- Home

- »

- Medical Devices

- »

-

Biologics Contract Manufacturing Market Report, 2030GVR Report cover

![Biologics Contract Manufacturing Market Size, Share & Trends Report]()

Biologics Contract Manufacturing Market Size, Share & Trends Analysis Report By Product (MABs, Recombinant Protein), By Indication (Oncology, CVDs), By Region (Europe, APAC), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-921-6

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

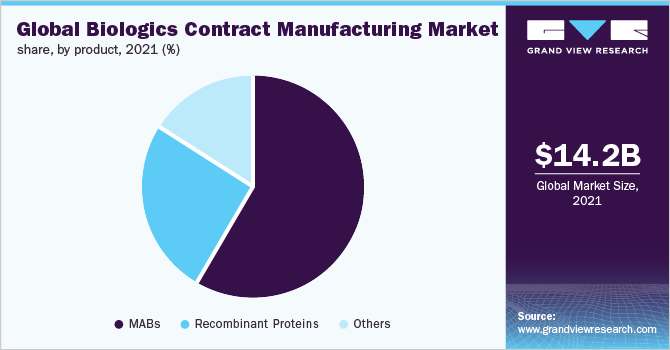

The global biologics contract manufacturing market size was valued at USD 14.2 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 10.5% from 2022 to 2030. There was unparalleled growth in 2020 due to the COVID-19 pandemic. The main drivers for this growth were the rise in investments by the government and prominent players in the biopharmaceutical market to increase productivity and efficiency. Biotechnology outsourcing of biologics has become a new trend. Biotech contract manufacturing is witnessing an increase in inquiries as well as orders, mostly related to coronavirus vaccines and therapeutics. Currently, Lonza has received over 40 inquiries about projects related to COVID-19. The COVID-19 pandemic has resulted in the disruptions in the supply chain.

However, supply chains have proven to be robust and supplies, manufacturing as well as services associated with biologics, have remained largely unaffected around the globe. Many organizations are attempting to speed up their productivity to meet the growing demand. Such companies are, therefore, appointing CDMOs to speed up their production processes. The worldwide effort to develop a vaccine against COVID-19 has created the greatest opportunity for many large CDMOs. Continuous advancements in biotechnology and biomedical science techniques have dramatically enhanced the process of biologics development for the management of several chronic conditions.

These advancements are aimed at a better understanding of cell-line production & protein identification and expression & engineering. Several biotechnology approaches for the production of self-adjuvanting antigen-adjuvant fusion protein subunit vaccines have been introduced in recent years. The development of new vaccines is observed to be aided by the availability of characterized platforms of new adjuvants. Furthermore, the use of nanosystems has increased in recent years as they help address the delivery challenges pertaining to the application of mRNA therapeutics in the treatment of diseases.

Several factors, such as a robust pipeline of biologics, an increase in the rate of FDA NDA/BLA approvals, a rise in patent expiration, as well as limited manufacturing capacity, and the need for realization of cost savings, have prompted the market players to opt for contract manufacturing services for biologics development to stay competitive in the market. Contract Manufacturing Organizations (CMO) play an important role in reshaping the biologics market as they can support startups and small-scale & emerging players.

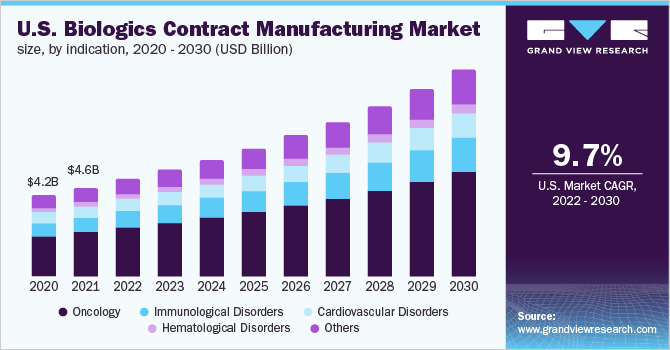

Indication Insights

On the basis of indications, the global market has been further categorized into oncology, immunological disorders, Cardiovascular Disorders (CVDs), hematological disorders, and others. The oncology indication segment dominated the global market in 2021. The segment accounted for the largest share of more than 49.8% of the overall revenue in the same year. It is estimated to remain dominant throughout the forecast period. The segment growth can be attributed to the high costs of drug development, rising cancer cases, and FDA regulations to accelerate the biologics drug development.

Despite the challenges related to COVID-19, the FDA approved 30 new drugs & biologics agents, 45 supplementary drugs, and 1 biosimilar application in oncology. On the other hand, the immunological disease segment is expected to witness the fastest CAGR over the forecast period. Biologics targeting autoimmune diseases have made a positive impact on the management of diseases, such as Rheumatoid Arthritis (RA), psoriasis, and other immunological disorders. Several biologics have been developed to attenuate common autoimmune diseases, and they target various pathological stages that occur during the development of immunological diseases.

Product Insights

On the basis of products, the global market has been further sub-segmented into Monoclonal Antibodies (MABs), recombinant proteins, and others. The MABs segment dominated the global market in 2021 and accounted for the maximum share of more than 58.00%. The segment is projected to expand further at the fastest CAGR maintaining its leading position during the forecast period. The high growth of the segment can be attributed to the extensive usage of the products made by MABs in different therapeutic areas. The drugs produced by MABs are used for the treatment of cancer, chronic Hepatitis B (HBV) infection, infectious diseases, and autoimmune diseases including rheumatoid arthritis.

For instance, in November 2021, Lonza Group AG entered into a manufacturing agreement with BlueJay, a developer of innovative therapeutics, for the development of BJT-778 monoclonal antibody for treating chronic HBV infection. Monoclonal antibodies are one of the most powerful tools in modern medicine and more than 100 of them have been licensed over the last 30 years. In addition, the MABs are relatively more effective than earlier available therapies and are also often better tolerated and easier to deliver.

Regional Insight

On the basis of geographies, the global market has been divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the market in 2021 and accounted for the maximum share of more than 41.00% of the global revenue. The regional market is estimated to expand further at a steady CAGR retaining its leading position over the forecast period. This growth is mainly attributed to the increasing outsourcing activities in North America. The region has a strong presence of several key players competing to capture higher market shares by introducing cost-efficient and high-quality work.

The development and manufacturing of advanced therapy in the region are also expected to boost the market growth over the years to come. On the other hand, Asia Pacific is projected to be the fastest-growing regional market during the forecast period. The regional growth can be attributed to the alteration in the clinical trial evaluation standards by regulatory organizations of biologics according to the global requirements. In addition, the costs of conducting clinical trials are low in Asia Pacific as compared to other regions. Thus, these factors are expected to augment the regional market growth over the forecast years.

Key Companies & Market Share Insights

Market players are undertaking various business strategies, such as forming alliances, to expand their geographical reach and capture a big market share. the key players are introducing advanced therapy and treatments to capture a big share in the market. These players have also engaged in partnerships, collaborations, and operational expansions to gain a competitive advantage over others. Also, improvements in treatment and therapy are the primary focus of the key players. For instance, in November 2021, Lonza signed a five-year service agreement with Bioqube Ventures, a venture capital firm, wherein Lonza will provide development and manufacturing service of biologics and small molecules to the portfolio companies of Bioqube Ventures. Some of the key players in the global biologics contract manufacturing market are:

-

Wuxi Biologics

-

Abzena Ltd.

-

FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

-

Boehringer Ingelheim GmbH

-

Lonza

-

SamsungBiologics

-

Abbvie

-

Catalent

-

Bioreliance

-

Thermo Fischer (Patheon)

-

Eurofins CDMO

Biologics Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 15.67 billion

Revenue forecast in 2030

USD 34.7 billion

Growth rate

CAGR 10.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K. Germany; France; Italy; Spain; China; Japan; Australia; South Korea; India; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Wuxi Biologics; Abzena Ltd.; FUJIFILM Diosynth Biotechnologies; BI BioXcellence; Lonza Group AG; Boehringer Ingelheim GmbH; Samsung Biologics; Abbvie; Catalent; Bioreliance; Eurofins CDMO; Thermo Fischer (Patheon)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global biologics contract manufacturing market report on the basis of product, indication, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

MABs

-

Recombinant Protein

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2017 - 2030)

-

Oncology

-

Immunological Disorders

-

Cardiovascular Disorders (CVDs)

-

Hematological Disorders

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017-2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global biologics contract manufacturing market size was estimated at USD 14.2 billion in 2021 and is expected to reach USD 15.67 billion in 2022.

b. The global biologics contract manufacturing market is expected to grow at a compound annual growth rate of 10.5% from 2022 to 2030 to reach USD 34.67 billion by 2030.

b. North America dominated the biologics contract manufacturing market with a share of 41.1% in 2020. This is attributable to the rise in the spending on R&D activities for developing innovative and effective biologics products.

b. Some key players operating in the biologics contract manufacturing market include Wuxi Biologics, Abzena Ltd., FUJIFILM Diosynth Biotechnologies, Boehringer Ingelheim, Lonza.

b. Key factors that are driving the biologics contract manufacturing market growth include cost-efficient services offered by CMOs in the Asia Pacific region, advancements in therapies, stringent regulations for manufacturing biologics, and increasing demand for biologics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."