- Home

- »

- Medical Devices

- »

-

Anti-acne Cosmetics Market Size, Industry Report, 2030GVR Report cover

![Anti-acne Cosmetics Market Size, Share & Trends Report]()

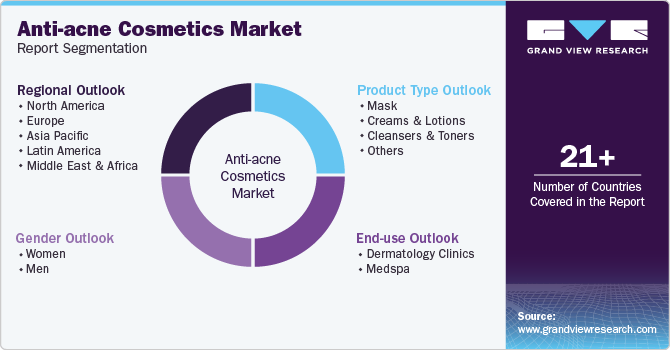

Anti-acne Cosmetics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Mask, Creams & Lotions), By Gender (Women, Men), By End-use (Dermatology Clinics, Medspa), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-139-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-acne Cosmetics Market Summary

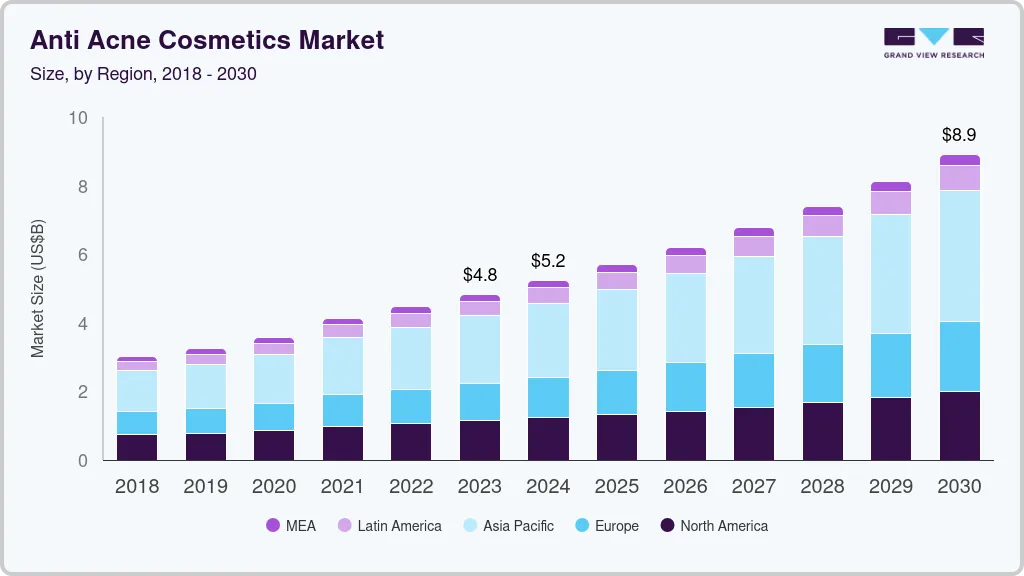

The global anti-acne cosmetics market size was estimated at USD 5.2 billion in 2024 and is projected to reach USD 8.9 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The rising consumption of cosmetics by both men and women and the negative social stigma associated with acne, especially from emerging economies, is majorly estimated to drive market growth.

Key Market Trends & Insights

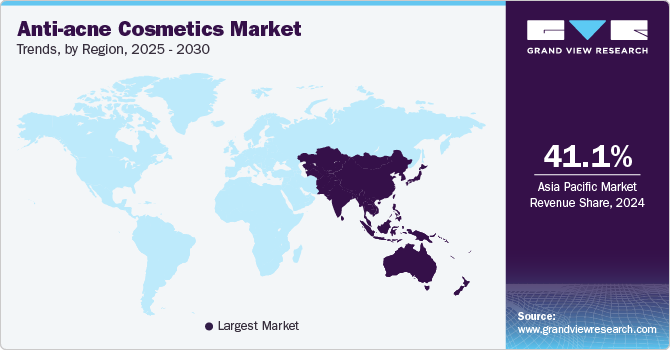

- Asia Pacific anti-acne cosmetics market dominated the global market with the largest revenue share of 41.1% in 2024.

- The U.S. anti-acne cosmetics market held the largest share of the regional market in 2024.

- On the basis of end-use, medspa segment accounted for the largest revenue share of 64.4% in 2024.

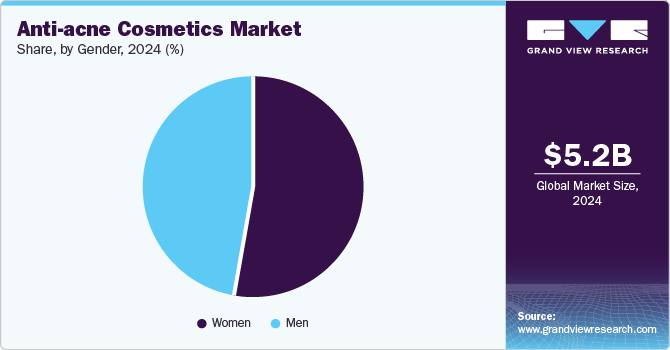

- On the basis of gender, women segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.2 Billion

- 2030 Projected Market Size: USD 8.9 Billion

- CAGR (2025-2030): 9.4%

- Asia Pacific: Largest market in 2024

Acne affects individuals of all age groups, particularly teenagers and young adults, increasing demand for effective skincare solutions. Consumers are becoming more conscious of their skin health, seeking products that offer long-term benefits. This shift toward preventive and therapeutic skincare, fueled by greater awareness of acne’s impact on self-esteem, propels market expansion. The rising demand for organic and natural products, driven by increasing consumer awareness of the harmful effects of chemicals, is significantly influencing the anti-acne cosmetics industry. More individuals are seeking safe and eco-friendly alternatives, leading to a rise in the popularity of organic skincare solutions. In addition, the increase in disposable income, particularly in emerging markets, enables consumers to invest in premium, high-quality anti-acne products. This combination of health-consciousness and greater purchasing power is expected to drive market growth, with consumers prioritizing effective, chemical-free solutions for acne treatment and skin care.

Acne patients are prone to anxiety, depression, low self-esteem, poor quality of life, and loneliness. This can be attributed to an individual's emotional and mental associations with their appearance. These psychological issues are anticipated to prompt patients to seek cosmetic solutions to improve their appearance, thereby driving market growth. For instance, according to the World Health Organization, around 3.8% of the global population suffers from depression, impacting 5% of adults (4% in men and 6% in women) and 5.7% of adults over 60 years old.

Factors such as the increasing number of e-commerce platforms selling these products, growing internet penetration, and rapid urbanization are estimated to boost market demand, especially in developing economies. Social media is one of the major market influencers. The impact of social media on esthetics has been massive, especially in terms of how consumers perceive and project themselves.

Consumers are well aware of the price, advantages, and side effects of products, which helps them make well-informed purchase decisions. Despite the adverse impact of the COVID-19 pandemic on several industries, skin care product manufacturers have witnessed increased sales. Cases of skin irritation, such as acne, increased during COVID-19 due to prolonged use of face masks. As a result, consumers rely on skin care products to keep their skin hydrated.

For instance, as per a survey by the United Nations Conference on Trade and Development (UNCTAD), a study involving approximately 3,700 participants from nine developed and emerging countries explored the impact of the pandemic on consumer behavior in e-commerce and digital solutions. The survey titled "COVID-19 and E-commerce" encompassed nations such as China, Brazil, Germany, the Republic of Korea, Italy, the Russian Federation, Switzerland, South Africa, and Turkey. The findings revealed that over 50% of the respondents have increased their online shopping frequency and are increasingly dependent on the Internet for news, health-related information, and digital entertainment since the pandemic.

Product Type Insights

On the basis of product type, the global market is sub-segmented into masks, creams & lotions, cleansers & toners, and others. The other segment includes products such as face wash, gels, serums, and essential oils. These products help unclog the pores and reduce inflammation, as acne is characterized by clogging and inflammation. These products are available in various types based on ingredients and their usage. For instance, in March 2022, Galderma launched TWYNEO cream in the U.S. which contains 3% benzoyl peroxide (BPO) & 0.1% tretinoin 2-in-1 combination to treat all types of acne.

The creams & lotions segment dominated the market with the largest revenue share of 42.0% in 2024 due to effectiveness, ease of use, and targeted action. owing to the high demand by both men and women, as moisturizing creams and body lotions protect the skin from bacteria and skin infections, such as psoriasis and eczema. Many times, these creams and lotions are produced in medicated form. They may contain Active Pharmaceutical Ingredients (API), vitamins like vitamin A, medications like antibiotics for acne caused due to bacterial infection, etc.

These products provide deep hydration while delivering active ingredients such as salicylic acid, benzoyl peroxide, and retinoids, which help control acne. The growing consumer preference for daily-use, noninvasive treatments and the convenience of at-home solutions further drive demand. In addition, their versatility for different skin types, including sensitive skin, has made creams and lotions the go-to choice for acne treatment, establishing their dominance in the market.

The cleansers & toners segment is anticipated to experience significant growth from 2025 to 2030. This growth can be attributed to the essential role of cleansers & toners in daily skincare routine. These products help remove excess oil, dirt, and impurities, which are key contributors to acne formation. As consumers increasingly seek preventive solutions for acne, cleansers and toners made with gentle, acne-fighting ingredients, including salicylic acid and tea tree oil, are gaining popularity. Their affordability, ease of use, and effectiveness in maintaining clear skin fuel segment growth.

The others segment is anticipated to grow at a rapid pace over the forecast period due to the compatibility of these products with various skin types and better skin absorption of these products. Serums like Salicylic acid are widely used now as it has been proven effective in unclogging blocked pores, acting as an anti-inflammatory, and also breaking down sebum, the oil found in the body responsible for acne. As per NCBI, the use of 0.5% and 2% solutions of salicylic acid for the treatment of acne vulgaris is reported to be more efficient as compared to benzoyl peroxide in reducing the total number of acne lesions.

Gender Insights

The women segment held the largest revenue share in 2024, attributed to increasing skin health awareness and a growing focus on skincare routines. The growth of the women segment can be attributed to the high prevalence of acne among the female population globally. Acne is more prevalent in women than men after adolescence, since it is linked to hormone changes, such as the menstrual cycle. Women are more likely to invest in products targeting acne, driven by concerns about appearance and self-esteem. Moreover, the rise of social media influencers and beauty experts promoting acne treatment solutions has further boosted market demand. The availability of a wide range of targeted products, such as cleansers, spot treatments, and moisturizers, has also contributed to the dominance of this segment.

According to a survey by Annals of International Medical and Dental Research, around 9.4% of the global population is believed to experience acne, with adolescents being the most affected group. The burden of acne vulgaris-related conditions is spread worldwide and has shown an increasing prevalence among adolescents. Furthermore, an expanding body of epidemiological evidence indicates that acne also impacts a significant number of adults, with adult women being more commonly affected by acne than men.

The men segment is projected to grow at the fastest CAGR during the forecast period, fueled by the shifting attitude toward skincare and grooming. As societal norms evolve, more men become conscious of their skin health and seek acne solutions. Increasing awareness through social media and the growing influence of male beauty influencers contribute to this trend. Moreover, the development of skincare products specifically designed for men’s skin, along with easier accessibility, drives demand for anti-acne products in this demographic, making it a rapidly growing market segment.

End-use Insights

Medspa segment accounted for the largest revenue share of 64.4% in 2024, as it combines advanced treatments and personalized care. Medspas offers professional-grade acne treatments such as chemical peels, laser therapy, and microdermabrasion, providing immediate and targeted results compared to over-the-counter products. Consumers seeking effective, long-lasting solutions are increasingly turning to medspas for their expertise and customized approach. With the rising demand for noninvasive, high-performance acne treatments, medspas emerged as a leading segment, driving growth in the anti-acne cosmetics industry. Medspas currently uses innovative, cutting-edge technology and products to provide clinical treatments that are in line with modern medicine. Currently, the millennial population is the largest target demographic for medical-grade skincare brands.

The dermatology clinics segment is expected to experience significant growth in the coming years, propelled by the growing demand for expert, personalized acne treatments. With consumers seeking professional guidance for acne management, dermatology clinics focus on offering tailored solutions, including prescription medications, advanced laser treatments, and acne-specific skincare regimens. Furthermore, dermatology clinics are gaining popularity due to increasing awareness of the long-term effects of untreated acne and the desire for effective, scientifically backed treatments. This shift toward medical-grade care is anticipated to drive significant growth.

Regional Insights

North America anti-acne cosmetics market is set to expand at a significant CAGR from 2025 to 2030. The growing preference for multifunctional products and the increasing focus on men's skincare are projected to fuel the market across the region. Consumers, especially men, seek products that target acne and offer additional benefits such as moisturizing, anti-aging, and skin tone improvement. As more men embrace skincare routines and look for efficient, all-in-one solutions, the demand for multifunctional anti-acne products is expected to grow. This shift is expected to drive the market, catering to a broader and more diverse consumer base.

U.S. Anti-acne Cosmetics Market Trends

The U.S. anti-acne cosmetics market held the largest share of the regional market in 2024. The growing demand for natural and organic products, along with personalized skincare solutions, is set to drive the U.S. anti-acne cosmetics industry. Consumers are increasingly seeking eco-friendly, chemical-free options that align with sustainability and skin health values. Furthermore, the growing trend of personalized skincare-where products are tailored to individual skin types and concerns-enables more effective solutions, enhancing customer satisfaction. These trends contribute to a shift toward premium, customized, natural anti-acne products, fueling market growth.

Europe Anti-acne Cosmetics Market Trends

Europe anti-acne cosmetics market is set to witness significant expansion over the forecast period. E-commerce growth and technological advancements are anticipated to drive the regional market. The rise of online retail platforms allows consumers to easily access a wide range of anti-acne products, with the convenience of home delivery and detailed product information. Technological advancements in skincare formulations, such as the use of bio-engineered ingredients and AI-driven product recommendations, enhance the effectiveness and personalization of treatments. These innovations, combined with the accessibility of e-commerce, are expected to impel regional growth.

Asia Pacific Anti-acne Cosmetics Market Trends

Asia Pacific anti-acne cosmetics market dominated the global market with the largest revenue share of 41.1% in 2024. This share is attributable tothe emergence of probiotic skincare and the growing influence of K-Beauty. Probiotics, known for their skin-balancing and healing properties, are gaining popularity in acne treatment products due to their ability to restore the skin's natural microbiome. In addition, the global rise of K-Beauty, with its focus on innovative formulations and multistep skincare routines, is reshaping consumer preferences. The combination of these trends is boosting demand for advanced, effective acne solutions, contributing to the expansion of the Asia Pacific anti-acne cosmetics industry.

Vietnam, Malaysia, and Indonesia are other countries expected to witness strong demand for these products in the forecast period. China is one of the most promising cosmetics markets in the Asia Pacific region. This can be attributed to the Chinese population's fascination with high-end foreign brands, as nearly 80% of the country’s cosmetics market is dominated by Western brands.

India anti-acne cosmetics market is expected to grow at the fastest CAGR during the forecast period, driven by the growing preference for dermatologist-approved products and a rising focus on sensitive skin solutions. Consumers are increasingly prioritizing safe, effective, and scientifically backed skincare products, especially those suitable for delicate skin. Dermatologist-endorsed formulations, often perceived as more reliable, are gaining popularity due to their ability to deliver targeted results without irritation. Moreover, the demand for gentle yet effective anti-acne solutions propel the market, reflecting a shift toward more personalized, skin-friendly options for treating acne.

Key Anti-acne Cosmetics Company Insights

Some of the key companies in the anti-acne cosmetics industry includeCP Skin Health Group, Inc.; Obagi Cosmeceuticals LLC; Phytomer; AbbVie; skinbetter science; Colorescience, Inc.; Sente Inc.; JMSR, Inc.; Revision Skincare; Beauty Health; Glowbiotics; and Perricone MD.

-

CP Skin Health Group, Inc., offers a variety of skincare solutions, focusing on dermatological treatments and products that address acne, aging, and skin health. Its offerings include advanced formulations designed to improve skin appearance and function.

-

Obagi Cosmeceuticals LLC provides a range of dermatologist-recommended skincare products, including treatments for aging, pigmentation, acne, and sun damage. Its formulations combine advanced ingredients to improve skin health, appearance, and overall complexion.

Key Anti-acne Cosmetics Companies:

The following are the leading companies in the anti-acne cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- PCA Skin (CP Skin Health Group, Inc.)

- Obagi Cosmeceuticals LLC

- Phytomer

- AbbVie

- skinbetter science

- Colorescience, Inc.

- Sente Inc.

- JMSR, Inc.

- Revision Skincare

- Beauty Health

- Glowbiotics

- Perricone MD

Recent Developments

-

In September 2024,Tikitoro, a trusted brand in holistic skincare and parent education, launched two new products: the Tikitoro Anti-Acne Spot Corrector and Tikitoro Anti-Dandruff Scalp Serum. These innovative products aim to address common skin and scalp concerns, reflecting the brand’s dedication to natural and effective skincare solutions.

-

In April 2024,SkinMedica, a brand by Allergan Aesthetics (an AbbVie company), introduced two new acne-focused products: the Acne Clarifying Treatment and Pore Purifying Gel Cleanser. These innovative products offer balanced care for acne-prone skin and complement the SkinMedica Pore Purifying Pro-Infusion Serum used in-office with DiamondGlow treatments.

Anti-acne Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.6 billion

Revenue forecast in 2030

USD 8.9 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, gender, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

PCA Skin (CP Skin Health Group, Inc.); Obagi Cosmeceuticals LLC; Phytomer; AbbVie; skinbetter science; Colorescience, Inc.; Sente Inc.; JMSR, Inc.; Revision Skincare; Beauty Health; Glowbiotics; and Perricone MD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-acne Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global anti-acne cosmetics market report on the basis of product type, gender, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mask

-

Creams & Lotions

-

Cleansers & Toners

-

Others

-

- Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology Clinics

-

Medspa

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.