- Home

- »

- Advanced Interior Materials

- »

-

Airflow And Zone Controls Equipment Market Report, 2030GVR Report cover

![Airflow And Zone Controls Equipment Market Size, Share & Trends Report]()

Airflow And Zone Controls Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dampers, Variable Air Volume), By Operation (Manual, Automatic), By Application, By Deployment, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-529-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

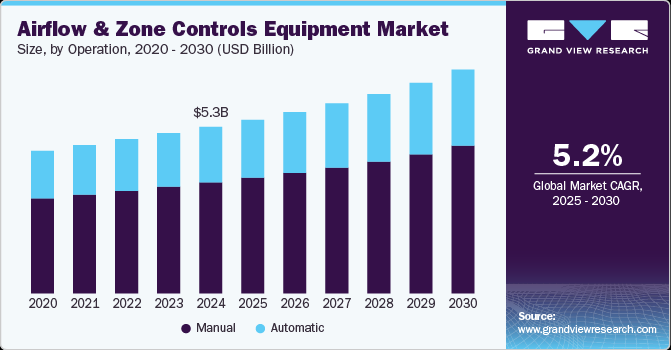

The global airflow and zone controls equipment market size was estimated at USD 5.34 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. The industry is evolving with a strong shift toward smart, automated systems. Increased adoption of IoT-based devices allows real-time monitoring and precise control, improving energy efficiency and user comfort. Furthermore, the demand for energy-efficient solutions is driven by stricter building codes and sustainability goals, particularly in commercial and industrial sectors.

There is also a rise in the use of advanced zoning systems that allow better regulation of airflow in multi-zone environments, catering to the varying needs of different areas within a building. Additionally, the integration of airflow and zone control technologies with HVAC systems is gaining traction, ensuring seamless operation and optimized performance. Moreover, increased awareness of indoor air quality (IAQ) is another key factor, prompting the use of advanced filtration and ventilation systems. Lastly, the growing focus on retrofit and upgrade projects, especially in existing buildings aiming for energy savings and improved performance, is fueling market growth.

Market Concentration & Characteristics

The industry is moderately concentrated, with a few large players dominating the market while smaller companies cater to niche segments. Leading manufacturers have significant market share due to their strong technological innovations, product quality, and brand recognition. However, there is still room for new entrants, especially those offering specialized or localized solutions. Over time, mergers and acquisitions have led to increased consolidation as companies seek to expand their product portfolios and regional reach.

One of the key characteristics of the market is the strong focus on technological advancements. Companies are increasingly developing IoT-integrated systems that allow for remote monitoring and control, providing enhanced energy management capabilities. Smart features like real-time data analysis, adaptive airflow, and integration with building automation systems (BAS) are becoming essential for staying competitive. These innovations are transforming how HVAC systems are managed and optimized.

Energy efficiency and sustainability are core drivers of the industry, with regulations becoming stricter globally. Government incentives and green building certifications, such as LEED, have pushed the demand for energy-saving equipment that improves building performance. Companies are responding by designing products that not only save energy but also contribute to reducing carbon footprints, making them attractive to environmentally conscious consumers and businesses.

The market is highly influenced by the construction industry, particularly in the commercial and industrial sectors. With rapid urbanization and an increase in new building projects, the demand for advanced airflow and zone control equipment is on the rise. Additionally, the growing trend of smart cities and sustainable infrastructure projects is creating new opportunities for the industry. As buildings become more complex, so does the need for advanced and customizable airflow solutions to meet diverse requirements.

Drivers, Opportunities & Restraints

The growing emphasis on energy efficiency and sustainability in both residential and commercial buildings is a major driver for the airflow and zone controls equipment market. With stricter energy regulations and the increasing adoption of green building standards like LEED, there is a rising demand for advanced HVAC systems that can optimize air distribution and minimize energy consumption. Additionally, the integration of IoT technology into these systems is enhancing real-time control and monitoring, further boosting their popularity.

One key restraint for the industry is the high initial cost of advanced systems and retrofitting existing buildings. Many businesses and homeowners may hesitate to invest in these technologies due to the perceived high upfront costs, especially when upgrading older HVAC systems. Additionally, the complexity of installation and maintenance can deter adoption, particularly in regions with limited technical expertise.

A significant opportunity for the industry lies in the increasing demand for smart, connected HVAC systems in emerging markets. As urbanization accelerates and the construction industry grows in regions like Asia-Pacific and Latin America, there is a substantial market for energy-efficient, automated systems. Furthermore, the rising awareness about indoor air quality (IAQ) presents an opportunity for businesses to develop and market advanced air filtration and ventilation solutions to meet consumer demand for healthier indoor environments.

Product Insights

The dampers segment accounted for a revenue share of 32.7% in 2024. The demand for dampers in airflow and zone control equipment is increasing as buildings and HVAC systems prioritize energy efficiency and precise airflow management. Modern dampers are now being integrated with smart technologies, allowing for automated and real-time control of airflow. This shift toward smart dampers enhances system performance by adapting to changing conditions and ensuring optimal air distribution, which is critical in both residential and commercial spaces aiming for sustainability and energy savings.

Airflow regulators are gaining traction due to their ability to maintain consistent air distribution and pressure throughout HVAC systems, optimizing performance. As building designs become more complex, particularly in multi-zone environments, these regulators help balance airflow across various zones, ensuring uniform comfort and energy efficiency. The trend is moving toward advanced, digitally controlled regulators that provide real-time monitoring and integration with building automation systems, further improving operational efficiency and reducing energy costs.

Operation Insights

The manual operation segment accounted for a revenue share of 66.7% in 2024. While manual airflow and zone control equipment are still in use, their demand is steadily declining as building owners and operators seek more efficient, automated solutions. Manual systems often require continuous adjustments, leading to higher energy consumption and inconsistent comfort levels. However, they remain popular in smaller or older buildings where budget constraints or lack of advanced infrastructure make automated systems less feasible.

The demand for automatic airflow and zone control systems is rapidly increasing due to the growing preference for energy efficiency and convenience. Automated systems offer real-time adjustments based on occupancy, temperature, and air quality, improving both comfort and energy savings. Integration with smart building technologies and IoT devices further enhances the functionality of these systems, making them the preferred choice for modern, sustainable buildings seeking optimized HVAC performance and cost-effective operation.

Application Insights

The commercial application segment accounted for a revenue share of 48.3% in 2024. In commercial applications, the demand for advanced airflow and zone control equipment is driven by the need for energy-efficient, customizable HVAC systems that meet the diverse needs of large buildings. Commercial spaces are increasingly adopting smart, automated systems that provide precise control over air distribution, ensuring both comfort and optimal energy usage.

In residential applications, the trend toward airflow and zone control equipment is growing due to increasing consumer interest in energy-efficient solutions that enhance comfort and reduce utility costs. Smart home integration, allowing homeowners to control airflow and temperature through smartphones or voice assistants, is becoming more common.

Deployment Insights

The new installation deployment segment accounted for a revenue share of 67.3% in 2024. The demand for new installations of airflow and zone control equipment is on the rise, driven by rapid urbanization, increased commercial construction, and the growing focus on energy-efficient, sustainable buildings. As new residential and commercial properties are built, there is a clear shift toward integrating advanced, smart airflow systems to optimize energy consumption and improve indoor air quality.

The replacement market for airflow and zone control equipment is also expanding, as older HVAC systems are upgraded to meet higher energy efficiency standards and improve system performance. Existing buildings, especially those in commercial sectors, are replacing outdated manual or less efficient systems with more advanced, automated solutions.

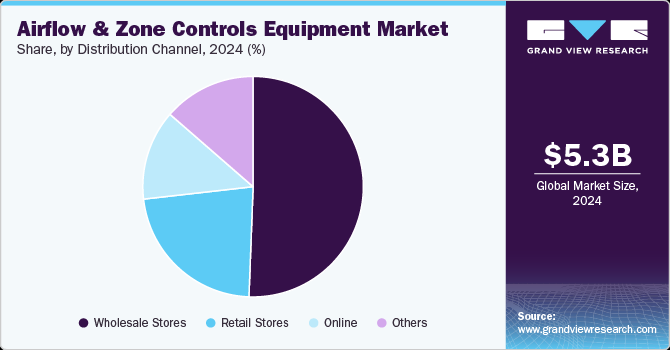

Distribution Channel Insights

The wholesale stores segment accounted for a revenue share of 50.6% in 2024. Wholesale stores play a significant role in the airflow and zone controls equipment market, particularly for large-scale commercial projects and bulk purchases. These stores offer a wide range of HVAC equipment and parts, including advanced zone control systems, at competitive prices. They serve as a primary distribution channel for contractors, engineers, and businesses looking to source equipment in bulk, ensuring quick access to necessary components for new installations and replacements.

The online distribution channel for airflow and zone control equipment is rapidly expanding, driven by the growing preference for digital shopping and the convenience it offers. Online platforms enable customers-ranging from contractors to homeowners-to access a broader range of products, compare prices, and read reviews, often with delivery options to their location. As smart home and IoT solutions become more mainstream, the online market is particularly attractive for consumers seeking easy-to-install, smart airflow systems that can be controlled via apps or voice assistants.

Regional Insights

North America airflow and zone controls equipment market is expanding rapidly, driven by the increasing demand for energy-efficient solutions and building regulations focused on sustainability. The U.S. and Canada are at the forefront of adopting advanced airflow control systems, with notable growth in both residential and commercial sectors.

U.S. Airflow And Zone Controls Equipment Market Trends

The airflow and zone controls equipment market in the U.S. is expected to grow at a CAGR of 5.1% from 2025 to 2030. The demand for airflow and zone control systems is rising as energy-efficient construction practices and green building certifications become more prevalent. The need for precise airflow control is especially significant in regions with extreme climates, where efficient heating and cooling are essential for energy savings.

Canada airflow and zone controls equipment market is expected to grow at a CAGR of 5.9% from 2025 to 2030. The market’s growth is driven by stringent energy efficiency standards and a strong desire to reduce heating costs, particularly in colder regions. To meet energy codes and maintain optimal indoor air quality, Canadian residential and commercial buildings are increasingly incorporating advanced airflow and zone control systems.

Europe Airflow And Zone Controls Equipment Market Trends

The airflow & zone controls equipment market in Europe is bolstered by strong regulatory efforts promoting energy-efficient building practices and environmental sustainability. Northern European countries, in particular, are leading the adoption of advanced airflow control systems in both residential and commercial buildings.

Germany airflow and zone controls equipment market held 32.4% share in the European market in 2024. The demand for advanced airflow systems is driven by the country’s robust green building initiatives and energy efficiency policies. Airflow & zone control equipment are especially sought after in both new constructions and renovation projects as Germany strives to meet its sustainability objectives.

The airflow and zone controls equipment market in the UK is driven by a national push to improve energy efficiency in both homes and commercial properties. Strict energy regulations, including those from the government, encourage the use of advanced zone control systems to help meet energy conservation targets.

Asia Pacific Airflow And Zone Controls Equipment Market Trends

The airflow and zone controls equipment market in Asia Pacific accounted for 39.3% of the global revenue share in 2024. Urbanization, rapid construction activity, and growing awareness of energy efficiency are driving significant demand for advanced airflow control systems. Countries like China and India are increasingly seeking energy-efficient solutions for both residential and commercial buildings.

China airflow and zone controls equipment market held a significant share in the Asia Pacific market. The growing demand for energy-efficient buildings and reduced carbon emissions aligns with China’s broader efforts to enhance energy efficiency in the construction sector. The rising middle class and urbanization are contributing to the demand for modern, sustainable airflow systems in both residential homes and commercial spaces.

The airflow and zone controls equipment market in the India is expected to grow at a CAGR of 5.9% from 2025 to 2030. With rapid urbanization and a booming construction sector, there is a rising demand for systems that improve air quality and reduce energy consumption. As urban air quality becomes a growing concern, Indian consumers and businesses are increasingly adopting advanced airflow control solutions for both residential and commercial buildings.

Middle East & Africa Airflow And Zone Controls Equipment Market Trends

The airflow and zone controls equipment market in the Middle East and Africa is driven by urbanization, increased construction activity, and a need for energy-efficient technologies. In countries like Saudi Arabia, high energy costs are spurring the adoption of advanced airflow systems to reduce cooling and heating costs.

Saudi Arabia airflow and zone controls equipment market is making significant investments in sustainable building practices, driving the demand for airflow and zone control systems in both residential and commercial buildings. The country’s extreme climate makes energy-efficient ventilation systems essential for managing indoor air quality and reducing cooling costs.

Latin America Airflow And Zone Controls Equipment Market Trends

The airflow and zone controls equipment market in Latin America is gradually expanding, propelled by growing construction activities and rising awareness of sustainable building practices. Countries like Brazil are seeing increased demand for energy-efficient solutions in both new residential and commercial developments, boosting the adoption of advanced airflow control systems.

Brazil airflow and zone controls equipment market is expanding as the country’s construction industry grows and energy efficiency standards become more stringent. With a rising focus on sustainable building practices and energy conservation, Brazil is increasingly adopting advanced airflow systems to enhance indoor air quality and reduce energy consumption in both residential and commercial buildings.

Key Airflow And Zone Controls Equipment Company Insights

Some of the key players operating in the market include Carrier, Daikin Industries, Ltd., among others.

-

Carrier is a leading global provider of heating, ventilation, and air conditioning (HVAC) solutions. Founded in 1902 by Willis H. Carrier, the company has a long history of innovation and industry leadership, particularly in the development of modern air conditioning systems. Carrier offers a wide range of products for residential, commercial, and industrial applications.

-

Daikin Industries, Ltd., established in 1924 and headquartered in Osaka, Japan, is a global leader in the HVAC industry. The company specializes in the design, manufacture, and distribution of air conditioning systems, refrigerants, and other energy-efficient climate control solutions. Daikin is renowned for its innovation in sustainable technologies, offering a wide range of products, including residential, commercial, and industrial HVAC systems, heat pumps, air purifiers, and air handling units.

Key Airflow And Zone Controls Equipment Companies:

The following are the leading companies in the airflow and zone controls equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Panasonic Corporation

- Carrier

- Broan-NuTone, LLC

- Zehnder America

- Daikin Industries, Ltd.

- Greenheck Fan Corporation

- Ruskin

- Aldes Group (American Aldes Ventilation Corporation)

- Trane Technologies

- RenewAire

- S&P USA Ventilation Systems, LLC

- Zonex Systems

- Arzel Zoning

- AprilAire

Recent Developments

-

In December 2024, Honeywell's Phoenix Controls launched the Critical Spaces Control Platform, designed to enhance safety and operational efficiency in critical environments. This advanced platform utilizes automation to manage airflow through a specialized venturi valve, ensuring optimal ventilation in settings such as hospitals, laboratories, cleanrooms, and research facilities, where precise environmental control is essential.

Airflow And Zone Controls Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.56 billion

Revenue forecast in 2030

USD 7.17 billion

Growth Rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, operation, application, deployment, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Panasonic Corporation; Carrier; Broan-NuTone, LLC; Zehnder America; Daikin Industries, Ltd.; Greenheck Fan Corporation; Ruskin; Aldes Group (American Aldes Ventilation Corporation); Trane Technologies; RenewAire; S&P USA Ventilation Systems, LLC; Zonex Systems; Arzel Zoning; AprilAire; Johnson Controls

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Airflow And Zone Controls Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global airflow and zone controls equipment market on the basis of product, operation, application, deployment, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dampers

-

VAV (Variable Air Volume)

-

Airflow Regulators

-

Zoning Panels

-

Others

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installation

-

Replacement

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global airflow and zone controls equipment market size was estimated at USD 5.34 billion in 2024 and is expected to reach USD 5.56 billion in 2025.

b. The global airflow and zone controls equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 and reach USD 7.17 billion by 2030.

b. The dampers product segment accounted for a revenue share of 32.7% in 2024. The demand for dampers in airflow and zone control equipment is increasing as buildings and HVAC systems prioritize energy efficiency and precise airflow management. Modern dampers are now being integrated with smart technologies, allowing for automated and real-time control of airflow.

b. Some of the key players operating in the airflow & zone controls equipment market include Panasonic Corporation, Carrier, Broan-NuTone, LLC, Zehnder America, Daikin Industries, Ltd., Greenheck Fan Corporation, Ruskin, Aldes Group (American Aldes Ventilation Corporation), Trane Technologies, RenewAire, S&P USA Ventilation Systems, LLC, Zonex Systems, Arzel Zoning, AprilAire, Johnson Controls.

b. The airflow & zone controls equipment market is evolving with a strong shift towards smart, automated systems. Increased adoption of IoT-based devices allows real-time monitoring and precise control, improving energy efficiency and user comfort.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.