- Home

- »

- Automotive & Transportation

- »

-

Automotive Ball Joint Market Size, Industry Report, 2033GVR Report cover

![Automotive Ball Joint Market Size, Share & Trends Report]()

Automotive Ball Joint Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Lower Ball Joints, Upper Ball Joints), By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles), By Material, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-760-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Ball Joint Market Summary

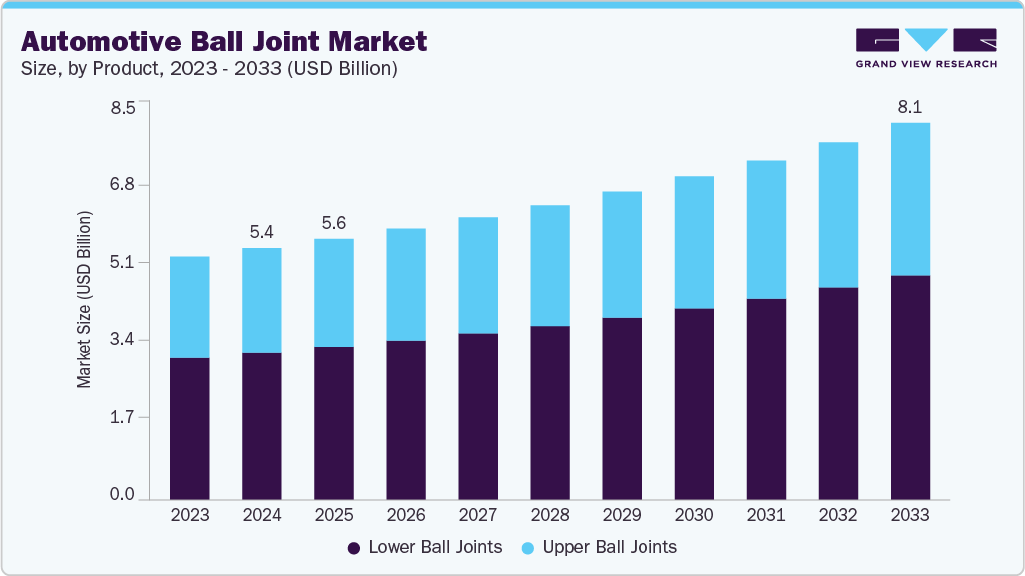

The global automotive ball joint market size was estimated at USD 5.40 billion in 2024, and is projected to reach USD 8.09 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The steady growth of the industry is attributed to the rising production of passenger and commercial vehicles, the growing demand for durable suspension systems to improve ride comfort and safety, and the increasing adoption of lightweight yet high-strength materials in ball joint manufacturing.

Key Market Trends & Insights

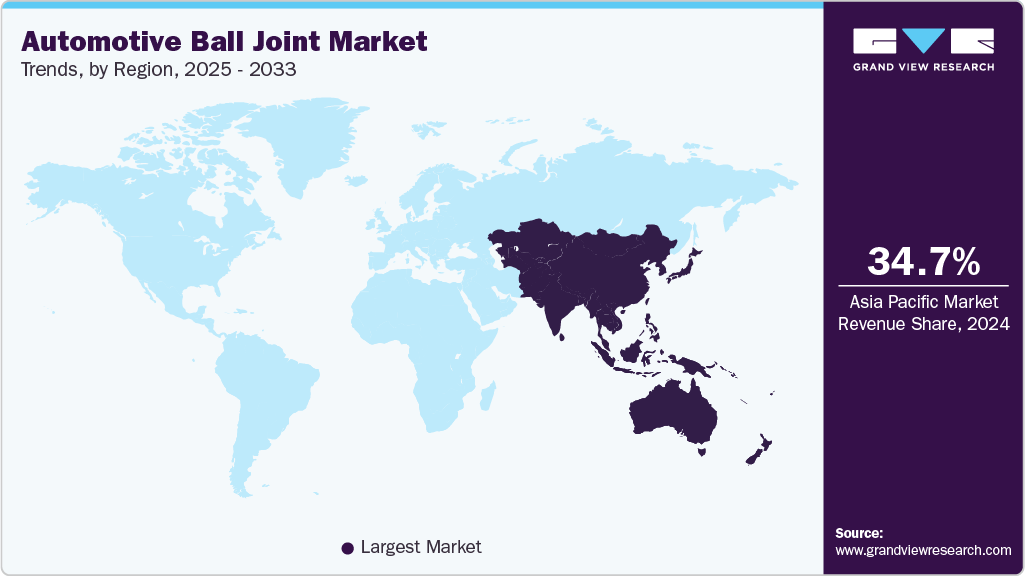

- Asia Pacific automotive ball joint market accounted for a 34.7% share of the overall market in 2024.

- The automotive ball joint industry in China held a dominant position in 2024.

- By product, the lower ball joints segment accounted for the largest share of 58.5% in 2024.

- By vehicle type, the passenger vehicles segment held the largest market share in 2024.

- By material, the steel segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.40 Billion

- 2033 Projected Market Size: USD 8.09 Billion

- CAGR (2025-2033): 4.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, the shift toward electric vehicles (EVs) and hybrid vehicles, which require advanced suspension components for handling and stability, further drives market expansion. Aftermarket demand from regular replacement due to wear and tear, coupled with stricter vehicle safety regulations, also contributes significantly to sustained growth. The rapid global adoption of battery electric vehicles (BEVs) and plug-in hybrids is reshaping vehicle layouts, axle loads, and suspension tuning, thereby propelling the market growth for specialized ball joints. Heavier battery packs positioned low in the chassis alter weight distribution and increase stress on suspension sub-assemblies, pushing OEMs to adopt ball joints with enhanced material strength, sealing, and fatigue resistance to ensure ride stability and durability. According to the U.S. Environmental Protection Agency (EPA), the accelerating penetration of EVs into the new-vehicle fleet underscores the need for reengineered suspension components, thereby boosting market demand for advanced ball joint solutions.Stricter regulatory focus on safety and driver assistance systems has been propelling the market growth of steering and suspension components, including ball joints. NHTSA’s recent New Car Assessment Program (NCAP) updates, alongside its Standing General Order for ADAS/ADS crash reporting, require higher component reliability and transparent post-market data. These policies are pushing OEMs and suppliers to prioritize ball joints with proven durability, corrosion resistance, and supplier traceability. As a result, validated quality control and performance assurance, rather than just cost, are becoming key procurement drivers, thereby boosting the adoption of advanced ball joints.

Government initiatives promoting fuel efficiency and emissions reduction continue to boost the market for lightweight automotive components. A 10% curb-weight reduction can yield measurable efficiency gains, prompting OEMs to seek lighter yet durable suspension solutions. Supported by the U.S. Department of Energy (DOE), R&D efforts into high-strength steels, engineered coatings, and hybrid material systems are propelling advancements in ball joint designs that balance strength, fatigue resistance, and recyclability. These material innovations are directly driving the market growth of advanced ball joint solutions as suppliers align with lightweighting targets.

As the automotive industry emerged from pandemic disruptions between 2021 and 2024, shifting production volumes and re-shoring initiatives highlighted the importance of resilient sourcing strategies. Data from the U.S. Bureau of Transportation Statistics (BTS) indicates fluctuating fleet activity, pushing OEMs and Tier-1s to strengthen supplier networks and implement dual sourcing for critical components like ball joints. This renewed emphasis on supplier reliability and conservative design safety margins is boosting demand for ball joints that meet stringent quality standards, thereby propelling overall market growth.

The rising average age of vehicles in operation, coupled with periodic suspension-related recalls, continues to boost the replacement market for ball joints. BTS data confirms that fleet age remains historically high, ensuring sustained maintenance needs, while NHTSA’s recall database records several campaigns related to ball-joint failures (e.g., corrosion, improper sealing, assembly torque issues). These factors are propelling the aftermarket growth of ball joints, creating consistent opportunities for both OEM-aligned and independent suppliers.

Product Insights

The lower ball joints segment accounted for the largest share of 58.5% in 2024. Lower ball joints are witnessing steady demand growth due to their critical role in bearing the vehicle’s weight and managing steering input. As vehicles become heavier, particularly SUVs and crossovers dominating global production volumes, OEMs are investing in durable, sealed-for-life lower ball joints with advanced coatings to withstand higher loads and corrosion. The growing preference for comfort and stability in passenger cars is propelling the adoption of heavy-duty lower ball joints across markets.

The upper ball joints segment is expected to grow at a significant CAGR during the forecast period. Upper ball joints, while carrying less load than lower ones, are gaining traction due to the rise of multi-link suspension systems in premium and electric vehicles. Their role in enhancing steering precision and tire alignment is becoming increasingly vital for vehicles with advanced safety features and driver-assist technologies. This shift toward multi-link suspension systems, especially in performance and EV segments, is boosting the growth of upper ball joints.

Vehicle Type Insights

The passenger vehicles segment held the largest market share in 2024. Passenger vehicles remain the largest consumer base for automotive ball joints, driven by the expanding global car parc and strong demand in emerging markets. Rising disposable incomes and urbanization are leading to higher sales of passenger cars equipped with comfort-oriented suspension systems. Additionally, government safety regulations mandating robust steering and suspension durability are propelling demand for ball joints in this segment.

The electric vehicles (EVs) segment is expected to grow at the fastest CAGR during the forecast period. EVs are reshaping ball joint requirements due to their unique weight distribution and torque characteristics. The heavy battery packs and instant torque delivery put additional stress on suspension systems, creating opportunities for suppliers of high-strength, fatigue-resistant ball joints. OEMs are turning to lightweight materials and advanced sealing technologies to ensure long service life in EV applications. The rapid global adoption of EVs is boosting the growth of this segment significantly faster than traditional ICE counterparts.

Material Insights

The steel segment dominated the market in 2024. Steel continues to dominate the market owing to its proven strength, fatigue resistance, and cost efficiency. The material’s ability to handle high loads makes it indispensable for commercial and high-performance vehicles. Moreover, advancements in anti-corrosion coatings and heat treatments are propelling demand for steel ball joints in regions with harsh climates and challenging road conditions.

The Plastic/Composite segment is projected to grow at the fastest CAGR over the forecast period. Plastic and composite ball joints, though still emerging, are experiencing growing adoption as part of the industry’s lightweighting trend. These materials reduce overall vehicle weight, contributing to better fuel economy and extended EV range. OEMs are increasingly experimenting with composite ball joints for small passenger cars and EVs, especially in Asia and Europe. This shift toward innovative materials is boosting growth in the plastic/composite segment.

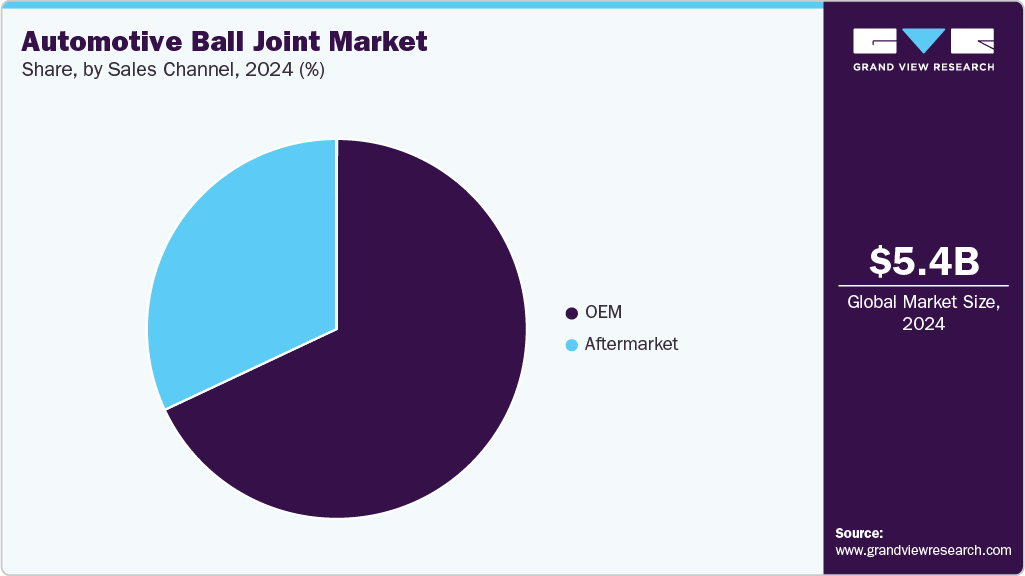

Sales Channel Insights

The OEMs segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. The OEM segment dominates due to the rising global production of vehicles and the growing integration of advanced suspension technologies. Automakers are seeking long-life, maintenance-free ball joints to meet consumer expectations for reliability and safety. Partnerships between OEMs and Tier-1 suppliers for high-precision ball joints are propelling growth in this channel.

The aftermarket segment is projected to grow at the fastest CAGR over the forecast period. The aftermarket is thriving due to the aging vehicle fleet and the frequent replacement needs of ball joints, which are subject to wear and tear. Recalls and road safety checks also sustain replacement demand. Independent workshops and e-commerce platforms are making it easier for consumers to access aftermarket ball joints, particularly in North America and Europe. This sustained replacement cycle is boosting the aftermarket growth of automotive ball joints globally.

Regional Insights

North America automotive ball joint market led the global market, with a revenue share of 30.4% in 2024, and is projected to grow at a significant CAGR over the forecast period. In North America, the demand for ball joints is being propelled by the resurgence in light truck and SUV sales, which place higher stress on suspension systems. According to the U.S. Department of Energy, light trucks accounted for nearly 79% of new vehicle sales in 2023, a record share that directly drives higher replacement and OEM demand for robust lower ball joints. Moreover, the region’s emphasis on advanced safety regulations and consumer preference for comfort-oriented suspensions is boosting market growth across OEM and aftermarket channels.

U.S. Automotive Ball Joint Industry Trends

The automotive ball joint industry in the U.S. held a dominant position in 2024.The U.S. market is distinguished by its large aging fleet and stringent recall environment. The average vehicle age in the U.S. reached 12.5 years in 2023 (Bureau of Transportation Statistics), ensuring a strong aftermarket for ball joint replacements. At the same time, NHTSA’s multiple recall campaigns between 2021 and 2024, including those related to suspension ball joint failures in pickup trucks and SUVs, have propelled aftermarket demand. Combined with rapid EV adoption, particularly in states like California, the U.S. is a central growth hub for both innovative and replacement ball joints.

Europe Automotive Ball Joint Industry Trends

The automotive ball joint industry in Europe is shaped by the continent’s strict vehicle safety regulations and commitment to sustainability. The European Commission’s Green Deal and CO₂ emissions standards push OEMs toward lightweighting, encouraging the adoption of advanced ball joint designs made from high-strength steels and composites. Meanwhile, the region’s strong preference for premium vehicles with multi-link suspension systems is boosting the demand for upper ball joints with higher precision and durability.

Germany, home to leading automakers like Volkswagen, BMW, and Mercedes-Benz, is propelling the demand for ball joints through its focus on premium and performance vehicles. German OEMs are pioneers in multi-link and adaptive suspension systems, which require precision-engineered ball joints. Additionally, Germany’s accelerated EV push, EVs accounted for nearly 18% of new registrations in 2023 (KBA, Kraftfahrt-Bundesamt), is further boosting demand for lightweight and durable suspension components, including advanced ball joints.

The automotive ball joint industry in the UK is experiencing growth due to rising EV penetration and vehicle maintenance needs in an aging fleet. According to the UK Department for Transport, battery-electric cars made up 16.5% of new car sales in 2023. Simultaneously, with one of the oldest passenger car fleets in Western Europe (average age 8.7 years in 2023), replacement demand is strong. This dual dynamic, new EV production and steady aftermarket replacement, is propelling the UK ball joint market forward.

Asia Pacific Automotive Ball Joint Industry Trends

The automotive ball joint industry in Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2033 and held the largest market share of 34.7% in 2024. Asia-Pacific remains the largest regional market, driven by high vehicle production volumes and rapid EV adoption. The International Energy Agency (IEA) reported that China alone accounted for over 60% of global EV sales in 2023, while India and Southeast Asia saw surging demand for affordable passenger vehicles. The combination of mass production, rising urbanization, and evolving suspension standards is boosting APAC’s dominance in the global ball joint market.

China is the epicenter of growth for the global ball joint industry. With over 8 million EVs sold in 2023 (IEA), demand for lightweight, fatigue-resistant ball joints is surging. The government’s “Made in China 2025” initiative also encourages domestic production of high-quality auto components, propelling supplier investments. Furthermore, recalls tied to local OEMs highlight the importance of robust aftermarket replacement, reinforcing steady demand across channels.

Japan’s automotive ball joint market is driven by precision engineering and hybrid vehicle dominance. Toyota and Honda continue to lead global hybrid production, requiring advanced suspension systems that rely on durable ball joints. According to the Japan Automobile Manufacturers Association (JAMA), hybrids accounted for over 40% of new vehicle sales in 2023. This trend is boosting demand for high-reliability ball joints designed for long service life in both domestic and export-oriented vehicles.

The automotive ball joint market in India is witnessing a dual growth story: booming passenger vehicle sales and government-backed EV adoption. The Society of Indian Automobile Manufacturers (SIAM) reported a record 4.1 million passenger vehicle sales in FY 2023-24, driving massive OEM demand for cost-effective ball joints. At the same time, the government’s FAME-II policy has accelerated EV adoption, requiring suspension adaptations to heavier battery packs. The combination of rising mass-market production and EV integration is propelling ball joint demand across OEM and aftermarket channels in India.

Key Automotive Ball Joint Companies Insights

Key players operating in the automotive ball joint market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Some of the leading players in the Automotive Ball Joint market include ZF Friedrichshafen AG, Hyundai Mobis, MOOG (Federal-Mogul Motorparts), CTR (Central Corporation), and Somic Automotive Components, among others. These companies manufacture and supply ball joints that serve a wide range of applications across passenger vehicles, light trucks, commercial vehicles, and electric vehicles (EVs). Their portfolios emphasize durability, lightweight materials, sealing technology, and advanced coatings to improve component life and support next-generation suspension systems. Additionally, many of these players collaborate with global OEMs to co-develop high-performance ball joints optimized for ADAS-equipped and EV platforms, positioning themselves as critical enablers of modern suspension and steering systems.

-

ZF is a global leader in chassis and suspension systems, offering a wide range of ball joints tailored for multi-link, MacPherson strut, and control arm applications. Through its TRW product line, ZF delivers OEM-grade and aftermarket ball joints with advanced sealing technologies designed to withstand harsh operating environments. The company’s R&D focus on lightweight construction and integrated mechatronic suspensions is propelling its position in EV and autonomous vehicle markets. Recent collaborations with German OEMs highlight ZF’s role in developing ball joints that support high-precision steering and enhanced durability for electric drivetrains.

-

NSK, a leading Japanese bearing and automotive component manufacturer, is expanding its ball joint product line to cater to steering linkages and suspension assemblies. The company emphasizes high-precision ball joints for electric and hybrid vehicles, leveraging its materials science expertise to develop low-friction, lightweight solutions. In 2023, NSK announced new joint R&D programs with Japanese OEMs focusing on durability and reliability for autonomous-ready vehicles, underscoring its growth trajectory in the APAC region.

Key Automotive Ball Joint Companies:

The following are the leading companies in the automotive ball joint market. These companies collectively hold the largest market share and dictate industry trends.

- CTR (Central Corporation / Korea)

- Delphi Technologies

- FRAP

- GMB

- Hyundai Mobis

- Mevotech

- Meyle

- MOOG (Federal-Mogul / DRiV / Tenneco)

- NSK Ltd.

- Somic Ishikawa

- ZF Friedrichshafen AG

Recent Developments

-

In July 2025, ZF achieved a major breakthrough with the series production launch of its Smart Chassis Sensor integrated into ball joints. This innovation debuted in the Cadillac CELESTIQ luxury sedan, representing the first commercial application of this technology.

-

In July 2025, Somic Ishikawa acquired 100% of the India-based Somic ZF Components JV from ZF, taking full control of three plants producing steering and suspension ball joints, with ZF to continue tech licensing and design support post-transaction.

Automotive Ball Joint Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.60 billion

Revenue forecast in 2033

USD 8.09 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle type, material, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

CTR (Central Corporation / Korea); Delphi Technologies; FRAP; GMB; Hyundai Mobis; Mevotech; Meyle; MOOG (Federal-Mogul / DRiV / Tenneco); NSK Ltd.; Somic Ishikawa; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Ball Joint Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive ball joint market report based on product, vehicle type, material, sales channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Lower Ball Joints

-

Upper Ball Joints

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Vehicles

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

Electric Vehicles (EVs)

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Steel

-

Aluminum

-

Plastic/Composite

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive ball joint market size was estimated at USD 5.40 billion in 2024 and is expected to reach USD 5.60 billion in 2025.

b. The global automotive ball joint market size is expected to grow at a significant CAGR of 4.7% to reach USD 8.09 billion in 2033.

b. Asia Pacific held the largest market share of 34.7% in 2024. Asia-Pacific remains the largest regional market, driven by high vehicle production volumes and rapid EV adoption. The International Energy Agency (IEA) reported that China alone accounted for over 60% of global EV sales in 2023, while India and Southeast Asia saw surging demand for affordable passenger vehicles. The combination of mass production, rising urbanization, and evolving suspension standards is boosting APAC’s dominance in the global ball joint market.

b. Some of the players in the automotive ball joint market are CTR (Central Corporation / Korea), Delphi Technologies, FRAP, GMB, Hyundai Mobis, Mevotech, Meyle, MOOG (Federal-Mogul / DRiV / Tenneco), NSK Ltd., Somic Ishikawa, and ZF Friedrichshafen AG.

b. The key driving trend in the automotive ball joint market is the increasing adoption of electric vehicles (EVs) and advancements in suspension system technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.