- Home

- »

- Research

- »

-

Autonomous Mobile Delivery Robots Market Size Report 2033GVR Report cover

![Autonomous Mobile Delivery Robots Market Size, Share & Trends Report]()

Autonomous Mobile Delivery Robots Market (2025 - 2033) Size, Share & Trends Analysis Report By Platform Type, By Payload Capacity, By End Use (Food Delivery, Grocery Delivery), By Region and Segment Forecasts

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Mobile Delivery Robots Market Summary

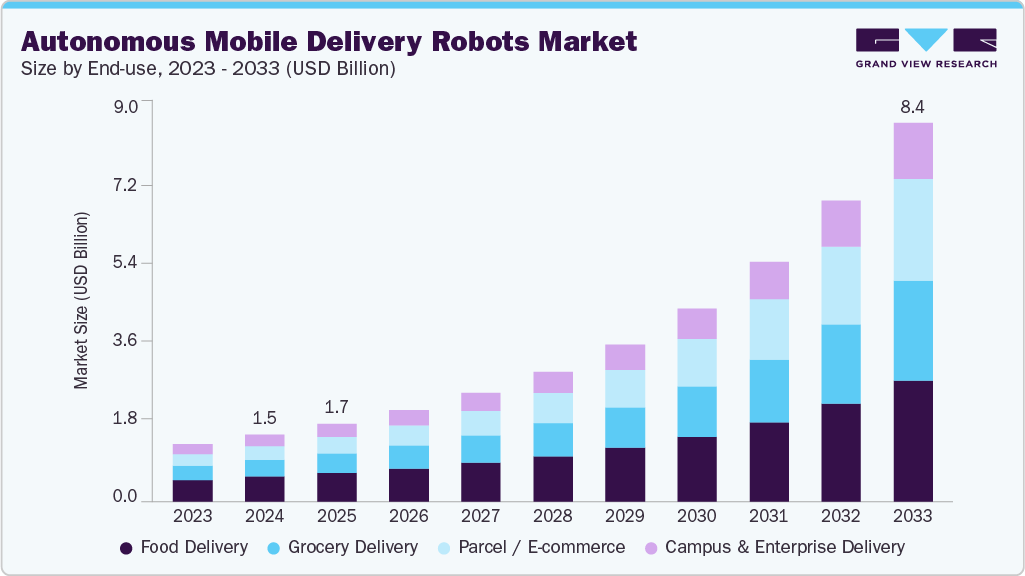

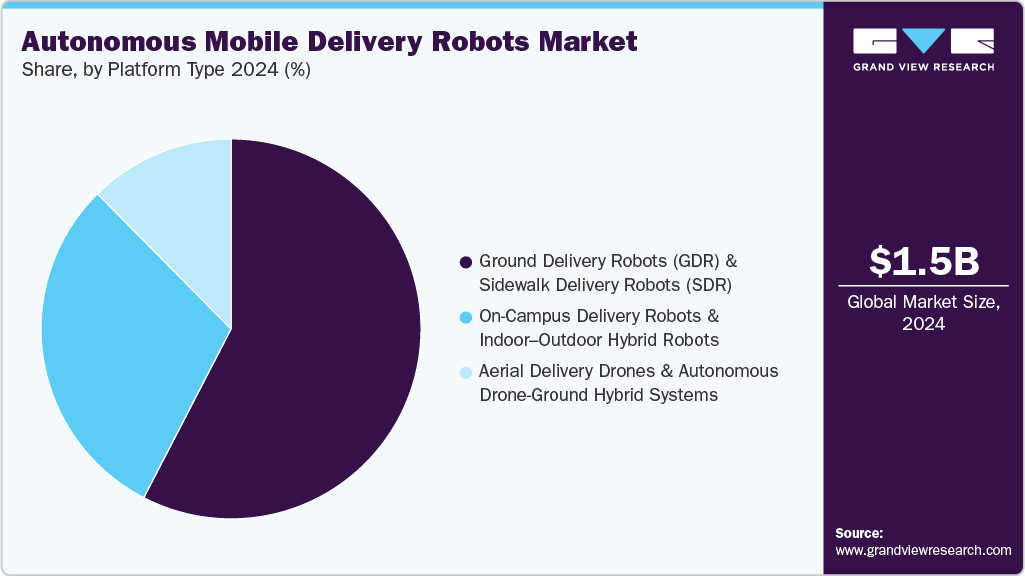

The global autonomous mobile delivery robots market size was valued at USD 1.48 billion in 2024 and is projected to reach USD 8.44 billion by 2033, growing at a CAGR of 21.9% from 2025 to 2033. Growing labor shortages, increasing wages, and pressure to reduce last-mile delivery costs are pushing enterprises toward autonomous mobile delivery robots.

Key Market Trends & Insights

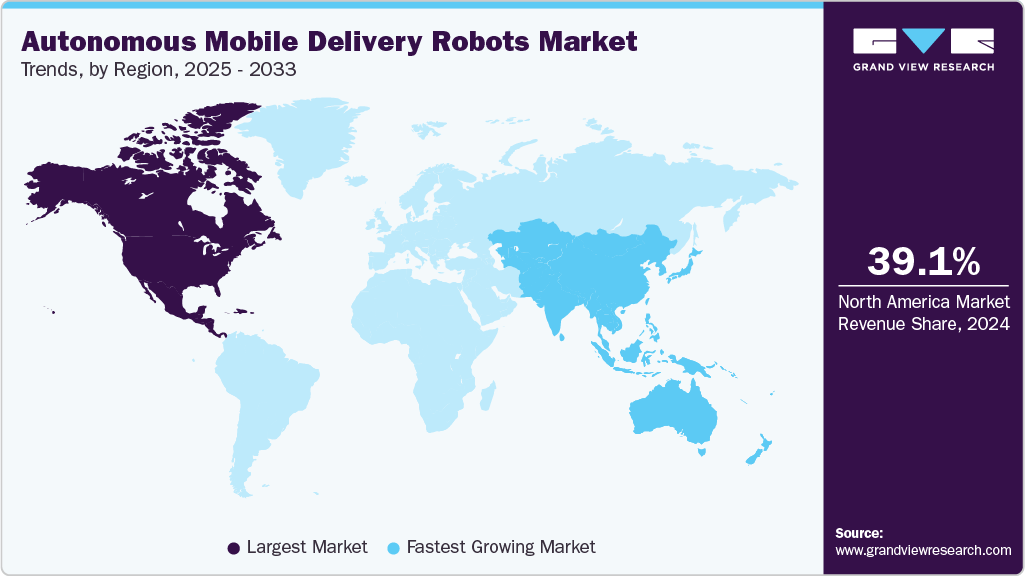

- North America dominated the global autonomous mobile delivery robots market with the largest revenue share of 39.1% in 2024.

- The autonomous mobile delivery robots market in the U.S. led the North America market and held the largest revenue share in 2024.

- By payload capacity, light-payload robots (Up to 10 kg) led the market, holding the largest revenue share of 49.8% in 2024.

- By platform type, Ground Delivery Robots (GDR) and Sidewalk Delivery Robots (SDR) segment held the dominant position in the market.

- By end use, food delivery segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 1.48 Billion

- 2033 Projected Market Size: USD 8.44 Billion

- CAGR (2025-2033): 21.9%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

These systems deliver predictable cost structures, higher delivery density, and faster turnaround, enabling businesses to maintain competitive margins while improving service efficiency.The exponential growth of e-commerce and the normalization of same-day or next-hour delivery have created strong demand for cost-efficient, high-frequency last-mile logistics. Autonomous mobile delivery robots address these pressures by enabling scalable, low-cost delivery operations in busy urban corridors, residential neighborhoods, and controlled premises. Retailers and marketplaces face strong consumer expectations for fast, accurate fulfillment, and human-based delivery models are increasingly unsustainable at peak volumes. AMDRs support continuous, 24/7 operations, predictable route optimization, and reduced operational bottlenecks. Their integration with micro-fulfillment centers, dark stores, and digital commerce platforms further accelerates adoption, positioning AMDRs as a structural solution to e-commerce-driven fulfillment challenges.

Advances in AI perception, sensor fusion, computer vision, SLAM, and edge-AI processing drastically improve the reliability, navigation accuracy, and safety of autonomous delivery robots. Enhanced localization and obstacle-avoidance capabilities enable robots to operate confidently in complex, mixed-traffic environments such as sidewalks, campuses, and retail hubs. Parallel improvements in battery density, charging efficiency, and thermal stability support longer duty cycles and lower operational downtime. These technology gains reduce the cost per delivery, improve throughput, and enhance regulatory compliance. As autonomous stacks mature, AMDRs become more commercially viable, reducing total cost of ownership and enabling broader deployment across retail, logistics, food service, and enterprise environments.

Governments and municipalities worldwide are establishing regulatory sandboxes and controlled deployment zones to test and validate robot delivery models. These supportive frameworks lower operational barriers and speed up commercial readiness. Logistics firms, food-delivery services, universities, and retailers are actively partnering with robot manufacturers to launch pilots, confirm economics, and improve delivery workflows. Such partnerships enhance ecosystem maturity, standardize operational protocols, and encourage investment in scalable deployment programs. Universities and enterprise campuses offer low-regulation environments where operational data, reliability metrics, and ROI benefits are quickly demonstrated. As policy clarity improves and industry alliances grow, AMDR adoption speeds up due to increased stakeholder confidence and proven commercial success.

Payload Capacity Insights

The Light-Payload Robots (up to 10 kg) segment led the market with a share of over 49.8% in 2024. These robots are gaining significant traction in the AMDR market due to their suitability for high-frequency, short-distance deliveries in food, grocery, pharmacy, and campus environments. Their compact size, lower hardware costs, and ease of navigation on sidewalks or indoors make them ideal for dense urban areas and controlled settings. Retailers and delivery platforms favor these robots because they enable rapid turnaround, scalable fleet management, and lower operating costs compared to human couriers. The increasing demand for small-basket orders and instant delivery models further accelerates adoption, establishing light-payload robots as a cost-effective and flexible solution for last-mile logistics.

The Heavy-Payload Robots (above 30 kg) segment is expected to register the highest CAGR during the forecast period. Heavy-payload robots (above 30 kg) are gaining strong traction in the AMDR market as retailers, logistics operators, and hyperlocal delivery companies increasingly need robots that can carry bulk orders, multi-item grocery loads, and medium-sized parcels in a single trip. Rising demand for efficient micro-fulfillment workflows, growing adoption of warehouse-to-curbside automation, and the need to cut labor-intensive handling of heavier goods drive faster adoption. Improvements in high-torque drivetrains, stability control, rugged chassis designs, and long-capacity batteries boost operational safety and range, allowing deployment across mixed indoor and outdoor routes. As e-commerce order sizes expand and companies aim for higher delivery productivity per mission, heavy-payload AMDRs are becoming essential for scalable last-mile logistics.

Platform Type Insights

Ground Delivery Robots (GDR) and Sidewalk Delivery Robots (SDR) segment dominated the market in 2024. Ground Delivery Robots (GDRs) and Sidewalk Delivery Robots (SDRs) are gaining momentum as retailers, food-service operators, and logistics companies seek scalable, low-cost solutions for last-mile deliveries, particularly for short-distance, high-frequency routes. Their ability to operate safely on sidewalks and low-speed zones, combined with advancements in vision-based navigation, mapping, and obstacle avoidance, enables reliable autonomous operations in dense urban environments. Rising labor costs, demand for faster delivery windows, and the expansion of micro-fulfillment centers further accelerate adoption. Supportive municipal pilot programs and partnerships with QSR chains, e-commerce platforms, and grocery retailers are strengthening commercial viability and driving broader deployment of GDR and SDR fleets.

The Aerial Delivery Drones and Autonomous Drone-Ground Hybrid Systems segment is expected to register a significant CAGR over the forecast period. Advancements in long-range navigation, automated flight management systems, and lightweight payload technologies are accelerating the adoption of aerial delivery drones and hybrid drone-ground systems in the AMDR market. These platforms offer significant advantages in bypassing road congestion, reducing delivery times, and accessing remote or infrastructure-limited regions. Growing regulatory approvals for beyond-visual-line-of-sight (BVLOS) operations, along with increasing investments from the e-commerce, logistics, and healthcare sectors, further strengthen the commercial viability. The integration of drones with ground robots in coordinated hybrid models enhances route efficiency and reduces the cost per delivery, making aerial and hybrid systems a high-growth segment in autonomous last-mile logistics.

End Use Insights

The food delivery segment dominated the market in 2024, driven by rising demand for fast, low-cost, and high-frequency meal deliveries, especially across urban centers, campuses, and hospitality environments. QSRs, cloud kitchens, and restaurant chains increasingly adopt autonomous delivery robots to reduce dependency on human couriers, stabilize delivery costs, and ensure consistent service quality during peak hours. Robots enable efficient short-distance routes, contactless delivery, and 24/7 operations, supporting higher order throughput and improved customer experience. Growing partnerships between food-delivery platforms, robotics vendors, and retail ecosystems further strengthen commercial viability and accelerate large-scale deployment.

The e-commerce segment is expected to register the highest CAGR over the forecast period, driven by the rapid surge in online shopping volumes, escalating pressure for same-day and next-day deliveries, and the growing need to streamline last-mile logistics costs. Autonomous mobile delivery robots enable high-frequency, short-distance parcel movements with lower operational expenses, predictable delivery windows, and reduced reliance on manual couriers. Their integration with micro-fulfillment centers, smart lockers, and urban consolidation hubs helps optimize routing and minimize congestion-related delays. As e-commerce platforms scale and labor constraints intensify, AMDRs offer a scalable, 24/7, and cost-efficient delivery alternative, strengthening their adoption across retail, logistics, and third-party delivery networks.

Regional Insights

North America dominated the autonomous mobile delivery robots industry with a revenue share of over 39.1% in 2024, driven by high labor costs, rapid e-commerce expansion, and strong demand for efficient last-mile logistics across urban and suburban regions. Regulatory support through state-level pilots, campus delivery programs, and controlled testing zones accelerates the real-world validation and commercial adoption of innovative solutions. Major retailers, food delivery platforms, and logistics providers are investing in autonomous delivery partnerships to reduce delivery times and operational costs. Advancements in AI navigation, LiDAR-based perception, and fleet-management platforms further enhance reliability and safety, enabling broader deployments. Collectively, these factors position North America as one of the fastest-scaling AMDR markets globally.

U.S. Autonomous Mobile Delivery Robots Market Trends

The U.S. Autonomous Mobile Delivery Robots industry is expected to grow significantly in 2024, primarily driven by escalating last-mile delivery costs, persistent labor shortages, and rising wage pressures that push logistics providers toward automation. Strong e-commerce penetration, rapid grocery and food-delivery demand, and the expansion of micro-fulfillment networks further accelerate adoption. Supportive regulatory initiatives, including state-level pilot approvals and controlled urban testing zones, enable safer and scalable deployments.

Europe Autonomous Mobile Delivery Robots Market Trends

The autonomous mobile delivery robots in Europe is expected to grow significantly over the forecast period driven by strong regulatory support for sustainable last-mile logistics, rising labor shortages in delivery-intensive economies, and the region’s aggressive decarbonization targets. European cities are promoting low-emission mobility zones, incentivizing retailers and logistics providers to adopt autonomous delivery robots for short-distance, zero-emission operations. Rapid e-commerce penetration, high urban density, and the maturity of 5G and smart-city infrastructure further accelerate deployment. Additionally, structured pilot programs across the UK, Germany, the Nordics, and the Netherlands provide favorable testing environments, strengthening technology validation.

Asia Pacific Autonomous Mobile Delivery Robots Market Trends

The autonomous mobile delivery robots industry in the Asia Pacific region is anticipated to be at the fastest CAGR over the forecast period driven by accelerating e-commerce expansion, rapid urbanization, and the region’s strong digital consumer base demanding faster and reliable delivery services. Governments in China, Japan, South Korea, Singapore, and Australia are actively supporting autonomous mobility pilots, smart-city programs, and last-mile automation frameworks, enabling quicker commercial deployment. High labor costs in developed APAC markets and acute delivery-workforce shortages in emerging economies further strengthen adoption. Increasing investments from retail, food-delivery, logistics, and technology companies, along with advancements in AI navigation and robotics hardware, are positioning APAC as the fastest-growing AMDR region.

Key Autonomous Mobile Delivery Robots Company Insights

Some key companies in the Autonomous Mobile Delivery Robots market are Starship Technologies and Nuro, Inc.

-

Starship Technologies is a key global provider of autonomous mobile delivery robots, operating large-scale fleets across campuses, residential zones, and retail districts. Its strong operational maturity, high delivery volume, and established commercial partnerships position it as a dominant player in the autonomous mobile delivery ecosystem.

-

Nuro, Inc. is a key player in autonomous mobile delivery robots, specializing in driverless road-going delivery vehicles designed for groceries, parcels, and consumer goods. Its regulatory breakthroughs, large-scale funding, and partnerships with major retailers position it among the most influential companies in automated last-mile delivery.

Key Autonomous Mobile Delivery Robots Companies:

The following are the leading companies in the autonomous mobile delivery robots market. These companies collectively hold the largest Market share and dictate industry trends.

- Starship Technologies

- Nuro, Inc.

- Serve Robotics Inc

- Zipline

- Ottonomy.IO

- Kiwibot

- JDLogistics

- Cartken Inc.

- Manna

- Refraction AI

Recent Developments

-

In October 2025, Serve Robotics, robotics and technology company, announced a multi-year strategic partnership with DoorDash, online food delivery company, to integrate its autonomous sidewalk delivery robots into the DoorDash platform, beginning in U.S. This collaboration supports DoorDash’s multimodal logistics model such as robots, drones, and human couriers, enables Serve to scale its order volume and geographic footprint.

-

In October 2025, Waymo LLC, autonomous driving technology company, and DoorDash, online food delivery company, announced a pilot for fully autonomous vehicle delivery in Phoenix, using Waymo LLC’s driverless cars to deliver food and grocery orders from participating merchants. Through the DoorDash Autonomous Delivery Platform, customers will be matched with Waymo LLC vehicles, unlocking the trunk via the app to retrieve orders.

-

In April 2025, Serve Robotics Inc, autonomous robotics company, launched autonomous delivery service in the Dallas-Fort Worth metro, Texas, U.S. via Uber Eats. The rollout covers over 22,000 households in Uptown neighborhoods and leverages existing Uber Eats partner merchants, signaling Serve Robotics Inc’s rapid scaling toward its 2,000-robot deployment goal by end-2025.

Autonomous Mobile Delivery Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.73 billion

Revenue forecast in 2033

USD 8.44 billion

Growth rate

CAGR of 21.9% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

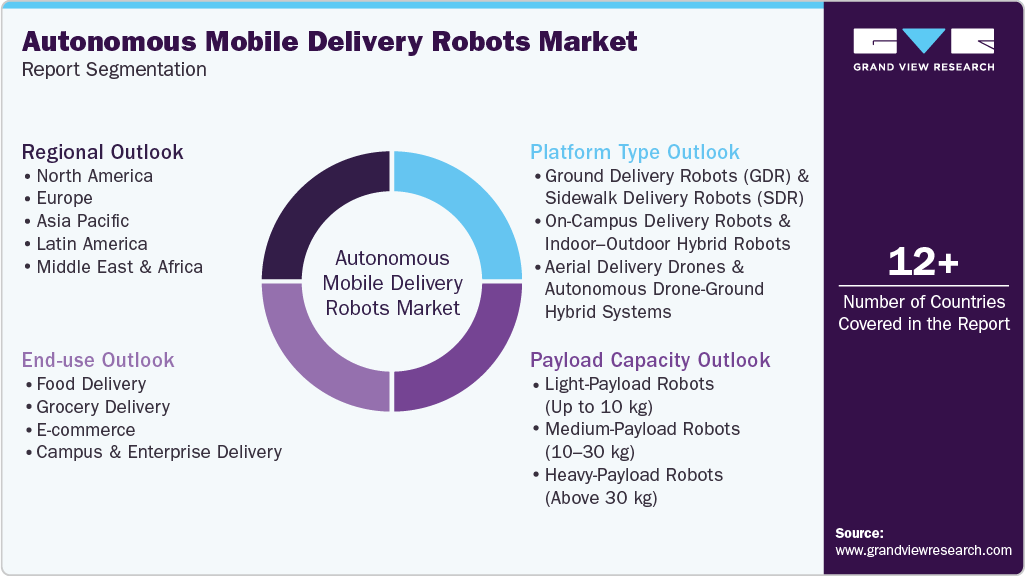

Platform Type, payload capacity, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Starship Technologies; Nuro, Inc.; Serve Robotics Inc; Zipline; Ottonomy.IO; Kiwibot; JDLogistics; Cartken Inc.; Manna; Refraction AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Mobile Delivery Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented global autonomous mobile delivery robots market report based on platform type, payload capacity, end use, and region.

-

Platform Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ground Delivery Robots (GDR) and Sidewalk Delivery Robots (SDR)

-

On-Campus Delivery Robots and Indoor-Outdoor Hybrid Robots

-

Aerial Delivery Drones and Autonomous Drone-Ground Hybrid Systems

-

-

Payload Capacity Outlook (Revenue, USD Billion, 2021 - 2033)

-

Light-Payload Robots (Up to 10 kg)

-

Medium-Payload Robots (10-30 kg)

-

Heavy-Payload Robots (Above 30 kg)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Food Delivery

-

Grocery Delivery

-

E-commerce

-

Campus & Enterprise Delivery

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.