- Home

- »

- IT Services & Applications

- »

-

Architectural, Engineering, And Construction Services Market Report, 2030GVR Report cover

![Architectural, Engineering, And Construction Services Market Size, Share & Trends Report]()

Architectural, Engineering, And Construction Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service, By Sector (Real Estate, Data Centers), By Transportation Infrastructure (Highways, Aviation), By Real Estate, And Segment Forecasts

- Report ID: GVR-4-68040-476-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AEC Services Market Summary

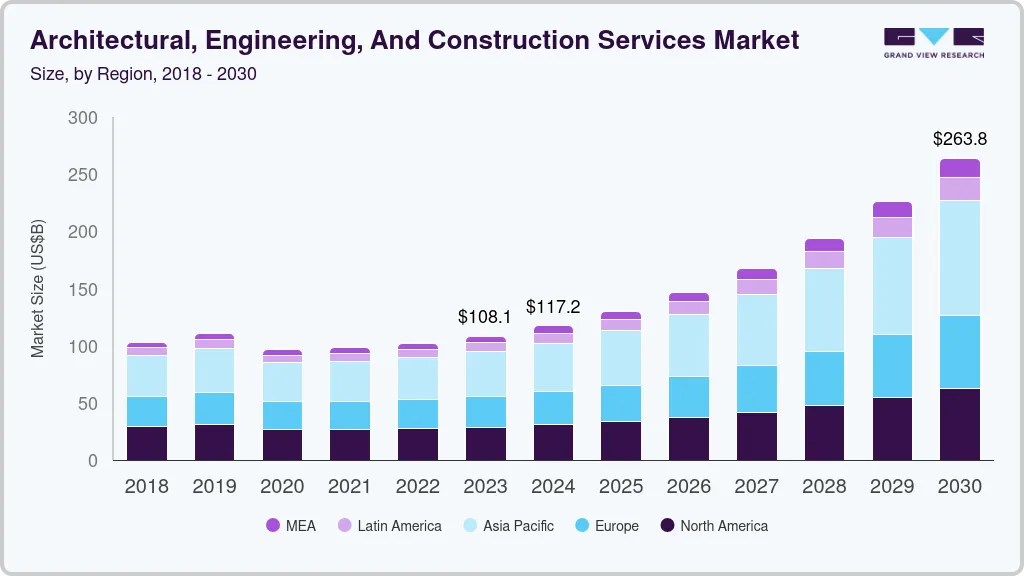

The global architectural, engineering, and construction services market size was estimated at USD 108.15 billion in 2023 and is projected to reach USD 263.77 billion by 2030, growing at a CAGR of 14.5% from 2024 to 2030. The most significant growth driver for the market is the increasing demand for infrastructure development, especially in emerging economies.

Key Market Trends & Insights

- The Architectural, Engineering, and Construction (AEC) services market in North America held a share of over 26.0% in 2023.

- The AEC services market in the U.S. is expected to grow significantly at a CAGR of 12.5% from 2024 to 2030.

- Based on service, the digital services segment accounted for the largest revenue share of over 48.0% in 2023.

- Based on transportation infrastructure, the highways segment accounted for the largest revenue share of over 40.0% in 2023.

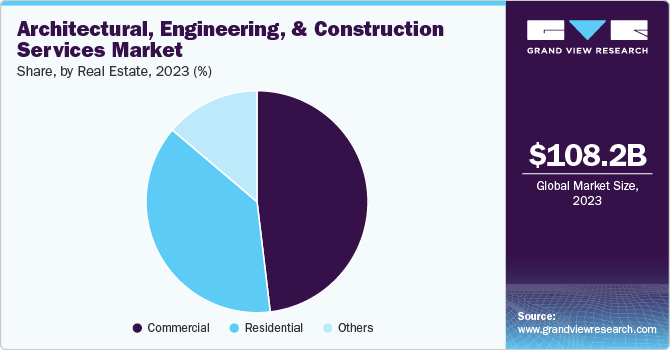

- Based on real estate, the commercial segment accounted for the largest revenue share of over 48.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 108.15 Billion

- 2030 Projected Market Size: USD 263.77 Billion

- CAGR (2024-2030): 14.5%

- North America: Largest market in 2023

Rapid urbanization and the need for modern, sustainable cities have pushed both public and private sectors to invest heavily in infrastructure projects like roads, railways, bridges, and buildings. Urban expansion also drives the demand for residential, commercial, and industrial construction projects, thereby boosting the need for architectural and engineering services.

The adoption of Building Information Modeling (BIM) and other advanced technologies has transformed the architectural, engineering, and construction (AEC) industry, making processes more efficient and reducing project costs. BIM facilitates real-time collaboration between architects, engineers, and construction professionals, improving project outcomes through enhanced design accuracy and efficient resource management. In addition, the use of artificial intelligence (AI), drones, 3D printing, and virtual reality (VR) in construction is accelerating growth by streamlining workflows and boosting productivity.

Government-backed initiatives and policies aimed at revitalizing infrastructure are another key driver for the AEC market. Many governments are launching large-scale construction projects to modernize aging infrastructure, such as roads, airports, and public transportation systems. Public-private partnerships (PPPs) are also becoming more common, with governments offering incentives and funding for construction companies to participate in major development projects.

The globalization of the AEC industry is another growth factor, with companies increasingly outsourcing design, engineering, and construction services to lower-cost regions. Offshoring certain tasks, such as drafting, modeling, and analysis, to countries with lower labor costs has become more common, making the AEC industry more cost-competitive and scalable.

Service Insights

The digital services segment accounted for the largest revenue share of over 48.0% in 2023. Cloud computing is a major factor driving the growth of digital services in the AEC market. Cloud-based platforms enable real-time access to project data, facilitating communication and collaboration among architects, engineers, and contractors across different locations. These tools improve project transparency, ensure version control, and enable quick access to updated designs or documents, which speeds up decision-making and project execution.

The city planning services segment is anticipated to grow at a significant CAGR from 2024 to 2030 due to an increase in urbanization. As populations continue to grow, especially in emerging economies, cities are expanding at a rapid pace. According to the United Nations, by 2050, it’s estimated that over two-thirds of the global population to live in urban areas, requiring comprehensive city planning to manage infrastructure, housing, transportation, and public services. This urban expansion demands innovative approaches to land use, zoning, and resource management, driving the need for advanced city planning services that can accommodate such growth.

Sector Insights

The real estate segment accounted for the largest revenue share of over 20.0% in 2023. Advancements in technology are significantly enhancing the real estate segment. Building Information Modeling (BIM), virtual reality (VR), and artificial intelligence (AI) are being used to improve the design, planning, and management of real estate projects. BIM, in particular, allows for more accurate design and construction processes, reducing the likelihood of costly errors and rework. VR is being used to provide virtual walkthroughs of properties before construction is completed, allowing developers and potential buyers to visualize projects in detail. Additionally, AI and machine learning algorithms can optimize real estate project timelines, predict market trends, and enhance decision-making for developers.

The data centers segment is anticipated to grow at a significant CAGR from 2024 to 2030. One of the most significant drivers of data center development is the exponential growth of cloud computing and digital transformation initiatives across industries. As businesses move their operations and data storage to the cloud, the demand for large-scale data centers continues to grow. Companies such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are leading this expansion, building massive data centers to support their cloud services. AEC firms play a critical role in designing and constructing these facilities, ensuring they meet the specific technical and operational requirements of cloud providers.

Transportation Infrastructure Insights

The highways segment accounted for the largest revenue share of over 40.0% in 2023, driven by substantial government investment in highway infrastructure globally. Numerous countries are undertaking large-scale projects to modernize and expand their road systems. As of March 2024, the U.S. Infrastructure Investment and Jobs Act (IIJA) allocated USD 128 billion in highway and bridge formula funds, leading to the initiation of over 70,200 new projects. Similar efforts in Europe, China, and India also contribute to the rising demand for highway construction and maintenance services. These investments present significant opportunities for architecture, engineering, and construction (AEC) firms specializing in highway-related design, construction, and engineering projects.

The aviation segment is anticipated to grow at a significant CAGR from 2024 to 2030. The adoption of advanced technologies in airport operations is transforming the aviation sector. Technologies such as automated baggage handling systems, biometric identification, and smart security screening are being implemented to enhance passenger experience and operational efficiency. Airports are also using data analytics and Internet of Things (IoT) to optimize operations, reduce delays, and improve resource management. AEC firms are increasingly involved in integrating these technologies into airport infrastructure, ensuring that new and upgraded facilities can support modern, tech-driven operations.

Real Estate Insights

The commercial segment accounted for the largest revenue share of over 48.0% in 2023. The shift to e-commerce is reshaping the commercial real estate segment, particularly in the retail sector. While traditional brick-and-mortar stores have faced challenges, the demand for logistics and distribution centers has surged to support the e-commerce supply chain. AEC firms are increasingly involved in the construction of last-mile distribution centers, warehouses, and mixed-use retail spaces that combine physical stores with e-commerce fulfillment. This transformation is changing the way retail spaces are designed, emphasizing efficiency and adaptability.

The residential segment is anticipated to grow at a significant CAGR from 2024 to 2030. Many cities are focusing on urban renewal and redevelopment initiatives to revitalize aging neighborhoods and increase housing stock. These projects often involve renovating existing buildings or repurposing underutilized land, creating new opportunities for residential construction and attracting both private investment and public interest.

Regional Insights

The Architectural, Engineering, and Construction (AEC) services market in North America held a share of over 26.0% in 2023. The AEC industry is increasingly leveraging technology to improve efficiency and collaboration. Tools such as Building Information Modeling (BIM), project management software, and virtual reality (VR) are being adopted to enhance design accuracy and streamline workflows. Moreover, the use of drones for site surveys and monitoring is gaining traction, providing valuable data and insights throughout the construction process.

U.S. Architectural, Engineering, And Construction Services Market Trends

The AEC services market in the U.S. is expected to grow significantly at a CAGR of 12.5% from 2024 to 2030 due to public-private partnerships (PPPs). These collaborations between government entities and private companies are becoming more common for large-scale infrastructure projects. PPPs provide an avenue for financing major projects that would otherwise be delayed or canceled due to budget constraints, driving demand for architectural and engineering services.

Europe Architectural, Engineering, And Construction Services Market Trends

The AEC services market in Europe is growing significantly at a CAGR of 14.2% from 2024 to 2030. Regulatory frameworks within Europe are becoming increasingly supportive of innovative construction methods and sustainable practices. Regulations promoting circular economy principles, waste reduction, and energy efficiency are encouraging AEC firms to adopt new materials and construction techniques that align with these goals. Compliance with these regulations drives project development and also incentivizes innovation within the sector.

Asia Pacific Architectural, Engineering, And Construction Services Market Trends

Asia Pacific is growing significantly at a CAGR of 15.2% from 2024 to 2030 due to the rapid urbanization occurring in many countries, particularly in developing economies such as India, Indonesia, and Vietnam. As populations migrate to urban centers in search of better opportunities, the demand for residential, commercial, and infrastructure projects is escalating. This urbanization trend is leading governments and private developers to invest heavily in new housing, transportation networks, and public utilities, creating a substantial need for AEC services.

Key Architectural, Engineering, And Construction Services Company Insights

Key players operating in the market include AECOM, HDR, Inc. Gensler, Stantec, and Trimble. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Architectural, Engineering, And Construction Services Companies:

The following are the leading companies in the architectural, engineering, and construction services market. These companies collectively hold the largest market share and dictate industry trends.

- AECOM

- Autodesk

- AVEVA Group Plc

- Gensler

- HDR, Inc.

- HEXAGON

- Oracle

- Schneider Electric SE

- Stantec

- Trimble

Recent Developments

-

In September 2024, Stantec agreed to acquire Morrison Hershfield, an engineering and management firm based in Markham, Ontario. This acquisition enhances Stantec's footprint in key Canadian markets and bolsters its presence in the U.S. building engineering sector.

-

In August 2024, AECOM established a multi-year partnership with One Click LCA, a Finland-based sustainability platform for the built environment. This collaboration strengthens AECOM’s ScopeX approach, which aims for a 50% carbon reduction by leveraging One Click LCA’s comprehensive carbon assessment and sustainability tools for buildings and infrastructure projects worldwide. The agreement provides AECOM access to One Click LCA’s verified platform, facilitating thorough carbon data collection and integration into the ScopeX portal.

Architectural, Engineering, And Construction Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 117.21 billion

Revenue forecast in 2030

USD 263.77 billion

Growth rate

CAGR of 14.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, sector, transportation, infrastructure, real estate, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

AECOM; Autodesk; AVEVA Group Plc; Gensler; HDR, Inc.; HEXAGON; Oracle; Schneider Electric SE; Stantec, Trimble

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Architectural, Engineering, And Construction Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global architectural, engineering and construction services market report based on service, sector, transportation infrastructure, real estate, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Digital Services

-

Sustainability Services

-

Technical Engineering

-

City Planning Services

-

Built Environmental Advisory

-

-

Sector Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy

-

Water & Environment

-

Resources

-

Transportation Infrastructure

-

Real Estate

-

Data Centers

-

Science & Technology

-

Healthcare

-

Others

-

-

Transportation Infrastructure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Highways

-

Rail

-

Aviation

-

Maritime

-

-

Real Estate Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global architectural, engineering, and construction services market size was estimated at USD 108.15 billion in 2023 and is expected to reach USD 117.21 billion in 2024.

b. The global architectural, engineering, and construction services market is expected to grow at a compound annual growth rate of 14.5% from 2024 to 2030 to reach USD 263.77 billion by 2030.

b. The digital services segment accounted for the largest market share of over 48.0% in 2023. Cloud computing is a major factor driving the growth of digital services in the AEC market. Cloud-based platforms enable real-time access to project data, facilitating communication and collaboration among architects, engineers, and contractors across different locations.

b. Some key players operating in the AEC services market include AECOM, Autodesk, AVEVA Group Plc, Gensler, HDR, Inc., HEXAGON, Oracle, Schneider Electric SE, Stantec, and Trimble.

b. The most significant growth driver for the AEC market is the increasing demand for infrastructure development, especially in emerging economies. Rapid urbanization and the need for modern, sustainable cities have pushed both public and private sectors to invest heavily in infrastructure projects like roads, railways, bridges, and buildings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.