- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Anti-Slip Coatings Market Size, Share & Growth Report, 2030GVR Report cover

![Anti-Slip Coatings Market Size, Share & Trend Report]()

Anti-Slip Coatings Market (2024 - 2030) Size, Share & Trend Analysis Report, By Resin (Epoxy, Polyurethane), By Application (Flooring, Marine), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-398-5

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anti-Slip Coatings Market Summary

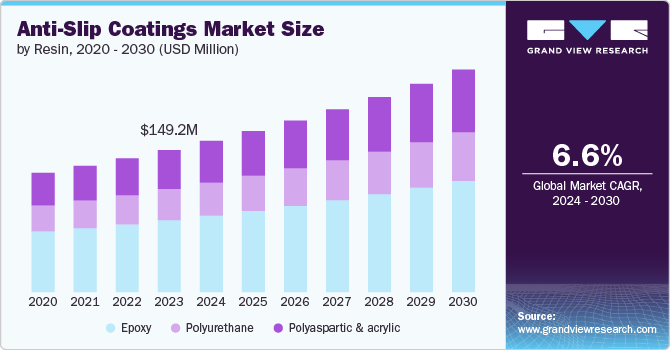

The global anti-slip coatings market size was estimated at USD 149.17 million in 2023 and is projected to reach USD 233.34 million by 2030, growing at a CAGR of 6.6% from 2024 to 2030. Increased focus on safety and accident prevention across various industries is anticipated to drive market growth over the coming years.

Key Market Trends & Insights

- Asia Pacific held over 55% revenue share of the overall anti-slip coatings market.

- Based on technology, epoxy resin held the largest revenue share of over 50% in 2023.

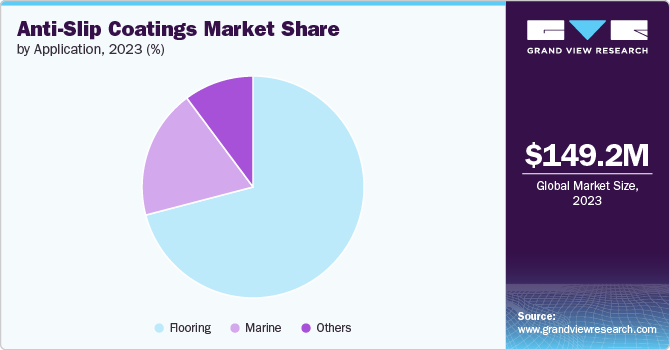

- Based on application, the flooring application held the largest revenue share of over 71% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 149.17 Million

- 2030 Projected Market Size: USD 233.34 Million

- CAGR (2024-2030): 6.6%

- Asia Pacific: Largest market in 2023

As there is a rise in accidents and injuries in workplaces, safety regulations have become more stringent, and businesses are investing in protective coatings to minimize the risk of slips and falls. This is particularly notable in sectors such as manufacturing, construction, and hospitality, where the well-being of employees and customers is paramount. This is anticipated to increase the demand for anti-slip products and thus coatings.

Drivers, Opportunities & Restraints

Owing to growing awareness, there is an increasing need for public safety in communal and residential areas is likely to benefit the market growth. Anti-slip coatings are being extensively used in public spaces, including parks, public pools, schools, and residential complexes, to ensure community members are safeguarded against accidents caused by slippery surfaces.

Innovation and development of environmentally friendly and sustainable products are likely to provide multiple opportunities for market participants. As global emphasis on eco-friendly materials grows, there is a substantial market potential for anti-slip coatings made from bio-based and non-toxic materials, offering enhanced safety without compromising environmental health.

The cost associated with the application and maintenance of these coatings is projected to hinder the market growth in a moderate ratio. High-quality anti-slip coatings require professional application and periodic reapplication, which can be financially taxing for small businesses and residential property owners, limiting the adoption rate across these segments.

Technology Insights

“Epoxy resin held the largest revenue share of over 50% in 2023.”

Epoxy resin-based coatings are known for their durability, chemical resistance, and strong adherence to a variety of substrates. These coatings are suitable for heavy-duty environments such as industrial and commercial flooring, where they provide a long-lasting solution against slip and fall accidents while withstanding harsh conditions.

Polyurethane resin-based coatings are characterized by their flexibility, UV resistance, and aesthetic versatility. These coatings are ideal for both indoor and outdoor applications, providing a non-slip surface that can endure fluctuating temperatures and prolonged exposure to sunlight, making them perfect for patios, school playgrounds, and athletic facilities.

Application Insights

“Flooring application held the largest revenue share of over 71% in 2023.”

The flooring application segment is expected to dominate the market over the forecast period. In flooring applications, anti-slip coatings are crucial for enhancing safety and preventing accidents in both commercial and residential settings. From factory floors to kitchen areas, these coatings provide rough along with a visually appealing surface that significantly reduces the risk of slips and falls, contributing to a safer environment overall.

Rising investments in the shipbuilding industry coupled with a growing focus on the defense sector are expected to benefit the marine industry. On marine decks, the application of anti-slip coatings is essential for ensuring the safety of passengers and crew members alike. The harsh marine environment demands coatings that can withstand saltwater, extreme weather, and constant wear, all while providing a secure footing, which is precisely what modern anti-slip solutions offer.

Regional Insights

“Asia Pacific held over 55% revenue share of the overall anti-slip coatings market.”

The Asia Pacific market is expected to observe rapid growth due to the expansion of industrial activities and infrastructural development. Countries like China, India, and Japan are anticipated to dominate the industry, driven by increasing awareness of workplace safety and government regulations mandating the use of safety coatings in construction and industrial projects.

North America Anti-Slip Coatings Market Trends

The North American market is characterized by technological developments and a stringent regulatory framework focused on safety standards. Strong emphasis on innovation and the adoption of eco-friendly coatings across various sectors including commercial, residential, and industrial is likely to remain as a key focus area for market players.

U.S. Anti-Slip Coatings Market Trends

The U.S. market is fueled by a robust economy and the presence of key industry players focusing on research and development to introduce more efficient and environmentally safe coatings. American industries are steadily adopting anti-slip solutions not just for compliance, but also as a strategic investment in personnel safety and liability reduction.

Europe Anti-Slip Coatings Market Trends

The European market is driven by a combination of stringent safety regulations and an awareness of occupational health. European countries have a strong demand for high-quality, eco-friendly anti-slip solutions, particularly in sectors such as healthcare, automotive, and food processing, where safety and hygiene are very important.

Key Anti-Slip Coatings Company Insights

Some key players operating in the market include 3M, RPM International, and PPG Industries.

-

3M is an international conglomerate company operating in industries such as worker safety, health care, and consumer goods. 3M has a diverse portfolio of products, including adhesives, abrasives, laminates, passive fire protection, personal protective equipment, window films, and more.

-

PPG Industries, U.S.-based manufacturer of paints, coatings, and specialty materials. The company serves a wide range of markets, including construction, consumer products, industrial, and transportation, with a focus on innovation and environmental responsibility.

Key Anti-Slip Coatings Companies:

The following are the leading companies in the anti-slip coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Amstep Products

- 3M

- Axalta Coating Systems

- Hempel A/S

- Paramelt

- PPG Industries

- Randolph Products

- RPM International

- Sherwin Williams

- Tesoplas

Recent Developments

-

In March 2024, Orientbell Tiles announced a new product line Safegrip Collection. The product focuses on slip-resistant tiles without compromising aesthetics.

-

In March 2022, Canadian company Daich Coatings announced a new product in the anti-slip coatings category. The product can be used in interior and exterior flooring materials such as tiles, stones, masonry, and pre-painted floors.

Anti-Slip Coatings Report Scope

Report Attribute

Details

Market size value in 2024

USD 158.72 million

Revenue forecast in 2030

USD 233.34 million

Growth rate

CAGR of 6.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Resin, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East, Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil; GCC; South Africa

Key companies profiled

3M; Amstep Products; Axalta Coating Systems; Hempel A/S; Paramelt, PPG Industries; Randolph Products; RPM International; Sherwin Williams; Tesoplas

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anti-slip Coatings Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anti-slip coatings market report based on the resin, application, and region.

-

Resin Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethane

-

Polyaspartic & acrylic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Flooring

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anti-slip coatings market size was estimated at USD 149.17 million in 2023 and is expected to reach USD 158.72 million in 2024.

b. The global anti-slip coatings market is estimated to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030 to reach USD 233.34 million by 2030.

b. Epoxy resin held the largest revenue share of over 50% in 2023. These coatings are known for their durability, chemical resistance, and strong adherence to a variety of substrates. These coatings are suitable for heavy-duty environments such as industrial and commercial flooring, where they provide a long-lasting solution against slip and fall accidents while withstanding harsh conditions.

b. Key players in the global anti-slip coatings market are 3M, Amstep Products, Axalta Coating Systems, Hempel A/S, Paramelt, PPG Industries, Randolph Products, RPM International, Sherwin Williams, and Tesoplas

b. The anti-slip coatings market is driven by increasing need for public safety in communal and residential areas is likely to benefit the market growth. Anti-slip coatings are being extensively used in public spaces, including parks, public pools, schools, and residential complexes, to ensure community members are safeguarded against accidents caused by slippery surfaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.