- Home

- »

- Next Generation Technologies

- »

-

Automotive Backup Camera Market Size, Share Report, 2030GVR Report cover

![Automotive Backup Camera Market Size, Share & Trends Report]()

Automotive Backup Camera Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Type, By Technology, By Viewing Angle, By Propulsion, By Sales Channel, By Mounting Position, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-395-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Backup Camera Market Trends

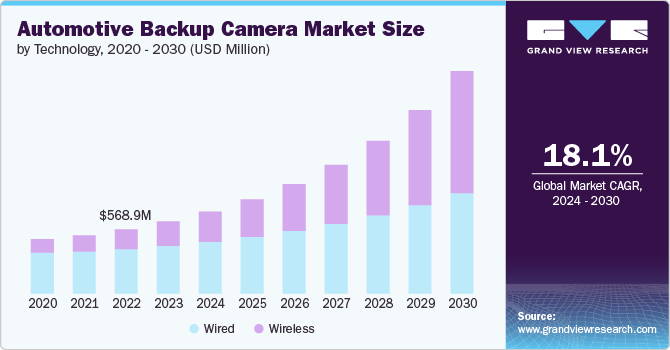

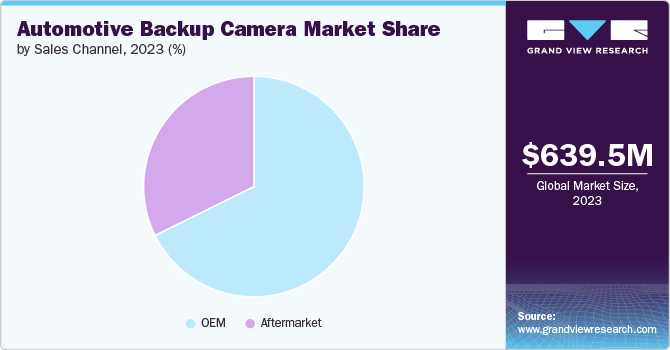

The global automotive backup camera market size was valued at USD 639.5 million in 2023 and is expected to grow at a CAGR of 18.1% from 2024 to 2030. The significant role of rear-view cameras in enhancing visibility behind vehicles, which helps prevent accidents and collisions during parking by addressing visibility limitations, is driving the automotive backup camera industry growth. Numerous governments have implemented mandatory regulations globally requiring cars to have a rear-view camera. This mandate aims to enhance safety during parking maneuvers, thereby boosting the growth of the market.

Modern consumers are more aware and concerned about vehicle safety, leading to increased demand for advanced safety features in automobiles. Backup cameras, which provide a clear view of the area behind the vehicle, are highly wanted features as they significantly reduce the risk of collisions. This growing consumer preference compels automotive manufacturers to integrate backup cameras in both high-end and budget vehicles. As a result, the market for these cameras expands, driven by consumer demand for enhanced safety and convenience.

Continuous advancements in automotive electronics have led to the development of high-resolution, wide-angle backup cameras with night vision capabilities. These technological improvements make backup cameras more effective and reliable, boosting their adoption. Innovations such as integration with other driver assistance systems, like parking sensors and automated parking, further enhance their functionality. As technology evolves, it creates new opportunities for market players to offer innovative and improved backup camera systems, driving market growth.

The global automotive industry is experiencing robust growth, particularly in emerging markets. This expansion is fueled by increasing urbanization, rising disposable incomes, and growing demand for personal vehicles. As the number of vehicles on the road increases, the demand for safety features like backup cameras is expected to increase. Moreover, the trend of upgrading existing vehicles with modern safety systems also contributes to the growth of the automotive backup camera market. A booming automotive sector thus directly impacts the demand for backup cameras, driving market expansion.

Furthermore, the shift towards electric and autonomous vehicles (EVs and AVs) is a significant driver for the automotive backup camera market. These vehicles often come equipped with advanced driver assistance systems (ADAS), in which backup cameras play a crucial role. The integration of backup cameras in EVs and AVs enhances safety and also supports the vehicles' automated functions, such as self-parking and obstacle detection. As the adoption of EVs and AVs grows, the demand for advanced backup camera systems is expected to grow further, propelling market growth.

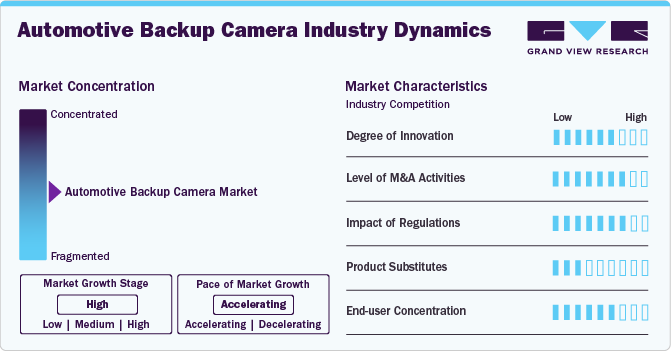

Industry Dynamics

The degree of innovation is high in the market. The market has witnessed a significant degree of innovation over recent years, thereby transforming vehicle safety features, and improving user experience. These advancements range from high-definition image quality and wide-angle lens technology to smart integration with in-vehicle infotainment systems, marking a new era in vehicle reversibility and accident prevention.

The impact of regulations is high in the market. Regulatory mandates have played an essential role in propelling the market forward, ensuring that all new vehicles are equipped with these life-saving devices. This not only standardizes safety features across the board but also encourages manufacturers to innovate, ensuring backup cameras are not just an addition but a seamlessly integrated essential component for modern vehicles.

The level of mergers & acquisitions (M&A) in the market is high. The market is also being influenced by the rising number of M&A, which helps companies increase market share, expand the customer base, and strengthen product portfolios.

The impact of product substitutes is low to moderate. The automotive backup camera industry faces competition from product substitutes such as rearview mirror screens and sensor-based parking assist systems, which offer alternative solutions for enhanced rear visibility and collision avoidance. These technologies complement and, in some instances, rival traditional backup cameras, providing consumers with a range of options to suit their safety needs and driving preferences.

The end user concertation is high in the market. The increasing emphasis on safety and regulatory compliance has significantly impacted end-user concentration in the automotive backup camera market, driving a higher demand among consumers for vehicles equipped with advanced driver assistance systems (ADAS). This shift highlights the growing safety consciousness among consumers and also steers automotive manufacturers towards integrating more sophisticated and reliable backup camera technologies in their offerings.

Vehicle Type Insights

The passenger vehicle segment dominated the market in 2023 with a share of around 67%, due to increased safety regulations and consumer demand for enhanced vehicle safety features. Governments globally are mandating the inclusion of backup cameras in new vehicles, which is driving the market. Additionally, advancements in camera technology and affordability are making these systems more accessible to a broader range of consumers, further boosting adoption in the passenger vehicle segment.

The light commercial vehicle (LCV) segment is expected to record the highest CAGR of over 21% from 2024 to 2030, due to increasing safety regulations and rising demand for enhanced driver assistance systems. The adoption of backup cameras in LCVs is driven by their role in reducing accidents and improving overall vehicle safety. Additionally, the proliferation of e-commerce and the consequent expansion of delivery services necessitates the use of LCVs with advanced safety features, further propelling the segment's growth.

Technology Insights

The wired segment held the highest revenue share in 2023, owing to its reliability and consistent performance. Wired backup cameras are less prone to interference and signal loss, ensuring clearer and more dependable video feeds. This reliability is crucial for safety and precision, making wired systems a preferred choice for manufacturers and consumers alike. Additionally, advancements in wiring technology and integration with other automotive systems are further bolstering the adoption of wired backup cameras.

The wireless segment is estimated to register the highest growth rate from 2024 to 2030, due to the increasing demand for advanced safety features in vehicles. Wireless backup cameras eliminate the need for complex wiring, making installation easier and more cost-effective. As consumers seek enhanced convenience and reliability, manufacturers are incorporating wireless technology to offer seamless connectivity with in-car displays and mobile devices. This trend is further driven by advancements in wireless communication technologies, improving the performance and range of these systems.

Viewing Angle Insights

The standard angle segment held the highest revenue share in 2023, due to the widespread adoption of advanced driver assistance systems (ADAS). These cameras, typically offering a field of view between 120° to 150°, provide a balanced perspective that enhances safety and parking efficiency. Increasing regulatory mandates for vehicle safety, coupled with consumer demand for improved rear visibility, are driving the integration of standard angle cameras in both passenger and commercial vehicles. As a result, the segment is seeing a notable surge in both production and installation rates.

The wide angle segment is estimated to register the highest growth rate from 2024 to 2030, primarily driven by the increased demand for enhanced safety features in vehicles. As more automakers integrate advanced driver assistance systems (ADAS), the adoption of wide-angle backup cameras, which offer broader visibility and reduced blind spots, is becoming a standard. This trend is further driven by regulatory mandates and consumer preference for vehicles with improved parking assistance and collision avoidance capabilities. Consequently, the wide-angle camera market segment is expanding rapidly as manufacturers and consumers prioritize safety and convenience.

Propulsion Insights

The ICE segment held the highest revenue share in 2023, driven by sustained demand for traditional vehicles in various regions, especially where electric vehicle infrastructure is less developed. As safety regulations become more stringent globally, the integration of backup cameras in ICE vehicles has become standard, further boosting market expansion. Additionally, advancements in camera technology and affordability are making these systems more accessible, contributing to the segment growth.

The electric vehicle (EV) segment is estimated to register the highest growth rate from 2024 to 2030. As EV adoption increases, manufacturers integrate advanced safety features, including backup cameras, to meet regulatory requirements and enhance vehicle safety. The rising consumer demand for enhanced safety features and the technological advancements in electric vehicles are further propelling the market growth. This trend is expected to continue, contributing to the overall growth and innovation in the segment growth.

Mounting Position Insights

The flush mounted segment held the highest revenue share in 2023, due to the increasing demand for seamless and aesthetically pleasing vehicle designs. This segment benefits from advancements in camera technology that allow for compact, integrated solutions, enhancing both safety and vehicle aesthetics. The rise in consumer preference for advanced driver-assistance systems (ADAS) and higher vehicle safety standards further drives the adoption of flush-mounted backup cameras, as they offer a sleek and unobtrusive installation while maintaining high functionality.

The license plate mounted segment is estimated to register the highest growth rate from 2024 to 2030, primarily fueled by the increased demand for enhanced safety features and convenience. These systems are becoming more prevalent as they offer an unobtrusive installation that provides a wide and clear view for reversing. Additionally, advancements in camera technology and rising consumer awareness about vehicle safety are driving the adoption of these solutions, leading to a significant expansion in this segment.

Sales Channel Insights

The OEM segment held the highest revenue share in 2023. This growth is driven by increasing regulatory mandates for vehicle safety, which require backup cameras in new vehicles, and the rising consumer demand for advanced driver assistance systems (ADAS). Automakers are integrating these cameras as standard or optional features, boosting the OEM segment's expansion.

The aftermarket segment is estimated to register the highest growth rate from 2024 to 2030, due to increasing consumer awareness about vehicle safety and the availability of cost-effective, easy-to-install backup camera solutions. As more vehicle owners seek to upgrade their older models with modern safety features, the demand for aftermarket backup cameras rises. Additionally, advancements in camera technology and increased online retail channels contribute to the accessibility and affordability of these products, further driving the growth of the segment.

Regional Insights

North America automotive backup camera market accounted for a revenue share of nearly 22% in 2023. In North America, the automotive backup camera industry is significantly propelled by stringent safety regulations and the consumers' growing preference for vehicles equipped with advanced safety technologies.

U.S. Automotive Backup Camera Market Trends

The automotive backup camera market in the U.S. is anticipated to grow at a CAGR of around 15% from 2024 to 2030. The automotive backup camera industry in the U.S. is experiencing steady growth, driven by stringent safety regulations and an increasing consumer preference for vehicles equipped with advanced safety features.

Asia Pacific Automotive Backup Camera Market Trends

The automotive backup camera market in Asia Pacific is anticipated to grow at the highest CAGR of over 20% from 2024 to 2030. The Asia Pacific industry's rapid growth is driven by an increase in vehicle production and a heightened focus on vehicle safety standards, making automotive backup cameras a popular feature among new models.

India automotive backup camera market is estimated to record a significant growth rate from 2024 to 2030. India’s automotive backup camera industry is on a rapid growth trajectory, powered by rising vehicle safety awareness among consumers and government initiatives aimed at enhancing road safety.

The automotive backup camera market in China is expected to grow considerably from 2024 to 2030. In China, the automotive backup camera industry is witnessing a significant surge, owing to booming electric vehicle sales and government mandates requiring new vehicles to be equipped with backup cameras.

Japan automotive backup camera market is projected to witness a considerable growth rate from 2024 to 2030. Japan's market is seeing moderate yet consistent growth, influenced by a culture that values technological integration into daily life, including advanced safety features in automobiles.

Europe Automotive Backup Camera Market Trends

Automotive backup camera market in Europe accounted for a notable revenue share in 2023. In Europe, the steady growth of the automotive backup camera industry is driven by high demand for luxury vehicles that prioritize the latest in safety features, along with the regulatory mandates that require such safety technologies.

The automotive backup camera market in the U.K. is projected to grow considerably from 2024 to 2030. The U.K. is experiencing steady growth in its automotive backup camera industry, supported by heightened safety standards and an increasing number of vehicles that come equipped with advanced driver-assistance systems.

Germany automotive backup camera market is expected to record significant growth from 2024 to 2030. Germany's automotive backup camera market is advancing, propelled by the country's leadership in automotive innovation and a strong emphasis on vehicle safety and efficiency.

Middle East & Africa (MEA) Automotive Backup Camera Market Trends

The automotive backup camera market in the Middle East and Africa (MEA) region is anticipated to grow at a significant CAGR of around 19% from 2024 to 2030. The Middle East and Africa (MEA) region sees its automotive backup camera industry growth driven by an emerging awareness about the importance of vehicle safety and the increasing sales of automobiles, which are gradually incorporating more safety features.

Saudi Arabia automotive backup camera market accounted for a considerable revenue share in 2023. The automotive backup camera market in Saudi Arabia is undergoing notable growth, driven by economic diversification efforts and a growing awareness of the importance of vehicle safety features.

Key Automotive Backup Camera Company Insights

Some of the key players operating in the market are Robert Bosch GmbH, Continental AG, and DENSO Corporation.

-

Robert Bosch GmbH is a multinational engineering and technology company headquartered in Germany. This company is known for its diverse range of products and services, including automotive components, industrial products, and household appliances. Bosch operates worldwide and is committed to innovation and quality in addressing the complex challenges of today's society.

-

Continental AG is a German multinational company specializing in automotive parts manufacturing, tire production, and other related electronics and safety components. Continental offers a wide range of products for various types of vehicles, emphasizing innovation and sustainability in the automotive and transportation sectors. The company operates globally, adapting to the evolving demands of the automotive industry.

EchoMaster, Garmin Ltd., and Magna International Inc., among others, are some of the emerging market participants in the automotive backup camera market.

-

EchoMaster specializes in the development and distribution of vehicle safety products, including rear-view cameras, parking sensors, and dash cameras. With a focus on enhancing driver visibility and safety, the company serves both the automotive aftermarket and commercial vehicle segments. By leveraging advanced technology and design, EchoMaster aims to improve road safety and help drivers navigate their surroundings more confidently.

-

Garmin Ltd. is a multinational technology company known for its specialization in GPS technology for automotive, aviation, marine, outdoor, and sport activities. The company has grown to be one of a significant player in the market, providing advanced navigation and wearable technology. The company focuses on developing products that are integral to the lives of its customers across the globe, enhancing their activities and endeavors through innovative technology.

Key Automotive Backup Camera Companies:

The following are the leading companies in the automotive backup camera market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Gentex Corporation

- Garmin Ltd.

- OmniVision Technologies Inc.

- HELLA GmbH & Co. KGaA

- Magna International Inc.

- Valeo SA

- EchoMaster

Recent Developments

-

In February 2024, VIA Optronics AG signed a contract with Immervision Inc. focused on the design and development of VIA´s upcoming Automotive Camera. As part of this agreement, VIA will collaborate with Immervision to innovate and tailor a unique lens technology, aiming to manufacture advanced exterior automotive cameras.

-

In August 2023, major companies within the semiconductor sector, including Infineon Technologies AG, NXP Semiconductors, Robert Bosch GmbH, Nordic Semiconductor, and Qualcomm Technologies, Inc., have collaborated to invest in a firm dedicated to promoting the global uptake of RISC-V. This initiative aims to facilitate the development of innovative hardware technologies.

-

In May 2023, Ford unveiled BlueCruise in the U.K., a sophisticated Level 2 Advanced Driver-Assistance System (ADAS) designed for hands-free driving. This system builds on Ford's existing Intelligent Adaptive Cruise Control technology, enabling cars to maintain a consistent speed with the flow of traffic while adhering to speed regulations. BlueCruise utilizes radar and automotive cameras to identify and monitor nearby vehicles' positions and velocities.

Automotive Backup Camera Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 727.0 million

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 18.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, technology, viewing angle, propulsion, sales channel, mounting position, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Robert Bosch GmbH, Continental AG, DENSO Corporation, Gentex Corporation, Garmin Ltd., OmniVision Technologies Inc., HELLA GmbH & Co. KGaA, Magna International Inc., Valeo SA, EchoMaster

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Backup Camera Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels and analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive backup camera market report into vehicle type, technology, viewing angle, propulsion, sales channel, mounting position, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle (PV)

-

Light Commercial Vehicle (LCV)

-

Heavy Commercial Vehicle (HCV)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Viewing Angle Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Angle

-

Wide Angle

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

Hybrid

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Mounting Position Outlook (Revenue, USD Million, 2018 - 2030)

-

Flush Mounted

-

License Plate Mounted

-

Surface Mounted

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive backup camera market size was estimated at USD 639.5 million in 2023 and is expected to reach USD 727.0 million in 2024.

b. The global automotive backup camera market is expected to grow at a compound annual growth rate of 18.1% from 2024 to 2030 to reach USD 1.97 billion by 2030.

b. The Europe region accounted for the largest share of around 33% in the automotive backup camera market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the automotive backup camera market include Robert Bosch GmbH, Continental AG, DENSO Corporation, Gentex Corporation, Garmin Ltd., OmniVision Technologies Inc., HELLA GmbH & Co. KGaA, Magna International Inc., Valeo SA, EchoMaster.

b. Key factors that are driving the automotive backup camera market growth include the significant role of rear-view cameras in enhancing visibility behind vehicles, which helps prevent accidents and collisions during parking by addressing visibility limitations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.