- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence Chipset Market, Industry Report, 2030GVR Report cover

![Artificial Intelligence Chipset Market Size, Share & Trends Report]()

Artificial Intelligence Chipset Market (2024 - 2030) Size, Share & Trends Analysis Report By Chipset (CPU, GPU, FPGA, ASIC, Others), By Workload Domain, By Computing Technology, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-044-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Intelligence Chipset Market Summary

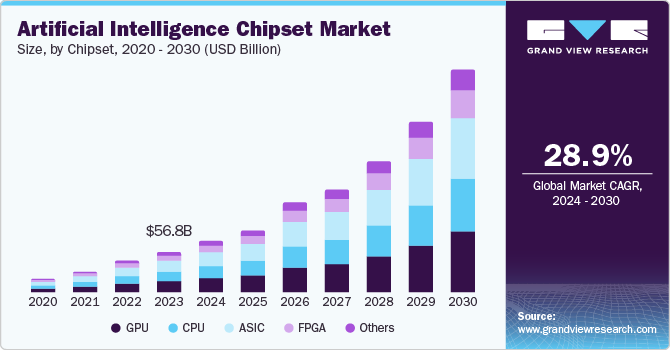

The global artificial intelligence chipset market size was valued at USD 56.82 billion in 2023 and is projected to reach USD 323.14 billion by 2030, growing at a CAGR of 28.9% from 2024 to 2030. The rising adoption of Artificial Intelligence (AI)-backed applications and devices across various industries such as consumer electronics, healthcare, BFSI, and automotive has led to exponential growth in demand for AI chipsets globally.

Key Market Trends & Insights

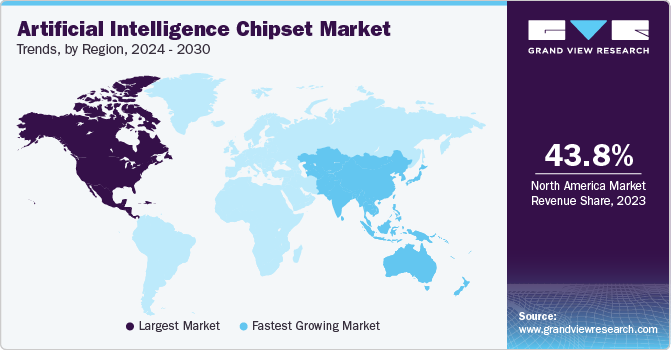

- North America dominated the market with a revenue share of 43.8% in 2023.

- By chipset, GPU chipsets dominated the market with a revenue share of 30.9% in 2023.

- By workload domain, the training segment is expected to register a substantial CAGR from 2024 to 2030.

- By computing technology, cloud AI computing held the largest market share in 2023.

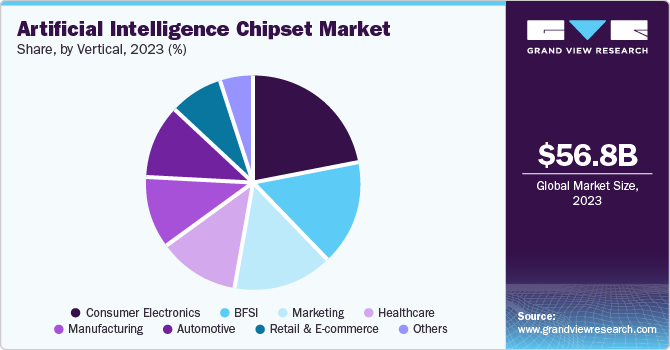

- By vertical, the consumer electronics segment accounted for the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 56.82 Billion

- 2030 Projected Market Size: USD 323.14 Billion

- CAGR (2024-2030): 28.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The high volume of data generation from various sources, including IoT devices and social media, has necessitated the presence of powerful hardware capable of processing and analyzing large datasets. AI chipsets are well-suited for these tasks, leading to increased adoption by the data processing industry. With the proliferation of AI technology in untapped regions such as Asia Pacific and Africa, the AI chipset industry is anticipated to experience exponential growth over the forecast period.

The growing need for enhanced computing power, memory, and data storage to support complex AI workloads is driving the development of advanced chipsets. For instance, at the MWC Barcelona event held in February 2024, Huawei launched three advanced data storage products equipped with AI capabilities. These solutions include an all-scenario data protection solution, an AI data lake solution, and a DCS full-stack data center solution. They have been developed to solve the challenges involved in data extraction, aggregation, and assetization, facilitating enhanced data processing capabilities for users. Additionally, the proliferation of edge AI applications, which require real-time processing and low latency, is creating new opportunities for AI chipset vendors.

AI is being integrated into a wide range of major industries, from healthcare and finance to manufacturing, weather prediction, and autonomous vehicles. This increased adoption drives a significant demand for AI-optimized hardware. For instance, in August 2024, NVIDIA Research introduced its generative AI model StormCast, which will be used to predict extreme weather events with high accuracy. Furthermore, the global demand for AI-compatible personal computers is on the rise, with manufacturers offering a variety of devices to address consumer requirements. In May 2024, during the launch of Copilot+, Microsoft and other global OEMs launched personal computers with Snapdragon X Elite and Snapdragon X Plus devices that can deliver Copilot+ experiences. The use of cutting-edge AI technology and performance efficiency of these platforms is expected to help transform user interactions with their computers. Such developments are expected to ensure strong industry growth.

Chipset Insights

GPU chipsets dominated the market with a revenue share of 30.9% in 2023. This isattributed to the exceptional parallel processing capabilities of GPUs, making them an ideal choice for compute-intensive AI workloads such as deep learning and neural networks. The ability of a GPU to handle massive volumes of data in minimum time and its expanding application base in healthcare, consumer electronics, and automotive sectors have made it a highly sought-after segment in the artificial intelligence chipset market. For instance, in August 2024, Intel announced the launch of its discrete graphics processing unit, called the ‘Intel Arc Graphics for Automotive.’ This new platform joins the company’s AI-powered software-defined vehicle system-on-chips (SoCs) solutions, providing car manufacturers with a scalable and flexible platform to ensure high-quality in-vehicle experiences.

Meanwhile, the ASIC segment is expected to register the fastest growth rate over the forecast period. This is owing to the increasing demand for custom-designed ASICs that cater to specific AI workloads. ASICs offer superior performance, power efficiency, and cost-effectiveness compared to general-purpose GPUs and CPUs, making them a better option for large-scale AI deployments. The growing adoption of ASICs in cloud data centers has further fueled this segment's growth. Additionally, the emergence of new AI applications, such as edge AI and IoT, has created new opportunities for ASIC vendors to design specialized chips that meet the unique requirements of these applications. Additionally, increasing investments in AI research and development have led to the creation of new ASIC designs and architectures, ensuring substantial demand for this segment.

Workload Domain Insights

The inference segment accounted for the largest share of the market in 2023. This is attributed to the growing demand for AI-powered applications in various industries, such as healthcare, finance, and automotive, which rely heavily on inference workloads to interpret and make decisions based on learned models. Inference workloads require high-performance chipsets that can efficiently process complex algorithms and large datasets in real time, making them a critical component of AI deployment. The widespread adoption of cloud-based AI services, such as Amazon SageMaker and Google Cloud AI Platform, has further driven the demand for inference-optimized chipsets. Additionally, increasing use of AI in edge devices, such as smartphones, smart home devices, and autonomous vehicles, has created new opportunities for inference chipsets that can operate within power and thermal constraints.

The training segment is expected to register a substantial CAGR from 2024 to 2030. This is driven by the increasing demand for high-performance chipsets that can efficiently handle complex machine learning (ML) and deep learning (DL) workloads. Training is the process of developing and refining AI models and requires massive amounts of data processing, computational power, and memory, making it a critical application for AI chipsets. The growing adoption of AI across critical industries has led to a surge in the development of new AI models, resulting in a corresponding increase in demand for training-optimized chipsets. Furthermore, strategic mergers and acquisitions of prominent AI solution providers have led to promising growth prospects for this segment. For instance, in August 2024, AMD announced the signing of an agreement for the acquisition of ZT Systems, which provides AI infrastructure to leading hyperscale computing organizations. This strategic move aligns with AMD's broader goal of becoming a leader in AI technology, offering innovative solutions for both training and inferencing AI models.

Computing Technology Insights

Cloud AI computing held the largest market share in 2023. This is owing to a high demand for flexible and cost-effective AI infrastructure. Cloud-based AI computing enables organizations to access vast computational resources, storage, and memory on demand, facilitating the development and deployment of complex AI models. The growing adoption of cloud-based AI services, such as Google Cloud AI Platform and Microsoft Azure Machine Learning, has created a surge in demand for high-performance AI chipsets that can optimize cloud-based AI workloads. Moreover, the increasing trend of cloud-first strategies among enterprises has led to a shift towards cloud-based AI computing, further fueling the demand for AI chipsets. The availability of specialized cloud-optimized chipsets, such as GPUs and TPUs, has also contributed to this segment's high share.

On the other hand, the edge AI computing segment is expected to register the fastest growth rate during the forecast period. This is owing to a rising demand for real-time, low-latency, and secure AI processing at the edge. The proliferation of IoT devices, smart sensors, and autonomous systems has created a range of edge AI applications, including industrial automation, smart homes, and autonomous vehicles. These applications require AI chipsets that can operate within specific power, thermal, and latency constraints, fueling the demand for specialized edge AI chipsets. The increasing adoption of edge AI computing has also been driven by the need for reduced reliance on cloud connectivity, enhanced data privacy, and improved real-time decision-making. Furthermore, advancements in AI algorithms and chip design have enabled the development of high-performance, low-power edge AI chipsets, such as System-on-Chip (SoC) and Field-Programmable Gate Array (FPGA) solutions.

Vertical Insights

The consumer electronics segment accounted for the largest market share in 2023.The steadily rising adoption of smart home devices, smartphones, laptops, and tablets has created a vast market for AI chipsets that can enable features such as voice recognition, image processing, and predictive maintenance. The increasing demand for intelligent personal assistants, such as Amazon Alexa and Google Assistant, has further fueled segment growth. Moreover, advancements in chipset fabrication technology and economies of scale have made it possible to manufacture high-powered processors at affordable costs. For instance, in August 2024, Qualcomm announced the release of its Snapdragon 7s Gen 3 mobile processor, which will enable AI capabilities in mid-range smartphones.

The healthcare vertical is anticipated to grow at the fastest rate from 2024 to 2030. This is driven by the rapid adoption of AI technologies in medical imaging, diagnostics, and personalized medicines. The increasing demand for accurate and efficient diagnosis, treatment, and patient care has led to the development of AI-powered medical devices, such as MRI and CT scanners, ultrasound machines, and portable diagnostic equipment. The growing need for real-time data analysis, predictive analytics, and decision support systems has fueled the adoption of high-performance AI chipsets in this sector. Furthermore, the emergence of telemedicine, remote monitoring, and wearable devices has created new opportunities for AI chipset vendors to address the specific needs of this industry.

Regional Insights

North America artificial intelligence chipset market dominated the market with a revenue share of 43.8% in 2023.The region's well-developed IT infrastructure, including data centers and cloud computing services, has supported the growth of this market. Additionally, untapped sectors such as automobile and manufacturing, in collaboration with software service providers, are finding innovative applications of AI in minimizing losses and downtime in production facilities. For instance, Eigen Innovations, a Canada-based AI software solutions company, provides the Intel-powered OneView AI platform, which facilitates early detection of defective products and minimizes losses for production facilities.

U.S. Artificial Intelligence Chipset Market Trends

The U.S. accounted for a majority share of the regional market in 2023. This is owing to the presence of prominent AI chipset vendors, such as NVIDIA, AMD, Intel, and Google, which are headquartered in the country. The economy's strong ecosystem of technology companies, research institutions, and venture capital firms has created a strong base for the innovation and adoption of AI chipsets. Additionally, the widespread acceptance of AI-powered applications in industries such as healthcare, finance, and automotive has fueled the demand for high-performance AI chipsets.

Europe Artificial Intelligence Chipset Market Trends

Europe held a notable share of the global market in 2023. The region's highly developed automotive and industrial sectors have fueled the demand for AI chipsets, particularly in areas such as autonomous vehicles, smart manufacturing, and predictive maintenance. Europe's commitment to AI adoption is further evident in initiatives such as the European Union's AI Strategy, which aims to promote AI development and deployment across the region. Additionally, innovative applications of AI in the broadcasting and entertainment sector have opened new growth avenues in this region. For instance, at the Paris Olympics 2024, Intel’s 5th Gen and 4th Gen Xeon processors with Intel AI accelerator-powered servers were used to carry out 8K OTT broadcast of the games.

The UK artificial intelligence chipset market accounted for a significant share of the European market.The presence of world-renowned research institutions and universities in the UK has facilitated frequent collaborations between industry and academia, driving innovations in AI chipset development. Additionally, the presence of global semiconductor manufacturers such as Graphcore in the economy has ensured a steady supply of next-gen Intelligence Processing Units (IPU) in the market. Furthermore, the UK’s strong focus on data protection and privacy has led to the development of AI chipsets that prioritize data security and compliance.

Asia Pacific Artificial Intelligence Chipset Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. This is owing to the rapid digital transformation and technological advancements in countries such as China, Japan, South Korea, and India. The region's growing demand for AI-powered applications, including smart cities, autonomous vehicles, and industrial automation, has fueled the adoption of high-performance AI chipsets. Additionally, software companies in this region are collaborating with prominent AI solution providers to enhance their AI capabilities. For instance, in May 2024, Chinese software companies Neusoft and ThunderSoft collaborated with Intel to create innovative solutions for intelligent cockpits in future vehicles. Leveraging Intel's advanced AI-enhanced SDV SoC, the initiative will combine the expertise of each company in hardware, software, and technology to ensure that automakers can provide intuitive and safe driving experiences.

India artificial intelligence chipset market accounted for a significant market share of the regional market in 2023. The increasing investments in AI research and development, coupled with government initiatives such as the Design Linked Incentive (DLI) Scheme, have accelerated the manufacturing of semiconductor chipsets. AI, with its technological advancements, is finding innovative applications in the economy. For instance, Calsoft, a technology solutions provider, utilizes the NVIDIA Jetson edge AI modules and NVIDIA A100 Tensor Core GPUs to develop its AI offerings. In its recent pilot project to streamline tollbooth traffic in the country, the company leveraged the NVIDIA Metropolis framework to decongest road traffic by faster recognition of vehicle number plates and dispatch of vehicles through tollbooths.

Key Artificial Intelligence Chipset Company Insights

Some key companies involved in the artificial intelligence chipset market include Advanced Micro Devices, Inc.; NVIDIA Corporation; and Intel Corporation, among others.

-

Advanced Micro Devices, Inc. (AMD) is a semiconductor manufacturing company headquartered in California thatspecializes in microprocessors, chipsets, and graphics processors for various applications. The company's products are widely used in servers, smartphones, workstations, personal computers, and embedded systems. AMD has expanded its reach into new markets, including data centers, gaming, and high-performance computing, via the launch of next-gen processors. In 2022, AMD acquired Xilinx, a company known for its field-programmable gate array (FPGA) products, further diversifying its offerings.

-

NVIDIA Corporation is a computer hardware, software, GPU, AI, semiconductor, and cloud computing solutions provider. The organization is known for its developments in graphics processing units (GPUs). Its professional-grade GPUs are utilized in various industries, including architecture, engineering, media, automotive, research, and manufacturing. These GPUs are employed in edge-to-cloud computing environments and supercomputers, enabling complex applications. In addition, NVIDIA offers the Maxine AI developer platform for deploying AI features in audio and video processing.

Key Artificial Intelligence Chipset Companies:

The following are the leading companies in the Artificial Intelligence Chipset market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Apple Inc.

- Baidu, Inc.

- Google LLC

- Graphcore

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- SK HYNIX INC.

Recent Developments

-

In August 2024, AMD completed the acquisition of Silo AI, a European AI lab. With this strategic move, AMD aims to expand its AI model portfolio by integrating the experience and expertise of the engineers and scientists at Silo AI, who have previously served several prominent clients. The Silo AI team has been responsible for developing multilingual, open-source Large Language Models such as Viking and Poro on AMD platforms.

-

In July 2024, Qualcomm announced that its flagship mobile device processor, Snapdragon 8 Gen 3, would be powering the Samsung Galaxy Z Flip6 and Galaxy Z Fold6 series of premium smartphones. The new processor will be equipped with enhanced capabilities to perform advanced creativity and productivity tasks by leveraging Galaxy AI, such as in gaming, camera features, and connectivity.

-

In June 2024, AMD announced the launch of the AMD Ryzen AI 300 Series processors featuring an advanced Neural Processing Unit (NPU) to power next-generation AI-enabled computers. The new Copilot+ compatible processors are equipped with up to 12 high-performance CPU cores with 24 threads, while also offering 50% higher on-chip L3 cache memory over previous generation processors for light and thin laptops. The new solutions are expected to deliver high-performance computing capabilities to consumers.

Artificial Intelligence Chipset Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 70.57 billion

Revenue Forecast in 2030

USD 323.14 billion

Growth rate

CAGR of 28.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Chipset, workload domain, computing technology, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Advanced Micro Devices, Inc.; Apple Inc.; Baidu, Inc.; Google LLC; Graphcore; Huawei Technologies Co., Ltd.; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; SK HYNIX INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence Chipset Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial intelligence chipset market report based on chipset, workload domain, computing technology, vertical, and region:

-

Chipset Outlook (Revenue, USD Million, 2018 - 2030)

-

CPU

-

GPU

-

FPGA

-

ASIC

-

Others

-

-

Workload Domain Outlook (Revenue, USD Million, 2018 - 2030)

-

Training

-

Inference

-

-

Computing Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud AI Computing

-

Edge AI Computing

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Marketing

-

Healthcare

-

Manufacturing

-

Automotive

-

Retail and E-commerce

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.