- Home

- »

- Specialty & Chemicals

- »

-

Ammonia Fuel Market Size & Share, Industry Report, 2033GVR Report cover

![Ammonia Fuel Market Size, Share & Trends Report]()

Ammonia Fuel Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Green Ammonia, Blue Ammonia, Grey Ammonia), By Application (Power Generation Fuel, Maritime Shipping Fuel, Industrial Process & Heat Fuel), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-793-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ammonia Fuel Market Summary

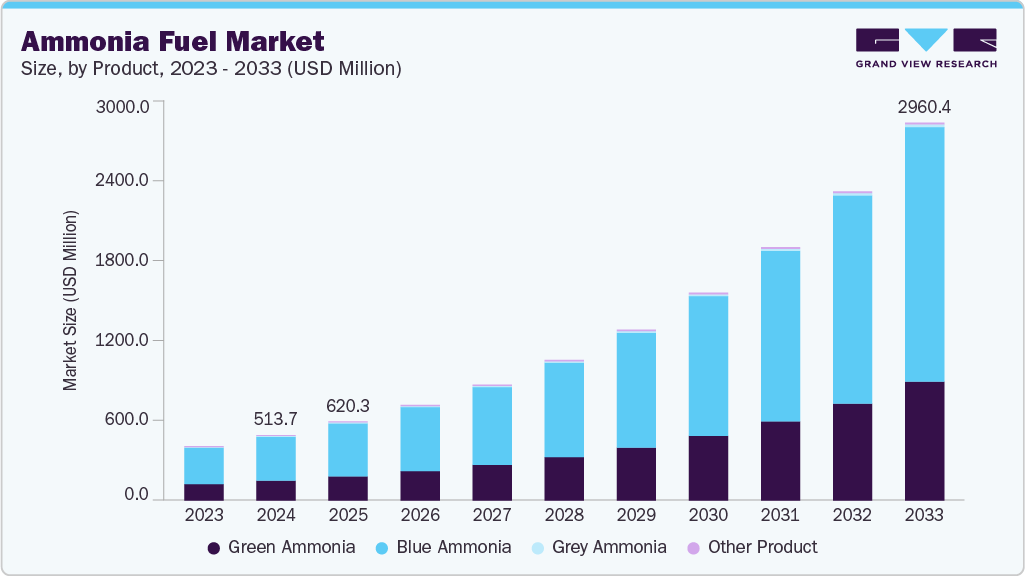

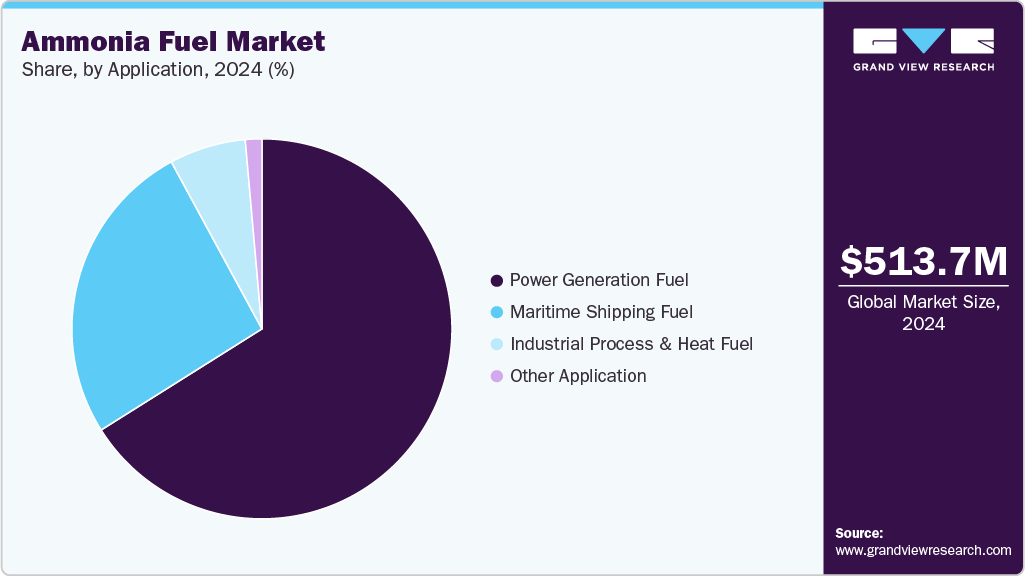

The global ammonia fuel market size was estimated at USD 513.7 million in 2024 and is projected to reach USD 2,960.4 million by 2033, growing at a CAGR of 21.6% from 2025 to 2033. Ammonia is rapidly emerging as a promising carbon-free fuel due to its ability to store hydrogen efficiently, its established global infrastructure, and its potential to reduce emissions across heavy industries and shipping.

Key Market Trends & Insights

- Asia Pacific leads the ammonia fuel market primarily due to the early adoption of blue and green ammonia in countries such as Japan, South Korea, and Australia.

- China held over 73.2% revenue share of the Asia Pacific ammonia fuel market.

- By product, blue ammonia dominated the market and accounted for the largest revenue share of 66.9% in 2024.

- By application, the industrial process & heat fuel segment is expected to grow with a CAGR of 25.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 513.7 Million

- 2033 Projected Market Size: USD 2,960.4 Million

- CAGR (2025-2033): 21.6%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

As decarbonization accelerates, ammonia’s dual role as an energy carrier and direct fuel is gaining significant commercial relevance. The industry transitioned from a research-driven concept to early commercialization. Pilot projects in power generation, maritime shipping, and hydrogen transport have validated its technical feasibility, prompting interest from both private investors and governments. Early adopters, particularly in Asia and Europe, are investing in large-scale green ammonia projects that integrate renewable power with ammonia synthesis. This momentum reflects growing confidence in ammonia’s long-term role within the global energy mix, supported by measurable cost reductions in renewable electricity and electrolyzers, which are making sustainable ammonia production more viable.Government commitments toward carbon neutrality and stricter maritime emission regulations are influencing rapid market development. The International Maritime Organization’s decarbonization goals have motivated shipbuilders and fuel suppliers to explore ammonia-fueled engines and bunkering facilities. Power utilities are also testing ammonia co-firing in turbines as part of their low-carbon transition. Despite operational and handling challenges, such as toxicity and nitrogen oxide emissions, the ongoing development of safer combustion methods and emission-control systems demonstrates industry readiness to overcome technical barriers. This period of expansion highlights a shift from experimentation to structured market creation supported by regulatory alignment and private capital.

Companies investing early in renewable-based ammonia plants, transportation infrastructure, and storage systems are likely to capture significant market share as demand expands. The growing integration of ammonia within hydrogen supply chains-especially as a hydrogen carrier-further strengthens its market position. Opportunities exist across value-chain segments, including electrolyzer manufacturing, logistics, fuel distribution, and marine engineering. With increasing international collaboration, price transparency, and standardization, ammonia is on track to evolve from a niche solution to a core component of the global clean energy economy.

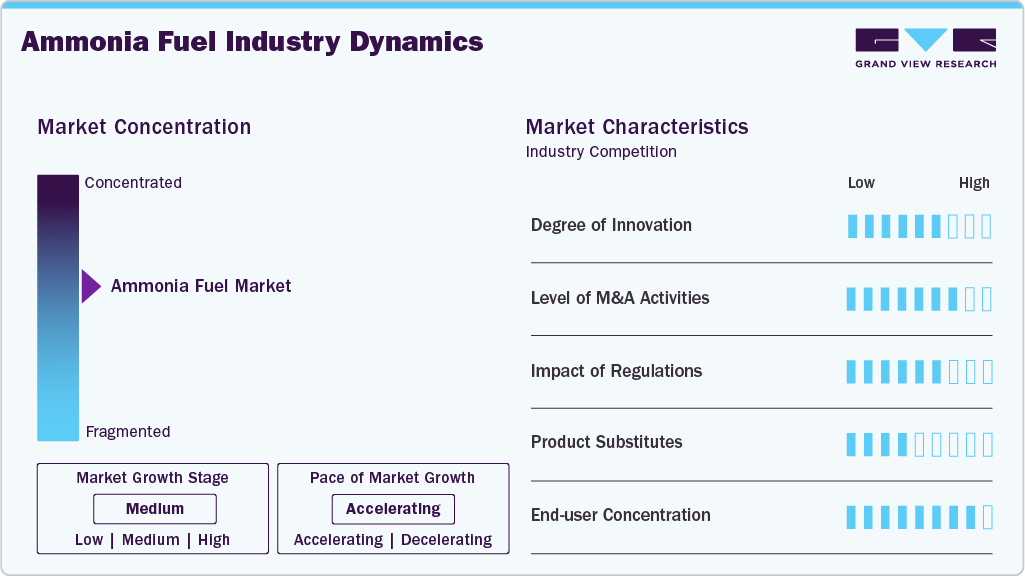

Market Concentration & Characteristics

The industry is characterized by a high degree of specialization and strategic development, driven by the global push for decarbonization. Its concentration is largely influenced by a small number of global players who dominate production, technology, and supply chains. These companies focus on producing low-carbon ammonia, including green and blue variants, and collaborate closely with industries such as power generation, maritime shipping, and industrial heat to enable adoption. Market dynamics are shaped by technological innovation, regulatory frameworks, and long-term offtake agreements, rather than widespread commercial deployment, making the market highly project-driven.

The industry exhibits a unique combination of industrial scale and emerging applications, blending traditional bulk chemical production with renewable energy integration. Adoption is currently focused on pilot projects, early-scale commercial trials, and strategic partnerships. Its characteristics include high capital intensity, complex logistics, and a growing emphasis on sustainability. The sector is also marked by collaboration between producers, technology providers, and end-users, reflecting a coordinated approach to building a reliable ammonia fuel ecosystem.

Product Insights

Blue ammonia dominated the market and accounted for the largest revenue share of 66.9% in 2024. The segment leads the market primarily due to its early commercial adoption and established production infrastructure. Produced using natural gas with carbon capture and storage (CCS), blue ammonia offers a lower-carbon alternative without requiring a complete shift to renewable energy. Its dominance is reinforced by large-scale co-firing projects in power generation and export agreements with countries pursuing transitional decarbonization strategies. The segment’s strong revenue share reflects both high production volumes and growing industrial demand, making it the primary driver of the industry.

Green ammonia segment is expected to grow at the fastest CAGR of 22.0% from 2025 to 2033. The green ammonia segment is projected to register the fastest growth owing to increasing global emphasis on sustainable energy and carbon-neutral solutions. Produced from renewable electricity through water electrolysis, it aligns with government policies and corporate commitments to reduce greenhouse gas emissions. Growth is further supported by rising interest from the maritime shipping sector, pilot projects, and planned commercial deployments. This combination of technological advancement, policy support, and strategic investment positions green ammonia as the most rapidly expanding segment in the industry.

Application Insights

The power generation fuel segment dominated the market and accounted for the largest revenue share of 66.0% in 2024. The segment leads the industry due to the early adoption of ammonia in co-firing applications within existing coal and gas power plants. Blue ammonia is particularly favored because it allows a lower-carbon transition without major infrastructure changes. Large-scale projects and long-term supply agreements with utilities have reinforced its dominance. This segment’s significant revenue share reflects both the volume of ammonia consumed and its strategic role in decarbonizing electricity generation.

Industrial process & heat fuel segment is expected to grow fastest with a CAGR of 25.6% from 2025 to 2033. The industrial process and heat fuel segment is projected to grow rapidly due to increasing industrial demand for low-carbon alternatives to conventional fuels. Ammonia’s high energy density and combustion characteristics make it suitable for high-temperature processes and heat-intensive applications. Growth is further driven by regulatory pressures on industries to reduce emissions and the adoption of pilot projects demonstrating feasibility.

Regional Insights

Asia Pacific leads the ammonia fuel market with a revenue share of 57.7% in 2024, primarily due to the early adoption of blue and green ammonia in countries such as Japan, South Korea, and Australia. The region benefits from strong industrial demand, established ammonia production capacity, and significant investments in pilot and commercial-scale fuel projects. Supportive government policies, energy transition targets, and long-term offtake agreements with shipping and power generation sectors have reinforced the dominance of Asia Pacific in terms of revenue share.

China dominates ammonia consumption and is increasingly focusing on low-carbon energy solutions, making it a key market for ammonia fuel. Government policies promoting carbon neutrality by 2060, substantial investments in renewable energy, and the modernization of industrial and power sectors drive demand. The country’s large maritime shipping fleet is exploring ammonia as a zero-emission fuel, while domestic industrial heat and power generation applications create significant adoption opportunities.

North America Ammonia Fuel Market Trends

North America is projected to register the fastest growth in the global ammonia fuel market due to large-scale investments in blue ammonia production, particularly in the United States. The region benefits from abundant natural gas resources, advanced carbon capture infrastructure, and supportive federal and state-level policies promoting low-carbon fuels. Increasing adoption in power generation and industrial applications, coupled with strategic export opportunities, positions North America as the fastest-growing regional market over the forecast period.

U.S. Ammonia Fuel Market Trends

The ammonia fuel market in the U.S. is witnessing strong growth due to abundant natural gas reserves, which enable cost-effective blue ammonia production. Advanced carbon capture and storage (CCS) infrastructure supports low-carbon ammonia projects, particularly for co-firing in power plants. Federal and state-level incentives promoting decarbonization, combined with significant private-sector investment in green ammonia pilot projects, are accelerating adoption. Additionally, strategic export opportunities to Asia further enhance the market’s growth potential.

Europe Ammonia Fuel Market Trends

The ammonia fuel market in Europe is supported by strong regulatory frameworks, including strict carbon emission targets and incentives for renewable energy adoption. Green ammonia projects are gaining traction in maritime shipping and power generation, particularly in Northern Europe. Public-private partnerships, advanced port infrastructure for ammonia handling, and increasing industrial demand for low-carbon heat contribute to Europe’s market expansion, positioning the region as a leader in sustainable fuel adoption.

Latin America Ammonia Fuel Market Trends

The ammonia fuel market in Latin America is driven by emerging interest in sustainable energy solutions and pilot projects in power generation. Abundant natural gas reserves in countries like Brazil and Argentina support potential blue ammonia production. However, adoption is limited by infrastructure constraints and early-stage regulatory support. Regional initiatives to decarbonize industrial and maritime sectors, combined with investment from global ammonia producers, are expected to gradually stimulate market growth.

Middle East & Africa Ammonia Fuel Market Trends

The Middle East & African market is gaining traction due to its strong ammonia production capacity and natural gas availability, which support both blue and green ammonia initiatives. The region’s governments are increasingly investing in clean energy and decarbonization projects, particularly for power generation and export-oriented ammonia. Strategic port infrastructure and partnerships with international shipping companies further drive the market, while industrial and maritime applications are beginning to adopt ammonia as a low-carbon fuel.

Key Ammonia Fuel Company Insights

Key players operating in the ammonia fuel market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. The two key dominant manufacturers in the market are Yara International ASA and CF Industries Holdings, Inc.

-

Yara International is a global leader in ammonia production with a strong focus on sustainable and low-carbon solutions. The company has strategically expanded into green ammonia and clean energy projects, positioning itself at the forefront of the ammonia fuel market. Its initiatives aim to integrate renewable energy into production processes, supporting the transition to zero-carbon applications in power generation and maritime shipping.

-

CF Industries is recognized as a major producer of ammonia with significant involvement in low-carbon and blue ammonia projects. The company is actively engaged in developing ammonia for use as a fuel, emphasizing clean energy applications and the reduction of carbon emissions in the industrial and power sectors.

Key Ammonia Fuel Companies:

The following are the leading companies in the ammonia fuel market. These companies collectively hold the largest market share and dictate industry trends.

- Yara International ASA

- CF Industries Holdings, Inc.

- ExxonMobil Corporation

- Royal Dutch Shell plc

- Eni S.p.A.

- OCI N.V.

- QatarEnergy

- SABIC

- BASF SE

- Air Liquide S.A.

Recent Developments

-

In January 2025, South Korea’s KIMM, in collaboration with Hyundai Motor and Kia, developed the world’s first 2-liter ammonia-fueled engine using high-pressure liquid injection technology, marking a major zero-carbon innovation for vehicles, ships, aircraft, and industrial power systems.

-

In August 2025, the Global Maritime Forum reported that methanol and ammonia have advanced as zero-emission shipping fuels, with methanol ready for low-carbon operation and ammonia for piloting, though greater policy and infrastructure support is needed for large-scale adoption.

Ammonia Fuel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 620.3 million

Revenue forecast in 2033

USD 2,960.4 million

Growth rate

CAGR of 21.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

Yara International ASA; CF Industries Holdings, Inc.; ExxonMobil Corporation; Royal Dutch Shell plc; Eni S.p.A.; OCI N.V.; QatarEnergy; SABIC; BASF SE; Air Liquide S.A.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ammonia Fuel Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global ammonia fuel market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Green Ammonia

-

Blue Ammonia

-

Grey Ammonia

-

Other Product

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Power Generation Fuel

-

Maritime Shipping Fuel

-

Industrial Process & Heat Fuel

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ammonia fuel market size was estimated at USD 513.7 million in 2024 and is expected to reach USD 620.3 million in 2025.

b. The global ammonia fuel market is expected to grow at a compound annual growth rate of 21.6% from 2025 to 2033, reaching USD 2,960.4 million by 2033.

b. The Blue Ammonia segment accounted for the largest share of the Ammonia as Fuel Market. This dominance is attributed to its early commercialization, established production infrastructure, and suitability for large-scale deployment in power generation and export applications. Blue ammonia offers a lower-carbon alternative by incorporating carbon capture and storage (CCS) technologies, making it a practical transitional fuel while green ammonia projects continue scaling up.

b. Some of the key players operating in the ammonia as fuel Market include Yara International ASA, CF Industries Holdings, Inc., ExxonMobil Corporation, Royal Dutch Shell plc, Eni S.p.A., OCI N.V., QatarEnergy, SABIC, BASF SE, Air Liquide S.A.

b. Key factors driving the Ammonia as Fuel Market include growing decarbonization goals, advancements in blue and green ammonia technologies, supportive government policies, rising demand for low-carbon fuels in shipping and power generation, and increasing investments in clean energy infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.