- Home

- »

- Healthcare IT

- »

-

AI In Cardiology Market Size & Share, Industry Report, 2033GVR Report cover

![AI In Cardiology Market Size, Share & Trends Report]()

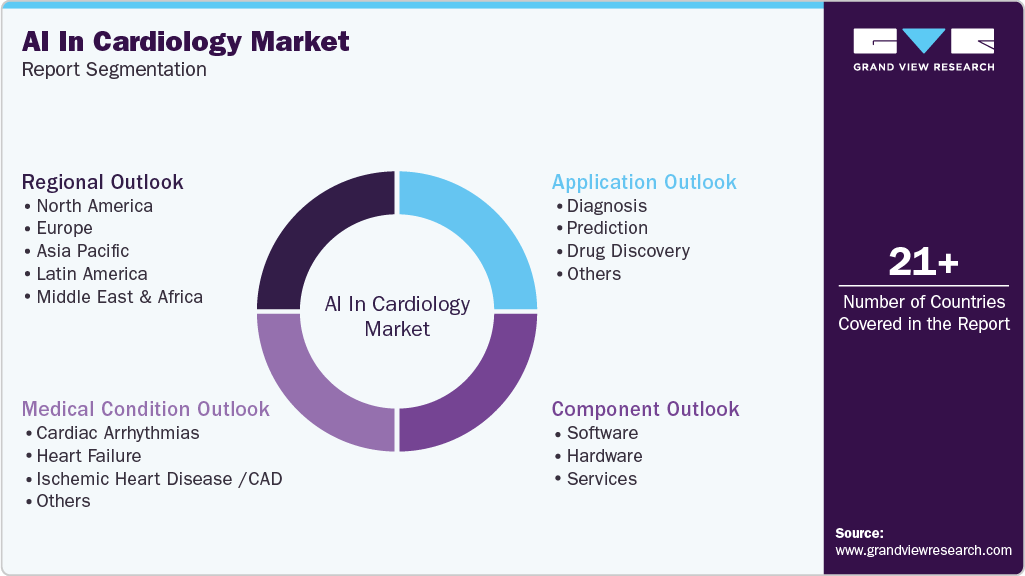

AI In Cardiology Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Services, Software), By Application (Diagnosis, Prediction, Drug Discovery), By Medical Condition (Cardiac Arrhythmias, Heart Failure), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-047-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Cardiology Market Summary

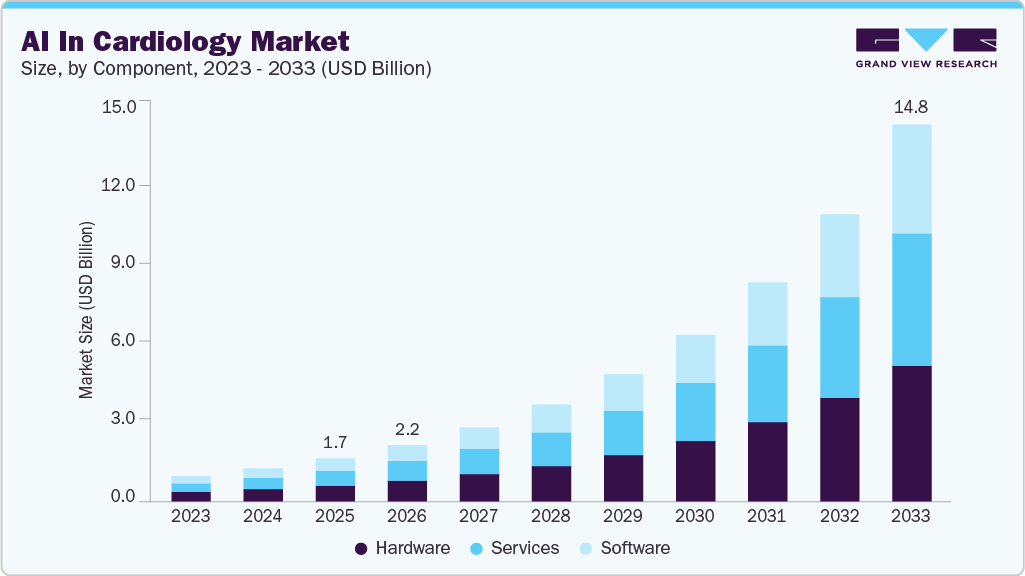

The global AI in cardiology market size was estimated at USD 1.69 billion in 2025 and is projected to reach USD 14.83 billion by 2033, growing at a CAGR of 31.17% from 2026 to 2033. The rising global prevalence of cardiovascular diseases, coupled with the increasing focus of cardiac specialists on enhancing diagnostic precision and rapid advancements in cardiac imaging technology, are among the key factors responsible for expanding the applications of AI in cardiology.

Key Market Trends & Insights

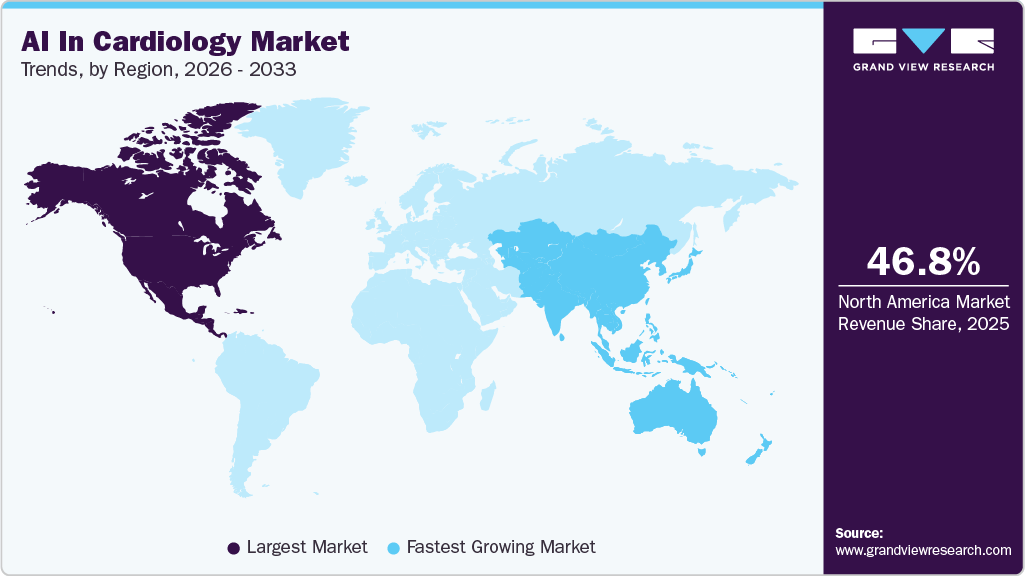

- North America dominated the AI in cardiology market with a revenue share of 46.79% in 2025.

- The AI in cardiology market in the U.S. is driven by the advancements in ML & deep learning technologies.

- By component, the hardware segment led the market with the largest revenue share of 36.87% in 2025.

- By application, the diagnosis segment led the market with the largest revenue share of 40.02% in 2025.

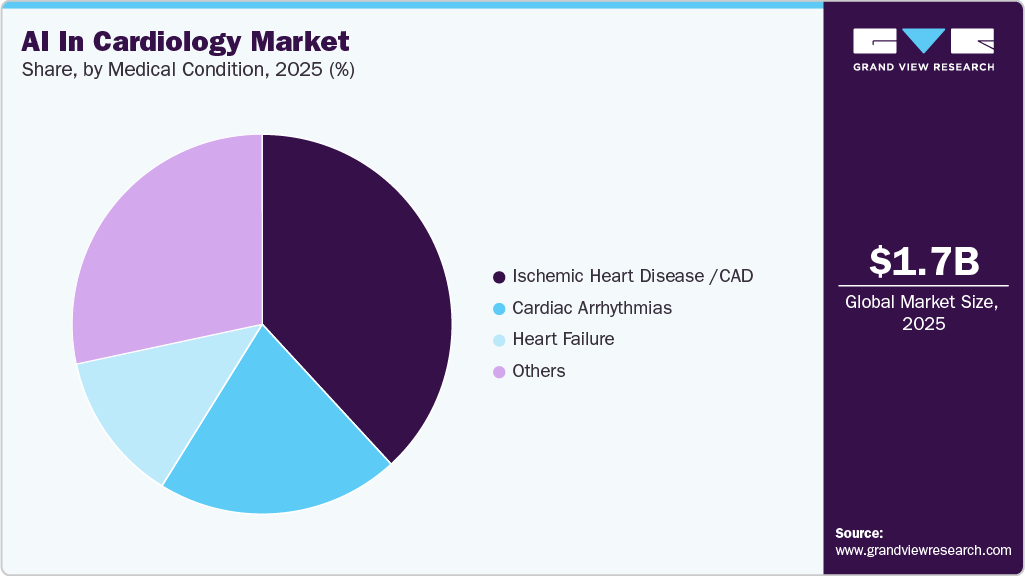

- By medical condition, the ischemic heart disease /CAD segment led the market with the largest revenue share of 38.15% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.69 Billion

- 2033 Projected Market Size: USD 14.83 Billion

- CAGR (2026-2033): 31.17%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing Market

For instance, in May 2023, Sensydia announced the development of its Cardiac Performance System (CPS), which uses biosensors and AI to detect heart abnormalities. The company secured USD 8 million in funding to advance its technology.A primary factor driving the growth of the artificial intelligence in cardiology industry is the increasing prevalence of cardiovascular diseases (CVDs) and the consequent need for efficient & effective healthcare solutions. According to the WHO, CVD remains the leading cause of mortality worldwide. For instance, an estimated 19.8 million people died from CVDs in 2022, representing approximately 32% of all global deaths. Similarly, according to the Centers for Disease Control and Prevention (CDC), 919,032 people died from cardiovascular disease in the U.S. in 2023, equivalent to one in every three deaths. This escalating burden necessitates the development and implementation of advanced technologies to improve disease management and patient outcomes.

The high prevalence of conditions such as hypertension, coronary artery disease, heart failure, and arrhythmia puts a substantial strain on healthcare systems globally. Traditional diagnostic & treatment methods are often time-consuming & resource-intensive and are likely to lack the precision required for optimal patient care. AI offers a transformative solution by enhancing the accuracy and efficiency of CVD detection, diagnosis, and management.

Moreover, the integration of AI in cardiology facilitates the delivery of personalized medicine. By analyzing individual patient data, AI helps tailor treatment plans to address the unique needs and conditions of each patient. For instance, in managing heart failure, AI helps determine the most effective combination of medications and lifestyle modifications for each patient based on their specific disease profile and response to previous treatments. This personalized approach enhances the efficacy of interventions and improves patients' overall quality of life.

Technological advancements in AI algorithms and imaging techniques significantly drive the market growth. The development of advanced machine learning and deep learning algorithms has revolutionized the capabilities of AI in medical imaging and diagnostics. These advanced algorithms can now process vast amounts of data with high precision, allowing early detection, accurate diagnosis, and personalized treatment plans for CVDs. For instance, in June 2024, UltraSight partnered with Mayo Clinic to advance AI-driven cardiac imaging solutions. The collaboration focuses on developing algorithms that enhance point-of-care ultrasound for cardiac assessments. Similarly, in February 2025, Heart Eye Diagnostics developed Dr.Noon CVD, an AI-driven retinal imaging system for cardiovascular disease (CVD) risk assessment. Using noninvasive retinal images instead of CT or blood tests, it offers accuracy comparable to heart CT scans and delivers results in three minutes.

In addition,the growth of AI in cardiology market is significantly propelled by the rise in strategic initiatives and the surge in startup funding. Strategic initiatives, including partnerships, new launches, collaborations, & acquisitions, foster innovation and accelerate the development & deployment of AI solutions in cardiology. For instance, in May 2024, iHridAI launched its novel, innovative product, HarmonyCVI, designed for thorough and precise cardiovascular diagnosis. HarmonyCVI is an advanced diagnostic and analysis tool that utilizes AI & machine learning to assist cardiologists and radiologists in the improved interpretation of cardiac MRI scans. Similarly, in September 2024, Abbott partnered with iCardio.ai to develop artificial intelligence imaging solutions to improve cardiovascular diagnostics. These initiatives are often aimed at integrating AI with existing healthcare infrastructure to enhance diagnostic accuracy and improve patient outcomes.

Case Study Insights: Accelerating Surgical Navigation through Ai-Driven Chest Ct Segmentation by RSIP Vision

RSIP Vision developed an advanced AI-based solution to automatically generate high-resolution 3D models of complex, patient-specific chest anatomies from CT scans. These models are crucial for planning intricate surgical navigation procedures, where precise anatomical visualization informs safer and more effective interventions. Conventional solutions were slow, lacked robustness, and required extensive manual editing, burdening clinical workflows.

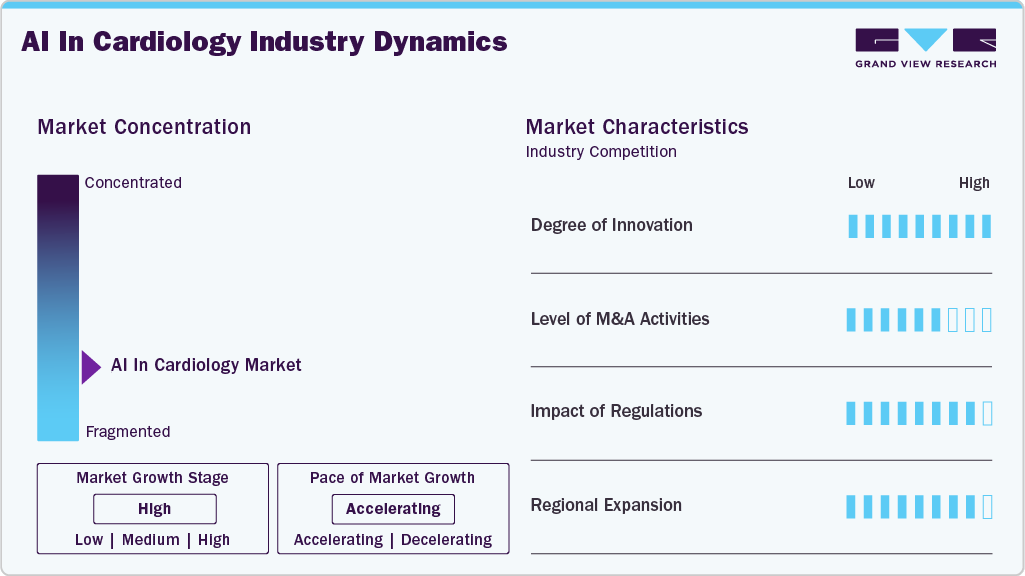

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, the level of mergers and acquisitions, the degree of innovation, the impact of regulations, and regional expansion. The artificial intelligence (AI) in cardiology market is fragmented. The degree of innovation, the impact of regulations, and the regional expansion of industry are high. Moreover, the level of mergers & acquisitions is moderate.

The degree of innovation in the AI in cardiology industry is high. Technological advancements are attributed to the growing utilization of machine learning, deep learning, cloud computing, big data analytics, and other technologies. For instance, in August 2025, Bordeaux-based AI company DESKi introduced its HeartFocus cardiac examination software, now integrated into Butterfly Network’s handheld ultrasound devices. The tool, available as an application and a software development kit, gained FDA clearance in April. Even with minimal training, it enables healthcare professionals to capture complete echocardiographic views.

M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in May 2023, Koninklijke Philips N.V. acquired DiA Imaging Analysis for approximately USD 100 million. This acquisition enhanced the cardiac monitoring and diagnostics capabilities of Philips with advanced ECG analysis and reporting services.

The impact of regulations is moderate to high in the industry. The industry involves several digital technologies, including Artificial Intelligence (AI) and Machine Learning (ML). It is regulated by different bodies in different countries. For instance, in October 2023, the WHO published key regulatory considerations for the use of AI in healthcare. It emphasized key factors such as transparency, documentation, risk management, AI systems development lifecycle methods, intended use, clinical & analytical validation, AI-based data quality, protection & privacy, and collaboration & engagement.

Geographic expansion significantly drives the market growth by increasing market penetration and revenue, enabling access to diverse data sources, and fostering regulatory compliance and standardization. For instance, in January 2024, UltraSight partnered with SELVAS Healthcare, a subsidiary of the SELVAS Group. This partnership would introduce UltraSight’s real-time AI guidance technology in Asia, starting with the regulatory approval process for potential distribution and commercialization in Korea and Southeast Asia.

Component Insights

AI-powered cardiology hardware devices dominated the artificial intelligence in cardiology market with the largest share of 36.87% in 2025 by offering enhanced diagnostic accuracy and treatment precision. These devices include advanced wearable monitors that continuously track vital signs, smart ECG machines that provide real-time analysis, and AI-enabled imaging systems that improve the detection of cardiac conditions through enhanced image processing. These innovations streamline workflows for healthcare providers and improve cardiovascular patient outcomes. For instance, in May 2024, Koninklijke Philips N.V. announced the successful deployment of ePatch across Spain. It utilizes the AI-driven Cardiologs analytics platform to detect heart arrhythmias, such as Atrial Fibrillation (AF).

The software segment is expected to grow at the fastest CAGR during the forecast period. AI-based software in cardiology is revolutionizing the field by enhancing diagnostic accuracy, improving patient monitoring, and enabling personalized treatments. Key applications include analyzing medical images, predicting cardiac events, and optimizing treatment plans. Moreover, AI software is used in clinical trials and administration work. These advancements lead to more effective healthcare delivery and better patient outcomes. For instance, in August 2023, Viz.aiannounced it had received De Novo approval from the U.S. FDA for the Viz HCM module, an AI detection algorithm for HCM. This approval establishes a new regulatory classification for machine learning-based cardiovascular notification software.

Application Insights

The diagnosis segment dominated the AI in cardiology industry, with the largest share of 40.02% in 2025. AI systems analyze medical data such as electrocardiograms, echocardiograms, and imaging scans to identify cardiac abnormalities & predict potential cardiovascular events accurately, leveraging advanced algorithms and machine learning techniques. These AI-powered diagnostic tools enable healthcare professionals to make quicker and more precise diagnoses, leading to earlier interventions & improved patient outcomes. For instance, in April 2024, Exo announced that the FDA had cleared its AI imaging applications for heart failure diagnosis on its handheld ultrasound system. The AI app Exo Iris aims to enhance point-of-care access to timely heart failure diagnosis, especially in under-resourced and rural settings.

The prediction segment is expected to grow at the fastest CAGR over the forecast period. The predictive models enable healthcare providers to identify high-risk individuals, implement preventive measures, and design treatment plans for individual patients, ultimately leading to improved patient outcomes and reduced healthcare costs. Hence, market players are actively advancing AI-powered prediction solutions in the cardiology domain. For instance, in May 2024, iHealthScreen created and approved risk prediction models for cardiovascular diseases by utilizing retinal color images of individuals, along with their health data.

Medical Condition Insights

The ischemic heart disease /CAD segment dominated the AI in cardiology market, with the largest share of 38.15% in 2025. The growth is attributed to the rising prevalence of CAD/IHD. Through advanced algorithms and machine learning techniques, AI analyzes medical images, genetic data, and patient health records to detect early signs of IHD/CAD, predict patient outcomes, and personalize treatment plans. For instance, in February 2024, the founders of Cincinnati-based Genexia developed AI technology to assess CAD risk during mammograms, offering women an additional preventative diagnostic health marker.

The cardiac arrhythmias segment is expected to grow at the fastest CAGR over the forecast period. Atrial Fibrillation (AF) is one of the most common clinically significant cardiac arrhythmias associated with various cardiovascular complications such as stroke and increased mortality. AI algorithms have significantly enhanced routine digital devices and diagnostic technology, enabling large-scale population screening and improved diagnostic assessments. For instance, in October 2023, researchers at the Smidt Heart Institute at Cedars-Sinai discovered that an AI algorithm can identify abnormal heart rhythms in asymptomatic individuals. This algorithm, capable of detecting concealed signals within standard medical diagnostic tests, could aid physicians in preventing stroke and various other cardiovascular difficulties in individuals with Atrial Fibrillation (AF).

Regional Insights

North America dominated the AI in cardiology market with a revenue share of 46.79% in 2025. Advancements in AI & ML technologies, growing demand for early & accurate diagnosis, strategic initiatives by market players, and increasing prevalence of cardiovascular diseases are key factors expected to drive the regional market. For instance, in April 2024, GE HealthCare launched Caption AI, an AI software designed for quick cardiac assessments at the point of care on Vscan Air SL devices. This innovative technology provides clinicians with real-time guidance for capturing high-quality images and automated ejection fraction estimation, facilitating informed clinical decisions in various cardiac settings.

U.S. AI In Cardiology Market Trends

The advancements in ML drive the AI in cardiology industry in the U.S. & deep learning technologies can enable the development of refined algorithms to analyze complex medical data, such as imaging & genetic information, to provide early detection, personalized treatment plans, and improved patient outcomes. For instance, in April 2024, Eko Health received FDA approval for its Low EF detection AI. This advancement enables U.S. healthcare providers to identify Low Ejection Fraction (EF), a crucial indicator of heart failure, within 15 seconds after using an Eko stethoscope during routine physical examinations. This breakthrough in early detection represents notable advancements in cardiovascular disease diagnosis.

Europe AI In Cardiology Market Trends

The AI in cardiology industry in Europe is expected to be driven by the region’s significant regulatory support for AI innovation, substantial funding from EU authorities & national governments, and well-established healthcare infrastructure are key factors expected to propel the regional market. For instance, in December 2023, the EU announced a provisional agreement on the basic content of the upcoming Artificial Intelligence Act (AI Act) to promote ethical data safeguarding and transparency regarding the usage of AI applications. The proposed legislation, anticipated to take effect between May 2024 and July 2024, was released early, providing stakeholders with a view of the Act’s structure.

The UK AI in cardiology market is expected to be driven by increased efforts of market players to promote AI-powered devices and tools in treating heart disorders. For instance, in November 2023, GP clinics in Wales and London announced participation in a trial deploying an AI-powered tool to improve the diagnosis of heart failure. The TRICORDER program, funded by a USD 1.3 million (EUR 1.2 million) award from the National Institute for Health and Care Research (NIHR) and led by researchers at Imperial College London, would provide AI-enabled smart stethoscopes to 100 primary care practices.

The AI in cardiology market in Germany is expected to grow due to the increasing number of R&D activities. In March 2024, researchers at Deutsches Herzzentrum der Charité announced a collaboration with the Mayo Clinic to study the telemedical monitoring of advanced heart failure patients using voice analysis. The study employs AI technology developed by a Berlin startup.

Asia Pacific AI In Cardiology Market Trends

The Asia Pacific AI in cardiology industry is expected to witness growth driven by the increasing prevalence of cardiovascular diseases in multiple countries, which is expected the boost demand for more efficient and accurate diagnostic & treatment solutions. A key factor driving market growth is the rising elderly population in the Asia Pacific region. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, approximately 697 million individuals aged 60 years or older lived in Asia and the Pacific region, constituting approximately 60% of the global older population. The elderly population is more susceptible to cardiovascular diseases, and the increase is leading to a higher demand for artificial intelligence in cardiology devices.

The Japan AI in cardiology market is expected to grow, due to the increasing collaborations among universities, hospitals, and companies. For instance, in October 2023, Mount Sinai's Icahn School of Medicine announced signing a Memorandum of Understanding (MoU) with the Chiba Institute of Technology (CIT), establishing a collaborative partnership to leverage AI in cardiovascular disease research. This initiative is designed to enhance the efficiency of clinical trials, accelerate improvements in patient care, and expedite the introduction of potential new treatments for individuals suffering from heart conditions.

The AI in cardiology market in India is expected to be driven by the high prevalence of cardiovascular diseases and increasing investments in healthcare technology. Collaborations between healthcare providers and technology companies promote the development & deployment of AI-driven cardiology solutions. For instance, in September 2022, Wipro GE Healthcare launched the first 'Made in India' Optima IGS 320, an AI-based Cath lab, to develop cardiac care in India. Developed at Wipro GE Healthcare's new factory in Bengaluru under the Production-linked Incentive (PLI) scheme, the Cath lab utilizes GE's proprietary AutoRight technology. AutoRight, powered by Edison, is the neural network-based interventional image chain featuring AI that optimizes image and dose parameters in real time, allowing clinicians to focus on patient care.

Moreover, in March 2025, Kanpur's Cardiology Institute integrated AI technology to enhance advanced cardiac care. This initiative aims to improve diagnostic accuracy and treatment outcomes for patients with heart conditions.

Key AI In Cardiology Company Insights

Strategic initiatives, including partnerships, new launches, collaborations, & acquisitions, foster innovation and accelerate the development & deployment of AI solutions in cardiology. For instance, in November 2023, VERSICLES TECHNOLOGIES PVT LTD, a Kerala, India-based startup, launched an AI-based digital health kiosk that claimed to offer basic diagnostics, such as blood sugar, blood pressure, and heart conditions, in multiple languages at the lowest cost. These initiatives are often aimed at integrating AI with existing healthcare infrastructure to enhance diagnostic accuracy and improve patient outcomes.

Furthermore, in October 2023, Ultromics Limited received approval from the Centers for Medicare & Medicaid Services (CMS) for the New Technology Add-On Payment (NTAP) for its AI system, EchoGo Heart Failure. This technology is a diagnostic aid for Heart Failure with Preserved Ejection Fraction (HFpEF) during routine echocardiography assessments.

Key AI In Cardiology Companies:

The following are the leading companies in the ai in cardiology market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Heartflow, Inc.

- IDOVEN

- CardiAI

- Ultromics Limited

- Arterys Inc. (Tempus AI)

- Ultrasight

- Koninklijke Philips N.V.

- Vista AI

- Viz.ai, Inc.

- RSIP Vision

- Cleerly, Inc.

- Medical AI Co., Ltd.

- anumana, Inc.

- Aidoc

- Circle Cardiovascular Imaging Inc.

- Eko Health, Inc.

- cardiomatics.com

Recent Developments

-

In June 2025, HeartSciences received FDA Breakthrough Device designation for its AI-driven ECG algorithm, designed to detect moderate-to-severe aortic stenosis. Trained on more than 120,000 ECG records, the model can predict the disease up to 24 months before confirmatory echocardiography, with high diagnostic accuracy.

-

In May 2025, Anumana expanded its AI platform to encompass complete cardiovascular care, beyond diagnostic ECG-AI technology, into perioperative and acute cardiac care. The company is developing generative AI imaging and visualization technologies to enhance heart patient outcomes.

-

In March 2025, Fujifilm collaborated with Us2.ai to implement AI automation in echocardiography. This collaboration integrates Us2.ai's AI-driven analysis with Fujifilm's LISENDO 800 Ultrasound System, enabling fully automated assessments of heart chambers.

-

In March 2025, Cleerly showcased its advanced AI heart imaging technology at the American College of Cardiology's Chicago Community Health Fair. The company demonstrated FDA-cleared heart image analyses using mobile scanners in collaboration with Corazon Imaging and Philips, aiming to enhance awareness of cardiovascular health and improve diagnostics.

-

In March 2025, GE HealthCare expanded its invasive cardiology solutions by introducing the AltiX AI.i edition of Mac-Lab, CardioLab, and ComboLab systems.

-

In January 2025, Philips and Myocardial Solutions partnered to enhance AI-powered cardiac MR imaging.

-

In May 2024, InfoBionic.Ai partnered with HBox.ai to develop a comprehensive cardiovascular care solution for the “Cardiology Clinic of the Future.” This collaboration combines the advanced cardiac telemetry of InfoBionic.Ai with the virtual care model of HBox.ai, providing AI-driven tools for virtual consultations, remote monitoring, and diagnostic care.

-

In April 2024, Viz.ai partnered with iCardio.ai to enhance aortic stenosis detection through the integration of ultrasound imaging and artificial intelligence.

-

In April 2024, the Faithful Innovation Project consortium, led by Idoven and supported by EIT Health, initiated the development of an AI-based solution for ECGs to reduce heart failure-related hospitalizations in Europe by 40%.

-

In January 2024, Cleerly launched Cleerly ISCHEMIA, cleared by the U.S. FDA under the 510(k) medical device category. Leveraging AI technology, Cleerly ISCHEMIA assesses coronary vessel ischemia’s potential presence or absence by analyzing quantitative data on stenosis, atherosclerosis, & notable vascular morphology from patients’ CCTA images.

-

In October 2023, Ultromics Limited obtained approval for the New Technology Add-On Payment (NTAP) from the Centers for Medicare & Medicaid Services (CMS) for its AI system, EchoGo Heart Failure. This technology is a diagnostic aid for Heart Failure with Preserved Ejection Fraction (HFpEF) during routine echocardiography assessments.

AI In Cardiology Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.22 billion

Revenue forecast in 2033

USD 14.83 billion

Growth rate

CAGR of 31.17% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, medical condition, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Heartflow, Inc.; IDOVEN; CardiAI; Ultromics Limited; Arterys Inc. (Tempus AI); Ultrasight; Koninklijke Philips N.V.; Vista AI; Viz.ai, Inc.; RSIP Vision; Cleerly, Inc.; Medical AI Co., Ltd.; anumana, Inc.; Aidoc; Circle Cardiovascular Imaging Inc.; Eko Health, Inc.; cardiomatics.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Cardiology Market Report Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global AI in cardiology market report based on component, application, medical condition, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnosis

-

Prediction

-

Drug Discovery

-

Others

-

-

Medical Condition Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiac Arrhythmias

-

Heart Failure

-

Ischemic Heart Disease /CAD

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in cardiology market size was estimated at USD 1.69 billion in 2025 and is expected to reach USD 2.22 billion in 2026.

b. The global artificial intelligence in cardiology market is expected to grow at a compound annual growth rate of 31.17% from 2026 to 2033 to reach USD 14.83 billion by 2033.

b. North America dominated the AI in cardiology market with a share of over 46.79% in 2025. This is attributable to well-established healthcare infrastructure, rapid adoption of technologically advanced products, and increasing regulatory approvals of AI products in the region.

b. Some key players operating in the artificial intelligence in cardiology market include GE Healthcare; Heartflow, Inc.; IDOVEN; CardiAI; Ultromics Limited; Arterys Inc. (Tempus AI); Ultrasight; Koninklijke Philips N.V.; Vista AI; Viz.ai, Inc.; RSIP Vision; Cleerly, Inc.; Medical AI Co., Ltd.; anumana, Inc.; Aidoc; Circle Cardiovascular Imaging Inc.; Eko Health, Inc.; cardiomatics.com

b. Key factors that are driving the market growth include the high burden of cardiovascular diseases worldwide, the growing interest of cardiac physicians to improve accuracy in diagnosing heart diseases, and technological advancement in cardiac imagining.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.