- Home

- »

- Plastics, Polymers & Resins

- »

-

Barrier Packaging Market Size, Share, Industry Report, 2033GVR Report cover

![Barrier Packaging Market Size, Share & Trends Report]()

Barrier Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastic Films, Aluminum Foil, Paper & Paperboard, Metallized Films, Coated Materials), By End Use (Food & Beverage, Pharmaceuticals, Personal Care, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-790-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Barrier Packaging Market Summary

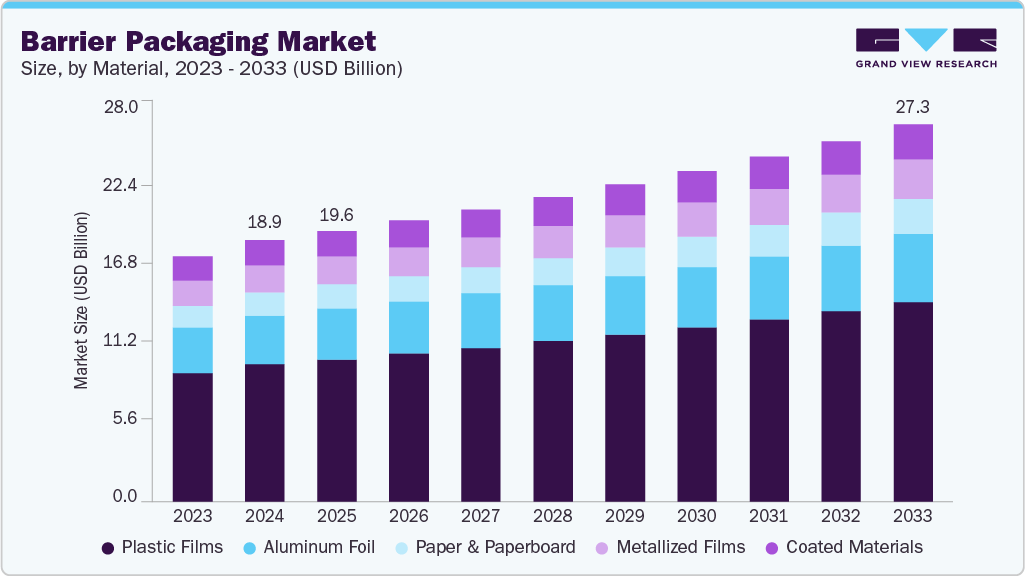

The global barrier packaging market size was estimated at USD 18.89 billion in 2024 and is projected to reach USD 27.28 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033. One of the primary reasons for the rising demand for barrier packaging globally is the increasing need to extend the shelf life of products and preserve their quality across long supply chains.

Key Market Trends & Insights

- North America dominated the barrier packaging market with the largest revenue share of over 32.4% in 2024.

- The Asia Pacific barrier packaging industry is expected to grow at a substantial CAGR of 4.7% from 2025 to 2033.

- By material, the paper & paperboard segment is expected to grow at a considerable CAGR of 4.7% from 2025 to 2033 in terms of revenue.

- By end use, the pharmaceutical segment is expected to grow at a considerable CAGR of 4.6% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 18.89 Billion

- 2033 Projected Market Size: USD 27.28 Billion

- CAGR (2025-2033): 4.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Barrier packaging provides a protective shield against external elements such as oxygen, moisture, light, and contaminants, all of which can deteriorate the freshness, flavor, and safety of consumables, especially in food, beverage, and pharmaceutical products. As global trade expands and supply chains become more complex, products must travel longer distances and remain stable in varied climatic conditions. This has created a strong push for packaging materials that maintain product integrity, ensuring safety, hygiene, and extended usability. Consequently, both manufacturers and retailers are increasingly adopting barrier packaging to reduce spoilage, enhance shelf appeal, and minimize product returns or wastage.

The explosive growth of the food and beverage industry, especially in emerging markets such as India, China, Brazil, and Indonesia, is a major factor driving the global demand for barrier packaging. Consumers today seek convenient, ready-to-eat, and on-the-go food formats that require longer storage times without refrigeration. Barrier packaging-through materials like multi-layer films, coated paper, and aluminum foils-prevents oxygen ingress and moisture loss, preserving the flavor, aroma, and texture of packaged foods and beverages. Moreover, in beverages such as juices, dairy, energy drinks, and alcoholic products, barrier packaging helps maintain carbonation and prevent oxidation, thus retaining freshness and quality. The growing consumption of processed foods and packaged beverages across urban and semi-urban regions continues to propel demand for advanced barrier solutions that balance performance, safety, and sustainability.

Modern consumers are increasingly drawn to on-the-go, portion-sized, and resealable packaging formats that fit their fast-paced lifestyles. Barrier packaging plays a crucial role in enabling such convenience-driven innovations by providing lightweight, flexible, and durable protection for food, pharmaceuticals, cosmetics, and personal care products. With the rise in dual-income households and increasing urbanization, consumers are demanding packaging that not only protects the product but also offers ease of handling, longer storage, and minimal mess or leakage. This consumer behavior shift has spurred innovation in flexible barrier films, pouches, and sachets, which are now replacing rigid packaging in many product categories. As a result, demand for barrier packaging continues to surge across both developed and developing economies.

Heightened awareness around food safety, contamination prevention, and traceability has accelerated the adoption of barrier packaging worldwide. Governments and regulatory agencies such as the U.S. FDA, EFSA, and FSSAI are enforcing stricter regulations on packaging materials to ensure that they do not interact negatively with the product or cause contamination. Barrier packaging materials-especially multi-layer laminates and coated polymers-are designed to comply with these safety norms, offering high resistance to microbial ingress and chemical migration. For pharmaceutical and nutraceutical products, the ability of barrier packaging to provide moisture-proof, tamper-evident, and contamination-resistant protection is particularly valuable. These regulatory requirements, coupled with rising consumer expectations for hygiene and authenticity, are significantly boosting the global demand in the barrier packaging industry.

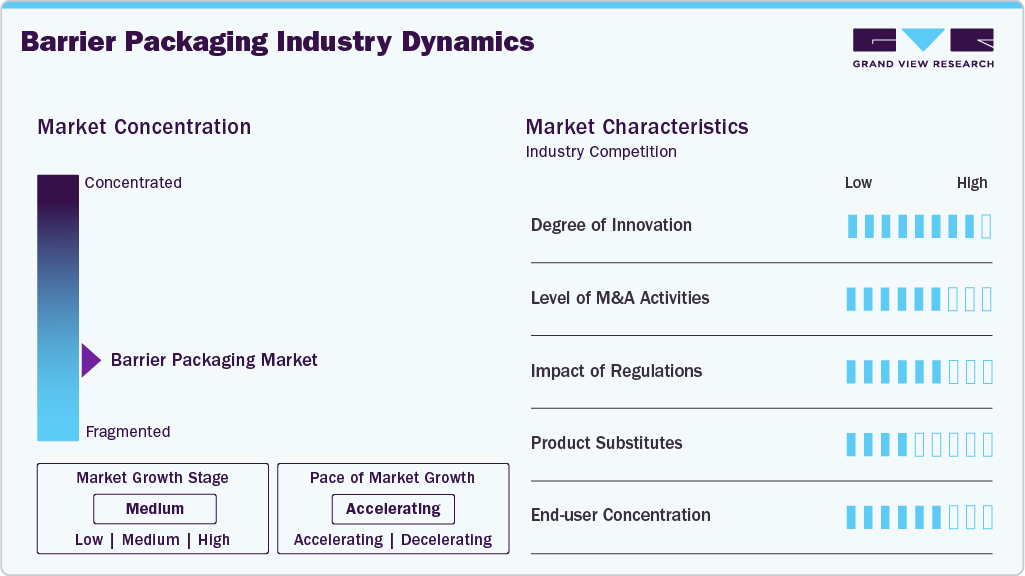

Market Concentration & Characteristics

The rapid growth of e-commerce has redefined packaging requirements globally. Products now need to be shipped over long distances, often passing through multiple handling stages and varying climatic conditions. Barrier packaging ensures that products remain intact, uncontaminated, and appealing upon delivery, making it a preferred choice for online retailers and logistics providers. The surge in cross-border trade and the globalization of supply chains have intensified the need for robust packaging that protects against temperature fluctuations, humidity, and rough handling. For perishable goods, pharmaceuticals, and personal care items, barrier packaging provides both functional protection and aesthetic value, helping brands maintain consistency in product quality and customer experience across regions.

Continuous innovation in material science has significantly improved the performance and cost-efficiency of barrier packaging. The development of multi-layer coextruded films, metallized foils, nanocoatings, and bio-based barrier polymers has expanded the applicability of barrier packaging across diverse industries. These innovations allow manufacturers to achieve superior gas and moisture resistance while reducing material thickness and improving recyclability. Moreover, advancements in active and intelligent packaging-which can monitor freshness, release preservatives, or absorb oxygen-are adding further value to barrier solutions. These technological upgrades not only enhance product protection but also align with sustainability goals, thus fueling demand from environmentally conscious brands and consumers alike.

Material Insights

The plastic films segment led the barrier packaging market, recording the largest revenue share of over 52.6% in 2024. It is expected to grow at a CAGR of 4.3% during the forecast period. Plastic films dominate the barrier packaging material segment because they offer an optimal balance between performance, flexibility, and cost-effectiveness. Materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), ethylene vinyl alcohol (EVOH), and polyamide (PA) provide exceptional barrier protection against oxygen, moisture, and aroma migration - critical for maintaining product quality. Unlike metal or glass, plastic films can achieve the same preservation benefits at a fraction of the cost and weight. This makes them the preferred choice for mass-market applications such as snacks, dairy, frozen foods, and ready-to-eat meals. Furthermore, the ability to fine-tune barrier properties by using multi-layer film structures allows packaging engineers to design solutions customized to specific product requirements, creating an unparalleled advantage for plastics over other materials.

Moreover, plastic films are inherently lightweight and flexible, offering substantial logistical and operational benefits. They reduce transportation costs, require less storage space, and are easier to handle during filling and sealing processes. The versatility of plastic films enables them to be used in a wide range of packaging formats, from pouches and wraps to blister packs and vacuum-sealed containers. These films also support high-quality printing, lamination, and embossing, which are essential for branding and visual appeal. This adaptability across industries, from food to pharmaceuticals and cosmetics, has made plastic films indispensable in the modern packaging landscape.

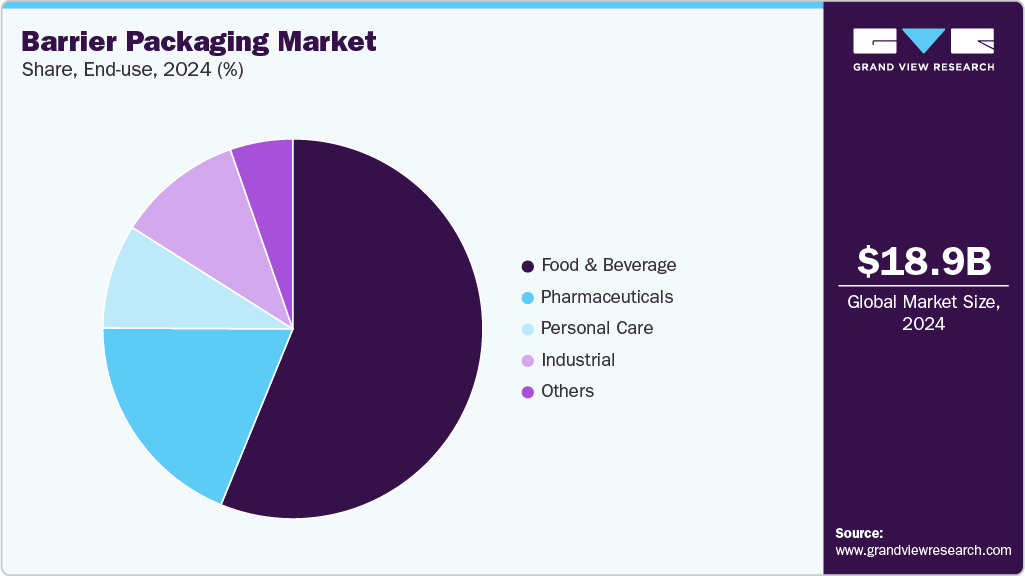

End Use Insights

The food & beverages segment dominates the barrier packaging industry, accounting for over 56.2% of the revenue share. The food and beverage industry accounts for the largest share of the barrier packaging market primarily because it relies heavily on protection, preservation, and presentation. Perishable food items such as meats, dairy, bakery products, snacks, and beverages require packaging that can prevent oxidation, moisture loss, and microbial contamination.

Barrier packaging materials, particularly plastic films and laminates, create an airtight environment that ensures freshness and maintains flavor integrity for extended periods. This functionality is essential for both shelf-stable and chilled food products, as it enables global distribution without compromising safety or quality. The growing consumer preference for packaged and processed foods has further accelerated demand in this segment.

Moreover, rapid urbanization, changing lifestyles, and an increase in dual-income households have transformed global eating habits. Consumers now prefer on-the-go, single-serve, and ready-to-eat meals, which require durable, lightweight, and protective packaging solutions. Barrier packaging fulfills these needs by offering flexible options like stand-up pouches, sachets, and resealable wraps that keep food fresh and portable. The demand for convenience-driven food formats, such as frozen meals, snack bars, and beverage pods, has surged, especially in North America, Europe, and Asia Pacific. This evolving consumer lifestyle is a primary reason why the food and beverage sector continues to dominate as the key end use market for barrier packaging.

Region Insights

The barrier packaging industry in North America is witnessing robust growth due to the strong presence of mature packaged food, beverage, and pharmaceutical industries, which demand advanced packaging materials to meet strict regulatory and safety standards. Consumers in the region prioritize convenience, freshness, and sustainability, driving innovation in high-performance multilayer films and recyclable materials. Moreover, the rapid expansion of e-commerce grocery delivery and meal kit services has increased the need for packaging that offers superior product protection during transit. Companies are also investing in smart and intelligent packaging technologies, integrating QR codes and freshness indicators to enhance consumer engagement. The strong emphasis on sustainable production practices and circular economy initiatives, particularly in the U.S. and Canada, further accelerates the adoption of recyclable and bio-based barrier materials.

U.S. Barrier Packaging Market Trends

In the U.S., the market growth is primarily fueled by technological advancements in flexible packaging and increasing demand from the frozen and ready-to-eat food sectors. The country’s dynamic consumer lifestyle, coupled with a high preference for portion-controlled and on-the-go food formats, has significantly increased reliance on advanced barrier films that ensure product freshness. The pharmaceutical industry’s expansion, driven by the aging population and increased healthcare spending, has also created strong demand for moisture- and oxygen-resistant packaging. Moreover, investments in recycling infrastructure and government-backed initiatives, such as the U.S. Plastics Pact, are fostering innovation in sustainable materials. Local manufacturers are also focusing on lightweight, monomaterial solutions to align with extended producer responsibility (EPR) frameworks, making the U.S. one of the most progressive markets for barrier packaging development.

Asia Pacific Barrier Packaging Market Trends

Asia Pacific has emerged as the fastest-growing region in the global barrier packaging market, driven by rapid urbanization, expanding middle-class populations, and rising consumption of packaged food and beverages. Countries like India, China, Japan, and South Korea are experiencing a surge in demand for convenient, long-lasting, and visually appealing packaging formats due to evolving dietary habits and busy lifestyles. The booming pharmaceutical, personal care, and nutraceutical sectors are further accelerating demand for high-barrier materials to ensure product stability and hygiene. Additionally, Asia-Pacific’s cost-efficient manufacturing ecosystem and increasing foreign investments in packaging innovation hubs have strengthened regional competitiveness. The ongoing shift toward eco-friendly and recyclable packaging alternatives, supported by stricter environmental regulations and consumer awareness, continues to fuel market expansion across the region.

China’s barrier packaging marketgrowth is driven by massive domestic consumption, rapid retail modernization, and advancements in packaging technology. The country’s large-scale food processing and beverage industries rely heavily on barrier materials to meet shelf-life and safety requirements amid rising demand for convenience foods. Additionally, China’s dual focus on innovation and sustainability has resulted in significant research into bio-based films and recyclable laminates.

Europe Barrier Packaging Market Trends

Europe represents one of the most technologically advanced and sustainability-driven markets for barrier packaging. The region’s growth is largely fueled by strict environmental regulations, including the EU Packaging and Packaging Waste Directive and the Circular Economy Action Plan, which mandate recyclable and reusable packaging solutions. European consumers have a strong preference for eco-friendly and ethically produced goods, prompting manufacturers to adopt bio-based polymers, solvent-free laminates, and mono-material structures.

Germany’s barrier packaging market is expected to grow over the forecast period. Germany stands out as a leader in sustainable packaging innovation and technological integration, making it a key growth hub for the barrier packaging industry in Europe. The country’s strong industrial base and emphasis on engineering excellence have led to the development of sophisticated multi-layer films and recyclable laminates tailored for food, pharmaceutical, and industrial applications. Moreover, Germany’s consumers are highly sustainability-conscious, encouraging packaging producers to transition toward compostable, paper-based, and recyclable plastic alternatives.

Key Barrier Packaging Company Insights

The global barrier packaging market is characterized by intense competition, driven by continuous innovation, sustainability mandates, and growing consumer expectations for high-performance yet eco-friendly materials. The market is moderately consolidated, with leading players such as Amcor plc, Sealed Air Corporation, Mondi Group, Berry Global, Huhtamaki Oyj, and Constantia Flexibles dominating global production capacities. These companies compete on parameters such as material innovation, barrier efficiency, recyclability, and cost optimization, while regional manufacturers focus on price competitiveness and local customization.

-

In March 2024, Berry Global Group, Inc., and Mitsubishi Gas Chemical Company, Inc. (MGC) announced a partnership to launch a recyclable barrier solution for thermoformed articles, plastic jars, tubes, and bottles using MXD6, a superior barrier resin manufactured by MGC.

-

In July 2023, Mondi, a global leader in packaging and paper, invested USD 16.81 million in new and advanced technologies to develop a new packaging range called FunctionalBarrier Paper Ultimate. The ultra-high barrier paper-based food solution fulfills the growing customer demand for sustainable packaging that contributes to a circular economy.

Key Barrier Packaging Companies:

The following are the leading companies in the barrier packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Huhtamaki

- Sealed Air

- Graphic Packaging International, LLC

- ProAmpac

- Mondi

- DS Smith

- Coveris

- TOPPAN Inc.

- CarePac

- ISOFlex Packaging

- C-P Flexible Packaging

Barrier Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.60 billion

Revenue forecast in 2033

USD 27.28 billion

Growth rate

CAGR of 4.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; Huhtamaki; Sealed Air; Graphic Packaging International, LLC; ProAmpac; Mondi; DS Smith; Coveris; TOPPAN Inc.; CarePac; ISOFlex Packaging; C-P Flexible Packaging.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barrier Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global barrier packaging market report based on material, end use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic Films

-

Aluminum Foil

-

Paper & Paperboard

-

Metallized Films

-

Coated Materials

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Pharmaceuticals

-

Personal Care

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global barrier packaging market size was estimated at USD 18.89 billion in 2024 and is expected to reach USD 19.60 billion in 2025.

b. The global barrier packaging market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033 to reach USD 27.28 billion by 2033.

b. The plastic films segment domianted the barrier packaging market with a major revenue share of 52.6% in 2024,on account of their optimal balance between performance, flexibility, and cost-effectiveness.

b. Some key players operating in the barrier packaging market include Amcor plc; Huhtamaki; Sealed Air; Graphic Packaging International, LLC; ProAmpac; Mondi; DS Smith; Coveris; TOPPAN Inc.; CarePac; ISOFlex Packaging; C-P Flexible Packaging.

b. Key factors that are driving the market growth include rising demand for barrier packaging globally is the increasing need to extend the shelf life of products and preserve their quality across long supply chains.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.