- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Foam Market Size, Share, Industry Report, 2033GVR Report cover

![Automotive Foam Market Size, Share & Trends Report]()

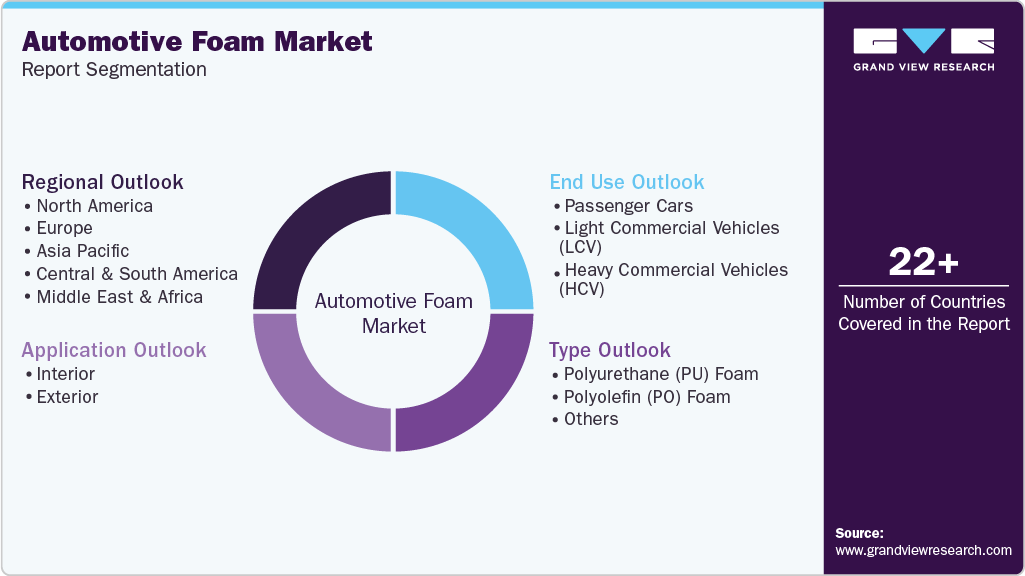

Automotive Foam Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (PU Foam, PO Foam), By Application (Interior, Exterior), By End Use (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-777-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Foam Market Summary

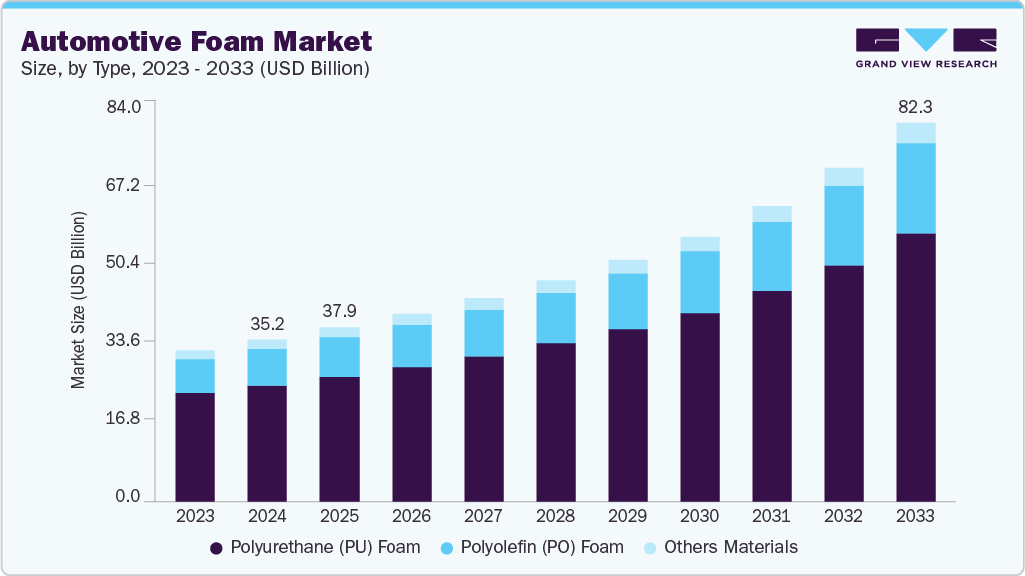

The global automotive foam market size was estimated at USD 35.24 billion in 2024 and is projected to reach USD 82.28 billion by 2033, growing at a CAGR of 10.2% from 2025 to 2033. The growth is anticipated to be driven by the rising automotive industry worldwide.

Key Market Trends & Insights

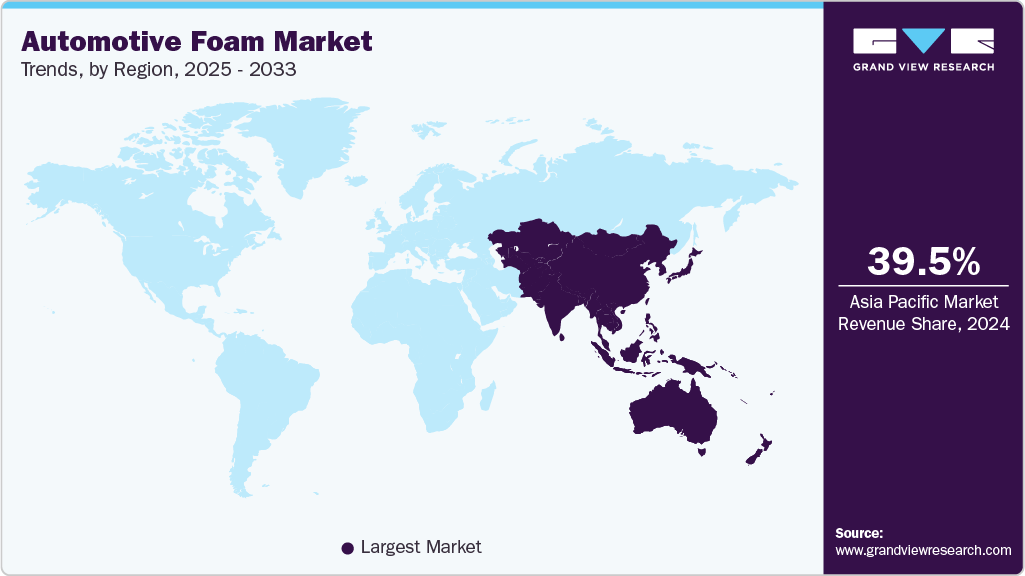

- Asia Pacific dominated the automotive foam market with the largest revenue share of 39.51% in 2024.

- The automotive foam industry in Brazil is expected to grow at a substantial CAGR of 11.1% from 2025 to 2033.

- By type, the polyolefin (PO) foam segment is expected to grow at a considerable CAGR of 10.9% from 2025 to 2033 in terms of revenue.

- By application, the interior segment is expected to grow at a considerable CAGR of 10.4% from 2025 to 2033 in terms of revenue.

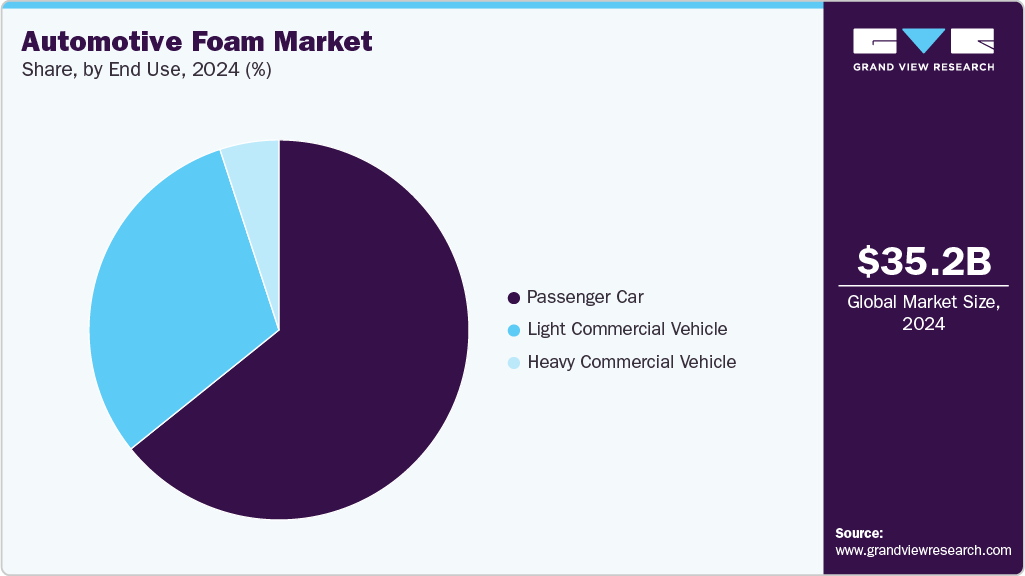

- By end use, the light commercial vehicle segment is expected to grow in revenue at a considerable CAGR of 11.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 35.24 billion

- 2033 Projected Market Size: USD 82.28 billion

- CAGR (2025-2033): 10.2%

- Asia Pacific: Largest market in 2024

The automotive industry has been witnessing a positive outlook globally, due to the introduction of economically priced vehicles, the thriving e-commerce sector, and increasing penetration of mobility & logistics services providing companies such as Uber; Lyft; ANI Technologies Private Limited (Ola); TOTAL QUALITY LOGISTICS, LLC; C.H. Robinson Worldwide, Inc.; Glovo; DiDi Global; and Bolt Technology OÜ. As vehicle electrification and software-defined cabins accelerate, automotive foam is shifting from a purely comfort material to a multifunctional systems material. Modern foam formulations are being engineered to deliver acoustic control, thermal insulation, and targeted energy absorption, while also contributing to vehicle lightweighting strategies that improve efficiency and range. This evolution places foam at the intersection of NVH design, passenger comfort, and packaging for electrified powertrains, driving closer collaboration between OEMs and material suppliers.

Drivers, Opportunities & Restraints

Buyer expectations for refined cabin experience and stringent crashworthiness requirements continue to push foam adoption across seating, door modules, and underbody insulation. Automakers treat foam as a cost-effective lever to differentiate perceived quality through quieter cabins and improved seat ergonomics while still meeting safety targets for impact energy management. At the same time, platform consolidation and higher content per vehicle from feature-rich interiors are compelling suppliers to develop more consistent, scalable foam processes.

Sustainability innovation represents a clear commercial runway for foam makers. Advances in bio-based polyols, safer isocyanate alternatives, and foam-to-foam recycling techniques open pathways to circular seat and interior solutions that answer OEMs’ decarbonization roadmaps and regulatory pressure. There is also a green premium opportunity for premium segment vehicles to adopt recycled or partially bio-derived foams as a market differentiator, and for specialty foams to move into battery pack insulation and module protection, where multifunction performance commands higher margins.

The sector faces material and end-of-life constraints that complicate scale-up. Conventional polyurethane chemistries present recycling challenges and regulatory scrutiny due to hazardous intermediates, which raises compliance and handling costs for manufacturers. In parallel, feedstock price volatility and competition from thermoplastic and composite alternatives create margin pressure and force continuous reformulation, making long-term supply and product economics less predictable for both converters and automakers.

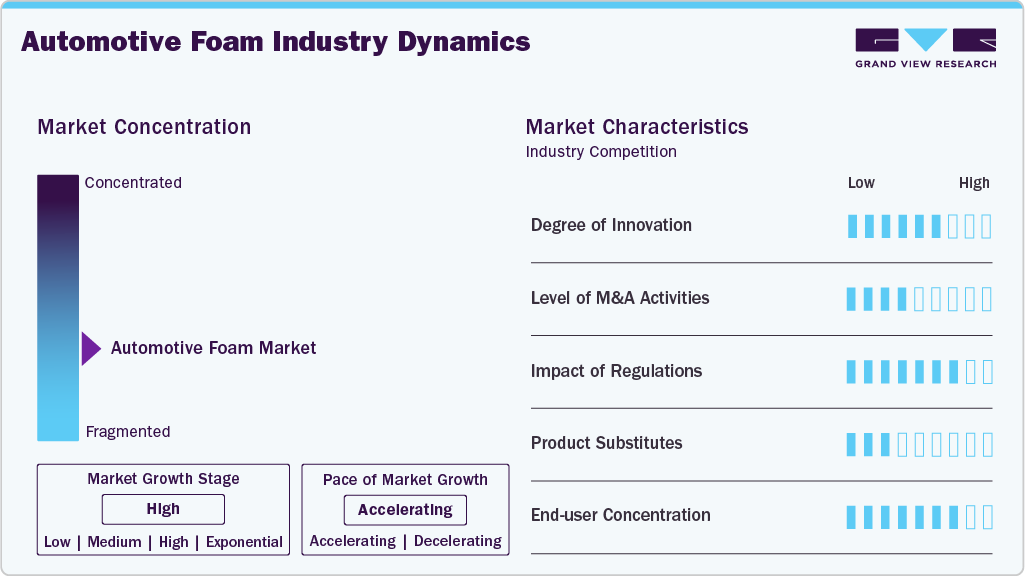

Market Concentration & Characteristics

The automotive foam market growth stage is high, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies like Armacell; BASF SE; Woodbridge; Dow; DuPont; Recticel NV; Borealis AG; Johnson Controls; Bridgestone Corporation; Saint-Gobain; Paul Bauder GmbH & Co. KG; CT Formpolster GmbH; Vita (Holdings) Limited; GF. Manufacturing Co., Ltd; Huntsman International LLC; Sekisui Voltek, LLC; Sondor; Asahi Kasei Corporation; Sheela Foam Ltd, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Demand for automotive foam is heavily shaped by a small number of large OEMs that control platform design and take concentrated purchasing decisions, which amplifies buyer bargaining power and compresses margins for material converters. As OEMs pursue platform consolidation and large electrification programs, they demand tighter cost control, longer qualification cycles, and closer integration with preferred Tier 1s, forcing foam suppliers to consolidate capabilities or accept thin, long-term supply contracts. Geopolitical trade actions and cost disputes further increase the pressure on suppliers to localize production or absorb tariff shocks to retain strategic customers.

Regulatory change is shifting foam development from a performance-only equation to one that must also meet safety, chemical, and circularity requirements, increasing compliance costs and time to market for new grades. European restrictions on diisocyanates have introduced mandatory handling and training obligations that elevate operational overheads for polyurethane producers, while emerging EU rules on end-of-life vehicles and recycled plastics are pushing OEMs to specify higher recycled content and design for disassembly, which challenges conventional foam chemistries. The net effect is a twin pressure on suppliers to invest in safer chemistries, validated recycling routes, and documented supply chains or risk disqualification from major programs.

Type Insights

Polyurethane (PU) foam dominated the global automotive foams market with a revenue share of 71.77% in 2024 and is expected to grow at 10.0% CAGR over the forecast period. Increasing penetration of foam-based components for automotive parts and interiors of vehicles is expected to impact PU foam demand. Its excellent mechanical strength properties, weight reduction abilities, wear, and weathering resistance have made it one of the most important materials in automobile production. PU foam is used in various automobile components, including seats, armrests & headrests, door panels, bumpers, and various other parts. PU foams reduce the overall weight of the vehicle and provide greater fuel efficiency.

Polyolefin (PO) foam is expected to grow at a significant CAGR of 10.9% over the forecast period. Polyolefin foams consist of polyethylene (PE) foam, polypropylene (PP) foam, ethylene vinyl acetate (EVA) foam, and ethylene propylene diene monomer (EPDM) foam. Regulatory authorities have laid down obligatory norms pertaining to increasing the fuel efficiency of vehicles, thus compelling companies to invest in research & development to make innovative changes in vehicle design and achieve higher engine efficiency. On account of these norms, emerging Asian economies, including India, Singapore, and Thailand, are rapidly becoming manufacturing hubs for electric vehicles for European companies. The rapid growth in the manufacturing of electric vehicles in the Asia Pacific region is expected to accelerate the use of polyolefin foam over the forecast period.

Application Insights

The interior segment dominated the automotive foam industry in terms of revenue with a share of 73.95% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The increasing automobile production across the globe, owing to rising disposable income and spending capacity, is expected to impact overall market growth. The moving vehicles transmit vibrations near the human spine. Seats possess low natural frequencies and magnify the vibration effect at some frequencies that of transmitted over a long period, which can result in spine injury. Using foam in car seats provides support to the tailbone and back. As a result, the vehicle driver can sit for long hours in conditions requiring longer travel times.

The exterior segment is projected to grow at a substantial CAGR of 9.5% through the forecast period. Exterior applications are evolving from simple sealing and impact pads to engineered protective elements and composite cores where foam delivers targeted energy absorption, weather resistance, and dimensional stability. Thermoplastic and crosslinked foams are now specified under bumpers, in bumper cores, and around battery enclosures because they combine low weight with predictable crash and thermal behaviour. For suppliers, this opens higher value opportunities to qualify specialty grades that meet flame, smoke, and outgassing expectations for underbody and engine bay exposure.

End Use Insights

Passenger car led the automotive foam market with the largest revenue share of 64.23% in 2024 and is expected to grow at a CAGR of 9.5% through the forecast period. This can be attributed to their high content of comfort and acoustic parts across trim levels. In this segment, foam is a baseline quality lever for OEMs seeking consistent ride feel and perceived cabin refinement, and it is often used as an inexpensive way to elevate mid-segment vehicles without significant redesign. For converters, the challenge is delivering repeatable, high-throughput processes that meet tight cycle time targets while supporting design variations across platforms.

The light commercial vehicle segment is expected to grow at a substantial CAGR of 11.7% over the forecast period. Light commercial vehicles are the fastest growing end use for foam innovation because two concurrent trends are reshaping requirements: electrification and mission-specific configurations such as refrigerated or last-mile delivery bodies. eLCVs require efficient battery insulation and vibration damping, while refrigerated and cargo variants need robust thermal panels that reduce payload energy consumption. This creates immediate demand for tailored foam architectures and aftermarket retrofit solutions, presenting a practical growth runway for specialty foam suppliers.

Regional Insights

The Asia Pacific automotive foam market held the largest revenue share of 39.51% in 2024. Rapid vehicle production and expanding domestic EV programs are creating a large, diverse demand base for multifunctional foams that serve everything from low-cost passenger cars to purpose-built commercial platforms. Local manufacturers prefer foams that are easy to thermoform and source regionally, which accelerates the adoption of polyolefin and thermoplastic grades for thermal and moisture control in battery and cargo applications. Growth in this region is also attracting global converters to set up regional capability to win platform content.

North America Automotive Foam Market Trends

In North America, the primary commercial driver is a convergence of fleet electrification and rising NVH expectations that forces OEMs to specify higher-performance foams for both battery protection and cabin refinement. Suppliers in North America are therefore prioritizing low-density, thermally stable grades that simplify assembly while meeting OEM targets for quieter cabins and safer battery packs. This demand is also encouraging near-market production and qualification programs to shorten supply chains and secure long-term platform contracts.

U.S. Automotive Foam Market Trends

The growth of the U.S. automotive foam industry is driven by large-scale OEM electrification programs and by a commercial vehicle fleet shift that values payload efficiency and battery thermal management. Tier suppliers are responding with tailored foam architectures for battery insulation, underbody protection, and lightweight seating solutions that reduce energy use and improve range per charge. The concentrated purchasing power of a few major OEMs means qualified, locally certified foam grades win long-life program content.

Europe Automotive Foam Market Trends

Regulatory pressure and circularity mandates are reshaping demand signals for automotive foam across the region. OEMs and Tier suppliers must now balance acoustic and crash performance with recycled content and safer chemistries, prompting investment in bio-based polyols, validated recycling routes, and documented supply chains. That regulatory push raises the bar for supplier credentials and creates premium opportunities for foams that can demonstrate compliance and end-of-life recoverability.

The China automotive foam market is expected to grow over the forecast period. China’s position as the global electric vehicle manufacturing hub is the single biggest driver for foam demand, with intense focus on battery insulation, thermal management, and NVH mitigation as NEV volumes expand. Automakers and suppliers are fast-tracking foam qualifications that meet tight outgassing, fire, and thermal criteria for battery packs while also addressing interior quality concerns highlighted in recent industry quality studies. This combination of scale and technical specification is creating a robust market for both commodity and specialty foam grades.

Key Automotive Foam Company Insights

The automotive foam industry is characterized by a competitive landscape with several key players driving innovation and growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Automotive Foam Companies:

The following are the leading companies in the automotive foam market. These companies collectively hold the largest market share and dictate industry trends.

- Armacell

- BASF SE

- Woodbridge

- Dow

- DuPont

- Recticel NV

- Borealis AG

- Johnson Controls

- Bridgestone Corporation

- Saint-Gobain

- Paul Bauder GmbH & Co. KG

- CT Formpolster GmbH

- Vita (Holdings) Limited

- GF. Manufacturing Co., Ltd

- Huntsman International LLC

- Sekisui Voltek, LLC

- Sondor

- Asahi Kasei Corporation

- Sheela Foam Ltd

Recent Developments

-

In July 2025, Covestro launched its next-generation flame-retardant encapsulation polyurethane foam, Baysafe BEF, aimed at enhancing electric vehicle (EV) battery safety by preventing fire spread between battery cells.

-

In April 2024, Huntsman launched a new series of lightweight, durable SHOKLESS™ polyurethane foam systems designed to protect electric vehicle (EV) batteries. These foams are developed for potting, fixing cells, and encapsulating battery modules or packs, offering both structural and thermal protection at various density levels. The systems provide good mechanical properties, fast curing at low temperatures, and compatibility with common manufacturing methods.

Automotive Foam Market Report Scope

port Attribute

Details

Market size value in 2025

USD 37.90 billion

Revenue forecast in 2033

USD 82.28 billion

Growth rate

CAGR of 10.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

August 2025

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Report segmentation

Type, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; Southeast Asia; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

Armacell; BASF SE; Woodbridge; Dow; DuPont; Recticel NV; Borealis AG; Johnson Controls; Bridgestone Corporation; Saint-Gobain; Paul Bauder GmbH & Co. KG; CT Formpolster GmbH; Vita (Holdings) Limited; GF. Manufacturing Co., Ltd; Huntsman International LLC; Sekisui Voltek, LLC; Sondor; Asahi Kasei Corporation; Sheela Foam Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Foam Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the automotive foam market report based on type, application, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyurethane (PU) Foam

-

Polyolefin (PO) Foam

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Interior

-

Seating

-

Instrument Panels

-

Headliners

-

Door Panels & Water shields

-

Seals, Gaskets & NVH

-

Others

-

-

Exterior

-

Bumper System

-

Others

-

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Passenger Cars

-

Light Commercial Vehicles (LCV)

-

Heavy Commercial Vehicles (HCV)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan’

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive foam market size was estimated at USD 32.24 billion in 2024 and is expected to reach USD 37.90 billion in 2025.

b. The global automotive foam market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2033 to reach USD 82.28 billion by 2033.

b. Polyurethane (PU) foam dominated the global automotive foams market in terms of revenue and accounted for 71.77% of the market share in 2024 and is expected to grow at 10.0% CAGR over the forecast period. Increasing penetration of foam-based components for automotive parts and interiors of vehicles is expected to impact PU foam and demand.

b. Some key players operating in the automotive foam market include Armacell; BASF SE; Woodbridge; Dow; DuPont; Recticel NV; Borealis AG; Johnson Controls; Bridgestone Corporation; Saint Gobain; Paul Bauder GmbH & Co. KG; CT Formpolster GmbH; Vita (Holdings) Limited; GF. Manufacturing Co., Ltd; Huntsman International LLC; and Sekisui Voltek, LLC; Sondor.

b. The market is anticipated to be driven by the growth of the automotive industry worldwide The automotive industry has been witnessing a positive outlook globally due to the introduction of economically priced vehicles, the thriving e-commerce sector, and increasing penetration of mobility & logistics services providing companies such as Uber, Lyft, ANI Technologies Private Limited (Ola), TOTAL QUALITY LOGISTICS, LLC, C.H. Robinson Worldwide, Inc., Glovo, DiDi Global, and Bolt Technology OÜ.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.