- Home

- »

- Automotive & Transportation

- »

-

Australia Forklift Market Size, Share & Growth Report, 2030GVR Report cover

![Australia Forklift Market Size, Share & Trends Report]()

Australia Forklift Market (2023 - 2030) Size, Share & Trends Analysis Report By Tonnage Capacity (Below 5 Ton, 6-30 Ton, Above 30 Ton), By Class, By Power Source, By Product Type, By State, And Segment Forecasts

- Report ID: GVR-4-68040-093-6

- Number of Report Pages: 87

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

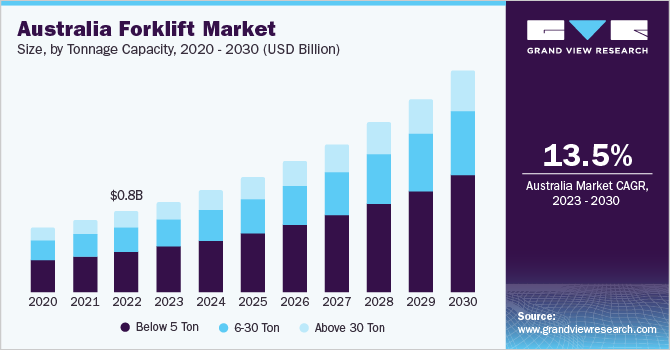

The Australia forklift market size was valued at USD 0.78 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 13.5% from 2023 to 2030. The rising demand for port-related operations drives the market’s growth. The country's robust economic growth and extensive global trade connections have propelled international commerce. Australia holds a prominent position as a major exporter of minerals, agricultural products, and liquefied natural gas commodities. Furthermore, the import of consumer goods, machinery, and industrial equipment has experienced substantial growth.

Hence, ports in Australia observe a notable increase in container material, necessitating efficient material handling solutions such as forklifts. With their versatility, maneuverability, and capability to handle heavy loads, forklifts have become essential equipment for port terminals, warehouses, and distribution centers.

In recent years, there has been a significant shift towards using electric forklifts in Australia due to a high emphasis on sustainability and reducing carbon emissions. growing government concern for the environment and the need to minimize harmful pollutants is resulting in a shift toward the adoption of electric material handling solutions.

Electric forklifts achieve this goal by producing no tailpipe emissions and enhancing indoor air quality which is increasing their preference among warehouse owners and product manufacturers. As environmental consciousness grows and regulations become more stringent, businesses increasingly move away from traditional ICE forklifts and embrace electric alternatives. The prioritization of sustainability and the need to optimize operations have made electric forklifts the preferred choice.

Fluctuating raw materials prices have emerged as a significant restraint on the growth of the Australia forklift market. The instability and unpredictability of costs for essential components such as steel, rubber, and fuel pose challenges for manufacturers and suppliers in maintaining consistent pricing and profitability. These price fluctuations disrupt production planning, inventory management, and the ability to offer competitive prices to customers. Hence, businesses considering investing in forklifts may hesitate due to the uncertain cost implications associated with these vital materials. This uncertainty affects the manufacturing and logistics sectors that rely on efficient material handling solutions.

The utilization of automation and robotics has brought about a transformative impact on the handling, transportation, and management of materials within industrial settings. Smart forklift machines are equipped with advanced sensors, computer vision capabilities, and artificial intelligence algorithms, enabling them to navigate intricate environments, execute tasks efficiently, and adapt to dynamic conditions.

By integrating sensor and camera technology into forklifts, businesses are experiencing significant productivity, safety, and operational efficiency improvements while minimizing the risks associated with human errors, accidents, and downtime. As a result, Australian companies are increasingly embracing autonomous forklifts to optimize their logistics and supply chain operations, thereby driving the growth of the Australia forklift market in the country.

The rising demand for efficient material handling solutions has prompted forklift manufacturers and suppliers to prioritize the development of cutting-edge technologies. These advancements aim to enhance the industry's productivity, safety, and sustainability. One notable area of progress is the integration of automation and artificial intelligence (AI) capabilities into forklifts. This includes the implementation of autonomous navigation systems and object detection mechanisms, resulting in improved accuracy and reduced human error.

Such innovations contribute to the overall efficiency of material handling operations. As a result, logistics, warehousing, and manufacturing industries can address their growing needs while aligning with sustainability goals. These technological advancements position Australia at the forefront of innovative forklift solutions and surge new business opportunities. By staying at the forefront of these developments, businesses can tap into the growing demand for advanced forklift technologies and cater to the evolving needs of various industries.

Tonnage Capacity Insights

The below 5 tons segment accounted for the largest market share of over 50.0% in 2022 and is anticipated to register the highest CAGR over the forecast period. The flexibility of these machines enables efficient and timely movement and transportation of goods. Moreover, the rising focus on workplace productivity and operational efficiency has led businesses to invest in the below 5-ton forklifts.

These forklifts offer improved maneuverability, compact size, and increased load capacities, enabling operators to navigate tight spaces and handle diverse loads easily. With continuous advancements in forklift technology and the increasing demand for agile material handling equipment, the demand for Below 5 Ton forklifts remains robust in Australia. They continue to play a vital role in enhancing overall productivity and safety in the industrial sector.

The 6-30 tons segment is expected to register significant growth over the forecast period. The rise of e-commerce has sparked a surge in demand for efficient material handling equipment, particularly larger capacity forklifts, to cater to the growing warehousing and logistics requirements.

Furthermore, the agricultural sector's push for mechanization to boost productivity and streamline operations has opened up opportunities for these forklifts to handle bulk materials such as fertilizers and produce. With a strong focus on sustainability and emission reduction, the shift towards electric forklifts emerges as a promising avenue for growth, given the increasing emphasis on environmental regulations and incentives. Hence, the Australian market exhibits substantial potential for expanding and adopting the segment across various industries.

Class Insights

The class 4/5 segment accounted for the largest market share of over 61.0% in 2022. The primary factors propelling the development of these forklifts are cutting-edge technology and design elements that amplify efficiency. These include electric or ICE, ergonomic controls, and enhanced lifting capabilities.

Moreover, the implementation of regulatory mandates and occupational health and safety considerations significantly contribute to the widespread use of these forklifts. Compliance with specific standards is essential for legal operations and safeguarding workers. Environmental consciousness and the increasing focus on sustainability have fuelled the adoption of electric-powered Class 4/5 forklifts. These models minimize emissions and encourage eco-friendly practices.

The Class 3 segment is expected to register the highest CAGR over the forecast period. Electric motor hand trucks, called Class 3 forklifts, are well-suited for indoor operations due to their enhanced maneuverability, improved energy efficiency, and reduced emissions. The demand for electric forklifts is further fuelled by the increasing emphasis on sustainability and government initiatives that promote environmentally friendly practices. Class 3 forklifts can navigate narrow spaces, handle lighter loads, and contribute to a greener environment. As a result, they are poised to capture a significant market share and thrive in Australia's evolving logistics landscape.

Power Source Insights

The internal combustion engines (ICE) forklift segment accounted for the largest market share of over 60.0% in 2022. In Australia, traditional fossil fuels such as gasoline or diesel are the primary power sources for ICE forklifts. These forklifts rely on internal combustion engines to convert the chemical energy stored in these fuels into mechanical power.

This power is used to drive the vehicle's wheels or hydraulic systems. The engines follow a combustion cycle, igniting fuel in a combustion chamber and producing expanding gases. These gases move pistons and generate rotational motion. The motion is then transmitted through the transmission system to the wheels or hydraulic pumps, allowing the forklift to efficiently perform lifting, carrying, and maneuvering tasks in various industrial and warehouse environments throughout the country.

The electric forklift segment is anticipated to register the highest CAGR over the forecast period. The nation's dedication to sustainability and the reduction of carbon emissions is in harmony with the benefits offered by electric forklifts, which emit no tailpipe pollutants. Moreover, the escalating expenses associated with conventional fuel options, coupled with the growing accessibility of renewable energy, enhance the economic viability of electric forklifts. Furthermore, the expanding e-commerce industry and the requirement for efficient, eco-friendly logistics solutions generate a robust demand for electric forklifts within warehouses and distribution centers.

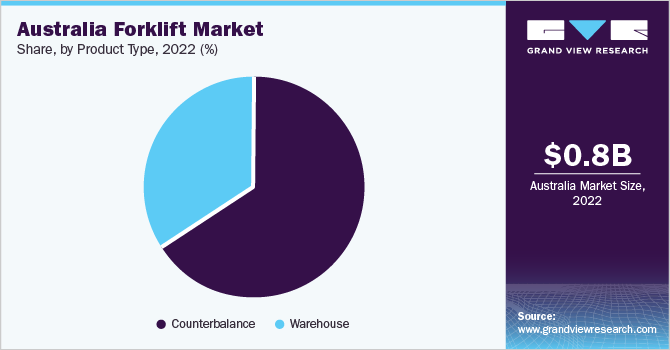

Product Type Insights

The counterbalance segment accounted for the largest market share of nearly 66.0% in 2022 and is anticipated to register the highest CAGR over the forecast period. The demand for counterbalance forklifts in various industries, such as warehousing, manufacturing, and construction, stems from the imperative to optimize productivity and streamline logistics operations.

These versatile machines, designed with a weight-bearing rear structure to maintain balance while handling heavy loads, facilitate efficient lifting, transporting, and stacking of goods, resulting in improved operational efficiency. The increasing focus on sustainability and reducing carbon emissions has propelled the adoption of electric counterbalance forklifts. These eco-friendly alternatives contribute to a greener approach to material handling. The convergence of these factors, coupled with the demand for effective and safe material handling practices, drives the segment’s growth.

The warehouse segment is expected to register considerable growth over the forecast period. The e-commerce industry is experiencing significant growth, resulting in a surge in demand for efficient warehousing and logistics operations. As many businesses embrace online retail models, warehouses need advanced forklift technologies to handle larger inventories and optimize order fulfillment processes effectively.

Furthermore, expanding manufacturing and construction sectors adds to the requirement for warehouses equipped with forklifts to manage material handling tasks. With a burgeoning economy and a rapidly evolving business landscape, investing in modernized warehouses with cutting-edge forklift solutions enables companies to capitalize on the thriving market.

State Insights

New South Wales led the Australia forklift market with a share of over 24.0% in 2022 and is expected to register the highest CAGR over the forecast period. The thriving industrial sector in the region, encompassing manufacturing, warehousing, and logistics, drives the demand for efficient material-handling equipment such as forklifts. As businesses strive to enhance productivity and operational efficiency, the importance of reliable and technologically advanced forklifts cannot be overstated.

Moreover, the burgeoning e-commerce industry, marked by increasing distribution centers and fulfillment warehouses, substantially fuels the market's expansion. Finally, the emergence of electric forklifts, propelled by environmental concerns and the shift towards sustainable practices, offers a significant opportunity in the market as companies actively seek greener alternatives to conventional internal combustion engine forklifts.

Victoria is anticipated to grow at a significant CAGR over the forecast period. Victoria provides an advantageous setting for the growth and acceptance of forklifts due to its robust logistics sector and strong industrial foundation. The state's flourishing manufacturing, warehousing, and distribution industries, combined with its strategic position as a major transportation hub, position it as a prime market for forklifts.

Moreover, Victoria's focus on innovation and technological advancements opens opportunities for incorporating intelligent and automated forklift solutions. As businesses strive to optimize their supply chains and enhance operational efficiency, the demand for forklifts in Victoria is projected to grow substantially, establishing the state as an essential market for forklifts.

Key Companies & Market Share Insights

The key companies engage in several growth strategies, including partnerships, mergers & acquisitions, and geographical expansions, to stay afloat in the competitive market scenario. For instance, in May 2023, Toyota Material Handling Australia Pty Limited announced the completion of its Melbourne branch. The new branch would undertake operations, such as sales, renting, assembly, and servicing of forklifts, skid steer loaders, scissor lifts, pallet jacks, and elevated work platforms, among other equipment. Some prominent players in the Australia forklift market include:

-

CLARK

-

Crown Equipment Corporation

-

Doosan Corporation

-

Hangcha

-

Hyster-Yale Materials Handling, Inc.

-

Jungheinrich AG

-

Komatsu Ltd.

-

Toyota Material Handling

Australia Forklift Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.12 billion

Growth rate

CAGR of 13.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tonnage capacity, class, power source, product type, state

State scope

New South Wales; Northern Territory; Queensland; South Australia; Tasmania; Victoria; Western Australia

Key companies profiled

CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Komatsu Ltd.; Toyota Material Handling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Forklift Market Report Segmentation

The report forecasts revenue growth at country and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia forklift market report based on tonnage capacity, class, power source, product type, and state:

-

Tonnage Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 5 Ton

-

6-30 Ton

-

Above 30 Ton

-

-

Class Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Class 1

-

Class 2

-

Class 3

-

Class 4/5

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Warehouse

-

Counterbalance

-

-

State Outlook (Revenue, USD Million, 2018 - 2030)

-

New South Wales

-

Northern Territory

-

Queensland

-

South Australia

-

Tasmania

-

Victoria

-

Western Australia

-

Frequently Asked Questions About This Report

b. Australia forklift market size was estimated at USD 0.78 billion in 2022 and is expected to reach USD 0.87 billion in 2023.

b. The Australia forklift market is expected to grow at a compound annual growth rate of 13.5% from 2023 to 2030 to reach USD 2.12 billion by 2030.

b. The class 4/5 segment accounted for the largest market share of over 61.0% in 2022. The primary factors propelling the development of these forklifts are cutting-edge technology and design elements that amplify efficiency.

b. Some key players operating in the Australia forklift market include CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Komatsu Ltd.; and Toyota Material Handling

b. The rising demand for port-related operations drives the Australia forklift market. The country's robust economic growth and extensive global trade connections have propelled international commerce.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.