- Home

- »

- Electronic Devices

- »

-

APAC Micro LED Market Size, Share, Industry Report, 2030GVR Report cover

![APAC Micro LED Market Size, Share & Trends Report]()

APAC Micro LED Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Display, Lighting), By Display (Television, AR & VR), By Lighting (General, Automotive), By Display Pixel Density, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-253-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

APAC Micro LED Market Size & Trends

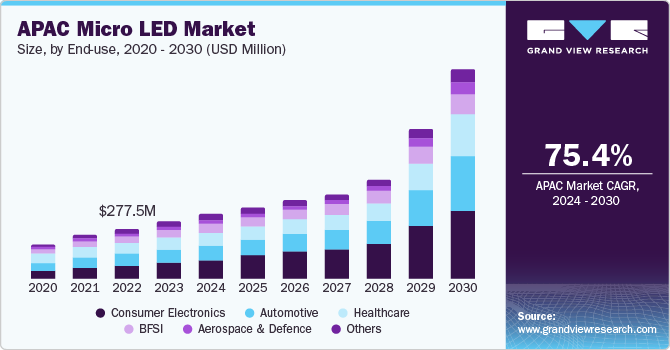

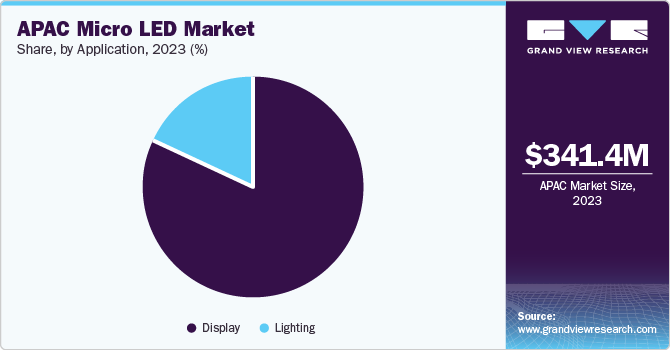

The APAC micro LED market size was valued at USD 341.4 million in 2023 and is projected to grow at a CAGR of 75.4% from 2024 to 2030. The APAC accounted for 54.7% of the global micro LED market. Micro Light Emitting Diodes (LEDs) are expected to witness significant adoption in the Asia Pacific (APAC) region over the next few years with several advancements in next-generation LED technologies. Micro LEDs are finding acceptance across various industries due to their compact size, which offers local dimming capabilities and high-density backlighting, propelling the APAC market's growth.

Moreover, the increased utilization of on-demand content, ranging from streaming OTT services to high-definition video content, necessitates screens that can display complex and detailed graphics resulting in demand for LED devices. Such device adaptability opens new avenues for creative design in goods such as smartphones, wearables, automobile screens, digital signage, and massive operations digital screens, fueling micro LEDs' growth in the APAC Market.

In addition, the potential of micro LEDs to deliver high-quality images meets the unique needs of customers involved in various content consumption activities. In APAC, micro LED technology can be used in the production of ultra-thin and flexible displays, which is one of its distinctive advantages. These factors are expected to drive growth in the APAC Micro LED Market over the forecast period.

Furthermore, the growing focus on health and wellness, particularly due to increasing global health crises, has fueled the demand for wearable devices, which include micro LEDs. As consumers become increasingly health-conscious, the market for wearable health monitoring devices is expected to expand, driving the adoption of micro LED displays in the APAC Market.

However, the high costs associated with the research & development and large-scale production of Micro LEDs can restrain the market's growth. Similarly, manufacturing micro LEDs is relatively complex, and integrating millions of individual micro-LEDs into a display matrix requires precise bonding techniques. Hence, these factors can be challenging for the growth of APAC CEM market.

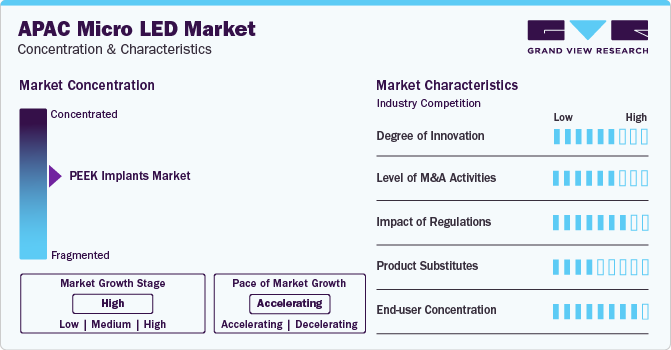

Market Concentration & Characteristics

The market growth stage is moderately high, and the pace of the market growth is accelerating. The APAC micro LED market is fairly concentrated. The Asia Pacific region, particularly China, Japan, and South Korea, has been at the epicenter of technical innovation. These countries are home to leading electronics brands, semiconductor manufacturers, and research organizations focusing on micro LED technology advancements. As a result, it is likely to generate domestic demand for Micro LED in APAC Market.

Market growth in APAC is driven by consumers' growing demand for micro-LED displays and their widespread adoption of micro-LED screens with very few product substitutes. Due to the high concentration of end-use consumers, the APAC micro-LED market is growing fast, and the market has a vast scope for innovation for a better customer experience.

The key companies frequently engage in partnerships, mergers & acquisitions, and new product launches to maintain their market share. Therefore, the market is experiencing a few strategic partnerships and product launches. For instance, in July 2023, Marelli Holdings Co. Ltd., an automotive parts supplier, introduced H-Digi Micro LED, an innovative digital front lighting solution for a wide range of automobiles.

Manufacturers must also adhere to manufacturing standards set by regulatory bodies, which often issue micro LED display-specific standards. In order to ensure their products meet the quality norms, manufacturers must follow these guidelines to deliver high-quality products. As a result of high standards, the market is expecting growth in APAC.

Application Insights

Display segment dominates the market and accounted for the highest revenue of USD 280.8 million in 2023. The growing demand among consumers for high-resolution displays, particularly in products such as televisions, smartphones, and monitors, has substantially driven the growth of the display segment. In addition, the display industry in APAC has gained traction among environmentally conscious customers and businesses owing to the sustainable practices of micro LED technology.

The services segment is anticipated to witness a significant CAGR of 74.6% from 2024 to 2030 in the APAC Micro LED Market. The segment growth can be attributed to the advent of smart homes and smart cities, which have fueled the demand for automated lighting solutions. Micro LED technology is at the front of the smart lighting revolution. The increased number of end-use industries in the APAC is driving the growth of this market.

Display Insights

Television segment led the market and accounted highest revenue share of 85.7% in 2023. The segment growth is attributed to the shift toward larger television displays and the changing customer tastes for home entertainment. Micro LED televisions meet the rising demands for improved clarity and authenticity as television buyers favor larger screens with ultra-high-definition screens. Therefore, Television has a significant market share in the APAC micro LED market.

Smartwatch segment is anticipated to witness CAGR of 141.8% from 2024 to 2030 in the APAC Micro LED Market. There is a growing demand for wearable devices, including smartwatches, driven by the growing demand for fitness tracking, health monitoring, and communication. Smartwatches equipped with micro LED displays offer compact form factors, energy efficiency, and high-resolution visuals, enhancing the user experience. As a result, the smartwatch sub-segment is showcasing huge growth in APAC during the forecast period.

Lighting Insights

General lighting segment led the market and accounted highest revenue share of 72.1% in 2023. The incorporation of micro LED lighting into smart lighting systems is a key driver for the growth of the general lighting segment. General lighting micro LED technology enables control over color temperatures, allowing lighting solutions to be tailored to specific settings and user preferences. As a result, the general lighting sub-segment is driving the APAC micro LED market growth.

Automotive lighting segment is anticipated to witness CAGR of 76.7% from 2024 to 2030 in the APAC Micro LED Market. The segment growth can be attributed to the emergence of electric and self-driving vehicles, which have opened new avenues for lighting innovation. Micro LED technology is at the core of these developments of automotive lighting. For instance, micro LED illumination combined with Advanced Driver Assistance Systems (ADAS) and Advanced Forward Lighting (AFLs) aim to improve the overall operational and safety aspects of automobiles manufacturing in APAC. Thus, automotive lighting is showcasing stable growth during the forecast period.

Display Pixel Density Insights

Greater than 5000ppi segment led the market and accounted highest revenue of USD 123.7 million in 2023. The gaming industry is a key consumer of high-performance displays, contributing significantly to the rising growth of 5000ppi panels. The increasing demand for devices with higher resolutions and more immersive displays contributes to the wide adoption of 5000ppi displays.

3000ppi to 5000ppi segment is anticipated to witness CAGR of 75.8% from 2024 to 2030 in the APAC Micro LED Market. The segment growth can be attributed to the increasing popularity of 3000ppi to 5000ppi pixel densities in small form-factor devices such as smartwatches, cell phones, and AR/VR glasses. The growing interest in virtual and augmented reality technologies has increased the need for displays with high pixel density.As a result, demand for 3000ppi to 5000ppi sub-segment is expecting a growth during the forecast period.

End-use Insights

Customer electronics segment accounted for the largest market revenue share of 50.1% in 2023. The widespread use of micro LED screens in smartphones has changed the gaming experience, propelling the growth of the consumer electronics segment in APAC. Manufacturers are incorporating micro LED technology in consumer electronics owing to the rising demand for gadgets with improved display quality, extended battery life, and appealing designs. As a result, customer electronics sub-segment is driving the growth of the APAC micro LED market.

Healthcare segment is expected to register the fastest CAGR of 77.3% during the forecast period. There is a growing demand for high-quality displays in healthcare settings for medical imaging, diagnostic purposes, patient monitoring, and surgical procedures. Micro LED displays offer high resolution, brightness, color accuracy, and contrast ratio, making them suitable for medical applications where visual clarity and accuracy are critical. Such technological advancements in the healthcare industry are expected to bode well for the segment growth.

Country Insights

China Micro LED Market Trends

The Micro LED market in China is growing significantly at a CAGR of 81.0% from 2024 to 2030. China is one of the leading countries dominating micro LED production. The automotive sector is driving the demand for micro LED displays in China. Similarly, China-based automakers are developing technologically advanced cars with advanced infotainment systems, digital cockpits, and Advanced Driver Assistance Systems (ADAS), which is leading to the growth of the micro LED market in China.

South Korea Micro LED Market Trends

South Korea micro LED market accounted for the largest market revenue share of 23.2% in 2023. In South Korea, the government emphasizes research & development for micro LED areas, which is transforming the country into a leading inorganic display technologies hub, strengthening supply chains throughout the production processes, and introducing flexible displays. As a result, the demand for the micro LED market in South Korea is growing.

Japan Micro LED Market Trends

The micro LED market in Japan is growing significantly at a CAGR of 74.6% from 2024 to 2030. In Japan, technological developments have helped improve manufacturing techniques, enhance chip designs, and increase production volumes of micro LED chips. Due to manufacturers producing low-cost micro LED displays, LED lighting companies are expanding their product portfolios.

Australia Micro LED Market Trends

Australia micro LED market accounted for the market revenue share of 9.4% in 2023. In Australia, various manufacturers of smart mobile devices are looking forward to expanding their product line by adding small-screen devices. The key driver for micro LEDs in the Australian market is smart wearables, where manufacturers use smaller display panels for smart glasses, wristbands, and smartwatches.

India Micro LED Market Trends

The micro LED market in Indiais growing significantly at a CAGR of 77.6% from 2024 to 2030. In India, the initiatives being pursued by the government to encourage domestic manufacturing and adoption of energy-efficient products have been a significant factor driving the growth of the micro LED market in the country. Such initiatives are expected to help reduce the prices of micro LED solutions and drive their adoption in the country.

Key APAC Micro LED Company Insights

Sony Corporation, Samsung Electronics Co., Ltd., LG Electronics, and among others are some of the prominent participants operating in the APAC Micro LED Market.

-

LG Electronics manufactures and distributes consumer electronics and home appliances and offers a diverse range of products. The company's portfolio includes monitors, televisions, personal computers, refrigerators, washing machines, audio devices, and air purifiers, among others. The company operates globally including APAC, offering innovative solutions in sectors such as entertainment, automotive components, and solar panels.

-

Sony Corporation designs, develops, manufactures, and sells electronic devices and equipment. The company is engaged in content businesses, including console and mobile games, music, and movies. It operates in various business domains, including home entertainment, technology, and services.

Some of the emerging companies operating in the Market include AUO Corporation, Jade Bird Display, Epistar, and among others.

-

AUO Corporation offers a variety of optoelectronic solutions. The company is involved in designing, developing, manufacturing, and assembling a broad range of panel display products. It integrates core display technology with AIoT, offering one-stop services for diverse markets, including mobility, manufacturing, energy, retail, medical, healthcare, enterprise, and education.

-

Jade Bird Display (JBD) is a developer and producer of micro LED displays. JBD has developed ultra-micro displays, contributing significantly to technological advancements in diverse sectors such as automobiles, mixed reality, and semiconductors. Utilizing its core display technologies, JBD has combined circuits and displays to offer a variety of advanced products, including AM-µLED micro display development kits, monochromatic/trichromatic displays, AM-µLED displays, AM-µLED optical engines, and optical modules.

Key APAC Micro LED Companies:

- AUO Corporation

- BOE Technology

- Cincoze Co., Ltd.

- Epistar

- Foshan NationStar Optoelectronics Co.,Ltd

- HC SemiTek

- Innolux Corporation

- Jade Bird Display

- KYOCERA Corporation

- Ledman Optoelectronic Co

- LEYARD

- LG Electronics

- PlayNitride

- Samsung Electronics Co., Ltd.

- SANAN Optoelectronics

- Seoul Semiconductor Co Ltd

- Sony Corporation

- Unilumin

Recent Developments

-

In January 2024, AUO Corporation unveils its Transparent Micro LED display series featuring a 60-inch display at a global professional audiovisual integration event, ISE 2024. This versatile technology seamlessly integrates into diverse settings, delivering an advanced visual experience for applications such as digital signage, commercial displays, corporate meeting rooms, and residential interiors.

-

In October 2023, Samsung Electronics is exploring the integration of Micro LED technology into its Galaxy Watch to tap into the expanding small display market. This initiative aimed to enhance display quality and efficiency as well as provide users with an advanced and immersive wearable experience.

-

In August 2023, Jade Bird Display announced the shipment of prototypes for its Phoenix series, showcasing single-panel monolithic RGB Micro LED micro-displays with a 0.22-inch panel, 2K resolution, and 2.5um sub-pixel pitch. The launch was aimed at pioneering a breakthrough in Micro LED technology, offering a unique emitter arrangement for high efficiency and converged light emission.

APAC Micro LED Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 446.4 million

Revenue forecast in 2030

USD 13000.7 million

Growth Rate

CAGR of 75.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, display, lighting, display pixel density, end-use

Country scope

APAC

Key companies profiled

AUO Corporation; BOE Technology;Cincoze Co., Ltd.; Epistar; Foshan NationStar Optoelectronics Co.,Ltd; HC SemiTek; Innolux Corporation; Jade Bird Display; KYOCERA Corporation; Ledman Optoelectronic Co; LEYARD; LG Electronics; PlayNitride; Samsung Electronics Co., Ltd.; SANAN Optoelectronics; Seoul Semiconductor Co Ltd; Sony Corporation; Unilumin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

APAC Micro LED Market Report Segmentation

This report forecasts revenue growth at region level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the APAC Micro LED Market report based on application, display, lighting, display pixel density, and end-use.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Display

-

Lighting

-

-

Display Outlook (Revenue, USD Million, 2018 - 2030)

-

Television

-

AR & VR

-

Automotive

-

Smartwatch

-

Smartphone, Tablets, and Laptops

-

-

Lighting Outlook (Revenue, USD Million, 2018 - 2030)

-

General Lighting

-

Automotive Lighting

-

-

Display Pixel Density Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 3000ppi

-

3000ppi to 5000ppi

-

Greater than 5000ppi

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

BFSI

-

Aerospace & Defence

-

Others

-

Frequently Asked Questions About This Report

b. The APAC micro LED market size was estimated at USD 341.4 million 2023 and is expected to reach USD 446.4 million in 2024

b. The APAC micro LED market is expected to grow at a compound annual growth rate of 75.4% from 2024 to 2030 to reach USD 13,000.7 million in 2030.

b. South Korea micro LED market accounted for the largest market revenue share of 23.2% in 2023. In South Korea, the government emphasizes research & development for micro LED areas, which is transforming the country into a leading inorganic display technologies hub, strengthening supply chains throughout the production processes, and introducing flexible displays.

b. Some key players operating in the APAC micro LED market are AUO Corporation; BOE Technology;Cincoze Co., Ltd.; Epistar; Foshan NationStar Optoelectronics Co.,Ltd; HC SemiTek; Innolux Corporation; Jade Bird Display; KYOCERA Corporation; Ledman Optoelectronic Co; LEYARD; LG Electronics; PlayNitride; Samsung Electronics Co., Ltd.; SANAN Optoelectronics; Seoul Semiconductor Co Ltd; Sony Corporation; and Unilumin among others.

b. Micro Light Emitting Diodes (LEDs) are expected to witness significant adoption in the Asia Pacific (APAC) region over the next few years with several advancements in next-generation LED technologies. Micro LEDs are finding acceptance across various industries due to their compact size, which offers local dimming capabilities and high-density backlighting, propelling the APAC market's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.