- Home

- »

- Advanced Interior Materials

- »

-

Battery Metals Market Size, Share & Trends Report, 2030GVR Report cover

![Battery Metals Market Size, Share & Trends Report]()

Battery Metals Market (2024 - 2030) Size, Share & Trends Analysis Report By Metal (Lithium, Nickel, Cobalt), By Application (EVs, Electronic Devices, Stationary Battery Energy Storage, SLI), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-753-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Metals Market Size & Trends

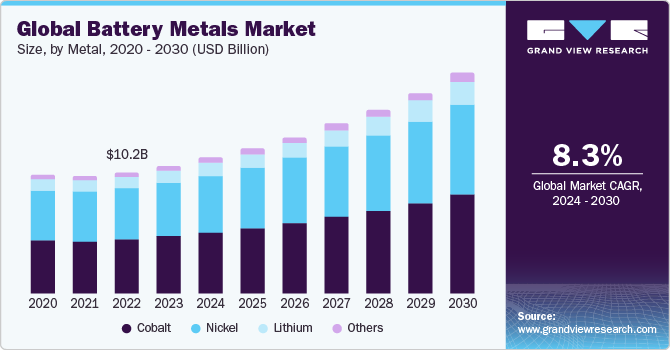

The global battery metals market size was estimated at USD 10.72 billion in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. The market is driven by growing demand for batteries in automotive industry and stationary battery energy storage (BES). Global electric vehicles (EVs) industry is growing at an accelerating rate across the globe, which is propelling market growth, as batteries constitute the most significant portion of EVs. Soon, they will account for a 40.0% share of the total cost in automotive manufacturing.

Global battery production is concentrated in a handful of countries, and the U.S. is one of them. Technological advancements, coupled with the presence of large players such as Tesla, EnerSys, and Panasonic, propel the growth of market. Growing demand from application industries is propelling production capacity. For instance, in October 2023, LG Energy Solution announced investing USD 3.0 billion to expand its lithium-ion battery production at Michigan manufacturing facility. Expansion is a part of a new supply agreement pertaining to lithium batteries with Toyota’s manufacturing facility in Kentucky.

The market is projected to face a challenge due to waste generated by batteries. Increasing demand for EVs worldwide is driving growth of automotive manufacturing industry. Eventually, this leads to a surge in battery production and, consequently, more waste that can have harmful effects on environment. Issue of battery disposal is a significant concern and a negative aspect of the market. However, concept of second-life EV batteries is gaining momentum, which could help overcome this disadvantage.

Market Concentration & Characteristics

The industry is characterized by continuous technological advancements, driving innovation in battery materials and manufacturing processes, leading to high levels of competition among industry players. M&A activities are prevalent, but they are not dominating the market. Companies engage in strategic acquisitions to expand their market reach and consolidate their position but do not overly concentrate on market control. Regulatory framework is diverse across various regions, varying to different levels of impact. However, it plays a significant role in terms of environmental standards and safety regulation and shaping the industry.

Battery metals, such as lithium, cobalt, and nickel, have limited substitutes in terms of their specific properties and performance characteristics; therefore, there is a low level of substitution. It is heavily influenced by demand from a few key industries, such as electric vehicles and energy storage systems, leading to high levels of concentration among end-users. This concentration further has an influence on market dynamics and trends in the market.

Metals Insights

The Cobalt segment dominated the market with the largest revenue share of 44.0% in 2023 and is anticipated to grow at a substantial pace owing to its usage in cathodes of lithium-ion batteries as it offers high conductivity and stable structural ability across charge cycles.

The Lithium segment is anticipated to grow at the fastest CAGR over the forecast period. Increasing demand for lithium-ion batteries from EV industry and consumer electronics is anticipated to drive demand for battery metals over the forecast period. Growing demand for lithium-ion cells has propelled manufacturers to expand their production capacities. Companies such as LG Chem, BYD, NorthVolt, and CATL are engaged in expansion of lithium-ion cell plant projects.

Application Insights

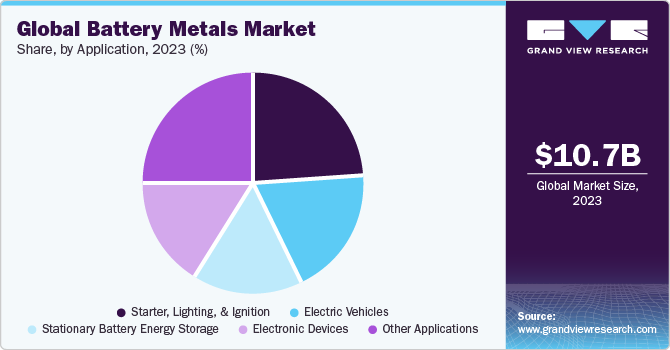

The starter, lighting, and ignition (SLI) segment dominated the market with the largest revenue share in 2023. SLI has been key application area in battery metals for several years. SLI battery is used in conventional vehicles for starting and igniting the engine and provides electricity to vehicle. It is essential owing to its power density, as starting an engine requires large currents for short periods, around 300 amperes for a few seconds.

Considering the impact on environment and other disadvantages, this application segment is expected to witness the least growth rate across the forecast period, owing to declining demand for conventional vehicles, which are being replaced by electric vehicles.

This makes electric vehicles segment the fastest-growing application segment of the market for battery metals. EVs can be categorized into four groups: hybrid, plug-in hybrid, full EVs, and commercial. Each group has a distinct set of requirements, such as full EVs do not have internal combustion engines, and hence, they need very large batteries. Key batteries used in EVs are lithium-ion and nickel-metal hydride.

Stationary battery energy storage is another application segment, which is expected to witness a rapid growth rate in the market across the forecast period. Significance of stationary battery energy storage is owing to its ability to smoothen supply-demand for power generated from renewable energy sources such as wind and solar. It stores electricity from renewable sources for use in absence of wind and solar rays. Increasing capacity for renewable energy sources is propelling demand and production for BES, which provides ease in consumption without relying on fossil fuel power plants. Lithium polymer batteries are majorly used for stationary battery energy storage.

Regional Insights

The battery metals market in North America is anticipated to register a CAGR of 6.9% over the forecast period. The growing emphasis on making a circular supply chain for EVs is anticipated to propel and augment market growth over the forecast period.

U.S. Battery Metals Market Trends

The battery metals market in the U.S.held a share of over 7.0% of the global market in 2023. The U.S. is a major battery producer in the region, which makes it the key consumer of metals in North America. Growing demand from EV sector is propelling production capacity in the country. For instance, in November 2023, Sumitomo Metal Mining announced its expansion plans in the U.S. It plans to expand its production of cathode battery material to cater to rising demand from EV industry.

Asia Pacific Battery Metals Market Trends

Asia Pacific dominated the global market in 2023 and accounted for a revenue share of more than 85.0% in 2023. This trend is expected to continue over the forecast period. Demand for battery metals in the region is driven by the battery production capacity of countries such as China, Japan, India, and South Korea. Furthermore, favorable government policies to promote EV adoption are expected to boost the industry. For instance, government of Japan allocated around JPY 140 billion (~USD 0.94 billion) to promote adoption of electric-powered vehicles such as Battery EVs (BEVs) in Japan and provide charging facilities for businesses as a part of Green Transformation (GX) budget proposal for the financial year 2024.

The China battery metals market held over 46.0% share of APAC market in 2023, as the country is the largest battery manufacturer in the world. The manufacturing capacity of China is owing to its dominance over supply chain. It holds a share of more than 20.0% in supplying battery metals to the world and also has the largest chemical production capacity of battery-grade raw materials, which is around 80.0% of the world.

Europe Battery Metals Market Trends

Europe accounts for a meager share of global battery production capacity. As a result, it has a lot of potential in terms of growth. Manufacturers across the world are investing in Europe to set up plants in the region, which is augmented by growing demand from the EV industry.

The UK battery metals market has potential to grow, as the Zero Emission Vehicle (ZEV) mandate has set the automotive industry course to have a complete transition by 2035. Strategies and policies to support this transition can augment the demand for metals in the UK battery sector. In July 2023, Tata Group announced construction of a battery plant in the UK with an investment of over EUR 4.00 billion (~USD 4.32 billion). This EV battery plant is anticipated to have a capacity of 40GW and would initially supply batteries to JLR and Tata Motors.

Central & South America Battery Metals Market Trends

Growth of battery production market is anticipated to be positively influenced by rising investments by automobile manufacturers and growing EV producers in the region. To achieve carbon emission goals, governments across the region have been directing their focus toward adoption of EVs.

Middle East & Africa Battery Metals Market Trends

Middle East and Africa are witnessing rapid development owing to swift industrialization and urbanization. The region is committed to achieving net-zero emissions and is witnessing an expanding market for electric and hybrid vehicles. For instance, in February 2024. CDSG Lithium announced a collaboration with Khalifa Economic Zone Abu Dhabi (KEZAD) Group to establish state of a state-of-the-art lithium processing facility and bring a shift in its energy and industrial sectors. It is going to invest AED 5 billion (~USD 1.36 billion) to construct the plant and boost demand for battery metals in Middle East & Africa.

Key Battery Metals Company Insights

Some of the key players operating in the market include Glencore, and Vale.

-

Glencore plc is a global producer of primary metals, copper, energy products, and recycling. Copper ore is extracted and processed in South Africa, the Democratic Republic of Congo, and Australia. Company’s business is divided into two segments, namely metals & minerals, and energy products. It has a global presence, buying and selling scrap on a large scale across geographies. It is a significant player in battery metals market that has a vertical presence across the value chain.

-

Vale is a global mining company having an integrated value chain. It is a leading producer of nickel and iron ore. It is also engaged in production of manganese ore, iron ore pellets, gold, silver, metallurgical and thermal coal, platinum group metals, and cobalt. It is the largest producer of manganese in Brazil and holds approximately 70% of the country’s market.

Key Battery Metals Companies:

The following are the leading companies in the battery metals market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle

- Bolt Metals

- China Molybdenum Co., Ltd.

- Galaxy Resources Limited

- Ganfeng Lithium Co. Ltd.

- Glencore

- SQM

- Sumitomo Metal Mining

- Umicore

- Vale

Recent Developments

-

In April 2023, Glencore, FCC Group, and Iberdrola, S.A. collaborated to offer circularity solutions for lithium-ion batteries to Spain and Portugal. The goal is to construct a purpose-built facility to address one of the largest medium to long-term difficulties in the industry and recycling of lithium-ion batteries.

-

In April 2022, Umicore partnered with Automotive Cells Company (ACC) for supply of EV battery materials in Europe. This partnership helped to safeguard Umicore's access to a sizable market with a high demand for its cathode materials.

Battery Metals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.40 billion

Revenue forecast in 2030

USD 18.41 billion

Growth Rate

CAGR of 8.3% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Metal, Application, and Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; China; Japan; and South Korea

Key companies profiled

Albemarle; Bolt Metals; China Molybdenum Co., Ltd.; Galaxy Resources Limited; Ganfeng Lithium Co. Ltd.; Glencore; SQM; Sumitomo Metal Mining; Umicore; Vale

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Metals Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global battery metals market report based on metal, application, and region.

-

Metal Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Lithium

-

Cobalt

-

Nickel

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Starter, Lighting, and Ignition

-

Electric Vehicles

-

Electronic Devices

-

Stationary Battery Energy Storage

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global battery metals market size was valued at USD 10.72 billion in 2023 and is expected to reach USD 11.40 billion in 2024.

b. The global battery metals market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 18.41 billion by 2030.

b. Key factors that are driving the market growth include rapid growth in electric vehicles production across the globe, which is propelling the demand for lithium-ion battery.

b. Cobalt dominated the battery metals market with a share of over 44.0% in 2023 and is anticipated to continue over the forecast period owing to its usage in cathodes of lithium-ion batteries as it offers high conductivity and stable structural ability across charge cycles.

b. Some key players operating in the battery metals market include Sumitomo Metals Mining Co. Ltd, Umicore, Albemarle, Zhejiang Huayou Cobalt Co., Ltd., and Glencore.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.