- Home

- »

- Medical Devices

- »

-

Angiographic Catheters Market Size, Industry Report, 2033GVR Report cover

![Angiographic Catheters Market Size, Share & Trends Report]()

Angiographic Catheters Market (2026 - 2033) Size, Share & Trends Analysis Report By Product Type (Diagnostic Catheters, Interventional Catheters), By Application, By Material, By End Use (Hospitals, Ambulatory Surgical Centers (ASCs)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-845-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Angiographic Catheters Market Summary

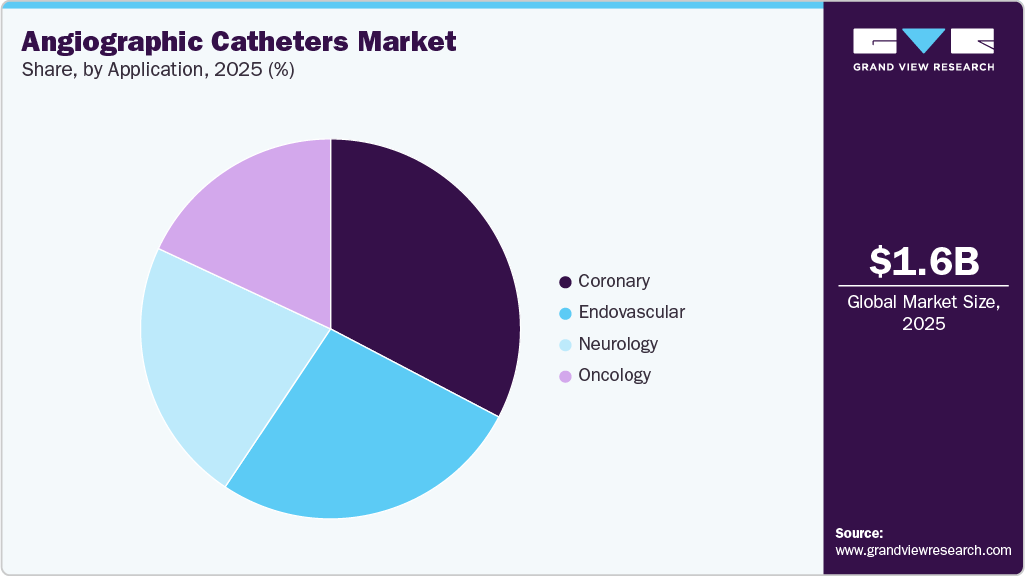

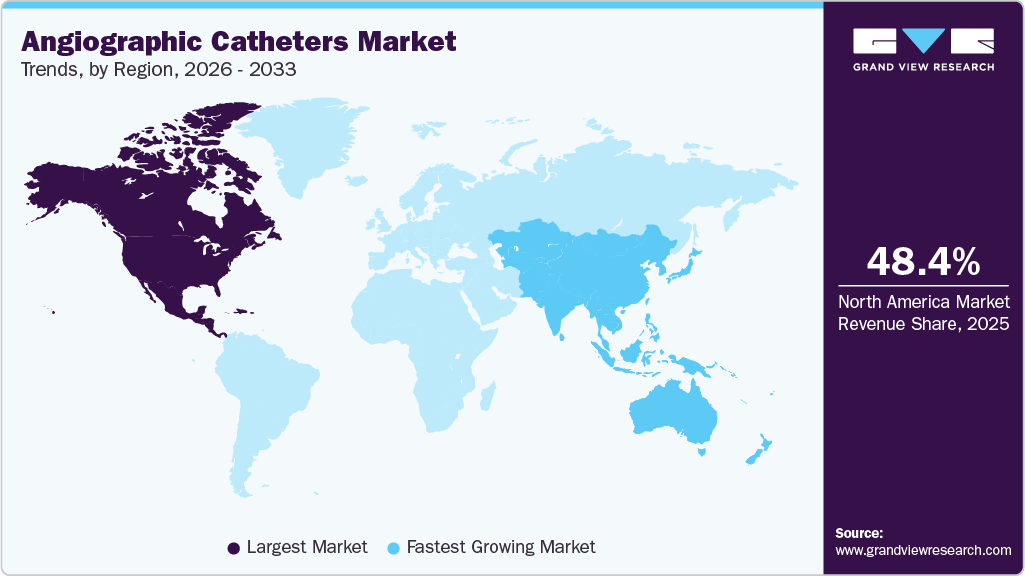

The global angiographic catheters market size was estimated at USD 1.61 billion in 2025 and is projected to reach USD 2.89 billion by 2033, growing at a CAGR of 7.71% from 2026 to 2033. The market growth is driven by the rising incidence of cardiovascular and peripheral vascular diseases, as well as the increasing reliance on image-guided diagnostic and interventional procedures.

Key Market Trends & Insights

- The North America angiographic catheters market accounted for the largest global revenue share of 48.43% in 2025.

- The U.S. angiographic catheters industry accounted for the largest share of North America in 2025.

- Based on product type, the diagnostic catheters segment held the largest share in 2025.

- Based on application, the coronary segment held the largest share in 2025.

- Based on material, the nylon segment held the largest share in 2025.

- Based on End use, the hospitals segment held the largest share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.61 Billion

- 2033 Projected Market Size: USD 2.89 Billion

- CAGR (2026-2033): 7.71%

- North America: Largest market in 2025

- Asia Pacific: Fastest market in 2025

The growing prevalence of coronary artery disease, cerebrovascular events, and peripheral artery disease is significantly increasing pressure on healthcare systems worldwide. Angiographic catheters play a key role in enabling precise vascular imaging, controlled contrast injection, and real-time procedural navigation. Healthcare providers are increasingly favoring minimally invasive diagnostic approaches and catheter-based interventions; consequently, the demand for angiographic catheters continues to rise across coronary, neurovascular, and peripheral endovascular procedures.Within this broader landscape, the hydrophilic angiographic catheters market is gaining traction, driven by the need for enhanced catheter trackability, reduced friction, and improved navigation through tortuous vascular anatomy. Hydrophilic-coated catheters are increasingly preferred in complex diagnostic and interventional procedures, as they support smoother advancement, reduce procedural time, and lower the risk of vascular trauma.

The increasing prevalence of cardiovascular diseases (CVDs) remains a primary factor driving the growth of the angiographic catheters industry. According to Oxford Academic (January 2025), the global age-standardized prevalence of CVD is estimated at approximately 7,179 cases per 100,000 population, highlighting the persistent global burden of heart-related disorders. In the U.S., the prevalence of CVDs, including heart failure and cardiac arrhythmias, continues to rise, largely due to sedentary lifestyles, obesity, and associated metabolic comorbidities.

As clinicians seek earlier diagnosis and safer, minimally invasive interventions, hydrophilic angiographic catheters are increasingly adopted in both coronary and peripheral angiography. Their lubricious surface facilitates smoother vessel access and catheter manipulation, supporting higher procedural success rates in patients with complex vascular disease.

Moreover, as reported by the American Heart Association (AHA) in January 2025, in the U.S., cardiovascular disease remains a significant public health challenge, with one death occurring approximately every 34 seconds, amounting to nearly 2,500 deaths each day. This high mortality burden highlights the urgent need for timely diagnosis and effective management of vascular conditions such as coronary artery disease and stroke. Angiographic catheters are integral to this effort, as they enable detailed visualization of blood vessels, accurate contrast delivery, and real-time guidance during both diagnostic angiography and interventional procedures. Clinicians seek to detect arterial blockages earlier and intervene using minimally invasive, catheter-based techniques. Still, the persistent and widespread impact of cardiovascular disease continues to drive the clinical reliance on angiographic catheters.

Table 1 Key Facts on Cardiovascular Disease and Related Events in the U.S. (2025)

Statistic

Value

Total CVD deaths per day

2,500

High Blood Pressure (Hypertension)

~47% of U.S. adults

Unhealthy Weight (BMI ≥25)

>72% of U.S. adults

Obesity (BMI ≥30)

~42% of U.S. adults

Type 2 Diabetes or Prediabetes

~57% of U.S. adults

Adults with Hypertension

>180 million

Adults with Obesity

>180 million

Adults with Diabetes

>80 million

Healthcare Costs Related to CVD

~300% increase

Source: American Heart Association, Inc. in January 2025 & GVR

The rising incidence of Peripheral Arterial Disease (PAD) drives the market's growth. According to an article published by Springer Nature Limited in July 2025, PAD affects an estimated 236.62 million people worldwide. It is associated with a substantially elevated risk of severe complications, including limb ischemia, amputation, and mortality. This large and growing patient population drives sustained demand for accurate vascular assessment and timely intervention. In PAD diagnosis and endovascular treatment, the hydrophilic angiographic catheters market benefits from increasing clinical reliance on devices that enable atraumatic navigation of long, calcified, or occluded peripheral vessels. Hydrophilic coatings improve catheter advancement and contrast delivery, particularly in below-the-knee and complex femoropopliteal interventions.

Technological innovation is one of the major factors driving the growth of the angiographic catheters market. For instance, in May 2025, the Sanjay Gandhi Postgraduate Institute of Medical Sciences (SGPGIMS) in Lucknow, India, introduced an AI-powered intravascular imaging system that combines real-time 3D angio co-registration with advanced imaging for catheter-guided procedures. The technology integrates artificial intelligence algorithms with intravascular optical coherence tomography (OCT) and angiographic imaging to produce high-resolution, 3D reconstructions of arterial plaque and vessel anatomy during angioplasty procedures. This allows clinicians to visualize vessel morphology in three dimensions, rapidly assess plaque characteristics, and tailor contrast injections and catheter positioning with greater precision than traditional imaging alone. Providing AI-driven, real-time procedural guidance and enhanced 3D imaging, the system improves treatment accuracy, optimizes stent selection and deployment, and supports the more effective use of angiographic catheters.

Table 2 Technological advancements & market impact

Date

Company

Technology Description

Market Impact

In December 2025

Koninklijke Philips N.V.

Expanded commercial availability of the LumiGuide real‑time AI‑enabled light‑based 3D navigation system. This system utilizes Fiber Optic RealShape (FORS) to visualize catheter and guidewire positions in 3D using light, rather than continuous X-ray, enabling clinicians to navigate complex endovascular anatomy more precisely.

Improves procedural precision, significantly reduces radiation exposure for both patients and clinicians, and enhances workflow efficiency during angiographic imaging and interventions. It is expected to accelerate the adoption of advanced guidance systems in cath labs across Europe and the U.S. from January 2026.

In May 2025

Koninklijke Philips N.V.

Launched VeriSight Pro 3D Intracardiac Echocardiography (ICE) catheter, a steerable catheter with an embedded miniaturized ultrasound probe that delivers real‑time 3D intravascular imaging from within the heart.

Enables high‑resolution, real‑time imaging inside cardiac chambers without general anesthesia, supporting structural heart procedures traditionally guided by external imaging. This expands angiographic and interventional catheter utility, reduces patient recovery time, and may lower procedural costs in structural heart care.

Investment and funding activity in the angiographic catheters market reflects sustained investor interest driven by the rising adoption of minimally invasive vascular diagnostic and interventional procedures. Capital deployment focuses on product innovation, expansion of manufacturing capacity, and geographic growth, particularly across endovascular and peripheral vascular segments. Funding also supports the development of catheters with improved biocompatibility, hydrophilic coatings, and enhanced navigational performance to address evolving clinical requirements related to procedural safety and efficiency. Overall, continued investment enables faster commercialization, strengthens competitive positioning, and supports manufacturers in meeting increasing global procedure volumes across coronary, neurovascular, and peripheral angiography applications.

Table 3 Investment & Funding

Date

Company

News Summary

Funding / Investment Amount

In September 2025

Poly Medicure / PendraCare

Poly Medicure acquired most of PendraCare, strengthening access to catheter technologies as part of a cost-reduction strategy.

~₹188.5 crore (~USD23M) acquisition

In February 2024

Cagent Vascular

Completed a new financing round to support the commercialization of its serrated balloon catheter technology for vascular disease.

USD 30 million Series C

In October 2023

Access Vascular

Raised funding to scale up production and expand its biocompatible catheter product portfolio.

USD 22 million Series C (2023)

Case Study: First‑in‑human robotic percutaneous coronary intervention by the ROSES robotic system:

According to the European Heart Journal in October 2023, this case report describes the first‑ever human percutaneous coronary intervention (PCI) performed using a novel robotic system called ROSES (RObotoic System for Endovascular Surgery). The patient had severe narrowing in the right coronary artery (RCA) requiring angioplasty.

In this procedure:

-

Angiographic catheters and guidewires were delivered using the robotic platform to navigate the coronary vessels.

-

The robotic system controlled the movement of the catheter and interventional devices under fluoroscopic guidance.

-

After positioning, balloon angioplasty and stenting were completed without manual intervention.

This case represents a major milestone in robotic coronary angiography and interventional cardiology, demonstrating that robotic systems can now be safely utilized to perform real-world coronary angioplasty and stenting procedures, potentially enhancing precision and reducing occupational radiation exposure for operators in the catheterization lab.

Table 4 Key Aspects and Market Impact

Key aspect

Market Impact

Procedural Feasibility & Safety

The robotic system successfully delivered angiographic catheters and completed PCI procedures without complications, validating the demand for high-precision, robotic-compatible catheters and supporting innovation and adoption in the catheter market.

Precision & Catheter Navigation

Accurate catheter positioning and deployment under robotic control demonstrated the value of advanced, trackable catheters for complex interventions, increasing the market potential of premium interventional devices.

Operator Safety & Efficiency

Reduced occupational radiation exposure and efficient device handling highlight the need for ergonomic, radiation-resistant catheter designs, promoting adoption in hospitals and cath labs focused on safe, efficient angiographic workflows.

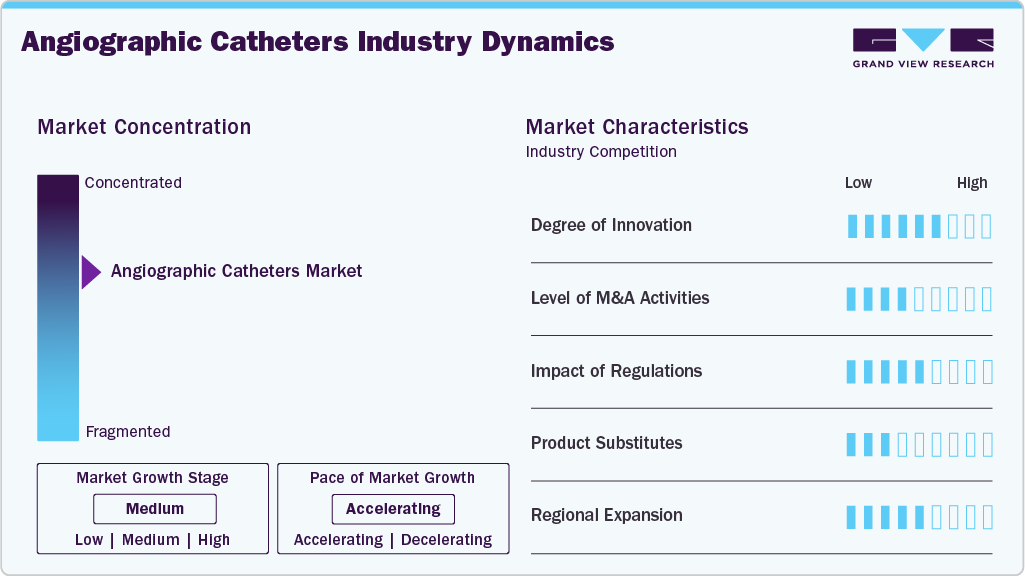

Market Concentration & Characteristics

The angiographic catheters industry exhibits a significant degree of innovation, driven by continuous refinement in catheter materials, tip design, and navigational performance to support complex vascular procedures. In January 2024, Cook Medical reintroduced its Slip Cath Beacon Tip Hydrophilic Selective Catheter in the United States and Canada, reflecting ongoing innovation focused on improving procedural efficiency and control during angiography. The catheter incorporates a hydrophilic coating to reduce friction, enhanced tip visibility for improved fluoroscopic guidance, and optimized pushability and torque response, allowing physicians to navigate tortuous and challenging vascular anatomy with greater precision.

The angiographic catheters market is witnessing a moderate level of merger and acquisition (M&A) activity, as companies seek to enhance technological innovation and expand their global presence. Strategic alliances and acquisitions are primarily aimed at integrating AI-driven analytics. For instance, in December 2025, Royal Philips announced an agreement to acquire SpectraWAVE, Inc., a U.S.-based company specializing in next-generation coronary intravascular imaging and AI-enabled vascular assessment technologies. The acquisition includes SpectraWAVE’s advanced HyperVue imaging system and angiography-derived fractional flow reserve (FFR) tools, which enhance physiological assessment from a single angiogram. The deal is expected to expand Philips’ capabilities in coronary image-guided therapy, bolstering its Azurion platform with AI-enhanced imaging and diagnostic solutions.

The market is moderately regulated, with products required to obtain FDA clearance in the U.S., CE marking under the EU Medical Device Regulation (MDR), and compliance with national medical device standards globally. These regulations ensure device safety, biocompatibility, and clinical performance, but they also increase development costs and extend approval timelines due to stricter clinical evidence and post-market surveillance requirements. Moreover, regulatory frameworks are evolving to accommodate advanced catheter materials, complex designs, and compatibility with AI-enabled and 3D imaging systems, supporting innovation while maintaining strong patient safety and quality standards.

The angiographic catheters industry is a significant product expansion, driven by continuous improvements in catheter design, materials, and performance characteristics. Manufacturers are expanding their product portfolios to include a wider range of catheter shapes, sizes, and coatings, supporting diverse angiographic applications across coronary, endovascular, and neurovascular procedures. This expansion is designed to enhance procedural efficiency, improve navigation in complex vascular anatomy, and support evolving clinical needs in modern catheterization laboratories.

The market is experiencing moderate regional expansion, as manufacturers strengthen their presence in Asia Pacific, the Middle East & Africa, and Latin America to address the rising demand for cardiovascular and endovascular procedures. Companies are focusing on establishing local manufacturing and distribution networks, expanding access to hospitals and cath labs, and supporting clinician training programs to improve procedural adoption. These efforts are enhancing access to angiography-based diagnostics and interventions in developing healthcare systems, while supporting sustained market growth across emerging regions.

Product Type Insights

The diagnostic catheters segment accounted for the largest revenue share of 52.31% in 2025. The increasing number of CVD cases, combined with the launch of technologically advanced products, drives the market's growth. For instance, in May 2025, the Oarsurvey Angiographic Sizing Catheter, independently developed by Kossel Medtech, received market approval from China’s National Medical Products Administration (NMPA), paving the way for its commercial launch. Unlike conventional angiographic catheters, which are limited to contrast delivery for imaging, this device integrates vascular measurement and imaging functions into a single catheter. It allows clinicians to accurately mark and measure vessel diameter and lesion length while simultaneously injecting contrast, eliminating measurement inaccuracies and avoiding the need to withdraw the guidewire during angiography. This innovation improves procedural efficiency and precision in diagnostic angiographic workflows.

The interventional catheters segment is expected to grow at the fastest CAGR over the forecast period. Rising CVD cases and technologically advanced product drives the growth of the market. For instance, in September 2025, AngioSafe secured U.S. FDA 510(k) clearance and CE marking for its Santreva ATK Endovascular Revascularization Catheter, enabling commercial rollout in Europe and upcoming availability in the United States. Powered by the company’s proprietary Atheroplasty technology, the device is designed for wire-free intraluminal crossing of peripheral chronic total occlusions (CTOs), allowing for simultaneous plaque compression and vessel recanalization in a single step without the need for external power. Early real-world use in Italy demonstrated its ability to simplify complex PAD interventions by improving procedural efficiency, predictability, and safety, particularly in patients with severe occlusive disease.

Application Insights

The coronary segment led the angiographic catheters industry, accounting for the largest revenue share of 32.68% in 2025. The increasing prevalence of heart disease, combined with the development of technologically advanced products, drives market growth. According to an AHA article published in January 2025, in the U.S., nearly half of the adult population, around 128 million people, are living with cardiovascular disease. This broad category includes coronary heart disease, heart failure, stroke, and hypertension. This widespread burden of cardiovascular disease drives a high volume of invasive cardiac evaluations, particularly for conditions involving coronary arteries. Individuals with symptoms or risk factors linked to coronary involvement often undergo coronary angiography to visualize arterial narrowing, assess blood flow, and guide clinical decision-making. The angiographic catheters are central to these procedures, enabling selective access to vessels, contrast injection, and real-time imaging. The high prevalence of cardiovascular conditions in the U.S. continues to sustain strong and ongoing demand for catheter-based coronary imaging and intervention.

The endovascular segment is expected to grow at the fastest CAGR over the forecast period. The rising incidence of PAD, combined with the launch of technologically advanced products, drives the market's growth. According to the Cleveland Clinic article published in November 2025, in the U.S., peripheral artery disease affects an estimated 12 million adults aged 40 years and older, with risk increasing significantly as the population ages. As this population ages, an increasing number of individuals present with symptoms and complications related to impaired blood flow in the peripheral arteries. Clinical evaluation of these patients increasingly relies on catheter-based vascular imaging to clearly visualize arterial anatomy, determine the extent of disease, and support clinical decision-making. Consequently, the expanding prevalence of peripheral artery disease continues to drive consistent utilization of angiographic catheters in endovascular diagnostic and treatment workflows.

Material Insights

The nylon segment accounted for the largest revenue share of 34.88% in 2025. The ongoing optimization for high torque transmission, shape retention, and consistent handling makes nylon a preferred material for routine coronary and peripheral diagnostic angiography. Manufacturers continue to utilize nylon to ensure predictable catheter response and stable contrast injection, thereby supporting efficient, high-volume workflows in catheterization laboratories. Key players offering advanced products drive the market's growth. For instance, Boston Scientific’s Imager II Angiographic Catheter, which employs a nylon shaft for reliable rotational control and imaging stability, and Cordis INFINITI Diagnostic Catheter, which uses a nylon-based shaft to provide dependable shape retention and smooth catheter manipulation during coronary and peripheral imaging procedures. The design supports accurate vessel engagement and stable contrast delivery, reinforcing nylon’s ongoing role in meeting the performance needs of high-volume angiographic workflows.

The polyurethane segment is expected to grow at the fastest CAGR over the forecast period, due to its ability to offer a balanced combination of flexibility, torque response, and kink resistance, making it well-suited for diagnostic coronary and peripheral angiography. Polyurethane-based catheters enable smoother navigation while maintaining sufficient shaft strength for controlled contrast delivery and precise vessel engagement. Key players offering advanced products drive the market's growth. For instance, the Cordis SUPER TORQUE Judkins Right (JR4) Polyurethane Angiographic Diagnostic Catheter is designed to deliver high torque transmission and stable catheter control during coronary imaging. These instances highlight how polyurethane continues to support both performance-driven and cost-conscious angiographic catheter solutions across global markets.

End Use Insights

The hospitals segment dominated the angiographic catheters market, accounting for the largest revenue share of 42.19% in 2025. Hospitals are increasingly central to demand for angiographic catheters as they expand cath lab capacity, adopt 24/7 interventional services, and consolidate complex care pathways; this is driving investments in higher performance diagnostic and guiding catheters that offer improved trackability, radiopacity, and multipurpose use to support both routine coronary angiography and advanced endovascular procedures, while hospital priorities shorter procedure times, lower contrast/radiation exposure, and streamlined inventory are accelerating uptake of versatile catheter designs and supplier partnerships that deliver training, service support, and bundled procurement options.

Table 5 U.S. Hospital Database 2025

Hospital Category

Number of Hospitals

Total Number of All U.S. Hospitals

6,093

Number of U.S. Community Hospitals

5,112

Number of Nongovernment Not-for-Profit Community Hospitals

2,978

Number of Investor-Owned (For-Profit) Community Hospitals

1,214

Number of State and Local Government Community Hospitals

920

Other Hospitals

120

Source: American Hospital Association & GVR

The ambulatory surgical centers (ASCs) segment is expected to grow at fastest CAGR over the forecast period. Ambulatory Surgical Centers are emerging as an important setting for angiographic catheter use as payers and providers shift suitable diagnostic and minimally invasive procedures away from inpatient hospitals to lower cost outpatient environments; this trend is increasing demand for angiographic catheters that are easy to handle, cost efficient, and compatible with streamlined workflows, while the focus in ASCs on rapid patient turnover, shorter recovery times, and standardized procedures is encouraging adoption of reliable, single use diagnostic catheters that support safe and efficient vascular imaging in an outpatient setting.

Table 6 Top 5 U.S. States by Number of Ambulatory Surgical Centers (ASCs) in 2025

Sr

State

Number of ASCs

1

California

896

2

Florida

517

Source: Ambulatory Surgery Center Association & GVR

Regional Insights

The North America angiographic catheters market dominated, accounting for a 48.43% share in 2025. Rising cases of CVD, including coronary cases, drive the market growth. According to a CDC article published in September 2025, an estimated 13.0 million physician office visits are recorded annually with coronary atherosclerosis or chronic ischemic heart disease as the primary diagnosis, and nearly 7% of office visits involve documented coronary artery disease, ischemic heart disease, or a history of myocardial infarction. This substantial outpatient disease burden reflects continuous monitoring, diagnosis, and referral of coronary patients, many of whom progress to coronary angiography for definitive assessment and treatment planning. Angiographic catheters are essential for these procedures; the high volume of coronary-related physician visits in North America supports consistent and ongoing demand for angiographic catheter use.

U.S. Angiographic Catheters Market Trends

The U.S. angiographic catheters industry led North America in 2025. Growing awareness and government initiatives are driving market growth. According to a CDC article published in May 2024, the U.S. Centers for Disease Control and Prevention (CDC) launched the Heart Disease Communications Toolkit to support public health professionals and clinicians in educating communities about heart disease, its risk factors, treatments, and preventive strategies. This heightened public and clinical awareness contributes to earlier diagnosis of heart failure and conduction abnormalities, expanding the eligible patient pool for Angiographic Catheters and fueling market growth.

Europe Angiographic Catheters Market Trends

The Europe angiographic catheters industry is expected to grow over the forecast period. According to a World Heart Federation article published in December 2024, cardiovascular disease remains the leading cause of mortality in Europe and globally, affecting more than 60 million people across Europe and placing a substantial burden on healthcare systems. This large and growing patient population drives sustained demand for accurate diagnosis, disease monitoring, and timely intervention across a wide range of cardiac conditions. Angiographic catheters play a critical role in this care pathway by enabling detailed visualization of the coronary and peripheral vasculature, supporting diagnostic angiography, and guiding catheter-based interventions. While clinicians increasingly rely on minimally invasive, image-guided procedures to manage complex cardiovascular disease, the widespread prevalence of CVD continues to reinforce the essential role of angiographic catheters in modern cardiovascular care.

The UK angiographic catheters market is anticipated to grow over the forecast period. Increasing CVD cases drive the growth of the market. According to a British Heart Foundation (BHF) article published in September 2025, in the UK, more than 7.6 million people are living with cardiovascular disease, including over 4 million men and more than 3.6 million women, reflecting a substantial and ongoing clinical burden. This large patient population drives sustained demand for diagnostic evaluation and vascular assessment, as many individuals require investigation for conditions affecting their coronary and peripheral arteries. Angiographic catheters are central to these procedures, enabling detailed visualization of vessels and guiding treatment decisions, thereby reinforcing their continued use across UK hospitals and cardiac care centers.

The angiographic catheters market in Germany is expected to grow over the forecast period. Increasing CVD incidence drives the growth of the market. According to an OECD article published in 2025, Germany’s high age-standardized cardiovascular disease incidence, at around 1,283 cases per 100,000 population, indicates a substantial flow of patients entering the healthcare system with suspected or newly identified vascular disease. Managing this volume of cases relies heavily on catheter-based imaging to accurately assess arterial anatomy and disease severity, making angiographic catheters a routine and essential tool in diagnostic evaluation and treatment planning across Germany’s cardiovascular care pathway.

Asia Pacific Angiographic Catheters Market Trends

The Asia Pacific has witnessed a growing demand for angiographic catheter devices, driven by the increasing burden of cardiovascular disease, the rapid expansion of catheterization laboratories, and the broader adoption of minimally invasive vascular diagnostics across China, India, Japan, and Southeast Asia. Improving healthcare infrastructure, government investment in cardiac care, and expansion of interventional cardiology services are accelerating the use of angiography in both urban and secondary care settings. Asia Pacific-headquartered companies are playing a central role in this trend. Terumo Medical Corporation (Japan) continues to strengthen its angiographic catheter portfolio for coronary and endovascular imaging. Meanwhile, MicroPort Scientific Corp. and Lepu Medical Technology (China) are expanding their locally manufactured diagnostic catheter offerings to improve affordability and access.

The China angiographic catheters market accounted for the largest share of Asia Pacific in 2025. Increasing CVD cases drive the market growth. According to an article published by Beijing Magtech Technology Development Co., Ltd. in January 2025, cardiovascular disease remains a significant public health issue in China, affecting approximately 330 million people nationwide. Among this population, roughly 13 million individuals experience stroke, and nearly 11.4 million are living with coronary heart disease. The rising occurrence of these conditions has contributed to an increase in heart failure cases, highlighting a growing demand for innovative and advanced cardiac treatment options to manage and improve patient outcomes.

The angiographic catheters market in India is expected to grow at a significant CAGR over the forecast period.Rising CVD incidence and the technologically advanced product launch drive the growth of the market. According to an NCBI article published in April 2025, a recent systematic review and meta-analysis of studies conducted across the country found that approximately 11 % of Indian adults have some form of cardiovascular disease, with prevalence being higher in urban populations compared to rural areas. This analysis highlights the widespread occurrence of CVD in India and the need for continued public health action to address this burden.

Latin America Angiographic Catheters Market Trends

The angiographic catheters industry in Latin America is expected to witness significant growth over the forecast period, driven by the rising prevalence of cardiovascular diseases and increasing access to catheter-based diagnostics, particularly in Brazil and Argentina. Hospitals and specialized cardiac centers across the region are strengthening their interventional cardiology capabilities, supported by investments in catheterization laboratories and growing clinician awareness of minimally invasive vascular imaging techniques. Global and regional manufacturers, such as Boston Scientific, Medtronic, Terumo Medical Corporation, Merit Medical, B. Braun, Cordis, Cook Medical, and AngioDynamics, are actively expanding their footprints through distributor partnerships, product availability expansions, and clinical education initiatives.

The Brazil angiographic catheters market is projected to grow over the forecast period. Increasing CVD incidence drives the market growth. According to the Elsevier Ltd. article published in July 2025, in Brazil, cardiovascular diseases continue to be a significant public health challenge, responsible for roughly 30 % of all deaths. Over the past several decades, CVDs have consistently ranked as the leading cause of mortality, except for the COVID‑19 pandemic years in 2020 and 2021, during which pandemic-related deaths temporarily surpassed them. This enduring high prevalence of heart conditions has contributed to an increased need for advanced angiographic catheters to support effective diagnosis and treatment.

MEA Angiographic Catheters Market Trends

The MEA angiographic catheters industry is growing significantly, driven by the rising prevalence of cardiovascular diseases and associated risk factors such as obesity, diabetes, and hypertension. Countries including Saudi Arabia, the United Arab Emirates, Kuwait, and South Africa are increasing investments in cardiac care infrastructure, with hospitals and specialty centers expanding catheterization laboratory capacity and access to image-guided vascular diagnostics. Government healthcare initiatives, coupled with the expansion of private healthcare providers, are supporting wider availability of coronary and endovascular angiography, strengthening steady demand for angiographic catheters across the MEA region.

The South Africa angiographic catheters market is expected to grow over the forecast period. The increasing incidence of CVD in South Africa drives the market growth. According to a Peertechz Publications article published in February 2024, in South Africa, cardiovascular disease (CVD) continues to exert a heavy toll on public health, accounting for approximately 17.3% of all deaths, or nearly one in six fatalities. Data further reveal that an average of 215 individuals die each day due to heart disease or stroke, emphasizing the persistent burden of cardiovascular conditions. This rising prevalence of heart-related illnesses is driving the demand for advanced interventions such as Angiographic Catheters, which can help improve heart function, reduce hospitalizations, and enhance the quality of life for patients with severe heart failure across the country.

Key Angiographic Catheters Company Insights

Leading players in the angiographic catheters market such as Boston Scientific Corp., Medtronic plc and Terumo Medical Corporation, have strategically employed innovative approaches, including mergers and acquisitions, market penetration initiatives, partnerships, and distribution agreements. These strategies aim to enhance their revenue streams by leveraging collaborative efforts, expanding market reach, and fostering synergies within the dynamic angiographic catheter market. Emerging market entrants, such as Angiodynamics Inc. and Cook Medical, are focusing their efforts on expanding their market presence, developing innovative technologies, and forming strategic partnerships as part of their strategy to compete with established industry leaders.

Key Angiographic Catheters Companies:

The following are the leading companies in the angiographic catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corp.

- Medtronic plc

- Terumo Medical Corporation

- Merit Medical System Inc

- B. Braun SE

- MicroPort Scientific Corp.

- Lepu Medical Technology (Beijing) Co Ltd

- Angiodynamics Inc

- Cook Medical

- Cordis

Recent Developments

-

In December 2025, Philips agreed to acquire SpectraWAVE, acquiring advanced coronary imaging technologies, including angiography‑based physiology assessment tools, expanding its portfolio in catheter‑guided imaging.

-

In June 2025, MedHub AI entered into a distribution partnership with Terumo Corporation to introduce its AI-based AutocathFFR software in the Japanese market. AutocathFFR is an AI-powered software medical device designed to assess coronary physiology directly from angiographic images, improving consistency and diagnostic confidence compared to conventional 3D FFR approaches.

-

In May 2024, the U.S. FDA granted 510(k) clearance to Merit Medical Systems, Inc. for its Impress Angiographic Catheter, classifying it as a Class II diagnostic intravascular catheter. The clearance confirms substantial equivalence to previously marketed devices, allowing the catheter to be commercialized in the U.S. for routine diagnostic angiography, including contrast delivery and anatomical measurement.

Angiographic Catheters Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.72 billion

Revenue forecast in 2033

USD 2.89 billion

Growth rate

CAGR of 7.71% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, unit volume, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boston Scientific Corp.; Medtronic plc; Terumo Medical Corporation; Merit Medical System Inc.; B. Braun SE; MicroPort Scientific Corp.; Lepu Medical Technology (Beijing) Co Ltd; Angiodynamics Inc.; Cook Medical; Cordis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Angiographic Catheters Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global angiographic catheters market report based on product type, application, material, end use, and region:

-

Product Type Outlook (Unit Volume in ‘000 Units; Revenue in USD Million, 2021 - 2033)

-

Diagnostic Catheters

-

Conventional Diagnostic Catheters

-

Microcatheters

-

-

Interventional Catheters

-

Guiding Catheters

-

Balloon Assisted Catheters

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Coronary

-

Endovascular

-

Neurology

-

Oncology

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Nylon

-

Polyurethane

-

PEBAX (Polyether block amide)

-

Silicone

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

-

Regional Outlook (Unit Volume in ‘000 Units; Revenue in USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global angiographic catheters market size was estimated at USD 1.61 billion in 2025 and is expected to reach USD 1.72 billion in 2026.

b. The global angiographic catheters market is expected to grow at a compound annual growth rate of 7.71% from 2026 to 2033 to reach USD 2.89 billion by 2033.

b. North America dominated the angiographic catheters market with a share of 48.43% in 2025. This is attributable to the rising cases of CVD, including coronary cases, driving market growth.

b. The market growth is driven by the rising incidence of cardiovascular and peripheral vascular diseases, increasing reliance on image guided diagnostic and interventional procedures. Growing prevalence of coronary artery disease, cerebrovascular events, and peripheral artery disease is significantly increasing pressure on healthcare systems worldwide.

b. Some key players operating in the angiographic catheters market include Boston Scientific Corp.; Medtronic plc; Terumo Medical Corporation; Merit Medical System Inc; B. Braun SE; MicroPort Scientific Corp.; Lepu Medical Technology (Beijing) Co Ltd; Angiodynamics Inc; Cook Medical and Cordis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.