- Home

- »

- Healthcare IT

- »

-

AI In Healthcare Market Size, Share & Growth Report, 2030GVR Report cover

![AI In Healthcare Market Size, Share & Trends Report]()

AI In Healthcare Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By Application, By End-use, By Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-951-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

AI In Healthcare Market Size & Trends

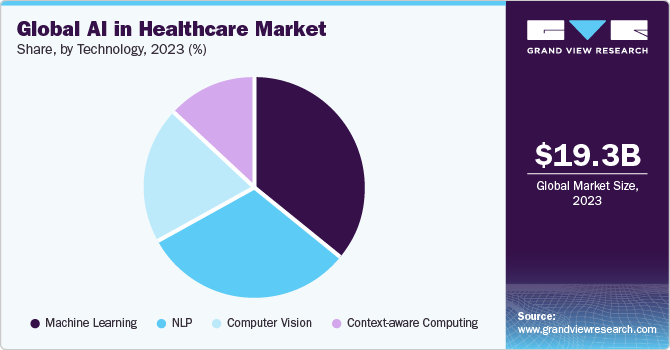

The global AI in healthcare market size was estimated at USD 19.27 billion in 2023 and is expected to grow at a CAGR of 38.5% from 2024 to 2030. One primary factor driving market growth is the increasing demand in the healthcare sector for enhanced efficiency, accuracy, and better patient outcomes. According to a March 2024 Microsoft-IDC study, 79% of healthcare organizations are presently utilizing AI technology. In addition, the return on investment (ROI) is realized within 14 months, generating USD 3.20 for every USD 1 invested in artificial intelligence (AI). AI technologies hold transformative potential in various areas including medical imaging analysis, predictive analytics, personalized treatment planning, and drug discovery, potentially transforming conventional healthcare practices.

The exponential growth in healthcare data, sourced from electronic health records (EHRs), medical imaging scans, wearable devices, and genomic sequencing, presents significant opportunities for AI-powered solutions to extract actionable insights and support clinical decision-making. The shortage of healthcare workers is also driving the adoption of AI and machine learning (ML) technologies. According to the World Economic Forum estimates from May 2023, there will be a global health worker deficit of 10 million by 2030. Hence, AI algorithms can be trained to analyze patient health data, aiding care providers in rapid diagnosis and treatment planning. Supportive government initiatives and the COVID-19 impact along with a rise in technological collaborations & M&A activities have contributed to the market's growth and accelerated the adoption of AI in healthcare.

AI and ML algorithms are increasingly being used for rapid and accurate diagnosis, including the detection of COVID-19-positive cases using personalized patient data. For instance, a 2020 NCBI study found that AI-based algorithms accurately detected 68% of COVID-19-positive cases in a dataset of 25 patients initially diagnosed as negative by healthcare professionals. The implementation of AI and ML technologies aims to enhance patient care, reduce machine downtime, and lower care expenses, driving market growth. The pandemic has further accelerated the adoption of AI-based technologies, particularly in diagnostics, patient and medication management, claims processing, workflow optimization, machine integration, and cybersecurity within healthcare settings.Survey/Case Study Insights

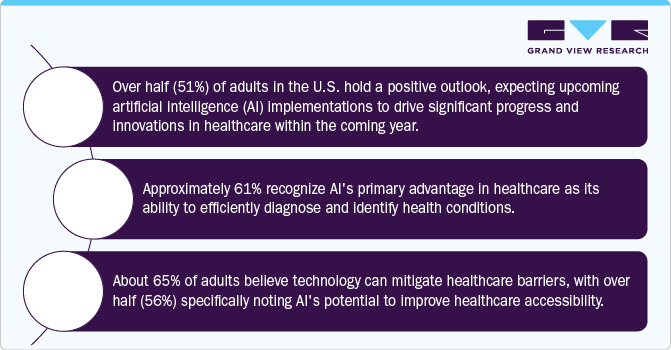

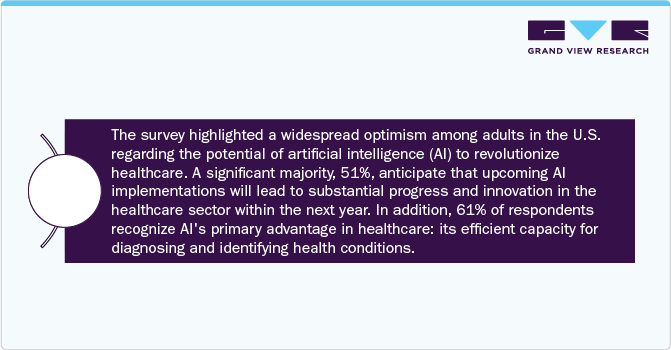

- Medtronic Survey, November 2023: AI's Potential for Earlier Diagnosis and Improved Access to Care

Survey Insights:

Analyst Insights:

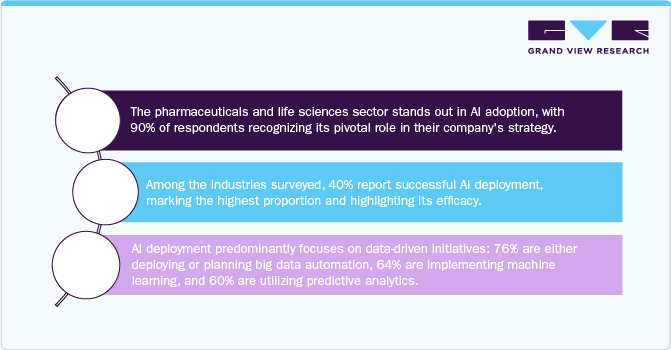

- Infosys 2018 Survey: Amplifying Human Potential Through Purposeful Artificial Intelligence

Survey Insights:

Analyst Insights:

Market Concentration & Characteristics

The Healthcare AI market exhibits a high degree of innovation, characterized by ongoing advancements in technology. Rapid developments in ML, deep learning, NLP, and computer vision are driving the evolution of AI-powered healthcare solutions. For instance, in June 2023, Saama introduced two innovative ML and AI-based solutions for clinical trials

Mergers & acquisitions (M&As) play a significant role in shaping the healthcare AI market landscape. Companies engage in M&A activities to expand their AI software and services, increase their market reach, or acquire specialized technology and expertise. For example, in January 2023, GE Healthcare acquired MIM Software Inc., a provider of AI-based imaging analysis software for radiology

Regulations, such as the Health Insurance Portability & Accountability Act (HIPAA), in the United States and General Data Protection Regulation (GDPR) in Europe establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access

The threat of substitute products in the market is anticipated to be low. While alternative technologies or approaches may serve as substitutes in specific AI applications within healthcare, their capabilities often differ from AI-driven solutions. For example, in drug discovery, traditional R&D methods may be utilized instead of AI-driven algorithms for identifying potential drug candidates. Similarly, wearable devices and IoT sensors offer alternative means of gathering patient data for monitoring and diagnosis, but they typically lack the advanced analytical capabilities inherent in AI systems

End-users are becoming increasingly aware of the potential benefits of AI in improving patient care, operational efficiency, and healthcare outcomes. Education initiatives and industry events helped raise awareness about the capabilities and applications of AI in healthcare

Component Insights

The software solution component segment is anticipated to grow at the fastest CAGR of 38.7% over the forecast period. The segment growth is attributed to the rapidly growing adoption of AI-based software solutions among healthcare providers, payers, and patients. For instance, in September 2019, GE Healthcare partnered with five Chinese local software developers namely, 12Sigma Technologies, Biomind, Shukun Technology, Yizhun Medical AI, and YITU Technology to collaboratively work on developing the Edison AI platform and support the smooth digital transformation of GE Healthcare.

The services component segment is anticipated to witness significant growth from 2024 to 2030. The growth of this segment can be attributable to the rising penetration of AI-based technologies in several healthcare applications, such as clinical trials, virtual assistants, robot-assisted surgeries, dosage error reduction, and fraud detection.

Technology Insights

The M) technology segment held the largest share in 2023. The healthcare industry generates vast amounts of data, including EHRs, medical imaging, genomic data, and wearable device data. Machine learning excels at extracting valuable insights from these large and diverse datasets, enabling healthcare providers to make data-driven decisions and improve patient outcomes. This technology is extensively integrated into healthcare solutions for disease diagnosis, prognosis, and treatment planning. Leveraging patient data patterns and correlations, ML models can detect early disease indicators, forecast patient outcomes, and propose personalized treatment strategies, thereby enhancing the accuracy and timeliness of interventions.

The natural language processing (NLP) technology segment is expected to grow at a significant CAGR from 2024 to 2030. Natural language processing facilitates the automation and optimization of clinical documentation processes, such as medical transcription, coding, and charting. By automatically extracting and coding relevant information from clinical narratives, NLP accelerates documentation workflows, reduces administrative burden, and ensures accuracy in billing and reimbursement.

Application Insights

The robot-assisted surgery application segment dominated the market in 2023 with the largest revenue share and is anticipated to witness significant CAGR growth from 2024 to 2030. A rise in the volume of robot-assisted surgeries and increased funding and investment in AI platform development are key drivers propelling AI penetration in this field. For instance, according to a May 2023 Nasdaq, Inc. article, Intuitive Surgical, a leading surgical robotics provider, reported robust Q1 2023 results, with revenue up by 14% YoY to USD 1.7B, driven by a 26% growth in robotics procedures, surpassing expectations by 12 points.

Moreover, the placement of 312 systems exceeded expectations. In addition, the establishment of the Clinical Robotic Surgery Association in India in August 2019 underscores the growing demand for robotic surgeries and the need for trained professionals in this domain. The anticipated rise in AI adoption is attributed to the shortage of skilled surgeons.

End-use Insights

The healthcare companies segment dominated the market with the largest revenue share in 2023. The widespread adoption of AI technologies in drug development, leveraging genomic information, medical records, and clinical trial data, enables the identification of personalized treatment options and the targeting of therapies to specific patient groups. AI-driven analytics and predictive modeling improve the design, execution, and analysis of clinical trials, resulting in more efficient and cost-effective trials. As per a study by Scilife N.V. in January 2024, approximately 80% of professionals in the pharmaceutical and life sciences sectors utilize AI in drug discovery. Furthermore, research from another study suggests that AI technology reduces the time required by pharmaceutical companies to discover new drugs from 5-6 years to just one year.

The healthcare providers (hospitals, outpatient facilities, and others) segment is expected to grow significantly over the forecast period. AI-powered medical imaging analysis tools aid healthcare providers in interpreting medical images like X-rays, MRIs, and CT scans. These tools improve diagnostic accuracy, shorten interpretation time, and facilitate early disease detection, resulting in prompt interventions and enhanced patient care. In addition, hospitals are leveraging AI-driven predictive analytics to anticipate patient admission rates, pinpoint at-risk populations, and allocate resources effectively. These factors are driving the segment growth.

Regional Insights

North America AI in healthcare market accounted for the largest revenue share of over 45% in 2023. This can be attributed to advancements in healthcare IT infrastructure, growing care expenditures, widespread adoption of AI/ML technologies, favorable government initiatives, lucrative funding options, and the presence of several key players. Factors, such as growing geriatric population, changing lifestyles, increasing prevalence of chronic disorders, growing demand for value-based care, and rising awareness levels about the implementation of AI-based technologies are further propelling market growth in North America.

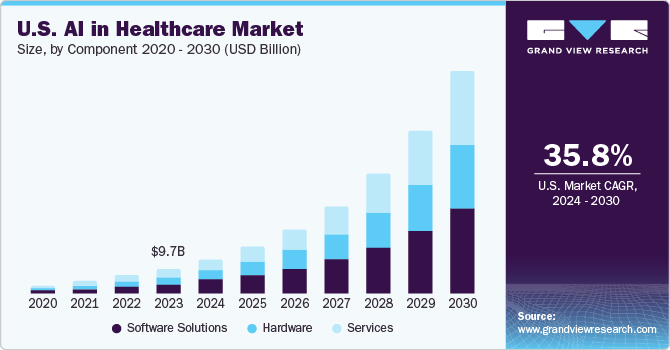

U.S. AI In Healthcare Market Trends

AI in healthcare market in the U.S. held the largest market share in 2023 due to increased demand for efficient and personalized healthcare solutions, coupled with advancements in AI research and development-especially in ML and NLP-alongside regulatory initiatives and supportive policies.

Europe AI In Healthcare Market Trends

Europe AI in healthcare market is anticipated to witness significant growth. This can be attributed to the widespread adoption of AI technologies and increasing investments in AI by both government and private organizations. For example, in 2021, the Department of Health and Social Care in Europe allocated USD 49.3 (£36 million) across thirty-eight AI initiatives aimed at enhancing patient care and expediting diagnosis.

AI in healthcare market in the UK held the largest share in 2023. AI applications are becoming increasingly prevalent in healthcare, particularly in areas, such as medical imaging analysis, predictive analytics, and personalized treatment planning. The UK's National Health Service (NHS) is actively exploring AI technologies to enhance patient care, optimize operations, and tackle various healthcare challenges.

Asia Pacific AI In Healthcare Market Trends

Asia Pacific AI in healthcare market is projected to experience significant growth in the coming years. This growth is fueled by rapid innovations and advancements in IT infrastructure, as well as the emergence of entrepreneurship ventures specializing in AI-based technologies. Increasing investments from private investors, venture capitalists, and non-profit organizations aimed at enhancing clinical outcomes, improving data analysis and security, and reducing costs are driving adoption rates in the region. In addition, favorable government initiatives that support and promote the adoption of AI-based technologies by healthcare organizations and providers are anticipated to boost market growth.

AI In Healthcare market in China held the largest share in 2023 due to the increased adoption of AI technologies for diagnosis, medical imagining, and robot-assisted surgeries in the country. For example, in 2019, Partners Healthcare collaborated with FUJIFILM Sonosite to develop AI-based ultrasound technology. This collaboration was aimed at enhancing accessibility to healthcare technology and improving the quality of diagnostic care provided to patients.

Latin America AI In Healthcare Market Trends

Latin America AI In Healthcare market is anticipated to grow significantly in the coming years. This can be attributed to the growing awareness about AI technologies, increasing government spending, and collaboration activities.

Middle East & Africa AI In Healthcare Market Trends

AI in healthcare market in Middle East & Africa is anticipated to grow significantly during the forecast period. The rising prevalence of chronic diseases in the region and growing need for efficient & accurate diagnosis and treatment methods are prompting healthcare providers to integrate AI into their systems.

Key AI In Healthcare Company Insights

Market players are utilizing innovative product development strategies, partnerships, and mergers and acquisitions to expand their presence in response to the increasing demand for early and accurate disease detection, cost containment, addressing the shortage of healthcare providers, and providing value-based care.

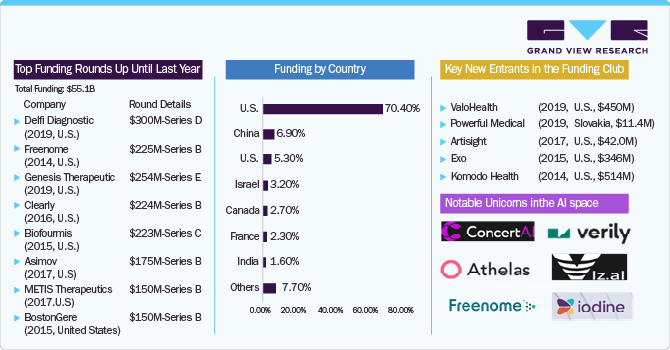

AI Startup Ecosystem:

The AI healthcare industry is teeming with startups driven by the funding, investment and innovations. These startups leverage AI and machine learning to address various healthcare challenges, from medical imaging and diagnostics to drug discovery and telemedicine.

Some of the key insights on the AI start up ecosystem:

Key AI In Healthcare Companies:

The following are the leading companies in the AI in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- IBM

- NVIDIA Corporation

- Intel Corporation

- Itrex Group

- GE Healthcare

- Medtronic

- Oracle

- Medidata

- Merck

- IQVIA

Recent Developments

-

In March 2024, Microsoft collaborated with NVIDIA to enhance AI innovation and accelerate computing capabilities. This collaboration leverages Microsoft Azure's global scale and advanced computing along with NVIDIA’s DGX Cloud and Clara suite to accelerate innovation and improve patient care

“Microsoft is building on its longstanding collaboration with NVIDIA to empower the healthcare and life sciences industry with the power of Azure and generative AI, helping unlock new horizons for clinical research, drug discovery, and patient care worldwide. Through this collaboration, we aim to help the industry unlock breakthroughs in healthcare, making care more precise, accessible, and effective to deliver a meaningful difference in the lives of patients globally.”

- Peter Durlach, corporate vice president, Health & Life Sciences, Microsoft

-

In March 2024, NVIDIA introduced new Generative AI Microservices to transform medical technology (MedTech), drug discovery, and digital health. This innovative approach aims to reshape healthcare technology by harnessing advanced AI capabilities

“For the first time in history, we can represent the world of biology and chemistry in a computer, making computer-aided drug discovery possible. By helping healthcare companies easily build and manage AI solutions, we’re enabling them to harness the full power and potential of generative AI.”

- Kimberly Powell, vice president of healthcare at NVIDIA

-

In September 2023, Merck KGaA entered into a strategic collaboration with Exscientia and BenevolentAI to drive accelerated drug discovery with the integration of high-end AI platforms

AI In Healthcare Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 26.6 billion

The revenue forecast in 2030

USD 187.7 billion

Growth rate

CAGR of 38.5% from 2024 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, technology, end-user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Sweden; Denmark; Norway; Russia; Japan; China; India; South Korea; Australia; Singapore; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Microsoft; IBM; NVIDIA Corp.; Intel Corp.; Itrex Group; GE Healthcare; Google; Medtronic; Oracle; Medidata; Merck; IQVIA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Healthcare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global AI in healthcare market report based on component, application, technology, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Processor

-

MPU (Memory Protection Unit)

-

FPGA (Field-programmable Gate Array)

-

GPU (Graphics Processing Unit)

-

ASIC (Application-specific Integrated Circuit)

-

-

Memory

-

Network

-

Adapter

-

Interconnect

-

Switch

-

-

-

Software Solutions

-

AI platform

-

Application Program Interface (API)

-

Machine Learning Framework

-

-

AI Solutions

-

On-premise

-

Cloud-based

-

-

-

Services

-

Deployment & Integration

-

Support & Maintenance

-

Others (Consulting, Compliance Management, etc.)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Robot-assisted Surgery

-

Virtual Assistants

-

Administrative Workflow Assistants

-

Connected Medical Devices

-

Medical Imaging & Diagnostics

-

Clinical Trials

-

Fraud Detection

-

Cybersecurity

-

Dosage Error Reduction

-

Precision Medicine

-

Drug Discovery & Development

-

Lifestyle Management & Remote Patient Monitoring

-

Wearables

-

Others (Patient Engagement, etc.)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Deep Learning

-

Supervised

-

Unsupervised

-

Others (Reinforcement Learning, Semi-supervised)

-

-

Natural Language Processing

-

Smart Assistance

-

OCR (Optical Character Recognition)

-

Auto Coding

-

Text Analytics

-

Speech Analytics

-

Classification & Categorization

-

-

Context-aware Computing

-

Computer Vision

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers (Hospitals, Outpatient Facilities, and Others)

-

Healthcare Payers

-

Healthcare Companies (Pharmaceutical, Biotechnology, Medical Devices)

-

Patients

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated AI in healthcare market and accounted for the largest revenue share of 57.7% in 2023.

b. Some key players operating in the AI in healthcare market include IBM Corporation; NVIDIA Corporation; Nuance Communications, Inc.; Microsoft; Intel Corporation; and DeepMind Technologies Limited.

b. Key factors that are driving the AI in healthcare market growth include the growing need for lowering healthcare costs, the growing importance of big data in healthcare, the rising adoption of precision medicine, and declining hardware costs.

b. The global artificial intelligence in healthcare market size was estimated at USD 19.27 billion in 2023 and is expected to reach USD 26.6 billion in 2024.

b. The global AI in healthcare market is expected to grow at a compound annual growth rate of 38.5% from 2024 to 2030 to reach USD 187.7 billion by 2030.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. GVR’s internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in North America

1.3.5.2. Data for primary interviews in Europe

1.3.5.3. Data for primary interviews in Asia Pacific

1.3.5.4. Data for primary interviews in Latin America

1.3.5.5. Data for Primary interviews in MEA

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Data Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.6.3. Volume price analysis (Model 2)

1.6.4. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Component outlook

2.2.2. Application outlook

2.2.3. Technology outlook

2.2.4. End-Use outlook

2.2.5. Regional outlook

2.3. Competitive Insights

Chapter 3. Artificial Intelligence (AI) In Healthcare Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.2.3. Market opportunity analysis

3.2.4. Market challenges analysis

3.3. Case Studies: Real-World Implementation Success Stories of AI-Driven Healthcare

3.4. AI In Healthcare Market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

3.4.2.4. Environmental Landscape

3.4.2.5. Legal Landscape

3.4.2.6. Social Landscape

3.4.3. Industry Analysis - COVID-19 impact

Chapter 4. Artificial Intelligence (AI) In Healthcare Market: Component Estimates & Trend Analysis

4.1. Definitions and Scope

4.2. Segment Dashboard

4.3. AI In Healthcare Market Movement Analysis

4.4. AI In Healthcare Market Size & Trend Analysis by Component, 2018 to 2030 (USD Million)

4.4.1. Software Solutions

4.4.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.1.1.1. AI platform

4.4.1.1.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.1.1.1.2. Application Program Interface (API)

4.4.1.1.1.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.1.1.1.3. Machine Learning Framework

4.4.1.1.1.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.1.1.2. AI Solutions

4.4.1.1.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.1.1.2.2. On premise

4.4.1.1.2.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.1.1.2.3. Cloud based

4.4.1.1.2.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2. Hardware

4.4.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.1. Processor

4.4.2.1.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.1.2. MPU (memory protection unit)

4.4.2.1.1.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.1.3. FPGA (Field-programmable gate array)

4.4.2.1.1.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.1.4. GPU (Graphics processing unit)

4.4.2.1.1.4.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.1.5. ASIC (Application-specific integrated circuit)

4.4.2.1.1.5.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.2. Memory

4.4.2.1.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.3. Network

4.4.2.1.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.3.2. Adapter

4.4.2.1.3.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.3.3. Interconnect

4.4.2.1.3.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.2.1.3.4. Switch

4.4.2.1.3.4.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.3. Services

4.4.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.3.1.1. Deployment & Integration

4.4.3.1.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.3.1.2. Support & Maintenance

4.4.3.1.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.3.1.3. Others (Consulting, Compliance management etc.)

4.4.3.1.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.4. Distributed Denial of Service (DDoS) Mitigation

4.4.4.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.5. Security Information and Event Management

4.4.5.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.6. Intrusion Detection System (IDS)/Intrusion Prevention System (IPS)

4.4.6.1. Market estimates and forecast 2018 to 2030 (USD Million)

4.4.7. Others

4.4.7.1. Market estimates and forecast 2018 to 2030 (USD Million)

Chapter 5. Artificial Intelligence (AI) In Healthcare Market: Application Estimates & Trend Analysis

5.1. Definitions and Scope

5.2. Segment Dashboard

5.3. AI In Healthcare Market Movement Analysis

5.4. AI In Healthcare Market Size & Trend Analyses, by Application, 2018 to 2030 (USD Million)

5.4.1. Robot-assisted Surgery

5.4.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.2. Virtual Assistants

5.4.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.3. Administrative Workflow Assistants

5.4.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.4. Connected Medical Devices

5.4.4.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.5. Medical Imagining & Diagnosis

5.4.5.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.6. Clinical Trials

5.4.6.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.7. Fraud Detection

5.4.7.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.8. Cybersecurity

5.4.8.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.9. Dosage Error Reduction

5.4.9.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.10. Precision Medicine

5.4.10.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.11. Drug Discovery & Development

5.4.11.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.12. Lifestyle Management & Remote Patient Monitoring

5.4.12.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.13. Wearables

5.4.13.1. Market estimates and forecast 2018 to 2030 (USD Million)

5.4.14. Others

5.4.14.1. Market estimates and forecast 2018 to 2030 (USD Million)

Chapter 6. Artificial Intelligence (AI) In Healthcare Market: Technology Estimates & Trend Analysis

6.1. Definitions and Scope

6.2. Segment Dashboard

6.3. AI In Healthcare Market Movement Analysis

6.4. AI In Healthcare Market Size & Trend Analyses, by Technology, 2018 to 2030 (USD Million)

6.4.1. Machine Learning

6.4.1.1. Market estimates and forecast 2018 to 2030 (USD million)

6.4.1.1.1. Deep learning

6.4.1.1.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.1.1.2. Supervised

6.4.1.1.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.1.1.3. Unsupervised

6.4.1.1.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.1.1.4. Others (Reinforcement learning, Semi supervised)

6.4.1.1.4.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.2. NLP

6.4.2.1. Market estimates and forecast 2018 to 2030 (USD million)

6.4.2.1.1. Smart Assistance

6.4.2.1.1.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.2.1.2. OCR (Optical Character Recognition)

6.4.2.1.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.2.1.3. Auto Coding

6.4.2.1.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.2.1.4. Text analytics

6.4.2.1.4.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.2.1.5. Speech analytics

6.4.2.1.5.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.2.1.6. Classification and categorization

6.4.2.1.6.1. Market estimates and forecast 2018 to 2030 (USD Million)

6.4.3. Computer Vision

6.4.3.1. Market estimates and forecast 2018 to 2030 (USD million)

6.4.4. Context-aware Computing

6.4.4.1. Market estimates and forecast 2018 to 2030 (USD million)

Chapter 7. Artificial Intelligence (AI) In Healthcare Market: End-use Estimates & Trend Analysis

7.1. Definitions and Scope

7.2. Segment Dashboard

7.3. AI In Healthcare Market Movement Analysis

7.4. AI In Healthcare Market Size & Trend Analyses, By End-Use, 2018 to 2030 (USD Million)

7.4.1. Healthcare Providers (Hospitals, Outpatient Facilities, and Others)

7.4.1.1. Market estimates and forecast 2018 to 2030 (USD million)

7.4.2. Healthcare Payers

7.4.2.1. Market estimates and forecast 2018 to 2030 (USD Million)

7.4.3. Healthcare Companies

7.4.3.1. Market estimates and forecast 2018 to 2030 (USD Million)

7.4.4. Patients

7.4.4.1. Market estimates and forecast 2018 to 2030 (USD Million)

7.4.5. Others

7.4.5.1. Market estimates and forecast 2018 to 2030 (USD Million)

Chapter 8. Artificial Intelligence (AI) In Healthcare Market: Regional Estimates & Trend Analysis by Component, Application, Technology & End-use

8.1. Regional Market Dashboard

8.2. Global Regional Market Snapshot

8.3. Market Size, & Forecasts Trend Analysis, 2018 to 2030

8.4. North America

8.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

8.4.2. U.S.

8.4.2.1. U.S. market estimates and forecast, 2018 - 2030 (USD Million)

8.4.3. Canada

8.4.3.1. Canada market estimates and forecast, 2018 - 2030 (USD Million)

8.5. Europe

8.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

8.5.2. UK

8.5.2.1. UK market estimates and forecast, 2018 - 2030 (USD Million)

8.5.3. Germany

8.5.3.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.5.4. France

8.5.4.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.5.5. Italy

8.5.5.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.5.6. Spain

8.5.6.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.5.7. Sweden

8.5.7.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.5.8. Denmark

8.5.8.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.5.9. Norway

8.5.9.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.5.10. Russia

8.5.10.1. Germany market estimates and forecast, 2018 - 2030 (USD Million)

8.6. Asia Pacific

8.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

8.6.2. Japan

8.6.2.1. Japan market estimates and forecast, 2018 - 2030 (USD Million)

8.6.3. China

8.6.3.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.6.4. India

8.6.4.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.6.5. Singapore

8.6.5.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.6.6. Australia

8.6.6.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.6.7. South Korea

8.6.7.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.6.8. Thailand

8.6.8.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.7. Latin America

8.7.1. Market estimates and forecasts 2018 to 2030 (USD Million)

8.7.2. Brazil

8.7.2.2. Brazil market estimates and forecast, 2018 - 2030 (USD Million)

8.7.3. Mexico

8.7.3.2. Mexico market estimates and forecast, 2018 - 2030 (USD Million)

8.7.4. Argentina

8.7.4.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.8. MEA

8.8.1. Market estimates and forecasts 2018 to 2030 (USD Million)

8.8.2. South Africa

8.8.2.1. South Africa market estimates and forecast, 2018 - 2030 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Saudi Arabia market estimates and forecast, 2018 - 2030 (USD Million)

8.8.4. UAE

8.8.4.1. China market estimates and forecast, 2018 - 2030 (USD Million)

8.8.5. Kuwait

8.8.5.1. China market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company/Competition Categorization

9.2.1. Key Innovators

9.2.2. Market Leaders

9.2.3. Emerging Players

9.3. Vendor Landscape

9.3.1. Key company market share analysis, 2023

9.3.2. Microsoft

9.3.2.1. Company overview

9.3.2.2. Financial performance

9.3.2.3. Product benchmarking

9.3.2.4. Strategic initiatives

9.3.3. IBM

9.3.3.1. Company overview

9.3.3.2. Financial performance

9.3.3.3. Product benchmarking

9.3.3.4. Strategic initiatives

9.3.4. NVIDIA Corporation

9.3.4.1. Company overview

9.3.4.2. Financial performance

9.3.4.3. Product benchmarking

9.3.4.4. Strategic initiatives

9.3.5. Intel Corporation

9.3.5.1. Company overview

9.3.5.2. Financial performance

9.3.5.3. Product benchmarking

9.3.5.4. Strategic initiatives

9.3.6. Itrex Group

9.3.6.1. Company overview

9.3.6.2. Financial performance

9.3.6.3. Product benchmarking

9.3.6.4. Strategic initiatives

9.3.7. GE Healthcare

9.3.7.1. Company overview

9.3.7.2. Financial performance

9.3.7.3. Product benchmarking

9.3.7.4. Strategic initiatives

9.3.8. Medtronic

9.3.8.1. Company overview

9.3.8.2. Financial performance

9.3.8.3. Product benchmarking

9.3.8.4. Strategic initiatives

9.3.9. Oracle

9.3.9.1. Company overview

9.3.9.2. Financial performance

9.3.9.3. Product benchmarking

9.3.9.4. Strategic initiatives

9.3.10. Medidata

9.3.10.1. Company overview

9.3.10.2. Financial performance

9.3.10.3. Product benchmarking

9.3.10.4. Strategic initiatives

9.3.11. Google

9.3.11.1. Company overview

9.3.11.2. Financial performance

9.3.11.3. Product benchmarking

9.3.11.4. Strategic initiatives

9.3.12. IQVIA

9.3.12.1. Company overview

9.3.12.2. Financial performance

9.3.12.3. Product benchmarking

9.3.12.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviation

Table 2 North America AI in Healthcare Market, By region, 2018 - 2030 (USD Million)

Table 3 North America AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 4 North America AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 5 North America AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 6 North America AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 7 U.S. AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 8 U.S. AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 9 U.S. AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 10 U.S. AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 11 Canada AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 12 Canada AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 13 U.S. AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 14 Canada AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 15 Europe AI in Healthcare Market, By region, 2018 - 2030 (USD Million)

Table 16 Europe AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 17 Europe AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 18 U.S. AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 19 Europe AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 20 Germany AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 21 Germany AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 22 U.S. AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 23 Germany AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 24 UK AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 25 UK AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 26 UK AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 27 UK AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 28 France AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 29 France AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 30 France AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 31 France AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 32 Italy AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 33 Italy AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 34 Italy AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 35 Italy AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 36 Spain AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 37 Spain AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 38 Spain AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 39 Spain AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 40 Sweden AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 41 Sweden AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 42 Sweden AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 43 Sweden AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 44 Denmark AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 45 Denmark AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 46 Denmark AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 47 Denmark AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 48 Norway AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 49 Norway AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 50 Norway AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 51 Norway AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 52 Russia AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 53 Russia AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 54 Russia AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 55 Russia AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 56 Asia Pacific AI in Healthcare Market, By region, 2018 - 2030 (USD Million)

Table 57 Asia Pacific AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 58 Asia Pacific AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 59 Asia Pacific AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 60 Asia Pacific AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 61 China AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 62 China AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 63 China AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 64 China AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 65 Japan AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 66 Japan AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 67 Japan AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 68 Japan AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 69 India AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 70 India AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 71 India AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 72 India AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 73 Singapore AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 74 Singapore AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 75 Singapore AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 76 Singapore AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 77 Australia AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 78 Australia AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 79 Australia AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 80 Australia AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 81 South Korea AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 82 South Korea AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 83 South Korea AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 84 South Korea AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 85 Thailand AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 86 Thailand AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 87 Thailand AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 88 Thailand AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 89 Latin America AI in Healthcare Market, By region, 2018 - 2030 (USD Million)

Table 90 Latin America AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 91 Latin America AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 92 Latin America AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 93 Latin America AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 94 Brazil AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 95 Brazil AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 96 Brazil AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 97 Brazil AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 98 Mexico AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 99 Mexico AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 100 Mexico AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 101 Mexico AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 102 Argentina AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 103 Argentina AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 104 Argentina AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 105 Argentina AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 106 MEA AI in Healthcare Market, By region, 2018 - 2030 (USD Million)

Table 107 MEA AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 108 MEA AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 109 MEA AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 110 MEA AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 111 South Africa AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 112 South Africa AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 113 South Africa AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 114 South Africa AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 115 Saudi Arabia AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 116 Saudi Arabia AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 117 Saudi Arabia AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 118 Saudi Arabia AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 119 UAE AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 120 UAE AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 121 UAE AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 122 UAE AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 123 Kuwait AI in Healthcare Market, By Components, 2018 - 2030 (USD Million)

Table 124 Kuwait AI in Healthcare Market, By Application, 2018 - 2030 (USD Million)

Table 125 Kuwait AI in Healthcare Market, By Technology, 2018 - 2030 (USD Million)

Table 126 Kuwait AI in Healthcare Market, By End-Use, 2018 - 2030 (USD Million)

Table 127 List of other players

Table 128 Participant’s overview

Table 129 Financial performance

Table 130 Key companies undergoing expansions

Table 131 Key companies undergoing acquisitions

Table 132 Key companies undergoing collaborations

Table 133 Key companies launching new components/services

Table 134 Key companies undergoing partnerships

Table 135 Key companies undertaking other strategies

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 AI in Healthcare market: market outlook

Fig. 10 AI In Healthcare competitive insights

Fig. 11 Parent market outlook

Fig. 12 Related/ancillary market outlook

Fig. 13 Penetration and growth prospect mapping

Fig. 14 Industry value chain analysis

Fig. 15 AI in Healthcare market driver impact

Fig. 16 AI in Healthcare market restraint impact

Fig. 17 AI in Healthcare market strategic initiatives analysis

Fig. 18 AI in Healthcare market: Components movement analysis

Fig. 19 AI in Healthcare market: Components outlook and key takeaways

Fig. 20 Software Solutions market estimates and forecast, 2018 - 2030

Fig. 21 Hradware management estimates and forecast, 2018 - 2030

Fig. 22 Services estimates and forecast, 2018 - 2030

Fig. 23 AI in Healthcare market: Application movement analysis

Fig. 24 AI in Healthcare market: Application outlook and key takeaways

Fig. 25 Robot assisted surgery market estimates and forecast, 2018 - 2030

Fig. 26 Virtual assistants market estimates and forecast, 2018 - 2030

Fig. 27 Administrative workflow assistants market estimates and forecast, 2018 - 2030

Fig. 28 Connected medical devices market estimates and forecast, 2018 - 2030

Fig. 29 Medical imaging & diagnostics market estimates and forecast, 2018 - 2030

Fig. 30 Clinical trials market estimates and forecast, 2018 - 2030

Fig. 31 Fraud detection market estimates and forecast, 2018 - 2030

Fig. 32 Cybersecurity market estimates and forecast, 2018 - 2030

Fig. 33 Dosage error reduction market estimates and forecast, 2018 - 2030

Fig. 34 Precision medicine market estimates and forecast, 2018 - 2030

Fig. 35 Drug discovery & developments market estimates and forecast, 2018 - 2030

Fig. 36 Lifestyle management & remote patient monitoring market estimates and forecast, 2018 - 2030

Fig. 37 Wearables market estimates and forecast, 2018 - 2030

Fig. 38 Others market estimates and forecast, 2018 - 2030

Fig. 39 AI in Healthcare market: End-User movement analysis

Fig. 40 AI in Healthcare market: End-User outlook and key takeaways

Fig. 41 Healthcare providers (hospitals, outpatient facilities, and others) market estimates and forecast, 2018 - 2030

Fig. 42 Healthcare payers market estimates and forecast, 2018 - 2030

Fig. 43 Healthcare Companies market estimates and forecast, 2018 - 2030

Fig. 44 Patients market estimates and forecast, 2018 - 2030

Fig. 45 Others market estimates and forecast, 2018 - 2030

Fig. 46 AI in Healthcare market: Technology movement analysis

Fig. 47 AI in Healthcare market: Technology outlook and key takeaways

Fig. 48 Machine learning market estimates and forecast, 2018 - 2030

Fig. 49 NLP market estimates and forecast, 2018 - 2030

Fig. 50 Context-aware computiing market estimates and forecast, 2018 - 2030

Fig. 51 Computer vision market estimates and forecast, 2018 - 2030

Fig. 52 Global AI in Healthcare market: regional movement analysis

Fig. 53 Global AI in Healthcare market: regional outlook and key takeaways

Fig. 54 Global AI in Healthcare market share and leading players

Fig. 55 North America, by country

Fig. 56 North America market estimates and forecast, 2018 - 2030

Fig. 57 U.S. market estimates and forecast, 2018 - 2030

Fig. 58 Canada market estimates and forecast, 2018 - 2030

Fig. 59 Europe market estimates and forecast, 2018 - 2030

Fig. 60 UK market estimates and forecast, 2018 - 2030

Fig. 61 Germany market estimates and forecast, 2018 - 2030

Fig. 62 France market estimates and forecast, 2018 - 2030

Fig. 63 Italy market estimates and forecast, 2018 - 2030

Fig. 64 Spain market estimates and forecast, 2018 - 2030

Fig. 65 Sweden market estimates and forecast, 2018 - 2030

Fig. 66 Denmark market estimates and forecast, 2018 - 2030

Fig. 67 Norway market estimates and forecast, 2018 - 2030

Fig. 68 Russia market estimates and forecast, 2018 - 2030

Fig. 69 Asia Pacific market estimates and forecast, 2018 - 2030

Fig. 70 China market estimates and forecast, 2018 - 2030

Fig. 71 Japan market estimates and forecast, 2018 - 2030

Fig. 72 India market estimates and forecast, 2018 - 2030

Fig. 73 Australia market estimates and forecast, 2018 - 2030

Fig. 74 South Korea market estimates and forecast, 2018 - 2030

Fig. 75 Singapore market estimates and forecast, 2018 - 2030

Fig. 76 Thailand market estimates and forecast, 2018 - 2030

Fig. 77 Latin America market estimates and forecast, 2018 - 2030

Fig. 78 Brazil market estimates and forecast, 2018 - 2030

Fig. 79 Mexico market estimates and forecast, 2018 - 2030

Fig. 80 Argentina market estimates and forecast, 2018 - 2030

Fig. 81 Middle East and Africa market estimates and forecast, 2018 - 2030

Fig. 82 South Africa market estimates and forecast, 2018 - 2030

Fig. 83 Saudi Arabia market estimates and forecast, 2018 - 2030

Fig. 84 UAE market estimates and forecast, 2018 - 2030

Fig. 85 Kuwait market estimates and forecast, 2018 - 2030

Fig. 86 Market share of key market players- AI in Healthcare marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- AI In Healthcare Component Outlook (Revenue, USD Million, 2018 - 2030)

- Hardware

- Processor

- MPU (Memory Protection Unit)

- FPGA (Field-programmable Gate Array)

- GPU (Graphics Processing Unit)

- ASIC (Application-specific Integrated Circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI Platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On-premise

- Cloud-based

- AI Platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance Management etc.)

- Hardware

- AI In Healthcare Application Outlook (Revenue, USD Million, 2018 - 2030)

- Robot-assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical Devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision Medicine

- Drug discovery & Development

- Lifestyle Management & Remote Patient Monitoring

- Wearables

- Others (Patient Engagement, etc.)

- AI In Healthcare Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Machine Learning

- Deep Learning

- Supervised

- Unsupervised

- Others (Reinforcement Learning, Semi-supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text Analytics

- Speech Analytics

- Classification and Categorization

- Context-aware Computing

- Computer Vision

- Machine Learning

- AI In Healthcare End-user Outlook (Revenue, USD Million, 2018 - 2030)

- Healthcare Providers (Hospitals, Outpatient Facilities, and Others)

- Healthcare Payers

- Healthcare Companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- AI In Healthcare Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management, etc.)

- Hardware

- North America AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- North America AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- North America AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- U.S.

- U.S. AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- U.S. AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- U.S. AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- U.S. AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- U.S. AI In Healthcare Market, by Component

- Canada

- Canada AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- Canada AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- Canada AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- Canada AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- Canada AI In Healthcare Market, by Component

- North America AI In Healthcare Market, by Component

- Europe

- Europe AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- Europe AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- Europe AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- Europe AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- Germany

- Germany AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- Germany AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- Germany AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- Germany AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- Germany AI In Healthcare Market, by Component

- U.K.

- UK AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- UK AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- UK AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- UK AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- UK AI In Healthcare Market, by Component

- Italy

- Italy AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- Italy AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- Italy AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- Italy AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- Italy AI In Healthcare Market, by Component

- Spain

- Spain AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- Spain AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- Spain AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- Spain AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- Spain AI In Healthcare Market, by Component

- France

- France AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- France AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- France AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- France AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- France AI In Healthcare Market, by Component

- Sweden

- Sweden AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services

- Deployment & Integration

- Support & Maintenance

- Others (Consulting, Compliance management etc.)

- Hardware

- Sweden AI In Healthcare Market, by Application

- Robot Assisted Surgery

- Virtual Assistants

- Administrative Workflow Assistants

- Connected Medical devices

- Medical Imaging & Diagnostics

- Clinical Trials

- Fraud Detection

- Cybersecurity

- Dosage Error Reduction

- Precision medicine

- Drug discovery & development

- Lifestyle management & remote patient monitoring

- Wearables

- Others (Patient engagement, etc.)

- Sweden AI In Healthcare Market, by Technology

- Machine Learning

- Deep learning

- Supervised

- Unsupervised

- Others (Reinforcement learning, Semi supervised)

- Natural Language Processing

- Smart Assistance

- OCR (Optical Character Recognition)

- Auto Coding

- Text analytics

- Speech analytics

- Classification and categorization

- Context-Aware Computing'

- Computer Vision

- Machine Learning

- Sweden AI In Healthcare Market, by End-User

- Healthcare providers (hospitals, outpatient facilities, and others)

- Healthcare payers

- Healthcare companies (Pharmaceutical, Biotechnology, Medical Devices)

- Patients

- Others

- Sweden AI In Healthcare Market, by Component

- Denmark

- Denmark AI In Healthcare Market, by Component

- Hardware

- Processor

- MPU (memory protection unit)

- FPGA (Field-programmable gate array)

- GPU (Graphics processing unit)

- ASIC (Application-specific integrated circuit)

- Memory

- Network

- Adapter

- Interconnect

- Switch

- Processor

- Software Solutions

- AI platform

- Application Program Interface (API)

- Machine Learning Framework

- AI Solutions

- On premise

- Cloud based

- AI platform

- Services