- Home

- »

- Advanced Interior Materials

- »

-

Automotive Heat Shield Market Size, Industry Report, 2030GVR Report cover

![Automotive Heat Shield Market Size, Share & Trends Report]()

Automotive Heat Shield Market Size, Share & Trends Analysis Report By Product (Single Shell, Double Shell), By Application (Exhaust System, Turbocharger, Engine Compartment), By Material, By Vehicle Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-306-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Automotive Heat Shield Market Trends

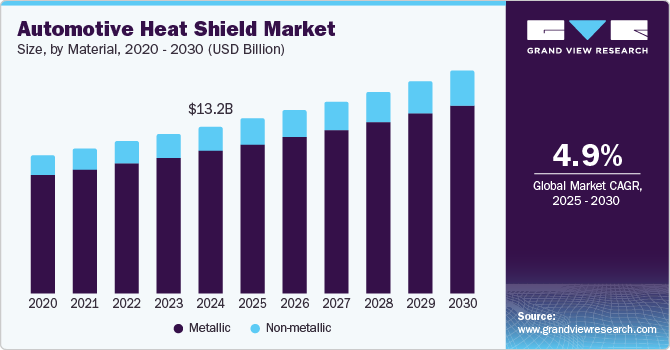

The global automotive heat shield market size was estimated at USD 13.18 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2030. The market is experiencing notable growth, driven by a combination of regulatory, technological, and demand-driven factors. A major driver is the increasing implementation of stringent emission standards across many regions, particularly Europe, North America, and Asia. These regulations aim to reduce the environmental impact of vehicles by controlling emissions and improving fuel efficiency. Heat shields play a critical role in enabling vehicles to meet these standards by insulating engine components and exhaust systems, which helps reduce heat build-up, improves fuel efficiency, and minimizes harmful emissions.

Another significant driver is the rising demand for electric and hybrid vehicles. As the automotive industry shifts toward electrification, the need for advanced heat management solutions becomes more pressing. Electric vehicle (EV) components, such as batteries, electric motors, and power electronics, generate considerable heat during operation. Effective thermal management is essential to ensure these components' safety, efficiency, and longevity. Consequently, heat shields designed specifically for EV applications are in higher demand, pushing manufacturers to innovate and develop specialized solutions for this rapidly growing segment.

Moreover, advancements in lightweight materials and heat-resistant composites further propel the market. Automotive manufacturers increasingly focus on reducing vehicle weight to enhance fuel efficiency and performance. Modern heat shield materials, such as aluminum and composites, offer the necessary thermal resistance while being lightweight, helping manufacturers meet fuel economy standards without compromising on vehicle safety or performance. This trend is particularly prominent in the high-performance and luxury vehicle segments, where heat management is crucial for optimizing engine output and overall vehicle performance.

Material Insights

The metallic segment accounted for 85.32% of the revenue share in 2024. This segment is driven by its superior heat resistance and durability compared to non-metallic alternatives. Metallic heat shields, often made from aluminum or steel, offer exceptional thermal conductivity and can withstand high-temperature environments commonly found in automotive engines and exhaust systems. This robustness ensures longer product life, reducing the need for frequent replacements, which appeals to manufacturers focused on reducing maintenance costs and improving vehicle longevity.

The non-metallic segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. This segment of the market is experiencing significant growth, driven by increasing demand for lightweight materials in vehicle manufacturing. Automotive manufacturers aim to improve fuel efficiency and reduce emissions.

Application Insights

The engine compartment accounted for 77.98% of the revenue share in 2024. This segment is driven by the increasing demand for improved vehicle performance and enhanced thermal management systems. As automotive manufacturers strive to deliver higher engine efficiency and power output, engines tend to generate more heat, necessitating efficient heat shields to protect sensitive components and improve engine performance.

Turbocharger is expected to grow at the fastest CAGR of 6.1% over the forecast period. Turbochargers play a crucial role in improving engine efficiency by compressing air, allowing smaller engines to produce more power. This process, however, generates intense heat, making heat shields essential for protecting nearby components from thermal damage and ensuring optimal performance. As more automakers incorporate turbochargers into a broader range of vehicle models, the need for reliable and effective heat shields continues to grow.

Vehicle Type Insights

The passenger car segment accounted for 30.83% of the revenue share in 2024, driven by the growing consumer demand for enhanced vehicle comfort and cabin temperature control. Heat shields help protect the cabin from engine and exhaust heat, contributing to a more comfortable driving experience. With consumers prioritizing comfort and safety in their vehicle choices, automakers are integrating more robust thermal insulation measures. Advanced heat shielding technology, capable of isolating heat in high temperature zones, meets these requirements, driving the adoption of heat shields in passenger cars across both premium and economy models.

HCV is expected to grow significantly at a CAGR of 4.7% over the forecast period. The Heavy Commercial Vehicles (HCV) segment in the market is witnessing growth driven by increasing regulatory pressure for emissions reduction and advancements in engine technology. As regulatory bodies worldwide continue to impose stringent standards to limit exhaust emissions, there is a rising demand for heat shields that effectively manage engine and exhaust system temperatures in HCVs.

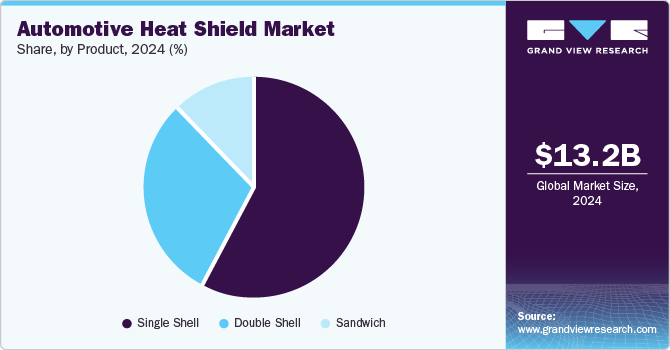

Product Insights

Single shell segment accounted for 58.31% of the revenue share in 2024. The single shell segment in the market is driven by factors such as its cost-effectiveness and straightforward design, making it an attractive option for vehicle manufacturers. This segment offers sufficient thermal protection for various automotive components, especially in situations where moderate heat insulation is required. The rising demand for lightweight materials to improve fuel efficiency also boosts the popularity of single-shell heat shields, as they are typically lighter than multi-layer alternatives. In addition, single-shell heat shields are easier to install and require minimal maintenance, appealing to automakers focused on reducing production costs and improving assembly line efficiency.

The sandwich segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. The driving force behind the adoption of sandwich heat shields is their enhanced durability and performance under extreme conditions. These heat shields are designed to withstand high temperatures and harsh environments, ensuring prolonged protection for critical components such as exhaust systems, turbochargers, and engine parts.

Regional Insights

Asia Pacific dominated the market and accounted for 38.11% of global revenue in 2024. The automotive heat shield market in Asia Pacific is witnessing significant growth, driven by the rapid expansion of the automotive industry in countries like China, India, and Japan, fueling demand. With increased production and sales of passenger and commercial vehicles, the need for high-performance, reliable heat shields is growing to protect vehicle components from the intense heat generated by engines and exhaust systems. This is especially relevant as Asia-Pacific automakers focus on producing vehicles with higher fuel efficiency and performance, making effective heat management crucial.

China Automotive Heat Shield Market Trends

The automotive heat shield market in China is the world's largest, with substantial domestic and export vehicle production growth. As vehicle manufacturing continues to rise, there is a growing need for automotive heat shields to protect components from excessive heat generated by engines and exhaust systems. The expansion of electric vehicles (EVs) and hybrid vehicles in China further contributes to the demand for heat shields, as these vehicles also require thermal management solutions.

Central & South America Automotive Heat Shield Market Trends

The automotive heat shield market in CSA is expected to grow significantly over the forecast period. With the growing focus on reducing emissions and improving fuel efficiency, there is an increasing demand for heat shields that help optimize vehicle performance. Heat shields control exhaust heat, contributing to improving engine efficiency and reducing the vehicle's carbon footprint. Furthermore, the growing implementation of stringent emission regulations and fuel economy standards in countries such as Brazil is driving the adoption of these components in vehicles to meet compliance.

North America Automotive Heat Shield Market Trends

The automotive heat shield market in North America is growing due to the increase in electric and hybrid vehicle production. As these vehicles often operate at higher temperatures due to high-powered batteries and advanced electric drivetrains, heat shields are increasingly used to protect these critical components. The push towards electrification in the automotive sector, driven by both consumer demand and governmental policies, directly impacts the demand for heat shields that can withstand higher levels of heat generated in EVs and hybrid vehicles.

The U.S. automotive heat shield market has stringent government regulations to reduce vehicle emissions and enhance safety. The Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) enforce regulations that require automakers to reduce vehicle environmental impact. Heat shields are crucial in protecting sensitive components from high temperatures and emissions. This has increased demand for advanced vehicle heat shield solutions to comply with these regulations.

Europe Automotive Heat Shield Market Trends

The automotive heat shield market in Europe is growing due to the demand for lightweight materials, and more advanced design capabilities in the automotive sector drive innovation in heat shield technologies. Heat shields must withstand high temperatures and contribute to vehicle weight reduction, a key factor for improving fuel economy. The use of lightweight materials such as aluminum, advanced composites, and ceramic coatings in manufacturing heat shields is gaining traction. These innovations are especially critical as electric vehicles (EVs) and hybrid vehicles, which require enhanced thermal management, become more popular in Europe.

Key Automotive Heat Shield Company Insights

Some key players operating in the market include DuPont, Dana Incorporated, and Others.

-

DuPont is a global company in advanced materials and chemicals, offering a range of solutions for the market. The company provides high-performance materials designed to withstand extreme temperatures, including its proprietary offerings like Kevlar and Nomex, used in automotive heat shielding applications to protect critical components from heat damage. DuPont’s heat-resistant solutions help enhance vehicle durability and safety by reducing heat transfer in areas such as exhaust systems, engine compartments, and underbody components.

-

Dana Incorporated offers a wide range of products, including advanced heat shields designed to protect critical components from excessive heat. Dana's product offerings include solutions for exhaust systems, underbody protection, and engine compartments, all engineered to enhance vehicle performance, fuel efficiency, and safety.

Key Automotive Heat Shield Companies:

The following are the leading companies in the automotive heat shield market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Dana Limited.

- Zircotec Ltd

- Morgan Advanced Materials

- Autoneum

- ElringKlinger AG

- Lydall, Inc.

- Tenneco Inc.

- CARCOUSTICS

- UGN Inc.

Recent Development

-

In April 2023, Autoneum completed the acquisition of Borgers Automotive. This development has led to Autoneum's operational scope now encompassing 67 production facilities across the globe, with a workforce of approximately 16,100 individuals spanning 24 different countries. By integrating the well-established German company into its operations, Autoneum has taken another significant step in fortifying its position as a worldwide leader in sustainable solutions for vehicle acoustic and thermal management

Automotive Heat Shield Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.81 billion

Revenue forecast in 2030

USD 17.56 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, material, vehicle type, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

DuPont; Dana Limited.; Zircotec Ltd; Morgan Advanced Materials; Autoneum; ElringKlinger AG; Lydall, Inc.; Tenneco Inc.; CARCOUSTICS; UGN Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Heat Shield Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive heat shield market based on product, material, application, vehicle type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Shell

-

Double Shell

-

Sandwich

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Exhaust System

-

Turbocharger

-

Under Bonnet

-

Engine Compartment

-

Under Chassis

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallic

-

Non-metallic

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Light Commercial Vehicle (LCV)

-

Heavy Commercial Vehicle (HCV)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global automotive heat shield market size was estimated at USD 13.18 billion in 2024 and is expected to reach USD 13.81 billion in 2025.

b. The global automotive heat shield market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 reaching USD 17.56 billion by 2030.

b. The metallic segment accounted for 85.32% of the revenue share in 2024. This segment of the automotive heat shield market is driven by its superior heat resistance and durability compared to non-metallic alternatives.

b. Some of the key players operating in the automotive heat shield market include DuPont, Dana Incorporated, Zircotec, Morgan Advanced Materials, Autoneum, ElringKlinger AG, Lydall Inc., Tenneco Inc., Carcoustics, and UGN Inc.

b. Key factors that are driving the automotive heat shield market are rising product utilization in the production of electric vehicles, lightweight and fuel-efficient passenger cars, and commercial vehicles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."