- Home

- »

- Biotechnology

- »

-

Autologous Cell Therapy Market Size, Industry Report, 2030GVR Report cover

![Autologous Cell Therapy Market Size, Share & Trends Report]()

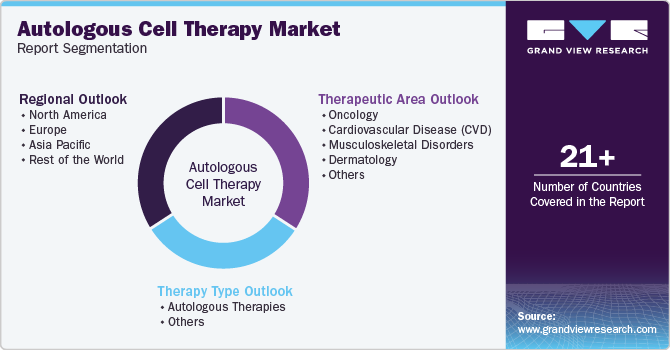

Autologous Cell Therapy Market Size, Share & Trends Analysis Report By Therapy Type ( Autologous Therapies, Non-Stem Cell Therapies, Non-Stem Cell Therapies), By Therapeutic Area (Oncology, Dermatology), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-017-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Autologous Cell Therapy Market Trends

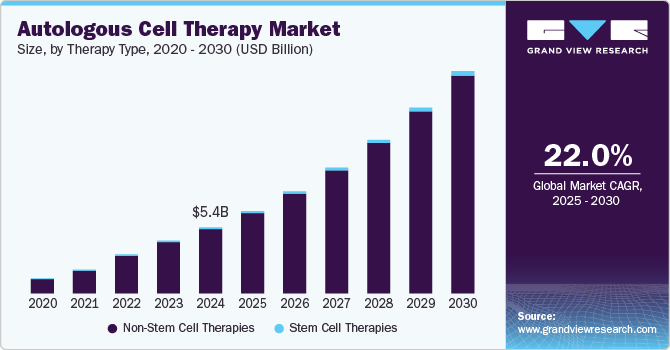

The global autologous cell therapy market size was estimated at USD 5.41 billion in 2024 and is projected to grow at a CAGR of 22.01% from 2025 to 2030. Some key factors driving the market growth include numerous immunological advantages, a rise in the proportion of the geriatric population across the globe, and a reduced risk of autologous cell therapy rejection. Autologous cell therapy is widely used in a range of diseases such as cancer, neurodegenerative disorders, cardiovascular disorders, autoimmune disorders, orthopedics, wound healing, and others.

The autologous approach significantly reduces the risk of therapy rejection, which is a major advantage over allogeneic therapies (using donor cells). This improves patient outcomes and simplifies the path to regulatory approval. The therapy minimizes the risk of immune rejection by using the patient's cells, creating a safer treatment option. This approach has shown considerable promise, particularly in cancer treatments, where immune compatibility is crucial for therapy success. Personalized treatments leveraging these advantages are becoming increasingly sought after, reflecting a broader trend toward individualized medicine.

Moreover, the global population of individuals aged 65 and older is projected to more than double by 2050, reaching over 1.5 billion. This demographic shift increases the prevalence of age-related diseases such as cardiovascular disorders and neurodegenerative diseases. These conditions are key application areas for autologous cell therapy, which, in turn, stimulates market growth as demand for effective treatments rises.

Autologous cell therapies' clinical and regulatory efficiency encourages investment and innovation in this sector, responding to the critical need for compatible and effective therapeutic options.In November 2023, Novartis secured global rights to a selection of Legend Biotech’s CAR-T cell therapies, including a promising candidate for lung cancer and large cell neuroendocrine carcinoma, in a deal worth over USD 1.0 billion. This agreement allows Novartis to leverage its T-Charge platform to develop and manufacture these therapies.

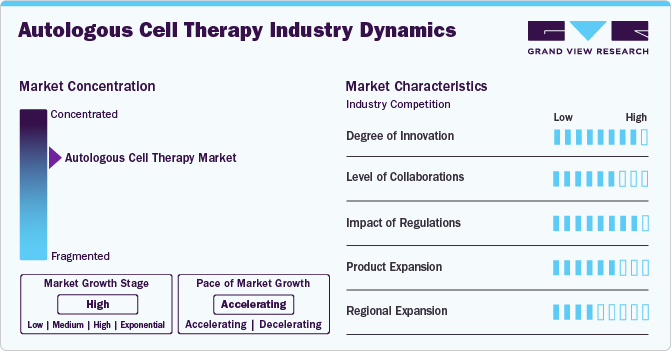

Market Concentration & Characteristics

The degree of innovation in the autologous cell therapy industry is currently high. This stems from technological advancements enabling new therapy cell types, such as iPSCs and CAR-T cells, offering significant improvements over traditional methods by targeting specific cancer cell antigens and enabling mass cell production. Advancements in manufacturing processes make these therapies efficient and cost-effective. In March 2024, the FDA approved Breyanzi by Bristol Myers Squibb for adults with CLL or SLL who are relapsed or refractory. This CAR T cell therapy is given as a one-time infusion. In the TRANSCEND trial, 20% of patients had a complete response to Breyanzi, which is also approved for treating relapsed or refractory large B-cell lymphoma.

Several companies participate in mergers and acquisitions to improve their market position. These activities boost their market expertise, diversify their product offerings, and enhance their skills. In December 2023, AstraZeneca announced its acquisition of Gracell Biotechnologies Inc., a clinical-stage biotech company specializing in cell therapies for cancer and autoimmune diseases. This deal aimed at boosting AstraZeneca's cell therapy portfolio, introducing a promising CAR-T therapy for multiple myeloma and other diseases.

The regulation in the autologous cell therapy industry involves complex and varying rules across different countries. In the U.S., the FDA oversees these therapies as biologics, demanding strict safety and efficacy standards. Similarly, Europe's European Medicines Agency (EMA) classifies them as advanced-therapy medicinal products (ATMPs), requiring detailed clinical and manufacturing benchmarks for approval. While ensuring safety, these regulations also impose significant financial and time burdens on developers, potentially limiting market entry for smaller entities due to the stringent and costly requirements for clinical trials and manufacturing compliance.

Currently, the autologous cell therapy market is highly regulated, with approval processes that vary from region to region. However, expanding into international markets such as Asia-Pacific, Europe, and Latin America have significant growth potential. Taking advantage of fast-tracking or conditional approval processes facilitate quicker market entry. Moreover, autologous cell therapy companies expand their product portfolios through partnerships with larger pharmaceutical or biotechnology firms. These collaborations provide funding, expertise, and distribution networks.

The autologous cell therapy industry has witnessed significant regional expansion over the past few years, with key growth areas including North America, Europe, and Asia-Pacific. This trend can be attributed to several factors, including technological advancements and increasing demand for personalized medicine.

Therapy Type Insights

The non-stem cell therapies segment dominated the market in 2024 with a 97.41% share. This large share can be attributed to several factors, including the expanding CAR T-cell therapy research landscape and increasing clinical trials. With growing scientific understanding and technological advancements, there is a notable surge in investigations into autologous stem cell therapies. This increased focus on research and development has led to new treatments & therapies and market growth

The stem cell therapies segment is projected to grow significantly over the forecast period.Stem cell transplants are usually used to treat various types of cancer, like lymphomas, leukemias, and multiple myeloma. Several advantages associated with autologous stem cell therapies, such as using own cells, no risk of GVHD, easy availability, and no need to identify an HLA-matched donor, are anticipated to boost the segment growth in the coming years.

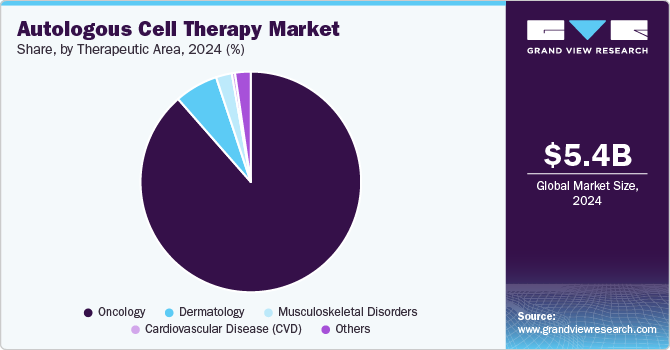

Therapeutic Area Insights

The oncology segment dominated the market in 2024 with an 88.55% share. CAR T-cells targeting CD19 can help treat Acute Lymphocytic Leukemia (ALL) patients with high rates of full and long-term remission. Furthermore, growing FDA approval of innovative medicines targeting various types of cancer is projected to impel growth in the cell therapy business within the oncology therapeutic area.

The market for musculoskeletal disorders is predicted to increase significantly in the coming years. Extensive research is being conducted to develop technologies that aid in regenerating or repairing injured musculoskeletal tissues. Various research groups examine therapeutically relevant cell types used in therapies to treat musculoskeletal tissue degeneration and use manufactured or native skeletal progenitor cells to trigger tissue repair & rejuvenate musculoskeletal tissues directly.

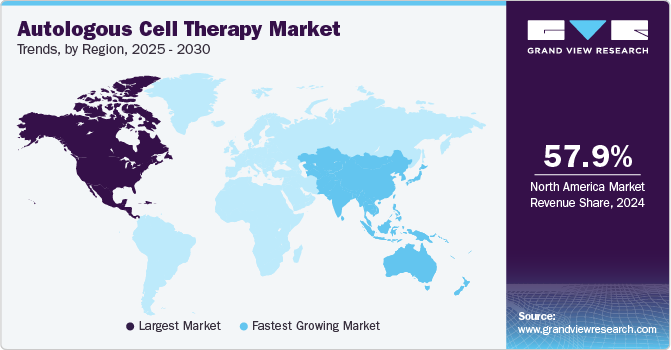

Regional Insights

The North America autologous cell therapy market accounted for 57.88% share in 2024. The market is highly competitive since most major players operate in this region, such as BrainStorm Cell Therapeutics and Bristol Myers Squibb. Furthermore, the growing burden of the geriatric population, numerous immunological advantages, and the reduced risk of autologous cell therapy rejection have created new growth opportunities for this region's autologous cell therapy industry.

U.S. Autologous Cell Therapy Market Trends

The autologous cell therapy market in the U.S. held the largest share in the North American region in 2024 and is expected to grow rapidly over the forecast period. In the US, the FDA’s approval of several autologous cell therapies for various indications has boosted market confidence and investment. A robust healthcare system and strong intellectual property protection laws support market growth. In January 2024, the FDA approved a manufacturing process change for Kite's Yescarta CAR T-cell therapy, reducing the median U.S. turnaround time for leukapheresis to product release from 16 to 14 days.

Europe Autologous Cell Therapy Market Trends

Europe is a lucrative region in the autologous cell therapy industry. The European Medicines Agency’s (EMA) supportive regulatory environment for advanced therapies drives market growth. The EU’s commitment to funding research through programs like Horizon 2020 supports the development of a dedicated bioreactor to expand tumor-infiltrating lymphocytes (TILs) for autologous cell therapy (ACT), contributing to market expansion. In addition to these factors, the growing prevalence of chronic diseases across all these regions creates a large patient pool for autologous cell therapies.

The UK autologous cell therapy market drivers include a robust healthcare system, growing research activities in stem cell therapies, and supportive regulatory frameworks. Moreover, partnerships between universities and biotech companies contribute to this sector's advancements.

The autologous cell therapy market in France is expected to grow rapidly during the forecast period. The country’s strong focus on research & development in the biotechnology and pharmaceuticals sectors, supportive regulatory environment, and growing awareness about regenerative medicine drive the market. Additionally, collaborations between academic institutions and industry players are crucial in market growth.

Germany Autologous cell therapy market is propelled by the country's aging demographic, enhanced government investment in research efforts, and beneficial reimbursement schemes. Additionally, partnerships between academic institutions and industry participants fuel advancements in this area.

Asia Pacific Autologous Cell Therapy Market Trends

Asia Pacific's autologous cell therapy market is anticipated to grow significantly over the forecast period. owing to the rising burden of diseases, strong research activities in autologous cell therapies, the presence of a well-established biotechnology sector, developing healthcare facilities, and growing awareness for cell therapies. In May 2024, Cytiva, in collaboration with Gilead Sciences' Kite Pharma, unveiled Sefia, a cutting-edge cell therapy manufacturing platform designed to overcome challenges like dependency on manual labor, limited capacity, and risk of batch failures. This innovation caters to the increasing demand for autologous cell therapies, highlighted by over 1,000 clinical trials worldwide and 10 approved CAR-T therapies across the U.S., Europe, and the Asia-Pacific region.

The autologous cell therapy market in China is driven by rapid economic growth and increasing healthcare expenditures, which have led to a surge in biotechnology research and development investments. The Chinese government’s focus on developing its domestic biotech industry is also fueling the growth of the autologous cell therapy market, such as the China National Science and Technology Development Plan.

Japan's autologous cell therapy market is expected to grow over the forecast period. The growth of the Japanese autologous cell therapy market can be attributed to the country’s aging population and increasing government investments in regenerative medicine. In addition, collaborations between academic institutions and industry players foster innovation in this field. In April 2022, Metcela Inc. strengthened its cardiac stem cell-based therapies development by acquiring Japan Regenerative Medicine Co., Ltd. (JRM), previously under Kidswell Bio. Following a partnership established with Kidswell Bio in January, Metcela enhanced this relationship by allotting new shares to Kidswell Bio.

Rest of the World Autologous Cell Therapy Market Trends

The rest of the world include regions such as LATAM and MEA. Latin America's autologous cell therapy market is expected to grow moderately due to the region's aging population, the increasing prevalence of chronic diseases, and supportive government initiatives. A key driver of this growth is the aging population, which is more susceptible to conditions treatable by autologous cell therapy, like cancer and neurological disorders. Moreover, the significant government support for R&D, including efforts by the Brazilian Health Ministry through the National Stem Cell Bank (BNHuCel), and the contribution of academic institutions like the Universidade de São Paulo drives the market.

Moreover, the autologous cell therapy market in the Middle East and Africa region is growing steadily due to increased adoption of cell-based therapies, advances in stem cell research, and rising awareness about the benefits of autologous cell therapies. Government efforts to boost biotechnology and partnerships between academia and industry leads to the market expansion.

Key Autologous Cell Therapy Company Insights

The market players operating in the autologous cell therapy market are undertaking new launches, collaborations, and expansion strategies to strengthen their market presence. In February 2024, BioNTech and Autolus partnered strategically to advance their CAR-T cell therapy programs. The partnership focuses on utilizing manufacturing and commercial capabilities to bring their autologous CAR-T therapies to market. BioNTech will use Autolus’ manufacturing for trials in CLDN6+ tumors and support the expansion of Autolus' obe-cel program, receiving royalties on its sales. Additionally, BioNTech has co-commercialization rights for Autolus’ AUTO1/22 and AUTO6NG programs.

Key Autologous Cell Therapy Companies:

The following are the leading companies in the autologous cell therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Bluebird bio, Inc.

- Novartis

- Gilead Sciences, Inc. (Kite)

- Bristol-Myers Squibb Company

- Pharmicell Co., Ltd.

- Johnson & Johnson (Janssen Global Services, LLC.)

- JW Therapeutics

- Holostem S.r.l.

- Vertex Pharmaceuticals, Inc.

- Autolus therapeutics

Recent Developments

-

In March 2024, Gamida Cell Ltd. secured a Restructuring Support Agreement with its main lender, Highbridge Capital Management, to ensure long-term financial stability and support the ongoing commercialization of Omisirge. The restructuring will take place through a voluntary process in Israel.

-

In November 2023, Selecta Biosciences and Cartesian Therapeutics announced their merger, forming a new entity under Cartesian Therapeutics that focuses on developing RNA cell therapies for autoimmune diseases. Trading on Nasdaq h the ticker "RNAC," the merged company, based in Watertown, Massachusetts, combines Selecta’s and Cartesian's resources, aiming for a pro forma cash balance exceeding USD 110 million.

-

In March 2023, Adaptimmune and TCR2 Therapeutics announced a strategic combination in an all-stock transaction to form a leading cell therapy company targeting solid tumors. This merger is expected to enhance clinical development and product delivery, extending the company's cash runway into 2026.

-

In January 2022, ProKidney merged with Chamath Palihapitiya’s SPAC, receiving USD 825 million to fund phase 3 trials for their kidney disease cell therapy, ReACT. If ProKidney captures 1% of its market at USD 360,000 per patient, it could earn USD16 billion.

Autologous Cell Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.74 billion

Revenue forecast in 2030

USD 18.23 billion

Growth Rate

CAGR of 22.01% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Rest of World

Country scope

U.S.; Canada; Mexico; UK; Germany; Switzerland; China; Japan; India; South Korea; Rest of world

Key companies profiled

Bluebird bio Inc.; Novartis; Gilead Sciences, Inc. (Kite); Bristol-Myers Squibb Company; Pharmicell Co., Ltd.; Johnson & Johnson (Janssen Global Services, LLC.); JW Therapeutics; Holostem S.r.l.; Vertex Pharmaceuticals, Inc.; and Autolus Therapeutics.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autologous Cell Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global autologous cell therapy market report based on therapy type, therapeutic area, and region:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Autologous Therapies

-

Stem Cell Therapies

-

BM, Blood, & Umbilical Cord-derived Stem Cells

-

Adipose-derived cells

-

Others

-

-

Non-Stem Cell Therapies

-

T-Cell Therapies

-

CAR T Cell Therapy

-

T Cell Receptor (TCR)-based

-

-

Others

-

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disease (CVD)

-

Musculoskeletal Disorders

-

Dermatology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global autologous cell therapy market size was estimated at USD 5.41 billion in 2024 and is expected to reach USD 6.74 billion in 2025.

b. The global autologous cell therapy market is anticipated to grow at a compound annual growth rate of 22.01% from 2025 to 2030 to reach USD 18.23 billion by 2030.

b. North America dominated the market with a revenue share of around 57.88% in 2024. The growing burden of the geriatric population, numerous immunological advantages, and the reduced risk of autologous cell therapy rejection have created new growth opportunities for this region's autologous cell therapy industry.

b. Key players operating in the autologous cell therapy market include Bluebird bio, Inc.; Novartis; Gilead Sciences, Inc. (Kite); Bristol-Myers Squibb Company; Pharmicell Co., Ltd.; Johnson & Johnson (Janssen Global Services, LLC.); JW Therapeutics; Holostem S.r.l.; Vertex Pharmaceuticals, Inc.; and Autolus Therapeutics.

b. Key factors driving the market growth include the FDA’s approval of several autologous cell therapies for various indications, growing investments, a robust healthcare system, and strong intellectual property protection laws.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."