- Home

- »

- Next Generation Technologies

- »

-

AI In Aerospace And Defense Market Size, Share Report 2030GVR Report cover

![AI In Aerospace And Defense Market Size, Share & Trends Report]()

AI In Aerospace And Defense Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Deployment Type, By Platform, By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-430-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Aerospace And Defense Market Summary

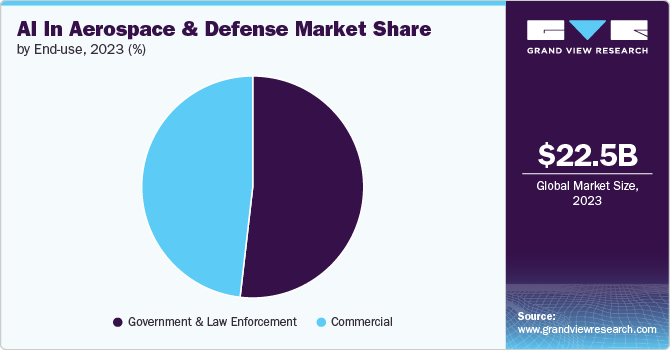

The global AI in aerospace and defense market size was valued at USD 22.45 billion in 2023 and is projected to reach USD 43.02 billion by 2030, growing at a CAGR of 9.8% from 2024 to 2030. AI-driven systems analyze data from various sources to optimize maintenance schedules, manage supply chains, and improve logistics.

Key Market Trends & Insights

- North America AI in aerospace & defense market accounted for the highest revenue share of 40% in 2023.

- The AI in aerospace & defense market in the U.S. is expected to have a notable CAGR from 2024 to 2030.

- By end-use, the government & law enforcement segment accounted for the largest market revenue share of 51.0% in 2023.

- Based on offering, the software segment is expected to register the fastest CAGR from 2024 to 2030.

- By deployment type, the on-premises segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 22.45 Billion

- 2030 Projected Market Size: USD 43.02 Billion

- CAGR (2024-2030): 9.8%

- North America: Largest market in 2023

Predictive maintenance powered by AI reduces unexpected equipment failures and downtime by forecasting when components need service before they break down. Additionally, AI enhances decision-making processes by providing actionable insights through data analytics, leading to streamlined operations, reduced costs, and improved resource allocation.AI advancements in surveillance and threat detection revolutionize aerospace and defense operations by processing and analyzing vast amounts of data from sensors, satellites, and other sources in real time. AI systems use machine learning algorithms to detect and identify potential threats with high accuracy, reducing false alarms and improving overall situational awareness. These systems can integrate data from diverse sources to provide comprehensive and timely intelligence, enabling more effective monitoring of borders, airspace, and strategic locations. Enhanced threat detection capabilities lead to quicker and more precise responses, improving national security and defense readiness while ensuring better protection of assets and personnel.

In aerospace and defense, AI-driven design tools and simulations are transforming the development and manufacturing processes. AI algorithms enhance the design phase by providing more accurate simulations and predictions, leading to innovative solutions and reduced design errors. AI-powered generative design tools can explore a broader range of design possibilities, optimizing for performance, weight, and cost. Additionally, Artificial Intelligence (AI) helps in creating detailed digital twins of systems, allowing for extensive virtual testing and validation before physical prototypes are built. This approach accelerates the innovation cycle, improves product reliability, and lowers production costs, contributing to more efficient and cost-effective development processes.

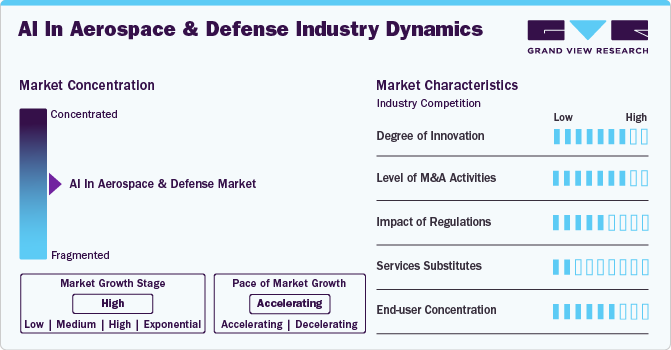

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by advancements in machine learning, data analytics, and autonomous systems. Cutting-edge technologies are being developed to enhance operational efficiency, improve threat detection, and streamline design and manufacturing processes. Innovative AI applications include predictive maintenance, advanced surveillance systems, and sophisticated training simulations. These technologies are continually evolving, enabling more precise, responsive, and efficient solutions in aerospace and defense, thereby pushing the boundaries of what is possible in these critical sectors.

The market is seeing an increasing number of merger and acquisition (M&A) activities as companies seek to bolster their technological capabilities and market presence. Strategic M&A deals are being pursued to acquire cutting-edge AI technologies, enhance data analytics capabilities, and integrate advanced solutions into existing systems. This trend allows companies to rapidly scale their artificial intelligence capabilities, foster innovation, and gain competitive advantages. As firms consolidate resources and expertise, the market is becoming more dynamic and competitive, driving accelerated growth and technological advancements.

The market is also subject to moderate regulatory scrutiny, which influences its operations and strategic decisions. Regulations focus on ensuring compliance with security standards, data privacy, and ethical use of AI technologies. Companies must navigate these regulations while integrating AI solutions into their systems, balancing innovation with legal and ethical considerations. This scrutiny affects decision-making processes, including development, deployment, and collaboration strategies. Adherence to regulatory requirements is crucial for maintaining operational integrity, fostering trust, and mitigating risks associated with the use of AI in sensitive aerospace and defense applications.

The market faces minimal competition from product substitutes in the market due to its unique capabilities and advantages. AI technologies offer unparalleled benefits, such as advanced predictive maintenance, real-time threat detection, and sophisticated simulation training, which are difficult to match with traditional methods or alternative technologies. The integration of AI enhances operational efficiency, accuracy, and responsiveness in ways that substitutes cannot easily replicate. Consequently, the market remains largely focused on AI-driven solutions, as they provide distinct and critical advantages essential for modern aerospace and defense operations.

End-use concentration is a moderate factor in the market. While a few major defense contractors and aerospace companies are dominant buyers of AI solutions, the market includes a diverse range of smaller firms and government agencies with varying needs. This moderate concentration impacts market dynamics by influencing pricing, innovation, and customer relationships. Companies in the sector must navigate this landscape by catering to both large-scale and niche customers, ensuring that their AI solutions meet the specific requirements of a broad and varied client base.

Offering Insights

The hardware segment accounted for the largest market share in 2023. The market is driven by the increasing demand for advanced computing and processing power necessary for AI applications. Enhanced hardware capabilities are crucial for running complex algorithms, managing large datasets, and performing real-time data analysis. As AI technologies evolve, they require more powerful processors, specialized GPUs, and high-performance computing systems. This demand is further fueled by advancements in sensor technologies, which are integral for data collection and integration into AI systems. Additionally, the push for more robust and reliable hardware to withstand harsh aerospace and defense environments contributes to the growth of this segment.

The software segment is expected to register the fastest CAGR from 2024 to 2030. The market is growing due to the increasing deployment of AI-driven applications for mission-critical tasks. Software advancements include sophisticated algorithms for data analytics, machine learning, and predictive maintenance, which enhance operational efficiency and decision-making. Innovations in software also facilitate the development of customized solutions tailored to specific defense and aerospace needs, such as advanced simulation tools and automated systems. The need for scalable, flexible software that can integrate with existing systems while addressing evolving challenges drives continued investment and growth in this segment.

Deployment Type Insights

The on-premises segment accounted for the largest market revenue share in 2023. The market is growing due to the need for secure and controlled environments where sensitive data and applications can be managed with high confidentiality. On-premises solutions offer robust security measures and compliance with strict regulations, making them ideal for handling classified and mission-critical information. Additionally, the preference for on-premises systems arises from the desire for greater control over hardware, software, and data management. The ability to customize and integrate these systems within existing infrastructure further supports the growth of on-premises AI solutions in the aerospace and defense sectors.

The cloud-based segment is expected to register the fastest CAGR from 2024 to 2030. The market is growing rapidly as organizations seek scalable and flexible solutions to manage and analyze vast amounts of data. Cloud-based AI platforms offer significant advantages, including cost-effectiveness, ease of deployment, and the ability to rapidly scale resources based on demand. These platforms facilitate collaboration and data sharing among distributed teams, enhance computational power, and support advanced analytics and machine learning. The increasing adoption of cloud services also enables real-time data processing and access to cutting-edge AI technologies without the need for substantial on-premises infrastructure investments.

Platform Insights

The airborne segment accounted for the largest market revenue share in 2023. The market is driven by the growing use of AI technologies in aviation and military aircraft to enhance operational capabilities and safety. AI-powered systems improve navigation, collision avoidance, and autonomous flight management, providing greater efficiency and precision. The integration of advanced sensors and real-time data analysis supports enhanced situational awareness and decision-making for pilots and defense operators. As aerospace and defense organizations seek to modernize their fleets and develop next-generation aircraft, the demand for AI-driven airborne systems continues to rise, fostering growth in this segment.

The space segment is expected to register the fastest CAGR from 2024 to 2030. The market benefits from the increasing application of AI in satellite operations, space exploration, and space-based monitoring systems. AI technologies enable more efficient data processing, real-time image analysis, and autonomous spacecraft operations. The ability to handle vast amounts of space-derived data, enhance mission planning, and improve satellite communication is driving growth in this segment. As space missions become more complex and ambitious, the demand for advanced AI solutions to support satellite management, space exploration, and in-orbit operations continues to expand, fueling growth in the space sector.

Technology Insights

The machine learning segment accounted for the largest market revenue share in 2023. The market is driven by the ability to analyze complex datasets and make data-driven predictions. Machine learning algorithms improve various applications, including predictive maintenance, threat detection, and automated decision-making. The technology’s ability to adapt and learn from new data allows for continuous improvement in system performance and accuracy. As aerospace and defense organizations seek to leverage machine learning for advanced analytics, pattern recognition, and autonomous systems, the demand for machine learning solutions is increasing, supporting expansion in this segment.

Computer vision is expected to register the fastest CAGR from 2024 to 2030. The market is growing due to its ability to provide advanced image and video analysis capabilities. Computer vision technologies enable real-time processing of visual data from cameras, satellites, and drones, enhancing surveillance, reconnaissance, and target identification. Applications such as facial recognition, object detection, and autonomous vehicle navigation benefit from computer vision’s accuracy and efficiency. As the need for precise visual data analysis and automation in aerospace and defense operations increases, the demand for computer vision solutions continues to rise, driving growth in this segment.

Application Insights

Surveillance and monitoring accounted for the largest market revenue share in 2023. The market is expanding due to the critical need for enhanced security and situational awareness. AI-driven surveillance systems provide advanced capabilities for real-time monitoring, threat detection, and data analysis. These systems leverage AI to analyze video feeds, sensor data, and other inputs to identify potential threats and anomalies with high accuracy. The growing emphasis on national security, border protection, and intelligence gathering drives demand for sophisticated surveillance and monitoring solutions, contributing to the segment’s growth.

Navigation & guidance systems are expected to register the fastest CAGR from 2024 to 2030. The market growth benefits from advancements in AI technologies that improve accuracy and reliability. AI-enhanced navigation systems support precise positioning, route optimization, and autonomous navigation for aircraft, spacecraft, and military vehicles. Guidance systems leverage AI for real-time adjustments, threat avoidance, and mission planning. The integration of AI into these systems enhances performance, reduces errors, and supports complex operational scenarios. As aerospace and defense organizations seek to enhance their navigation and guidance capabilities, the demand for AI-driven solutions in this segment continues to grow.

End-use Insights

The government & law enforcement segment accounted for the largest market revenue share of 51.0% in 2023. The market is growing due to the increasing adoption of AI technologies for public safety and security. AI solutions support various applications, including surveillance, crime prediction, and intelligence analysis. The ability to process large volumes of data and provide actionable insights enhances law enforcement agencies' effectiveness in preventing and responding to threats. Additionally, AI-driven tools assist in managing critical infrastructure and emergency response. As governments and law enforcement agencies seek to leverage advanced technologies for improved security, the demand for AI solutions in this segment rises.

The commercial segment is expected to grow at a CAGR of 10.0% from 2024 to 2030. The market is driven by the increasing use of AI technologies in commercial aviation and related industries. AI applications enhance operational efficiency, safety, and customer experience in commercial airlines through predictive maintenance, flight optimization, and automated systems. Additionally, AI supports advanced analytics for market forecasting, route planning, and passenger services. The growing focus on improving operational performance and competitive advantage in the commercial aerospace sector fuels the demand for AI-driven solutions, contributing to the expansion of this segment.

Regional Insights

North America AI in aerospace & defense market accounted for the highest market revenue share of nearly 40% in 2023. The market is driven by significant investment in research and development, technological innovation, and the presence of major defense contractors and aerospace companies. The region benefits from a strong technological infrastructure, extensive government funding, and a high demand for advanced AI solutions to enhance national security and operational efficiency. Additionally, collaboration between private and public sectors accelerates the development and adoption of cutting-edge AI technologies. The focus on modernization and the integration of AI in military and aerospace systems further fuels growth in this region.

U.S. AI In Aerospace And Defense Market Trends

The AI in aerospace & defense market in the U.S. is expected to have a notable CAGR from 2024 to 2030. The market is growing due to its substantial defense budget, technological leadership, and extensive research initiatives. The U.S. government and military invest heavily in AI technologies to enhance operational capabilities, security, and efficiency. The presence of major technology firms, defense contractors, and innovative startups contributes to rapid advancements in AI applications. Additionally, strategic partnerships, public-private collaborations, and a focus on maintaining technological superiority drive the widespread adoption and development of AI solutions in various aerospace and defense sectors.

Asia Pacific AI In Aerospace And Defense Market Trends

The AI in aerospace and defense market in Asia Pacific accounted for a significant revenue share in 2023. The market is driven by increasing defense expenditures, rapid technological advancements, and growing regional security concerns. Countries in APAC are investing in modernizing their aerospace and defense capabilities, with a focus on integrating AI technologies for improved operational efficiency, surveillance, and threat detection. The region's expanding defense budgets and strategic initiatives to enhance national security contribute to the rising demand for AI solutions. Additionally, collaborations with global technology providers and local innovation hubs are further propelling growth in this market segment.

Japan AI in aerospace and defense market is estimated to grow significantly from 2024 to 2030. The market is fueled by its strong technological base, significant government investment in defense innovation, and a focus on enhancing national security. The country is actively integrating AI into its aerospace and defense systems to improve operational efficiency, precision, and safety. Japan's emphasis on advanced research, particularly in robotics and autonomous systems, drives the development of cutting-edge AI applications. Furthermore, strategic partnerships with international defense and technology firms contribute to the advancement and adoption of AI technologies in Japan's defense sector.

The AI in aerospace and defense market in India is estimated to record a notable CAGR from 2024 to 2030. The market is driven by its expanding defense budget, strategic focus on modernization, and increasing emphasis on technological innovation. The Indian government is investing in AI technologies to enhance defense capabilities, improve surveillance, and streamline operations. Initiatives like "Make in India" and public-private partnerships support the development and deployment of AI solutions in aerospace and defense. Additionally, India's growing technology sector and emphasis on research and development contribute to the advancement and integration of AI technologies in the country's defense and aerospace systems.

China AI in aerospace and defense market had the largest revenue share in 2023. The market is driven by its substantial investment in defense modernization, technological advancements, and strategic focus on enhancing national security. The Chinese government prioritizes the integration of AI technologies into its aerospace and defense systems to improve operational efficiency, surveillance, and threat detection. China's growing defense budget and ambitious research initiatives support the development and deployment of advanced AI solutions. Additionally, partnerships with global technology providers and investments in domestic innovation contribute to the expansion of AI applications in China's defense sector.

Europe AI In Aerospace And Defense Market Trends

The AI in aerospace & defense market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030. The market is fueled by its commitment to technological innovation, strategic defense initiatives, and collaborative research efforts. The European Union and individual countries are investing in AI technologies to enhance aerospace and defense capabilities, improve operational efficiency, and strengthen security measures. Europe's focus on cross-border collaboration, joint defense projects, and public-private partnerships accelerates the development and adoption of AI solutions. Additionally, the region's emphasis on maintaining technological competitiveness and addressing emerging threats drives the growth of AI in the aerospace and defense sectors.

France AI in aerospace and defense market accounted for a significant revenue share in 2023. The market is driven by its robust defense industry, significant government investments in technology, and focus on innovation. The French government prioritizes the integration of AI technologies to enhance national security, improve operational efficiency, and support advanced defense capabilities. France's defense contractors and aerospace firms are actively developing and deploying AI solutions for various applications, including surveillance, navigation, and autonomous systems. Strategic collaborations and research initiatives further support the advancement and adoption of AI technologies in France's aerospace and defense sectors.

The AI in aerospace and defense market in the UK is estimated to grow at the highest CAGR from 2024 to 2030. The market is propelled by its strong defense sector, technological innovation, and government investment in advanced technologies. The UK government supports the integration of AI to enhance defense capabilities, improve operational efficiency, and address emerging security challenges. The presence of leading defense contractors, research institutions, and technology firms contributes to the development and deployment of AI solutions. Additionally, strategic partnerships with international allies and ongoing research initiatives drive the adoption and advancement of AI technologies in the UK's aerospace and defense sectors.

Germany AI in aerospace and defense market is estimated to grow at a moderate CAGR from 2024 to 2030. The market is driven by its focus on technological innovation, strong defense industry, and government support for advanced research. The German government invests in AI technologies to enhance defense capabilities, improve operational efficiency, and support the modernization of aerospace systems. Germany's emphasis on research and development, coupled with partnerships between industry and academia, accelerates the deployment of AI solutions.

Middle East & Africa AI In Aerospace And Defense Market Trends

The AI in aerospace and defense market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030. The rapid growth is due to increasing defense expenditures, strategic focus on modernization, and growing security concerns. Countries in the region are investing in AI technologies to enhance surveillance, improve operational efficiency, and strengthen national security. The expanding defense budgets and collaboration with global technology providers drive the adoption of advanced AI solutions. Additionally, ongoing regional conflicts and security challenges contribute to the rising demand for AI-driven aerospace and defense technologies in the Middle East and Africa.

Saudi Arabia AI in aerospace and defense market accounted for a considerable revenue share in 2023. The market is driven by its substantial defense investments, strategic focus on modernization, and Vision 2030 initiatives. The Saudi government is investing in AI technologies to enhance national security, improve defense capabilities, and support advanced aerospace systems. The country’s emphasis on technological innovation and partnerships with international defense and technology firms contributes to the development and deployment of AI solutions. Additionally, Saudi Arabia's efforts to diversify its economy and strengthen its defense sector drive the adoption of AI technologies in its aerospace and defense industries.

Key AI In Aerospace And Defense Company Insights

Some of the key players operating in the market include Deutsche Telekom AG, General Electric Co., and Honeywell International Inc.

-

Deutsche Telekom AG focuses on leveraging its robust telecommunications infrastructure to drive AI innovation in aerospace and defense. The company invests in developing advanced network solutions, enhancing cybersecurity, and integrating AI-driven IoT applications. Strategic partnerships and collaborations with defense contractors and aerospace firms support its growth, while continuous advancements in 5G technology enable more reliable and efficient AI solutions for critical defense and aerospace operations.

-

General Electric Co. focuses on digital transformation and predictive maintenance. GE invests in AI technologies to enhance its aviation and defense systems, improve operational efficiency, and reduce downtime. The company leverages its strong industrial expertise and research capabilities to develop advanced AI solutions for real-time data analytics and automation, supporting its position as a leader in smart infrastructure and aerospace technology.

Indra Sistemas SA, Iris Automation Inc., SparkCognition Inc. are some of the emerging market participants in the AI in Aerospace & Defense market.

-

Indra Sistemas SA emphasizes growth in AI for aerospace and defense through innovation in IT and defense solutions. The company invests in developing AI-powered systems for surveillance, navigation, and command-and-control applications. Strategic collaborations with global defense and aerospace firms enhance its market presence, while a focus on digital transformation and smart technology integration positions Indra as a key player in providing cutting-edge AI solutions tailored to defense and aerospace needs.

-

Iris Automation Inc. drives growth by specializing in AI-driven collision avoidance systems for unmanned aerial vehicles (UAVs). The company focuses on advancing its AI technologies to improve autonomous flight safety and navigation. By forming strategic partnerships with aerospace and defense organizations, Iris Automation expands its market reach and integrates its solutions into various UAV applications. Continuous innovation in computer vision and machine learning supports its growth and adoption in the aerospace and defense sectors.

Key AI In Aerospace And Defense Companies:

The following are the leading companies in the AI in aerospace and defense market. These companies collectively hold the largest market share and dictate industry trends.

- Deutsche Telekom AG

- General Electric Co.

- Honeywell International Inc.

- Indra Sistemas SA

- Infosys Ltd.

- Intel Corporation

- International Business Machines Corporation

- Iris Automation Inc.

- Lockheed Martin Corporation

- Microsoft Corporation

- Northrop Grumman Corporation

- NVIDIA Corporation

- Raytheon Technologies Corporation

- SparkCognition Inc.

- Thales Group

Recent Developments

-

In June 2024, Safran acquired Preligens, a leader in artificial intelligence (AI) for aerospace and defense. This potential acquisition represented a unique opportunity for Safran to add state-of-the-art AI capabilities to its product offering and to accelerate its digital transformation roadmap, particularly for Manufacturing 4.0. Through its global presence, Safran was also poised to reinforce the development of Preligens internationally, especially in the U.S. market.

-

In August 2024, QuickLogic Corporation announced a strategic partnership with CTG, a division of Blue Raven Solutions, appointing CTG as the sole distributor for its eFPGA Hard IP in the Aerospace & Defense sector. This partnership aimed to leverage CTG’s experience to connect QuickLogic's eFPGA IP solutions with key industry players.

AI In Aerospace And Defense Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.52 billion

Revenue Forecast in 2030

USD 43.02 billion

Growth Rate

CAGR of 9.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment type, platform, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Deutsche Telekom AG, General Electric Co., Honeywell International Inc., Indra Sistemas SA, Infosys Ltd., Intel Corporation, International Business Machines Corporation, Iris Automation Inc., Lockheed Martin Corporation, Microsoft Corporation, Northrop Grumman Corporation, NVIDIA Corporation, Raytheon Technologies Corporation, SparkCognition Inc., Thales Group, and among others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Aerospace And Defense Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI in aerospace & defense market report based on offering, deployment type, platform, technology, application, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Processors

-

Memory Devices

-

Network Devices

-

-

Software

-

AI Solutions

-

AI Platforms

-

-

Services

-

Deployment & Integration

-

Support & Maintenance

-

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Land

-

Naval

-

Airborne

-

Space

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Computer Vision

-

Context-Aware Computing

-

Robotics

-

Big Data Analytics

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Predictive Maintenance

-

Surveillance & Monitoring

-

Mission Systems

-

Cybersecurity

-

Data Analytics

-

Autonomous Systems

-

Navigation & Guidance Systems

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Government & Law Enforcement

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in aerospace and defense market size was estimated at USD 22.45 billion in 2023 and is expected to reach USD 24.52 billion in 2024.

b. The global AI in aerospace and defense market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 43.02 billion by 2030.

b. The North America region dominated the industry with a revenue share of 41.5% in 2023. The market is driven by significant investment in research and development, technological innovation, and the presence of major defense contractors and aerospace companies.

b. Some key players operating in AI in aerospace & defense market include Deutsche Telekom AG, General Electric Co., Honeywell International Inc., Indra Sistemas SA, Infosys Ltd., Intel Corporation, International Business Machines Corporation, Iris Automation Inc., Lockheed Martin Corporation, Microsoft Corporation, Northrop Grumman Corporation, NVIDIA Corporation, Raytheon Technologies Corporation, SparkCognition Inc., and Thales Group

b. Key factors that are driving AI in aerospace & defense market growth include increased demand for AI-driven systems to analyze data from various sources to optimize maintenance schedules, manage supply chains, and improve logistics coupled with increased government investments and defense budgets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.