- Home

- »

- Plastics, Polymers & Resins

- »

-

E-commerce Packaging Market Size, Industry Report, 2033GVR Report cover

![E-commerce Packaging Market Size, Share & Trends Report]()

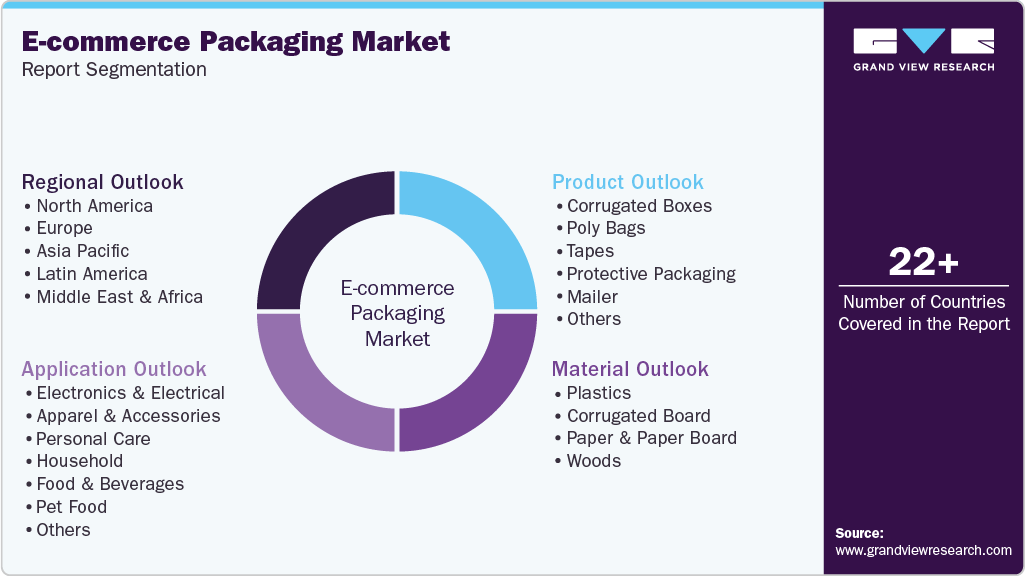

E-commerce Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Corrugated Board, Paper & Paperboard, Woods), By Product (Corrugated Boxes, Poly Bags, Tapes, Protective Packaging, Mailer), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-998-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-commerce Packaging Market Summary

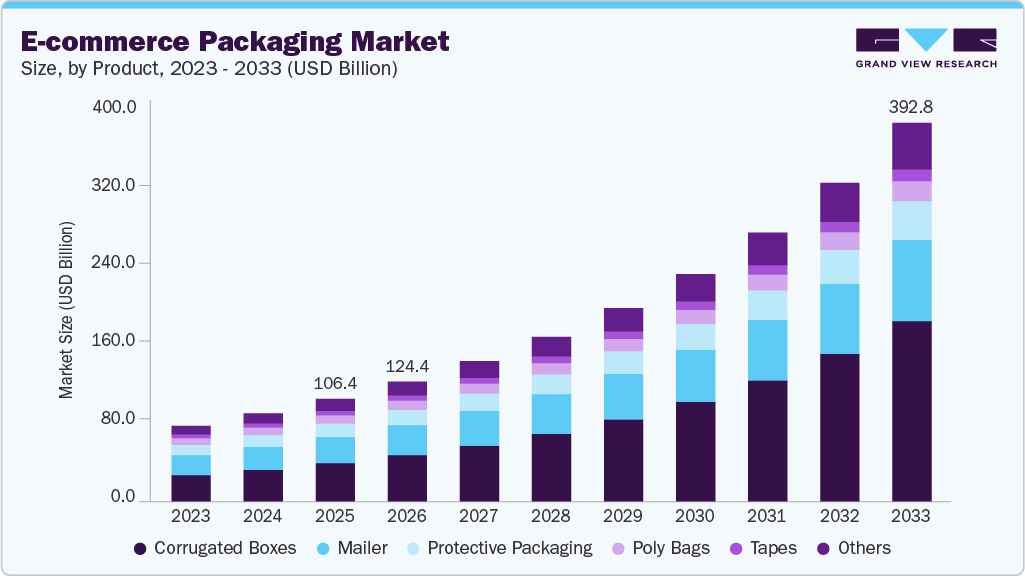

The global e-commerce packaging market size was valued at USD 106.46 billion in 2025 and is projected to reach USD 392.85 billion by 2033, growing at a CAGR of 17.9% from 2026 to 2033. The industry is experiencing substantial growth, primarily driven by the rapid expansion of the e-commerce sector.

Key Market Trends & Insights

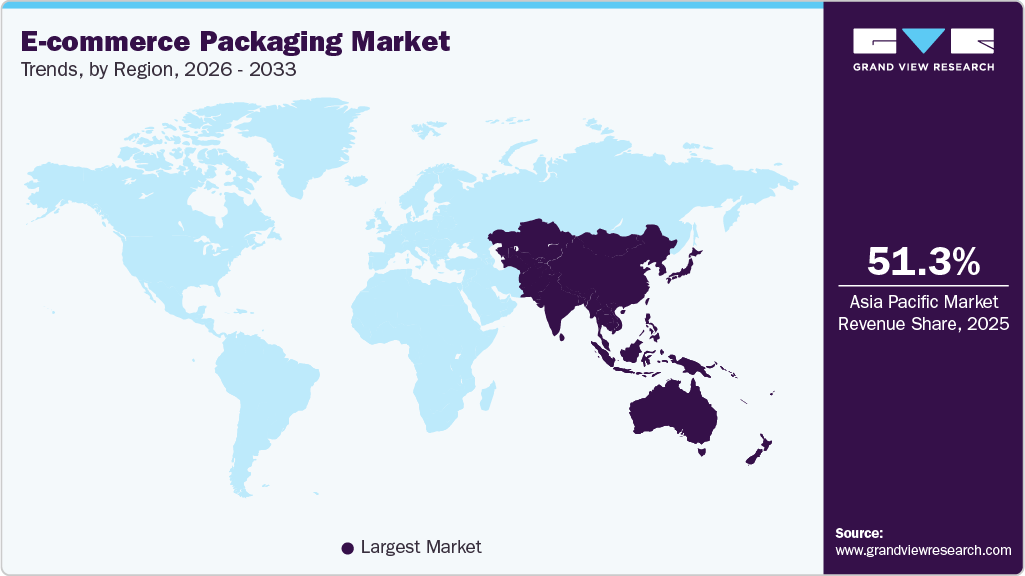

- Asia Pacific dominated the e-commerce packaging market with the largest revenue share of 51.34% in 2025.

- The e-commerce packaging market in India is expected to grow at a substantial CAGR of 26.9% from 2026 to 2033.

- By product, the corrugated boxes segment is expected to grow at the fastest CAGR of 21.5% from 2026 to 2033 in terms of revenue.

- By material, the corrugated board segment is poised to grow at the fastest CAGR of 21.9% from 2026 to 2033 in terms of revenue.

- By application, the pharmaceutical segment is forecast to grow at the fastest CAGR of 20.4% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 106.46 Billion

- 2033 Projected Market Size: USD 392.85 Billion

- CAGR (2026-2033): 17.9%

- Asia Pacific: Largest market in 2025

In addition, increasing internet penetration, smartphone usage, and convenience in shopping have led consumers to gravitate toward online purchasing, thus driving the market growth. Sustainability is a critical driver for the e-commerce packaging industry, as consumer awareness regarding environmental issues intensifies. E-commerce giants, driven by both consumer pressure and regulations, are committing to reducing plastic waste, minimizing the use of packaging materials, and integrating recyclable and compostable options into their packaging solutions. As a result, companies are adopting eco-friendly materials, such as paper-based packaging, biodegradable plastics, and reusable boxes. This shift aligns with brands’ efforts to enhance their green credentials and appeal to environmentally conscious consumers, further influencing packaging strategies and production standards across the industry.

The increase in product customization and differentiation also drives the market for e-commerce packaging. Brands strive to enhance the unboxing experience, which has become a crucial aspect of e-commerce, particularly for premium products and sectors such as cosmetics, electronics, and fashion. Companies are investing in packaging that creates a memorable first impression through a combination of aesthetic and functional elements, such as easy-open designs, secure closures, and visually appealing prints. This approach not only protects products but also supports brand building and customer retention in a highly competitive market by enhancing the customer experience and making it more personalized.

Advances in automation and smart packaging technologies are also propelling growth, as companies strive to streamline fulfillment processes and reduce labor costs. Automated packaging solutions and integrated systems optimize warehouse management and improve operational efficiency, which is crucial for handling high order volumes during peak seasons. Furthermore, smart packaging technologies, such as QR codes and near-field communication (NFC), are being incorporated to enhance product traceability, anti-counterfeiting measures, and customer engagement, adding a layer of security and interactivity to the consumer experience.

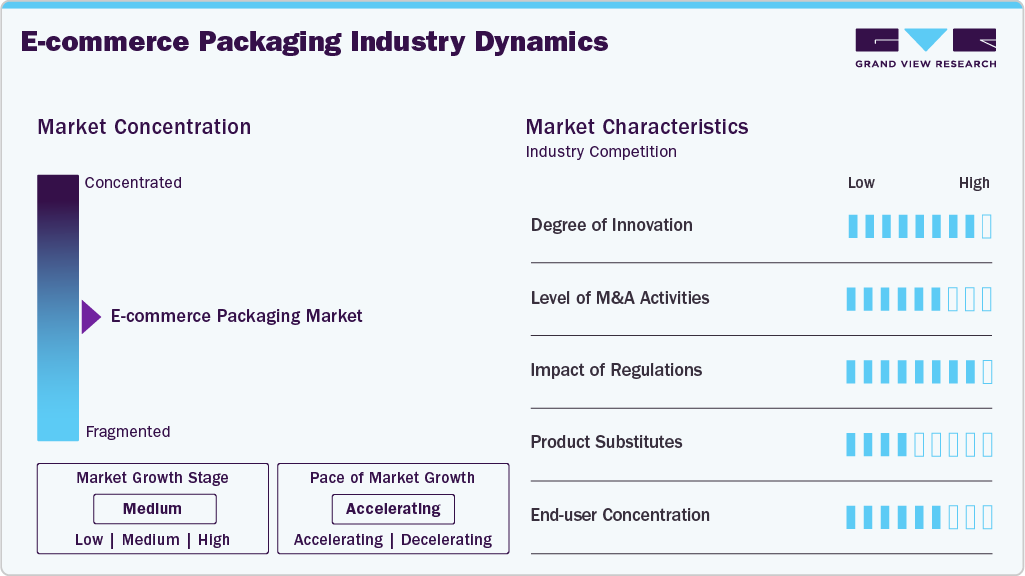

Market Concentration & Characteristics

The degree of innovation in the e-commerce packaging industry is high, driven by automation, sustainability, and data-driven logistics optimization. Key innovation areas include right-sized automated packaging systems, recyclable protective materials, smart packaging with tracking features, and lightweight cushioning solutions that reduce shipping costs without compromising protection.

M&A activity is moderate to high, characterized by acquisitions aimed at expanding geographic reach, automation capabilities, and sustainable product portfolios. Large packaging companies frequently acquire niche players specializing in protective packaging, digital printing, or automation technologies to strengthen their value proposition for major e-commerce clients.

Regulations have a significant and growing impact, particularly in the areas of reducing packaging waste, promoting recyclability, and implementing extended producer responsibility (EPR). Governments are imposing stricter rules on single-use plastics, excess packaging, and labeling, prompting e-commerce companies to adopt recyclable, reusable, and minimal packaging formats, particularly in Europe and certain parts of Asia.

Product substitutes include reusable shipping containers, returnable packaging systems, and minimal packaging approaches that eliminate secondary packaging. Some large retailers are experimenting with ship-in-own-container (SIOC) models, which reduce the need for traditional corrugated boxes and cushioning materials.

End-user concentration is highly polarized, with a small number of global e-commerce giants accounting for a large share of packaging demand, thereby exerting significant bargaining power over suppliers. At the same time, millions of small and mid-sized online sellers create a fragmented long-tail market, sustaining demand for standardized, scalable packaging solutions.

Product Insights

The corrugated boxes segment recorded the largest market revenue share of 37.22% in 2025. Corrugated boxes are one of the most widely used packaging options in e-commerce due to their strength, durability, and ability to protect items during transit. These boxes are structured with layers of fluted paper, providing cushioning against shocks and vibrations. They are highly customizable, allowing retailers to use various shapes and sizes to fit diverse product types, from electronics to clothing.

Poly bags are lightweight, flexible, and cost-effective, making them ideal for smaller, non-fragile items such as apparel and accessories. These bags often come with self-sealing adhesive strips, which simplify the packaging process and enhance shipping efficiency. Poly bags are also waterproof, providing additional protection against moisture and humidity during transportation.

The mailer segment is expected to grow at a CAGR of 15.2% over the forecast period. Mailers are padded or non-padded envelopes used primarily for smaller or flat items, such as books, documents, and small electronics. They are a lightweight alternative to boxes, reducing shipping costs. Mailers can be made from various materials, including paper and plastic, and generally include bubble wrap or foam padding for additional protection.

Material Insights

The corrugated board segment accounted for the largest market share of 38.35% in 2025 and is expected to grow at the fastest CAGR of 21.9% over the forecast period. Corrugated board is a top preference for e-commerce due to its strength and recyclability, commonly used for shipping boxes and sturdy packaging materials. Its ability to cushion products against potential shipping damage makes it indispensable for a wide variety of items, from electronics to fragile goods.

Plastics play a significant role in e-commerce packaging, particularly for items that require waterproofing or secure wrapping. Lightweight and flexible, plastic packaging options, such as bubble wrap, poly mailers, and air pillows, provide robust protection during transit. However, environmental concerns are increasingly influencing the types of plastic materials used, with a shift toward biodegradable and recyclable alternatives gaining traction among retailers.

Paper and paperboard are widely used for secondary packaging, such as inner wrapping, envelopes, and smaller product containers. As sustainable packaging becomes increasingly critical in e-commerce, paper and paperboard have seen rising demand due to their renewable, recyclable, and biodegradable qualities. They are often used as fillers or cushioning, adding an eco-friendly layer of protection to the inside of boxes.

Application Insights

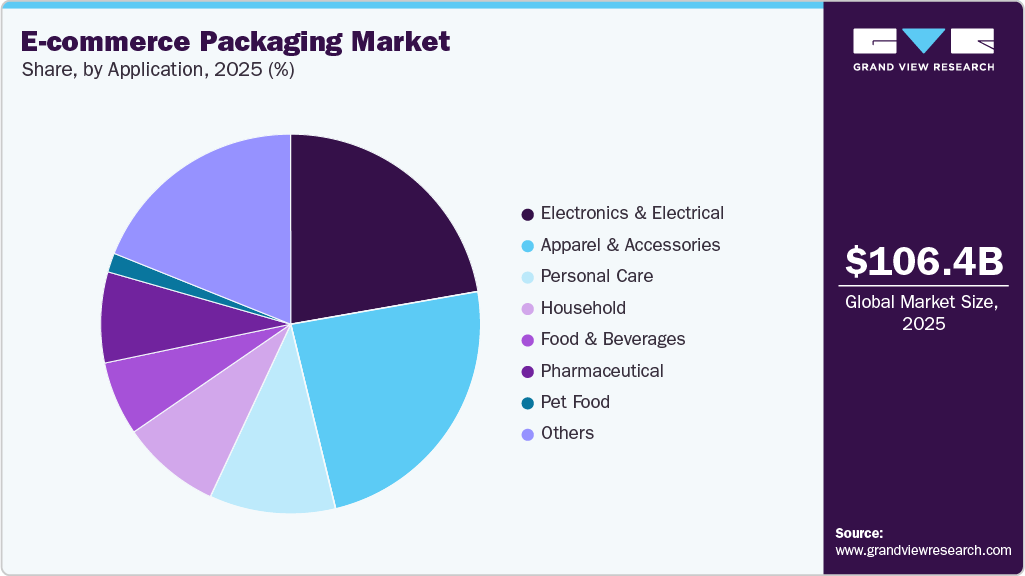

The apparel & accessories segment recorded the largest market share of 23.96% in 2025. The rapid growth of online shopping, accelerated by trends such as fast fashion and direct-to-consumer (DTC) sales, is driving demand for apparel packaging. Brand differentiation, combined with the growing trend toward sustainable packaging, is encouraging companies to adopt materials such as recycled cardboard and biodegradable plastics.

Pharmaceutical packaging includes solutions for over-the-counter (OTC) medications, prescription drugs, and health supplements. Packaging in this category prioritizes security features, such as tamper-evident seals, child-resistant closures, and labeling for regulatory compliance. The increasing adoption of online pharmacies, spurred by greater access to healthcare and the popularity of health and wellness products, is driving demand in this segment.

The electronics and electrical segments encompass packaging solutions designed to protect delicate electronic devices and electrical components during transit. This includes smartphones, laptops, gaming consoles, and home appliances, all of which are susceptible to damage from shocks, static electricity, or moisture. The increasing adoption of consumer electronics, driven by technological advancements and digitalization, is boosting demand in this segment.

Regional Insights

The e-commerce packaging industry in the Asia Pacific dominated the market and accounted for the largest revenue share of 51.34% in 2025. The Asia Pacific region's dominance in e-commerce packaging is primarily driven by its massive consumer base, rapid digital adoption, and growing middle class. Countries such as China, India, Indonesia, and Vietnam have experienced unprecedented growth in online shopping, driven by increased smartphone penetration and enhanced internet infrastructure. For example, China dominates the global e-commerce sales, with platforms such as Alibaba and JD.com handling billions of packages annually, creating massive demand for packaging solutions.

China E-commerce Packaging Market Trends

The China e-commerce packaging industry is primarily driven by its robust manufacturing ecosystem and advanced packaging infrastructure. The country is investing heavily in automated packaging facilities, smart logistics centers, and research into new materials. The concentration of manufacturing capabilities allows for rapid scaling and cost-effective production, making China a key supplier of packaging materials to both domestic and international markets.

North America E-commerce Packaging Market Trends

The e-commerce packaging industry in North America is primarily driven by its advanced digital infrastructure, high internet penetration rates, and strong consumer purchasing power. The region, particularly the U.S., has seen explosive growth in online shopping, accelerated by the shift in consumer behavior during recent years. Major retailers such as Amazon, Walmart, and Target have invested heavily in their e-commerce operations, driving significant demand for innovative packaging solutions. The region's robust logistics network and advanced supply chain management systems have also contributed to this growth.

The e-commerce packaging industry in the U.S. has witnessed innovation in packaging technology and sustainability initiatives. Companies are investing significantly in smart packaging solutions, such as Amazon's "Frustration-Free Packaging" program, which has had a profound influence on the entire industry. Major retailers are also responding to consumer demand for eco-friendly packaging options, with initiatives aimed at reducing plastic usage and increasing the use of recyclable materials.

Europe E-commerce Packaging Market Trends

The e-commerce packaging industry in Europe is rising due to its strong environmental regulations and sustainability initiatives. The European Green Deal and the Circular Economy Action Plan have pushed retailers and packaging manufacturers to adopt eco-friendly solutions. For instance, companies such as H&M and Zara have implemented recyclable and reusable packaging programs, while Amazon Europe has eliminated single-use plastic packaging in its fulfillment centers across multiple European countries.

The Germany e-commerce packaging industry is mainly fueled by its strict environmental regulations, particularly the Packaging Act (VerpackG), which has pushed companies to adopt eco-friendly packaging solutions. Besides, the country has one of Europe's largest e-commerce markets, with the majority of its population shopping online regularly. Major German retailers such as Zalando and Otto, along with Amazon's strong presence, have created sophisticated logistics networks that demand innovative packaging solutions, thus driving the market growth in the region.

Key E-commerce Packaging Company Insights

The market is highly competitive. Key players range from established packaging manufacturers to specialized firms focusing on sustainable materials, customized packaging solutions, and technology-enabled logistics. Companies are differentiating through innovations in lightweight, durable, and biodegradable materials, while addressing concerns such as protection during transit, environmental impact, and reducing packaging waste. Competitive pressures are intense, with firms striving for cost-efficiency and unique designs to enhance customer satisfaction and brand recognition.

-

In November 2025, UFlex Ltd. announced an investment of over INR 700 crore (USD 77.15 million) to expand its packaging film capacity at its Karnataka plant. The expansion aims to meet the rising demand for flexible packaging films both domestically and globally, strengthen UFlex’s manufacturing footprint in southern India, and enhance supply chain efficiency. This investment underscores UFlex’s strategy to scale up production capacity, support sustainability initiatives, and reinforce its position as a leading player in the packaging industry.

-

In March 2024, Reedbut Group, a UK packaging manufacturer, launched a new range of exclusive e-commerce packaging products, such as cardboard mailers, mail-wraps, and cardboard inserts. This launch is significant as it reflects the growing demand for innovative packaging solutions tailored to e-commerce needs.

Key E-commerce Packaging Companies:

The following are the leading companies in the e-commerce packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Berry Global, Inc.

- CCL Industries

- Coveris

- Sealed Air

- Sonoco Products Company

- WINPAK Ltd.

- Alpha Packaging

- Constantia Flexibles

- Mondi

- Gerresheimer AG

- Silver Spur Corp.

- Greif

- Transcontinental Inc.

- ALPLA

E-commerce Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 124.41 billion

Revenue forecast in 2033

USD 392.85 billion

Growth rate

CAGR of 17.9% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; UAE; South Africa; Saudi Arabia

Key companies profiled

Amcor plc, Berry Global, Inc., CCL Industries, Coveris, Sealed Air, Sonoco Products Company, WINPAK Ltd., Alpha Packaging, Constantia Flexibles, Mondi, Gerresheimer AG, Silver Spur Corp., Greif, Transcontinental Inc., ALPLA.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-commerce Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global e-commerce packaging market report based on product, material, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Corrugated Boxes

-

Poly Bags

-

Tapes

-

Protective Packaging

-

Mailer

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Corrugated Board

-

Paper & Paper Board

-

Woods

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronics & Electrical

-

Apparel & Accessories

-

Personal Care

-

Household

-

Food & Beverages

-

Pet Food

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global e-commerce packaging market was estimated at around USD 106.46 billion in the year 2025 and is expected to reach around USD 124.41 billion in 2026.

b. The global e-commerce packaging market is expected to grow at a compound annual growth rate of 17.9% from 2026 to 2033 to reach around USD 392.85 billion by 2033.

b. The apparel & accessories segment recorded the largest market share of 23.96% in 2025 owing to the rapid growth of online shopping, accelerated by trends such as fast fashion and direct-to-consumer (DTC) sales.

b. The key players in the e-commerce packaging market include Amcor plc, Berry Global, Inc, CCL Industries, Coveris, Sealed Air, Sonoco Products Company, WINPAK Ltd., Alpha Packaging, Constantia Flexibles, Mondi, Gerresheimer AG, Silver Spur Corp., Greif, Transcontinental Inc., and ALPLA.

b. Growing e-Commerce retail platforms and technology advancements such as 5G and wider geographic internet connectivity are increasing the e-commerce market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.