- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Dry PVC Compounds Market Size, Report, 2030GVR Report cover

![Asia Pacific Dry PVC Compounds Market Size, Share & Trends Report]()

Asia Pacific Dry PVC Compounds Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Films And Sheets, Wires And Cables, Pipes And Fittings), By End-use (Automotive, Building & Construction, Consumer Goods), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-090-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

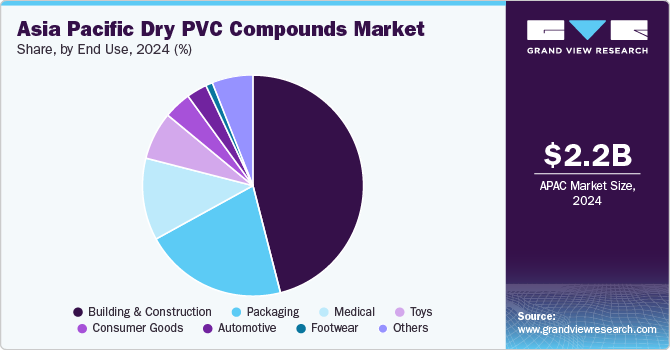

The Asia Pacific dry PVC compounds market size was valued at USD 2.16 billion in 2024 and is expected to grow at a CAGR of 10.62% from 2025 to 2030. The market is primarily driven by the expansion of numerous significant application areas, such as personal and home care, medicines, food and beverage, and the increasing penetration of e-retail in the region.

There is an increasing shift toward sustainable and specialty formulations as environmental awareness grows among both manufacturers and consumers. This trend is fueled by rising regulatory pressures and a more discerning consumer base seeking materials that minimize environmental impact. For instance, the demand for non-toxic, lead-free, and phthalate-free PVC compounds is growing, especially in the construction, automotive, and consumer goods sectors. Additionally, eco-friendly formulations, including bio-based and recycled PVC compounds, are gaining traction, supported by various government incentives and corporate sustainability programs, particularly in key markets such as China, Japan, and South Korea. This trend is driving significant R&D investment within the region and fostering innovation in developing PVC compounds that meet high standards of safety, performance, and sustainability.

Drivers, Opportunities & Restraints

The rapid growth of construction and infrastructure projects across Asia Pacific is a major driver for the dry PVC compounds market. With extensive urbanization and industrialization, especially in emerging economies like India, China, Indonesia, and the Philippines, there is a rising need for durable, cost-effective materials for applications like pipes, cables, window profiles, and flooring. PVC compounds are favored in these applications due to their resilience, affordability, and adaptability in diverse climates. Government-backed infrastructure programs, including China’s Belt and Road Initiative and India’s Smart Cities Mission, are set to boost demand for PVC-based products significantly. This expansion not only creates substantial growth avenues for PVC compound manufacturers but also intensifies competition within the market, pushing companies to optimize production capabilities to cater to large-scale demand.

In recent years, there has been an upward trend in the use of dry PVC compounds within the medical and healthcare sectors across Asia Pacific. As countries like Japan, South Korea, China, and India invest heavily in upgrading healthcare infrastructure, the demand for medical-grade PVC compounds, especially those used in flexible tubing, blood bags, and other medical disposables, is surging. These compounds are popular due to their cost-efficiency, durability, and sterilizability, meeting stringent medical standards and regulatory requirements. The shift toward advanced healthcare systems and the increasing prevalence of medical tourism in countries like Thailand and Malaysia further bolster this opportunity. For manufacturers, this sector represents a promising niche to develop specialized PVC compounds that are compliant with healthcare regulations, enhancing both market presence and profit margins.

The market faces a significant restraint in the form of raw material price volatility, particularly with respect to ethylene and chlorine, which are key inputs in PVC production. Market fluctuations in crude oil and natural gas prices, often impacted by geopolitical tensions, supply chain disruptions, and energy market dynamics, directly affect the cost structure of PVC compound manufacturers. Additionally, environmental policies in regions like China have led to stricter production controls, sometimes causing supply shortages and further driving up costs. For smaller manufacturers, these price uncertainties can strain profit margins and limit investment in R&D or production capacity expansion. This volatility places added pressure on companies to strategize effectively, from securing stable supplier agreements to adopting alternative production processes, in order to mitigate potential losses.

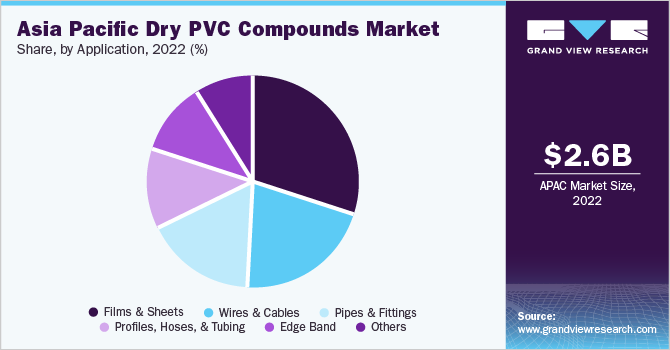

Application Insights

Based on application, the pipes and fittings segment led the market with a revenue share of 30.99% in 2024 owing to large-scale urban infrastructure and water management initiatives across the region. As countries like China, India, Indonesia, and Vietnam continue to experience rapid urbanization, governments and private developers are increasingly investing in resilient water distribution, sewage systems, and sanitation networks to meet the needs of expanding urban populations. Dry PVC compounds are essential in these projects due to their corrosion resistance, longevity, and ease of installation, making them a preferred material for pipes in potable water supply and wastewater management.

The growth of the wires and cables segment is primarily driven by the region’s expansive telecommunication and electrification projects. Emerging economies, particularly India, Indonesia, and the Philippines are investing heavily in modernizing power grids, expanding rural electrification, and rolling out 5G networks, which require a substantial volume of PVC-insulated wires and cables for efficient, cost-effective installation. The resilience of PVC compounds against fire and moisture makes them suitable for protective cable sheathing in high-demand applications, ensuring safety in residential, industrial, and commercial settings.

End Use Insights

Based on end use, the building & construction segment dominated the market with the largest revenue share of 47.41% in 2024, driven by the surge in real estate development and large-scale government housing initiatives. Rapid urbanization in countries such as China, India, and Vietnam has created an immense demand for affordable and durable construction materials, positioning dry PVC compounds as a preferred choice for applications like flooring, wall panels, windows, doors, and roofing. Known for their cost-effectiveness, durability, and ease of installation, PVC compounds support faster and more economical construction, making them essential in mass housing projects aimed at middle- and low-income populations. Programs like China’s affordable housing scheme and India’s Pradhan Mantri Awas Yojana (PMAY) prioritize sustainable and low-cost housing, further driving demand for PVC-based building materials.

The automotive segment is poised to grow at a significant rate from 2025 to 2030. This can be attributed to the region’s push toward electric vehicles (EVs) and the automotive industry’s focus on lightweight materials to improve fuel efficiency. Leading automotive markets, such as China, Japan, and South Korea, are heavily investing in EV manufacturing and infrastructure, where PVC compounds are utilized in interior components, cable insulation, and protective coverings. Due to their lightweight properties, cost-effectiveness, and resistance to corrosion, dry PVC compounds are ideal for automotive components that need to be durable and perform reliably under various conditions.

Country Insights

China Dry PVC Compounds Market Trends

China dominated the Asia Pacific dry PVC compounds market and accounted for the largest revenue share in 2024. As China continues its shift from traditional manufacturing to high-tech industries, the demand for durable, adaptable PVC compounds has surged, especially in electronics, automotive, and construction applications. Government initiatives, such as “Made in China 2025,” aim to advance high-tech manufacturing and upgrade infrastructure, creating substantial demand for PVC materials in pipes, wiring, and structural components.

India Dry PVC Compounds Market Trends

In India, the booming real estate sector and extensive rural electrification programs are major drivers for the dry PVC compounds market. With urban migration and a rapidly growing middle class, there is an increasing demand for affordable housing, which relies heavily on cost-effective and durable materials like PVC compounds for applications in piping, flooring, and window frames. Additionally, the Indian government’s “Housing for All” initiative aims to construct millions of low-cost homes, further driving the demand for PVC-based construction materials.

Key Asia Pacific Dry PVC Compounds Company Insights

The Asia Pacific dry PVC compounds market is highly competitive, with several key players dominating the landscape. Major companies include TP Polymer Private Limited, NHAT HUY GROUP, AGC Vinythai, Shin-Etsu Chemical Co., Ltd., Prism Masterbatches, Sinochem Holdings Corporation Ltd., Hanwha Solutions, Xinjiang Zhongtai Chemical Co., Ltd., SCG Chemicals Public Company Limited, NAN YA PLASTICS CORPORATION, East Hope Group, Vinacompound Co. Ltd., Teknor Apex, and RIKEN TECHNOS CORP. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Asia Pacific Dry PVC Compounds Companies:

- TP Polymer Private Limited

- NHAT HUY GROUP

- AGC Vinythai

- Shin-Etsu Chemical Co., Ltd.

- Prism Masterbatches

- Sinochem Holdings Corporation Ltd.

- Hanwha Solutions

- Xinjiang Zhongtai Chemical Co., Ltd.

- SCG Chemicals Public Company Limited

- NAN YA PLASTICS CORPORATION

- East Hope Group

- Vinacompound Co. Ltd.

- Teknor Apex

- RIKEN TECHNOS CORP

Recent Developments

-

In July 2024, Adani Group announced plans to establish a petrochemical project in Mundra, Gujarat, aimed at addressing India's growing demand for polyvinyl chloride (PVC). Currently, India requires about 4 million tons of PVC annually, but domestic production only meets 1.5 million tons, leading to a significant supply gap.

-

In January 2020, South Korea implemented a ban on certain hard-to-recycle plastics in food and beverage packaging as part of its strategy to cut plastic waste by 50% and boost recycling rates from 34% to 70% by 2030. The ban specifically targets PVC and colored PET bottles, which are more difficult to recycle than clear PET bottles. This regulation is enforced under the Act on the Promotion of Saving and Recycling of Resources.

Asia Pacific Dry PVC Compounds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.37 billion

Revenue forecast in 2030

USD 3.94 billion

Growth rate

CAGR of 10.62% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors and trends

Segments covered

Application, end use, country

Regional scope

Asia Pacific

Country Scope

China; Japan; India; Australia; Southeast Asia

Key companies profiled

TP Polymer Private Limited; NHAT HUY GROUP; AGC Vinythai; Shin-Etsu Chemical Co., Ltd.; Prism Masterbatches; Sinochem Holdings Corporation Ltd.; Hanwha Solutions; Xinjiang Zhongtai Chemical Co. Ltd.; SCG Chemicals Public Company Limited; NAN YA PLASTICS CORPORATION; East Hope Group; Vinacompound Co. Ltd.; Teknor Apex, RIKEN TECHNOS CORP

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Dry PVC Compounds Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Asia Pacific dry PVC compounds market report on the basis of application, end use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Films & Sheets

-

Wires & Cables

-

Pipes & Fittings

-

Profiles, Hoses, & Tubing

-

Edge Band

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Consumer Goods

-

Packaging

-

Medical

-

Footwear

-

Toys

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

Australia

-

Southeast Asia

-

Frequently Asked Questions About This Report

b. The global Asia Pacific dry PVC compounds Market size was estimated at USD 2.16 billion in 2024 and is expected to reach USD 2.37 billion in 2025.

b. The global Asia Pacific dry PVC compounds market is expected to grow at a compound annual growth rate of 10.62% from 2025 to 2030 to reach USD 3.94 billion by 2030.

b. Based on application, the pipes and fittings segment led the market with a revenue share of 30.99% in 2024 owing to large-scale urban infrastructure and water management initiatives across the region.

b. Some key players operating in the Asia Pacific dry PVC compound market include TP Polymer Private Limited, NHAT HUY GROUP, AGC Vinythai, Shin-Etsu Chemical Co., Ltd., Prism Masterbatches, Sinochem Holdings Corporation Ltd., Hanwha Solutions, Xinjiang Zhongtai Chemical Co., Ltd., SCG Chemicals Public Company Limited, NAN YA PLASTICS CORPORATION, East Hope Group, Vinacompound Co. Ltd., Teknor Apex, and RIKEN TECHNOS CORP.

b. The market is primarily driven by the expansion of numerous significant application areas, such as personal and home care, medicines, food and beverage, and the increasing penetration of e-retail in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.