- Home

- »

- Clinical Diagnostics

- »

-

Companion Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Companion Diagnostics Market Size, Share & Trends Report]()

Companion Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product And Services (Assays, Kits, & Reagents, Instruments & Systems, Software & Services), By Indication, By Technology, By Sample Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-536-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Companion Diagnostics Market Summary

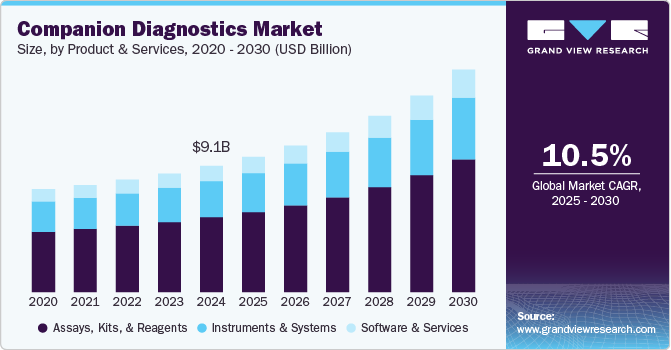

The global companion diagnostics market size was estimated at USD 9,058.1 million in 2024 and is projected to reach USD 15,977.6 million by 2030, growing at a CAGR of 10.5% from 2025 to 2030. Companion diagnostics are crucial in tailoring treatments to individual patients by identifying biomarkers that predict responses to specific therapies.

Key Market Trends & Insights

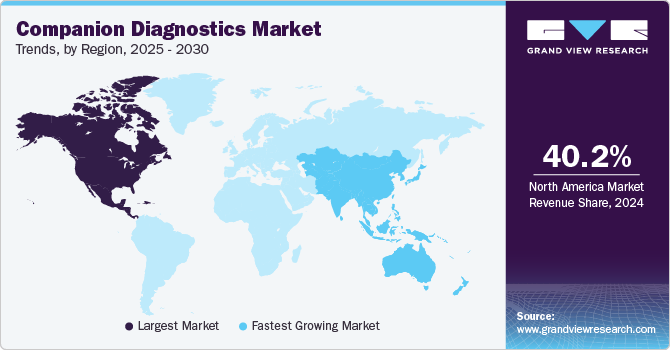

- In terms of region, North America was the largest revenue generating market in 2024.

- The companion diagnostics market in U.S. is projected to see significant market expansion.

- Based on product and services, the assays, kits, and reagents segment led the market with a 59.1% share in 2024.

- Based on sample type, the tissue samples segment held the largest market share of 62.7% in 2024.

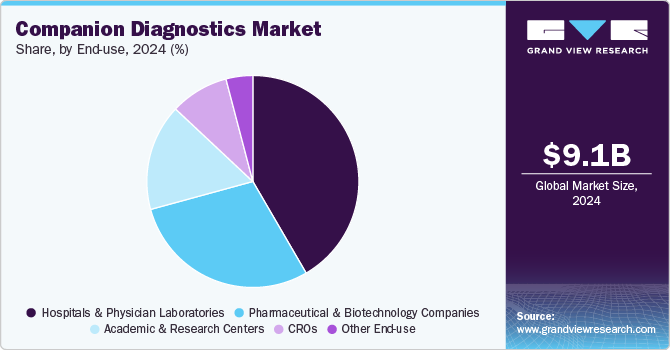

- Based on end use, the hospitals and physician laboratories segment held the largest market share of 38.6.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9,058.1 Million

- 2030 Projected Market Size: USD 15,977.6 Million

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

The rising prevalence of cancer, cardiovascular diseases, and autoimmune disorders has driven the need for targeted therapies, where companion diagnostics help determine the most effective treatment for patients. This approach minimizes adverse effects and enhances treatment efficacy, improving patient outcomes. The shift from a one-size-fits-all treatment approach to personalized medicine is a primary driver of market expansion. Additionally, pharmaceutical companies are increasingly integrating companion diagnostics into drug development pipelines to improve the success rate of novel therapeutics, further accelerating market growth.

Another key factor fueling the growth of the companion diagnostics market is the rapid advancement in diagnostic technologies. Innovations in next-generation sequencing (NGS), polymerase chain reaction (PCR), and digital pathology have significantly improved the accuracy and efficiency of biomarker identification. These technological advancements enable faster and more precise detection of genetic mutations and protein expressions, which are critical for personalized treatment decisions. Artificial intelligence (AI) and machine learning (ML) are also essential in enhancing diagnostic accuracy and data interpretation, enabling clinicians to make informed treatment choices. The increasing adoption of these advanced diagnostic tools in research laboratories and healthcare institutions is driving the expansion of the market, as healthcare providers seek to optimize patient care with precise, data-driven insights.

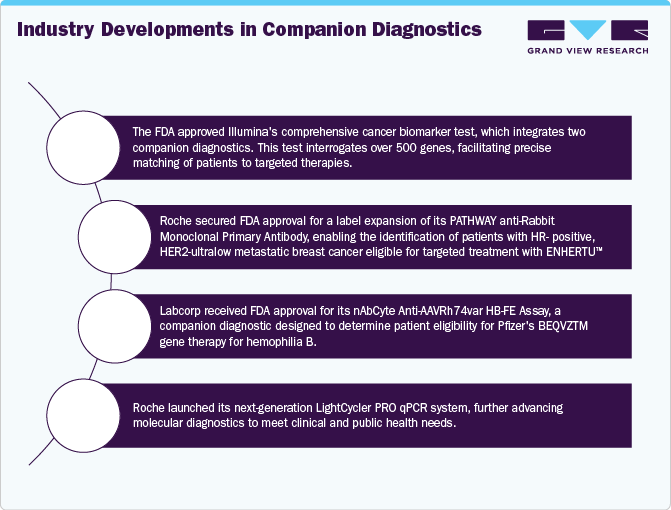

Regulatory support and favorable reimbursement policies are also contributing to the growth of the companion diagnostics market. Government agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established clear regulatory pathways to facilitate the approval of companion diagnostic tests alongside targeted therapies. The increasing number of FDA-approved companion diagnostics indicated the growing acceptance of personalized medicine. For instance, in October 2024, Roche announced that its VENTANA Assay has become the first immunohistochemistry (IHC) companion diagnostic approved by the U.S. Food and Drug Administration (FDA) for assessing CLDN18 protein expression in tumors of patients with gastric or gastroesophageal junction adenocarcinoma. This approval enables eligible patients to receive treatment with Astellas' targeted therapy, VYLOY. Additionally, reimbursement policies are evolving to accommodate the cost of these advanced diagnostics, making them more accessible to patients. As regulatory bodies continue to support the co-development of drugs and diagnostics, pharmaceutical and biotech companies are investing heavily in developing new companion diagnostic tests to enhance treatment precision and market penetration.

The rising prevalence of oncology-related diseases is another significant factor driving market growth. Cancer remains one of the leading causes of death worldwide, and companion diagnostics play a vital role in oncology treatment by identifying genetic mutations that guide the selection of targeted therapies. According to the CDC, an estimated 2,001,140 new cancer cases are expected to be diagnosed in the United States in 2024, with 611,720 individuals projected to succumb to the disease. Companies such as Roche Diagnostics, Thermo Fisher Scientific, and Qiagen are actively investing in companion diagnostics for various cancer types, including lung, breast, and colorectal cancer. The increasing incidence of these cancers has led to higher demand for early and accurate diagnosis, pushing healthcare providers to integrate companion diagnostics into routine clinical practice. As precision oncology continues to gain traction, the market for companion diagnostics is expected to expand further, driven by the need for better treatment outcomes and reduced healthcare costs.

List of Cleared or Approved Companion Diagnostic Devices

Diagnostic Name (Manufacturer)

Indication - Sample Type

Drug Trade Name (Generic) NDA / BLA

Biomarker(s) (Details)

Diagnostic Name (Manufacturer)

Indication - Sample Type

Drug Trade Name (Generic) NDA / BLA

Biomarker(s) (Details)

xT CDx (Tempus Labs, Inc.)

Colorectal Cancer (CRC) - Tissue (Matching Blood/Saliva)

Erbitux (cetuximab) BLA 125084

KRAS wild-type (absence of mutations in codons 12 or 13)

xT CDx (Tempus Labs, Inc.)

Colorectal Cancer (CRC) - Tissue (Matching Blood/Saliva)

Vectibix (panitumumab) BLA 125147

KRAS wild-type (absence of mutations in exons 2, 3, or 4) and NRAS wild-type (absence of mutations in exons 2, 3, or 4)

Vysis CLL FISH Probe Kit (Abbott Molecular, Inc.)

B-cell Chronic Lymphocytic Leukemia - Peripheral Blood

Venclexta (venetoclax) NDA 208573

Deletion chromosome 17p (17p-)

Vysis ALK Break Apart FISH Probe Kit (Abbott Molecular Inc.)

Non-Small Cell Lung Cancer (NSCLC) - Tissue

Xalkori (crizotinib) NDA 202570

ALK gene rearrangements

Vysis ALK Break Apart FISH Probe Kit (Abbott Molecular Inc.)

Non-Small Cell Lung Cancer (NSCLC) - Tissue

Alunbrig (brigatinib) NDA 208772

ALK gene rearrangements

Ventana PD-L1 (SP263) Assay (Ventana Medical Systems, Inc)

Non-Small Cell Lung Cancer (NSCLC) - Tissue

Tecentriq (atezolizumab) BLA 761034

PD-L1 protein expression

Ventana PD-L1 (SP263) Assay (Ventana Medical Systems, Inc.)

Non-Small Cell Lung Cancer (NSCLC) – Tissue

Libtayo (cemiplimab-rwlc) – BLA 761097

PD-L1 protein expression (PD-L1 stained ≥ 50% of tumor cells [TC ≥ 50%])

Ventana PD-L1 (SP142) Assay (Ventana Medical Systems, Inc.)

Urothelial Carcinoma - Tissue

Tecentriq (atezolizumab) BLA 761034

PD-L1 protein expression (PD-L1 stained tumor-infiltrating immune cells [IC] covering ≥ 5% of the tumor area)

Ventana PD-L1 (SP142) Assay (Ventana Medical Systems, Inc.)

Non-Small Cell Lung Cancer (NSCLC) - Tissue

Tecentriq (atezolizumab) BLA 761034

PD-L1 protein expression (PD-L1 stained ≥ 50% of tumor cells [TC ≥ 50%] or PD-L1 stained tumor-infiltrating immune cells [IC] covering ≥ 10% of the tumor area [IC ≥ 10%])

Ventana MMR RxDx Panel (Ventana Medical Systems, Inc.)

Endometrial Carcinoma (EC) - Tissue

Imfinzi (durvalumab) BLA 761069

MLH1, PMS2, MSH2 and MSH6

Market Concentration & Characteristics

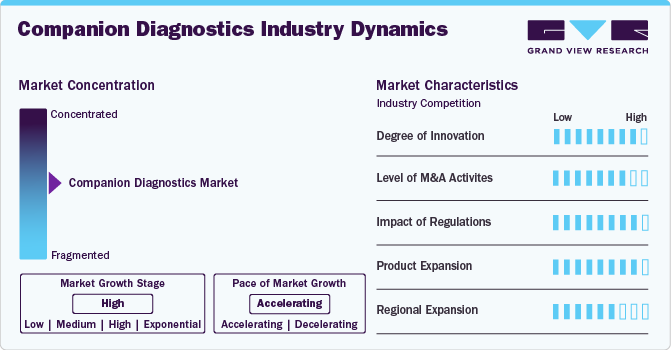

The companion diagnostics market is witnessing continuous innovation, driven by advancements in genomics, proteomics, and precision medicine. Emerging technologies such as next-generation sequencing (NGS) and artificial intelligence (AI) are enhancing diagnostic accuracy and efficiency. Companies are developing highly specific biomarkers to improve targeted therapy selection, ensuring better patient outcomes. These innovations are transforming personalized medicine, making treatments more effective while minimizing adverse effects.

Mergers and acquisitions (M&A) are shaping the companion diagnostics market as companies seek to expand their technological capabilities and market reach. Major pharmaceutical and diagnostics firms are acquiring biotech startups to integrate novel biomarker technologies. Collaborations between diagnostic firms and pharmaceutical companies are also increasing, aiming to develop co-approved therapies. Such strategic moves strengthen market positioning and accelerate the development of cutting-edge diagnostic solutions.

Regulatory frameworks significantly influence the growth of the companion diagnostics market. Stringent approval processes by agencies like the FDA and EMA ensure the safety and efficacy of diagnostics linked to targeted therapies. The regulatory landscape is evolving to accommodate innovative diagnostics, with streamlined pathways for approvals. Compliance with these regulations is crucial for market entry, shaping product development strategies and ensuring high standards in precision medicine.

The companion diagnostics market is experiencing significant product expansion, with new assays being developed for various cancer types, autoimmune diseases, and neurological disorders. Companies are focusing on multiplex diagnostics, which allow simultaneous testing of multiple biomarkers. Additionally, advancements in liquid biopsy technology are enabling non-invasive diagnostic options. This expansion is broadening the clinical utility of companion diagnostics, offering more comprehensive solutions for personalized treatment approaches.

The global adoption of companion diagnostics is increasing, with emerging markets such as Asia-Pacific and Latin America witnessing rapid growth. Rising healthcare investments, improved regulatory frameworks, and growing awareness of precision medicine are driving expansion. Key players are establishing partnerships and research collaborations in these regions to strengthen their presence. As access to advanced diagnostics improves worldwide, the companion diagnostics market is set for substantial geographical growth.

Product And Services Insights

In 2024, assays, kits, and reagents led the market with a 59.1% share, driven by increasing demand for personalized medicine and targeted therapies. These components play a crucial role in detecting specific biomarkers that help determine a patient’s eligibility for precision treatments, particularly in oncology, cardiovascular diseases, and rare genetic disorders. The expansion of next-generation sequencing (NGS) and polymerase chain reaction (PCR)-based assays has further fueled market growth, enabling rapid, accurate, and high-throughput testing. Pharmaceutical and biotechnology companies are heavily investing in companion diagnostic development to support regulatory approvals and enhance treatment efficacy. The increasing adoption of in vitro diagnostics (IVD) and immunohistochemistry (IHC)-based assays is also contributing to the market expansion. Additionally, regulatory agencies such as the FDA and EMA continue to approve new CDx assays, accelerating market penetration.

However, software and services are projected to experience the fastest CAGR over the forecast period, driven by the need for advanced data analysis, regulatory compliance, and test development support. Companies such as Covance, LabCorp, and Q2 Solutions offer specialized services for CDx development, assisting pharmaceutical firms in designing and validating diagnostic tests. These service providers play a crucial role in ensuring compliance with regulatory standards and facilitating efficient biomarker identification. In June 2023, the FDA launched a pilot program aimed at mitigating risks associated with laboratory tests used to detect cancer biomarkers. This initiative enhances the accuracy and reliability of companion diagnostics, helping healthcare professionals select the most effective targeted therapies for patients. The increasing reliance on bioinformatics, AI-driven analytics, and cloud-based platforms is further fueling market growth.

Indication Insights

Oncology secured the dominant market share in 2024, driven by the increasing global cancer burden and the growing demand for personalized medicine. CDx plays a crucial role in identifying biomarkers that help select targeted therapies, improving treatment outcomes for cancer patients. Advances in next-generation sequencing (NGS), immunohistochemistry (IHC), and liquid biopsy techniques are further propelling market growth. According to WHO (February 2022), approximately 400,000 children develop cancer annually worldwide. Additionally, the World Cancer Research Fund International reported 18.09 million cancer cases diagnosed globally in 2020, highlighting the rising need for precise diagnostic tools. The demand for CDx continues to surge as pharmaceutical companies develop targeted therapies for various cancers, including lung, breast, and colorectal cancer. Increased regulatory approvals and collaborations between diagnostic and pharmaceutical firms are expected to further drive the expansion of oncology-focused CDx solutions.

The cardiovascular disease indication in the companion diagnostics market is expected to grow at a CAGR of 11.4% over the forecast period. This substantial share is attributed to the global increase in cardiovascular disorders and a heightened emphasis on early detection and personalized treatment approaches. Companion diagnostics in cardiovascular diseases aim to optimize medication choices and manage risk factors effectively. Advancements in biomarker discovery and targeted therapies further contribute to the expansion of this segment, enabling healthcare providers to tailor treatments to individual patient profiles, thereby improving outcomes and reducing adverse effects.

Technology Insights

The Polymerase Chain Reaction (PCR) segment dominated the companion diagnostics market in 2024, holding a 27.67% share. Real-time PCR assays are widely used due to their high specificity and sensitivity, making them a preferred method for identifying cancer biomarkers. In clinical laboratories, real-time PCR enables simultaneous gene analysis, cost-effective reagent use, internal controls, and sample preservation for tumor profiling. For instance, in November 2023, Roche introduced the LightCycler PRO qPCR system, enhancing molecular diagnostics for clinical and research applications.

The Next-Generation Sequencing (NGS) segment is projected to grow at the fastest CAGR during the forecast period. The advent of NGS technology has significantly advanced cancer biomarker discovery, supporting tumor genomics, transcriptomics, and epigenomics research. NGS offers detection of minor mutations, simultaneous identification of SNPs and structural variants, high throughput, and rapid analysis, driving its adoption in companion diagnostics. These advantages position NGS as a crucial tool for tumor stratification and precision oncology.

Sample Type Insights

Tissue samples held the largest market share of 62.7% in 2024, driven by the widespread adoption of biomarker-based tissue testing for targeted therapies. Tissue samples are essential for identifying genetic mutations and protein expressions in solid tumors, guiding precision medicine in oncology. Techniques such as immunohistochemistry (IHC), in situ hybridization (ISH), and polymerase chain reaction (PCR) are widely used to analyze tissue specimens, ensuring accurate diagnosis and treatment selection. Regulatory approvals for tissue-based companion diagnostics further drive market growth. For instance, in October 2024, Roche’s VENTANA assay became the first FDA-approved IHC companion diagnostic for CLDN18 protein expression in gastric cancer patients eligible for targeted therapy. The increasing prevalence of cancer and chronic diseases, coupled with the advancements in molecular pathology, is fueling the demand for tissue-based companion diagnostics. As precision medicine continues to expand, the tissue sample segment will remain dominant in the market.

Blood samples are expected to be the fastest-growing segment over the forecast period, driven by the increasing adoption of liquid biopsy techniques for non-invasive cancer diagnostics. Blood-based companion diagnostics enable the detection of circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and other biomarkers, offering a minimally invasive alternative to tissue biopsies. This approach is particularly beneficial for patients who cannot undergo traditional tissue biopsies due to tumor location or health conditions. The rising prevalence of cancer and chronic diseases, along with advancements in next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies, has accelerated the demand for blood-based diagnostics.

End-use Insights

In 2024, the hospitals and physician laboratories segment dominated the oncology companion diagnostics market, holding a 38.6% share. Hospitals typically offer a comprehensive range of cancer diagnostic tests to address the increasing cancer burden and aging populations. As companion diagnostics gain traction, hospitals are rapidly adopting innovative technologies to enhance early cancer detection and personalized treatment strategies. The evolution of hospital laboratories is pivotal in meeting changing patient needs, prompting healthcare facilities to broaden their service offerings. Additionally, hospitals are investing in advanced diagnostic platforms and forging collaborations with pharmaceutical companies to bolster their personalized cancer care capabilities. For instance, in May 2023, NHS Borders launched its Rapid Cancer Diagnostic Service (RCDS), a significant step forward in early detection for patients presenting with vague or nonspecific symptoms. This initiative exemplifies the growing commitment among hospitals to integrate cutting-edge companion diagnostic solutions to improve patient outcomes.

Pharmaceutical and biotechnology are projected to grow at a CAGR of 10.6% during the forecast period. These organizations are heavily involved in research and development, focusing on targeted therapies that require precise biomarker identification. Companion diagnostics play a crucial role in facilitating effective clinical trials and optimizing patient selection, thereby enhancing drug efficacy and safety profiles. Additionally, the increasing prevalence of precision medicine has prompted companies to collaborate with diagnostic manufacturers or develop in-house testing capabilities. Regulatory support for co-development and streamlined approvals further accelerates adoption. As these partnerships and R&D initiatives continue to expand, pharmaceutical and biotechnology companies will drive robust market growth.

Regional Insights

North America companion diagnostics market held the largest revenue share at 40.2% in 2024, primarily due to advanced healthcare infrastructure, substantial healthcare expenditure, and a robust regulatory framework that expedites approvals for new diagnostic technologies. Leading research institutions and biotech firms across the region are driving innovation through the development of cutting-edge diagnostic methods. These factors collectively position North America for continued growth in the companion diagnostics market over the forecast period.

U.S. Companion Diagnostics Market Trends

The companion diagnostics market in U.S. is projected to see significant market expansion, driven by the high prevalence of chronic diseases (including cancer) and the rapid adoption of advanced diagnostic solutions. Ongoing technological advancements, frequent FDA approvals for novel tests, and growing competition among biotechnology companies further bolster market growth prospects in the country.

Europe Companion Diagnostics Market Trends

Europe commands a notable share of the global companion diagnostics market, supported by developed economies such as Germany, Spain, the UK, France, and Italy. These nations benefit from strong healthcare infrastructure and robust clinical research capabilities, spurring market growth. In the UK, advanced healthcare systems, strategic partnerships, and the introduction of innovative products drive adoption. Meanwhile, France’s focus on in-house genomic testing and Germany’s rising disease incidence also contribute to market expansion. Overall, these factors position Europe for sustained growth in companion diagnostics.

The UK companion diagnostics market is experiencing steady growth, driven by advanced healthcare infrastructure, strategic collaborations, and a strong focus on precision medicine. Increased investments in innovative diagnostic technologies and strong regulatory support facilitate the development of cutting-edge tests for personalized therapies. Partnerships between biotech and pharmaceutical companies boost research efforts, enhancing diagnostic accuracy and treatment outcomes. With an emphasis on early detection and care, the UK market is poised for continued expansion and greater integration of companion diagnostic solutions.

Asia Pacific Companion Diagnostics Market Trends

The companion diagnostics market in Asia Pacific is set to record the fastest CAGR, propelled by healthcare reforms, infrastructure enhancements, and a large patient pool. The region’s high burden of chronic diseases, including cancer, underscores the need for effective diagnostic solutions. According to Global Cancer Statistics 2022, nearly half of global cancer cases and over 56% of cancer deaths occurred in Asia. Governments and local firms are increasingly investing in precision diagnostics, driving the adoption of companion diagnostic technologies. China’s market growth is supported by lifestyle changes, dietary shifts, and an aging population, while Japan’s focus on reducing cancer incidence through substantial government funding underlines the region’s strong growth potential.

China companion diagnostics market is witnessing growth, driven by a rising prevalence of chronic diseases and an increasing focus on precision medicine. Significant investments in research and development, along with favorable government policies, have accelerated the adoption of advanced diagnostic technologies. Local companies and international collaborations are fostering innovation, enhancing test accuracy, and treatment outcomes. This dynamic market environment is expected to sustain momentum as healthcare infrastructure expands and regulatory support strengthens, driving the growth of companion diagnostics in China.

Latin America Companion Diagnostics Market Trends

Latin America offers lucrative opportunities in the companion diagnostics space, driven by the rapid advancement of precision medicine and various R&D initiatives. Collaborations between pharmaceutical companies, diagnostic firms, and service providers are improving access to cutting-edge testing technologies. In Brazil, growing genetic testing capabilities and a heightened emphasis on precision medicine are propelling market expansion. These partnerships between global innovators and local healthcare providers continue to reinforce Latin America’s standing as a promising region for companion diagnostics.

Middle East And Africa Companion Diagnostics Market Trends

The Middle East & Africa (MEA) region also presents substantial growth prospects, although many areas remain underpenetrated due to limited screening programs. Governments are increasingly focusing on expanding early detection efforts and promoting noninvasive diagnostic methods. Saudi Arabia, in particular, is expected to witness a surge in companion diagnostics adoption, driven by rising government involvement and growing awareness of personalized treatment benefits. These developments underscore the MEA region’s potential for steady market growth in the coming years.

Key Companion Diagnostics Company Insights

Leading players in the market, such as Agilent Technologies, Inc., Illumina Inc., and Merck KGaA, are actively developing innovative Next-Generation Sequencing (NGS) products, panels, kits, and IHC systems that emphasize portability and sequencing efficiency. They invest heavily in research and development, often collaborating with pharmaceutical and biotechnology organizations to introduce new technologies. These companies boast robust product portfolios and consistently focus on expanding their R&D efforts.

Emerging participants like Biosystems, Guardant Health, Inc., and EntroGen, Inc. are also making their mark. They are partnering with both major and local players to secure a competitive advantage, focusing on regional expansion and developing companion diagnostics, NGS platforms, and laboratory services to enhance clinical testing capabilities.

Key Companion Diagnostics Companies:

The following are the leading companies in the companion diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- Agilent Technologies, Inc.

- Abbott

- Thermo Fisher Scientific, Inc.

- F. Hoffmann La Roche Ltd

- Foundation Medicine

- Myriad Genetics

- Illumina, Inc.

Recent Developments

-

In January 2025, Roche revealed that the FDA granted approval for a label expansion of the PATHWAY anti-Rabbit Monoclonal Primary Antibody*. This update enables the detection of patients with HR-positive, HER2-ultralow metastatic breast cancer who could qualify for treatment.

-

In August 2024, the FDA approved Illumina's cancer biomarker test, featuring two companion diagnostics to swiftly match patients with targeted therapies. This test analyzes 500 genes to profile solid tumors, enhancing the chances of identifying immuno-oncology or clinically actionable biomarkers. TSO Comprehensive is FDA-approved as a CDx for detecting NTRK gene fusions in solid tumors, aiding treatment with Bayer’s VITRAKVI (larotrectinib).

-

In April 2024, Labcorp, a global provider of innovative laboratory services, announced that the FDA has approved its nAbCte Anti-AAVRh74var HB-FE Assay. This companion diagnostic (CDx) is designed to assess patient eligibility for treatment with BEQVZ™, Pfizer's newly FDA-approved gene therapy for hemophilia B.

Companion Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.71 billion

Revenue forecast in 2030

USD 15.98 billion

Growth rate

CAGR of 10.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and services, indication, sample type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies Inc.; Illumina Inc.; QIAGEN; Thermo Fisher Scientific Inc.; Foundation Medicine Inc.; Myriad Genetics, Inc.; F. Hoffmann-La Roche Ltd.; BioMérieux; Abbott; Leica Biosystems; Guardant Health, Inc.; EntroGen, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global companion diagnostics market report based on product & services, indication, technology, sample type, end-use, and region.

-

Product and Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Assays, Kits, and Reagents

-

Instruments and Systems

-

Software and Services

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Cardiovascular Diseases

-

Neurological Disorders

-

Other Indications

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

Next-generation Sequencing (NGS)

-

In-situ Hybridisation (ISH)

-

Immunohistochemistry (IHC)

-

Magnetic Resonance Imaging (MRI)

-

Other Technology

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tissue Samples

-

Blood Samples

-

Other Sample Types

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic and Research Centers

-

Hospitals and Physician Laboratories

-

CROs

-

Reference Laboratories

-

Pharmaceutical and Biotechnology Companies

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global companion diagnostics market size was estimated at USD 9.06 billion in 2024 and is expected to reach USD 9.71 billion in 2025.

b. The global companion diagnostics market is expected to grow at a compound annual growth rate of 9.92% from 2025 to 2030 to reach USD 15.98 billion by 2030.

b. North America dominated the companion diagnostics market with a share of 40.71% in 2024. This is attributable to presence of advanced healthcare infrastructure, substantial healthcare expenditure, and a robust regulatory framework that expedites approvals for new diagnostic technologies.

b. Some key players operating in the companion diagnostics market include Agilent Technologies Inc.; Illumina Inc.; QIAGEN; Thermo Fisher Scientific Inc.; Foundation Medicine Inc.; Myriad Genetics, Inc.; F. Hoffmann-La Roche Ltd.; BioMérieux; Abbott; Leica Biosystems; Guardant Health, Inc.; EntroGen, Inc.

b. Key factors that are driving the market growth include increasing demand for precision medicine. Companion diagnostics play a crucial role in tailoring treatments to individual patients by identifying biomarkers that predict responses to specific therapies. The rising prevalence of cancer, cardiovascular diseases, and autoimmune disorders has driven the need for targeted therapies, where companion diagnostics help determine the most effective treatment for patients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.