- Home

- »

- Advanced Interior Materials

- »

-

Barite Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Barite Market Size, Share & Trends Report]()

Barite Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Fillers, Oil & Gas, Chemicals, Fillers), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-171-1

- Number of Report Pages: 89

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Barite Market Summary

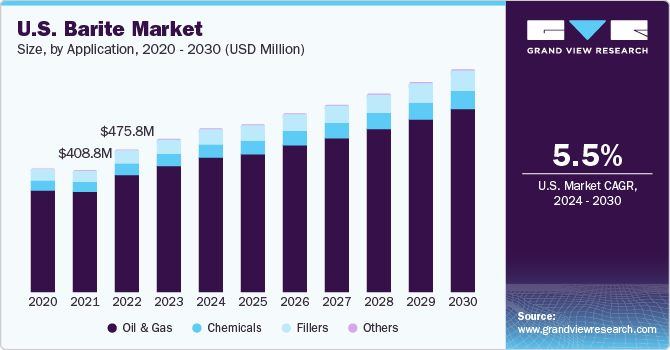

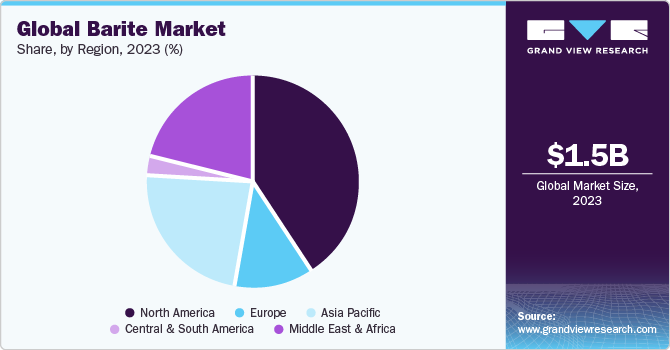

The global barite market size was estimated at USD 1,505.0 million in 2023 and is projected to reach USD 2,131.2 million by 2030, growing at a CAGR of 5.1% from 2024 to 2030. The rise in oil & gas exploration and drilling activities is anticipated to augment the demand for barite over the forecast period.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Venezuela is expected to register the highest CAGR from 2024 to 2030.

- Based on application, the oil & gas segment accounted for a revenue share of over 76.0% in 2023

Market Size & Forecast

- 2023 Market Size: USD 1,505.0 Million

- 2030 Projected Market Size: USD 2,131.2 Million

- CAGR (2024-2030): 5.1%

- North America: Largest market in 2023

The surging global requirement for oil & gas owing to the expanding population, ongoing urbanization, and increasing energy demand, along with the rising number of infrastructure development projects, is anticipated to prove fruitful for the growth of the market in the coming years.

In response to this trend, domestic sales of ground barite grew by 26% in the same year.A steady increase in exploration and tight oil production investments has played a vital role in driving the market growth. According to the Carnegie Endowment for International Peace, the output of tight oil in the U.S. has ramped significantly over the past few years and is projected to peak by 2029. Increased offshore oil & gas drilling activities and investments by major oil companies in deep and ultra-deep offshore exploration are expected to boost market growth over the forecast period.The increasing demand for paints & coatings in the construction of new residential and non-residential buildings is also fueling product demand.

The importance of barite is growing in applications, such as paints & coatings, rubber, plastics, cement, and cosmetics. It is an excellent substitute for titanium dioxide, basofor, and crypton, which are also used as fillers in paints & coatings, and other industries. It is used to replace titanium dioxide in paints & coatings without loss of glossiness and fluidity. The U.S. is one of the largest consumers of barite in the world owing to its large-scale oil & gas production, which has increased in recent years owing to the exploration of shale gas and tight oil reserves in the country. This, in turn, has led to an increase in demand for drilling fluids and therefore, barite. According to USGS, the annual average rig counts increased by nearly 50% in the country in 2022.

Rapid urbanization & industrialization, increasing population, and improved standard of living arekey factors propelling the construction industry and thus, influencing the production of paints and coatings. Furthermore, barite has several important uses in the medical industry as well. It is widely used as a radiopaque agent in diagnostic medical tests, such as X-rays and CT scans, as it helps create a clear image of the gastrointestinal tract and other parts of the body. It is also used as a filler in tablets and capsules to help maintain their shape and size. It is sometimes used as a rheology modifier in liquid medications to control the flow and consistency of the medication.

Increasing government expenditure on healthcare is expected to increase the consumption of barite over the forecast period.Ilmenite, synthetic hematite, iron ore, nano silica, and celestite are common barite substitutes used across different applications in various industries. For instance, celestite is considered a good substitute for barite in various sectors, especially in oil & gas drilling activities due to similar properties. Also, nano-silica grains can be used as a substitute for improving lubrication, upgrading drilling mud density, lowering pressure transmission, and reducing permeability.

Regional Insights

North America dominated the market and accounted for a revenue share of over 40.0% in 2023. This is because barite is primarily used as a weighting agent in drilling fluids during oil & gas exploration and production. The demand for it is also driven by the expansion of the energy generation industry in North America.The growth of the oil & gas industry due to initiatives undertaken by their respective governments is anticipated to propel the demand for barite over the forecast period. For instance, in April 2022, the Government of Canada approved the offshore oil project proposed by Equinor ASA.

In January 2022, the National Hydrocarbons Commission (CNH) of Mexico authorized onshore & offshore plans of Pemex Exploracion y Produccion S.A. de C.V. (PEP) involving an investment worth USD 800.0 million.The Middle East and Africa are expected to register a CAGR of 4.3% over the forecast period. The Middle East is a major producer and exporter of crude oil & natural gas, which makes it a key consumer of barite. The increasing investments by countries of the region to increase their oil & gas production is expected to propel market growth. For instance, in January 2023, the discovery of a new gas field in the eastern Damanhur in Egypt’s Nile Delta onshore was announced by Germany-based Wintershall Dea AG.

Market Dynamics

Industry 4.0 is a technological revolution that promises to transform the way businesses operate. It involves the use of advanced technologies such as artificial intelligence, the Internet of Things (IoT), and big data to optimize production processes and increase efficiency. In the market, Industry 4.0 offers several opportunities for companies to improve their operations.

Barite is a mineral that is used in the oil & gas industry as a weighting agent in drilling fluids. Industry 4.0 technologies can be used to optimize production processes, reduce waste, and improve overall efficiency. For instance, advanced analytics can be used to monitor and optimize drilling fluid properties in real time, ensuring that the right amount of barite is added to achieve the desired fluid density.

Application Insights

Based on application, the oil & gas segment accounted for a revenue share of over 76.0% in 2023 and is anticipated to continue its dominance over the forecast period. The growth of this segment can be attributed to the primary use of barite as a weighting agent in drilling fluids for mud. It is used to elevate the hydrostatic pressure and increase the density of drilling fluids as it possesses high specific gravity. The softness of this mineral helps in preventing any damage to drilling tools and also acts as a lubricant and cooling agent to avoid overheating of the tools.

Chemicals are another vital segment of the market that is expected to grow at a CAGR of 5.4% over the forecast period. Barite is used in the chemicals industry due to its unique properties, such as low oil absorption, chemical inertness, and insolubility. Its powder is used in manufacturing barium compounds that are further utilized in the production of rubber, paper, glass, and ceramics.It is also popularly used as a filler and used in the paints & coatings industry to improve film coatings’ thickness, durability, and strength. Its applications also include meal material for reflections of the stomach and intestines. Owing to its unique properties to block gamma rays and X-ray emissions, it is used in hospitals, power plants, and laboratories.

Key Companies & Market Share Insights

Staying competitive in the market is one of the key concerns for the key players, which compels them to engage in activities, such as capacity expansions, R&D investments, and mergers & acquisitions. For instance, in March 2021, CIMBAR Performance Minerals acquired North American assets of TOR Minerals located at the Texas facility to expand its product portfolio in barite and alumina trihydrate business operations.

Key Barite Companies:

- Anglo Pacific Minerals Ltd.

- Ashapura Group

- CIMBAR Performance Minerals

- Demeter O&G Supplies Sdn Bhd

- Excalibur Minerals Corp.

- International Earth Products LLC

- P & S Barite Mining Co., Ltd.

- PVS Chemicals

- SLB

- The Andhra Pradesh Mineral Development Corporation Ltd.

Barite Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1570.0 million

Revenue forecast in 2030

USD 2,131.2 million

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report update

November 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Russia; Turkey; China; India; Japan; South Korea; Brazil; Colombia; Argentina; Venezuela; Saudi Arabia; Morocco

Key companies profiled

Anglo Pacific Minerals Ltd.; Ashapura Group; CIMBAR Performance Minerals; Demeter O&G Supplies Sdn Bhd; Excalibur Minerals Corp.; International Earth Products LLC; P & S Barite Mining Co., Ltd.; PVS Chemicals; SLB; The Andhra Pradesh Mineral Development Corporation Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barite Market Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global barite market report based on application and region:

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals

-

Fillers

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Colombia

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global barite market size was estimated at USD 1.51 billion in 2023 and is expected to reach USD 1.57 billion in 2024.

b. The global barite market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 2.13 billion by 2030.

b. The oil & gas segment dominated the market with a revenue share of over 76.0% in 2023.

b. Some of the key vendors of the global barite market are Anglo Pacific Minerals Ltd, Ashapura Group, CIMBAR Performance Minerals, Demeter O&G Supplies Sdn Bhd, Excalibur Minerals Corp., International Earth Products LLC, P & S Barite Mining Co., Ltd, PVS Chemicals, SLB, and The Andhra Pradesh Mineral Development Corporation Ltd.

b. The key factor that is driving the growth of the global barite market is the rise in oil & gas exploration and drilling activities due to the surge in oil & gas demand worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.