- Home

- »

- Clinical Diagnostics

- »

-

Biomarker-based Immunoassays Market Size Report, 2033GVR Report cover

![Biomarker-based Immunoassays Market Size, Share & Trends Report]()

Biomarker-based Immunoassays Market (2025 - 2033) Size, Share & Trends Analysis Report By Sample (Blood, Saliva, Tissue, Urine) By Product (Reagents & Kits, Consumables), By Biomarker, By Diseases, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-722-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biomarker-based Immunoassays Market Summary

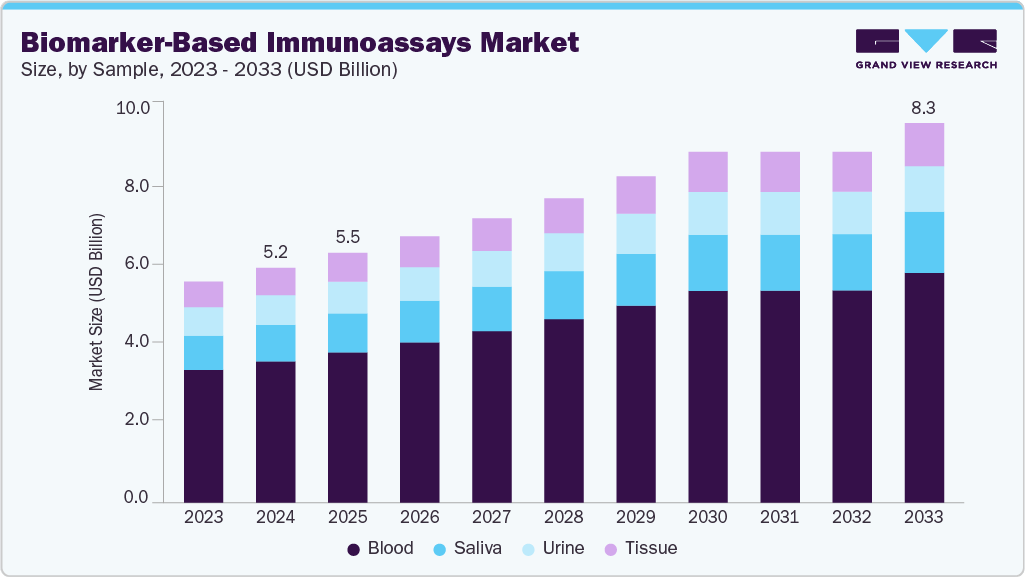

The global biomarker-based immunoassays market size was valued at USD 5.15 billion in 2024 and is expected to reach USD 8.33 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market growth is fueled by the rising global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which require precise and early diagnostic tools.

Key Market Trends & Insights

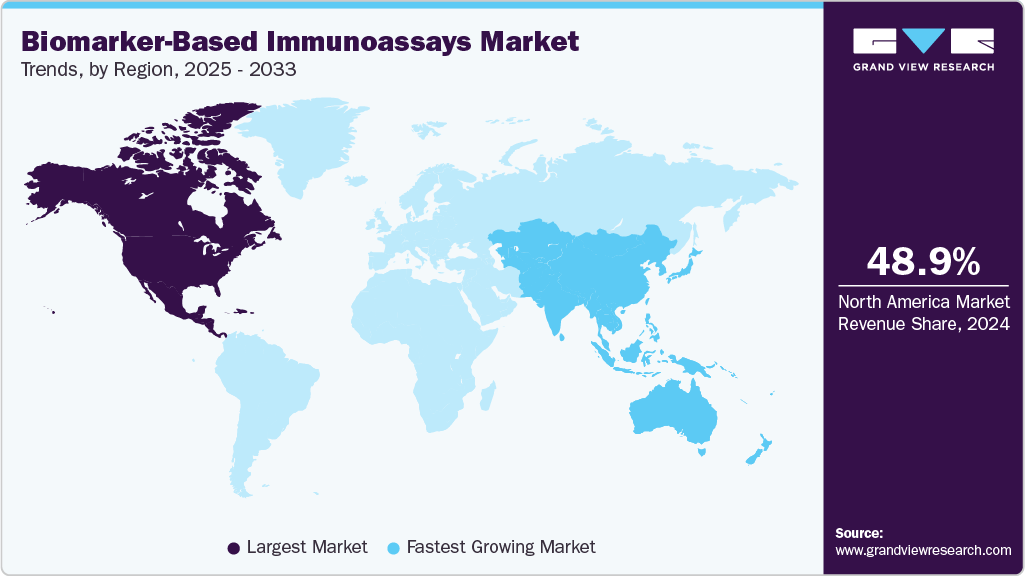

- North America biomarker-based immunoassays market dominated the global market and accounted for the largest revenue share of 48.99% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- By sample, the blood segment led the market with the largest revenue share of 60.14% in 2024.

- By product, the reagents & Kits segment led the market with the largest revenue share of 42.81% in 2024.

- By biomarkers, the efficacy & pharmacodynamic biomarkers segment led the market with the largest revenue share of 35.12% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.15 Billion

- 2033 Projected Market Size: USD 8.33 Billion

- CAGR (2025-2030): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing demand for personalized medicine has driven clinicians and pharmaceutical companies to adopt biomarker-guided strategies, where immunoassays play a central role in both disease detection and therapeutic monitoring. The increasing reliance on companion diagnostics, along with regulatory support for biomarker-driven disease development, has solidified immunoassays as an essential technology in modern healthcare. Additionally, public and private investments in translational research and clinical diagnostics have sped up adoption across hospitals, laboratories, and academic institutions.

Technological advancements are also reshaping the scope of the market, with multiplexing platforms, high-throughput analyzers, and next-generation immunoassay systems enabling the simultaneous detection of multiple biomarkers with enhanced sensitivity and specificity. The integration of artificial intelligence (AI) and machine learning (ML) into biomarker-based testing improves data interpretation, while liquid biopsy-based immunoassays offer less invasive options for oncology and neurology diagnostics. Companies are also developing reagents and kits tailored for predictive and prognostic biomarkers, which are increasingly valuable in precision medicine. These innovations not only enhance diagnostic accuracy but also reduce turnaround times, making biomarker immunoassays more accessible and clinically relevant.

The market offers significant opportunities, especially in emerging regions where healthcare systems are rapidly modernizing and investing in advanced diagnostic infrastructure. Growing awareness of early disease detection and government efforts to strengthen cancer screening programs are expected to further boost market growth. Additionally, the expansion of clinical trials using biomarker-driven endpoints is increasing demand for robust immunoassay solutions, creating opportunities for diagnostic companies to partner with pharmaceutical firms. The rising importance of safety and toxicity biomarkers in disease development also adds to market potential, as pharmaceutical companies seek reliable assays to evaluate therapeutic safety.

The competitive landscape remains highly dynamic, with global leaders such as Abbott, Roche, Thermo Fisher Scientific, Siemens Healthineers, and Bio-Rad Laboratories leading innovation while also facing increasing competition from regional and specialized players. This has encouraged collaborations, mergers, and technology licensing deals across the industry, as companies aim to expand their biomarker assay portfolios and enhance their global reach. Overall, the combination of rising disease prevalence, technological advances, and growing adoption in clinical and research settings highlights a strong growth outlook for the biomarker-based immunoassays market during the forecast period.

According to a national survey by American Addiction Centers, 15.3% of U.S. workers reported working under the influence of alcohol, while 2.9% admitted to being under the influence of illicit disease in 2024. These figures underscore a significant challenge for U.S. employers, highlighting the need for strong workplace disease testing policies. Furthermore, there is a growing emphasis on workplace safety and productivity, prompting organizations to adopt measures that ensure a disease-free environment. Rising awareness of the adverse effects of substance misuse in the workplace, including reduced productivity, increased absenteeism, workplace accidents, and legal liabilities, further drives demand for diseases testing services.

Moreover, advancements in diseases testing technologies have made testing more accurate, efficient, and cost-effective, encouraging more employers to incorporate these solutions into their human resource practices. As organizations increasingly recognize the value of maintaining a safe and productive work environment, the market for workplace diseases testing continues to expand.

Overall, innovation in the biomarker-based immunoassays market is improving the efficiency, accuracy, and scope of screening programs. Advances in portable devices and non-invasive sampling are making testing more convenient and less disruptive for both employers and employees, while sophisticated laboratory techniques are increasing the ability to identify a wider range of substances with high precision. The integration of AI-driven data management and multi-panel rapid testing is streamlining operations, lowering costs, and helping ensure compliance with strict regulatory requirements. These advancements are allowing organizations to adopt more proactive and reliable workplace disease testing strategies, enhancing safety and productivity across various industry sectors.

Market Concentration & Characteristics

The biomarker-based immunoassays market is characterized by a medium degree of innovation, with growth driven by steady improvements in assay performance, automation, and integration with advanced data analytics. While the foundational immunoassay technologies remain consistent, incremental advancements such as digital platforms, multiplexing capabilities, and microfluidic-based solutions have enhanced diagnostic accuracy and throughput. In addition, the discovery of novel biomarkers, particularly predictive and prognostic types, continues to support the evolution of personalized medicine and companion diagnostics, anchoring innovation as a central market feature.

The market has experienced a moderate level of merger and acquisition activity, with companies aiming to broaden their product portfolios and strengthen technological capabilities. Collaborations between diagnostic manufacturers and pharmaceutical companies are also noteworthy, reflecting the interdependence of biomarker immunoassays and disease development, especially in oncology and targeted therapy markets. These activities underline the industry’s focus on portfolio diversification and enhanced technological capabilities.

Regulatory impact remains a defining element of the market, as stringent standards set by authorities such as the U.S. FDA and EMA ensure the clinical reliability, safety, and reproducibility of immunoassay-based biomarker tests. While rigorous validation requirements can act as barriers for smaller companies, they also reinforce confidence in assay performance and support adoption in clinical and research settings. Importantly, regulatory bodies have increasingly recognized the role of biomarker-based diagnostics in precision medicine, accelerating pathways for companion diagnostics approvals and thereby stimulating innovation and uptake in the field.

Leading diagnostic manufacturers are broadening their assay menus to include emerging biomarkers in oncology, neurology, and immunology while simultaneously improving existing assay platforms for greater sensitivity and reproducibility. This expansion often focuses on reagent and kit development, as these remain the backbone of routine diagnostic testing, but is increasingly supported by investments in next-generation analyzers and automated platforms

Regional expansion is a critical characteristic shaping market growth. While North America and Europe dominate due to advanced infrastructure and established healthcare systems, companies are increasingly focusing on emerging regions such as Asia Pacific, Latin America, and the Middle East & Africa. Rising disease prevalence, growing investments in healthcare infrastructure, and government support for diagnostic innovation are creating fertile grounds for expansion.

Sample Insights

The blood segment led the biomarker-based immunoassays market in 2024 with a 60.14% share. Blood has long been regarded as the gold standard for biomarker-based immunoassays because it provides direct access to systemic biomarkers that indicate disease progression and treatment response. Its well-established collection techniques, compatibility with high-throughput platforms, and the availability of validated assays have helped it maintain its leadership. Growing demand for early detection of chronic conditions such as cancer and cardiovascular diseases has further strengthened the importance of blood-based biomarker testing.

A major breakthrough supporting this trend occurred in April 2024, when the FDA awarded Breakthrough Device designation to Roche’s Elecsys pTau217 plasma biomarker test for Alzheimer’s disease. This test illustrates how blood-based immunoassays are advancing into new areas, expanding their role beyond oncology into neurological disorders. The announcement highlighted the increasing significance of blood biomarkers for detecting diseases that previously depended on more invasive or less accessible sample types, strengthening blood’s role as the foundation of biomarker diagnostics.

The saliva segment is expected to grow at the fastest CAGR of 5.8% during the forecast period. Saliva offers unique advantages as a diagnostic medium because it is non-invasive, easy to collect, and well-suited for repeated sampling. These qualities are highly attractive for point-of-care testing, population-level screening, and patient self-monitoring. As healthcare increasingly shifts toward patient-friendly diagnostics, saliva-based assays are gaining wider adoption in infectious disease detection, stress biomarker monitoring, and even oncology applications. Recent innovations highlight saliva’s expanding potential. In October 2024, researchers introduced a saliva-sensing dental floss platform capable of detecting cortisol, a stress biomarker, within minutes. This novel approach demonstrates how non-traditional devices can be integrated into biomarker diagnostics, expanding the accessibility of immunoassays beyond laboratories and hospitals.

Product Insights

The reagents & kits segment led the market with the largest revenue share of 42.81% in 2024. These products are used in nearly every diagnostic or research test, ensuring a recurring revenue stream that maintains their dominance. Their continued demand is also connected to the growth of companion diagnostics and precision medicine, where highly specific reagents are needed to identify therapeutic targets. Standardization and regulatory validation have further increased confidence in their reliability, encouraging widespread adoption across hospitals, diagnostic laboratories, and academic research institutes. A major market development reinforcing this leadership was Roche’s launch of the Elecsys HBeAg quant immunoassay in 2023, designed for hepatitis B diagnostics. This new product highlights ongoing innovation in reagents and kits tailored for infectious disease applications.

The instruments and analyzers segment is expected to grow at the fastest CAGR of 6.1% during the forecast period. Growth in this segment is driven by the increasing demand for automation, high-throughput capacity, and precision in diagnostic workflows. Hospitals and diagnostic labs are progressively adopting advanced analyzers that support multiplexing, enabling simultaneous testing of multiple biomarkers. In December 2024, researchers introduced a chemiluminescence vertical flow assay combined with deep learning technology, which allowed ultra-sensitive detection of cardiac troponin I (cTnI) at the point of care. This advancement highlights the increasing sophistication of immunoassay instruments, integrating machine learning with next-generation assay technologies to provide near-laboratory accuracy in rapid testing environments.

Biomarker Insights

Based on the biomarkers, the efficacy and pharmacodynamic biomarkers segment led the market with the largest revenue share of 35.12% in 2024. These biomarkers are essential for evaluating how well a therapy works and for monitoring biological responses in clinical trials. Pharmaceutical companies and contract research organizations heavily rely on these markers to support disease development, optimize dosing strategies, and ensure therapeutic effectiveness. Their broad applicability across oncology, neurology, and cardiovascular therapies has cemented their status as the leading biomarker category. For instance, ATPase-copper Transporting β Polypeptide (ATP7B) is a biomarker used for detection of ovarian cancer. Furthermore, collaborative efforts between companies and academic institutions are expected to enhance the discovery of biomarkers. For instance, in June 2023, the National Cancer Institute announced the launch of the ComboMatch platform trial, which helps researchers test the efficacy of treatment combinations.

The predictive & prognostic biomarkers segment is expected to grow at the fastest CAGR of 5.6% over the forecast period. These biomarkers are pivotal in identifying which patients are likely to benefit from a specific therapy and in forecasting disease outcomes. Their role in precision oncology, in particular, has fueled rapid uptake, as clinicians increasingly depend on them to stratify patients and personalize treatments. The growing emphasis on tailored therapeutic strategies has propelled predictive and prognostic markers to the forefront of next-generation diagnostics.

Diseases Insights

Based on diseases, the cancer segment led the market with the largest revenue share of 38.91% in 2024. The growth of this segment is due to an increase in demand for rapid and accurate diagnostic tools and a rise in the global incidence of cancer. Leading participants are focusing on introducing programs that can boost the commercialization of biomarker-based products. For instance, in November 2022, NeoGenomics, under the sponsorship of ImmunoGen, launched a new biomarker testing program for patients with Epithelial Ovarian Cancer (EOC). This initiative targeted FRα in patients with platinum-resistant EOC and increased patient access to FDA-approved ImmunoGen's ADC, ELAHERE.

The neurological segment is expected to grow at the fastest CAGR during the forecast period. According to a WHO article published in February 2023, nearly 5 million people worldwide are diagnosed with epilepsy each year. Rising cases of Alzheimer’s disease in older adults are expected to drive market growth. For example, WHO reports that about 10 million new cases of Alzheimer’s are diagnosed annually, and approximately 50 million people have dementia globally. Additionally, the Alzheimer’s Association estimates that around 13.8 million people aged 65 and older will suffer from Alzheimer’s dementia by 2050. A WHO report from March 2023 states that approximately 55 million people worldwide are living with Alzheimer’s dementia. Companies are adopting strategies that leverage their resources to develop new products and strengthen their supply chains. For instance, in March 2023, Abbott Laboratories announced the FDA clearance of the Alinity i laboratory traumatic brain injury (TBI) blood test, the first of its kind, which will help medical professionals evaluate individuals with mild TBIs.

End-use Insights

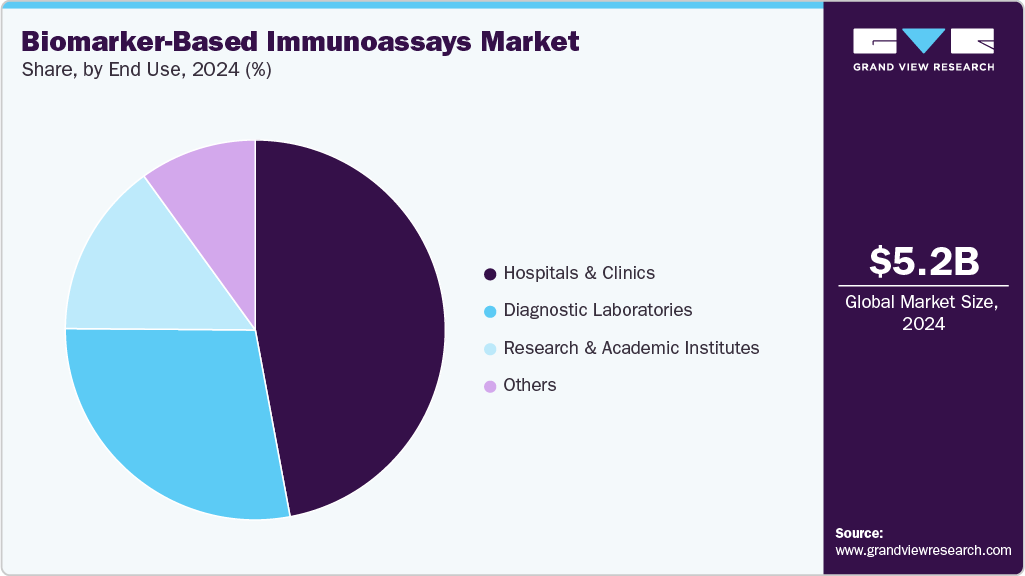

Based on end use, the hospitals and clinics segment led the market with the largest revenue share of 46.79% in 2024. Hospitals and clinics often serve as the first point of care for patients, making them key centers for the adoption of biomarker-based immunoassays across disease areas such as oncology, cardiology, and neurology. Additionally, the increased integration of immunoassay platforms within hospital diagnostic workflows allows physicians to adopt more personalized treatment strategies, especially as biomarker-driven therapies become more widespread.

The diagnostic laboratories segment is projected to grow at the fastest CAGR of 5.3% during the forecast period. Hospitals, which mainly rely on immunoassays for immediate clinical needs, along with laboratories that handle large volumes of testing for clinical trials, public health initiatives, and specialized diagnostics, hold a unique position in the ecosystem. The increasing demand from pharmaceutical companies and smaller hospitals for outsourcing complex biomarker testing further drives growth in this segment. A significant development is the expansion of Eurofins Scientific’s biomarker testing services in Asia and Europe, highlighting the growing global need for specialized, cost-effective, and validated immunoassay services.

Regional Insights

North America dominated the biomarker-based immunoassays market in 2024 with a share of 48.99%, driven by the widespread adoption of precision medicine, high R&D investments, and the dominance of established diagnostic players. The U.S. regulatory environment, particularly FDA approvals for novel biomarker assays, continued to accelerate adoption across oncology, neurology, and cardiology. For instance, in early 2024, Roche received FDA clearance for its Elecsys Amyloid Plasma Panel to support early Alzheimer’s disease diagnosis, reinforcing the region’s focus on neurological biomarkers. Furthermore, collaborations between pharmaceutical companies and diagnostic developers have expanded the use of companion diagnostics, making North America a key hub for innovation and clinical translation of biomarker assays.

U.S. Biomarker-based Immunoassays Market Trends

The biomarker-based immunoassays market in the U.S. held a significant share of the North American market in 2024, driven by the presence of key players in the country, such as Abbott, Thermo Fisher, and Bio-Rad, along with advanced healthcare infrastructure. Growth was also supported by increasing cancer prevalence and initiatives in early detection programs funded by the National Cancer Institute. In 2024, Thermo Fisher Scientific launched new multiplex immunoassay panels for oncology biomarkers, which are being adopted in both clinical and research environments. The U.S. also experienced rapid expansion of biomarker-based immunoassays in clinical laboratories, with Mayo Clinic announcing new testing capabilities in precision oncology, showcasing how leading institutions continue to push market growth.

Europe Biomarker-based Immunoassays Market Trends

The biomarker-based immunoassays market in Europe is experiencing strong growth. The European Medicines Agency (EMA) has increasingly focused on biomarker-guided clinical trials, which is driving adoption in oncology and cardiovascular disease management. In 2024, Siemens Healthineers announced an expansion of its immunoassay test menu in Europe to support cardiovascular biomarker testing, reflecting the market’s response to rising chronic disease burdens. Additionally, the EU’s Horizon Europe program is funding large-scale biomarker research projects, positioning the region as a global leader in translational diagnostics.

The UK biomarker-based immunoassays market has been advancing rapidly, supported by the National Health Service’s (NHS) precision medicine programs and strong biotech innovation ecosystem. With cancer diagnostics being a priority area, UK laboratories are increasingly integrating biomarker immunoassays for early detection and therapy selection. In March 2024, the UK’s Cancer Research Institute partnered with QIAGEN to develop new liquid biopsy immunoassays for breast cancer, showcasing how public-private partnerships are fostering innovation. The country’s regulatory framework also supports accelerated diagnostic adoption, making the UK one of Europe’s most dynamic markets for biomarker-based immunoassays.

The biomarker-based immunoassays market in Germany is experiencing significant growth. Germany has emerged as a leading European hub for biomarker-based immunoassays, thanks to its strong pharmaceutical and diagnostic industry base and a well-established research ecosystem. German hospitals and laboratories have been early adopters of advanced immunoassay systems for oncology, neurology, and cardiovascular diagnostics. In 2024, Merck KGaA launched new immunoassay reagent kits designed for predictive biomarkers in oncology, underscoring Germany’s role in precision diagnostics development. Additionally, collaborations between German biotech firms and global diagnostic players are increasing the availability of biomarker-based companion diagnostics in the country, reinforcing Germany’s position as a growth driver in the European market.

Asia Pacific Biomarker-based Immunoassays Market Trends

Asia Pacific is emerging as one of the fastest-growing regions in the biomarker-based immunoassays market, propelled by rising investments in healthcare infrastructure, growing clinical adoption of biomarker-guided therapies, and the increasing prevalence of chronic diseases such as cancer and cardiovascular disorders. The region has witnessed a surge in biomarker research collaborations, with both multinational companies and local players expanding immunoassay offerings. In 2024, Japan and China saw multiple approvals for new biomarker-based diagnostic tests for oncology, while India’s biotech sector also advanced low-cost immunoassay platforms for population-wide screening. This regional momentum reflects both rising healthcare demand and supportive government policies that encourage innovation in diagnostics.

The biomarker-based immunoassays market in Japan is experiencing growth. The government’s commitment to precision medicine through the Japan Agency for Medical Research and Development (AMED) has accelerated clinical validation of biomarker-based diagnostics. In 2024, Sysmex Corporation announced a new immunoassay-based diagnostic solution for Alzheimer’s disease biomarkers, highlighting Japan’s focus on neurodiagnostics. Additionally, collaborations between Japanese universities and diagnostic companies are fueling innovation, particularly in multiplex biomarker assays that address the complexity of personalized medicine.

The China biomarker-based immunoassays market is growing, driven by government-backed healthcare reforms, rising cancer burden, and expanding domestic diagnostic manufacturing capabilities. With a strong push toward self-sufficiency, Chinese companies are increasingly developing homegrown immunoassay kits and analyzers. In late 2024, Mindray announced the launch of new immunoassay platforms targeting oncology and infectious disease biomarkers, signaling the country’s progress in scaling advanced diagnostics.

Latin America Biomarker-based Immunoassays Market Trends

The biomarker-based immunoassays market in Latin America is experiencing significant growth. Despite economic challenges, governments and private healthcare providers are expanding laboratory capacities to support biomarker-based testing. Roche partnered with local diagnostic labs in Mexico and Argentina to expand access to immunoassay-based oncology diagnostics, highlighting the growing demand for advanced diagnostic solutions.

The Brazil biomarker-based immunoassays market is anticipated to grow at the fastest CAGR during the forecast period. Brazilian hospitals are increasingly implementing biomarker-based immunoassays for early cancer detection and treatment monitoring. In 2024, Dasa, one of Brazil’s largest diagnostic networks, announced the integration of new biomarker-based immunoassay panels for lung and breast cancer, illustrating the nation’s rapid adoption of advanced diagnostics. Brazil’s growing role as a regional hub for clinical trials also strengthens its position in biomarker-driven research and clinical testing.

Middle East and Africa Biomarker-based Immunoassays Market Trends

The biomarker-based immunoassays market in Middle East & Africa is expanding. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced diagnostic capabilities, with oncology and infectious diseases being primary areas of focus. In 2024, Siemens Healthineers partnered with healthcare providers in the UAE to deploy new immunoassay analyzers for cancer biomarker testing, reflecting growing regional demand. While adoption levels remain lower compared to developed markets, increasing collaborations with global diagnostic leaders are driving accessibility.

The Saudi Arabia biomarker-based immunoassays market is growing, Saudi hospitals and research institutions are adopting biomarker-based immunoassays to address rising cancer and cardiovascular disease prevalence. In 2024, King Faisal Specialist Hospital and Research Centre launched a new biomarker testing program for oncology patients, highlighting the country’s commitment to advanced diagnostics. Partnerships with international diagnostic players are also expanding biomarker assay availability, making Saudi Arabia an important growth node in the region.

Key Biomarker-based Immunoassays Company Insights

Key participants in the biomarker-based immunoassays market are focusing on developing innovative testing solutions and securing necessary certifications to broaden their offerings. In addition, companies are entering into partnerships, collaborations, mergers, and acquisitions to strengthen their presence in the sector. These players are heavily investing in advanced technology and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Key Biomarker-based Immunoassays Companies:

The following are the leading companies in the biomarker-based immunoassays market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche AG

- Abbott

- Thermo Fisher Scientific Inc

- Eurofins Scientific

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- Merck KGaA

- PerkinElmer Inc.

- Agilent Technologies, Inc.

Recent Developments

-

In October 2023, Labcorp announced the launch of tri-biomarkers blood test for diagnosis of Alzheimer’s disease.

-

In October 2023, Mindray announced the launch of high-sensitivity NT-proBNP and troponin I (hs-cTnI) cardiac biomarkers. The launch is expected to enhance the company’s product portfolio of cardiac biomarkers used in the management and diagnosis of cardiovascular diseases.

-

In August 2023, Quest Diagnostics entered into partnership with Envision Sciences for the commercial launch of novel prostate cancer biomarker test for identification of severe and aggressive forms of the disease.

-

In July 2023, Quanterix announced the launch of LucentAD, a biomarker blood test to assist in the diagnosis of Alzheimer’s disease in individuals.

-

For instance, in July 2022, the U.S. FDA granted Breakthrough Device Designation to Elecsys Amyloid Plasma Panel for early detection of Alzheimer’s disease. Roche is the first IVD manufacturer to receive Breakthrough Device Designation for a blood-based biomarker test for Alzheimer’s.

Biomarker-based Immunoassays Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.48 billion

Revenue forecast in 2033

USD 8.33 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million. and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample, product, biomarkers, diseases, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche AG.; Abbott.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biomarker-based Immunoassays Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the biomarker-based immunoassays market on the basis sample, product, biomarkers, diseases, end-use, and region:

-

Sample Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood

-

Tissue

-

Urine

-

Saliva

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Instruments/ Analyzers

-

Reagent & Kits

-

Services

-

-

Biomarker Outlook (Revenue, USD Million, 2021 - 2033)

-

Safety & toxicity biomarkers

-

Efficacy & Pharmacodynamic Biomarkers

-

Predictive & Prognostic Biomarkers

-

Surrogate/Exploratory Biomarkers

-

-

Diseases Outlook (Revenue, USD Million, 2021 - 2033)

-

Cancer

-

Cardiovascular Diseases

-

Neurological Diseases

-

Immunological Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biomarker-based immunoassays market size was estimated at USD 5.15 billion in 2024 and is expected to reach USD 5.48 billion in 2025.

b. The global biomarker-based immunoassays market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach USD 8.33 billion by 2033.

b. The blood segment led the biomarker-based immunoassays market in 2024 with a share of 60.18%. Blood has long been considered the gold standard for biomarker-based immunoassays because it offers direct access to systemic biomarkers that reflect disease progression and therapeutic response

b. Some key players operating in the market include F. Hoffmann-La Roche AG.; Abbott.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

b. Key factors that are driving the biomarker-based immunoassays market growth include the rising global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which require precise and early diagnostic tools

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.