- Home

- »

- Next Generation Technologies

- »

-

Automotive Image Sensors Market Size & Share Report 2030GVR Report cover

![Automotive Image Sensors Market Size, Share & Trends Report]()

Automotive Image Sensors Market Size, Share & Trends Analysis Report By Technology (CCD, CMOS), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-133-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global automotive image sensors market size was estimated at USD 3.02 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.6% from 2023 to 2030. The increasing consumer demand for improved safety features in vehicles has become a significant factor, encouraging automakers to integrate more image sensors. This, in turn, drives growth in the market. In addition, the increased adoption of image sensors to augment functionalities such as blind-spot monitoring, parking assistance, and pedestrian detection is expected to fuel the demand for the market over the forecast period.

The ongoing advancement and rigorous testing of autonomous vehicles rely extensively on using image sensors, encompassing cameras, LiDAR, and radar. With the significant growth in the autonomous vehicle sector, the demand for high-quality image sensors is expected to rise considerably. This trend is expected to serve as a dominant factor, which is augmenting the robust growth of the market.

Furthermore, key market players are continuously working on improving the product portfolio with technological advancements to offer enhanced user experience. For instance, in June 2022, Infineon Technologies AG collaborated with pmdtechnologies ag, to introduce the second iteration of the REAL3 automotive image sensor. This range of sensors is recognized for its ISO26262-compliant attributes, serving as a high-resolution 3D image sensor tailored for automotive applications. Moreover, they play a crucial role in achieving compliance with regulations and NCAP ratings, as well as in realizing the vision of transforming the driver into a passenger. Such product developments in automotive sectors are expected to boost market growth over the forecast period.

The COVID-19 pandemic led to the subsequent lockdown restrictions and temporarily forced manufacturing units and factories to remain shut, which hampered numerous industries. The disruption in global supply chains also led to delays in the production and delivery of image sensors and related components, further affecting market dynamics. However, as the industry adapted to the new normal, economic conditions improved, and vaccination campaigns progressed, the market began to recover. The demand for vehicles, including those equipped with advanced safety features enabled by image sensors, progressively picked up, indicating the flexibility of the automotive industry, thereby significantly boosting the market growth.

Moreover, key market players are continuously innovating and adopting technologies to improve their product efficiency and increase their foothold in the industry, further driving the market growth. For instance, in September 2022, STMicroelectronics International N.V., a multinational corporation and technology company, launched a new sensor, the VD/VB1940. This product provides an economical solution by integrating the sensitivity and fine detail of infrared sensing with the exceptional High Dynamic Range (HDR) capabilities of color imaging into a single, unified component. It can capture frames alternatively using both rolling-shutter and global-shutter modes. Such product innovations by market players are anticipated to compel market growth over the forecast period.

Technology Insights

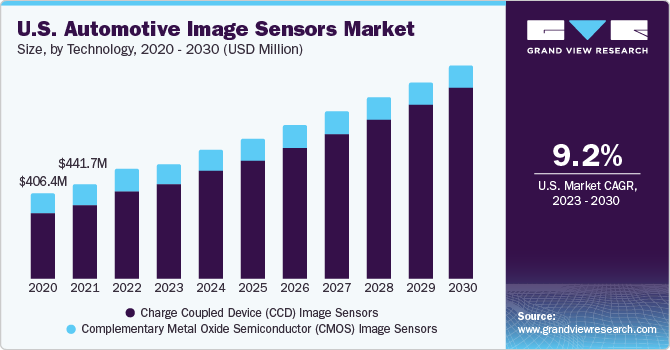

Based on technology, the CMOS technology segment accounted for the largest revenue share of over 79% in 2022 and is projected to sustain the same trend over the forecast period. This can be attributed to its compact design, low energy consumption, and cost-efficient characteristics, making it a considerably preferred option for diverse applications. For instance, in September 2023, Sony Semiconductor Solutions Corporation launched the CMOS image sensor for automotive cameras, equipped with a notable 17.42 effective megapixels. This innovative sensor is expected to boost the advancement of automotive camera systems with advanced sensing and recognition capabilities, ultimately enhancing the safety and security of automated driving, which is expected to drive segment growth over the forecast period.

The CCD technology segment is anticipated to grow at a CAGR of around 0.5% during the forecast period. The segment's growth is attributed to the growing application in the automotive sector for enhanced image quality. CCD sensors' prominent capability to deliver superior image quality, particularly in low-light conditions, makes them an essential option in situations where visibility and image precision are of utmost importance, which includes advanced driver-assistance systems (ADAS) and autonomous vehicles, compelling the segment's growth over the forecast period.

Vehicle Type Insights

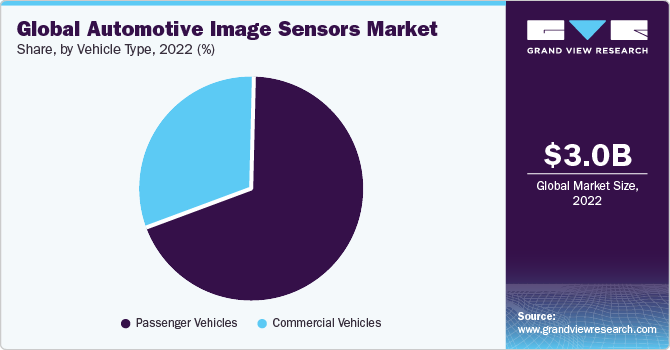

Based on vehicle type, the passenger vehicles segment accounted for the largest market share of over 69.0% in 2022. This is attributed to the use of advanced image sensor technology by automakers as a competitive differentiator to attract customers. Adding high-resolution cameras and advanced safety features can significantly augment the vehicle's appeal and market competitiveness. Furthermore, as the automotive sector increases its image sensor production on a larger scale, economies of scale have led to cost reductions. This, in turn, is enhancing the integration of image sensors into a wide range of passenger vehicle models, which is expected to drive the segment growth over the forecast period.

Following the passenger vehicles segment, the commercial vehicles segment is expected to grow at a significant CAGR of over 11.0% during the forecast period. Commercial vehicle operators are increasingly adopting image sensor technology to enhance fleet management and safety. Image sensors help monitor driver behavior, provide real-time feedback, and offer critical data for optimizing commercial vehicle operations, which is expected to augment the segment demand over the forecast period.

Regional Insights

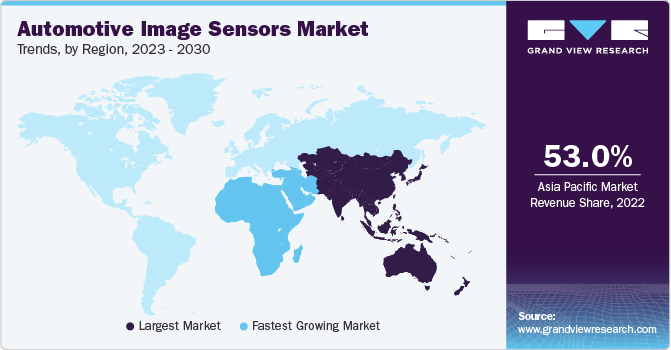

The Asia Pacific region captured the highest revenue share of over 53.0% in 2022. The increasing adoption of electric vehicles (EVs) across the region, especially in countries including China, Japan, and South Korea, is boosting the demand for automotive image sensor infrastructure, creating significant opportunities for the market players in the region. Moreover, consumers are becoming more aware of the benefits of advanced safety features in vehicles. This awareness drives the demand for vehicles equipped with image-sensing technologies, which is expected to drive market growth across the region.

The Middle East & Africa region is anticipated to grow at the fastest CAGR of over 13.0% over the forecast period. The region is distinguished for its prospering luxury automobile market, which drives market growth. High-end and luxury car manufacturers frequently integrate advanced image-sensing sensors as integral elements of their premium features, thereby making a significant contribution to the market expansion and is expected to fuel the expansion throughout the forecast period.

Key Companies & Market Share Insights

The market is classified as highly competitive, with the presence of several players worldwide. The key players operating in the industry are focusing on strategic alliances, product development, expansion, mergers & and acquisitions to remain competitive. For instance, in May 2023, Semiconductor Components Industries, LLC (onsemi), a leader in intelligent power and sensing technologies, introduced Hyperlux into their automotive image sensor family. Featuring a pixel size of 2.1 µm, an unparalleled 150dB ultra High Dynamic Range (HDR), and LED Flicker Mitigation (LFM) that operates perfectly across the entire automotive temperature range, the Hyperlux family stands as a high-performance solution. This offering encompasses speed and advanced capabilities, effectively propelling the evolution of the next generation of Advanced Driver Assistance Systems (ADAS). Such product developments by the key players are anticipated to augment the market growth over the forecast period. Some prominent players in the global automotive image sensors market include:

-

Samsung Electronics Co., Ltd.

-

Continental AG

-

Infineon Technologies AG

-

Semiconductor Components Industries, LLC

-

DENSO Corporation

-

OmniVision Technologies, Inc.

-

Sharp Corporation

-

NXP Semiconductors N.V.

-

Gentex Corporation

-

Sony Semiconductor Solutions Corporation

-

Canon Inc.

-

Teledyne Technologies Incorporated

-

STMicroelectronics International N.V.

-

SmartSens Technology (Shanghai) Co., Ltd.

-

PixArt Imaging Inc.

Automotive Image Sensors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.31 billion

Revenue forecast in 2030

USD 7.15 billion

Growth rate

CAGR of 11.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Mexico; Saudi Arabia; UAE

Key companies profiled

Samsung Electronics Co., Ltd.; Continental AG; Infineon Technologies AG; Semiconductor Components Industries, LLC; DENSO Corporation; OmniVision Technologies, Inc.; Sharp Corporation; NXP Semiconductors N.V.; Gentex Corporation; Sony Semiconductor Solutions Corporation; Canon Inc.; Teledyne Technologies Incorporated; STMicroelectronics International N.V.; SmartSens Technology (Shanghai) Co., Ltd.; PixArt Imaging Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

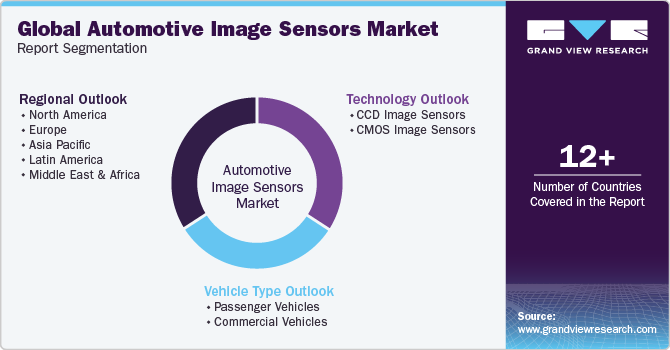

Global Automotive Image Sensors Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive image sensors market report based on technology, vehicle type, and region:

-

Technology Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

CCD Image Sensors

-

CMOS Image Sensors

-

-

Vehicle Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive image sensors market size was estimated at USD 3.02 billion in 2022 and is expected to reach USD 3.31 billion in 2023.

b. The global automotive image sensors market is expected to grow at a compound annual growth rate of 11.6% from 2023 to 2030 to reach USD 7.15 billion by 2030.

b. Asia Pacific region dominated the automotive image sensors market with a share of over 53.0% in 2022. The increasing adoption of electric vehicles (EVs) across the region, especially in countries including China, Japan, and South Korea, is boosting the demand for automotive image sensors infrastructure, creating significant opportunities for the market players in the region.

b. Some key players operating in the automotive image sensors market include Samsung Electronics Co., Ltd., Continental AG, Infineon Technologies AG, DENSO Corporation, Semiconductor Components Industries, LLC, and many others.

b. The market's growth is due to the increasing consumer demand for improved safety features in vehicles encouraging automakers to integrate an increased number of image sensors. In addition, the increased adoption of image sensors to augment functionalities such as blind-spot monitoring, parking assistance, and pedestrian detection, is expected to fuel the demand for the automotive image sensors market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."