- Home

- »

- Advanced Interior Materials

- »

-

Beverage Packaging Equipment Market Size Report, 2033GVR Report cover

![Beverage Packaging Equipment Market Size, Share & Trends Report]()

Beverage Packaging Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Filling & Capping Machines, Labelling & Coding Machines), By Automation (Fully Automatic, Semi-automatic), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-702-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Beverage Packaging Equipment Market Summary

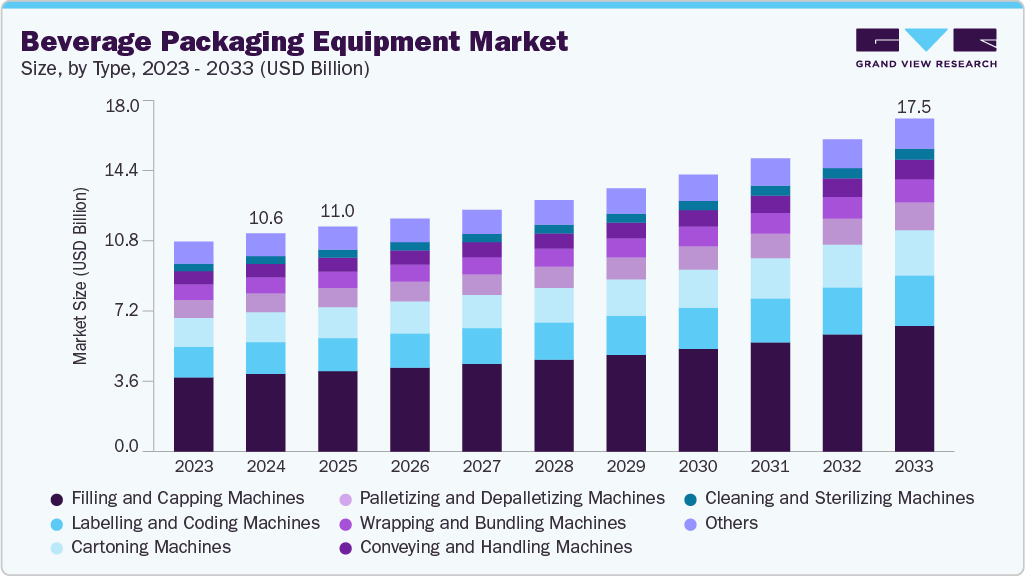

The global beverage packaging equipment market size was estimated at USD 10,643.3 million in 2024, and is projected to reach USD 17,464.6 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The market growth is primarily driven by the increasing demand for ready-to-drink beverages, rising automation in manufacturing, and the push for sustainable packaging solutions.

Key Market Trends & Insights

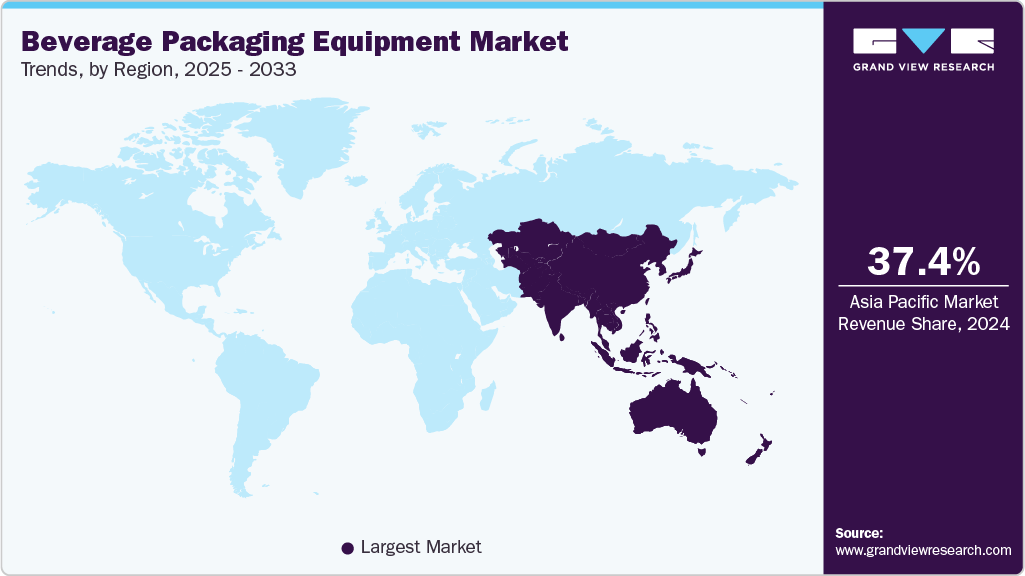

- Asia Pacific dominated the beverage packaging equipment market with the largest revenue share of 37.4% in 2024.

- The beverage packaging equipment industry in the U.S. is expected to grow at a substantial CAGR of 5.5% from 2025 to 2033.

- By type, the filling and capping machines segment is expected to grow at a considerable CAGR of 6.6 % from 2025 to 2033.

- By automation, the fully automatic segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

- By application, the dairy beverage segment is expected to grow at a considerable CAGR of 6.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 10,643.3 Million

- 2033 Projected Market Size: USD 17,464.6 Million

- CAGR (2025-2033): 5.9%

- Asia Pacific: Largest market in 2024

Technological advancements, including AI integration and smart systems, are enhancing efficiency and flexibility. Emerging markets in Asia Pacific are fueling the growth of beverage packaging by increasing both production and consumption. Rapid urbanization, rising disposable incomes, and changing lifestyles are boosting demand for packaged beverages. Manufacturers are investing in advanced packaging technologies to meet regional preferences, while favorable government policies and expanding retail infrastructure support the industry’s development across these high-growth economies.

Market Concentration & Characteristics

The beverage packaging equipment market is moderately fragmented, with a mix of global giants and numerous regional players. While large companies lead in innovation and global reach, smaller firms compete through niche offerings and local expertise. This structure fosters healthy competition, prevents monopolies, and encourages continuous technological advancement and customization to meet diverse consumer and regulatory demands worldwide.

The beverage packaging equipment industry is rapidly innovating with sustainable materials, smart automation, modular designs, and digital connectivity. Advances like AI, robotics, IoT, and smart labeling are enhancing operational efficiency, customization, and eco-friendliness. Consumer demand, sustainability goals, and the need for production flexibility drive these innovations.

Merger and acquisition activities in the market have been increasing over the years, aimed at expanding product portfolios, entering new geographic markets, and enhancing technological capabilities. Major players are acquiring firms specializing in flexible and sustainable packaging solutions. These strategic moves aim to enhance innovation, streamline supply chains, and increase competitiveness amid growing demand for efficient, eco-conscious packaging equipment. For instance, in August 2024, Duravant acquired T-TEK, a U.S.-based manufacturer specializing in end-of-line packaging equipment. This strategic move strengthens Duravant’s automation portfolio, especially in palletizing and material handling, enabling it to offer more integrated, high-performance solutions for the beverage industry.

Regulations focused on environmental sustainability are significantly shaping the beverage packaging equipment market. Bans on single-use plastics and requirements for recyclable or compostable packaging are prompting manufacturers to adopt greener technologies. Incentives for energy-efficient machinery and waste reduction are driving innovation, aligning industry practices with global environmental and circular economy goals.

Drivers, Opportunities & Restraints

The rising global demand for ready-to-drink beverages such as bottled water, energy drinks, and functional drinks is a major growth driver for the beverage packaging equipment industry. Factors like rapid urbanization, increasingly health-conscious consumers, and the growing preference for convenience are compelling beverage manufacturers to adopt high-speed, automated packaging solutions. These systems not only enhance production efficiency but also ensure product safety and extended shelf life. For example, in June 2025, Sidel launched CoboREEL, an automated reel-loading solution for label packaging. This innovation offers three times the reel capacity of conventional systems, significantly reducing manual handling, changeover time, and operational downtime.

The growing demand for sustainable and eco-friendly packaging presents a major opportunity. Manufacturers can develop equipment compatible with recyclable, compostable, and biodegradable materials. As global regulations tighten and consumers favor green brands, offering machinery that supports low-waste, energy-efficient packaging formats allows companies to differentiate, capture emerging markets, and align with long-term environmental and ESG goals.

High capital investment and maintenance costs pose a major challenge for small and mid-sized beverage producers. Advanced packaging equipment often requires significant upfront investment, skilled labor, and regular servicing. These costs strain limited budgets and can hinder expansion. Frequent upgrades due to evolving technology and the risk of downtime also affect overall efficiency and long-term profitability.

Type Insights

Filling and capping machines led the beverage packaging equipment market in 2024, capturing the largest revenue share of 36.1%. Their dominance is attributed to their critical role in maintaining production speed, accuracy, and hygiene, key factors for beverage manufacturers. Automatic systems are widely adopted in high-volume production environments, while semi-automatic machines cater to small and mid-sized producers. Rotary fillers remain the most commonly used due to their high throughput, and the growing demand for aseptic filling, especially for juices and preservative-free beverages, is further driving innovation and efficiency in this segment.

The labelling and coding machines segment is expected to witness significant growth during the forecast period due to increasing demand for product traceability, regulatory compliance, and brand differentiation. Growth in e-commerce and consumer preference for detailed packaging information is driving the adoption of automated, high-speed labeling and coding systems. Technologies like QR codes, RFID, and laser marking are gaining popularity across various beverage segments.

Automation Insights

The fully automatic segment dominated the beverage packaging equipment industry in 2024, accounting for the highest revenue share of 56.7%. This can be attributed to the rising demand for high-speed, efficient, and low-labor production. These systems enhance productivity, reduce human error, and integrate seamlessly with smart technologies. As manufacturers seek to scale operations and meet hygiene standards, fully automated lines are becoming increasingly essential.

The semi-automatic segment is expected to grow steadily during the forecast period. Ideal for small to mid-sized producers, these systems offer flexibility and lower upfront costs compared to full automation while maintaining higher efficiency and safety than manual processes. As producers scale gradually, semi-automatic equipment helps manage operational costs, supports smaller batch runs, and eases incremental automation adoption.

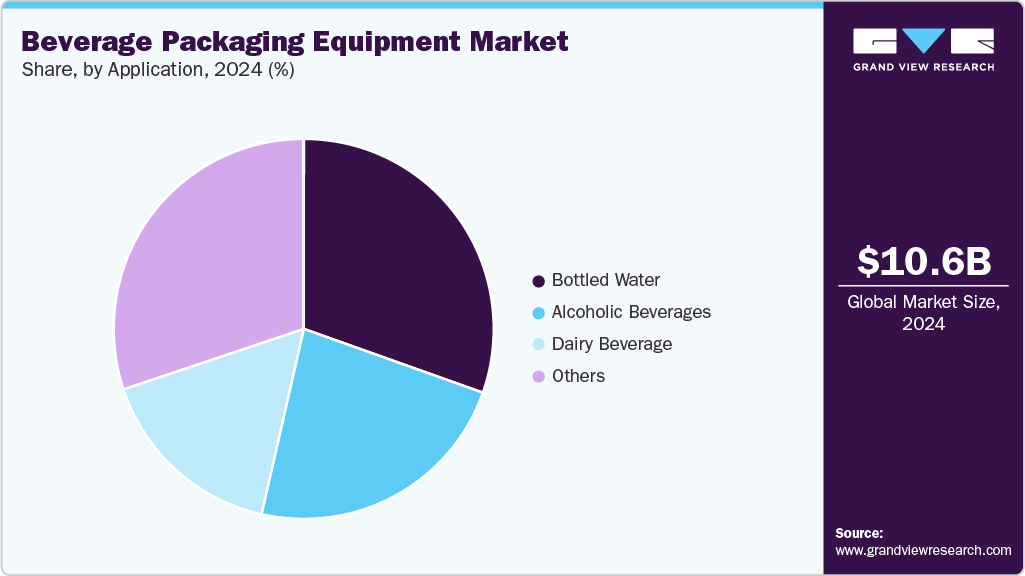

Application Insights

The bottled water segment dominated the beverage packaging equipment market in 2024, holding the largest revenue share at 30.5%. This can be attributed to the increasing health awareness and consumer preference for convenient hydration. This drives demand for advanced, safe, and sustainable packaging technologies. Innovations in eco-friendly materials and packaging designs further support this growth, making bottled water a key focus for equipment manufacturers worldwide.

The dairy beverage segment is expected to grow the fastest during the forecast period, due to rising demand for ready-to-drink dairy products like flavored milk and yogurt drinks. Advanced packaging technologies help maintain freshness, extend shelf life, and comply with strict hygiene standards. Increasing automation and innovative packaging designs are essential to meet evolving consumer preferences and industry needs.

Regional Insights

The Asia Pacific beverage packaging equipment market dominated with a revenue share of 37.4% in 2024, due to rising urbanization, increasing disposable incomes, and expanding middle-class consumption. The surge in demand for bottled water, dairy, and functional beverages is driving investment in advanced, automated packaging systems. Regional manufacturing hubs and favorable government policies further support industry expansion.

China Beverage Packaging Equipment Market Trends

The China beverage packaging equipment market leads Asia Pacific, due to its large-scale beverage production, technological advancement, and export-oriented manufacturing base. Demand for high-speed, energy-efficient machines is rising as domestic brands modernize operations. Government support for automation and environmental regulations is accelerating the shift toward smart, sustainable packaging technologies across China's industrial sector.

The beverage packaging equipment market in India is growing rapidly, due to rising consumption of bottled water, soft drinks, and dairy beverages, particularly in urban areas. The rise of local beverage startups and increased retail penetration are creating demand for compact, cost-effective packaging solutions. Government initiatives supporting manufacturing and food safety also encourage investment in modern packaging equipment.

North America Beverage Packaging Equipment Market Trends

The North America beverage packaging equipment industry is anticipated to register a CAGR of 5.6% during the forecast period, fueled by the increasing demand for ready-to-drink and premium beverages. The region’s strong shift toward convenience-oriented lifestyles is boosting the use of packaging formats like PET bottles, cans, and cartons. This trend is driving beverage manufacturers to invest in high-speed, automated filling, capping, and labeling machinery to meet rising consumer expectations for quality, safety, and on-the-go accessibility. Furthermore, advancements in packaging technologies and a focus on operational efficiency continue to support the market’s robust growth across the region.

The beverage packaging equipment industry in the U.S. is expected to grow at a CAGR of 5.5% from 2025 to 2033. The U.S. is growing rapidly as manufacturers invest in automation and sustainable technologies. Rising consumption of functional beverages, sparkling water, and ready-to-drink products is increasing demand for flexible, high-efficiency packaging systems.

Mexico’s beverage packaging equipment market is expanding due to rising demand for processed beverages, growing exports, and increased investment in automation. The adoption of modern filling, sealing, and labeling systems is accelerating, especially in response to sustainability goals.

Europe Beverage Packaging Equipment Market Trends

Europe is witnessing strong growth in the beverage packaging equipment industry, driven by strong environmental regulations and sustainability goals. Demand for recyclable, biodegradable, and returnable packaging formats is pushing investment in advanced, eco-friendly machinery. Automation, AI, and IoT-enabled systems are increasingly adopted to enhance efficiency, flexibility, and compliance across beverage filling, capping, labeling, and secondary packaging lines.

Germany’s beverage packaging equipment market is supported by its advanced engineering capabilities and strong R&D. Home to major manufacturers, the country drives innovation in high-speed, energy-efficient machinery. Growing demand for sustainable solutions and strict environmental standards are accelerating the adoption of smart technologies, positioning Germany as a hub for cutting-edge beverage packaging system development and exports.

The beverage packaging equipment market in the UK is growing due to rising demand for sustainable packaging, including recycled PET and refillable containers. Regulatory measures like the Plastic Packaging Tax are prompting manufacturers to upgrade machinery.

Middle East & Africa Beverage Packaging Equipment Market Trends

The Middle East & Africa beverage packaging equipment industry is witnessing growth, driven by rising packaged beverage consumption in countries like South Africa, Egypt, Nigeria, and the UAE. Urbanization, higher disposable incomes, and demand for convenient and healthy drinks are encouraging investments in automated filling, labeling, and sealing equipment.

Saudi Arabia’s beverage packaging equipment market is growing significantly. Economic diversification, urban population growth, and expanding food and beverage industries boost demand. Vision 2030’s focus on automation and sustainability encourages investment in smart filling and packaging technologies. Strict hygiene and labeling standards also require advanced equipment, making Saudi Arabia a key hub for modern packaging innovation.

Latin America Beverage Packaging Equipment Market Trends

The beverage packaging equipment industry in Latin America is growing steadily. Key countries like Brazil and Argentina are investing in advanced packaging technologies to improve efficiency and sustainability. Automation and eco-friendly materials are increasingly adopted, aligning with global trends toward more sustainable and efficient packaging solutions.

The Brazil beverage packaging equipment market is the largest in Latin America. Its strong beverage industry, including soft drinks, juices, and alcoholic beverages, drives high demand for packaging machinery. Growing investments focus on automation and sustainable packaging to meet environmental goals. Government support for recycling and waste reduction further fuels market growth, alongside Brazil’s strong manufacturing sector and export potential.

Key Beverage Packaging Equipment Company Insights

Some of the key players operating in the market include Barry-Wehmiller Companies, Syntegon Technology GmbH, Bradman Lake Group Ltd., and Coesia S.p.A

-

Barry-Wehmiller Companies is a diversified engineering and manufacturing company that provides a broad range of equipment and services to packaging, converting, and manufacturing industries. The company designs and manufactures systems and machinery for packaging applications, including filling, labeling, and automation solutions. Its portfolio includes equipment for the beverage, food, consumer goods, and healthcare sectors. Barry-Wehmiller emphasizes integration of mechanical engineering, software, and controls to offer customized solutions.

-

Syntegon Technology GmbH specializes in the design and manufacturing of processing and packaging equipment for the food and pharmaceutical industries. The company’s product range includes filling, sealing, inspection, and labeling machines, supporting a variety of packaging formats such as pouches, cartons, and bottles. Syntegon focuses on technologies that enable product safety, quality, and traceability. Its equipment is used in applications including liquid, solid, and powder packaging.

Key Beverage Packaging Equipment Companies:

The following are the leading companies in the beverage packaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Barry-Wehmiller Companies

- Syntegon Technology GmbH

- Bradman Lake Group Ltd.

- Coesia S.p.A.

- Clearpack

- EconoCorp Inc.

- GEA Group

- Jacob White Packaging Ltd.

- KHS Group

- Mpac Group plc

- A. Jones

- Sacmi

- Sidel Group

- SIG Combibloc Group

- Tetra Laval/Tetra Pak

Recent Developments

-

In May 2025, IMA Food North America launched the Hamba Flexline, a high-speed cup fill-seal system with integrated sterilization capabilities. Designed for efficiency and hygiene, it can produce over 57,000 cups per hour, making it ideal for dairy and other food sectors requiring fast, sterile, and flexible packaging solutions.

-

In July 2024, Coesia acquired a minority stake in PWR (Packaging with Robots), forming a strategic partnership to offer full-line automated packaging solutions using robotics and vision systems, boosting productivity, flexibility, and geographic reach.

Beverage Packaging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,048.3 million

Revenue forecast in 2033

USD 17,464.6 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, automation, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Russia, China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Barry-Wehmiller Companies; Syntegon Technology GmbH; Bradman Lake Group Ltd.; Coesia S.p.A.; Clearpack; EconoCorp Inc.; GEA Group; Jacob White Packaging Ltd.; KHS Group; Mpac Group plc; A. Jones; Sacmi; Sidel Group; SIG Combibloc Group; Tetra Laval/Tetra Pak

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beverage Packaging Equipment Market Report Segmentation

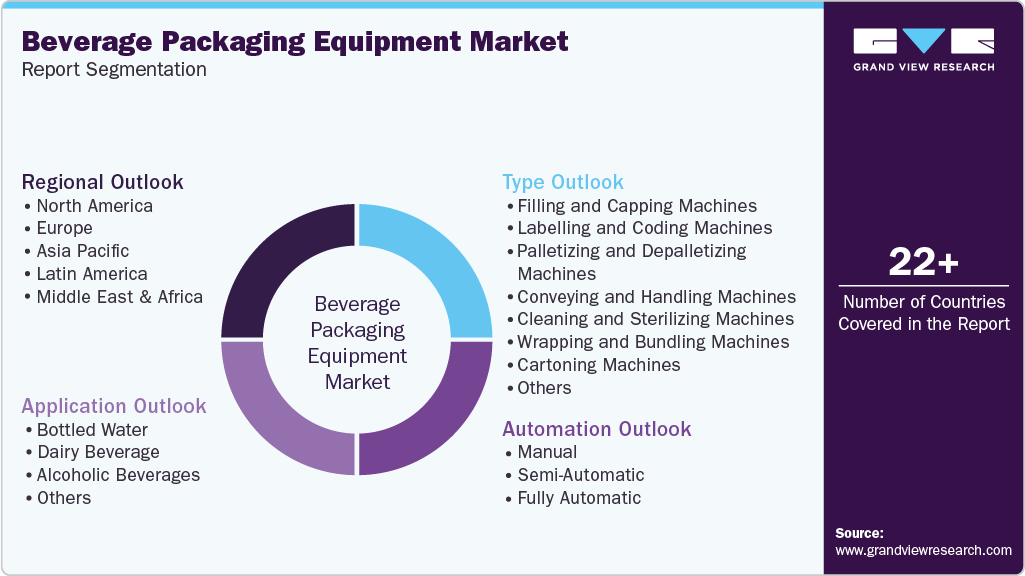

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global beverage packaging equipment market report based on type, automation, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Filling and Capping Machines

-

Labelling and Coding Machines

-

Palletizing and Depalletizing Machines

-

Conveying and Handling Machines

-

Cleaning and Sterilizing Machines

-

Wrapping and Bundling Machines

-

Cartoning Machines

-

Others

-

-

Automation Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual

-

Semi-Automatic

-

Fully Automatic

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bottled Water

-

Dairy Beverage

-

Alcoholic Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beverage packaging equipment market size was estimated at USD 10,643.3 million in 2024 and is expected to be USD 11,048.3 million in 2025.

b. The global beverage packaging equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 17,464.6 million by 2033.

b. Fully automatic segment dominated the market in 2024, accounting for the highest revenue share at 56.7% due to rising demand for high-speed, efficient, and low-labor production. These systems enhance productivity, reduce human error, and integrate seamlessly with smart technologies.

b. Some of the key players operating in the global beverage packaging equipment market include Barry-Wehmiller Companies, Syntegon Technology GmbH, Bradman Lake Group Ltd., Coesia S.p.A., Clearpack, EconoCorp Inc., GEA Group, Jacob White Packaging Ltd., KHS Group, Mpac Group plc, A. Jones, Sacmi, Sidel Group, SIG Combibloc Group, Tetra Laval/Tetra Pak.

b. Key factors driving the global beverage packaging equipment market include rising demand for ready-to-drink beverages, increasing automation, sustainability initiatives, strict hygiene standards, and growing consumption in emerging markets. Technological advancements and the need for efficient, flexible packaging solutions also contribute significantly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.