- Home

- »

- Renewable Chemicals

- »

-

Bio-acetic Acid Market Size, Share & Growth Report, 2030GVR Report cover

![Bio-acetic Acid Market Size, Share & Trends Report]()

Bio-acetic Acid Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Ethanol), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-984-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-acetic Acid Market Size & Trends

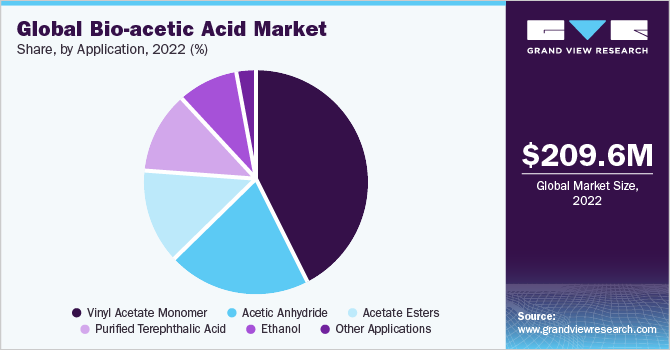

The global bio-acetic acid market size was valued at USD 209.6 million in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 5.3% from 2023 to 2030. The growth is attributed to the increasing demand for eco-friendly and sustainable alternatives to traditional petrochemical-based products. Bio-acetic acid is a renewable alternative to petroleum-based acetic acid, which is used in a wide range of applications such as polymer production, textiles, and solvents. The growing awareness and focus on reducing the carbon footprint and environmental impact of various industries has led to a shift towards sustainable and eco-friendly production processes, driving the demand for bio-based products like bio-acetic acid.

The COVID-19 pandemic negatively impacted the product market in 2020. This was largely due to the temporary suspension of automotive and construction manufacturing activities that led to a reduction in demand for vinyl acetate monomer, a primary ingredient in many end-user products such as paints, adhesives, coatings, composites, and plastics, consequently affecting the demand for bio-acetic acid. However, the market appears to have rebounded in 2022 as production processes across all industries have resumed normalcy.

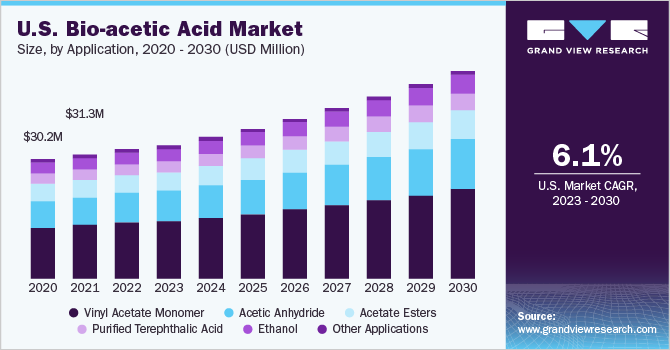

The U.S. is the largest consumer of the product in North America with a revenue share of 73.2% in 2022. This is attributed to the growing demand for vinyl acetate monomer (VAM) in paints & coatings and automobile industries in the country. VAM is a key ingredient in the production of copolymers used in different types of coatings, such as automotive and industrial coatings, due to its excellent adhesion properties.

Additionally, is it used to create polyvinyl alcohol (PVOH), which is used in coatings and adhesives due to its film-forming properties Thus, the rising demand for automobiles and construction in the U.S. is likely to propel the demand for paints & coatings in the country over the forecast period which in turn will drive the demand for bio-acetic acid used in the production of Vinyl Acetate Monomers (VAM).

Application Insight

Vinyl Acetate Monomer (VAM) in the application segment dominated the market with a revenue share of 42.4% in 2022. This growth is attributed to its wide use in the production of adhesives, films, textiles, paints, coatings, and other end-use products. VAM is utilized as a key raw material in the manufacturing of several prominent polymers and resins. It is also used to develop high-performance emulsions and adhesives, which find applications in the automotive, construction, and packaged food industries. Increasing demand for VAM and its derivatives is expected to positively impact the growth of the bio-acetic acid market in the coming years.

Acetic anhydride is another segment expected to witness significant growth over the forecast period. It is a chemical intermediate used in the production of pharmaceutical products, tetraacetylethylenediamine (TAED), and cellulose acetate, among others. The wide use of acetic anhydride in producing drugs, such as aspirin, paracetamol, acetyl-p-aminophenol, acetylcholine hydrochloride, sulfa drugs, cortisone, and acetanilide, among others, coupled with the growing demand for cellulose acetate from the packaging industry, is expected to be a major driver contributing to the growth of the segment.

Additionally, the growing demand for clear masks, face shields, food, and e-commerce packaging has resulted in an increased demand for purified terephthalic acid, dimethyl terephthalate, and polyethylene terephthalate. This has led to the growth of the segment and advancements in production technologies are expected to offer lucrative opportunities for the segment in the future.

Regional Insights

Asia Pacific emerged as the dominating region with a revenue share of 46.6% in 2022. This is attributed to the presence of multinational companies in the region and the high demand from automobile, paints & coatings, and plastics industries in the region. The presence of leading motor vehicle manufacturers such as Toyota, Kia, Nissan, and Hyundai across the region is anticipated to drive the automotive industry in the coming years.

In 2021, the Asia Pacific region produced 3,538,396 units of motor vehicles and 3,144,243 units of motorcycles and scooters, selling over 2,791,307 and 3,550,848 units of motor vehicles and two-wheelers, respectively. The spike in production and sales of vehicles has been fueled by rising consumer purchasing power and a growing population in Asia Pacific. These factors are expected to contribute to the demand for plastics, paints & coatings, and, ultimately, the growth of the regional market.

Further, North America is also witnessing significant growth owing to the increasing demand for vinyl acetate monomers from the packaging and food & beverage industries. Moreover, bio-acetic acid is an essential raw material consumed in the production of personal care products such as shampoos, creams, conditioners, and more as a pH regulator and a preservative. According to the International Trade Administration, the cosmetics & personal care market in Canada accounted for USD 1.24 billion in 2021, which is anticipated to grow at a rate of 1.45% annually, reaching USD 1.8 billion by 2024. Thus, Canada’s thriving cosmetics & personal care industry is likely to propel the demand over the forecast period.

Key Companies & Market Share Insights

The bio-acetic acid market is characterized by high competition due to the presence of a large number of large- and small-scale manufacturers and suppliers. Enterprises operating in product manufacturing make use of various methods to address the growing demand in the market. Such methods aim to expand their global reach, while also optimizing distribution costs to potential consumers. Companies are observed to undertake mergers and acquisitions, joint ventures, as well as expansion activities, to take advantage of the opportunities presented to them in the global market.

The players are actively engaging in technological innovations and new product launches to establish their position in the market. For instance, in May 2022, Afyren SAS announced that it is all set to launch new brands for its bio-based products to offer another level of sustainable solutions. This strategy is expected to attract more customers and investors who are seeking more green method solutions. Some prominent players in the global bio-acetic acid market include:

-

Airedale Chemicals

-

Bio-Corn Products EPZ Ltd.

-

GODAVARI BIOREFINERIES LTD

-

Sucroal SA

-

Cargill, Inc.

-

Novozymes A/S

-

LanzaTech

-

Afyren SAS

-

BTG Bioliquids

Bio-acetic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 213.5 million

Revenue forecast in 2030

USD 317.8 million

Growth Rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million, volume in thousand tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; Qatar; Egypt; South Africa

Key companies profiled

Airedale Chemicals; Bio-Corn Products EPZ Ltd.; GODAVARI BIOREFINARIES LTD; Sucroal SA; Cargill, Inc.; Novozymes A/S; LanzaTech; Afyren SAS; BTG Bioliquids

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-acetic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Bio-Acetic Acid market report based on application and region:

-

Application Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Vinyl Acetate Monomer

-

Acetic Anhydride

-

Acetate Esters

-

Purified Terephthalic Acid

-

Ethanol

-

Other Applications

-

-

Regional Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Qatar

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-acetic acid market size was estimated at USD 209.6 million in 2022 and is expected to reach USD 213.5 million in 2023.

b. The global bio-acetic acid market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 317.8 million by 2030.

b. The Asia Pacific dominated the bio-acetic acid market with revenue share of 46.6% in 2022 owing to the presence of global multinational companies in the region with high demand from end-use markets such as food & beverages, and paints & coatings.

b. The key players in bio-acetic acid market include Airedale Chemicals, Novozymes A/S, GODAVARI BIOREFINARIES LTD., Afyren, and others.

b. Increasing consumption of bio-acetic acid in food and beverages and construction industry is a major factor driving the bio-acetic acid market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.