- Home

- »

- Automotive & Transportation

- »

-

Battery Swapping Charging Infrastructure Market Report 2030GVR Report cover

![Battery Swapping Charging Infrastructure Market Size, Share & Trends Report]()

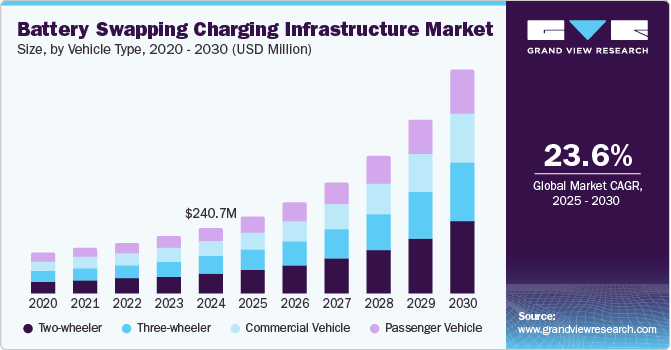

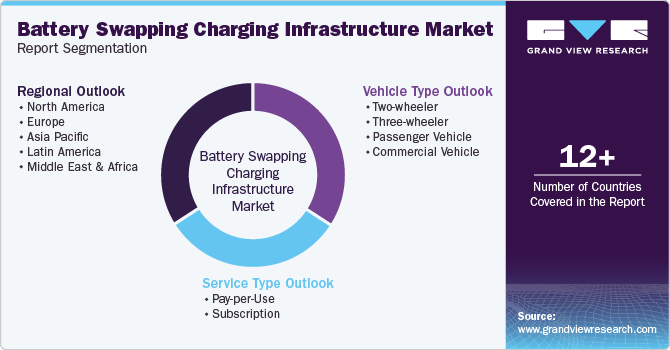

Battery Swapping Charging Infrastructure Market Size, Share & Trends Analysis Report By Vehicle Type (Two-wheeler, Three-wheeler, Passenger Vehicle, Commercial Vehicle), By Service Type (Pay-per-use, Subscription), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-991-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

The global battery swapping charging infrastructure market size was valued at USD 240.7 million in 2024 and is projected to grow at a CAGR of 23.6% from 2025 to 2030. Battery swapping charging infrastructure allows electric vehicle users to replace their discharged batteries with charged batteries at the swap stations. Consumers are charged for these batteries on a pay-per-use or subscription basis. Reduced charging time, reduced upfront costs of buying an electric vehicle, increasing demand for public charging infrastructure, and favorable government subsidies are driving the installation of battery swapping charging infrastructure, thereby driving the market’s growth.

Additionally, battery swapping charging infrastructure of battery-as-a-service allows customers to lease batteries, which reduces their overall upfront cost of purchasing the battery. Batteries account for about 30-40% of the overall EV cost, and leasing them can reduce this cost considerably for consumers. The time and cost-saving capabilities of battery swapping charging infrastructure are expected to play a crucial role in their adoption, driving the market’s growth.

Governments worldwide are working toward bridging the gap between electric vehicle demand and public charging infrastructure. Government initiatives are crucial in the electric vehicle market to solve these disparities and kick-start market growth. Governments worldwide are drafting policies to address key technical, regulatory, institutional, and financial challenges in the electric vehicle market. For instance, in April 2022, the Indian government introduced a policy for electric vehicle battery-swapping that aims to catalyze the rapid adoption of EVs by promoting the adoption of battery swapping technology, which ensures minimal downtime, lower upfront costs, and lower space requirements. Such initiatives are fostering the growth of battery swapping charging infrastructure industry.

A well-established network of battery swapping charging infrastructure could be instrumental in driving the adoption of electric vehicles. However, the market faces a few roadblocks that need to be tackled by the authorities and key market players. For instance, standardization of EV Lithium-Ion battery packs remains a constraint for the market, and battery disposal is yet another issue for environmental pollution. However, with battery swapping charging infrastructure, the burden of removing and recycling batteries will reduce as the responsibilities for safe battery disposal and recycling will shift to private players, which is expected to drive the adoption of battery swapping charging infrastructure over the forecast period.

Vehicle Type Insights

The two-wheeler segment accounted for the largest share of 31.0% in 2024. The cost-effectiveness offered by the battery swapping technology drives the growth of the industry. Battery swapping eliminates the need for owning a battery, reducing the upfront cost of electric two-wheelers. Many battery-as-a-service (BaaS) models enable users to pay for battery usage rather than purchase, making electric two-wheelers more affordable. This cost-effective approach has accelerated adoption in price-sensitive markets, particularly in developing countries.

The three-wheeler segment is expected to grow at a significant CAGR during the forecast period. The rapid growth of e-commerce and the increasing demand for efficient last-mile delivery solutions drive the adoption of electric three-wheelers. These vehicles are widely used for transporting goods and passengers in urban areas. Battery swapping offers a practical solution for maintaining high operational efficiency in these applications, as vehicles can stay on the road longer without needing to pause for extended charging periods.

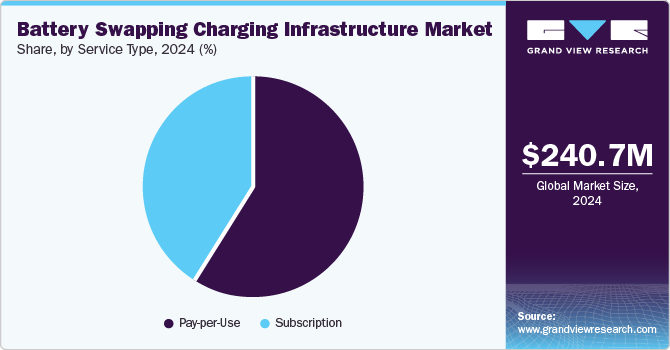

Service Type Insights

The pay-per-use segment held the largest market share in 2024. The pay-per-use or pay-as-you-go service allows the separation of battery from the vehicle and enables users to buy electric vehicles at a lower upfront cost. It allows electric vehicles to be financially viable for the first time. Moreover, the pay-per-use model addresses key EV adoption issues such as high upfront costs, long refueling time, and range anxiety. The pay-per-use segment is powered by smart batteries, quick interchange stations, smart networks, and plug-and-play docks. The technological innovations and viable economic options provided by the pay-per-use payment model are driving the segment’s growth in the battery swapping charging infrastructure industry.

The subscription segment is expected to register the fastest CAGR during the forecast period. The subscription service segment allows electric vehicle users to subscribe to battery-as-a-service and opt for battery swapping at the swap station at pre-determined subscription prices. Governments across the globe are taking initiatives to increase the adoption of subscription battery-swapping charging infrastructure. For instance, in August 2022, the South Korean government announced that it would revise the law to allow battery subscription services for electric vehicles, reducing the upfront cost of electric vehicles by almost one-third. Such initiatives are expected to drive the segment's growth over the forecast period.

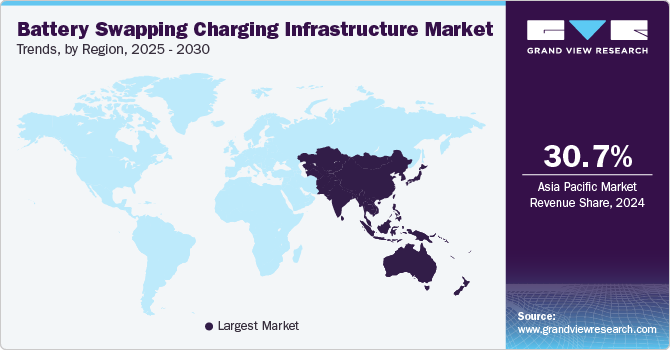

Regional Insights

North America battery swapping charging infrastructure industry held a significant share in 2024. Supportive government policies and incentives promoting EV adoption are indirectly driving the growth of battery swapping infrastructure. Federal and state governments in the U.S. and Canada are investing heavily in EV-related infrastructure development, including subsidies for battery technologies and grants for innovative charging solutions. Programs aimed at reducing greenhouse gas emissions and improving urban air quality further accelerate the demand for efficient charging alternatives like battery swapping and drive the growth of the battery swapping charging infrastructure industry.

U.S. Battery Swapping Charging Infrastructure Market Trends

The battery swapping charging infrastructure market in the U.S. held a dominant position in 2024 due to the growth of shared mobility services, such as ride-hailing and car-sharing platforms. It is boosting the need for efficient charging solutions. Battery swapping is particularly beneficial for these services as it enables quick turnarounds and ensures high fleet utilization.

Europe Battery Swapping Charging Infrastructure Market Trends

The battery swapping charging infrastructure market in Europe was identified as a lucrative region in 2024. The presence of stringent regulations and aggressive targets for reducing greenhouse gas emissions drives the growth of the industry. These regulatory measures have accelerated the shift to EVs, creating a need for robust charging infrastructure. Battery swapping aligns with these goals by promoting faster and more sustainable EV adoption, particularly in commercial and public transportation sectors.

The UK battery swapping charging infrastructure industry is expected to grow rapidly in the coming years due to the government mandates to phase out internal combustion engine (ICE) and incentives for EV buyers. While plug-in charging is prevalent, battery swapping is gaining traction as it addresses two critical EV challenges: range anxiety and long charging durations.

The battery swapping charging infrastructure market in Germany held a substantial market share in 2024, owing to the presence of the automotive industry in the country. Automakers and battery technology companies are collaborating to develop standardized battery packs and modular systems that support interoperability. This focus on innovation ensures the scalability and efficiency of battery swapping solutions and drives the growth of the industry.

Asia Pacific Battery Swapping Charging Infrastructure Market Trends

The battery swapping charging infrastructure industry in Asia Pacific dominated the overall market and accounted for 30.66% of the global share in 2024. The growing EV adoption in the region, particularly in markets such as China, India, and Southeast Asia, is fueling the growth of the industry. In addition, the growth is fueled by government incentives, increasing consumer awareness about sustainable transportation, and the need to reduce dependency on fossil fuels.

Japan battery swapping charging infrastructure market is expected to grow rapidly over the forecast period. Japan's densely populated urban areas and efficient public transport systems present an ideal environment for battery swapping, especially for commercial vehicles. Fleets involved in last-mile delivery, public transportation, and ride-hailing services benefit significantly from reduced charging downtime and operational costs enabled by battery swapping technology.

The battery swapping charging infrastructure market in China held a substantial market share in 2024 owing to rapid urbanization has increased demand for sustainable and efficient mobility solutions. Battery swapping stations, which require less space than traditional charging infrastructure, are particularly well-suited for densely populated urban centers. They also help mitigate grid strain by enabling pre-charged batteries to be swapped during non-peak hours, reducing energy demand spikes.

Key Battery Swapping Charging Infrastructure Company Insights

Some of the key companies in the battery swapping charging infrastructure market include NIO Inc., SUN Mobility Private Ltd., BYD Co. Ltd., Gogoro Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

NIO Inc. is a Chinese multinational automobile manufacturer specializing in the design and development of premium electric vehicles (EVs). It offers battery-swapping technology, which allows users to exchange depleted batteries for fully charged ones in a matter of minutes, enhancing convenience and reducing range anxiety. The company operates over 1,300 battery swap stations across China and has plans to expand internationally.

-

Gogoro Inc. is a battery-swapping technology company customized for urban electric scooters, mopeds, and motorcycles. The company operates the Gogoro Energy Network, a modular battery-swapping infrastructure that allows riders to quickly exchange depleted batteries at designated GoStations for a subscription fee. In addition to its operations in Taiwan, Gogoro is expanding internationally with initiatives in countries such as India and Indonesia, aiming to promote sustainable urban mobility solutions globally.

Key Battery Swapping Charging Infrastructure Companies:

The following are the leading companies in the battery swapping charging infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- NIO Inc.

- Gogoro Inc.

- Leo Motors Inc.

- Yadea Technology Group Co.,Ltd.

- SUN Mobility Private Ltd.

- BYD Co. Ltd.

- BattSwap Inc.

- Kwang Yang Motor Co. Ltd. (KYMCO)

- Panasonic Corp.

- Lithion Power Pvt. Ltd.

Recent Developments

-

In December 2024, SUN Mobility launched modular battery-swapping technology designed for heavy electric vehicles (HEVs). The solution was showcased during a workshop in Chennai, attended by over 100 private bus operators from Tamil Nadu. Technology aims to address significant challenges faced by commercial fleet operators, such as high initial costs, inadequate charging infrastructure, and prolonged downtime associated with traditional charging methods.

-

In November 2024, Honda Power Pack Energy India Private Ltd (HEID) announced an ambitious plan to establish 500 battery-swapping stations across three major Indian cities, including Bengaluru, Delhi, and Mumbai, by March 2026. This initiative is part of the launch of Honda's e:Swap service, which aims to enhance the accessibility and convenience of electric two-wheelers, particularly the newly introduced Honda Activa e.

Battery Swapping Charging Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 280.8 million

Revenue forecast in 2030

USD 811.5 million

Growth rate

CAGR of 23.6% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, service type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Netherlands, China, Japan, India, South Korea, Australia, Brazil

Key companies profiled

NIO Inc.; Gogoro Inc.; Leo Motors Inc.; Yadea Technology Group Co.,Ltd.; SUN Mobility Private Ltd.; BYD Co. Ltd.; BattSwap Inc.; Kwang Yang Motor Co. Ltd. (KYMCO); Panasonic Corp.; Lithion Power Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Swapping Charging Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global battery swapping charging infrastructure market report based on vehicle type, service type, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Two-wheeler

-

Three-wheeler

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pay-per-Use

-

Subscription

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global battery swapping charging infrastructure market size was estimated at USD 240.7 million in 2024 and is expected to reach USD 280.8 million in 2025.

b. The global battery swapping charging infrastructure market is expected to grow at a compound annual growth rate of 23.6% from 2025 to 2030 to reach USD 811.5 million by 2030.

b. Asia Pacific dominated the battery swapping charging infrastructure market with a share of 30.66% in 2024. The regional market's growth can be attributed to initiatives by various governments to promote the adoption of electric vehicles and swappable batteries

b. Some key players operating in the battery swapping charging infrastructure market include NIO Inc.; Gogoro Inc.; Leo Motors Inc.; Yadea Technology Group Co.,Ltd.; SUN Mobility Private Ltd.; BYD Co. Ltd.; BattSwap Inc.; Kwang Yang Motor Co. Ltd. (KYMCO); Panasonic Corp.; Lithion Power Pvt. Ltd.

b. Key factors that are driving the market growth include reduced charging time, reduced upfront costs of buying an electric vehicle, increasing demand for public charging infrastructure, and favorable government subsidies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."