- Home

- »

- IT Services & Applications

- »

-

Application Development Software Market Size Report, 2030GVR Report cover

![Application Development Software Market Size, Share & Trends Report]()

Application Development Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Low-code Development Platforms, No-code Development Platforms), By Deployment, By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-613-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Application Development Software Market Summary

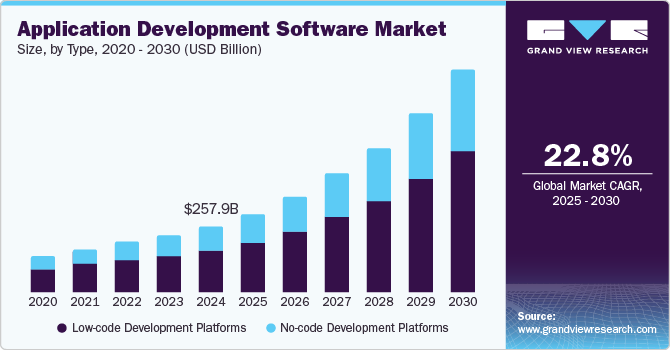

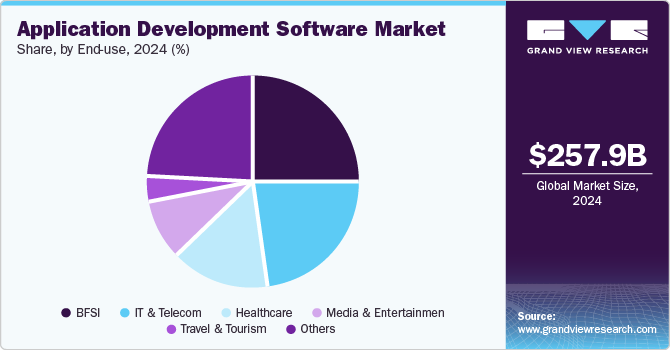

The global application development software market size was estimated at USD 257.94 billion in 2024 and is projected to reach USD 862.67 billion by 2030, growing at a CAGR of 22.8% from 2025 to 2030. The growing adoption of digitalization across businesses globally and the rising demand for software applications that can simplify and accelerate operations are anticipated to maintain a significant pace of development in this market.

Key Market Trends & Insights

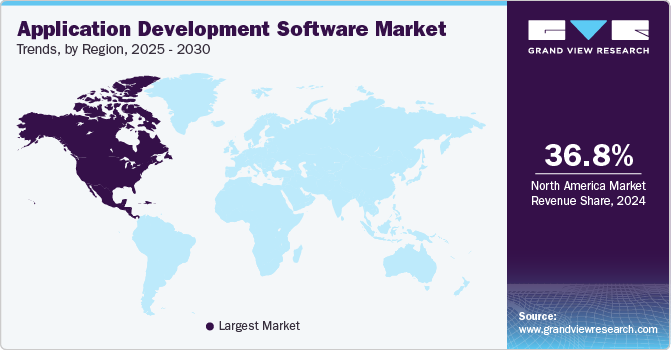

- North America led the market with 36.8% of the global revenue share in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- The Asia Pacific region is anticipated to witness the fastest CAGR from 2025 to 2030.

- In terms of type, low-code development platforms accounted for a leading revenue share in 2024.

- In terms of deployment, cloud segment accounted for a dominant revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 257.94 Billion

- 2030 Projected Market Size: USD 862.67 Billion

- CAGR (2025-2030): 22.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Application development software designs and develop various advanced applications depending on the end user’s requirements. The apps developed can be run on several computer devices, digital gadgets, and smartphones. They help in accomplishing tasks more quickly and efficiently. The developed application is equipped with several characteristics to perform tasks such as generating sales reports, scheduling appointments, calculating monthly expenditures, and helping businesses automate processes. The increasing demand for cloud deployment among various small, medium, and large enterprises is expected to support market growth in the coming years.

Application development software allows organizations to develop software products, including desktop and mobile applications, which assist them in reaching mass audiences and catering to different user requirements. They require vast technical knowledge such as code assist tools, mobile development and integration, development tools, application programming interface (API), and testing to cater to customer expectations and requirements. The app assists in managing complex operations with better efficiency at a high speed and minimal cost. It can also help automate robotic automation processes and enable feedback collection from end-users for better business alignment.

According to a West Monroe survey published in September 2023 for 700 C-suite executives in the U.S., 61% of respondents stated that digital transformation was the leading priority in their enterprises. Organizations are increasingly adopting digital technologies to improve efficiency, enhance customer experiences, and stay competitive, aiding the demand for development tools to facilitate quick and effective application creation. Moreover, the rapid emergence of the Internet of Things (IoT) and cloud-based technologies and the need for customized and scalable software remain major factors for industry advancement.

The constantly rising popularity of agile methodologies and DevOps practices has highlighted the need for tools that support continuous integration and continuous delivery (CI/CD), collaboration, and automation. Application development software is utilized in designing and developing several advanced applications customized as per the end-user's requirements. These apps are being developed to run on multiple platforms, including personal computers, smartphones, and digital gadgets. With the constant rise in mobile usage and the availability of various advanced features, there is a substantial need for software that enables the rapid development of mobile applications across various platforms.

Furthermore, the emergence of low-code and no-code platforms has democratized app development, allowing non-technical users to create applications, which drives demand for intuitive development tools. Most low-code and no-code applications are deployable on the cloud, thus bringing on-demand scalability and substantially lowering the upfront investment required in IT infrastructure. Businesses increasingly require applications that can easily integrate with existing systems and data sources, driving the use of development tools that facilitate seamless interoperability. As organizations boost their use of data analytics and AI tools, there has been an urgent demand for applications that can effectively process and analyze large volumes of data. This offers another promising avenue for market players to provide advanced solutions and services with regard to app development.

Type Insights

In terms of type, low-code development platforms accounted for a leading revenue share in 2024 on account of their increasing popularity due to their ability to simplify software development. These platforms offer a visual development environment that utilizes drag-and-drop interfaces to build applications without requiring extensive coding knowledge. Moreover, the availability of pre-built templates and components helps accelerate the application development process while collaboration tools ensure better teamwork among business analysts, developers, and stakeholders.

Low-code development platforms reduce development costs by minimizing the need for extensive coding and specialized developer resources. They are increasingly being leveraged for the general purpose of applications, with the provision of adding custom codes when required. Appian is a prominent cloud computing company that offers a low-code development platform for businesses across verticals such as insurance, financial services, life sciences, and the public sector. In April 2024, the company announced an extension of its partnership with TELUS International to enable businesses to simplify complex processes through a cutting-edge low-code automation platform. Similar developments are expected to maintain strong growth of this segment in the coming years.

Meanwhile, no-code development platforms are anticipated to witness the fastest CAGR during the forecast period. These application development platforms enable users to create applications without writing any code, making them accessible to a wider range of users, including those with no technical background. They offer features such as built-in integrations with popular services and APIs, facilitating data exchange and functionality. The presence of customizable workflows allows users to suit their specific business processes without needing to write scripts, while responsive design tools help in making applications responsive to work across various devices, including desktops smartphones, and tablets.

Organization Size Insights

The large enterprise segment accounted for a leading revenue share in the overall market in 2024. Large enterprises often require robust application development software to handle complex projects, integrate with existing systems, and support large teams. Moreover, the increasing emphasis on data analytics has necessitated using applications that can efficiently gather, process, and analyze large volumes of data, highlighting the need for tools to facilitate data integration and real-time analytics. The shift towards remote and hybrid working models has driven the demand for mobile applications and platforms that support remote collaboration, communication, and productivity. Enterprises can simplify business processes in systems such as supply chain management, enterprise resource planning, and customer relationship management.

The small and medium enterprises (SMEs) segment is anticipated to advance at the fastest CAGR during the forecast period. Application development software enables SMEs to prioritize processes and functions, improve collaboration, and enhance visibility. The rapidly growing number of small-sized businesses, particularly in developing economies, presents a major avenue that drives strong market expansion. SMEs often have unique processes and requirements, boosting the implementation of these platforms to create custom applications that address their specific challenges, thus improving efficiency and productivity. As customer acquisition and retention form an important part of their strategy, SMEs increasingly leverage low-code and no-code platforms to develop customer-facing applications such as mobile apps or web portals to improve engagement, streamline communication, and enhance the overall customer experience. By developing in-house applications, SMEs can reduce reliance on third-party vendors, leading to lower long-term costs and more control over software features and updates.

Deployment Insights

The cloud segment accounted for a dominant revenue share in the global market in 2024 and is further expected to advance at the fastest CAGR during the forecast period. Cloud-based deployment has become very popular, especially among smaller organizations, due to its flexibility, scalability, and cost-effectiveness. According to a report by Kissflow, which is a low-code/no-code platform for application development, cloud-based applications offer 40% higher cost-efficiency for small businesses. Moreover, these platforms enable quick setup and deployment of applications, leading to faster time-to-market for new products and features. Teams using agile methodologies can leverage cloud platforms to iterate quickly and respond to user feedback, while it is also ideal for short-term projects that require flexible resources without the need for long-term resources and planning.

The on-premise segment is expected to grow steadily from 2025 to 2030. This deployment mode of application development software involves installing and running the software on an organization's servers and infrastructure rather than using cloud-based services. This enables enterprises to have complete control over their data, including security, access, and compliance with regulations. Organizations can ensure that their data remains restricted within specific geographic boundaries, which is crucial for adhering with specific regional regulations. Sectors such as financial services, healthcare, and government often make use of on-premise solutions for compliance purposes. Larger organizations with well-established IT infrastructure may prefer to leverage their resources for application development, aiding segment demand.

End-use Insights

The BFSI segment accounted for the largest revenue share in the global market in 2024, owing to the rapid pace of digital transformations undertaken by BFSI institutions to enhance customer experience, streamline operations, and remain competitive. These factors have necessitated the development of user-friendly and robust applications that require a reliable platform to be built on. With the emergence of fintech and digital-only banks, customers now expect seamless, convenient, and personalized banking experiences. Application development software helps institutions create mobile apps and online platforms that meet these expectations. The industry constantly seeks solutions to address bottlenecks such as errors due to manual processes, issues with paper-based documents, security issues, and regulatory challenges, driving the adoption of multi-platform applications. In October 2024, Intergiro, a Sweden-based banking-as-a-service provider, launched its no-code white-label application platform to enable the quick launch of branded banking applications for businesses. Such developments enable customers to boost their user engagement and generate new revenue streams.

The healthcare segment is anticipated to advance at the fastest CAGR from 2025 to 2030. A steadily growing emphasis on providing personalized and accessible healthcare solutions has driven segment expansion, as applications that facilitate patient engagement, appointment scheduling, and telehealth services have witnessed high demand in recent years. Additionally, with the generation of vast volumes of patient data, the need for its effective management has highlighted the necessity of applications that can aggregate, analyze, and visualize data to improve clinical decision-making and operational efficiency. The exponential growth of the mHealth segment presents another avenue for segment advancement, as these applications enable patients to manage their health, access medical records, and communicate with healthcare providers in a secure and effective manner.

Regional Insights

North America led the market with 36.8% of the global revenue share in 2024 and is expected to maintain a leading contribution in the coming years. The region has a well-established technology infrastructure and is a leading adopter of innovative solutions such as cloud computing and machine learning across different domains, leading to a substantial demand for application development tools and platforms. Additionally, the increasing proliferation of the internet and the steadily growing number of internet users in Canada and Mexico supports market expansion. Regional companies prioritize customer-centric applications, leading to increased demand for development tools supporting user-friendly designs and enhanced functionality. The fast-growing technology sector in Canada, particularly in cities such as Toronto, Vancouver, and Montreal, has encouraged strong demand for innovative application development tools. The country's supportive environment for startups, with access to funding and incubators, encourages new companies to adopt agile and cost-effective development solutions.

U.S. Application Development Software Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by the high adoption rate of smartphones, extensive Internet proliferation, and the establishment of several major application development software companies in the economy. The presence of technology hubs such as Silicon Valley, Austin, and New York has created a robust startup ecosystem, with such businesses seeking agile and cost-effective development solutions, fueling strong demand for development platforms. Moreover, the country has a diverse technology landscape that hosts a range of application development tools, from traditional IDEs (Integrated Development Environments) to modern low-code/no-code platforms, catering to various developer needs and skill levels. Increasing cybersecurity concerns further present promising growth avenues, owing to the focus on development tools that incorporate security features and help organizations meet regulatory compliance requirements.

Europe Application Development Software Market Trends

Europe accounted for a substantial revenue share in 2024, aided by the increasing digital transformation in regional businesses that are aimed at improving efficiency and enhancing customer experiences. Europe’s diverse economy includes various industries such as finance, healthcare, and manufacturing, with each vertical requiring customized application development solutions to meet specific needs. The shift to cloud services is driving significant demand for cloud-native development tools that facilitate creating and managing scalable applications. Companies such as Netguru (Poland), SoftwareHut (Poland), and Tapptitude (Romania) are some notable regional names that specialize in providing advanced offerings that help businesses with their digital transformation.

Asia Pacific Application Development Software Market Trends

The Asia Pacific region is anticipated to witness the fastest CAGR from 2025 to 2030, aided by the increasing pace of industrialization and digitalization in regional economies such as China, India, and South Korea. Furthermore, the region has witnessed a sharp growth in its mobile user base, creating substantial demand for mobile applications that has compelled companies to leverage robust development tools.

Key Application Development Software Company Insights

Some key companies involved in the application development software market include Salesforce, Microsoft, and Zoho Corporation, among others.

-

Microsoft is an American technology company involved in developing software and hardware solutions. The former includes Windows operating systems, the Microsoft 365 productivity application suite, the Edge web browser, and the Azure cloud computing platform.

-

Zoho Corporation is a technology company that offers a comprehensive suite of cloud-based business applications. Zoho provides solutions for customer relationship management (CRM), project management, accounting, HR, and marketing, among other functions. The company has invested substantially in enhancing its products with features such as AI and automation, making it easier for businesses to operate efficiently and make data-driven decisions. Zoho partnered with NVIDIA in October 2024 to utilize the latter's NVIDIA AI platform to develop business-specific large language models (LLMs).

Key Application Development Software Companies:

The following are the leading companies in the application development software market. These companies collectively hold the largest market share and dictate industry trends.

- Fujitsu

- HCL Technologies Limited

- IBM

- Microsoft

- Oracle

- Salesforce, Inc.

- SAP SE

- ServiceNow

- Wipro

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In September 2024, Oracle announced new capabilities to help accelerate the development of applications. Oracle Code Assist is expected to provide developers with advanced suggestions to enable them to build and optimize applications written in various programming languages, including Python, Java, JavaScript, Rust, Ruby, SuiteScript, PL/SQL, C, and C#. These features would help accelerate application development by reducing the time spent by developers on generic tasks inherent to the software development process.

Application Development Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 309.53 billion

Revenue Forecast in 2030

USD 862.67 billion

Growth rate

CAGR of 22.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, organization size, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Fujitsu; HCL Technologies Limited; IBM; Microsoft; Oracle; Salesforce, Inc.; SAP SE; ServiceNow; Wipro; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Application Development Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global application development software market report based on type, organization size, deployment, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low-code Development Platforms

-

No-code Development Platforms

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Media & Entertainment

-

IT & Telecom

-

Healthcare

-

Travel & Tourism

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.