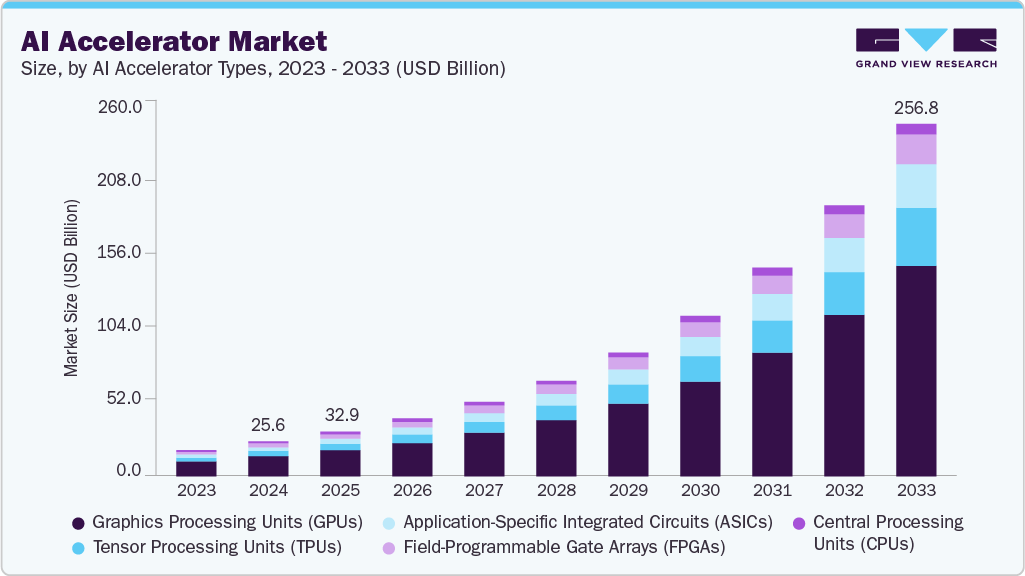

The global AI accelerator market size was estimated at USD 25.56 billion in 2024 and is projected to reach USD 256.84 billion by 2033, growing at a CAGR of 29.3% from 2025 to 2033. The market is growing rapidly, driven by a surge in demand for high-performance computing in artificial intelligence (AI) applications.

Key Market Trends & Insights

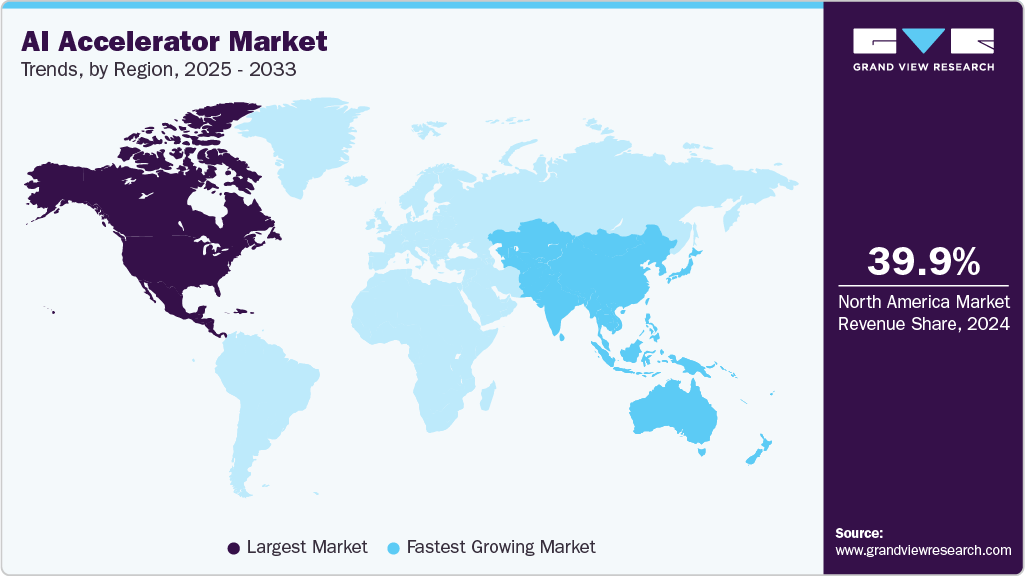

- North America dominated the global AI accelerator market with the largest revenue share of 39.9% in 2024.

- The AI accelerator market in the U.S. led the North America market and held the largest revenue share in 2024.

- By AI accelerator types, Graphics Processing Units (GPUs) segment led the market and held the largest revenue share of 58.4% in 2024.

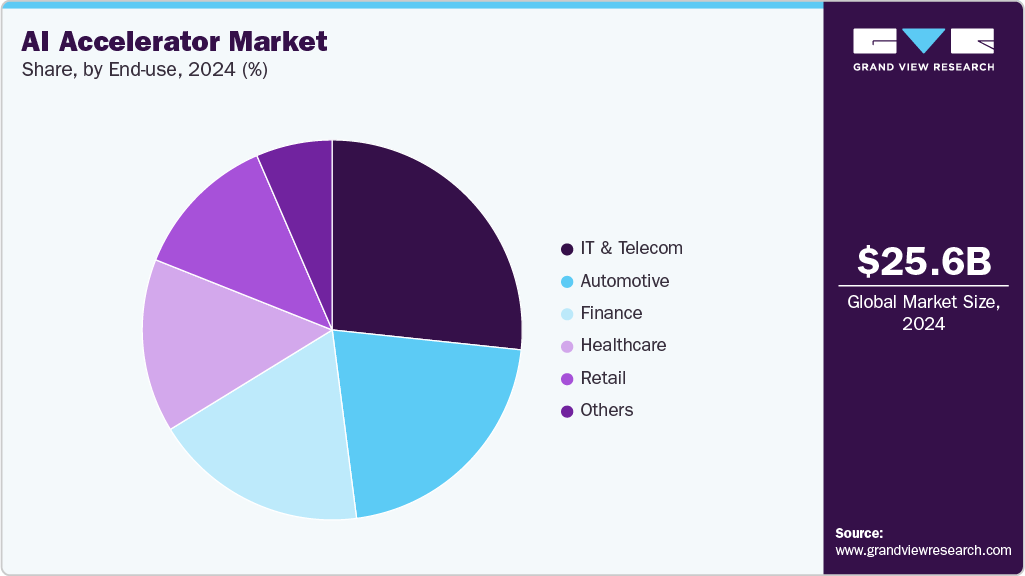

- By end-use, the IT & telecom segment held the dominant position in the market and accounted for the leading revenue share of 26.7% in 2024.

- By technology integration, the cloud-based AI accelerators segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.56 Billion

- 2033 Projected Market Size: USD 256.84 Billion

- CAGR (2025-2033): 29.3%

- North America: Largest market in 2024

As businesses and industries integrate AI for tasks like machine learning, predictive analytics, and real-time decision-making, there is a pressing need for specialized hardware that can handle these intensive computations efficiently. AI accelerators, such as Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), and Field-Programmable Gate Arrays (FPGAs), are becoming essential due to their superior processing capabilities compared to traditional CPUs. The expansion of AI applications across various sectors, including healthcare, automotive, and finance, has created a substantial market for these advanced accelerators. Companies are investing heavily in developing new and improved AI accelerator technologies to meet the growing demands. The increasing use of AI in everyday technology further propels the need for efficient and powerful computing solutions. As a result, the market is witnessing a significant uptrend in both growth and investment.Technological advancements are a key driver of market expansion. Leading technology companies such as NVIDIA Corporation, Google LLC, and Intel Corporation are at the forefront of innovation, continuously developing new generations of accelerators that offer enhanced performance and efficiency. These advancements are crucial for supporting complex AI tasks such as deep learning model training and real-time data processing. Moreover, the advent of edge computing is amplifying the demand for AI accelerators, as businesses seek to process data closer to its source to minimize latency and maximize efficiency. This shift fosters the development of edge-optimized accelerators, which complement traditional data center solutions. The growing complexity of AI applications necessitates the constant evolution of hardware to keep pace with increasing computational needs. Consequently, technological progress is driving substantial market growth.

The market is rapidly evolving, with major tech companies and innovative startups competing for dominance. Significant investments in AI research and development fuel innovation, leading to diverse accelerator solutions tailored for different applications and industries. This increased competition is accelerating technological advancements and broadening the range of available products, making AI accelerators more accessible. As AI technology becomes more integral to various sectors, the need for specialized hardware solutions continues to rise. The market's expansion is supported by increasing partnerships and collaborations to advance AI capabilities and optimize hardware performance. This dynamic environment indicates a robust market growth trajectory in the coming years. As AI becomes more ubiquitous, the role of accelerators in driving technological progress will only become more critical.

AI Accelerator Types Insights

The graphics processing units (GPUs) segment led the market revenue, accounting for 58.8% in 2024. This is due to their superior parallel processing capabilities, essential for handling the large-scale computations required for AI and deep learning tasks. Originally designed for rendering graphics, GPUs have proven highly effective for the matrix operations and tensor calculations common in machine learning. Their architecture allows them to perform thousands of simultaneous operations, making them ideal for training complex neural networks efficiently. Companies such as NVIDIA Corporation have further optimized GPUs with software and hardware customized specifically for AI, solidifying their leadership in the market. The broad adoption of GPUs across various industries for AI applications has established them as the primary choice for high-performance computing tasks.

Tensor processing units (TPUs) is predicted to foresee significant growth in the forecast period due to their design, which is specifically optimized for the tensor computations used in deep learning. Developed by Google LLC, TPUs offer high performance for training and inference tasks, providing significant speed and efficiency improvements over general-purpose processors. The integration of TPUs into Google Cloud services has driven their adoption by enterprises and researchers needing scalable AI solutions. As AI applications become more complex and data-intensive, TPUs are increasingly favored for efficiently handling large-scale computations. Continued innovation and the expanding availability of TPUs contribute to their growing presence and influence in the market.

Technology Integration Insights

The cloud-based AI accelerators segment accounted for the largest market revenue share in 2024. This is due to its scalability and flexibility in managing large-scale AI workloads. These solutions enable organizations to access powerful AI hardware without significant upfront investments, utilizing cloud infrastructure to handle computational demands. The ability to scale resources up or down based on needs makes cloud-based accelerators attractive to enterprises and researchers. The cost-effective pay-as-you-go model associated with cloud services further enhances their appeal. Major cloud providers, such as AWS, Google Cloud, and Microsoft Azure, have heavily invested in AI accelerators, cementing their dominance in the market.

Edge AI accelerators is predicted to foresee significant growth in the forecast period. The Edge AI Accelerators segment is growing rapidly due to the increasing need for real-time data processing at the source. These accelerators enable AI computations directly on devices like smartphones, IoT gadgets, and autonomous vehicles, minimizing latency and reducing bandwidth usage. This localized processing is essential for applications requiring immediate responses, such as real-time analytics and facial recognition. The rise of the Internet of Things (IoT) and advancements in edge computing technology are fueling this growth. Enhanced performance and efficiency in remote or mobile scenarios drive the demand for edge AI accelerators.

End-use Insights

The IT & telecom segment accounted for the largest market revenue share in 2024 due to its extensive use of AI for managing and optimizing network infrastructure and services. AI accelerators enhance the performance of data centers and cloud computing platforms, critical for telecommunications companies handling vast amounts of data. Moreover, telecom operators utilize AI for network management, predictive maintenance, and improving customer experiences, all of which require high-performance computing power that AI accelerators provide. The rapid growth of cloud-based services and the increasing complexity of IT infrastructures drive the demand for these specialized accelerators.

Automotive is projected to grow significantly over the forecast period due to the increasing integration of AI technologies in vehicles. AI accelerators enable advanced driver-assistance systems (ADAS), autonomous driving, and real-time vehicle-to-everything (V2X) communication. As vehicles become more intelligent, with features such as object detection, lane-keeping assistance, and automated parking, the need for high-performance accelerators to process data quickly and accurately grows. Automakers invest heavily in AI to enhance safety, efficiency, and user experience, driving the demand for specialized accelerators. The rise of electric and autonomous vehicles further accelerates the adoption of AI technologies in the automotive industry.

Regional Insights

North America dominated the market and accounted for 39.9% share in 2024. North America is experiencing significant market growth due to its strong technological infrastructure and innovation ecosystem. The region is home to leading tech companies, research institutions, and startups at the forefront of AI development, driving demand for advanced accelerators. Heavy investments by major tech giants and cloud service providers in AI infrastructure contribute to this growth. Moreover, the high adoption rate of AI technologies across various sectors, including IT, telecom, and healthcare, fuels the need for powerful accelerators.

U.S. AI Accelerator Market Trends

The AI accelerator market in the U.S. is expected to grow significantly over the forecast period. With major tech companies such as NVIDIA Corporation, Google LLC, and Intel Corporation leading the charge, the U.S. remains at the forefront of AI hardware development. Significant investments from private sector firms and government initiatives propel AI accelerator advancements. The broad adoption of AI technologies across various industries, including finance, healthcare, and automotive, heightens the demand for specialized hardware.

Europe AI Accelerator Market Trends

The AI accelerator market in Europe is witnessing increasing growth driven by a rising focus on digital transformation and technological advancements. The region is investing heavily in AI research and development, with several countries prioritizing AI as part of their national strategies. Europe’s robust automotive and industrial sectors significantly contribute to the demand for AI accelerators, particularly for applications like autonomous driving and smart manufacturing. Moreover, European tech companies and startups are developing and deploying AI solutions, driving the need for high-performance accelerators.

Asia Pacific AI Accelerator Trends

The AI accelerator market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific market is rapidly growing due to its expanding technology sector and increasing AI adoption across various industries. The region is home to major tech hubs in countries such as China, Japan, and South Korea, which heavily invest in AI research and development. The growing demand for AI in sectors such as consumer electronics, automotive, and finance drives the need for advanced accelerators. Moreover, significant government support and funding for AI initiatives in countries such as China bolster the market.

Key AI Accelerator Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in April 2024, Microsoft, collaborating with Seedrs, an online equity crowdfunding company in the UK, launched SERIES AI, an innovative accelerator to advance the growth of UK startups integrating AI into their products and services. The initiative seeks to provide essential resources and mentorship to help these early-stage companies refine their AI solutions and enhance their business strategies.

Key AI Accelerator Companies:

The following are the leading companies in the AI accelerator market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Google Inc.

- Graphcore

- IBM Corporation

- Intel Corporation

- Micron Technology

- Microsoft Corporation

- NVIDIA Corporation

- Qualcomm Technologies

- Xilinx Inc.

Recent Developments

-

In September 2024, Intel Corporation and IBM Corporation collaborated to deploy Intel’s Gaudi 3 AI accelerators on the IBM Cloud platform. This collaboration focuses on improving enterprise AI capabilities with more secure and cost-effective solutions. It is designed to integrate Gaudi 3 with IBM’s Watsonx AI and data platform, providing both hybrid and on-premise options to enhance cost performance and drive innovation..

-

In August 2024, IBM Corporation introduced its Spyre accelerator chip for IBM Z, designed to scale enterprise AI workloads with advanced capabilities and high performance. The Spyre accelerator, featuring 32 cores and 25.6 billion transistors, enhances AI inferencing and integrates with IBM’s Watsonx platform, providing businesses with improved AI processing power and security on IBM mainframes.

-

In June 2024, Google LLC launched an AI-first, equity-free accelerator in Australia as part of its $1 billion Digital Future Initiative. This program aims to support seed and Series A startups in AI and machine learning. It will help Australian entrepreneurs utilize AI technologies by providing mentorship, technical support, and access to Google's global networks.

-

In January 2024, Google Cloud and Hugging Face, a computer application corporation in the U.S., partnered to enable developers to utilize Google's infrastructure, including TPUs and GPUs, for training and deploying AI models, enhancing enterprises' ability to implement generative AI. This collaboration supports open-source innovation and offers enterprises flexible options for scaling AI workloads across cloud platforms.

AI Accelerator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.91 billion

Revenue forecast in 2033

USD 256.84 billion

Growth rate

CAGR of 29.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

AI accelerator types, technology integration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Google Inc.; Graphcore; IBM Corporation; Intel Corporation; Micron Technology; Microsoft Corporation; NVIDIA Corporation; Qualcomm Technologies; Xilinx Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

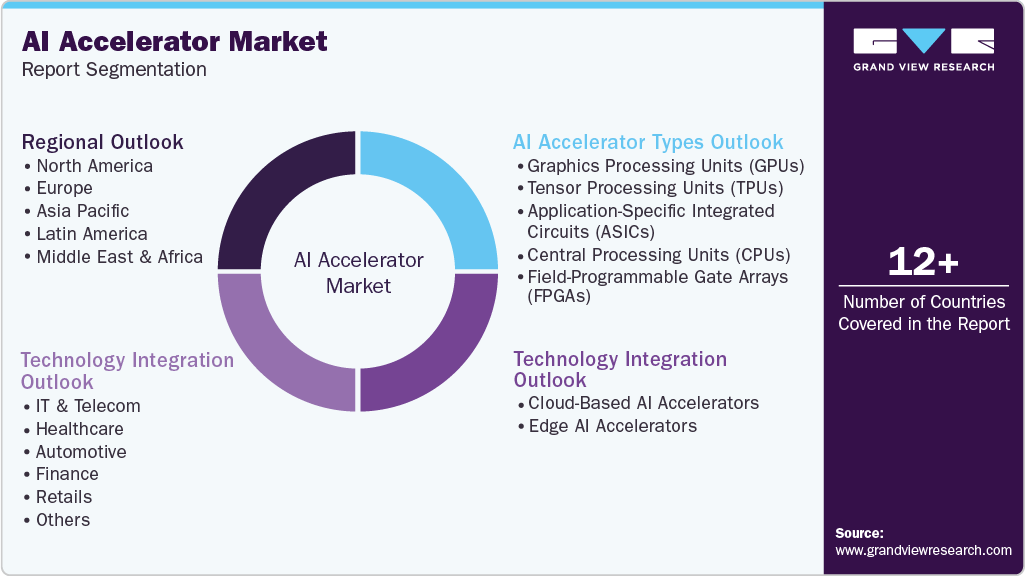

Global AI Accelerator Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI accelerator market report based on AI accelerator types, technology integration, end-use, and region:

-

AI Accelerator Types Outlook (Revenue, USD Million, 2021 - 2033)

-

Graphics Processing Units (GPUs)

-

Tensor Processing Units (TPUs)

-

Application-Specific Integrated Circuits (ASICs)

-

Central Processing Units (CPUs)

-

Field-Programmable Gate Arrays (FPGAs)

-

-

Technology Integration Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-Based AI Accelerators

-

Edge AI Accelerators

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

IT & Telecom

-

Healthcare

-

Automotive

-

Finance

-

Retails

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI accelerator market size was estimated at USD 25.56 billion in 2024 and is expected to reach USD 32,91 billion in 2025.

b. The global AI accelerator market is expected to grow at a compound annual growth rate of 29.3% from 2025 to 2033, reaching USD 256.84 billion by 2033.

b. North America dominated the market and had a 39.9% share in 2024. Due to its strong technological infrastructure and innovation ecosystem, North America is experiencing significant growth in the AI accelerator market.

b. Some key players operating in the AI accelerator market include Amazon Web Services, Inc., Google Inc., Graphcore, IBM Corporation, Intel Corporation, Micron Technology, Microsoft Corporation, NVIDIA Corporation, Qualcomm Technologies, and Xilinx Inc.

b. Key factors driving market growth include a surge in demand for high-performance computing in artificial intelligence (AI) applications. The increasing use of AI in everyday technology further propels the need for efficient and powerful computing solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.