- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Flooring Market Size And Share Report, 2030GVR Report cover

![Asia Pacific Flooring Market Size, Share & Trends Report]()

Asia Pacific Flooring Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Ceramics, Vitrified, Carpet, Vinyl, LVT), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-731-5

- Number of Report Pages: 126

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

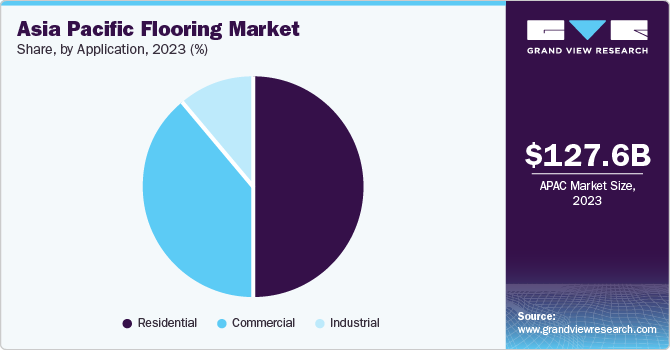

The Asia Pacific flooring market size was valued at USD 127.56 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030. The growth of the market in this region can be attributed to the positive outlook of flooring manufacturers toward the overall construction industry in the region. Moreover, the surging demand for aesthetically pleasing, durable, and easy-to-maintain flooring products such as vinyl flooring, vitrified (porcelain) tiles, and ceramic tiles is projected to lead to the growth of the market in Asia Pacific over the forecast period.

The construction industry in Asia Pacific is anticipated to witness significant growth over the forecast period owing to the presence of China, India, Indonesia, and Vietnam, which are some of the key construction markets in the region. Factors such as stable exchange rates of Asian countries, subdued oil prices in China, and a moderate inflation rate lead to the overall economic growth of these countries. This, in turn, drives the construction of residential and commercial establishments in Asia Pacific.

The establishment of distribution channels that cater to the requirements of consumers acts as a challenge for the market players. The distributors of flooring materials are appointed by manufacturers based on geographies served by them, as well as by their warehousing capabilities, capital investments, and logistics. Moreover, material handling is a concern to ensure the safe delivery of ceramic tiles to end users.

Prominent players in the value chain are engaged in providing flooring installation services to end users along with post-installation care. This increases profit margins of industry players. Logistics bridges manufacturing and retail. There is high traffic in trade of flooring solutions such as tiles, carpets, and laminates between countries and regions. Cost, design, and aesthetics also play an important role in terms of selecting the flooring options. The availability of a wide choice to consumers, presence of sales offices of key manufacturers across the region, and provision of services to consumers have resulted in high trade volume of flooring solutions.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The Asia Pacific flooring industry has seen continuous technological advancements in terms of raw materials and production processes for various flooring types such as engineered wood flooring and resilient floorings such as vinyl flooring, linoleum flooring, and luxury vinyl tiles. This has enabled manufacturers to develop realistic tiles duplicating the natural looks of other flooring products such as stone and wood.

The Asia Pacific flooring market is governed by a number of regulations and standards with regard to its use and production. Several agencies, such as the Indian Standards, Japanese Industrial Standard, Standards NZ, and The International Organization for Standardization, have levied regulations for floorings. These regulations are related to the strength, stability, weather, moisture, and fire resistance.

Major players in the market are opting for various strategies to strengthen their market position. For instance, Kajaria Ceramics Limited acquired an 82.37% share in Jaxx Vitrified Private Limited. With this acquisition, Kajaria Ceramics Limited extended its product portfolio in vitrified & ceramic tiles.

Application Insights

Residential application accounted for largest market revenue share in 2023. This is attributed to increasing construction of single family and multi-family homes in the region. In addition, subsidies from governments for first-time homebuyers in developing and developed economies have positively affected growth of residential sector. Countries such as Australia, South Korea, the Philippines, and India have announced various schemes to support development of real estate sector. These schemes are partially or fully funded by governments in these countries, which, in turn, benefit the demand side of the construction sector.

Commercial applications in Asia Pacific are subject to high foot traffic and, therefore, require durable floorings such as resilient and wooden. Increasing construction of commercial buildings, such as drugstores, grocery stores, and big-box stores, in emerging economies such as India, Malaysia, Indonesia, Vietnam, and Philippines in past few years, is expected to benefit growth of segment in coming years. Moreover, robust demand for office spaces, especially in urban areas of emerging economies, is boosting the demand for high-quality commercial flooring products.

Product Insights

Ceramic flooring tiles dominated the market and accounted for a share of 23.7% in 2023. The market growth is attributed to its characteristics including scratch and stain resistance, durability, and recyclability. These flooring tiles are made from white clay, calcite, kaolinite clay, sand, dolomite, talc, etc. All these materials are mixed in a required ratio for development of lightweight and durable ceramic tiles.

Solid wood flooring is made using planks milled from a single piece of timber. It is vulnerable to moisture and thus, is not preferred for humid areas. A small amount of moisture is sufficient to deteriorate solid wood flooring. These floorings are aesthetically pleasing owing to their natural wood grain patterns and offer warmth and richness to interiors. Moreover, they are easy to install. Solid wood flooring offers richness and durability and can be maintained to retain its original look for long. However, it is expensive and not preferred for humid areas.

Regional Insights

Asia Pacific is one of the largest consumers of flooring products in the world. Factors such as increasing investments in development of affordable housing units and smart cities, as well as in upgradation of existing infrastructures and the construction of new ones, are anticipated to fuel the demand for these products in the region. Moreover, the surge in investments to promote growth of tourism sector in region is also anticipated to boost the demand for flooring products in Asia Pacific over forecast period.

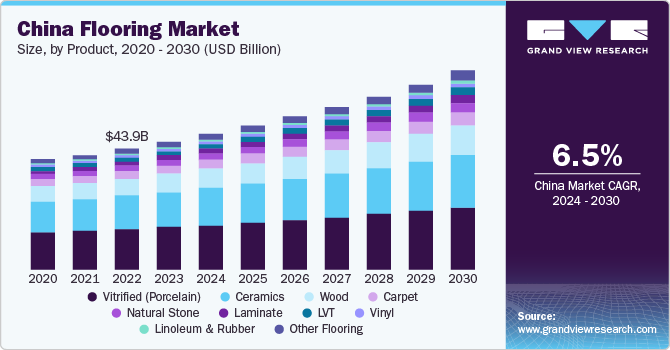

China dominated market and accounted for a 36.4% revenue share in 2023. The easy availability of essential resources and skilled labor at a low cost, along with presence of favorable government regulations related to flooring, are prime factors attracting multinational companies to invest in country for business expansions. This has created scope for construction of new office buildings and work facilities, thereby driving demand for flooring products used in office spaces in China. In addition, flooring market in China is expected to flourish in coming years with presence of multinational manufacturers and easy availability of skilled workforce and raw materials. In addition, industrial development in country is anticipated to support the growth of flooring market in China over forecast period.

The construction industry in Japan has witnessed significant growth in past few years owing to its ongoing industrial development and growing economy. Commercial and residential construction activities together accounted for a major share of the overall development of the construction industry in country. In addition, adoption of new tools and construction technologies has accelerated demand for improved building materials. As such, flooring products with varied types, colors, sizes, and finishes are gaining popularity in commercial and residential flooring applications in Japan.

Key Companies & Market Share Insights

Some of key players operating in market include Kajaria Ceramics Limited; MOHAWK INDUSTRIES, INC., RAK Ceramics, and Shaw Industries Group, Inc.

-

RAK Ceramics designs and manufactures ceramic tiles and sanitary ware for residential & commercial purposes. It majorly serves the Asia Pacific and European regions, with over 40 subsidiaries operating in tiles, bathroom fittings, and tableware.

-

Kajaria Ceramics Limited offers floor tiles and wall tiles. Its floor tiles are classified into ceramic tiles, polished vitrified tiles, paving tiles, and glazed vitrified tiles. The company produces over 800 types of ceramic floor tiles, over 147 types of polished vitrified tiles, more than 850 types of glazed vitrified tiles, and over 84 types of paving tiles.

-

TOLI Corporation, Forbo Flooring Systems, and Milliken & Company. are some of the emerging market participants in the Asia Pacific flooring market.

-

TOLI Corporation is engaged in manufacturing curtains, carpets, wall coverings, vinyl sheets & tiles, and other interior goods for residential and commercial buildings. The company has 40 sales offices and 4 showrooms located across Asia Pacific and Middle East. It operates through two subsidiaries, namely Toli Corporation Japan and Toli Floor Middle East.

-

Milliken & Company manufactures and markets chemicals, composite materials, floor coverings, industrial textiles, performance wear, work wear, protective fabrics, and specialty textiles. It has over 40 manufacturing facilities located in UK, U.S., China, Australia, India, France, and Belgium. The company has sales operations in North America, Europe, and Asia Pacific.

Key Asia Pacific flooring Companies:

- TOLI Corporation

- AHF, LLC.

- Forbo Flooring Systems

- Interface, Inc.

- Gerflor Group

- RAK CERAMICS

- Tarkett

- Shaw Industries Group, Inc.

- Polyflor Ltd

- Karndean

- Carpet One Australasia Pty Ltd

- Kajaria Ceramics Limited

- Ceramiche Atlas Concorde S.p.A.

- Milliken & Company

- EGGER

- MOHAWK INDUSTRIES, INC.

Recent Developments

-

In January 2023, Ceramiche Atlas Concorde S.p.A announced completion of a new plant that has started production of large-format porcelain slabs from May 2023. This initiative is expected to help Ceramiche Atlas Concorde S.p.A. consolidate leadership of Atlas Concorde as its international partner for all ceramic products.

-

In September 2022, TOLI Corporation announced relocation of TOLI (Shanghai) Corporation office, which sells and purchases brand products in China. This relocation was part of business expansion plan.

Asia Pacific Flooring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 165.50 billion

Revenue forecast in 2030

USD 190.64 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Asia Pacific

Country scope

China; Japan; India; South Korea; Australia; New Zealand; Malaysia; Indonesia; Philippines; Vietnam; Taiwan; Thailand; Singapore

Key companies profiled

TOLI Corporation; AHF; LLC.; Forbo Flooring Systems; Interface; Inc.; Gerflor Group; RAK CERAMICS; Tarkett; Shaw Industries Group; Inc.; Polyflor Ltd; Karndean; Carpet One Australasia Pty Ltd; Kajaria Ceramics Limited; Ceramiche Atlas Concorde S.p.A.; Milliken & Company; EGGER

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Flooring Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific flooring market report based on product, application, and region.

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Ceramics

-

Vitrified (Porcelain)

-

Carpet

-

Vinyl

-

LVT

-

Linoleum & Rubber

-

Wood

-

Solid Wood

-

Engineered Wood

-

Multiply Engineered

-

3-Ply Engineered

-

HDF Core Engineered

-

Others

-

-

Parquet

-

-

Laminate

-

Natural Stone

-

Other Flooring

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Malaysia

-

Indonesia

-

Philippines

-

Vietnam

-

Taiwan

-

Thailand

-

Singapore

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific flooring market size was estimated at USD 127.56 billion in 2023 and is expected to reach USD 134.5 billion in 2024.

b. The Asia Pacific flooring market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 190.64 billion by 2030.

b. China dominated the Asia Pacific flooring market with a share of 36% in 2023. This is attributable to increasing investments in residential and commercial construction and renovation activities.

b. Some of the key players operating in the Asia Pacific flooring market include Karndean Design Flooring, Armstrong Flooring, Inc., Carpet One Australasia Pty. Ltd., Kajaria Ceramics Limited, Toli Corporation, Shaw Industries Group, Inc., and others.

b. The key factors that are driving the Asia Pacific flooring market include a positive outlook toward the overall construction industry in the region, rising demand for aesthetically pleasing, durable, and easy to maintain flooring products such as vinyl flooring and ceramic tiles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.