- Home

- »

- Medical Devices

- »

-

Airway Clearance Systems Market Size & Share Report 2030GVR Report cover

![Airway Clearance Systems Market Size, Share & Trends Report]()

Airway Clearance Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Device Type (Positive Expiratory Pressure, Flutter Mucus Clearance Device), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-110-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Airway Clearance Systems Market Trends

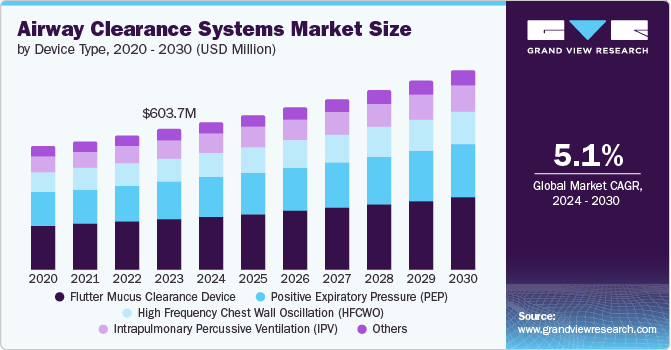

The global airway clearance systems market size was valued at USD 603.7 million in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The driving factors of the growth are rising chronic respiratory diseases, leading to the rising adoption of airway clearance systems. The increase in chronic respiratory diseases is a major factor driving market growth.

According to a March 2023 report published by the World Health Organization (WHO), approximately 90% of deaths from chronic obstructive pulmonary disease (COPD) occur in people under the age of 70. The emergence of obstructive pulmonary disease affects the airway structure of the lungs, leading to the increased adoption of airway clearance systems and driving the market growth.

The rising tobacco consumption and air pollution are attributed to the increasing chronic respiratory diseases. According to the World Health Organization (WHO), about 99% of people breathe air exceeding the WHO guideline limit. In addition, the World Health Organization (WHO) data published in July 2023 stated tobacco consumption kills more than 8 million people globally. Such conditions aggravate respiratory diseases and are responsible for increasing demand for airway clearance systems in the market.

The emergence of COVID-19 negatively impacted the airway structure, causing cough and difficulty in breathing. Severe COVID-19 cases raised more complications, such as pneumonia and acute respiratory disease syndrome (ARDS), causing harm to the lungs. According to the Health published data in April 2024, 88.8% of COVID-19 hospitalized patients lost their lives from ARDS issues. According to The Johns Hopkins University, patients suffering from ARDS are unable to breathe and require ventilator support. Such instances are expected to drive the airway clearance systems market growth.

Device Type Insights

Flutter mucus clearance devices dominated the market and accounted for a share of 35.9% in 2023. The factors attributed to the marker growth include the rising cases of chronic lung diseases such as chronic bronchitis and asthma. Rising asthma cases in children and adults is a primary non-communicable disease that causes mucus buildup in the lungs leading to congestion. Flutter mucus clearance devices are used to treat this condition. Various companies that offer flutter mucus clearance devices, such as Flexicare (Group) Limited, Sanrai, and Clement Clarke International Limited, are expected to drive the segment growth.

The high frequency chest wall oscillation (HFCWO) segment is expected to grow significantly during the forecast period. The rise in genetic conditions such as cystic fibrosis and bronchiectasis, which build mucus in the lungs and block the airways, are driving the segment growth. HFCWO is a physical therapy for the chest to clear the mucus from the airways and enable breathing. The increased demand due to growing incidences encourages companies to launch new products. For instance, Medik-Link Sales & Services launched the Lifotronic PV-100 HFCWO device in November 2021 in Malaysia. Such new developments are expected to drive the segment growth.

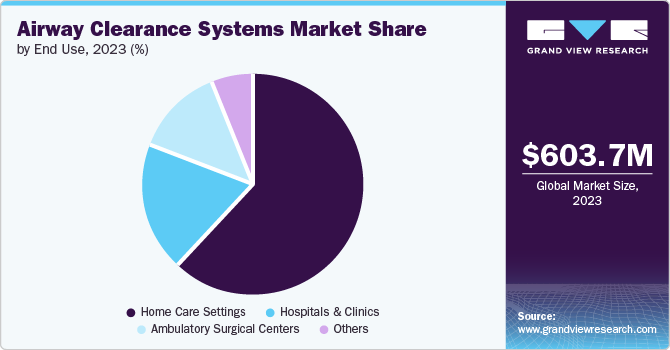

End Use Insights

Home care settings accounted for the largest market revenue share of 61.9% in 2023. The factors driving the segment growth are majorly attributable to the device’s portability, affordability, user-friendly systems, and emergency need to enable breathing for patients with congestion. For instance, Clement Clarke’s flutter mucus clearance device is portable, user-friendly and effective in clearing mucus and enabling patients to breathe without any difficulty. Companies are involved in making innovative advanced solutions available in the market, such as Hill-Rom’s VisiVest Airway Clearance system enabled with Bluetooth and Monarch airway system, a mobile respiratory solution. Such wide availability in the market drives segment growth.

Ambulatory surgical centers are projected to grow at the fastest CAGR of 4.9% over the forecast period. Ambulatory surgical centers can help patients reduce their risk of infection by reducing antibiotic resistance compared to hospitals. In addition, they are inexpensive and efficient and increase patient satisfaction. According to the World Health Organization (WHO) report published in 2023, COPD is the third leading cause of death globally and claimed 3.23 million deaths in 2019. In such severe cases, doctors recommend additional therapies such as oxygen therapy, and surgical options, such as lung volume reduction surgery, lung transplant, and bullectomy. Such advanced treatment options are owing to the growth of the segment.

Application Insights

Cystic fibrosis dominated the market and accounted for a share of 34.5% in 2023. The rising prevalence of the genetic condition is driving the segment growth. According to the Cystic Fibrosis Foundation data published in July 2022, 105,000 people are diagnosed with cystic fibrosis across 94 countries. This genetic condition builds mucus that causes blockages or lung infections, making breathing difficult. Various airway clearance techniques are used to treat cystic fibrosis, such as HFCWO, resulting in an increased demand for airway clearance systems driving segment growth.

The bronchiectasis segment is expected to register the fastest CAGR during the forecast period. The condition damages the airways and cannot clear the mucus, affecting the lung’s immune system and deteriorates with old age. For instance, nearly 500,000 people in the U.S. have the bronchiectasis. Various airway removal devices and therapies are used to treat the condition, such as HFCWO therapy and oscillating positive expiratory pressure (OPEP) devices. Companies such as Electromed, Inc. are involved in offering solutions such as SmartVest Airway Clearance System to treat bronchiectasis. Such innovations are expected to drive the segment growth in the market.

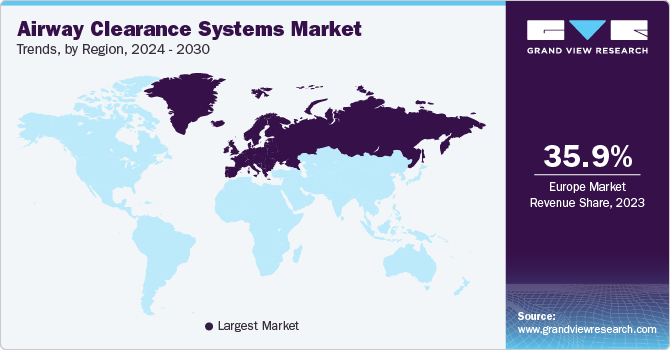

Regional Insights

North America airway clearance systems market dominated in 2023. The rising prevalence of chronic respiratory disease is driving the market growth. According to the Canadian Lung Association, more than 2 million people in the country are suffering from COPD. The Canadian government is taking initiatives and is forming guidelines for chronic respiratory diseases, including asthma and COPD. The government has also initiated the National Lung Health framework, an approach to prevent and manage chronic respiratory diseases and positively impact lung health in the country. Such progressions are expected to drive the region’s airway clearance systems market.

U.S. Airway Clearance Systems Market Trends

The U.S. airway clearance systems market accounted for a 32.5% share of the global market in 2023. The rising prevalence of chronic respiratory diseases such as COPD and cystic fibrosis drives market growth. For instance, according to the American Lung Association recorded 30,000 people in the country suffering from cystic fibrosis in June 2024. Such rising incidences nationwide are causing an increase in demand for airway clearance systems. Companies are involved in serving rising demand and expanding their airway clearance products portfolio. For instance, Inogen, Inc. acquired PhysioAssist’s Simeox, a technology-powered airway clearance device in July 2023 to expand its portfolio. Such instances are expected to drive market growth.

Europe Airway Clearance Systems Market Trends

Europe accounted for a significant market share in 2023 in the airway clearance systems market. The rising number of patients, companies developing advanced alternatives, and government initiatives drive market growth. According to the World Health Organization (WHO) report published in December 2023, respiratory infectious disease incidences are rising in the region. Overlooking the rising infectious diseases, the government is taking initiatives to provide better health options. For instance, the European Respiratory Society (ERS) and Lungs Europe have formed an association for a project named EU PAL-COPD, to integrate respiratory medicine across the region. Such initiatives are expected to drive market growth in the region.

The rise in respiratory disease incidences is driving an increase in airway clearance systems in the UK. According to the NHS England, respiratory disease affects one in five people. It is the third most significant cause of death in the country, which includes COPD, lung cancer, and pneumonia. Various institutions and companies are involved in the research and development of advanced solutions to treat respiratory diseases. For instance, a team from South Warwickshire University NHS Foundation Trust, University Hospitals Coventry, and Warwickshire NHS Trust collaborated in creating an innovative HydroBubble, a positive expiratory pressure (PEP) device in May 2024. Such groundbreaking innovations are expected to drive market growth.

Asia Pacific Airway Clearance Systems Market Trends

Asia Pacific airway clearance systems market is estimated to register the fastest CAGR over the forecast period. The rising incidences of chronic respiratory diseases such as COPD are the primary factors for the market growth in the region. According to the Australian Institute of Health and Welfare report published in June 2024, about 638,000 people, accounting for 2.5% of Australian citizens, were suffering from COPD, which led to 4.0% deaths in 2022. Companies are offering a range of airway clearance devices in the nation, such as flutter mucus clearance respiratory device,aerobika device to treat COPD, cystic fibrosis, and bronchiectasis and a positive expiratory pressure exerciser (PEPE) to clear mucus and reduce airway obstruction. Such instances are expected to drive market growth.

The rising incidences of chronic respiratory diseases in India are driving market growth in the region. According to Nanavati Max Super Specialty Hospital data published in April 2023, COPD is the second leading cause of death in the country. Companies are collaborating to innovate respiratory devices in India owing to the increasing demand. For instance, AirPhysio, an Australian firm, collaborated with Apollo Hospitals Group and Medsmart in October 2022 to launch respiratory products in India. Such collaborative activities are expected to drive market growth.

Key Airway Clearance Systems Company Insights

Some key companies in the Airway Clearance Systems market include Baxter, Electromed Inc., Koninklijke Philips N.V., AbbVie Inc., and Med Systems, Inc. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Baxter develops, manufactures, and markets medical products catered to hospitals, clinics, kidney dialysis centers, and research laboratories. The company offers a wide range of respiratory care products such as monarch airway clearance, volara system, life2000 ventilators, and vest airway clearance system.

-

Med Systems, Inc. is an airway clearance device manufacturer that provides respiratory care products. The company has manufactured patented anatomical anesthesia masks and offers a range of respiratory products such as electro flo 5000, fluid flo 2500, fluid flo 2700, and fluid flo 2900.

Key Airway Clearance Systems Companies:

The following are the leading companies in the airway clearance systems market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- Electromed, Inc

- Koninklijke Philips N.V.

- General Physiotherapy II LLC

- AbbVie Inc

- Med Systems, Inc.

- Smiths Group plc

- VYAIRE

- PARI GmbH

- Dymedso

Recent Developments

-

In May 2023, Afflowest received the U.S. Food and Drug Administration (FDA’s) 510(k) approval for the U.S. market availability and clearance from Medicare, Medicaid, and private health insurance reimbursement.

-

In January 2022, ICU Medical Inc. acquired Smiths medical business from Smiths Group plc. The acquisition was expected to help in further boosting its infusion therapy business.

-

In December 2021, Baxter acquired Hillrom, a medical technology company. The acquisition is expected to help in company’s geographic expansion and further enhance its business.

-

In September 2021, Tactile Medical acquired Afflowest respiratory therapy business from International Biophysics Corporation.

Airway Clearance Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 633.3 million

Revenue forecast in 2030

USD 852.9 million

Growth Rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Baxter, Electromed, Inc, Koninklijke Philips N.V., General Physiotherapy II LLC, AbbVie Inc., Med Systems, Inc., Smiths Group plc, VYAIRE, PARI GmbH, Dymedso

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

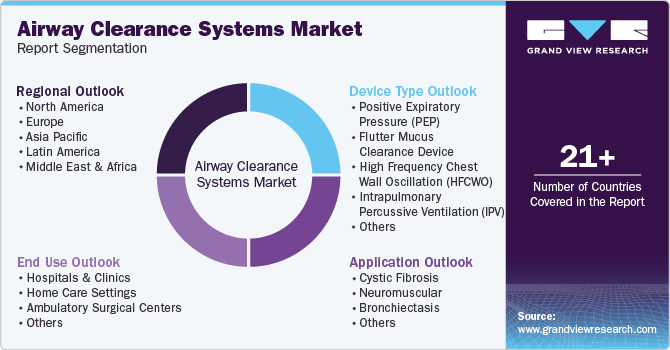

Global Airway Clearance Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global airway clearance systems market report based on device, application, end use, and region.

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Positive Expiratory Pressure (PEP)

-

Flutter Mucus Clearance Device

-

High Frequency Chest Wall Oscillation (HFCWO)

-

Intrapulmonary Percussive Ventilation (IPV)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cystic Fibrosis

-

Neuromuscular

-

Bronchiectasis

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Home care settings

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.