- Home

- »

- Plastics, Polymers & Resins

- »

-

Americas Stick Packaging Market Size, Industry Report, 2030GVR Report cover

![Americas Stick Packaging Market Size, Share & Trends Report]()

Americas Stick Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Biaxially Oriented Polypropylene (BOPP), Polyethylene (PE), Paper, Metallized Films), By End Use (Food & Beverages, Pharmaceuticals, Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-572-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Americas Stick Packaging Market Trends

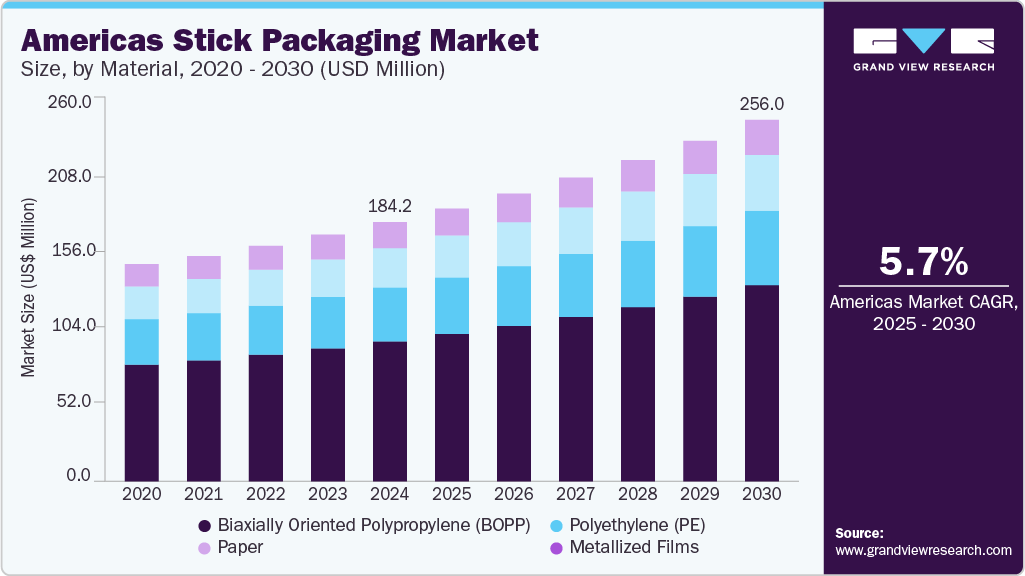

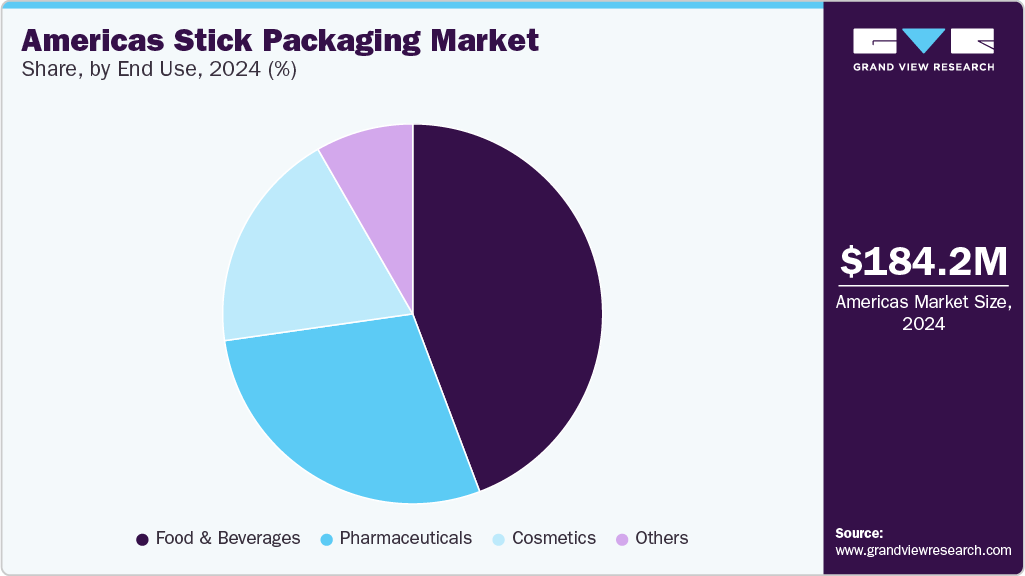

The Americas stick packaging market size was estimated at USD 184.2 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. The market is driven by rising demand for single-serve, portable packaging in the food, pharmaceutical, and personal care sectors. Increasing consumer preference for convenience and portion control further boosts market growth. The pharmaceutical and nutraceutical industries in the Americas have experienced consistent growth, significantly boosting demand for innovative and convenient packaging solutions such as stick packs.

The pharmaceutical and nutraceutical industries are increasingly focused on patient-centric delivery methods, particularly those that improve compliance, portability, and ease of use. Stick packaging, which allows for precise single-dose administration and easy handling, aligns perfectly with these evolving requirements. For example, in the U.S., over the counter (OTC) medications and dietary supplements are frequently being reformulated into powder or granular forms for stick packs to target on-the-go consumers seeking convenience and discretion in consumption.

As per European Federation of Pharmaceutical Industries and Associations (EFPIA), the U.S. holds a significant position in the global production and sales of pharmaceuticals as well as carries out research activities to launch new pharmaceuticals in the market. In 2023, North America accounted for 53.3% of global pharmaceutical sales, significantly outpacing Europe, which held 22.7% of the market share. Additionally, 67.1% of sales of new medicines launched globally between 2018 and 2023 occurred in the U.S. market, compared to only 15.8% in the European market (top 5 countries). This dominance reflects North America's large and growing pharmaceutical market, driven by high healthcare expenditure, extensive access to innovative medicines, and a strong presence of leading pharmaceutical companies. This positive outlook of North America’s pharmaceutical industry is expected to positively influence the Americas stick packaging market during the forecast period.

The U.S. leads the region in pharmaceutical innovation and dietary supplement consumption, followed closely by Brazil and Canada, which are witnessing rising health awareness and preventive healthcare trends. The demand for nutraceuticals, encompassing vitamins, minerals, herbal supplements, and functional foods, has surged due to aging populations, increasing incidences of chronic diseases, and shifting consumer preferences toward natural and health-boosting products. Stick packaging has become an attractive solution for such products due to its lightweight nature, extended shelf life, and enhanced barrier properties that protect sensitive ingredients from moisture and oxidation.

Another factor boosting stick packaging demand is the growing popularity of functional and fortified food & beverage products, such as energy powders, electrolyte mixes, and protein supplements. Health-conscious consumers prefer pre-measured stick packs for portion control and freshness, reducing waste and ensuring accurate dosing. For example, nutraceuticals brands use stick packs for their hydration and immunity-boosting powders, appealing to athletes and wellness-focused individuals. The convenience of tearing open a stick pack and mixing it with water aligns perfectly with active lifestyles, driving adoption across the U.S. and Latin America.

Material Insights

The biaxially oriented polypropylene (BOPP) segment recorded the largest market revenue share of over 50.0% in 2024. BOPP is a thermoplastic polymer used extensively in flexible packaging applications, including stick packs, due to its excellent clarity, moisture resistance, and printability. In the Americas, it is commonly used in food, pharmaceuticals, and personal care packaging. BOPP’s lightweight nature and adaptability to high-speed packaging lines make it a preferred choice for brands seeking efficiency. The growth of the BOPP segment is driven by increasing demand for lightweight, transparent, and cost-effective packaging, particularly in snack foods and powdered beverages.

Paper segment is projected to grow at the fastest CAGR of 6.0% during the forecast period. Paper-based stick packaging offers a sustainable alternative to plastics, often used for dry products such as instant coffee, sugar, and pharmaceutical powders. It is biodegradable, easy to print on, and appeals to eco-conscious consumers. Paper is often combined with barrier coatings or laminates for improved protection. Growing environmental concerns and regulatory restrictions on single-use plastics are major drivers for paper usage.

End Use Insights

The food & beverages segment recorded the largest market share of over 44.0% in 2024. Stick packs are increasingly used for products such as coffee, sugar, drink mixes, sauces, and spices due to their portion-control capability, lightweight nature, and ease of use. Their slim, single-serve format is ideal for on-the-go consumption, making them particularly appealing in urban settings. The primary driver for this segment is the growing consumer preference for convenience and portability, particularly among busy professionals and younger demographics. Moreover, the expansion of e-commerce and D2C food brands favor compact, lightweight packaging solutions such as stick packs.

Pharmaceutical segment is projected to grow at the fastest CAGR of 6.1% during the forecast period. Stick packaging is gaining momentum in the pharmaceutical sector across the Americas, especially for over the counter (OTC) medications, nutraceuticals, and dietary supplements in powder or liquid form. The unit-dose feature ensures accurate dosage, hygiene, and convenience, which are critical in pharmaceutical applications. Rising health awareness, especially post-COVID-19, has increased the demand for immunity-boosting supplements and OTC products.

Region Insights

North America stick packaging market dominated and accounted for the largest revenue share of over 79.0% in 2024 and is expected to grow at the fastest CAGR of 5.9% over the forecast period. The North American stick packaging market represents the most mature and largest segment within the Americas, with the U.S. serving as the dominant regional force due to its robust consumer goods industry and well-established retail infrastructure. Canada contributes significantly with its focus on sustainable packaging solutions, while Mexico's rapidly growing urban population drives increased adoption of convenience packaging formats. This region features sophisticated manufacturing capabilities, high levels of automation, and strong adoption of innovative packaging technologies.

Latin America Stick Packaging Market Trends

The Latin American stick packaging market presents growth potential, with Brazil emerging as the regional leader due to its large population base and expanding middle class, followed by Argentina with its established food processing sector, and Colombia experiencing rapid industrialization in packaging industries. This region is characterized by increasing urbanization, growing retail modernization, and rising consumer awareness of convenience packaging benefits, albeit with varying levels of technological adoption across countries. Key driving factors for Latin America include rapid urbanization creating demand for convenient packaged goods, rising disposable incomes allowing consumers to purchase premium single-serve products, and growing health consciousness favoring portion-controlled packaging formats.

Key Americas Stick Packaging Company Insights

The Americas stick packaging market operates in a highly competitive environment. Key players, including Amcor plc, Huhtamaki, Constantia Flexibles, and Glenroy, Inc. compete on innovation, sustainability, and cost efficiency, while regional manufacturers leverage localized supply chains to cater to niche markets. The rise of eco-friendly materials and flexible packaging solutions has intensified competition, with companies striving to meet regulatory standards and consumer preferences for sustainable options. Additionally, the growing popularity of on-the-go snacking and liquid supplements in North and South America further fuels market rivalry, pushing firms to enhance product differentiation and expand their distribution networks.

Key Americas Stick Packaging Companies:

- Amcor plc

- Constantia Flexibles

- Glenroy, Inc.

- Catalent, Inc

- Huhtamaki

- ePac Holdings, LLC

- Korpack

- Polynova Industries Inc

- Elitefill

- Kimac Industries

- CarePac

- ProAmpac

- Associated Labels & Packaging

Recent Developments

-

In April 2025, Amcor plc completed its all-stock acquisition of Berry Global Inc, creating a global packaging leader with around 400 facilities, 75,000 employees, and operations in 140 countries. The merger, valued at approximately USD 13.0 billion, enhances Amcor's portfolio with expanded material science and innovation capabilities, positioning it to deliver more consistent growth and improved margins.

-

In February 2025, Karma Water launched its new Probiotic and Energy Stick Packs, representing a significant innovation in portable wellness hydration by delivering the same premium ingredients and functional benefits as their bottled waters in a compact, easy-to-mix powder format.

-

In January 2025, Safety Shot, Inc. launched revolutionary on-the-go stick packs of its clinically backed, patented Sure Shot formula, designed to reduce blood alcohol content while boosting clarity, energy, and mood. Available immediately online in two flavors-Citrus Splash and Berry Blast-these convenient powder stick packs aim to disrupt the rapidly growing wellness market.

Americas Stick Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 193.9 million

Revenue forecast in 2030

USD 256.0 million

Growth rate

CAGR of 5.7% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

States scope

North America; Latin America

Key companies profiled

Amcor plc; Constantia Flexibles; Glenroy, Inc.; Catalent, Inc; Huhtamaki; ePac Holdings, LLC; Korpack; Polynova Industries Inc; Elitefill; Kimac Industries; CarePac; ProAmpac; Associated Labels & Packaging

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Stick Packaging Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Americas stick packaging market report based on material, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Biaxially Oriented Polypropylene (BOPP)

-

Polyethylene (PE)

-

Paper

-

Metallized Films

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Cosmetics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Frequently Asked Questions About This Report

b. The Americas stick packaging market was estimated at around USD 184.2 million in the year 2024 and is expected to reach around USD 193.9 million in 2025.

b. The Americas stick packaging market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach around USD 256.0 million by 2030.

b. The food & beverages dominated the Americas stick packaging market in 2024 with 44.0% value share due to rising demand for convenient, single-serve packaging formats and growing consumption of snacks, powdered drinks, and condiments.

b. The key players in the Americas stick packaging market include Amcor plc; Constantia Flexibles; Glenroy, Inc.; Catalent, Inc; Huhtamaki; ePac Holdings, LLC; Korpack; Polynova Industries Inc; Elitefill; Kimac Industries; CarePac; ProAmpac; Associated Labels & Packaging

b. The Americas stick packaging market is driven by rising demand for convenient, single-serve packaging formats in food, pharmaceutical, and personal care sectors. Additionally, increasing consumer preference for on-the-go products and growing focus on reducing packaging waste are fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.