- Home

- »

- Medical Devices

- »

-

Bioresorbable Coronary Stents Market, Industry Report, 2030GVR Report cover

![Bioresorbable Coronary Stents Market Size, Share & Trends Report]()

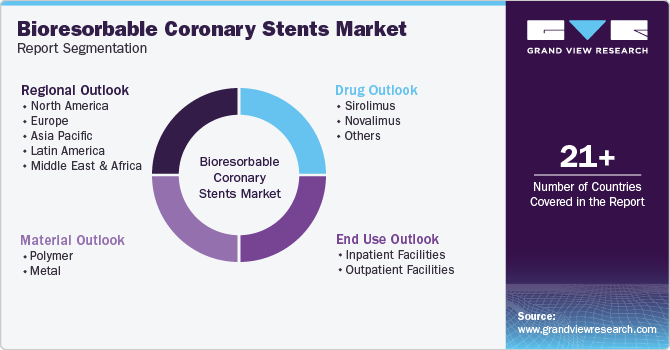

Bioresorbable Coronary Stents Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Polymer, Metal), By Drug (Sirolimus, Novalimus), By End Use (Outpatient, Inpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-234-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

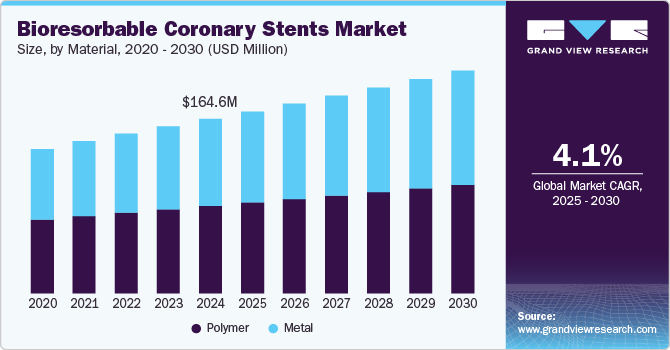

The global bioresorbable coronary stents market size was estimated at USD 164.6 million in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. Innovations in material science, the rising prevalence of cardiovascular diseases, and the growth of minimally invasive procedures are driving the market growth. These factors contribute to the demand for safer, more efficient coronary interventions that offer long-term benefits for patients. In June 2024, an article in Frontiers in Cardiovascular Medicine highlighted that Bioresorbable scaffolds (BRS), utilized for post-percutaneous coronary intervention (PCI) vascular restoration, thereby positioning the technology as a safe intervention.

Developing advanced, biocompatible materials is a primary growth driver of the bioresorbable coronary stents market. These materials are designed to dissolve gradually in the body, minimizing the need for long-term implantation. Patients experience fewer complications associated with permanent metal stents, such as inflammation and restenosis. In September 2023, an article in Acta Biomaterialia highlighted the investigation of bioresorbable polymers for stent applications, focusing on aliphatic polyesters, polyorthoesters, and polyanhydrides. Among these, aliphatic polyesters, particularly polylactide (PLA), are the most commonly used materials for bioresorbable stents due to their excellent biocompatibility, biodegradability, processability, and mechanical properties.

Advancements in minimally invasive procedures also play a significant role in expanding the bioresorbable coronary stent market. The trend toward less invasive cardiac interventions, such as percutaneous coronary interventions (PCIs), has encouraged the adoption of bioresorbable stents, which are easier to implant and remove. In August 2024, an article in Frontiers in Bioengineering and Biotechnology investigated bioresorbable polymer-coated stents for treating coronary artery perforations and neointimal hyperplasia. The study highlighted the performance of various polymers, revealing that polylactide-co-caprolactone membranes showed promise despite increased thrombogenicity. The authors emphasized the need for further preclinical studies that better replicate clinical conditions.

A significant limitation for the bioresorbable coronary stent technology has been the setbacks experienced due to Abbott's recall and the subsequent negative sentiment in the market. In 2017, Abbott recalled its bioresorbable stent, the Absorb, due to concerns over higher rates of adverse events such as thrombosis and restenosis, which significantly tarnished the reputation of bioresorbable stents. This recall led to a loss of confidence among both physicians and patients in technology’s safety and efficacy. As a result, the overall adoption of bioresorbable stents slowed, and many in the medical community were hesitant to embrace this technology, favoring more established metal stents.

Market Concentration & Characteristics

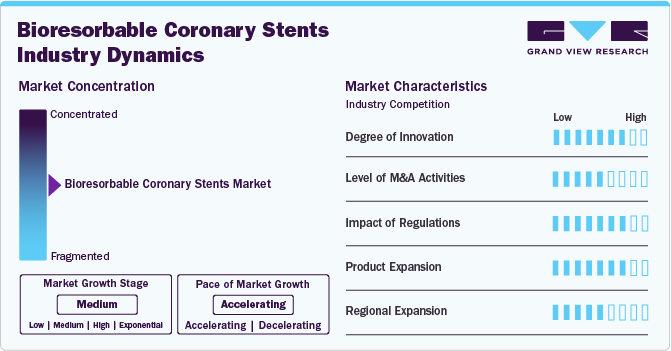

The degree of innovation in the bioresorbable coronary stents market is high, driven by significant advancements in material science and technology. Companies are focused on improving the performance and safety of stents, developing new biodegradable materials, and refining the design for better patient outcomes. These innovations are essential for the market's growth, directly addressing restenosis and long-term stent complications.

The level of mergers and acquisitions in the bioresorbable coronary stents industry is moderate. While there is collaboration between companies and academic institutions, the market remains fragmented, with companies focusing on technology integration and expanding their product offerings. M&A activity helps companies acquire new technologies and strengthen their product portfolios, yet it is not as intense as in some other medical device sectors.

Regulations play a significant role in the bioresorbable coronary stents industry, and their impact is high. The approval processes for medical devices, particularly stents, are rigorous and require extensive clinical trials to demonstrate safety and effectiveness. These stringent regulations ensure that only the most reliable products reach the market, contributing to lengthy development timelines but ultimately promoting higher-quality innovations in the sector.

Product expansion in the bioresorbable coronary stents industry is high, as companies continue to innovate and launch new stent designs and materials. With the increasing demand for minimally invasive procedures, firms are expanding their product lines to offer more customizable solutions. This expansion addresses the varied needs of patients, particularly those with complex cardiovascular conditions requiring long-term, effective treatment options.

Regional expansion in the bioresorbable coronary stents industry is moderate, with developed countries leading adoption due to advanced healthcare systems. Emerging markets are gradually increasing their market share, but barriers such as cost, healthcare infrastructure, and regulatory hurdles slow the pace of adoption. As healthcare infrastructure improves in developing regions, the demand for advanced coronary stents is expected to rise steadily.

Material Insights

The polymer segment held the largest market share of 50.2% in 2024. Polymers are crucial in the bioresorbable coronary stents market due to their flexibility and ability to be engineered with specific properties like biocompatibility, controlled degradation, and mechanical strength. These characteristics allow for stents that temporarily support the artery during healing and then dissolve over time, reducing long-term complications. In October 2024, an article in the Journal of Clinical Medicine discussed a clinical trial comparing everolimus-eluting bioresorbable scaffolds (BRS) to bioresorbable polymer everolimus-eluting stents (BP-EES) for coronary stenting. BP-EES showed superior angiographic performance with lower in-device diameter stenosis, although clinical event rates between the groups did not differ significantly up to five years.

The metal segment is anticipated to grow at the fastest CAGR over the forecast period. Metal-based bioresorbable stents, particularly those made from magnesium alloys, have gained traction because of their superior mechanical properties. Metals offer strong initial support to the artery after implantation, preventing restenosis while being gradually absorbed by the body. They provide the necessary structural integrity while avoiding long-term foreign body presence, which reduces chronic inflammation and late thrombosis risks. In June 2023, an article in Bioactive Materials highlighted advancements in metallic bioresorbable stents (BRS) compared to polymer alternatives. Magnesium and iron-based stents have shown promising clinical results, while zinc-based ones are being tested.

Drug Insights

The sirolimus segment held the largest market share of 63.1% in 2024. Sirolimus is a potent drug used in drug-eluting bioresorbable stents due to its ability to inhibit smooth muscle cell proliferation, a key factor in restenosis. This drug helps prevent the re-narrowing of the artery by controlling cell growth at the site of the stent. Its inclusion in bioresorbable stents enhances the stent’s efficacy, offering a dual benefit of vessel support and reduced restenosis risk, driving its popularity in the market. In May 2024, an article published in Circulation: Cardiovascular Interventions examined the clinical outcomes of the Coroflex ISAR and Orsiro sirolimus-eluting stents in coronary interventions. The study found that the Orsiro sirolimus-eluting stent significantly reduced the rate of target lesion failure at one year compared to the Coroflex ISAR, primarily due to less clinically driven target lesion revascularization.

Novalimus segment is anticipated to grow at the fastest CAGR over the forecast period. Novolimus, a next-generation drug, has emerged as a promising alternative to sirolimus in bioresorbable coronary stents. It offers improved pharmacological benefits, such as enhanced anti-inflammatory and anti-proliferative effects. Novolimus is gaining popularity for its potential to reduce the risk of restenosis even further, providing a better therapeutic profile for patients undergoing coronary interventions. Its use in bioresorbable stents is pushing forward innovations in stent technology. In July 2024, an article in Clinical Cardiology compared the novolimus-eluting DESyne stent and the bioresorbable polymer sirolimus-eluting Orsiro stent in patients undergoing percutaneous coronary intervention. The study found similar rates of major adverse cardiovascular events (MACE) between the two stents, suggesting that both offer favorable clinical outcomes.

End Use Insights

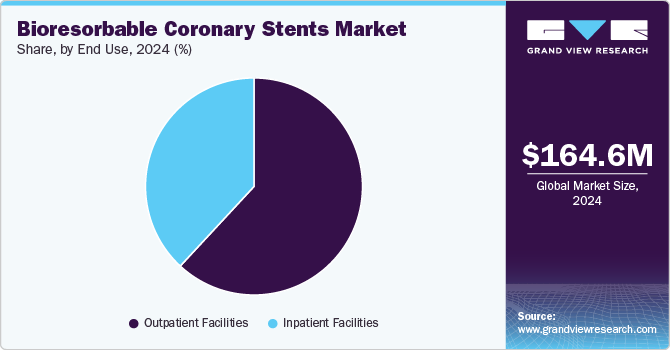

The outpatient facilities segment held the largest market share of 61.9% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Outpatient facilities are rapidly expanding in the bioresorbable coronary stent market due to their ability to provide less invasive, more affordable, and accessible healthcare options. Bioresorbable stent procedures are increasingly being performed in these settings because of their minimally invasive nature, allowing patients to recover quickly and reducing the need for prolonged hospitalization. This accessibility helps drive the adoption of bioresorbable stents by offering a convenient alternative to traditional inpatient treatments.

The growing trend of bioresorbable stent implantation in outpatient settings is also fueled by the cost-effectiveness of these facilities. By eliminating the need for extended hospital stays and minimizing healthcare expenses, outpatient clinics can offer competitive pricing for stent procedures. This makes advanced treatments more affordable to a larger patient base, encouraging the use of bioresorbable coronary stents, which is especially important as the demand for minimally invasive cardiovascular treatments continues to rise.

Regional Insights

The bioresorbable coronary stents market in North America is primarily driven by advanced healthcare infrastructure, rising cardiovascular disease rates, and a high demand for minimally invasive procedures.In December 2024, the American Heart Association released its annual review that highlighted significant scientific advancements in the fight against cardiovascular disease, which claimed more than 850,000 lives each year in the U.S. and was the leading cause of death and disability worldwide. These factors are pushing the demand for innovative treatments, including bioresorbable stents, to improve patient outcomes and reduce long-term complications.

U.S. Bioresorbable Coronary Stents Market Trends

In the U.S., the adoption of bioresorbable coronary stents is supported by an aging population, increased cardiovascular disease prevalence, and a strong preference for minimally invasive treatments. Regulatory support and the presence of leading medical device manufacturers further drive the demand for these advanced stents. In January 2024, the Population Reference Bureau estimated that by 2050, the number of Americans aged 65 and older will increase to 82 million, up from 58 million in 2022, representing a 47% growth. In September 2022, an article in the Journal of the American College of Cardiology discussed the MASTER DAPT trial, which examined the outcomes of patients with high bleeding risk (HBR) who received bioresorbable polymer-coated stents. The study found that a 1-month dual antiplatelet therapy (DAPT) regimen resulted in similar rates of net adverse clinical outcomes while significantly reducing bleeding complications compared to a prolonged DAPT strategy.

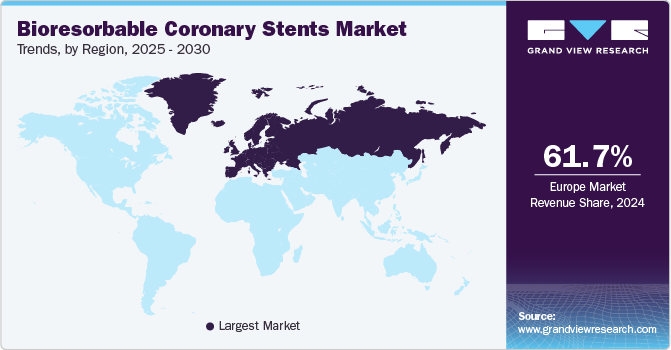

Europe Bioresorbable Coronary Stents Market Trends

Bioresorbable coronary stents market in Europe is growing due to an aging population, rising rates of cardiovascular diseases, and a focus on improving cardiovascular care through advanced medical devices. Strong healthcare systems, especially in countries like the UK, France, and Germany, facilitate the widespread adoption of these innovative stents. In April 2023, Terumo Europe N.V. announced a new prospective clinical study, the NAGOMI COMPLEX PMCF, for the Ultimaster Nagomi sirolimus-eluting coronary stent system in complex PCI patients. This device, which received CE mark approval in November 2022, enhances the Ultimaster family with an optimized delivery system and expanded size range, enabling treatment of more complex lesions.

Germany bioresorbable coronary stents market is supported by astrong healthcare system, a focus on high-quality medical treatments, and a growing cardiovascular disease burden. These are key drivers for adopting bioresorbable coronary stents. In July 2024, an article in Biomedical Materials & Devices addressed cardiovascular diseases (CVDs) and the dogboning effect observed in coronary stent placements. Researchers optimized the design of polymeric bioresorbable Palmaz-Schatz stents using SolidWorks and finite element analysis, achieving a 78.67% reduction in the dogboning effect through response surface methodology.

Bioresorbable coronary stents market in France is growing due to awareness of cardiovascular health, an aging population, and increasing healthcare investments. In May 2024, Elixir Medical reported promising 12-month results from the DESyne BDS Plus Randomized Controlled Trial. The data showed that the DESyne BDS Plus, which is the first coronary stent using a triple drug-eluting strategy along with a site-specific antithrombotic coating, demonstrated a significantly lower rate of target lesion failure (TLF) compared to a standard durable polymer drug-eluting stent.

Asia Pacific Bioresorbable Coronary Stents Market Trends

The Asia Pacific region is rapidly expanding in the bioresorbable coronary stents market, driven by increasing rates of heart disease, improving healthcare infrastructure, and rising awareness of advanced treatment options. This growth is particularly notable in China, Japan, and India, where large populations and improved healthcare access contribute to market demand.An article from August 2024 in The Lancet Regional Health - Western Pacific predicts a 91.2% rise in cardiovascular deaths in Asia between 2025 and 2050. Ischemic heart disease and stroke are expected to remain the top causes of mortality, with Central Asia having the highest rates. High systolic blood pressure will be the leading risk factor, except in Central Asia, where elevated fasting plasma glucose will take precedence.

Bioresorbable coronary stents market in China is growing due to the rising incidence of cardiovascular diseases, expanding healthcare access, and increasing awareness of modern treatment options. In June 2024, an article in Reviews in Cardiovascular Medicine addressed the contentious issue of the effectiveness of bioresorbable vascular scaffolds (BVS) compared to metallic stents in treating coronary heart disease. The research aimed to analyze five-year outcomes from randomized controlled trials involving BVS, utilizing a systematic review and meta-analysis to provide insights into clinical outcomes after treatment.

Japan bioresorbable coronary stents market is a leader in adopting bioresorbable coronary stents, with a well-developed healthcare system, an aging population, and a focus on innovative medical technologies. The country’s high demand for advanced, minimally invasive treatments is driving the adoption of bioresorbable stents. In September 2024, Japan’s Ministry of Internal Affairs and Communications reported that the elderly constitute approximately 29.3% of the population, the highest rate globally for regions with over 100,000 residents. The elderly population has reached a record 36.25 million, with those aged 65 and older making up nearly one-third of the total population.

The bioresorbable coronary stents market in India is growing due to the increasing prevalence of cardiovascular diseases, a large population, and improving healthcare infrastructure. In September 2024, the Indian government explored the creation of a distinct category for advanced coronary stents and considered increasing the price ceiling to encourage manufacturers who had postponed introducing their next-generation devices due to existing price regulations. This consideration arose after coronary stents were added to the National List of Essential Medicines in 2022 to improve affordability. Stent manufacturers had requested a higher price cap for advanced devices.

Latin America Bioresorbable Coronary Stents Market Trends

Bioresorbable coronary stents market in Latin America is driving due to a rising incidence of cardiovascular diseases, improvements in healthcare access, and the increasing availability of advanced medical devices. The regional economic development and healthcare investments further support market growth. In June 2024, a PLoS ONE article examined the impact of socioeconomic status (SES) on coronary heart disease (CHD) in Argentina. It found that 56% of adults aged 35 to 64 are low SES, experiencing nearly double the rates of incident CHD and deaths compared to high SES individuals.

Brazil bioresorbable coronary stents market is agrowing healthcare sector. Increasing cardiovascular disease rates and investments in modern medical technology contribute to the growing demand for bioresorbable coronary stents. The country’s shift toward adopting innovative medical solutions positions it as a key player in the region’s market. In July 2024, an article in Cardiovascular Revascularization Medicine found that in STEMI patients treated with primary percutaneous coronary intervention, biodegradable (BP) drug-eluting stents had similar major adverse cardiac events compared to durable (DP) stents. However, BP-DES showed significantly lower rates of target lesion revascularization at the 2-year follow-up.

Middle East And Africa Bioresorbable Coronary Stents Market Trends

The Middle East and Africa’s markets are experiencing growing demand for bioresorbable coronary stents, especially in Saudi Arabia and Kuwait. These countries invest heavily in healthcare infrastructure and modern medical technologies, driven by rising cardiovascular disease cases and a focus on improving healthcare delivery. In May 2024, Al Qassimi Hospital in Sharjah successfully performed the first implantation of a dissolvable magnesium stent in the Middle East. This pioneering procedure enhances blood flow for patients with heart disease and marks a significant step forward in cardiac treatment and the application of cutting-edge medical technologies.

Bioresorbable coronary stents market in Saudi Arabia is expanding due to the country’s investment in healthcare modernization, an increasing prevalence of cardiovascular diseases, and the adoption of advanced medical technologies. In March 2024, a study found a 1.6% prevalence of cardiovascular diseases (CVDs) in Saudi Arabia among those aged 15 and older, with higher rates in males (1.9%) and adults over 65 (11%). Makkah had the highest prevalence at 1.9%, while Najran had the lowest at 0.76%, highlighting the need for targeted public health interventions. The government’s focus on improving healthcare facilities is contributing to market growth.

Key Bioresorbable Coronary Stents Company Insights

Some of the key market players operating in the bioresorbable coronary stents market include Biotronik, REVA Medical, and Microport Scientific Corporation. These companies are making significant infrastructure investments, which enables them to develop, manufacture, and commercialize a high volume of stents worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Bioresorbable Coronary Stents Companies:

The following are the leading companies in the bioresorbable coronary stents market. These companies collectively hold the largest market share and dictate industry trends.

- Biotronik

- Meril Life Sciences Pvt. Ltd.

- Elixir Medical

- REVA Medical, LLC

- Arterial Remodeling Technologies SA

- LEPU Medical

- Microport Scientific Corporation

- LifeTech Scientific

Recent Developments

-

In November 2024, Microport Scientific Corporation introduced its latest-generation bioresorbable scaffold, Firesorb, in the international market. The product utilizes a combination of single-sided drug coating with targeted related technology to mitigate the previous ill effects of delayed endothelial healing.

-

In September 2024, an article published in Frontiers in Cardiovascular Medicine discussed a study comparing the 10-year clinical outcomes of bioresorbable vascular scaffolds (BVSs) and drug-eluting stents (DESs) in patients undergoing percutaneous coronary intervention. The study revealed similar rates of device-oriented and patient-oriented composite events between the two groups. Still, it noted a higher rate of possible stent thrombosis in the BVS group compared to the DES group.

-

In June 2024, an article from the McCormick School of Engineering discussed the exploration of 3D printing and citrate biomaterials for developing dissolvable stents. These stents had the potential to replace permanent implants by gradually dissolving in the body, thereby reducing complications such as inflammation and restenosis. This innovative approach aimed to improve patient recovery and treatment outcomes in cardiovascular care.

Bioresorbable Coronary Stents Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 171.7 million

Revenue forecast in 2030

USD 210.1 million

Growth rate

CAGR of 4.1% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, drug, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Biotronik; Meril Life Sciences Pvt. Ltd.; Elixir Medical; REVA Medical, LLC; Arterial Remodeling Technologies SA; LEPU Medical; Microport Scientific Corporation; LifeTech Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioresorbable Coronary Stents Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioresorbable coronary stents market report based on material, drug, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer

-

Metal

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Sirolimus

-

Novalimus

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioresorbable coronary stents market size was estimated at USD 164.6 million in 2024 and is expected to reach USD 171.7 million in 2025.

b. The global bioresorbable coronary stents market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 210.1 million by 2030.

b. Europe dominated the bioresorbable coronary stents market with a share of 61.77% in 2024. This is attributable to the clinical pipeline of second generation bioresorbable stents with better device attributes and design features.

b. Some of the players operating in bioresorbable coronary stents include BIOTRONIK, Meril Lifesciences Pvt. Ltd., Elixir Medical Corporation, REVA Medical, Arterial Remodeling Technologies, Amaranth Medical, Microport Scientific Corporation, and Arterius, competing against established drug-eluting coronary stent players.

b. Availability of post-approval, real-world evidence data for Magmaris, Magnitude and second generation Absorb is expected to be the turning point for the current lagging pace of this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.