- Home

- »

- Animal Health

- »

-

Animal Intestinal Health Market Size & Share Report, 2030GVR Report cover

![Animal Intestinal Health Market Size, Share & Trends Report]()

Animal Intestinal Health Market Size, Share & Trends Analysis Report By Animal Type, By Product, By Mode Of Delivery, By Function, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-313-6

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Animal Intestinal Health Market Trends

The global animal intestinal health market size was estimated at USD 4.45 billion in 2023 and is projected to grow at a CAGR of 7.60% from 2024 to 2030. Key factors expected to drive the market growth include the rising livestock population, rising gut health complications in animals, the emergence of prebiotics & probiotics as an alternative to antibiotics, and growing R&D advancements. Animal intestinal health products primarily focus on maintaining a healthy microbiota, feed absorption, nutrient absorption, and immune system, regardless of the presence or absence of gastrointestinal diseases.

The market is witnessing a shift towards maintaining a selective use of antibiotics and other pharmaceuticals and increasing usage of medicated feed additives like probiotics, prebiotics, and other nutritional products. This trend is owing to the increasing risk of antimicrobial resistance (AMR) among animals and gradually in humans. There is growing research establishing the relationship between the use of antibiotics in livestock leading to the development of antibiotic-resistant bacteria. This antibiotic-resistant bacteria may threaten both animal and human health. Many leading companies and animal welfare organizations are reducing antibiotic use as growth promoters (AGPs) in animals and boosting the adoption of gut health feed additives & supplements with the help of global programs.

For instance, Alltech, conducts an Alltech Antibiotic Reduction Program to ensure a healthy animal and minimize prophylactic use of antibiotic products in gut health. The company is promoting a process known as Seed-Feed-Weed (SFW). Optimizing the composition of the gut microbes is essential in this process for improving animal performance in environments without antibiotics. From birth, delivering good bacteria into the gut promotes a robust microbial community that improves growth, feed conversion, and vitality. Furthermore, promoting the dominance of beneficial organisms helps promote gut wellness and effective absorption of nutrients. Eliminating harmful microbes using blockers may strengthen the animal's natural defenses, shorten the healing duration, and inhibit disease risks.

Furthermore, in 2006, the European Union (EU) banned the widespread use of pharmaceuticals like antibiotics in animal feeds as AGPs. It directed that only the selective use of antibiotics in disease treatment be allowed. Such programs promote the effective use of nutritional gut health products and the selective use of antibiotics in cases of gastrointestinal diseases, thus driving market growth.

Furthermore, the rising livestock population globally is another driving factor for market growth. For instance, according to a December 2023 release by the Press Information Bureau of India (PIB), the country's livestock sector grew at a high rate of 13.36% between 2014-15 and 2021-22. The country is home to the world's largest cattle population, i.e., 303.76 million or more than 30% of the global population. Moreover, India is home to over 851.81 million poultry and ranks 2nd & 5th globally in poultry egg and meat production. The animal husbandry sector in the country is boosted by various government schemes like the Rashtriya Gokul Mission (development and conservation of indigenous cattle), the National Livestock Mission, and others.

According to a December 2023 release by Agencia IBGE (a Brazilian government agency), in the third quarter of 2023 alone, beef production in Brazil was 12.2% higher than in 2022. Hog & pig meat production reached 14.62 million heads, the highest level in the country. Poultry meat production grew over 3% in 2023 compared to 2022.

Therefore, livestock animals are used for multiple purposes, like dairy and meat. An increase in their population will boost the sales of products like probiotics, prebiotics, enzymes, immunomodulators, and others. These nutritional products are used in animals since their early years to instill good bacteria in them as a preventive measure to avoid the development of gastrointestinal diseases.

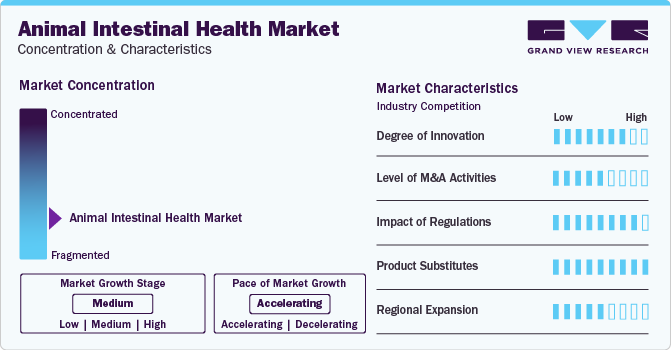

Market Concentration & Characteristics

The industry demonstrates a high level of innovation, characterized by investment in research and development of innovative products. For instance, researchers in Oregon (U.S.) are exploring the potential of bacteria from wolves' guts in treating inflammatory bowel syndrome (IBS) in dogs.

Within the market, a moderate level of mergers and acquisitions activity exists, which indicates a market consolidation strategy among industry players. For instance, in April 2024, Phibro entered into a definitive agreement to acquire the medicated feed additive (MFA) product portfolio from Zoetis. The deal is expected to be closed in the second half of 2024.

The market experiences a moderate to high impact of regulations. Governments and regulatory agencies globally are enforcing strict measures to limit antibiotic usage due to rising concerns about AMR among animals. In Europe, the EU has banned the use of AGPs in veterinary and allowed pharmaceuticals like antibiotics for disease treatment to be used selectively. Furthermore, regulatory authorities have established strict laws ensuring that the feed additives used in animals have the proper classification and must have completed all the required testing, detailed labeling, etc., to ensure the safety of their use in animals.

The market has plenty of substitutes for the product. Despite the presence of global leaders like Cargill, Alltech, DSM, and others, it has been observed that at the country/regional level, domestic manufacturers are given preference by animal owners. This can be mainly due to factors like cost-effectiveness and trust among the end-users for these domestic companies. This creates a major challenge for the established players to capture the remote areas of the market.

The market participants aim to expand growth operations at the regional level to boost their global penetration into the industry. For example, in January 2024, Evonik Vland Biotech, a joint venture between Evonik Industries and Shandong Vland Biotech, initiated its operations in Qingdao, China. This venture aims to expand the livestock gut health product portfolio like probiotics in Greater China region.

Animal Type Insights

The production animal segment held a dominant revenue share of 75.23% in 2023. Increased consumption of meat and dairy products is a major factor driving the market growth. According to a March 2024 release by The Guardian, meat and dairy production rose by 9% and 13%, respectively, between 2015 and 2021. This rise in demand for animal products prompts an increase in the overall population of these animals, thus further increasing the consumption of these intestinal health products to maintain proper health.

The companion segment is anticipated to grow at the fastest CAGR over the forecast period. The segment comprises canine, feline, equine, etc. Globally, the number of pet owners is projected to rise, especially in developed countries. In addition, globally, pet owners have started increasing spending on maintaining their pets' good health. These nutritional products are effective in managing gut health complications if administered properly since the animal's birth. This will lead to a higher demand for preventive care products to maintain a healthy gut and increase demand for products like probiotics and prebiotics. An added advantage of these products in companion animals is that they are manufactured in different forms, like chewable tablets and food/water additives, which increase their palatability.

Product Insights

The nutrition segment dominated the market in 2023, with a revenue share of 83.22% in 2023. This segment is further segmented into products like probiotics, prebiotics, postbiotics, phytogenics, enzymes, and immunomodulators. These products are used widely across the animal health industry in animals like cattle, poultry, swine, dogs, cats, equine, and others. They are mainly administered to animals as a preventive measure since birth to maintain a healthy gut microbiome and reduce the possibility of developing gastrointestinal diseases. In recent years, the rising cases of AMR among animals and their effects on humans have prompted professionals to adopt these nutritional products as an alternative to antibiotics. Apart from the preventive capabilities, these products are also utilized in treating gastrointestinal diseases in tandem with pharmaceuticals. Traditionally, nutritional products came in the form of feed additives, which were mixed with the feed/food of the animal and administered. Chewable tablets/supplements have increased recently, mainly in companion animals, as these products are manufactured with various flavors that increase their palatability.

Mode of Delivery Insights

Feed/Water Additives segment dominated the animal intestinal health market with a share of over 60% in 2023. This can be attributable to the high palatability & animal compliance. This mode of delivery enhances the animal's sense of taste and improves the palatability of the food. Products administered to the animals through this mode ensure effortless intake of essential nutrients. It allows owners to easily combine the essential additives to the animal's feed, increasing its compliance. Increased compliance leads to high intake and digestibility, thus driving market growth.

The supplements & tablets segment is anticipated to grow at the fastest CAGR over the forecast period. This high growth is attributed to the emergence of chewable supplements for gut health. Market players launched products like chewable supplements & tablets to increase the adoption of nutritional products. These supplements resemble a pet/animal food in appearance, which strengthens its adoption within the animals, specifically in companion animals. For dogs, cats, horses, etc., these supplements are manufactured in various flavors to increase their palatability. The supplements are versatile, as they can be easily mixed with normal pet food and administered as treats.

Function Insights

The preventive care segment dominated the market in 2023 in terms of revenue share and is projected to witness the fastest CAGR over the forecast period. This can be attributable to the fact that products like probiotics, prebiotics, and immunomodulators are widely used in various nutritional regimes for animals like cattle, poultry, swine, dogs, cats, and horses. Generally, when an animal is born, this regime is initiated to maintain a healthy gut microbiome. Their adoption is more widespread in production animals as feed/water additives. They enhance the animal feed to include the good microbes that act as a preventive force against gastrointestinal diseases, decreasing their possibility of occurrence.

Distribution Channel Insights

The animal farms segment dominated the market in terms of revenue share in 2023 owing to the high adoption of feed additives in these channels. Globally, animal farm owners directly procure these nutritional and pharmaceutical products from the companies. Wholesale acquisition of these products ensures that the farm receives them at a lower price than the market rate. This is the primary reason for the dominance of this segment. Animal owners and companies generally have a multi-year contract ensuring a steady supply of products.

The e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. This growth can be due to its high adoption among the pet owners. Pet parents worldwide are increasingly employing this channel to procure the product of their choice from any website. They can even compare prices among multiple websites and choose the website that offers the products at the lowest prices. Among the production animal owners, in case they require a specialized feed or supplement unavailable in their vicinity, e-commerce is considered the best alternative procurement channel.

Regional Insights

The animal intestinal health market in North America held the second-largest market share globally and is expected to grow at a significant CAGR over the forecast period. This can be due to factors like structured animal husbandry infrastructure, major market players, high pet adoption and expenditure, and dominance in the global animal production industry.

U.S. Animal Intestinal Health Market Trends

The U.S. animal intestinal health market is driven by the dominance in the global animal production industry. The U.S. is estimated to be the world’s largest poultry producer. For instance, as per March 2024 data published by GeeksforGeeks, the U.S. ranks at the top of global poultry-producing countries with a production of 21,297 million tons.

Europe Animal Intestinal Health Market Trends

The market for animal intestinal health in Europe is anticipated to expand rapidly due to beneficial legislation like the Veterinary Medicines Regulation of the European Union (EU). According to a publication by the European Public Health Alliance, strict guidelines hindering the application of veterinary antibiotics became effective throughout the EU in January 2022. These guidelines will increase the adoption of nutritional products, such as probiotics, enzymes, prebiotics, etc., in the region.

Germany animal intestinal health market growth is expected to be fueled by the growing animal husbandry and the growing popularity of pets. Germany has the second-biggest cattle population in the European Union and the highest number of dairy cattle, i.e., 3.8 million or ~17% of the EU population, according to the March 2024 estimates by the Agriculture and Horticulture Development Board (AHDB) of the UK. Furthermore, approximately 50% of German farms are livestock-focused, according to the International Committee for Animal Recording (ICAR), which is expected further to encourage beneficial circumstances for the animal intestinal health industry.

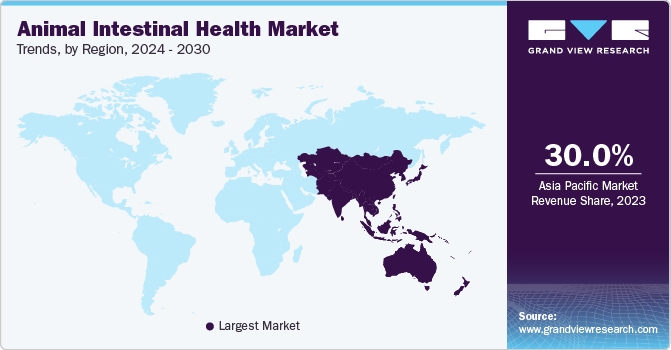

Asia Pacific Animal Intestinal Health Market Trends

Asia Pacific animal intestinal health market held the largest global revenue share of over 30% in 2023 and is anticipated to continue its growth over 2024-2030. This region is home to two of the largest animal husbandry producers in the world, i.e., India & China. Together, these countries comprise more than 40% of the world's cattle population. These factors will act as major driving factors for APAC.

The animal intestinal health market in India is anticipated to witness the fastest CAGR of over 10% during the forecast period. This is attributed to the country's dominance in production of animal husbandry and agriculture products. According to 2023 government estimates, the livestock sector alone contributed over 5% to the country's Gross Value Added (GVA). Furthermore, in 2022-23, India exported poultry products worth over USD 134 million to more than 50 countries.

Latin America Animal Intestinal Health Market Trends

The animal intestinal health market in Latin America is driven by the presence of large meat-producing countries in the region. Countries like Brazil and Argentina are considered among the world's top producers of meats such as beef, poultry, etc. For instance, as per 2023 publications by Secretaría Técnica-Administrativa (STA) de FONTAGRO, out of the 312 million tons of meat produced in 2020, about 18% was produced in this region. Poultry meat took over 50% of the meat production, followed by beef (35%) and pork (16%).

Brazil animal intestinal health market dominated with the largest revenue share in Latin America region in 2023 owing to its second-highest beef production after the U.S. According to 2024 data by USDA, Brazil produced over 10.95 million metric tons of beef (18% of global production).

Middle East & Africa Animal Intestinal Health Market Trends

The animal intestinal health market in the Middle East & Africa is driven by the increasing number of innovative product launches in the region. South Africa, Saudi Arabia, Kuwait, and UAE comprise the Middle East & Africa (MEA) region. For instance, in March 2024, Innovative Solutions launched Humisyn, a nutritional and medicinal product targeted at reducing Necrotic enteritis (NE) in the Middle Eastern region. This especially will prove to be a boosting factor for the region as it is considered one of the prominent poultry-producing regions.

Since many farmers groom their animals to produce milk and meat to individuals across the country and around the globe, livestock is an essential component of the economy in this country. Yet, since livestock may acquire a variety of infectious diseases, there is a growing demand for veterinary antibiotics and feed additives for treating companion animals and livestock and preventing the disease from spreading to other animals.

Key Animal Intestinal Health Company Insights

The market is highly competitive due to the large number of domestic players in each country. Therefore, the market is fragmented to a significant extent. Thus, major players may face intense competition to maintain their market position at the country level. Moreover, companies are increasingly adopting mergers & acquisitions and geographic expansion strategies to expand in the market. For instance, in May 2023, AB Vista acquired Progres, a resin acids feed used to improve gut integrity in livestock animals, from a Finnish company, Hankkija.

Key Animal Intestinal Health Companies:

The following are the leading companies in the animal intestinal health market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill

- Evonik Industries

- Kemin Industries

- Alltech

- dsm-firmenich (DSM)

- Adisseo

- Kerry Group plc.

- Novozymes A/S

- Karyotica Biologicals Pvt Ltd.

- EW Nutrition

- AB Vista

- AdvaCarePharma

- ADM

- Zoetis

- Boehringer Ingelheim

- Dechra Pharmaceuticals

Recent Developments

-

In November 2023,General Mills acquired Fera Pets. This acquisition facilitated General Mills' entry into pet care supplements. The company aimed at producing high quality supplements for pets that are scientifically proven and are a combination of Eastern as well as Western medicine.

-

In July 2023, DSM acquired Adare Biome for USD 299.5 million to expand their product portfolio into animal postbiotics.

-

In June 2022, Cargill acquired Delacon, a phytogenic animal feed manufacturer. Through this acquisition, the company has expanded into its phytogenic feed additives portfolio, which is manufactured using natural herbs, plants as well as their extracts to enhance livestock & companion animal health.

Animal Intestinal Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.80 billion

Revenue forecast in 2030

USD 7.40 billion

Growth rate

CAGR of 7.60% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, mode of delivery, function, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cargill; Evonik Industries; Kemin Industries; Alltech; dsm-firmenich (DSM); Adisseo; Kerry Group plc.; Novozymes A/S; Karyotica Biologicals Pvt Ltd.; EW Nutrition; AB Vista; AdvaCarePharma; ADM; Zoetis; Boehringer Ingelheim; Dechra Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Intestinal Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal intestinal health market report based on animal type, product, mode of delivery, function, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animal

-

Cattle

-

Swine

-

Poultry

-

Others (sheep, goats, aquaculture, etc.)

-

-

Companion Animal

-

Canine

-

Feline

-

Equine

-

Others (turtles, fish, rabbits, etc.)

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nutrition

-

Probiotics

-

Prebiotics

-

Postbiotics

-

Phytogenics

-

Enzymes

-

Immunomodulators

-

-

Pharmaceuticals

-

Antibiotics

-

Others

-

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

Feed/Water Additives

-

Supplements & Tablets

-

Other mode of delivery

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Preventive Care

-

Disease Treatment

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Animal Farms

-

E-Commerce

-

Animal Specialty Stores

-

Other Distribution Channel

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global animal intestinal health market size was estimated at USD 4.45 billion in 2023 and is expected to reach USD 4.80 billion in 2024.

b. The global animal intestinal health market is expected to grow at a compound annual growth rate of 7.60% from 2024 to 2030 to reach USD 7.40 billion by 2030.

b. By animal type, the production animal segment held the dominant share of 75.23% in the animal intestinal health market 2023. Increased consumption of meat and dairy products is a major factor driving this market. According to a March 2024 release by The Guardian, meat & dairy production rose by 9% & 13%, respectively, between 2015 and 2021. This rise in demand for animal products prompts for increase in the overall population of these animals, thus further increasing the consumption of these intestinal health products to maintain proper health.

b. Some key players operating in the animal intestinal health market include Cargill, Evonik Industries, Kemin Industries, Alltech, dsm-firmenich (DSM), Adisseo, Kerry Group plc., Novozymes A/S, Karyotica Biologicals Pvt Ltd., EW Nutrition, AB Vista, AdvaCarePharma, ADM, Zoetis, Boehringer Ingelheim and Dechra Pharmaceuticals.

b. Key factors that are driving the market growth include rising livestock population, rising gut health complications in animals, the emergence of prebiotics & probiotics as an alternative to antibiotics, and growing R&D advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."