- Home

- »

- Next Generation Technologies

- »

-

AI Assistant Market Size And Share, Industry Report, 2033GVR Report cover

![AI Assistant Market Size, Share & Trends Report]()

AI Assistant Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment, By Technology (NLP, ML, Automatic Speech Recognition), By Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-750-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Assistant Market Summary

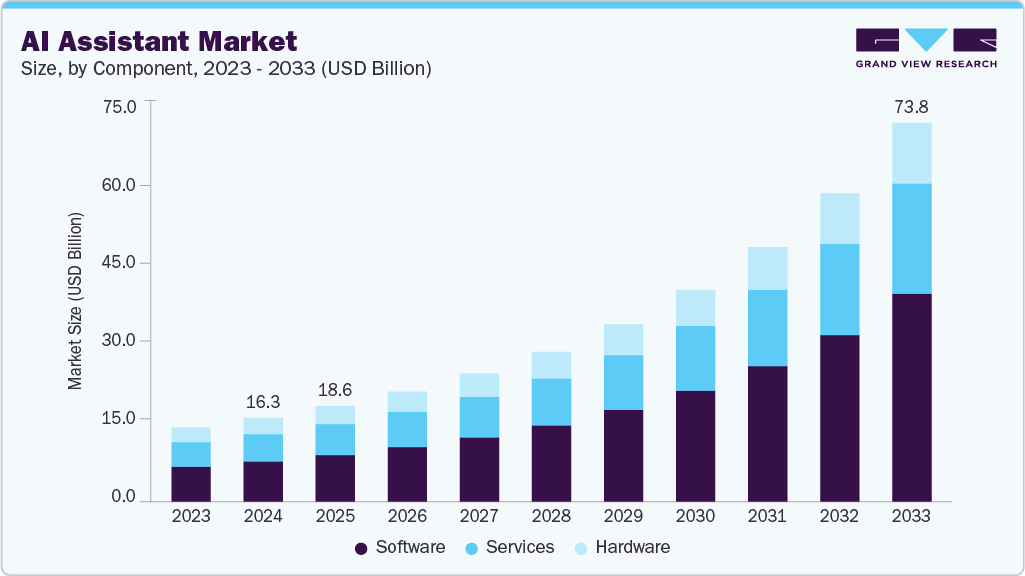

The global AI assistant market size was estimated at USD 16.29 billion in 2024 and is projected to reach USD 73.80 billion by 2033, growing at a CAGR of 18.8% from 2025 to 2033. The growth is driven by various factors such as the advancements in natural language processing (NLP), machine learning (ML), and voice recognition, growing enterprise adoption for automation and cost optimization, rising consumer demand for personalized and hands-free experiences, smartphone and IoT proliferation, and expanding applications across healthcare, BFSI, retail, and automotive sectors.

Key Market Trends & Insights

- North America dominated the global AI assistant market with the largest revenue share of 35.2% in 2024.

- The AI assistant industry in the U.S. led North America with the largest revenue share in 2024.

- By component, software led the market, holding the largest revenue share of 47.9% in 2024.

- By deployment, cloud held the dominant position in the market.

- By technology, the natural language processing (NLP) segment held the dominant market position in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.29 Billion

- 2033 Projected Market Size: USD 73.80 Billion

- CAGR (2025-2033): 18.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The AI assistant industry is primarily driven by rapid advancements in NLP, ML, and deep learning technologies, which have significantly enhanced contextual understanding, speech recognition, and personalization capabilities. These improvements enable AI assistants to deliver seamless conversational experiences, automate routine tasks, and support decision-making across diverse industries. The growing integration of AI with Internet of Things (IoT) devices, smart wearables, and connected ecosystems further expands its utility in both consumer and enterprise applications. Continuous innovation in voice-enabled interfaces and multimodal AI is accelerating adoption, allowing organizations to enhance productivity, customer engagement, and operational efficiency.Enterprise-wide digital transformation initiatives are a major factor fueling AI assistant adoption across IT & telecom, BFSI, healthcare, retail, and automotive sectors. Businesses are increasingly leveraging AI assistants to streamline workflows, enhance customer service, and improve employee productivity through automated support and self-service solutions. The rising demand for cost optimization and faster query resolution has positioned AI assistants as an efficient alternative to traditional support models. Additionally, their ability to provide data-driven insights, automate scheduling, and manage complex transactions enhances decision-making efficiency. As organizations seek competitive differentiation, investment in AI assistants as strategic enablers of agility, scalability, and innovation continues to accelerate.

On the consumer front, increasing smartphone penetration, widespread internet access, and adoption of smart home ecosystems are key factors driving AI assistant market growth. Virtual assistants integrated into mobile devices, smart speakers, and connected appliances are enhancing everyday convenience, from managing schedules to controlling smart devices and facilitating e-commerce transactions. Growing consumer preference for personalized, hands-free, and voice-enabled interactions is fueling demand for AI-driven experiences. Moreover, the shift toward digital-first lifestyles and rising acceptance of conversational commerce are expanding AI assistant applications in shopping, entertainment, and travel. This strong consumer adoption, coupled with evolving AI capabilities, is expected to sustain long-term market momentum.

Component Insights

The software segment dominated the AI assistant market with a share of over 48.0% in 2024. The AI assistant software segment is experiencing strong growth, driven by advancements in natural language processing, machine learning, and speech recognition technologies that enhance contextual understanding, personalization, and decision-making. Enterprises are increasingly adopting AI assistant software to streamline customer engagement, automate workflows, and deliver 24/7 support, reducing operational costs while improving efficiency. Cloud-based deployment models and integration with CRM, ERP, and collaboration tools further expand adoption across industries such as healthcare, BFSI, retail, and IT & telecom. Rising consumer expectations for intuitive, voice-enabled, and personalized digital experiences also propel demand. Additionally, continuous innovation in conversational AI platforms and APIs enables scalable, adaptable solutions, accelerating market expansion.

The services segment is expected to register a significant CAGR over the forecast period. The services segment in the AI assistant market is driven by rising enterprise demand for customized deployment, integration, and maintenance solutions that ensure seamless adoption of intelligent assistants. Organizations across BFSI, healthcare, retail, and IT are increasingly relying on managed and professional services to optimize workflows, enhance customer interactions, and improve return on technology investments. Growing complexity in conversational AI ecosystems, combined with the need for continuous upgrades, training, and data security, is fueling demand for specialized service providers. Additionally, businesses are seeking consulting expertise to align AI assistant strategies with digital transformation initiatives. At the same time, post-deployment support ensures scalability, reliability, and long-term efficiency in highly dynamic business environments.

Deployment Insights

The cloud segment held the largest share of the AI assistant industry in 2024. The cloud segment in the AI assistant market is propelled by enterprises’ growing demand for scalable, cost-effective, and easily deployable solutions that reduce infrastructure overhead. Cloud-based AI assistants enable seamless integration across multiple platforms, ensuring real-time access to data and faster response times, which enhance both customer and employee experiences. Their ability to support continuous updates, advanced analytics, and cross-device synchronization makes them highly suitable for businesses seeking agility and global reach. Additionally, cloud infrastructure provides enhanced flexibility for handling large volumes of data generated by IoT devices and customer interactions. Increasing adoption among SMEs and large enterprises for digital transformation further strengthens cloud segment growth.

The hybrid segment is expected to register the fastest CAGR over the forecasted period. The hybrid AI assistant segment is gaining traction as enterprises seek a balanced approach that combines the scalability of cloud-based solutions with the control and security of on-premises deployment. This model addresses growing concerns over data privacy, regulatory compliance, and industry-specific governance while still enabling advanced analytics, continuous updates, and integration with emerging technologies. Organizations in BFSI, healthcare, and government sectors are particularly driving demand, as hybrid deployment ensures sensitive data remains on-premises while leveraging cloud for flexibility and cost efficiency. Additionally, the hybrid approach supports seamless user experiences across distributed teams, enhances business continuity, and allows enterprises to future-proof operations by adapting to evolving IT infrastructure requirements.

Technology Insights

The Natural Language Processing (NLP) segment accounted for the largest revenue share in 2024. The Natural Language Processing (NLP) segment is an essential growth driver, enabling more accurate, human-like interactions and contextual understanding. Advances in deep learning algorithms, semantic analysis, and sentiment detection have significantly enhanced the ability of AI assistants to interpret complex queries, regional languages, and conversational nuances. This capability supports enterprises in improving customer engagement, automating service delivery, and providing personalized experiences at scale. Moreover, NLP integration in multilingual markets accelerates adoption across diverse geographies, while its application in healthcare, BFSI, and e-commerce strengthens decision-making and operational efficiency. The rising demand for voice-enabled, real-time communication further propels NLP’s importance within the AI assistant ecosystem.

The Machine Learning (ML) & Deep Learning segment is expected to register the fastest CAGR over the forecasted period. The market growth is propelled by their ability to deliver more personalized, context-aware, and adaptive interactions. ML algorithms enable assistants to continuously learn from user behavior, preferences, and historical data, improving accuracy and responsiveness. DL, with advanced neural networks and natural language processing, enhances speech recognition, intent analysis, and conversational fluency, making assistants more human-like. The growing adoption of voice-enabled devices, smart homes, customer service automation, and enterprise productivity tools accelerates demand. ML and DL collectively drive innovation by enabling predictive, proactive, and highly scalable AI assistant solutions across industries.

Type Insights

The smartphone-based assistants segment accounted for the largest revenue share of the AI assistant market in 2024. The smartphone-based assistants segment is witnessing strong growth, primarily driven by the widespread adoption of smartphones and increasing reliance on mobile devices for everyday tasks. Advancements in voice recognition, natural language processing, and contextual understanding enable virtual assistants such as Siri, Google LLC Assistant, and Alexa to deliver personalized, hands-free experiences. Rising consumer demand for convenience in scheduling, navigation, online shopping, and entertainment further accelerates adoption. Integration of AI assistants with mobile applications, messaging platforms, and e-commerce ecosystems enhances user engagement and brand loyalty. Moreover, the shift toward digital-first lifestyles and the expansion of 5G connectivity strengthen the role of smartphone-based assistants as essential productivity and lifestyle tools.

The enterprise/workplace assistants’ segment is expected to register the fasest CAGR over the forecasted period. The enterprise/workplace assistants’ segment is driven by rising demand for automation, productivity enhancement, and efficient workflow management across organizations. Businesses are adopting AI-powered assistants to streamline repetitive tasks such as scheduling, email management, meeting coordination, and internal query resolution, thereby reducing employee workload and operational costs. Increasing reliance on remote and hybrid work models has further accelerated the need for intelligent assistants that facilitate seamless communication, collaboration, and project tracking. Moreover, the ability of workplace AI assistants to integrate with enterprise applications such as CRM, ERP, and HRM systems enables data-driven insights and faster decision-making, positioning them as strategic enablers of digital transformation.

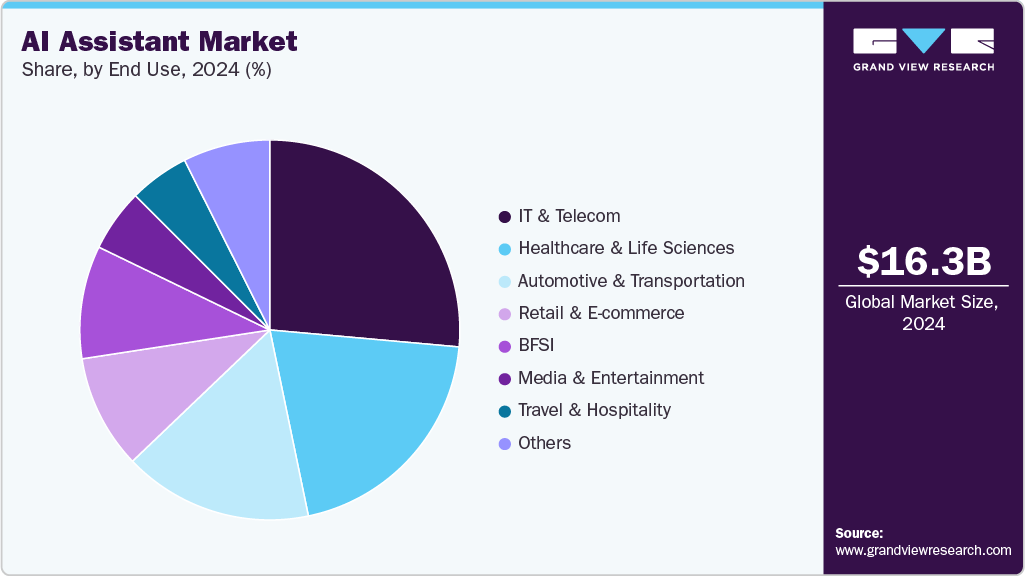

End Use Insights

The IT & telecom segment accounted for the largest revenue share of the AI assistant industry in 2024.The IT & Telecom segment is witnessing strong adoption of AI assistants, driven by the growing need for intelligent customer support, efficient query resolution, and network management automation. Telecom providers are increasingly deploying AI-powered virtual assistants to handle high volumes of customer interactions, reduce service costs, and improve response times. AI assistants also help manage complex billing queries, troubleshoot connectivity issues, and personalize user experiences based on data insights. In the IT sector, they streamline workflows, automate repetitive tasks, and support employees with real-time knowledge management. Rising demand for digital transformation, 24/7 support services, and enhanced customer satisfaction continues to accelerate AI assistant adoption in this segment.

Theretail & e-commerce segment is expected to register the fastest CAGR over the forecast period. The segment is witnessing strong growth in AI assistant adoption, driven by the need to enhance customer engagement, streamline operations, and boost sales conversion. Retailers are increasingly deploying AI assistants to provide personalized shopping experiences, product recommendations, and 24/7 customer support through conversational interfaces. In e-commerce, AI-powered chatbots and voice assistants simplify product search, order tracking, and payment processing, reducing cart abandonment and improving customer satisfaction. Furthermore, the integration of AI assistants with omnichannel platforms allows retailers to deliver consistent, data-driven experiences across digital and physical touchpoints. Rising competition, demand for personalization, and the shift toward conversational commerce are fueling accelerated adoption in this segment.

Regional Insights

North America dominated the AI assistant market with a revenue share of over 35% in 2024. The growth is driven by advanced technological infrastructure, high adoption of smart devices, and the strong presence of leading AI companies. Rising enterprise investments in automation, increasing demand for personalized customer experiences, and rapid integration of AI in healthcare, retail, and BFSI sectors further fuel market growth.

U.S. AI Assistant Market Trends

The U.S. AI assistant industry is expected to grow significantly in 2024, driven by advanced technological infrastructure, strong enterprise adoption across IT, BFSI, and healthcare, and high consumer demand for smart devices and personalized services. Rising investment in conversational AI, widespread smartphone penetration, and integration with IoT and cloud platforms further accelerate adoption and market expansion.

Europe AI Assistant Market Trends

The AI assistant industry in Europe is expected to grow significantly over the forecast period, driven by strong digital transformation initiatives, widespread adoption of smart devices, and stringent data protection regulations encouraging secure AI deployment. Rising demand for multilingual AI solutions, growing e-commerce, and investments in customer experience optimization further accelerate market adoption across industries.

Asia Pacific AI Assistant Market Trends

The AI assistant industry in Asia Pacific is anticipated to be at the fastest CAGR over the forecast period. The market growth is driven by rapid digital transformation, rising smartphone and internet penetration, and strong adoption of smart devices. Expanding e-commerce, growing demand for multilingual support, and government-backed AI initiatives further fuel adoption across enterprises, while cost-sensitive markets embrace AI assistants to enhance efficiency and customer engagement.

Key AI Assistant Company Insights

Some key companies in the AI assistant industry areGoogle LLC, Amazon Web Services, Inc. and Microsoft.

-

Google LLC leads the AI assistant market with Google Assistant, integrated across Android smartphones, Nest smart devices, and third-party platforms. Its advanced natural language processing, continuous machine learning improvements, and support for multiple languages give it global reach. Backed by Google LLC’s search engine, Maps, and ecosystem services, it delivers highly contextual responses and seamless integration, making it a dominant player for consumers and enterprise applications.

-

Amazon Web Services, Inc., through Alexa, established a strong foothold in the AI assistant industry, particularly in smart homes, IoT, and connected devices. Alexa’s integration into Echo smart speakers, automotive systems, and enterprise solutions gives it broad adoption. Backed by AWS infrastructure and developer tools, Alexa offers scalability, third-party skill development, and cross-industry applications, reinforcing its leadership. Its ecosystem-driven approach and early market entry continue to make it a top competitor globally.

Key AI Assistant Companies:

The following are the leading companies in the AI assistant market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- Microsoft

- Salesforce, Inc.

- Oracle

- SAP SE

- IBM Corporation

- Meta

- Apple Inc.

- Amazon Web Services, Inc.

- SoundHound AI Inc.

Recent Developments

-

In April 2025, Capgemini, a business consulting company, expanded its partnership with Google LLC to deliver industry-specific agentic AI solutions for customer experience (CX). Under this collaboration, the companies are building systems that can handle customer requests across channels such as phone and web to automate workflows, gain customer insights, and deliver more personalized engagement.

-

In February 2025, Honeywell International Inc. launched Honeywell Forge Production Intelligence. This platform combines performance monitoring with a generative AI assistant to support operators and production managers in automating tasks and resolving issues. Powered by advanced AI models, the Intelligent Assistant enables engineers, plant managers, and executives to access crucial insights through natural language prompts. It also allows users to visualize, analyze, and troubleshoot production challenges by examining KPI deviations and asset interdependencies.

-

In February 2025, Amazon Web Services, Inc., launched Alexa+, a next-generation assistant powered by generative AI. Key features include more natural conversations, better personalization, integration of agentic capabilities, and connection to many services and devices via new SDKs.The latest version of Alexa offers advanced personalization, leveraging user purchase history, media consumption patterns, shipping details, and preferred payment methods. It also provides users with flexible options to further tailor their experience, enhancing engagement and strengthening customer loyalty.

AI Assistant Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.60 billion

Revenue forecast in 2033

USD 73.80 billion

Growth rate

CAGR of 18.8% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Google LLC; Microsoft; Salesforce, Inc.; Oracle; SAP SE; IBM Corporation; Meta; Apple Inc.; Amazon Web Services, Inc.; SoundHound AI Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Assistant Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI assistant market report based on component, deployment, technology, type, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premises

-

Hybrid

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Natural Language Processing (NLP)

-

Machine Learning (ML)

-

Automatic Speech Recognition (ASR)

-

Text-to-Speech & Speech-to-Text

-

Computer Vision

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Smartphone-based Assistants

-

Smart Speaker Assistants

-

Wearables Assistants

-

Automotive AI Assistants

-

Enterprise/Workplace Assistants

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecom

-

BFSI

-

Healthcare & Life Sciences

-

Retail & E-commerce

-

Automotive & Transportation

-

Media & Entertainment

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI assistant market size was estimated at USD 16.29 billion in 2024 and is expected to reach USD 18.60 billion in 2025.

b. The global AI assistant market is expected to grow at a compound annual growth rate of 18.8% from 2025 to 2033 to reach USD 73.80 billion by 2033.

b. North America dominated the AI assistant market with a share of 35.2% in 2024. The North America AI assistant market is driven by advanced technological infrastructure, high adoption of smart devices, and the strong presence of leading AI companies. Rising enterprise investments in automation, increasing demand for personalized customer experiences, and rapid integration of AI in healthcare, retail, and BFSI sectors further fuel market growth.

b. Some key players operating in the AI assistant market include Google LLC; Microsoft; Salesforce, Inc.; Oracle; SAP SE; IBM Corporation; Meta; Apple Inc.; Amazon Web Services, Inc.; and SoundHound AI Inc.

b. Key factors that are driving the AI assistant market growth include the advancements in Natural Language Processing (NLP), Machine Learning (ML), and voice recognition, growing enterprise adoption for automation and cost optimization, rising consumer demand for personalized and hands-free experiences, smartphone and IoT proliferation, and expanding applications across healthcare, BFSI, retail, and automotive sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.