- Home

- »

- Clinical Diagnostics

- »

-

Analytical Standards Market Size, Share, Trends Report 2030GVR Report cover

![Analytical Standards Market Size, Share & Trends Report]()

Analytical Standards Market (2024 - 2030) Size, Share & Trends Analysis Report By Category (Organic Analytical Standards, In-organic Analytical Standards), By Technique, By Application, By Methodology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-218-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Analytical Standards Market Summary

The global analytical standards market size was estimated at USD 1.34 billion in 2023 and is projected to reach USD 2.08 billion by 2030, growing at a CAGR of 6.57% from 2024 to 2030. The market growth is attributed to the increasing demand for testing in pharmaceuticals, environmental monitoring, and food and beverage industries.

Key Market Trends & Insights

- North America dominated the market with the revenue share of 43.92% in 2023.

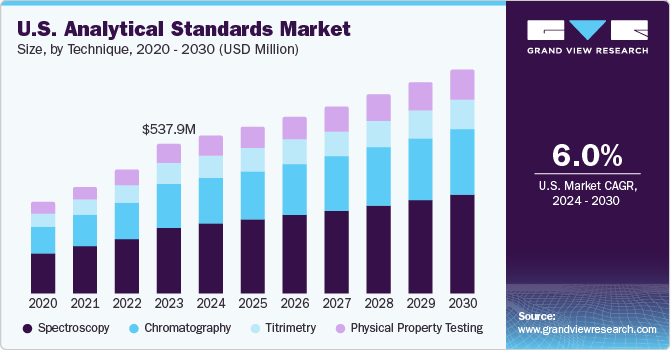

- Based on technology, the spectroscopy segment led the market with the largest revenue share of 44.27% in 2023.

- Based on category, the organic analytical standards segment led the market with a largest revenue share of 56.49% in 2023.

- Based on application, the pharmaceutical and life science segment led the market with a largest revenue share of 22.72% in 2023.

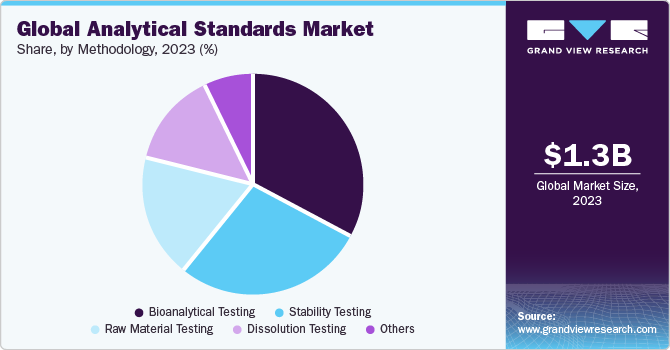

- Based on methodology, the bioanalytical testing segment led the market with a largest revenue share of 33.08% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.34 Billion

- 2030 Projected Market Size: USD 2.08 Billion

- CAGR (2024-2030): 6.57%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Growth is further fueled by stringent regulations, technological advancements, and the need for accurate and reliable analysis across various industries.One of the key drivers of market growth is the rising demand for analytical standards in the pharmaceutical industry. With the increasing complexity of drug molecules and the growing emphasis on quality and safety, pharmaceutical companies are increasingly relying on analytical standards for drug development, quality control, and regulatory compliance. This trend is expected to drive significant market growth, as pharmaceutical companies continue to invest in new drug development and testing.

In addition, increasing focus on food safety and quality by manufacturers is expected to keep up the demand for analytical standards in coming years. Food manufacturers are under pressure to ensure the safety and authenticity of their products, leading to a growing demand for analytical standards for food testing and analysis. This trend is expected to drive market growth, particularly in emerging markets where food safety regulations are becoming more stringent. Environmental testing is also driving growth in the market, as governments and regulatory bodies around the world are increasingly focusing on environmental protection and sustainability. Analytical standards are used in environmental testing to monitor pollutants, assess environmental risks, and ensure compliance with environmental regulations. This trend is expected to drive significant market growth, as environmental testing becomes more widespread and sophisticated.

In addition to these factors, several trends are shaping the market. One trend is the increasing adoption of advanced analytical techniques such as chromatography, spectroscopy, and mass spectrometry. These techniques require high-quality analytical standards to ensure accurate and reliable results, driving demand in the market. Another trend is the growing popularity of certified reference materials (CRMs) in analytical testing. CRMs are used as a benchmark for analytical measurements, providing a reliable basis for quality control and method validation. The demand for CRMs is expected to grow as industries seek to improve the accuracy and reliability of their analytical measurements.

Market Concentration & Characteristics

The market exhibits a moderate degree of innovation, primarily driven by advancements in analytical techniques and the development of new reference materials. Innovations include the introduction of novel analytical standards for complex molecules, such as biologics and biosimilars, as well as the use of advanced analytical techniques to improve the accuracy and reliability of measurements in various industries.

The market has seen a moderate level of merger and acquisition activity, with companies seeking to expand their product portfolios and geographic presence. Key players in the market have acquired smaller companies to gain access to new technologies and capabilities. Additionally, strategic partnerships and collaborations are common in the market, enabling companies to leverage each other's strengths and enhance their market position.

Regulations significantly impact the market by ensuring the accuracy and reliability of measurements and tests. Compliance with stringent regulations for life sciences research and process validation & standardization drives the demand for analytical standards. The market's growth is also influenced by the expansion of life sciences and healthcare industries, which require precise analytical testing.

In the global market, product substitutes are limited due to the unique role of standards in ensuring accuracy and reliability in analytical measurements. While some alternative approaches exist, such as using in-house reference materials or calibrating instruments with external standards, these methods often lack the accuracy and traceability provided by certified analytical standards. As a result, certified standards remain the preferred choice for most analytical applications.

The market exhibits a high level of end-user concentration, with key industries such as pharmaceuticals, food and beverage, and environmental testing dominating the market. These industries have a significant demand for analytical standards due to regulatory requirements and quality control needs. While there are other end-user segments, these key industries drive a large portion of the market demand and trends.

Technique Insights

Based on technology, the spectroscopy segment led the market with the largest revenue share of 44.27% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is fueled by the increasing adoption of advanced spectroscopic techniques in industries like pharmaceuticals, environmental testing, and food and beverage. One driving factor is the demand for accurate and reliable analysis in pharmaceutical development, where spectroscopy plays a critical role in drug formulation and quality control. For instance, in the pharmaceutical industry, high-performance liquid chromatography (HPLC) coupled with mass spectrometry is used for the analysis of drug compounds, driving the need for certified reference materials (CRMs) to ensure the accuracy and reliability of analytical results. In addition, the expansion of the food and beverage industry and the stringent regulations regarding food safety are also driving the demand for spectroscopic analysis and, consequently, analytical standards. For instance, in September 2023, PepsiCo announced that they would be setting up a new food manufacturing plant in India. Such capacity expansions are likely to increase the demand for the markets.

The physical property testing segment is anticipated to grow at a lucrative CAGR over the forecast period. As industries strive for higher quality products, the need for robust quality control and assurance measures becomes essential. Physical property testing helps ensure that materials and products meet specified standards, helping companies maintain consistency and reliability.

Category Insights

Based on category, the organic analytical standards segment led the market with a largest revenue share of 56.49% in 2023. Organic analytical standards are essential for ensuring the accuracy and reliability of analytical measurements in various industries, including pharmaceuticals, environmental testing, and food and beverage. One driving factor for the use of organic analytical standards is the increasing complexity of organic compounds used in these industries. For instance, in the pharmaceutical industry, the development of new drug compounds requires precise analysis, driving the demand for organic analytical standards for calibration and validation.

In addition, the growing focus on environmental protection has led to the need for organic analytical standards for the analysis of pollutants and contaminants in air, water, and soil. This trend is expected to continue driving the demand for organic analytical standards in the coming years. On the other hand, the inorganic analytical standards segment is likely to grow at a steady CAGR over the forecast period.

Application Insights

Based on application, the pharmaceutical and life science segment led the market with a largest revenue share of 22.72% in 2023. Analytical standards play a vital role in pharmaceutical and life science research and development. They are essential for ensuring the accuracy and reliability of measurements, which is critical for drug development and testing. For example, in the development of a new drug, analytical standards are used to measure the purity and potency of the active pharmaceutical ingredient (API).

In addition, the market for analytical standards in the pharmaceutical and life science industries is driven by several factors, including increasing regulatory requirements, technological advancements, and the growing demand for high-quality analytical data. As the pharmaceutical and life science industries continue to innovate and develop new drugs and medical devices, the demand for analytical standards is expected to grow, driving market growth in the coming years.

The food and beverage analysis segment is likely to grow with a lucrative CAGR over the forecast period. The increasing complexity of global food supply chains and the need for rigorous quality control have driven a surge in demand for analytical standards in food and beverage industry. Accurate measurement and verification of ingredients, contaminants, and nutritional content are essential to ensure compliance with regulatory requirements and meet consumer expectations for safety and transparency. Such compliances are likely to spur the demand in coming years.

Methodology Insights

Based on methodology, the bioanalytical testing segment led the market with a largest revenue share of 33.08% in 2023. Bioanalytical testing is a crucial aspect of drug development and pharmacokinetic studies, relying heavily on analytical standards for accurate and reliable results. One driving factor for the use of analytical standards in bioanalytical testing is the need for consistent and reproducible measurements to ensure the safety and efficacy of drugs. For example, in pharmacokinetic studies, analytical standards are used to calibrate instruments and validate methods for the quantification of drugs and their metabolites in biological samples.

The methodology for bioanalytical testing typically involves sample preparation, chromatographic separation, and detection using techniques such as liquid chromatography-mass spectrometry (LC-MS) or gas chromatography-mass spectrometry (GC-MS). Analytical standards are used at various stages of the methodology to ensure the accuracy and reliability of the results, including in the calibration of instruments, validation of methods, and quantification of analytes in samples.

The stability testing segment is projected to witness the fastest CAGR over the forecast period. Driving factors include regulatory requirements and the need to ensure product quality. For instance, in stability testing, analytical standards are used to monitor the degradation of drugs over time. The methodology involves exposing samples to various stress conditions and analyzing them using chromatography or spectroscopy. The stability testing segment is expected to experience one of the fastest growth rates due to increasing drug development and regulatory requirements.

Regional Insights

North America dominated the market with the revenue share of 43.92% in 2023, owing to factors such as including stringent regulatory requirements, technological advancements, and the presence of key market players. Regulatory bodies such as the FDA and EPA require the use of analytical standards for ensuring the quality and safety of pharmaceuticals, food, and environmental samples. Technological advancements, such as the development of high-performance analytical instruments, are driving the demand for more sophisticated analytical standards. Additionally, the presence of major market players like Agilent Technologies, Merck KGaA, and Waters Corporation in North America contributes to the market growth in the region, as these companies drive innovation and provide a wide range of products to meet market demand.

U.S. Analytical Standards Market Trends

The analytical standards market in the U.S. is expected to grow at the fastest CAGR over the forecast period due, to increasing demand for quality control in pharmaceuticals, stringent regulations in environmental testing, and growing adoption of advanced analytical techniques. These factors are driving the market growth and shaping the competitive landscape in the region.

Europe Analytical Standards Market Trends

Europe analytical standards market was identified as a lucrative region in this industry. The market growth in the region can be attributed to an increasing demand for food safety testing, stringent regulations in pharmaceuticals, and a growing emphasis on environmental monitoring.

The analytical standards market in UK is expected to grow at the fastest CAGR over the forecast period due to growing demand for high-quality analytical measurements in pharmaceutical and environmental sectors, stringent regulatory requirements, and increasing adoption of advanced analytical techniques.

The France analytical standards market is expected to grow at the fastest CAGR over the forecast period, attributed to the increasing focus on research and development in pharmaceutical and biotechnology industry.

The analytical standards market in Germany is expected to grow at the fastest CAGR over the forecast period, due to the increasing adoption of advanced analytical techniques across various industries such as pharmaceutical and life sciences, environmental agencies, and food & beverage.

Asia Pacific Analytical Standards Market Trends

The Asia Pacific is anticipated to witness the fastest CAGR during the forecast period, driven by factors such as increasing industrialization, growing pharmaceutical and biotechnology industries, and rising focus on food safety and environmental monitoring. The region offers significant opportunities for market expansion, particularly in countries like China, India, and Japan, which are witnessing rapid economic growth and technological advancements. In addition, the increasing adoption of advanced analytical techniques and the presence of a large population base are further driving market growth in the region. The Asia-Pacific market is poised for substantial growth and presents lucrative opportunities for market players.

The analytical standards market in China is expected to grow at the fastest CAGR over the forecast period, due to the growing focus on improving healthcare R&D aided by development of novel technologies.

The Japan analytical standards market is expected to grow at the fastest CAGR over the forecast period, due to the presence of a well-established healthcare system, increasing spending on new drug development and a robust pipeline of numerous therapeutic categories

Latin America Analytical Standards Market Trends

The analytical standards market of Latin America was identified as a lucrative region in this industry. Technological advancements in the region are anticipated to fuel market growth.

The Brazil analytical standards market is expected to grow at the fastest CAGR over the forecast period, due to the growing need for quality control and compliance with regulatory requirements.

MEA Analytical Standards Market Trends

The analytical standards market in MEA was identified as a lucrative region in this industry. The market in this region is driven by the increasing adoption of advanced analytical techniques in industries such as pharmaceuticals, environmental testing, and food safety.

The Saudi Arabia analytical standards market is expected to grow at the fastest CAGR over the forecast period, owing to the stringent regulatory requirements in industries such as pharmaceuticals and food safety is also driving the demand for analytical standards in the country.

Key Analytical Standards Company Insights

Some of the leading players operating in the global market include Merck KGaA, Agilent Technologies, Waters Corporation, and Restek Corporation. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

AccuStandard, Inc., LGC Standards, SPEX CertiPrep, and Chiron AS are some of the emerging market participants in the global market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Analytical Standards Companies:

The following are the leading companies in the analytical standards market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Waters Corporation

- Agilent Technologies, Inc.

- Shimadzu Corporation

- PerkinElmer Inc.

- LGC Limited

- Restek Corporation.

- AccuStandard

- Cayman Chemical

- RICCA Chemical Company

Recent Developments

-

In June 2023, Agilent Technologies Inc. launched two cutting-edge liquid chromatography mass spectrometry systems: the Agilent 6495D LC/TQ and the Agilent Revident LC/Q-TOF. In addition, to enhance the top-tier performance of the Revident LC/Q-TOF, Agilent has introduced the new Agilent MassHunter Explorer Profiling software and the Agilent ChemVista library manager software

-

In March 2023, LGC has announced the acquisition of Lipomed AG's reference materials business, which includes standards used in drugs of abuse and toxicology applications. This acquisition significantly enhances LGC's existing reference standards portfolio, providing a broader range of offerings to its customers

Analytical Standards Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.42 billion

Revenue forecast in 2030

USD 2.08 billion

Growth rate

CAGR of 6.57% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, technique, application, methodology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Merck KGaA; Waters Corporation; Agilent Technologies, Inc.; Shimadzu Corporation; PerkinElmer Inc.; LGC Limited; Restek Corporation.; AccuStandard; Cayman Chemical; RICCA Chemical Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Analytical Standards Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global analytical standards market report based on category, technique, application, methodology, and region:

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic Analytical Standards

-

In-organic Analytical Standards

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Spectroscopy

-

Atomic Absorption Spectroscopy

-

Mass Spectroscopy

-

IR Spectroscopy

-

-

Chromatography

-

Ion Chromatography

-

Gas Chromatography

-

Liquid Chromatography

-

Thin Layer Chromatography

-

Others

-

-

Titrimetry

-

Physical Property Testing

-

Sieve Calibration and Particle Size Testing

-

Viscosity Testing

-

Color Reference Testing

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Life Science Analysis

-

Environmental Analysis

-

Food and Beverage Analysis

-

Forensic Standards

-

Petrochemical Analysis

-

Veterinary Drug Analysis

-

Others

-

-

Methodology Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalytical Testing

-

Stability Testing

-

Raw Material Testing

-

Dissolution testing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global analytical standards market size was estimated at USD 1.34 billion in 2023 and is expected to reach USD 1.42 billion in 2024.

b. The global analytical standards market is expected to grow at a compound annual growth rate of 6.57% from 2024 to 2030 to reach USD 2.08 billion by 2030.

b. North America dominated the analytical standards market with a share of 43.9% in 2023. This is attributable to well established regulatory landscape within the region

b. Some key players operating in the analytical standards market include Merck KGaA; Waters Corporation; Agilent Technologies, Inc.; Shimadzu Corporation; PerkinElmer Inc.; LGC Limited; Restek Corporation; AccuStandard; Cayman Chemical; RICCA Chemical Company

b. Key factors that are driving the market growth growing burden of chronic diseases coupled with continuous demand for novel therapeutics and stringent regulations pertaining to quality control and assurance

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.