- Home

- »

- Petrochemicals

- »

-

Allyl Chloride Market Size & Share, Industry Report, 2030GVR Report cover

![Allyl Chloride Market Size, Share & Trends Report]()

Allyl Chloride Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Allyl Amines, Allyl Sulfonates, Epichlorohydrin, Glycidyl Ether, Water Treatment Chemicals), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-509-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Allyl Chloride Market Summary

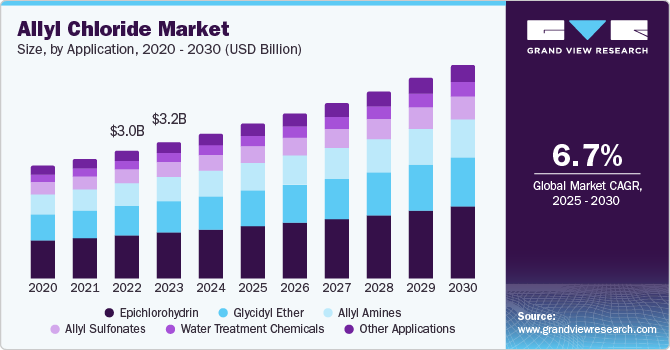

The global allyl chloride market size was estimated at USD 3.41 billion in 2024 and is projected to reach USD 5.02 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The growth of the industry is especially noticeable in emerging economies, where rapid industrialization and infrastructure development drive demand for epoxy resins and related products.

Key Market Trends & Insights

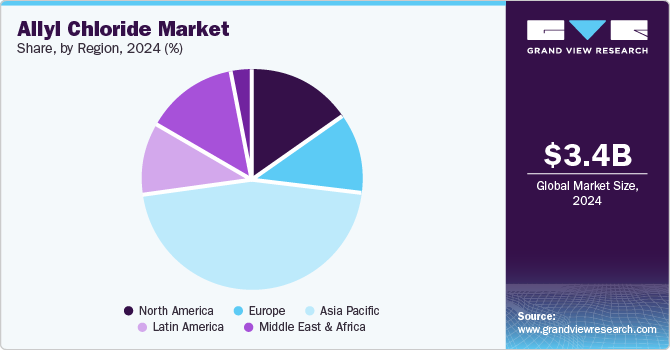

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of application, the epichlorohydrin segment dominated the market with a market share of 35.2% in 2024.

- In terms of application, Glycidyl Ether is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.41 Billion

- 2030 Projected Market Size: USD 5.02 Billion

- CAGR (2025-2030): 6.7%

- Asia Pacific: Largest market in 2024

Additionally, the industry's landscape is being shaped by an increase in vertical integration among major manufacturers, who are focusing on securing their raw material supply chains and improving production efficiency. The water treatment sector is a crucial growth area for products based on allyl chloride, especially in developed countries with strict environmental regulations.

In the United States, approximately 34 billion gallons of wastewater are processed daily, emphasizing the large scale of water treatment operations and the high demand for treatment chemicals. The industry is experiencing a significant shift towards advanced treatment technologies and sustainable solutions, with many facilities upgrading their capabilities to comply with increasingly stringent environmental standards. Substantial investments in water treatment infrastructure across various regions support this trend.

The water treatment sector is a significant growth area for products derived from allyl chloride, especially in developed countries that enforce strict environmental regulations. The industry is transforming towards advanced treatment technologies and sustainable solutions, as many facilities are enhancing their capabilities to comply with increasingly stringent environmental standards. Furthermore, substantial investments in water treatment infrastructure across various regions support this trend.

Drivers, Opportunities & Restraints

Due to their versatile chemical properties, allyl chloride derivatives have gained significant traction in various applications. They are commonly utilized in synthesizing pharmaceuticals, agrochemicals, and polymers, offering advantageous reactivity for carbon-carbon bond formation. Additionally, these derivatives serve as intermediates in producing fine chemicals, contributing to advancements in chemical manufacturing processes. Their growing importance is driven by the demand for more efficient and sustainable chemical solutions.

Stringent environmental regulations surrounding the allyl chloride market focus on minimizing the ecological impact of its production and use. These regulations are primarily driven by the compound's potential toxicity and environmental persistence. Governments are imposing stricter emission standards, waste management protocols, and safety measures to ensure that the manufacturing processes do not harm workers or the surrounding environment. Compliance with these regulations can increase manufacturers' operational costs but it is crucial for promoting sustainable practices within the industry. Additionally, these regulations encourage innovation, prompting companies to explore safer and greener alternatives in their production processes.

The industry presents opportunities driven by its diverse chemical, pharmaceutical, and agricultural applications. With the growing demand for specialty chemicals, allyl chloride can serve as a key intermediate in synthesizing various compounds. Additionally, the shift towards sustainable practices encourages the exploration of eco-friendly production methods, opening avenues for innovative solutions within the market. As industries seek to comply with stringent environmental regulations, companies that invest in developing safer alternatives could gain a competitive edge. Furthermore, the rising demand for agrochemicals offers potential growth as allyl chloride is utilized in producing herbicides and pesticides.

Application Insights

The epichlorohydrin segment dominated the market with a market share of 35.2% in 2024. The significant presence in the market can be attributed mainly to the widespread use of epichlorohydrin in the production of epoxy resins. These resins are essential for coatings, adhesives, and plastics industries. The increasing demand from various end-use industries further enhances the dominance of this segment. Moreover, the strong performance of this segment is supported by the growing applications of epoxy resins in the construction, automotive, and aerospace industries, where they are vital materials.

Due to its reactive epoxide group, the Glycidyl ether is derived from allyl chloride and is widely used in producing epoxy resins and adhesives. This compound enhances materials' chemical resistance, durability, and thermal stability. It serves as an essential intermediate in various chemical syntheses, contributing to the development of high-performance coatings, sealants, and composites in the automotive, aerospace, and construction industries. Its versatility makes glycidyl ether a significant application segment within the broader uses of allyl chloride.

Regional Insights

North America allyl chloride market is driven by significant technological advancements and a well-established manufacturing infrastructure throughout the United States, Canada, and Mexico. Strong demand in water treatment applications and the pharmaceutical industry primarily drives this market. The presence of major manufacturers and continuous investments in chemical manufacturing facilities further support the market's steady growth.

Asia Pacific Allyl Chloride Market Trends

The allyl chloride market in Asia Pacific dominated the global industry, with China, India, Japan, and South Korea being the leading consumers. This dominance results from the increasing production capacity of epichlorohydrin and its growing use in water treatment applications. The presence of major manufacturers and a growing industrial base, particularly in China and India, has strengthened the region's position in the global allyl chloride industry.

China allyl chloride market is fueled by rising investments in water treatment infrastructure and a booming pharmaceutical sector. The country's emphasis on industrial development and increasing demand from industries such as water treatment, pharmaceuticals, and adhesives continue to enhance its market position.

Europe Allyl Chloride Market Trends

The allyl chloride market in Europe is driven by a strong demand from Germany, the United Kingdom, France, and Italy. A well-established chemical manufacturing infrastructure and strict environmental regulations support this. The market in this region is characterized by a growing emphasis on sustainable production methods and an increasing demand from various end-use industries.

Latin America Allyl Chloride Market Trends

The allyl chloride market in Latin America is experiencing steady growth in its chemical manufacturing capabilities. Brazil stands out as the region's largest and fastest-growing market, fueled by the expansion of its water treatment infrastructure and a growing pharmaceutical sector. This market growth is further supported by increasing investments in water treatment projects and rising demand from various end-use industries.

Middle East & Africa Allyl Chloride Market Trends

The allyl chloride market in the Middle East and Africa shows significant potential, particularly in Saudi Arabia, South Africa, and other countries. Saudi Arabia is notable as both the most significant and fastest-growing market, supported by its strong chemical manufacturing sector and increasing investments in water treatment infrastructure. The market development in this region is driven by rising industrialization and an increasing demand for water treatment chemicals.

Key Allyl Chloride Company Insights

Some of the key players operating in the market include Solvay, Dow, and Olin Corporation.

-

The Dow Chemical Company is engaged in the production of plastics, agriculture products, and chemicals. It has a presence in over 160 countries and operates through five business units, namely consumer solutions, agricultural sciences, performance plastics, infrastructure solutions, and performance materials & chemicals. The company is engaged in manufacturing and distributing chemicals for various industries including agriculture, automobile, building & construction, consumer goods, electronic materials, energy & water, industrial, infrastructure, packaging, and sports. It offers over 6,000 products that are manufactured in 113 sites located in 31 countries. The company provides a broad range of surfactants under its performance materials & chemicals segment.

-

Solvay company has expertise in chemicals, materials, and solutions and offers its products and solutions to various industries such as automotive, healthcare, and water treatment, among others. It focuses on developing safer, cleaner, and sustainable solutions. The company is in 64 countries, and its major markets include Asia Pacific, Europe, and North America. As of 2023, it had 45 production sites in 41 countries and 20 major research & innovation centers.

Key Allyl Chloride Companies:

The following are the leading companies in the allyl chloride market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- Befar Group Co. Ltd.

- Gelest, Inc.

- INEOS

- Kashima Chemical Co., LTD

- Olin Corporation

- OSAKA SODA

- AccuStandard

- Sumitomo Chemical Co., Ltd

- Olin Corporation

- Dow

- DuPont

Recent Developments

-

In March 2023, INOVYN, a prominent chemical company based in the UK, has launched a sustainable, bio-based variant in the allyl chloride segment. This new product addresses environmental concerns and meets the increasing demand for eco-friendly chemical solutions.

Allyl Chloride Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.63 billion

Revenue forecast in 2030

USD 5.02 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Solvay; Befar Group Co. Ltd.; Gelest, Inc.; INEOS; Kashima Chemical Co., LTD; Olin Corporation; OSAKA SODA; AccuStandard; Olin Corporation; Dow; DuPont.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Allyl Chloride Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global allyl chloride market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Allyl Amines

-

Allyl Sulfonates

-

Epichlorohydrin

-

Glycidyl Ether

-

Water Treatment Chemicals

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global allyl chloride market size was estimated at USD 3.41 billion in 2024 and is expected to reach USD 3.63 billion in 2025.

b. The global allyl chloride market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 and reach USD 5.02 billion by 2030

b. Asia Pacific dominated the allyl chloride market with a share of 49.9% in 2024. This is attributable to the rising demand for allyl chloride in the region is driven by the growing chemical manufacturing sector, the expanding pharmaceutical industry, and the increasing demand for plastics.

b. Some key players operating in the allyl chloride market include AccuStandard, Befar Group Co.ltd. Gelest, Inc., INEOS, Kashima Chemical Co.,LTD , Olin Corporation, OSAKA SODA , Solvay, and Sumitomo Chemical Co., Ltd

b. The allyl chloride market is growing due to increased demand for plastics and polymers, pharmaceuticals, and water treatment chemicals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.