- Home

- »

- Consumer F&B

- »

-

Australia Dairy Alternatives Market, Industry Report, 2033GVR Report cover

![Australia Dairy Alternatives Market Size, Share & Trends Report]()

Australia Dairy Alternatives Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Soy, Almond, Coconut, Rice, Oats), By Product (Milk, Yogurt, Cheese), By Distribution Channel (Convenience Stores, Online retail), And Segment Forecasts

- Report ID: GVR-4-68040-677-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Dairy Alternatives Market Summary

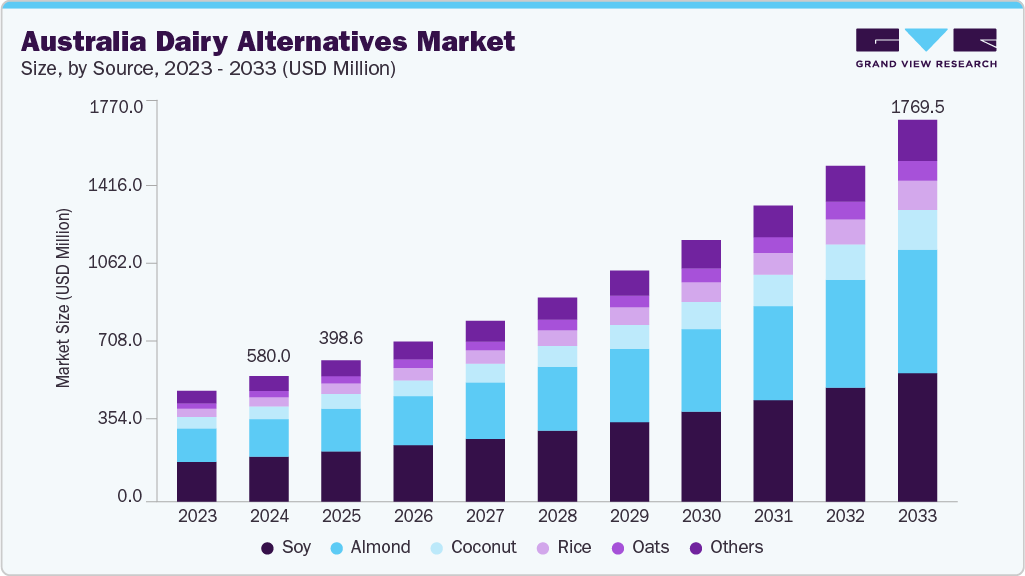

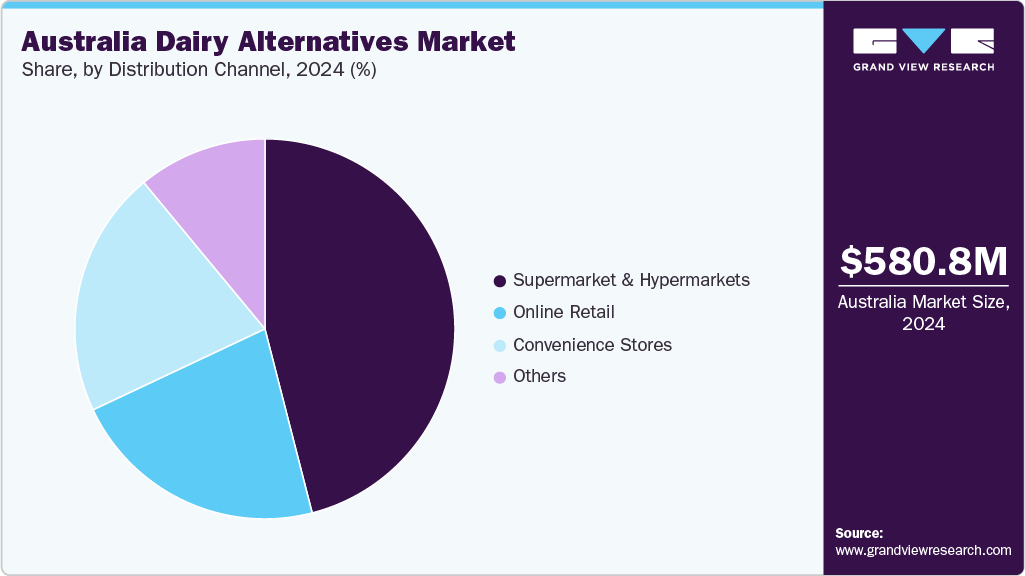

The Australia dairy alternatives market size was estimated at USD 580.8 million in 2024 and is projected to reach USD 1,769.5 million by 2033, growing at a CAGR of 13.2% from 2025 to 2033. The market is driven by rising health awareness, a shift toward a plant-based diet, and increasing awareness about sustainability in the country.

Key Market Trends & Insights

- By source, the soy segment held the highest market share of 35.4% in 2024.

- Based on product, the milk segment held the highest market share in 2024.

- By distribution channel, the supermarket & hypermarkets segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 580.8 Million

- 2033 Projected Market Size: USD 1,769.5 Million

- CAGR (2025-2033): 13.2%

Furthermore, government regulations around food labeling, health claims, and sustainability are encouraging transparency in ingredient sourcing and product formulation, which is expected to increase market demand. The increasing prevalence of lactose intolerance and dairy allergies drives the Australia dairy alternatives industry. In addition, a societal shift toward plant-based eating is also driving the market. In Australia, the vegan population has grown from roughly 250,000 in 2019 to about 1.3 million in 2024, meaning around 5% of the population now follows a vegan diet, a noteworthy 2% increase from 2023. This significant rise in the vegan population directly correlates with increased demand for plant-based products, which is expected to drive the growth of Australia dairy alternatives market and encourage both domestic and international brands to expand their product offerings.The diversity of dairy alternatives is rapidly expanding, with improved taste, nutrition, and applications. Companies are investing in barista-formulated oat milks, vegan cheeses, and fermented plant yogurts that mimic the taste and texture of dairy products. Supermarkets, cafes, and restaurants nationwide now carry a wide range of options, making plant-based dairy more accessible than ever. According to a report published by Convenience World in May 2024, Brownes Dairy launched its alternative dairy range, including oat, soy, and almond milks, designed specifically for cafes. Developed in partnership with Dimattina Coffee, the range is formulated to perform well in steaming and frothing, targeting the Western Australia foodservice sector for future opportunities.

Environmental sustainability and ethical concerns are driving the Australian dairy alternatives industry. Traditional dairy farming is associated with significant greenhouse gas emissions, high water usage, and land degradation. In contrast, plant-based dairy alternatives are generally considered more environmentally friendly, requiring fewer resources and creating less waste. This ecological advantage is significant to younger and environmentally conscious consumers motivated by climate change, animal welfare, and resource conservation concerns.

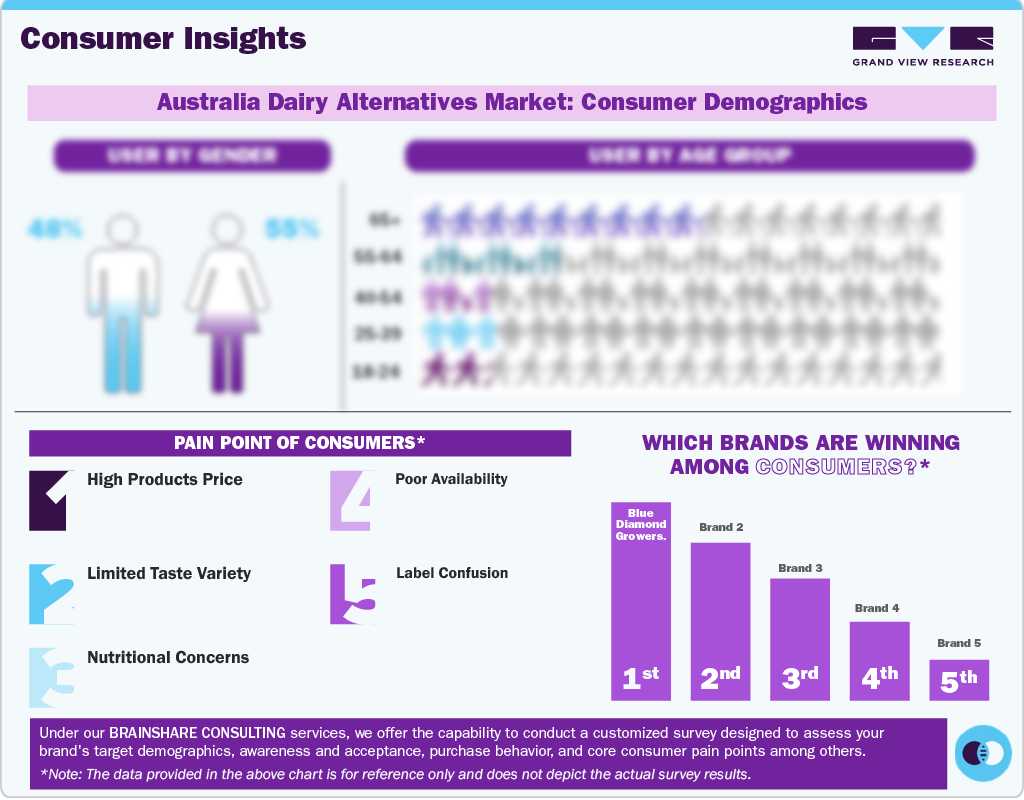

Consumer Insights

The dairy alternatives market in Australia reveals a steady shift in dietary preferences, driven by health awareness, environmental concerns, and changing social values. Many Australians are reducing their consumption of traditional dairy and exploring plant-based options such as oat, almond, soy, and coconut milks. This change is particularly pronounced among younger demographics, urban dwellers, and those identifying as flexitarians. These individuals are not strictly vegetarian or vegan but are consciously reducing their intake of animal products.

Health remains a key motivator, with many consumers choosing dairy alternatives due to lactose intolerance, dairy allergy, or a desire to lower saturated fat intake. Sustainability and animal welfare are also important, with more consumers seeking products that align with ethical and environmental values. In addition, improved taste, broader product availability, and the rising popularity of barista-style milks in cafes drive the demand for the Australia dairy alternatives industry.

Source Insights

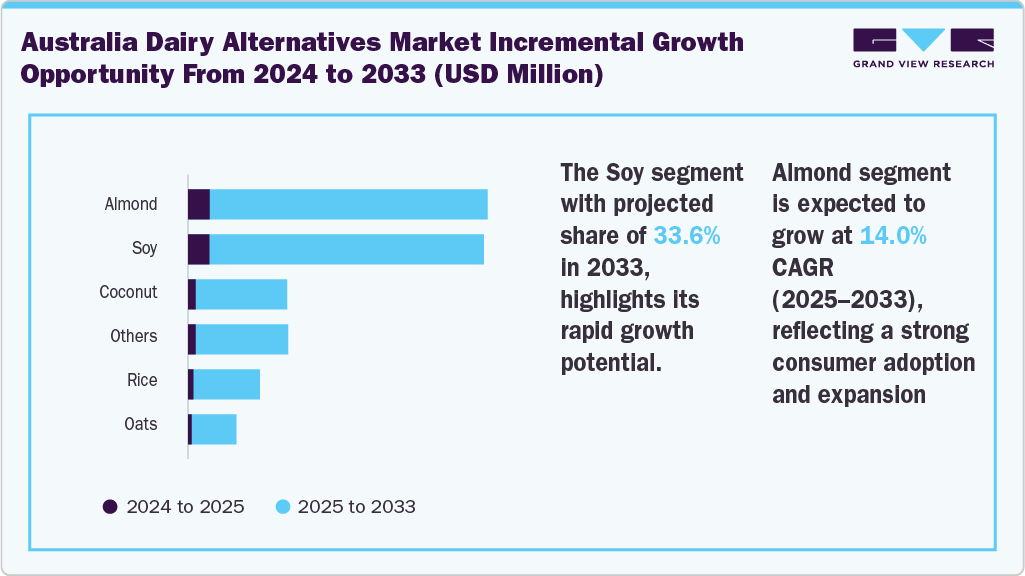

The soy segment dominated the market with a revenue share of 35.4% in 2024. High nutrition value, health benefits, and cost and supply advantages drive the demand for dairy alternatives in Australia. According to a study published by NIH in September 2024, plant-based milks, especially almond, oat, and soy, were calcium fortified; only a small percentage included other key nutrients such as vitamin B12 and iodine. Soy milk stood out nutritionally, matching cow milk in protein content. This positions soy milk as a leading option within the plant-based products for health-conscious consumers seeking a nutritionally comparable alternative to cow’s milk, particularly in terms of protein intake.

The almond segment is projected to experience the fastest CAGR of 14.0% from 2025 to 2033. A combination of health, lifestyle, and sustainability factors drives the market. Almond milk is widely perceived as a healthy, low-calorie beverage, often fortified with essential nutrients such as calcium and vitamin D, appealing to health-conscious consumers. Its naturally lactose-free and vegan-friendly profile also makes it suitable for individuals with dairy allergies, lactose intolerance, or those adopting plant-based or flexitarian diets.

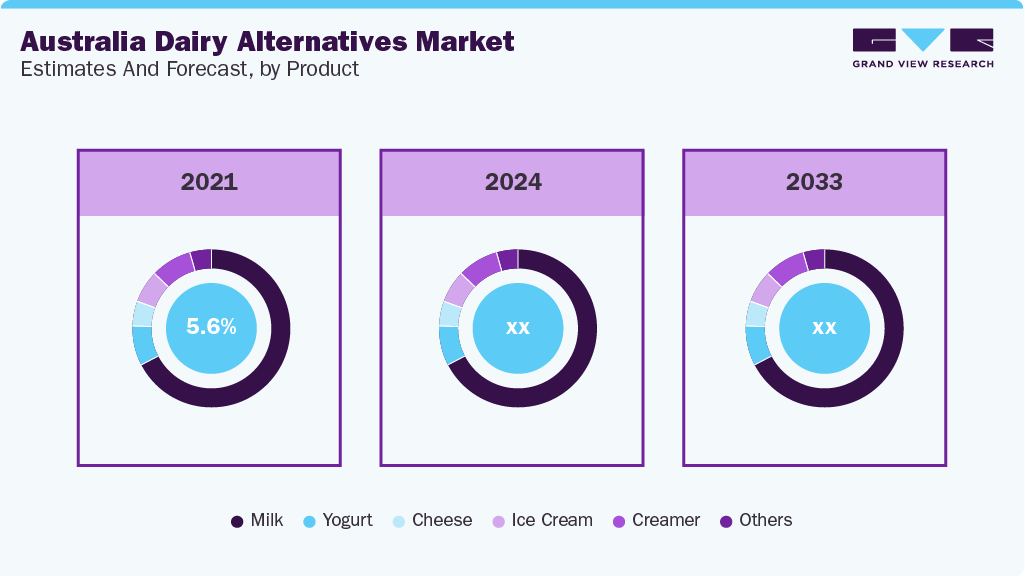

Product Insights

The milk segment held the largest revenue share of the Australian dairy alternative market in 2024. The market is driven mainly by innovation in flavors and category expansion through brand collaboration. The rising demand for low-calorie foods and the increasing popularity of plant-based nutritional products are expected to drive the demand for milk-based dairy alternatives in the coming years.

The ice cream segment is projected to experience the fastest CAGR from 2025 to 2033. Innovation in lactose-free products, sustainability, food waste reduction, and rising demand for dairy and allergy-free products are expected to drive the growth of Australia's dairy alternatives industry. According to a report by Let's Go Vegan in October 2024, Streets Blue Ribbon launched a vegan version of its iconic ice cream, earning praise for its creamy texture, rich flavor, and widespread retail availability in major stores such as Woolworths and Coles at a competitive price of USD 6.50 for a 2 L tub. The launch stands out in a competitive market by offering great taste and easy availability, making it a top choice among dedicated vegans and those seeking quality dairy-free treats.

Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the Australian dairy alternatives market in 2024, driven by wider product accessibility and private label expansion. These retail channels offer wide accessibility, enabling consumers to easily find a broad selection of plant-based dairy products such as almond, soy, oat, and coconut milks, as well as dairy-free yoghurts, cheeses, and ice creams. With increasing consumer demand for health-conscious, lactose-free, and sustainable food choices, supermarkets have rapidly expanded their plant-based offerings through well-known brands and private-label lines.

The online retail segment is anticipated to experience the fastest CAGR from 2025 to 2033. Rising adoption of digital technologies, booming e-commerce infrastructure, and evolving consumer preferences are expected to increase the demand for the Australia dairy alternatives industry. As more Australians embrace digital lifestyles and shop online, the demand for convenient, healthy food options such as dairy alternatives is growing. Some online retail sites selling dairy alternatives in the country are Woolworths Online, Coles Online, Harris Farm Markets, and IGA Online.

Key Australia Dairy Alternatives Company Insights

Some key players in the Australia dairy alternatives market include Danone, Sanitarium, PureHarvest, and Oatly Group AB.

-

Danone is a global food and beverage leader operating in over 120 countries. Its main business areas include essential dairy and plant-based products and specialized nutrition.

-

Oatly Group AB is a Swedish food company that develops, manufactures, and sells oat‑based alternatives to dairy, including oat drinks, yogurt, ice cream, and cooking creams under the Oatly brand in more than 20 countries.

Key Australia Dairy Alternatives Companies:

- Blue Diamond Growers

- Danone

- Sanitarium

- PureHarvest

- Oatly Group AB

Recent Developments

-

In July 2024, Sanitarium launched its PLANTWELL range, a lineup of dairy‑free milks specially formulated with clinically proven superfood ingredients. The range comprises a high‑protein soy milk with seaweed calcium and prebiotic fiber, an oat milk with plant sterols to help lower cholesterol, and an almond milk with beta‑glucans to support immune health.

-

In September 2024, Oatly Group AB launched three new oat drink variants in Australia: Full, Light, and Low‑Sugar. Each variant is tailored for different uses, such as cooking and baking; coffee; and tea, cereal, and reduced sweetness, respectively, strengthening its footprint in the growing plant-based dairy sector.

Australia Dairy Alternatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 580.8 million

Revenue forecast in 2033

USD 1,769.5 million

Growth rate

CAGR of 13.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Source, product, distribution channel

Key companies profiled

Blue Diamond Growers, Danone, Sanitarium, PureHarvest, Oatly Group AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Dairy Alternatives Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Australia dairy alternatives market report based on source, product, and distribution channel:

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Soy

-

Almond

-

Coconut

-

Rice

-

Oats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Milk

-

Yogurt

-

Cheese

-

Ice cream

-

Creamer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Distribution Channel

-

Supermarket & Hypermarkets

-

Convenience Stores

-

Online retail

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.