- Home

- »

- Next Generation Technologies

- »

-

AI Hardware Market Size And Share, Industry Report, 2033GVR Report cover

![AI Hardware Market Size, Share & Trends Report]()

AI Hardware Market (2025 - 2033) Size, Share & Trends Analysis Report By Hardware Component (Processors, Memory, Storage, Network, Specialized Embedded Hardware), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-745-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Hardware Market Summary

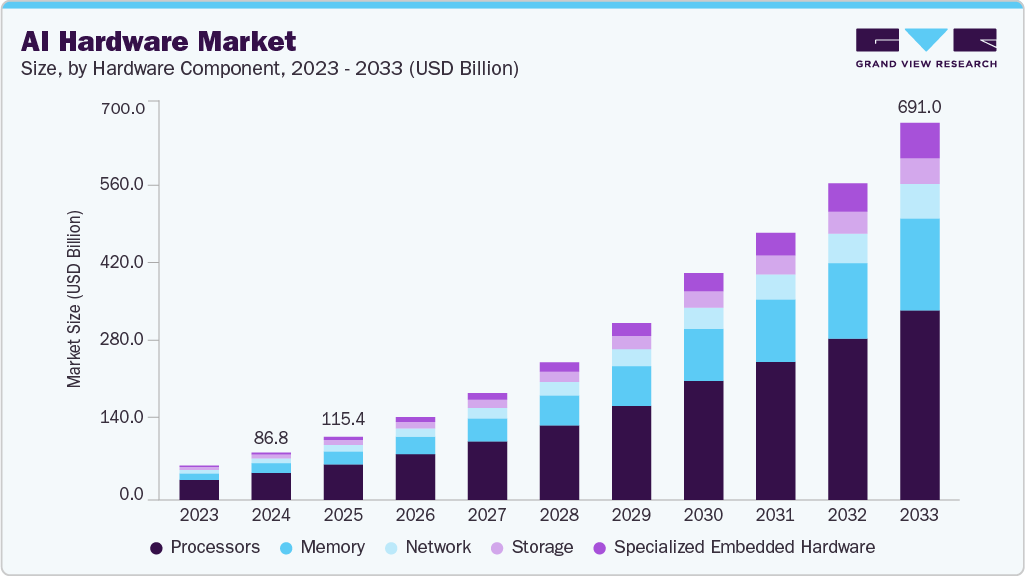

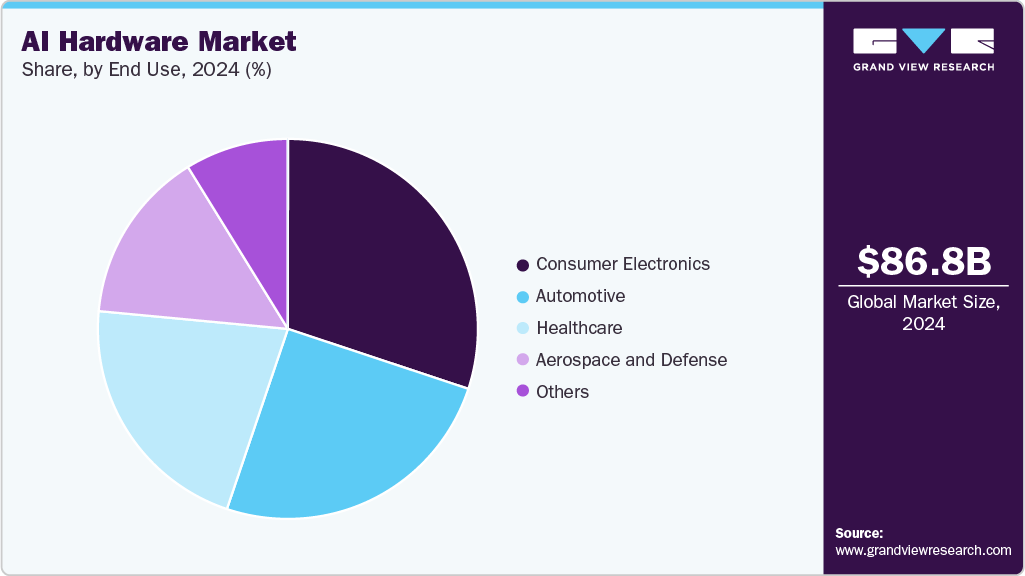

The global AI hardware market size was estimated at USD 86.79 billion in 2024 and is projected to reach USD 691.04 billion by 2033, growing at a CAGR of 25.1% from 2025 to 2033. The market is expanding rapidly, driven by the rising adoption of Artificial Intelligence (AI) across industries such as consumer electronics, automotive, healthcare, and defense.

Key Market Trends & Insights

- The North America AI hardware market dominated with the largest global revenue share of 32.4% in 2024.

- The AI hardware industry in the U.S. led North America with the largest revenue share in 2024.

- By hardware component, the processors segment held the largest revenue share of 57.3% in 2024.

- By application, the machine learning/deep learning held the dominant position with the largest revenue share of 42.1% in 2024.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 27.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 86.79 Billion

- 2033 Projected Market Size: USD 691.04 Billion

- CAGR (2025-2033): 25.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growth is fueled by increasing demand for high-performance processors, memory, and specialized chips to support training and inference of complex AI models. Chip designs are now being optimized to handle AI workloads directly on devices. This advancement enables smartphones, wearables, and PCs to process complex models with greater efficiency. The reduced reliance on cloud connectivity ensures faster performance for real-time applications. At the same time, keeping computations local enhances data privacy and security. Together, these developments are driving a stronger shift toward on-device AI processing.

For instance, in September 2025, Arm Holdings plc, a UK-based semiconductor company, launched its Lumex chip designs, engineered for artificial intelligence on mobile devices, spanning from low-power wearables to advanced smartphones capable of running large AI models locally without relying on cloud access. The Lumex series, part of Arm’s Compute Subsystems business, is built on 3-nanometer manufacturing nodes.

The development of specialized chips for complex AI tasks is driving the growth of the AI hardware industry. These chips enhance efficiency and speed for real-world AI applications, prompting organizations to invest in advanced hardware capable of handling large-scale computations. This emphasis on practical AI workloads is fostering innovation in chip design, memory architecture, and system integration. It also encourages manufacturers to provide scalable solutions that support diverse AI applications. Companies are increasingly developing high-performance, task-focused chips that enable practical AI solutions efficiently. For instance, in September 2025, NVIDIA Corporation, a U.S.-based technology company specializing in GPUs and AI hardware, announced its Rubin CPX GPU, designed for disaggregated AI inference, where compute-focused chips handle context processing and memory-bandwidth-optimized chips manage generation tasks. The Rubin CPX, paired with standard Rubin GPUs in the upcoming Vera Rubin NVL144 CPX rack, will deliver up to 8 exaFLOPs of performance, targeting large AI workloads such as multi-step reasoning and AI video generation.

Edge computing is increasingly influencing chip design, focusing on processing data near its source. This approach reduces latency for real-time AI applications. Chips must operate independently to support decentralized workloads, while power efficiency remains crucial for devices at the edge. Compact design allows integration into small form factors, and low thermal output ensures stable operation in confined spaces. Reliability is essential to handle varied and remote environments. Edge-focused designs often integrate multiple functions on a single chip. These innovations improve performance and responsiveness for AI tasks. Chip developers are prioritizing versatility and efficiency. Manufacturers are also exploring new materials and architectures to further optimize edge performance.

Hardware Component Insights

The processors segment dominated the market with a revenue share of 57.3% in 2024, driven by growing demand for high-performance computing solutions. These processors are central to AI workloads, enabling faster data processing and efficient model execution. Advances in GPU, CPU, and AI accelerator technologies have enhanced their capabilities, supporting complex AI applications across industries. The adoption of specialized processors for both training and inference further strengthened their market position. Increasing investments in data centers and edge computing fueled the need for powerful processors. Consequently, this segment maintained a dominant share in the AI hardware market throughout 2024.

Specialized embedded hardware is expected to experience significant growth over the forecast period. These devices are designed to perform dedicated AI tasks efficiently, offering low power consumption and compact form factors. Their adoption is rising across industries such as automotive, healthcare, and industrial automation. As AI workloads become more diverse and decentralized, the demand for embedded solutions continues to increase. This trend shows the market’s shift toward more application-specific and energy-efficient AI hardware. Manufacturers are investing in research and development to enhance processing capabilities and reduce latency.

Application Insights

Machine learning and deep learning held the largest share of the AI hardware industry in 2024. The hardware, primarily high-performance GPUs, supports a broad range of tasks, including computer vision, natural language processing, and general data analysis. The established use of these technologies across industries such as healthcare, finance, and manufacturing makes this segment the largest by market share. This dominance is due to the maturity and widespread implementation of these foundational AI models. This continued dominance is further solidified by the constant need for more powerful and efficient hardware to train increasingly complex models.

Generative AI is a rapidly growing force in the AI hardware market, though it is still a smaller segment. The demand for specialized and powerful hardware is accelerating as the complexity of large language models and image-generation tools increases. This sector's explosive growth is fueled by massive investments in creating next-generation models that require unprecedented computational resources for both training and inference. The future market share of generative AI is projected to significantly expand, challenging the dominance of traditional machine learning hardware.

End Use Insights

Consumer electronics dominated the AI hardware industry in 2024. The ubiquity of smart devices such as smartphones, smart speakers, and smart TVs has driven immense demand for on-device AI chips and processors. This market is further boosted by the integration of AI-powered features such as voice assistants, personalized recommendations, and advanced image processing directly into consumer products. This widespread adoption, combined with the sheer volume of devices sold annually, solidifies consumer electronics' dominant position in the market. The constant innovation in smart devices, with each new generation offering more advanced AI capabilities, ensures this dominance will continue for the foreseeable future.

The automotive sector is an increasingly important and rapidly growing market for AI hardware. The rise of Advanced Driver-Assistance Systems (ADAS) and the push for fully autonomous vehicles are creating a massive demand for powerful and specialized AI chips. Hardware is crucial for processing real-time sensor data from cameras, LiDAR, and radar to enable features such as lane-keeping assist and automatic emergency braking. As regulations tighten and consumer demand for smarter, safer cars increases, the automotive industry's investment in AI hardware is growing exponentially. This explosive growth is further fueled by the transition to electric vehicles, which heavily rely on AI for optimizing battery management and improving energy efficiency.

Regional Insights

North America held the largest share of the AI hardware market at 32.4% in 2024, a position driven by its thriving technology ecosystem. The region hosts a number of leading hardware developers who are at the forefront of creating powerful processors. These organizations make substantial investments in research and development, which solidifies the region's technological leadership. Furthermore, North America benefits from significant venture capital funding and a strong concentration of top research institutions and skilled talent. The early and widespread adoption of AI across various industries, from IT to healthcare, further drives the demand for advanced hardware.

U.S. AI Hardware Market Trends

The U.S. is a primary market for AI hardware, driving a significant portion of the global market's value. This position is a result of a highly developed technology ecosystem and a strong presence of numerous leading AI hardware innovators. The U.S. benefits from substantial private and public sector investment in AI research and development, a robust venture capital environment, and a deep pool of skilled talent.

Europe AI Hardware Market Trends

Europe represents a major and steadily growing market for AI hardware, fueled by increasing adoption in manufacturing, automotive, and healthcare. The region is actively strengthening its own semiconductor and AI capabilities through government initiatives and a focus on building a robust technological foundation. While Europe's market share is smaller than the U.S.'s, its emphasis on ethical AI frameworks and the development of specialized industrial applications positions it for consistent and deliberate expansion.

Asia Pacific AI Hardware Market Trends

The Asia Pacific region is the fastest-growing AI hardware industry and is poised to significantly increase its global share. This rapid growth is driven by massive digitalization efforts, government support, and a booming consumer electronics sector. Countries such as China, Japan, and South Korea are making large-scale investments in AI and 5G infrastructure, creating a vast and expanding market for AI-enabled devices. The region is a critical hub for both innovation and manufacturing, making it a key player in the global AI hardware supply chain.

Key AI Hardware Company Insights

Some of the key companies in the AI hardware industry include Amazon.com, Inc.; Apple Inc.; Cerebras Systems Inc.; Graphcore; and Intel Corporation. Organizations are focusing on increasing their customer base to gain a competitive edge. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Microsoft has been actively expanding its AI hardware and cloud infrastructure capabilities to support AI workloads. Its Azure cloud platform provides specialized AI instances optimized for machine learning and deep learning tasks. The company is investing in high-performance computing clusters to accelerate AI research and enterprise adoption. Microsoft collaborates with hardware vendors to integrate cutting-edge GPUs and FPGAs into its offerings. These efforts enable Microsoft to provide scalable, efficient, and secure AI solutions for a wide range of industries.

-

NVIDIA Corporation is a major player in AI hardware, particularly known for its GPUs used in machine learning and deep learning applications. Its GPU architectures are designed to deliver high performance for both training and inference workloads. NVIDIA also develops AI software frameworks, enabling seamless integration with its hardware for accelerated computation. The company’s innovations have positioned it as a preferred choice for cloud providers, research institutions, and enterprises. NVIDIA continues to advance AI hardware with new products targeting next-generation AI models and high-efficiency computing.

Key AI Hardware Companies:

The following are the leading companies in the AI hardware market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc. (AMD)

- Amazon.com, Inc.

- Apple Inc.

- Cerebras Systems Inc.

- Graphcore

- Intel Corporation

- Microsoft

- NVIDIA Corporation

- Qualcomm Incorporated

- Robert Bosch GmbH

Recent Developments

-

In June 2025, Hewlett Packard Enterprise, a U.S.-based Information technology company, and NVIDIA Corporation expanded their partnership at HPE Discover in Las Vegas, launching new modular AI infrastructure and turnkey AI platforms, including HPE’s AI-enabled RTX PRO Servers and the HPE Private Cloud AI platform. The aim is to help enterprises build and scale generative, agentic, and industrial AI applications by providing full-stack AI factory solutions that combine computing hardware, software, and services.

-

In September 2024, Intel Corporation launched Xeon 6 processors and Gaudi 3 AI accelerators to enhance enterprise AI performance and efficiency. These AI hardware solutions aim to optimize the total cost of ownership and support large-scale AI workloads.

-

In June 2024, NVIDIA Corporation launched new AI hardware and products at Computex 2024 in Taipei, including the general availability of Nvidia ACE generative AI, plans for an ultra version of the Blackwell platform in 2025, and a next-generation GPU architecture codenamed Rubin. It aims to accelerate AI adoption by transforming traditional data centers into AI-focused factories, supporting generative AI applications, and enabling AI-powered autonomous systems.

AI Hardware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 115.41 billion

Revenue forecast in 2033

USD 691.04 billion

Growth rate

CAGR of 25.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Hardware component, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Advanced Micro Devices, Inc. (AMD); Amazon.com, Inc.; Apple Inc.; Cerebras Systems Inc.; Graphcore; Intel Corporation; Microsoft; NVDIA Corporation; Qualcomm Incorporated; Robert Bosch GmbH

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI Hardware Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI Hardware market report based on hardware component, application, end use, and region:

-

Hardware Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Processors

-

Memory

-

Storage

-

Network

-

Specialized Embedded Hardware

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Machine Learning/Deep Learning

-

Computer Vision

-

Natural Language Processing

-

Robotics

-

Generative AI

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI hardware market size was estimated at USD 86.79 billion in 2024 and is expected to reach USD 115.4 billion in 2025.

b. The global AI hardware market is expected to grow at a compound annual growth rate of 25.1% from 2025 to 2033 to reach USD 691.0 billion by 2033.

b. North America dominated the AI hardware market with a share of 32.4% in 2024. This is attributable to strong semiconductor manufacturing capabilities, significant investments in AI infrastructure, and early adoption of advanced computing technologies across industries.

b. Some key players operating in the AI hardware market include Advanced Micro Devices, Inc. (AMD), Amazon.com, Inc., Apple Inc., Cerebras Systems Inc., Graphcore, Intel Corporation, Microsoft, NVIDIA Corporation, Qualcomm Incorporated, and Robert Bosch GmbH.

b. Key factors that are driving the market growth include the rising demand for high-performance computing, rapid expansion of data centers, increasing adoption of AI in edge devices, continuous advancements in semiconductor design, and growing investments in AI-driven applications across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.